Sexually Transmitted Disease Testing Market Outlook:

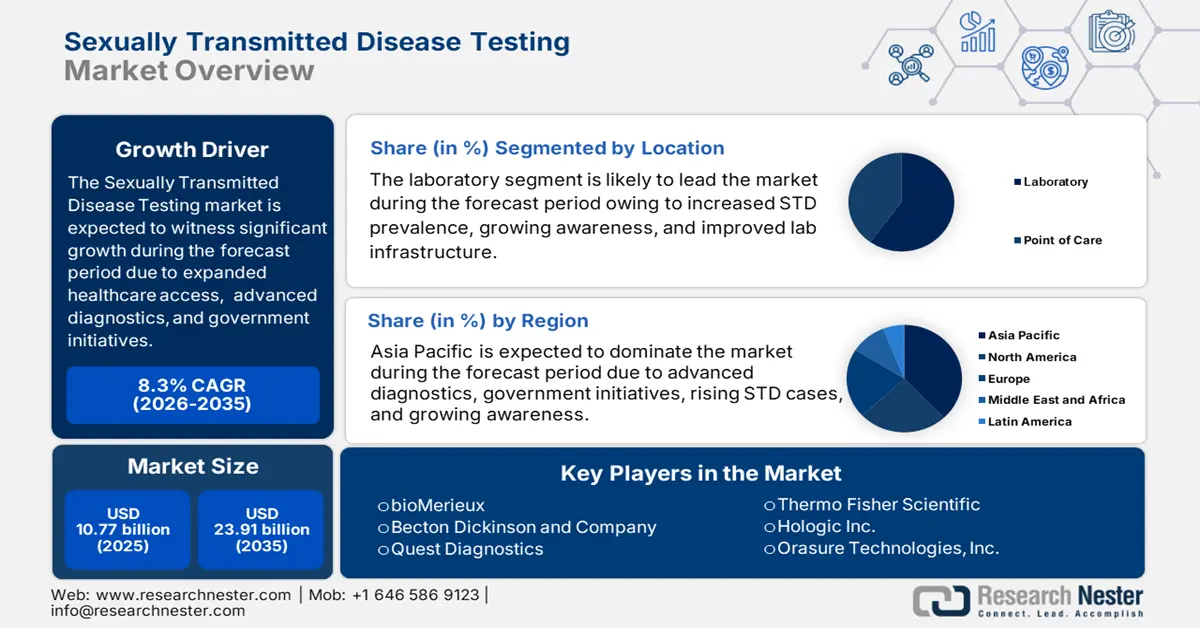

Sexually Transmitted Disease Testing Market size was valued at USD 10.77 billion in 2025 and is likely to cross USD 23.91 billion by 2035, expanding at more than 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sexually transmitted disease testing is assessed at USD 11.57 billion.

An increase in cases of sexually transmitted diseases (STDs) in the younger adult population, followed by unprotected sex and a lower level of awareness about safe sex in younger adults, are expected to increase the transmission of diseases. Hence, it is anticipated to boost the growth of the global market. As per the data reported, every 1 in 4 teens gets infected by STD every year around the globe.

The rise in sexual crimes against women has accelerated the transmission of sexually transmitted infections among women. Rape, sexual molestation, and assault against women are expected to increase sexually transmitted diseases, which are projected to bring lucrative growth opportunities. According to the United Nations, globally, 736 million women, at least once in their lifetime have experienced sexual intimate partner violence, non-partner violence, or both. Furthermore, a higher number of people working as sex workers, insurance covering the treatment of STDs, and increased cases of STDs are propelling the growth of the global STD Testing Market. Moreover, HIV remains a significant public health concern around the world. Therefore, the goal of testing is to identify individuals that are suffering from the STD, so that it cannot be transferred to a healthy person. In the United Kingdom, for instance, the National Chlamydia Screening Program (NCSP) was launched in March 2022. The project's primary objective is to decrease the threat of undiagnosed chlamydia infection.

Key Sexually Transmitted Disease Testing Market Insights Summary:

Regional Highlights:

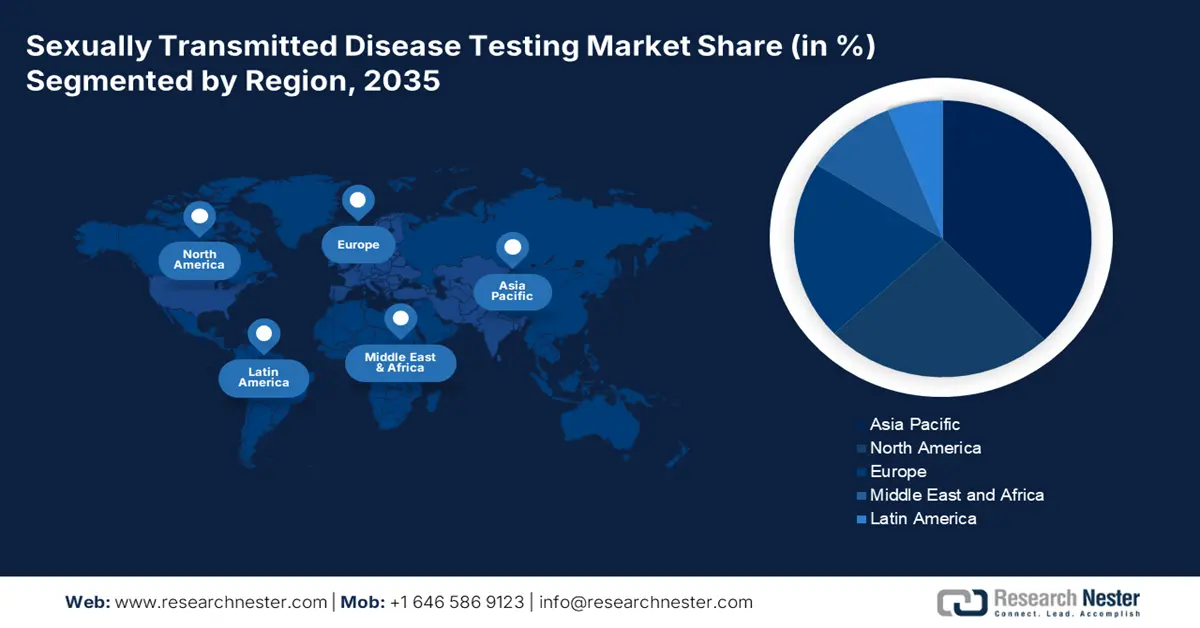

- The Asia Pacific sexually transmitted disease testing market holds the largest share by 2035, driven by increasing STDs linked to sexual crimes and lack of sex education.

- The North America market will achieve the fastest growth from 2026 to 2035, attributed to the increased STD incidence and stronger healthcare awareness.

Segment Insights:

- The chlamydia segment in the sexually transmitted disease testing market is projected to achieve the highest market share by 2035, fueled by the high incidence rates of chlamydia and increased awareness about its treatment.

- The laboratory segment in the sexually transmitted disease testing market will hold the highest market share, driven by the precision, reliability, and widespread trust in laboratory-based STD testing, forecast year 2035.

Key Growth Trends:

- Insurance Policy for STD Testing and Treatment

- Rise in Global Population of Young Adults

Major Challenges:

- Social Stigma Sticked with Sexually Transmitted Diseases

- Higher Cost of Systems Required for STD Detection

Key Players: Abbott Laboratories, bioMerieux, Becton Dickinson and Company, Quest Diagnostics, Thermo Fisher Scientific, Hologic Inc., Orasure Technologies, Inc., S&P Global, DiaSorin Molecular LLC.

Global Sexually Transmitted Disease Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.77 billion

- 2026 Market Size: USD 11.57 billion

- Projected Market Size: USD 23.91 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Sexually Transmitted Disease Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Insurance Policy for STD Testing and Treatment - In many cases, health insurance companies offer urgent care STD testing. As a result, patients with limited financial resources are expected to benefit from these policies, which are estimated to contribute to market growth. For instance, the Affordable Care Act (ACA) requires that most private insurance plans and public health coverage projects, such as Medicaid, encompass STI screening and counseling at no cost.

-

Rise in Global Population of Young Adults - Young adults are generally more curious, both sexually and socially active. As a result, their broadened mentality leads them to engage sexually with more partners, therefore, they are more susceptible to STDs. This trend is expected to fuel the STD Testing Market growth over the forecast period. By the statistics of the WHO, globally one in 20 young people catches STD each year. The rate is higher among the age group of 20-24 years.

- Alarming Elevation in the Number of Rape Cases and Sexual Harassment - According to the WHO, every 1 in 3 women experience sexual violence at least once in their lifetime worldwide.

- Rising Prevalence of Sexually Transmitted Disease (STD) - Cases of sexually transmitted is rising owing to people's active sexual life, choices of multiple partners and not using contraceptives. According to a World Health Organization report released in November 2021, over 1.0 million sexually transmitted infections are obtained globally, with the majority of them being asymptomatic. It also stated that approximately 374.0 million new infections with one of four sexually transmitted infections occurring annually: gonorrhea, chlamydia, trichomoniasis, and syphilis. As a consequence of the growing frequency and prevalence rate of sexually transmitted diseases around the world, the requirement for STD diagnostics is anticipated to rise, expanding market growth during the forecast period.

Challenges

-

Social Stigma Sticked with Sexually Transmitted Diseases - There is a huge share of the population, that hesitates to talk about sex or go for STD testing and treatment. Sexually transmitted disease is proven to be a common disease, despite the social stigma surrounding STDs, still exists. Even after the rise in the educated population, people have a false notion about sex or sex-related problems. Therefore, the rising social stigma is expected to hinder market growth.

-

Higher Cost of Systems Required for STD Detection

- Inaccurate Result by Detection Systems

Sexually Transmitted Disease Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 10.77 billion |

|

Forecast Year Market Size (2035) |

USD 23.91 billion |

|

Regional Scope |

|

Sexually Transmitted Disease Testing Market Segmentation:

Disease Segment Analysis

The global sexually transmitted disease testing market is segmented and analyzed for demand and supply by disease into human immunodeficiency virus, herpes simplex virus, human papillomavirus, chlamydia, syphilis, gonorrhea, cancroid, and others. Out of these, the chlamydia segment is expected to garner the highest revenue by the end of 2035. This can be attributed to the higher instances of chlamydia in the younger population owing to unprotected sex and in adults owing to involvement with different partners. Furthermore, there has been surging awareness related to chlamydia treatment, that is further predicted to boost the segment’s growth in the market. According to the World Health Organization, in 2020 there was nearly 129 million instances of chlamydia around the world. The Center for Disease Control and Prevention reported a total of 1,808,703 cases of chlamydia in 2019.

Location Segment Analysis

The STD Testing Market is segmented by location into laboratory and point of care. Out of these, the laboratory segment is expected to garner highest revenue, as laboratories are the most commonly used place for assessing Sexually Transmitted Diseases (STDs) worldwide. The blood screening is performed in laboratories with proper care in order to give correct results, and it is predicted to surge the segment’s growth in the market. Moreover, laboratory tests are precise and trustworthy, their use is widespread, and people place more faith in them, that is further anticipated to surge the segment’s growth in the market. Abbott laboratories provide an in vitro reverse transcription-polymerase chain reaction (RT-PCR) test and an in vitro polymerase chain reaction (PCR) assay for the identification of sexually transmitted diseases induced by Chlamydia trachomatis, Trichomonas vaginalis, and Mycoplasma genitalium, including gonorrhea. Correspondingly, Qiagen Inc. offers a diverse selection of screening test kits, along with STI assessments for Chlamydia trachomatis (CT) and Neisseria gonorrhoeae (NG) infections with significant clinical sensitiveness and specificity, that are utilized to identify a variety of sexually transmitted diseases. More product introductions enable laboratories to configure devices or machinery as needed. For instance, with European Commission authorization, Qiagen Inc. released the NeuMoDxHSV 1/2 Quant Test for the measurement and distinction of herpes simplex virus type 1 (HSV-1) DNA and/or herpes simplex virus type 2 (HSV-2) in May 2022. These factors, as a result, are anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Disease |

|

|

By Location |

|

|

By Device |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sexually Transmitted Disease Testing Market Regional Analysis:

APAC Market Insights

The Asia Pacific STD Testing Market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. This can be attributed to the rising crimes related to sexual harassment in the region are increasing the chances of sexually transmitted disease along with the rising population, and the lack of sex education. In 2021, nearly 86 daily rapes and around 50 sexual crimes against women have been reported every hour in India. Moreover, in Thailand, the population of sex workers is around 250,000 to 2 million. Additionally, in 2021, over 20,000 deaths were caused by STDs in China, and nearly 20 thousand people died of AIDS.

North American Market Insights

On the other hand, the STD Testing Market in North America region is also expected to have a fastest growth owing to the increased incidence of STDs in the region. Moreover, there has been rising number of a substantial of clinical organizations and increased disease consciousness, that is anticipated to drive the market’s growth in the North American region. A survey released in April 2022 by the Centers for Disease Control and Prevention (CDC) titled "Sexually Transmitted Disease Surveillance, 2020" asserted that STDs persist as a major public health issue in the nation. Based on the same source, Chlamydia trachomatis disease was the highest common reportable sexually transmitted infection in the United States in 2020, with 1,579,885 people infected as per the CDC.

Sexually Transmitted Disease Testing Market Players:

- Abbott Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- bioMerieux

- Becton Dickinson and Company

- Quest Diagnostics

- Thermo Fisher Scientific

- Hologic Inc.

- Orasure Technologies, Inc.

- S&P Global

- DiaSorin Molecular LLC.

Recent Developments

- Quest Diagnostics has announced the release of three new sexually transmitted disease laboratory test packages that are easy to operate and are accessible to consumers digitally.

- Abbott announced an agreement with Johns Hopkins University, the University of Missouri-Kansas City (UMKC), the National Institute of Allergy and Infectious Diseases (NIAID), and the Universite Protestante au Congo (UPC), which resulted in the identification of a group of rare HIV carriers in a patient who had no symptoms.

- Report ID: 4461

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sexually Transmitted Disease Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.