Contraceptive Devices Market Outlook:

Contraceptive Devices Market size was over USD 11.4 billion in 2025 and is estimated to reach USD 17.6 billion by the end of 2035, expanding at a CAGR of 5% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of contraceptive devices is assessed at USD 11.9 billion.

The growing awareness about reproductive health is primarily fueling the market. Particularly, the worldwide surge in solutions to prevent sexually transmitted infections (STIs) is creating a substantial consumer base for this sector. Testifying to the same, the 2025 findings by the World Health Organization (WHO) unveiled that, every day, more than 1.0 million people around the globe acquire STIs, where 520 million individuals aged between 15 and 49 are afflicted by herpes simplex virus type 2 (HSV-2). These figures indicate the urgent need for an adequate supply of effective birth control commodities, which is propelling demand in this field.

Payers' pricing dynamics in the contraceptive devices market are highly influenced by regulatory mandates aimed at expanding public access. For instance, under the federal guarantee and additional guidance, insurers in the U.S. are forced to offer financial backing for all contraceptives approved by the FDA, even the over-the-counter (OTC) products, without charging copayment or coinsurance. Despite such coverage, some plans still impose restrictions, particularly in resource-constrained regions, for certain devices. For instance, in 2022, the cost of modern birth control options in India ranged from USD 12 for condoms to USD 48 for a contraceptive implant, as per the NLM findings.

Key Contraceptive Devices Market Insights Summary:

Regional Highlights:

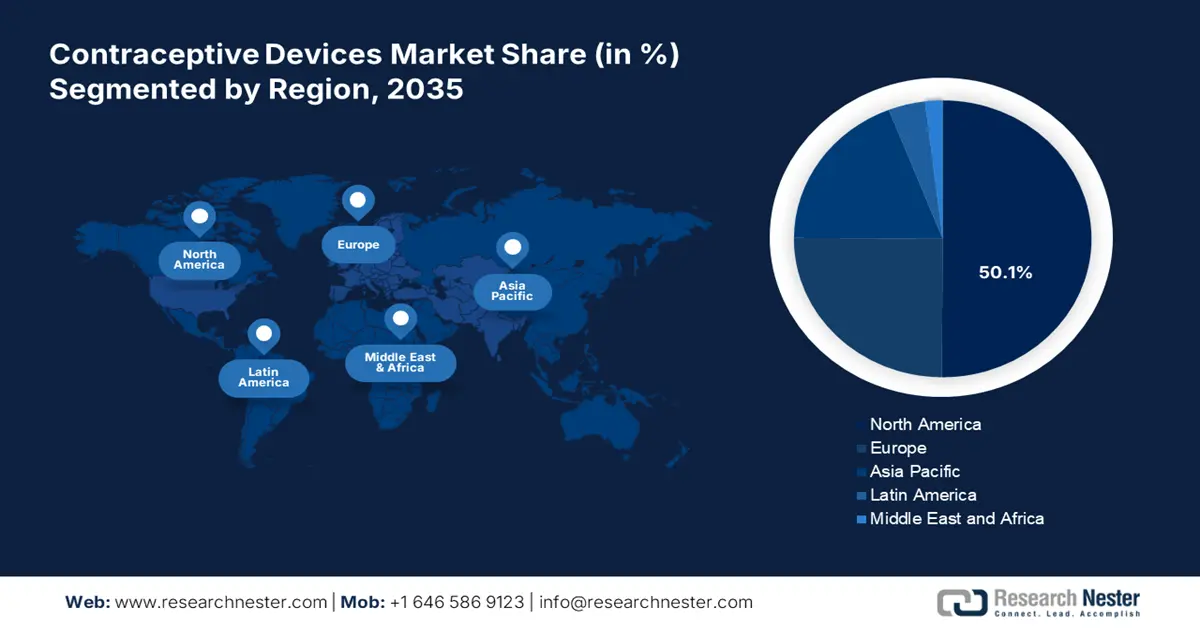

- North America contraceptive devices market is projected to capture a 50.1% share by 2035, driven by strong healthcare infrastructure, high awareness, and supportive government policies.

- Asia Pacific is anticipated to emerge as the fastest-growing region by 2035, impelled by government-led family planning initiatives and expanding population.

Segment Insights:

- The hormonal contraceptives segment is projected to account for 65.3% share by 2035 in the contraceptive devices market, propelled by the increased use of patches and implantable solutions.

- Condoms are anticipated to hold the largest market share over the forecast period 2026-2035, owing to global health initiatives promoting safe intercourse practices.

Key Growth Trends:

- Favorable demographics and population trends

- Emerging trend of modern birth control approach

Major Challenges:

- Concerns about user compliance and social stigma

Key Players: Bayer AG, Merck & Co., Inc. (MSD), Pfizer Inc., AbbVie Inc. (via Allergan), Reckitt Benckiser Group plc (Durex), CooperCompanies (CooperSurgical), Church & Dwight Co., Inc. (Trojan), Teva Pharmaceutical Industries Ltd., Ansell Limited (SKYN, Lifestyles), Veru Inc. (FC2), Okamoto Industries, Inc., Lupin Limited, HLL Lifecare Limited, Cupid Limited, FUJILATEX Co., Ltd., Medicines360, Mayer Laboratories, Inc. (Kimono), SMB Corporation of Malaysia, DKT International, Unipath Ltd. (SPD), Sebela Women's Health Inc.

Global Contraceptive Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.4 billion

- 2026 Market Size: USD 11.9 billion

- Projected Market Size: USD 17.6 billion by 2035

- Growth Forecasts: 5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (50.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, United Kingdom, Japan

- Emerging Countries: India, China, Brazil, Mexico, Indonesia

Last updated on : 24 September, 2025

Contraceptive Devices Market - Growth Drivers and Challenges

Growth Drivers

- Favorable demographics and population trends: The growing population of Earth, especially in developing regions, creates a notable demand for effective birth control, hence fueling the market. According to the United Nations report, the number of people living worldwide is predicted to surpass 10.0 billion by the end of the 20th century, with over 227,000 babies being born daily. As a result, the number of younger demographics entering reproductive age is amplifying, which requires access to a wide range of contraceptive options.

- Emerging trend of modern birth control approach: The contraceptive devices market is evolving with revolutionary technological progress, translating to safer, more effective, and user-friendly products. Ongoing advances, such as hormone-releasing IUDs, biodegradable implants, and self-administered tools, already improved user experience and efficacy, prompting more individuals to invest in this category. Further, to capitalize on this trend, in February 2024, Bayer and Daré Bioscience allied to expand current contraceptive methods by developing a hormone-free monthly contraceptive ring for vaginal insertion that can stay effective over three weeks without any action required.

- Initiatives to promote reproductive decisions: Public authorities around the world are updating their strategies to control population growth and improve maternal health through bulk procurement and distribution of products available in the market. Particularly, government-backed subsidies, free distribution programs, and incentives for sterilization or IUD adoption are becoming highly common in high-population countries, such as China and India. For instance, India started realizing its 2030 commitment to securing access to a range of contraceptives with the addition of new choices with an aim to improve healthy timing and spacing of pregnancies (HTSP) through postpartum family planning (PPFP).

Historical Overview of the Global Demographics in the Market

STI-related Global Statistics and Health Impacts (2020)

|

Type of STI |

Demographic Trend |

|

Chlamydia |

129 million new infections |

|

Gonorrhoea |

82 million new infections |

|

Syphilis |

7.1 million new infections |

|

Trichomoniasis |

156 million new infections |

|

Genital Herpes (HSV) |

520 million people living with it |

|

HPV Infection |

300 million women infected (primary cause of cervical cancer) |

Source: WHO

Challenges

- Concerns about user compliance and social stigma: The cases of side effects, such as hormonal imbalances, weight gain, and discomfort, from using these devices often lead to discontinuation. Besides, in many underserved regions, a lack of awareness about available options and persistent social restrictions on usage also contribute to underutilization in the contraceptive devices market. Moreover, the limited autonomy of women over reproductive health decisions due to patriarchal norms and societal pressure imposes an unavoidable limitation on widespread adoption in this sector.

Contraceptive Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5% |

|

Base Year Market Size (2025) |

USD 11.4 billion |

|

Forecast Year Market Size (2035) |

USD 17.6 billion |

|

Regional Scope |

|

Contraceptive Devices Market Segmentation:

Technology Segment Analysis

The hormonal contraceptives segment is poised to dominate the contraceptive devices market with a 65.3% revenue share by the end of 2035. The leadership is largely attributed to the increased use of patches and implantable solutions. Moreover, the continued industrial expansion in these categories solidifies the dominance of this technology in this sector for the upcoming years. This can be testified by the explosive global trade value of the subdermal contraceptive implants industry. Furthermore, the heightened awareness efforts from governing bodies and commercial suppliers are enabling continuous growth in this segment.

Product Type Segment Analysis

Condoms are estimated to hold the largest share in the market over the assessed timeline. The capability to offer dual protection against both pregnancy and sexually transmitted infections (STIs), coupled with high accessibility, low cost, and minimal side effects, makes these products the gold standard for this sector. The segment’s predominant captivity over revenue generation can also be evidenced by the amplifying value of global trade in sheath contraceptives, which accounted for USD 822 million in 2023 alone, as per the OEC records. On the other hand, global health initiatives promoting safe intercourse practices are remarkably boosting their adoption.

Distribution Channel Segment Analysis

Retail pharmacies are predicted to be the dominant distribution channel in the contraceptive devices market throughout the discussed period. Their widespread accessibility and convenience make them the preferred choice for consumers seeking products available in this field. Besides, they offer a broad range of over-the-counter (OTC) options, most of which do not require a prescription, enhancing user privacy and ease of purchase. Additionally, pharmacists play an important role in counseling and guiding consumers on proper use based on their retail experience and locality awareness, which boosts an individual’s confidence and adherence to purchasing new launches.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegment |

|

Product Type |

|

|

Technology |

|

|

Material |

|

|

Gender |

|

|

Age Group |

|

|

Distribution Channel |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Contraceptive Devices Market - Regional Analysis

North America Market Insights

The North America contraceptive devices market is estimated to account for the leading share of 50.1% over the analyzed tenure. The region’s dominance is primarily attributed to the presence of a strong healthcare infrastructure, high levels of awareness, and supportive government policies. Besides, MedTech advancements and a rise in the use of modern contraceptive methods are also playing an influential role in this landscape, which is accompanied by robust investments in innovation and product development. Further, the rising concerns about unintended pregnancies and growing demand for long-acting reversible contraceptives (LARCs) are solidifying the region’s forefront position in this sector.

The U.S. is one of the world’s biggest consumer bases and innovation hubs in the market. Evidencing the same, the OEC reported that the country ranked among the top 5 importers of sheath contraceptives in 2023, accounting for USD 58.1 million. On the other hand, testifying to the enlarging demography, a 2024 study from an international reproductive health journal unveiled that around 66.6% women in the U.S. use contraception. It also mentioned that almost 45% of the total annual 2.5 million pregnancies nationwide were classified as unintended during the same timeline.

The Canada contraceptive devices market is following the upward trajectory of growth, owing to federal and provincial healthcare initiatives that emphasize reproductive and women’s health. As evidence, from 2021 to 2027, a total of USD 81 million was allocated to strengthen the healthcare system and related supports for the underserved community through the Sexual and Reproductive Health Fund (SRHF). Further, in February 2025, the Ministry of Health in Canada again dedicated USD 1.7 million in funding to support projects aimed at improving access to sexual and reproductive health services.

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the global market by the end of 2035. The region's pace of progress in this category is accelerated by the enlarging population and government-led promotional activities for family planning, where highly populated countries, such as India and China, are taking an active part. On the other hand, rapid urbanization and evolving social attitudes toward birth control translate to greater uptake rates and improved access to healthcare services.

The dominance of China over both global and local manufacturing capacity is a major advantage for its domestic contraceptive devices market. Specifically, the country’s ability to offer cost-effective products is creating a favorable environment for the merchandise. Additionally, the government-backed relaxation from the one-child policy and growing emphasis on modern contraception methods are collectively securing a progressive future for the country in this sector. Moreover, with one of the largest populations in the world, China is making remarkable progress in this sector.

In 2023, India won the status as the world’s most populous country by surpassing 1.4 billion, followed by the downfall in China after 2022, as per a report from the United Nations (UN). Another finding from the PIB established that the proportion of people aged 15-64 crossed 68% in 2024, where more than 78% of women aged 15-49 were using modern methods of contraception in 2022. These figures indicate a lucrative opportunity to cultivate a strong foundation for suppliers and manufacturers in this field. Besides, the ongoing government initiatives, Mission Parivar Vikas (MPV) and Scheme for Home Delivery of Contraceptives, are also amplifying adoption.

Country-wise Trade Values of Sheath Contraceptives (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

China |

75.7 million |

134.9 million |

|

India |

90.9 million |

2.9 million |

|

Japan |

35.9 million |

12.5 million |

|

Malaysia |

80.9 million |

9.9 million |

|

Australia |

1.2 million |

9.0 million |

|

Thailand |

250.6 million |

7.5 million |

|

Indonesia |

263.9 thousand |

10.2 million |

|

Philippines |

739.0 thousand |

3.8 million |

|

Korea Rep. |

1.0 million |

7.3 million |

Source: WITS

Europe Market Insights

Europe is expected to hold a strong position in revenue generation from the contraceptive devices market during the timeline between 2026 and 2035. With the supportive government policies, a rise in public awareness, and advancements in the MedTech industry, the region consolidated its significance in this sector. As evidence, in April 2024, Aspivix, in alliance with Bayer, shared its plans for widespread access to its Carevix across Switzerland as a modern and gentler alternative to a cervical tenaculum. The UK, Germany, and France are augmenting this cohort of development, owing to their strong healthcare systems and proactive reproductive health programs.

Massive grant allocation to public welfare is a major growth driver for the UK market. This also helps the country enable widespread provision of a variety of services offered through the National Health Service (NHS), which ensures sufficient resource supply to people in need. Furthermore, the country's commitment to sexual and reproductive wellness shines through its policies and innovations. Natural Cycles in January 2025 announced the launch of a Reproductive UK Women’s Health Initiative to help them make informed decisions.

The dedication of governing authorities in Germany to funding research and innovation in the contraceptive devices market plays a pivotal role in fostering a profitable business environment for both domestic and foreign players in this field. Specifically, government allocations to sexual health programs are securing a consistent capital influx in this sector, encouraging more companies to invest and participate. As evidence, in September 2023, Bayer invested USD 294.4 million in a new manufacturing facility in Finland to improve public access to modern contraception methods and resources.

Country-wise Trade Values of Sheath Contraceptives (2023)

|

Country |

Export Value (in USD) |

Import Value (in USD) |

|

Germany |

23.6 million |

17.7 million |

|

Hungary |

14.4 million |

15.4 million |

|

Poland |

12.8 million |

23.1 million |

|

Spain |

10.5 million |

19.2 million |

|

Belgium |

9.1 million |

7.2 million |

|

Netherlands |

8.4 million |

9.0 million |

|

UK |

8.1 million |

12.6 million |

|

France |

5.3 million |

20.0 million |

|

Sweden |

4.6 million |

2.4 million |

|

Romania |

3.3 million |

3.1 million |

|

Greece |

2.5 million |

6.5 million |

|

Italy |

973.8 thousand |

18.4 million |

|

Turkey |

1.0 million |

14.2 million |

|

Austria |

1.2 million |

6.4 million |

Source: WITS

Key Contraceptive Devices Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co., Inc. (MSD)

- Pfizer Inc.

- AbbVie Inc. (via Allergan)

- Reckitt Benckiser Group plc (Durex)

- CooperCompanies (CooperSurgical)

- Church & Dwight Co., Inc. (Trojan)

- Teva Pharmaceutical Industries Ltd.

- Ansell Limited (SKYN, Lifestyles)

- Veru Inc. (FC2)

- Okamoto Industries, Inc.

- Lupin Limited

- HLL Lifecare Limited

- Cupid Limited

- FUJILATEX Co., Ltd.

- Medicines360

- Mayer Laboratories, Inc. (Kimono)

- SMB Corporation of Malaysia

- DKT International

- Unipath Ltd. (SPD)

- Sebela Women's Health Inc

The global contraceptive devices market in 2025 is a dynamic blend of well-established pharmaceutical powerhouses and up-and-coming regional players. Big names like Bayer and Johnson & Johnson are at the forefront, boasting diverse product lines that include IUDs, implants, and vaginal rings. Manufacturers from countries like India and Malaysia are stepping up with cost-effective options aimed at growing populations. Many companies are forming strategic partnerships with governments, investing in digital health to help patients stick to their regimens, and looking to expand into emerging markets.

Here is a list of key players operating in the market:

Recent Developments

- In February 2025, Sebela Women's Health attained FDA approval for its hormone-free copper intrauterine system (IUS), MIUDELLA. designed to prevent pregnancy for up to three years and features a flexible nitinol frame with a reduced copper dose, making it a next-generation, low-dose option.

- In September 2024, CooperSurgical launched a new inserter designed for the single-hand placement of FDA-approved Paragard. This marked a milestone for the company in the innovation portfolio of the market’s leading hormone-free contraceptive by offering more than a 99% efficacy rate.

- Report ID: 3835

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Contraceptive Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.