Global Gluten-Free Food Market

- An Outline of the Global Gluten-Free Food Market

- Market Definition

- Market Segmentation

- Industry Overview

- Assumptions & Abbreviations

- Research Methodology & Approach

- Research Process

- Primary Research

- Manufacturers

- End Users

- Secondary Research

- Market Size Estimation

- Summary of the Report for Key Decision Makers

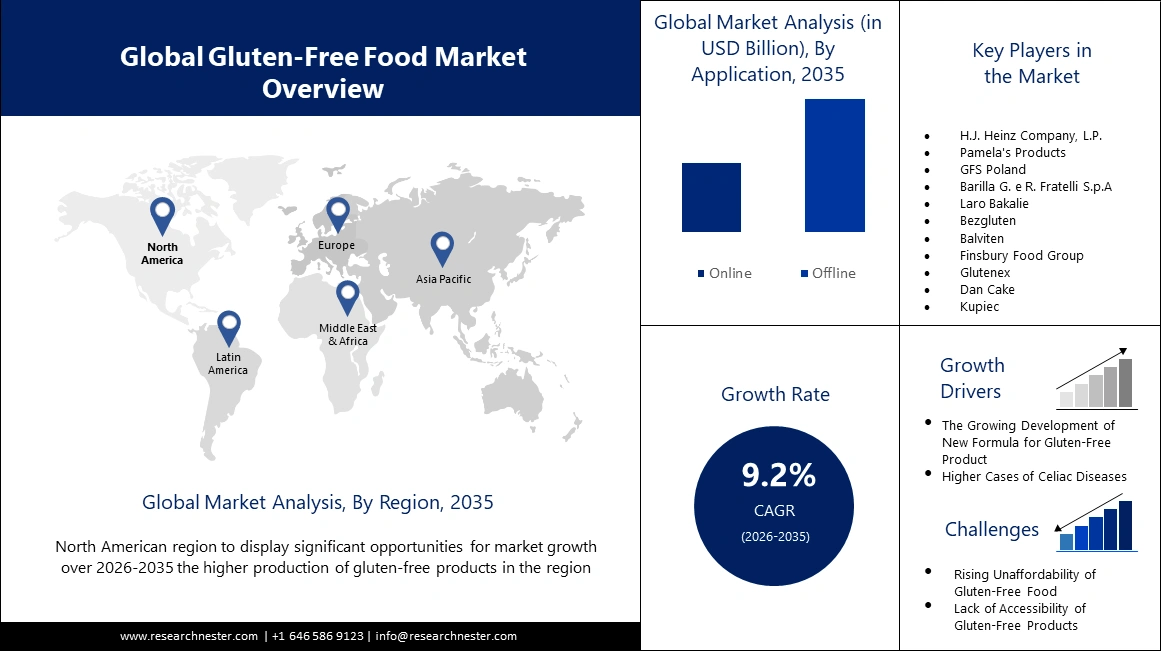

- Forces of Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

- Key Market Opportunities for Business Growth

- Major Roadblocks for the Market Growth

- Decarbonization Strategy and Carbon Credit Benefits for Market Players

- Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

- Measures taken by Countries to Reduce Carbon Footprints

- Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

- Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

- Demand Impact on the Companies Opting for Carbon Credits

- Government Regulation: How They Would Aid Business?

- Industry Risk Analysis

- Impact of Recession on the Global Economy

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Gluten-Free Food Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Regional Demand Analysis

- Industry Value Chain Analysis

- Outlook

- Analysis on Ongoing Trends in Gluten-Free Foods Market

- Consumer Buying Behavior Analysis

- Porter’s Five Forces Analysis

- Pricing Analysis

- Competitive Positioning: Strategies to Differentiate a Company from Its Competitor

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share (2022)

- Business Profile of Key Enterprise

- Amy's Kitchen, Inc.

- Bob’s Red Mill Natural Foods

- Dr. Schär AG/Spa

- Conagra, Inc.

- Genius Foods

- H.J. Heinz Company, L.P.

- Pamela's Products

- GFS Poland

- Barilla G. e R. Fratelli S.p.A

- Laro Bakalie

- Bezgluten

- Balviten

- Finsbury Food Group

- Glutenex

- Dan Cake

- Kupiec

- Sonko

- Sante

- Sam Mills

- Dawn Food Products

- Global Gluten-Free Food Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Global Gluten-Free Food Market Outlook & Projections, Opportunity Assessment by Segment, 2022-2035, By Product Type

- Bread Products, Market Value (USD Million) and CAGR, 2022-2035F

- Cookies and Snacks, Market Value (USD Million) and CAGR, 2022-2035F

- Condiments, Seasonings & Spreads, Market Value (USD Million) and CAGR, 2022-2035F

- Pasta & Pizza, Market Value (USD Million) and CAGR, 2022-2035F

- Dairy/Dairy Substitutes, Market Value (USD Million) and CAGR, 2022-2035F

- Flour & Flakes, Market Value (USD Million) and CAGR, 2022-2035F

- Desserts and Sweets, Market Value (USD Million) and CAGR, 2022-2035F

- Drinks and Beverages, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Global Gluten-Free Food Market Segmentation Analysis (2022-2035), By Distribution Channel

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Hypermarket & Supermarket, Market Value (USD Million) and CAGR, 2022-2035F

- Specialty Stores, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Online, Market Value (USD Million) and CAGR, 2022-2035F

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

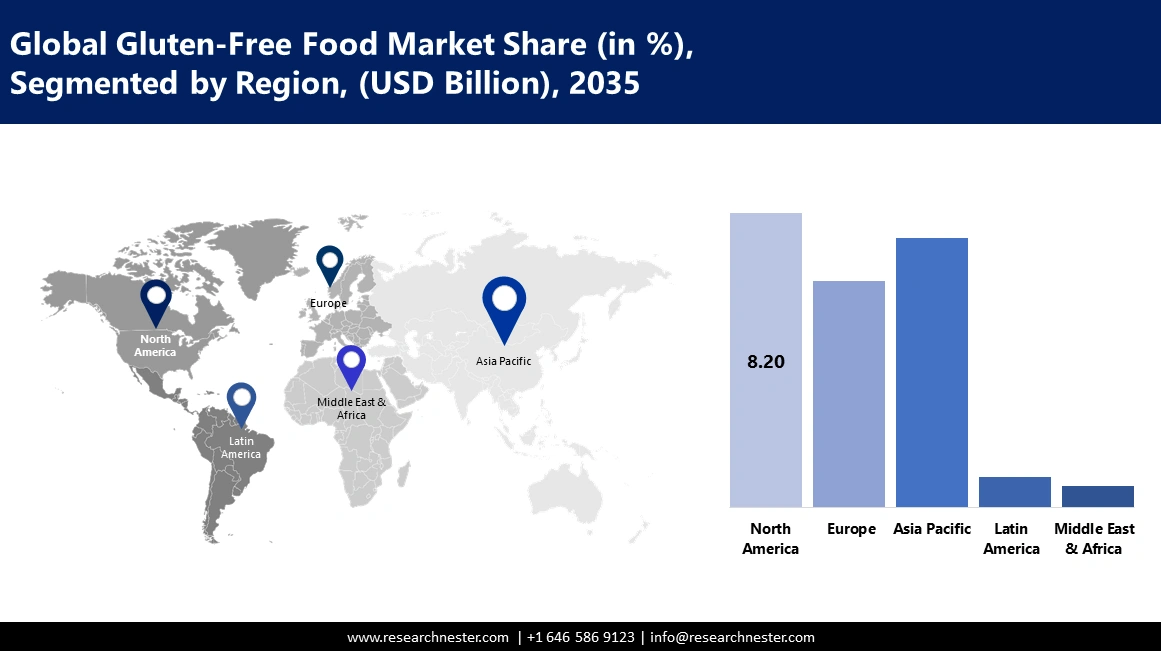

- Global Gluten-Free Food Market Segmentation Analysis (2022-2035), By Geography

- North America, Market Value (USD Million) and CAGR, 2022-2035F

- Europe, Market Value (USD Million) and CAGR, 2022-2035F

- Asia Pacific, Market Value (USD Million) and CAGR, 2022-2035F

- Latin America, Market Value (USD Million) and CAGR, 2022-2035F

- Middle East & Africa, Market Value (USD Million) and CAGR, 2022-2035F

- Cross Analysis of Product Type w.r.t. Distribution Channel (USD Million), 2022

- North America Gluten-Free Food Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- North America Gluten-Free Food Market Outlook & Projections, Opportunity Assessment by Segment, 2022-2035, By Product Type

- Bread Products, Market Value (USD Million) and CAGR, 2022-2035F

- Cookies and Snacks, Market Value (USD Million) and CAGR, 2022-2035F

- Condiments, Seasonings & Spreads, Market Value (USD Million) and CAGR, 2022-2035F

- Pasta & Pizza, Market Value (USD Million) and CAGR, 2022-2035F

- Dairy/Dairy Substitutes, Market Value (USD Million) and CAGR, 2022-2035F

- Flour & Flakes, Market Value (USD Million) and CAGR, 2022-2035F

- Desserts and Sweets, Market Value (USD Million) and CAGR, 2022-2035F

- Drinks and Beverages, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- North America Gluten-Free Food Market Segmentation Analysis (2022-2035), By Distribution Channel

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Hypermarket & Supermarket, Market Value (USD Million) and CAGR, 2022-2035F

- Specialty Stores, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Online, Market Value (USD Million) and CAGR, 2022-2035F

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- North America Gluten-Free Food Market Segmentation Analysis (2022-2035), By Country

- US, Market Value (USD Million) and CAGR, 2022-2035F

- Canada, Market Value (USD Million) and CAGR, 2022-2035F

- Europe Gluten-Free Food Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Europe Gluten-Free Food Market Outlook & Projections, Opportunity Assessment by Segment, 2022-2035, By Product Type

- Bread Products, Market Value (USD Million) and CAGR, 2022-2035F

- Cookies and Snacks, Market Value (USD Million) and CAGR, 2022-2035F

- Condiments, Seasonings & Spreads, Market Value (USD Million) and CAGR, 2022-2035F

- Pasta & Pizza, Market Value (USD Million) and CAGR, 2022-2035F

- Dairy/Dairy Substitutes, Market Value (USD Million) and CAGR, 2022-2035F

- Flour & Flakes, Market Value (USD Million) and CAGR, 2022-2035F

- Desserts and Sweets, Market Value (USD Million) and CAGR, 2022-2035F

- Drinks and Beverages, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Europe Gluten-Free Food Market Segmentation Analysis (2022-2035), By Distribution Channel

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Hypermarket & Supermarket, Market Value (USD Million) and CAGR, 2022-2035F

- Specialty Stores, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Online, Market Value (USD Million) and CAGR, 2022-2035F

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Europe Gluten-Free Food Market Segmentation Analysis (2022-2035) By Country

- Germany, Market Value (USD Million) and CAGR, 2022-2035F

- UK, Market Value (USD Million) and CAGR, 2022-2035F

- France, Market Value (USD Million) and CAGR, 2022-2035F

- Netherlands, Market Value (USD Million) and CAGR, 2022-2035F

- Spain, Market Value (USD Million) and CAGR, 2022-2035F

- Poland, Market Value (USD Million) and CAGR, 2022-2035F

- Rest of Europe, Market Value (USD Million) and CAGR, 2022-2035F

- Asia Pacific Gluten-Free Food Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Asia Pacific Gluten-Free Food Market Outlook & Projections, Opportunity Assessment by Segment, 2022-2035, By Product Type

- Bread Products, Market Value (USD Million) and CAGR, 2022-2035F

- Cookies and Snacks, Market Value (USD Million) and CAGR, 2022-2035F

- Condiments, Seasonings & Spreads, Market Value (USD Million) and CAGR, 2022-2035F

- Pasta & Pizza, Market Value (USD Million) and CAGR, 2022-2035F

- Dairy/Dairy Substitutes, Market Value (USD Million) and CAGR, 2022-2035F

- Flour & Flakes, Market Value (USD Million) and CAGR, 2022-2035F

- Desserts and Sweets, Market Value (USD Million) and CAGR, 2022-2035F

- Drinks and Beverages, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Asia Pacific Gluten-Free Food Market Segmentation Analysis (2022-2035),By Distribution Channel

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Hypermarket & Supermarket, Market Value (USD Million) and CAGR, 2022-2035F

- Specialty Stores, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Online, Market Value (USD Million) and CAGR, 2022-2035F

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Asia Pacific Gluten-Free Food Market Segmentation Analysis (2022-2035), By Country

- China, Market Value (USD Million) and CAGR, 2022-2035F

- India, Market Value (USD Million) and CAGR, 2022-2035F

- South Korea, Market Value (USD Million) and CAGR, 2022-2035F

- Australia, Market Value (USD Million) and CAGR, 2022-2035F

- Rest of Asia Pacific, Market Value (USD Million) and CAGR, 2022-2035F

- Latin America Gluten-Free Food Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Latin America Gluten-Free Food Market Outlook & Projections, Opportunity Assessment by Segment, 2022-2035, By Product Type

- Bread Products, Market Value (USD Million) and CAGR, 2022-2035F

- Cookies and Snacks, Market Value (USD Million) and CAGR, 2022-2035F

- Condiments, Seasonings & Spreads, Market Value (USD Million) and CAGR, 2022-2035F

- Pasta & Pizza, Market Value (USD Million) and CAGR, 2022-2035F

- Dairy/Dairy Substitutes, Market Value (USD Million) and CAGR, 2022-2035F

- Flour & Flakes, Market Value (USD Million) and CAGR, 2022-2035F

- Desserts and Sweets, Market Value (USD Million) and CAGR, 2022-2035F

- Drinks and Beverages, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Latin America Gluten-Free Food Market Segmentation Analysis (2022-2035), By Distribution Channel

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Hypermarket & Supermarket, Market Value (USD Million) and CAGR, 2022-2035F

- Specialty Stores, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Online, Market Value (USD Million) and CAGR, 2022-2035F

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Latin America Gluten-Free Food Market Segmentation Analysis (2022-2035), By Country

- Brazil, Market Value (USD Million) and CAGR, 2022-2035F

- Argentina, Market Value (USD Million) and CAGR, 2022-2035F

- Rest of Latin America, Market Value (USD Million) and CAGR, 2022-2035F

- Middle East & Africa Gluten-Free Food Market Outlook

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (YoY) Growth Trend Analysis

- Middle East & Africa Gluten-Free Food Market Outlook & Projections, Opportunity Assessment by Segment, 2022-2035, By Product Type

- Bread Products, Market Value (USD Million) and CAGR, 2022-2035F

- Cookies and Snacks, Market Value (USD Million) and CAGR, 2022-2035F

- Condiments, Seasonings & Spreads, Market Value (USD Million) and CAGR, 2022-2035F

- Pasta & Pizza, Market Value (USD Million) and CAGR, 2022-2035F

- Dairy/Dairy Substitutes, Market Value (USD Million) and CAGR, 2022-2035F

- Flour & Flakes, Market Value (USD Million) and CAGR, 2022-2035F

- Desserts and Sweets, Market Value (USD Million) and CAGR, 2022-2035F

- Drinks and Beverages, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Middle East & Africa Gluten-Free Food Market Segmentation Analysis (2022-2035),By Distribution Channel

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Hypermarket & Supermarket, Market Value (USD Million) and CAGR, 2022-2035F

- Specialty Stores, Market Value (USD Million) and CAGR, 2022-2035F

- Others, Market Value (USD Million) and CAGR, 2022-2035F

- Online, Market Value (USD Million) and CAGR, 2022-2035F

- Sub-segmented by Offline, Market Value (USD Million) and CAGR, 2022-2035F

- Middle East & Africa Gluten-Free Food Market Segmentation Analysis (2022-2035), By Country

- GCC, Market Value (USD Million) and CAGR, 2022-2035F

- Israel, Market Value (USD Million) and CAGR, 2022-2035F

- Rest of Middle East & Africa, Market Value (USD Million) and CAGR, 2022-2035F

Gluten-free Food Market Outlook:

Gluten-free Food Market size was over USD 10.2 Billion in 2025 and is poised to exceed USD 24.59 Billion by 2035, growing at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gluten-free food is estimated at USD 11.04 Billion.

The growth of the gluten-free food market is due to demand for products is anticipated to be driven by the increased incidence of disorders like celiac and others brought on by bad lifestyle choices. As mentioned by National Library of Medicine; 275,818 people had a 1.4% pooled global prevalence of celiac disease, according to test findings showing positive for tissue transglutaminase and/or endomysial antibodies.

Key Gluten-free Food Market Insights Summary:

Regional Highlights:

- The North America gluten-free food market will hold over 37% share by 2035, attributed to increasing awareness of digestive benefits and celiac disease.

- The Asia Pacific market will achieve significant growth during the forecast timeline, driven by favorable demographics and increasing internet usage.

Segment Insights:

- The bakery products segment in the gluten-free food market is projected to hold a 30% share by 2035, fueled by growing awareness of healthy eating including gluten-free options.

- The supermarkets & hypermarkets segment in the gluten-free food market is projected to exhibit lucrative growth over 2026-2035, attributed to large customer bases and nationwide distribution increasing product sales.

Key Growth Trends:

- Growth in the market for gluten-free goods

- Growing knowledge of food allergies to gluten

Major Challenges:

- Growth in the market for gluten-free goods

- Growing knowledge of food allergies to gluten

Key Players: The Kraft Heinz Company, WK Kellogg Co, General Mills Inc., PepsiCo, Chobani, LLC., Premier Foods Group Limited., Danone S.A., The Hain Celestial Group, Inc., Conagra Brands, Inc., Dr. Schär AG / SPA.

Global Gluten-free Food Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.2 Billion

- 2026 Market Size: USD 11.04 Billion

- Projected Market Size: USD 24.59 Billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Italy, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Gluten-free Food Market Growth Drivers and Challenges:

Growth Drivers

-

Growth in the market for gluten-free goods - Due in large part to consumer knowledge of health concerns and dietary choices related to gluten, the market is expanding as a result of the food industry's increased demand for gluten-free goods. The market can grow to suit a greater consumer base searching for gluten substitutes for lifestyle and health-related reasons as more food manufacturers provide gluten-free products. Of those surveyed, 18% had gone gluten-free in less than a year. 15% over a two-year period. 21% over a period of three to five years. Of them, 24% had given up gluten ten years ago.

-

Growing knowledge of food allergies to gluten - Growing awareness of gluten-related sensitivity presents a significant opportunity in the global gluten-free food market. The demand for gluten-free products is rising as more people become aware of celiac disease and gluten intolerance.

In the general population, the prevalence of celiac disease ranges from 0.5% to 1%. Food producers may now offer more items in this particular market and reach a larger audience thanks to this knowledge. It promotes innovation and the development of safer, gluten-free food products, creating opportunities for market diversification and growth. - Utilizing microencapsulation technology to extend the shelf life of goods free of gluten - Gluten proteins are in charge of controlling and holding onto moisture in traditional gluten-containing foods and food items, giving the latter a longer shelf life. But, in order to meet the growing demand of end users worldwide, items that are made gluten-free typically have a shorter shelf life and, most of the time, lose their appealing texture.

In addition, producing a range of gluten-free products that improve moisture retention and shelf life is a challenge for the major companies. To achieve the intended shelf-life, they thus need ongoing research and development as well as the integration of newer technology.

One such modern technique that can help producers reach this objective of extending the texture and shelf life of their assortment of gluten-free goods is microencapsulation. The same technique has been used to extend the shelf life of frozen and refrigerated dough, frozen biscuit dough, scoop and bake frozen muffins, and biscuits. 38% of those who eat frozen meals do it either everyday or every few days.

Challenges

-

Insufficient knowledge about celiac disease - Because celiac disease is often misdiagnosed, fewer people actively look for products that are gluten-free. There is still unrealized potential in the market because many people who suffer from health issues associated to gluten may not even be aware of their condition. This ignorance may restrict the uptake of gluten-free goods and hinder market expansion, which would restrict the expansion of the sector.

-

Manufacturers encounter formulation problems - It is quite challenging to convert a customer to a gluten-free dietary regimen. For a variety of reasons, including differences in texture, flavor, and taste, most people find it difficult to adjust to. This poses a serious problem for a number of important participants in the global gluten-free food market.

The main competitors in the market for gluten-free products are faced with the problem of creating a product that tastes, feels, and is as appetizing as traditional gluten-containing items. This is due to a number of issues, one of which is that it can be challenging to employ substitute ingredients and get them to function similarly to those in the original product.

Gluten-free Food Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 10.2 Billion |

|

Forecast Year Market Size (2035) |

USD 24.59 Billion |

|

Regional Scope |

|

Gluten-free Food Market Segmentation:

Product Segment Analysis

Bakery products segment is expected to account for gluten-free food market share of around 30% by 2035. The expansion of this market is expected to be driven by the growing awareness of healthy eating, which includes natural, organic, and gluten-free meals. Furthermore, it is anticipated that having a varied product line and continuous innovation would have a favorable impact on market expansion in the years to come. The main element behind the expansion of the bakery product segment is the rising demand for gluten-free bread.

Packaged bread manufacturers, most notably Warburtons, the leading player in the UK, are creating healthier versions of its trademark brands to cater to the growing demand. These versions are gaining popularity among consumers across all income levels. With over a 52% revenue share in the bakery business in 2019, bread remained the market leader.

Distribution Channel Segment Analysis

Supermarkets & hypermarkets segment in the gluten-free food market is estimated to register lucrative growth till 2035. Supermarkets and hypermarkets make it simple for customers to select products from a wide selection because they offer a variety of goods under one roof. Gluten-free items are part of seasonally driven displays that help to promote new products and ultimately accelerate segment growth.

Having a single, sizable customer base simplifies operations for supermarkets, which is advantageous when opposed to having multiple smaller, independent clients. Supermarkets and hypermarkets have huge sales volumes because they have access to a large consumer base. Additionally, nationwide distribution increases brand recognition for products, which boosts sales volumes.

In addition, the supplier gains from a contract with large supermarkets as they look for funding for product development. Because of this, producers of these goods favor selling through hypermarkets and supermarkets, which increases penetration. The National Retail Federation reports that as of 2021, Kroger Co. had 2,874 locations across the country.

Our in-depth analysis of the market includes the following segments:

|

Product |

|

|

Form |

|

|

Source |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gluten-free Food Market Regional Analysis:

North America Market Insights

North America region in gluten-free food market is likely to dominate revenue share of over 37% by 2035. The market growth in the region is also expected because foods without gluten are said to be less fatty, decrease cholesterol, and soothe digestive issues. According to National Library of Medicine; digestive disorders were a factor in over 126 million ambulatory care visits, 41 million ER visits, 16 million hospital discharges, and 472,000 deaths in the US population per year.

It is anticipated that their widespread availability at almost all grocery stores will increase demand, especially in the United States. With more people becoming aware of celiac disease, the U.S. market is probably going to rise. Celiac disease affects an estimated 1 in 133 Americans, or 1% of the total population.

APAC Market Insights

Asia Pacific region is set to witness significant growth till 2035. The regional market is showing signs of promise due to variables like favorable demographics, a burgeoning online retail, and an increasing rate of internet usage. In 2022, the Asia-Pacific region's internet user base skyrocketed to over 2.6 billion.

The growing popularity of gluten-free products in China is fueled by a shift in the country's eating habits toward processed foods and higher disposable incomes. China imported processed foods and beverages worth about 126.1 billion Canadian dollars in 2020, up from roughly 107.3 billion Canadian dollars the year before.

Japan's commitment to culinary perfection and the skill of satisfying even the most discerning palate is evident in its gluten-free products, which range from the creative accuracy of a gluten-free mochi confection to the delicate balance of flavors in a miso soup. The global dairy company Lactalis has sold a firm that specialized in gluten-free nutrition to Otsuka Pharmaceutical subsidiary Nutrition & Santé, which produces and sells functional meals and nutrition products.

Food producers and businesses in Korea have been putting a lot of effort into innovating and enhancing their gluten-free product offerings. They have made it easier for consumers to maintain a gluten-free diet without sacrificing flavor by creating unique and delicious gluten-free versions of traditional Korean dishes including rice cakes, noodles, and snacks. A July 2022 poll by Opensurvey in South Korea revealed that approximately 78% of participants in their sixties regularly ate health-promoting meals.

Gluten-free Food Market Players:

- The Kraft Heinz Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- WK Kellogg Co

- General Mills Inc.

- PepsiCo

- Chobani, LLC.

- Premier Foods Group Limited.

- Danone S.A.

- The Hain Celestial Group, Inc.

- Conagra Brands, Inc.

- Dr. Schär AG / SPA

The market is extremely competitive due to the large number of multinational corporations operating in major economies. Most of the businesses that produce gluten-free products are vertically integrated.

Recent Developments

- Chobani Greek Yogurt Spiced Holiday Nog, a creamy holiday yogurt with warming spices, is a new seasonal taste from Chobani LLC. This limited-edition yogurt included probiotics, calcium, and protein along with all-natural ingredients free of artificial flavors.

- The Hain Celestial Group, Inc. redefined snacking with the introduction of Flavor Burst Nacho Cheese and Zesty Ranch Flavored Tortilla Chips with the flavor of crunchy maize and vibrant vegetables. The chips, which came in five veggie varieties, were verified to be free of artificial flavors and preservatives, non-GMO, and gluten.

- Report ID: 5362

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gluten-free Food Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.