Microencapsulation Market Outlook:

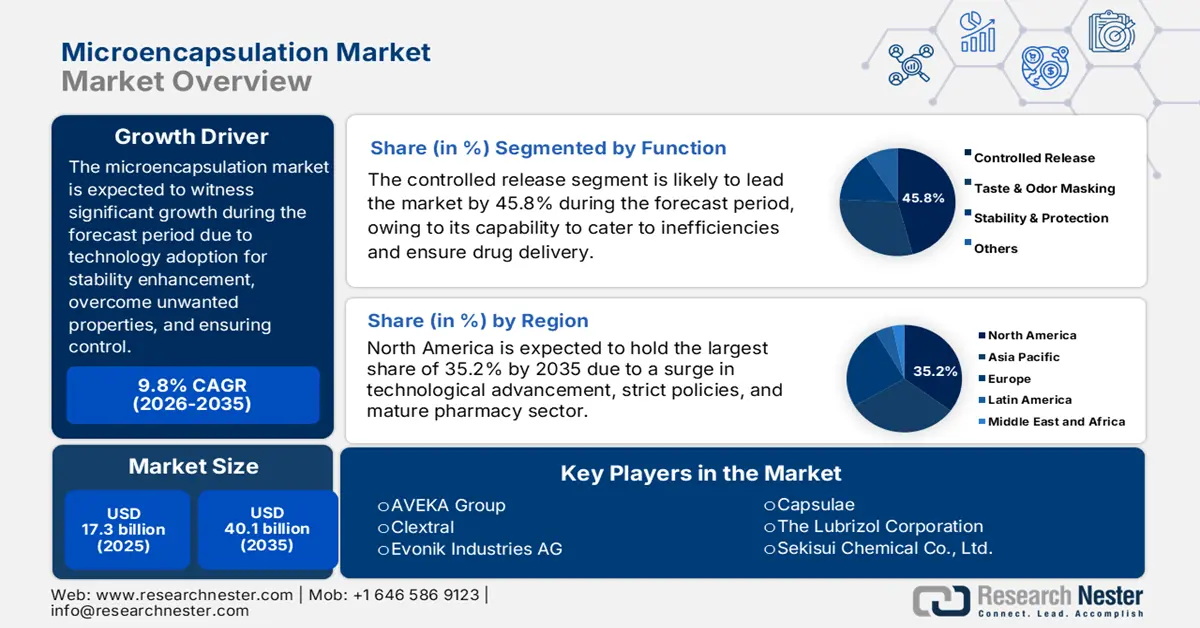

Microencapsulation Market size was over USD 17.3 billion in 2025 and is estimated to reach USD 40.1 billion by the end of 2035, expanding at a CAGR of 9.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of microencapsulation is evaluated at USD 19 billion.

The international microencapsulation market is considered a high-growth and sophisticated segment within advanced materials, which are characterized by the technology of enclosing active substances within capsules to enhance stability, mask undesirable properties, and control their release. Besides, according to an article published by Materials Today Sustainability in June 2024, the worldwide biodegradable plastic sector is valued at USD 4.1 billion, which is expected to increase to 97%, thus bolstering the market’s growth. Besides, the overall packaging industry is projected to grow by more than 3% by the end of 2028, which will reach USD 1.2 trillion. Meanwhile, the overall plastic business approximately contributes 19% of the carbon budget, which is required to meet the 1.5-degree Celsius goal, while polyethylene and polypropylene represent 40% of total materials, thereby denoting an optimistic outlook for the overall market’s development.

Furthermore, the aspect of innovation in manufacturing technologies, the rise in smart and multi-functional capsules, and tactical partnerships and consolidation are other factors that are also driving the microencapsulation market globally. As per a report published by the World Manufacturing Organization in 2024, the international diversification of severe supply chains has boosted foreign investments for setting semiconductor manufacturing centers in Malaysia. This comprises a generous investment of USD 13.5 billion as of 2023. Likewise, China has initiated USD 1 billion investment with Canada to significantly mine Argentina’s lithium reserves to ensure green technologies manufacturing. Besides, as stated in the December 2024 European Journal of Pharmaceutical Sciences article, inflammatory bowel disease approximately affects 2.5 million to 3.0 million people in Europe as of 2022, which has enhanced the development of smart capsules, thereby suitable for proliferating the overall market’s growth.

Key Microencapsulation Market Insights Summary:

Regional Insights:

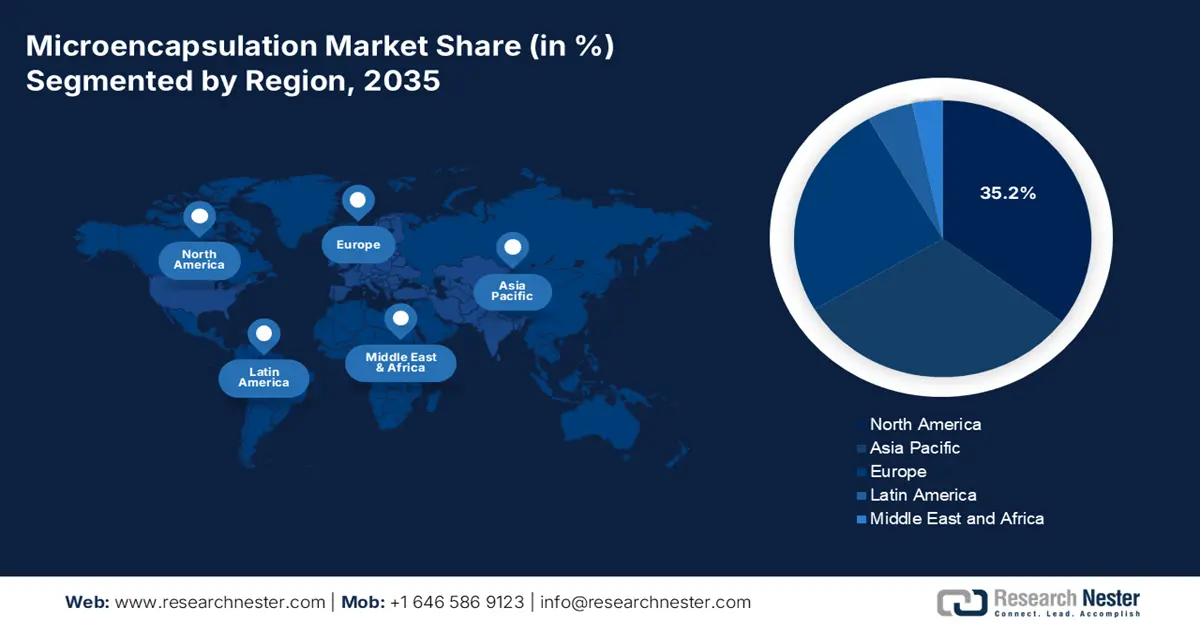

- By 2035, North America in the microencapsulation market is anticipated to capture a 35.2% share, upheld by its technologically advanced pharmaceutical landscape and supportive federal investments.

- Europe is expected to be the fastest-growing region by 2035, owing to its stringent regulatory environment and strong shift toward sustainable material development.

Segment Insights:

- By 2035, the controlled release segment within the microencapsulation market is forecasted to secure a 45.8% share, sustained by its efficacy in addressing inefficiencies across high-value sectors.

- The pharmaceuticals and nutraceuticals sub-segment is projected to account for the second-largest share by 2035, impelled by increasing demand for enhanced efficiency, patient experience, and product stability.

Key Growth Trends:

- Increased demand for targeted drug delivery

- Expansion in functional food

Major Challenges:

- Increased production expenses and scalability issues

- Environmental scrutiny and regulatory hurdles

Key Players: BASF SE (Germany), Syngenta Group (Switzerland), Royal FrieslandCampina N.V. (Netherlands), Givaudan SA (Switzerland), DSM-Firmenich AG (Switzerland), International Flavors & Fragrances Inc. (IFF) (U.S.), Corbion N.V. (Netherlands), Lycored Corp. (Israel), Balchem Corporation (U.S.), Koei Chemical Co., Ltd. (Japan), Encapsys, LLC (U.S.), Microtek Laboratories, Inc. (U.S.), AVEKA Group (U.S.), Clextral (France), Evonik Industries AG (Germany), Capsulae (France), The Lubrizol Corporation (U.S.), Sekisui Chemical Co., Ltd. (Japan), Ronald T. Dodge Company (U.S.), Matsumoto Yushi-Seiyaku Co., Ltd. (Japan).

Global Microencapsulation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.3 billion

- 2026 Market Size: USD 19 billion

- Projected Market Size: USD 40.1 billion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Canada, Australia

Last updated on : 26 November, 2025

Microencapsulation Market - Growth Drivers and Challenges

Growth Drivers

- Increased demand for targeted drug delivery: The pharmaceutical sector’s transition towards personalized therapies and medicine with lowered side effects is a primary driver for the microencapsulation market. This has fueled investments in sophisticated encapsulation methods for targeted and controlled drug release. According to an article published by NLM in June 2023, an estimated 30% of comprehensively marketed medicinal entities, along with almost 50% of advanced drug compounds accessible for product manufacture, are considered hydrophobic in nature. Besides, the use of a liquid-specific carrier system is suitable for boosting the bioavailability of low water-soluble medications, which has successfully gained popularity in recent years. Therefore, with the presence of such drug delivery systems, there is a huge growth opportunity for the microencapsulation market across different nations.

- Expansion in functional food: The rise in customer health awareness is readily propelling the need for fortified beverages and food, wherein the microencapsulation market is essential for protecting sensitive bioactive ingredients. This includes protection for probiotics and Omega-3s from masking off-tastes and degradation. Besides, as stated in the 2022 NITI Aayog article, fortified rice has the tendency to diminish the risk of iron deficiency by 35% and enhance the average concentration of hemoglobin by nearly 2 g/L. In addition, it has a positive impact on functional outcomes and ensures a 34% reduction in anemia from improved iron intake, 74% reduction from goiter, and 41% from neural tube defects. Meanwhile, the continuous supply chain of micro-organism culture preparations, particularly for probiotics, is also uplifting the microencapsulation market internationally.

2023 Micro-Organism Culture Preparation Export and Import

|

Countries/Components |

Export (USD) |

Import (USD) |

|

U.S. |

1.0 billion |

293 million |

|

France |

432 million |

- |

|

UK |

357 million |

- |

|

Netherlands |

- |

308 million |

|

China |

- |

293 million |

|

Global Trade Valuation |

3.4 billion |

|

|

Global Trade Share |

0.01% |

|

|

Product Complexity |

1.0 |

|

Source: OEC

- Customer need for enhanced product performance: In personal and household care, customers demand long-lasting fragrances, advanced product formats, and effective skincare actives, all of which are enabled by the microencapsulation market. According to an article published by NLM in February 2023, the encapsulation efficacy of polymers typically ranges from 27% to 45%. In addition, prepared capsules with hydrophobic vitamins ensure the suitable thermal stability of sensitive molecules for almost 170 degrees Celsius. This eventually enables the standard manufacturing process of functional products. Besides, as stated in the February 2024 NLM article, the chemical process technology for simple condensates constitutes 20 to 200 /µm particle size, along with more than 60% encapsulation rate. Likewise, for spray-drying, the particle size ranges between 1 to 50 /µm as well as over 40% encapsulation rate, all of which is positively impacting the overall microencapsulation market globally.

Challenges

- Increased production expenses and scalability issues: The manufacturing and development of microcapsules demonstrate technical barriers and substantial economic gaps, especially when scaling from laboratory proof-of-concept to industrial-volume production. Besides, progressive encapsulation technologies, such as microfluidics and coacervation, provide superior performance and control, but are extremely expensive and complicated in comparison to basic methods, including spray drying, which in turn is negatively impacting the microencapsulation market. Furthermore, the need for high-purity, frequently specialty, coating polymers is increasing material expenses. This particular cost structure has created an effective barrier for small-scale firms and has limited the adoption of innovative microencapsulation in price-sensitive markets.

- Environmental scrutiny and regulatory hurdles: The administrative landscape for the microencapsulation market, particularly for those utilizing notable materials for environmental release and human consumption, is increasingly strict and complex. In the food and pharmaceutical sectors, the latest encapsulation process or polymer needs extended approval and safety testing from bodies such as EFSA and FDA, which is usually a costly and lengthy process. Moreover, the environmental fate of microencapsulation is experiencing continuous scrutiny, and administrative agencies, including the Europe Chemicals Agency (ECHA), are severely examining the potential and persistence bioaccumulation of non-biodegradable synthetic polymer shells in the environment, which causes a limitation in the market’s growth.

Microencapsulation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 17.3 billion |

|

Forecast Year Market Size (2035) |

USD 40.1 billion |

|

Regional Scope |

|

Microencapsulation Market Segmentation:

Function Segment Analysis

The controlled release segment, which is part of the function, is anticipated to hold the largest share of 45.8% by the end of 2035. The segment’s upliftment is highly attributed to its capability to address severe inefficiencies across different high-value sectors. Besides, in the pharmaceutical industry, this particular technology is considered the cornerstone of innovative drug delivery systems, which has enabled sustained release that can maintain therapeutic drug levels over an expanded duration. This is transformative in agrochemicals, wherein microencapsulated fertilizers and pesticides ensure a controlled and slow diffusion of proactive ingredients. This process can significantly enhance efficiency by aligning release rates with plant uptake or pest life cycles, while simultaneously combating environmental damage by lowering volatilization and leaching, thereby making it suitable for the segment’s growth.

End user Industry Segment Analysis

The pharmaceuticals and nutraceuticals sub-segment, falling under the end user industry segment, is projected to constitute the second-largest share during the predicted period. The sub-segment’s growth is highly driven by an increase in the need for enhanced efficiency, patient experience, and stability. Besides, in pharmaceuticals, the technology is indispensable for creating oral-based formulations for targeted cancer therapies that reduce systemic toxicity, along with stabilizing sensitive biologic drugs. Likewise, in the case of nutraceuticals, it is essential for combating primary challenges of masking unpleasant tastes and protecting fragile vitamins and probiotics from degradation. Moreover, the segment’s growth is highly propelled by the international rise in chronic diseases, consumer proactive health management, and an aging population.

Application Segment Analysis

Based on the application, the pharmaceutical drug delivery segment is expected to account for the third-largest share in the microencapsulation market by the end of the forecast period. The segment’s development is highly fueled by its ability to sustain release and control, reduce dosing frequency, and improve efficiency. It also protects sensitive drugs from degradation, permits targeted delivery, and masks unpleasant tastes, thereby minimizing side effects and boosting patient compliance. According to a data report published by the ASPE Government in December 2024, the U.S. significantly made up to 50% of international sales revenue for prescription drugs as of 2022. In addition, the overall sales valuation increased from USD 582 billion to USD 716 billion, denoting a 23% increase in comparison to 2% surge from other nations, which is driving the drug delivery demand.

Our in-depth analysis of the microencapsulation market includes the following segments:

|

Segment |

Subsegments |

|

Function |

|

|

End user Industry |

|

|

Application |

|

|

Core Material |

|

|

Technology |

|

|

Coating Polymer |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microencapsulation Market - Regional Analysis

North America Market Insights

North America in the microencapsulation market is anticipated to garner the highest share of 35.2% by the end of 2035. The market’s upliftment in the region is highly attributed to the technologically advanced and mature pharmaceutical industry, strict regulatory frameworks for incentivizing safe development, and generous federal investments in advanced manufacturing and materials. According to an article published by the IFPMA in 2025, the combined share of commercial clinical trials has varied in the region, from 28% in 2013 to 23% in 2023. This has resulted in changes in developing vaccines and manufacturing, which is positively impacting the market’s growth in the region. Besides, there have been 75 cross-sector active collaborations in the region between advanced pharmaceutical organizations and their partners, which is also responsible for fueling the market’s expansion.

Historical Commercial Clinical Trials in America (2013-2023)

|

Year |

Trial Prevalence |

|

2013 |

28% |

|

2018 |

26% |

|

2019 |

25% |

|

2020 |

24% |

|

2021 |

23% |

|

2022 |

24% |

|

2023 |

23% |

Source: IFPMA

The U.S. in the microencapsulation market is growing significantly, owing to an increase in the demand for drug delivery to optimize efficiency and diminish side effects, which has created an ongoing pipeline for progressive encapsulation technologies. According to an article published by the EPA Government in February 2025, children's exposure to carbamates decreased by 70%. In addition, tomatoes with detectable organophosphate pesticide residues also reduced from 37% to 9%, which led to the restricting of organophosphates. Therefore, this further resulted in sustainability and regulatory policy, based on which the Environmental Protection Agency (EPA) has readily promoted the Integrated Pest Management (IPM). This is heavily dependent on controlled-release formulations to reduce pesticide volume and environmental impact, which is driving the market’s upliftment in the country.

Canada in the microencapsulation market is also growing due to the strong presence of the public and private research ecosystem, a tactical focus on natural resource valorization, and advanced regulatory frameworks. Besides, as per an article published by the OECD STIP Compass in August 2025, an estimated three-quarters of CIHR's CAD 1.1 billion budget has been utilized to support investigator-based research. This particular fund is offered initially through competitive research grants, including the Project Grant program and the Foundation Grant program. Besides, the remaining one-quarter of the budget actively supports priority-based research strategies, which are designed to cater to specific areas needed. Meanwhile, the presence of massive natural products and the agricultural industry is also driving the microencapsulation market in the country to provide the newest raw commodities.

Europe Market Insights

Europe in the microencapsulation market is projected to emerge as the fastest-growing region, owing to the presence of a strict regulatory environment, along with world-leading cosmetic and pharmaceutical sectors. Additionally, the robust alignment with the Green Deal strategy and its Circular Economy Action Plan has pushed regional industries to create sustainable materials. According to the January 2025 Europe Environment Agency report, the recycled material accounted for 11.8% of materials utilization as of 2023, denoting a surge of 1.1%. Moreover, the region’s circular economy action plan has aimed to reduce natural resources and double its circular material use rate (CMUR). However, the continuous growth in the CMUR from 10.7% to 11.8% in 2023 is also poised to increase waste recycling efforts, which is further driven by Member States to cater to the regional recycling targets.

Germany in the microencapsulation market is gaining increased traction, owing to the existence of tactical government-based partnerships as well as an unparalleled industrial base. Besides, the country’s High-Tech Strategy 2025 directly offers generous grants, particularly for sustainable industry and personalized medicine. As per an article published by the ITA in August 2025, the country’s healthcare expenditure is continuously growing, and employs an estimated 6.1 million people. In addition, the nation’s medical device market accounts for approximately EUR 38 billion (USD 44 billion) in revenue every year, which makes up almost 26.5% of the region’s market. Further, the yearly economic footprint has generated EUR 775 billion (USD 838 billion), which constitutes 12.8% of the country’s gross domestic product (GDP), which in turn is suitable for developing the overall market in the country.

Poland in the microencapsulation market is also developing due to its presence as the tactical manufacturing center, along with significant funding inflows, and an increasingly modernized regional industry. As per an article published by the Research in Poland Organization in 2025, the National Centre for Research and Development tends to perform tasks of the Smart Growth Operational Programme, which has allocated over PLN 50 billion for ensuring effective innovation, along with research and development. Based on this, 56 beneficiaries have successfully received PLN 1.4 billion through the Bridge Alfa Program that comprises NCBR Investment Fund ASI S.A. The yearly investment budget for the fund is more than PLN 100 million, and the valuation of a single investment is PLN 3 million to PLN 64 million, thus extremely suitable for bolstering the market in the country.

APAC Market Insights

The Asia Pacific in the microencapsulation market is expected to grow steadily, owing to the robust mixture of an increase in disposable incomes, huge manufacturing capacity, and tactical government strategies that are pushing industrial upgradation. In addition, the explosive growth of the nutraceutical as well as pharmaceutical sectors, especially in China and India, is continuously growing, wherein encapsulation has become critical for stabilizing cost-effective generic and nutritional drugs. According to a report published by the MOFPI Government in August 2025, the nutraceutical industry in the region is valued at USD 45 billion as of 2024, which is exhibited by an upsurge in expansion, fueled by an increase in health awareness and a modification in dietary patterns. In addition, this accounts for 23% of the regional share, which is positively impacting the overall market’s growth.

The microencapsulation market in China is gaining increased exposure, owing to its enduring legacy of Made in China 2025 industrial policy and the Dual Circulation strategy, both of which have prioritized the development of innovative materials and high-value pharmaceuticals. The Ministry of Industry and Information Technology (MIIT), along with the National Development and Reform Commission (NDRC), offers direct subsidies as well as tax incentives for national innovation in functional and green chemicals. As stated in an article published by the International Review of Economics & Finance in October 2025, the country has successfully covered notable enterprises by utilizing trading mechanisms and quota allocation to gain an average yearly emission reduction of more than 150 million carbon dioxide, thus ensuring both economic and environmental governance efficacy.

The microencapsulation market in India is also growing due to the presence of proactive government policy, huge foreign direct investment, and an increase in the domestic customer market. Besides, the actual cornerstone is the Production Linked Incentive (PLI) Scheme, which is suitable for the food and pharmaceutical processing sectors, directly incentivizing the integration of innovative technologies, such as microencapsulation, to enhance domestic value addition and enhance export. As per an article published by the IBEF Organization in October 2025, the country is projected to triple the petrochemicals and chemicals demand, which is expected to reach USD 1 trillion by the end of 2040. In addition, exports of chemicals effectively reached USD 9,194 million. Meanwhile, the country’s green chemicals industry is anticipated to grow more than 10% and exceed USD 15 billion, thereby suitable for boosting the market.

Key Microencapsulation Market Players:

- BASF SE (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Syngenta Group (Switzerland)

- Royal FrieslandCampina N.V. (Netherlands)

- Givaudan SA (Switzerland)

- DSM-Firmenich AG (Switzerland)

- International Flavors & Fragrances Inc. (IFF) (U.S.)

- Corbion N.V. (Netherlands)

- Lycored Corp. (Israel)

- Balchem Corporation (U.S.)

- Koei Chemical Co., Ltd. (Japan)

- Encapsys, LLC (U.S.)

- Microtek Laboratories, Inc. (U.S.)

- AVEKA Group (U.S.)

- Clextral (France)

- Evonik Industries AG (Germany)

- Capsulae (France)

- The Lubrizol Corporation (U.S.)

- Sekisui Chemical Co., Ltd. (Japan)

- Ronald T. Dodge Company (U.S.)

- Matsumoto Yushi-Seiyaku Co., Ltd. (Japan)

- BASF SE is one of the global leaders in polymer-specific microencapsulation, offering high-performance coating materials, along with tailored solutions for controlled release in pharmaceuticals and agrochemicals. Its expanded research and development focus has driven advancement in functional materials for targeted stability and delivery. Based on these, and as stated in its 2024 annual report, the organization generated €65.3 billion in sales, along with €7.9 billion in EBITDA, 5.1% in ROCE, and €6.9 billion in cash flow from operational activities.

- Syngenta Group extensively utilized microencapsulation to create innovative and environment-based crop protection products, including controlled insecticides and herbicides. This particular technology is central to its approach for optimizing product efficiency while diminishing environmental impact.

- Royal FrieslandCampina has leveraged its dairy expertise and is a pioneer in nutrient delivery by utilizing microencapsulation to mask and protect sensitive ingredients, such as minerals, vitamins, and probiotics, in food and infant nutrition. The company’s proprietary processes ensure bioavailability and ingredient stability in finalized products. Besides, according to its 2024 annual report, the company’s operating profit amounted to EUR 527 million, denoting a rise of 602.7%. In addition, there has been EUR 321 million generated in the net result, along with EUR 12.0 billion in revenue.

- Givaudan SA has readily employed sophisticated microencapsulation technologies to develop stable and long-term fragrances and flavors for consumer goods. This has permitted the controlled release of sensory experiences in products ranging from functional foods to fine perfumery and detergents.

- DSM-Firmenich AG comprises nutritional science with expertise in scent and taste, which makes it a powerhouse in microencapsulation for wellness and health. The organization specializes in masking unpleasant tastes among supplements and fortifying foods with bioactive and protective ingredients.

Here is a list of key players operating in the global microencapsulation market:

The international microencapsulation market is characterized and fragmented by the existence of massive chemical conglomerates and specialized niche players. The top five organizations collectively account for an approximate share ranging between 30% and 35%, with U.S. and Europe-based firms highly dominating the overall landscape. Besides, notable strategies are focused on vertical integration and technological differentiation. Moreover, leading companies are strongly investing in research and development to create innovative delivery systems for environmentally friendly coatings and pharmaceuticals for agrochemicals. Besides, in November 2025, the microencapsulation technology in INNOBIO has readily evolved into its third generation, IMT 3.0, through iterative research-based active ingredients, equipment, and microencapsulating materials. The organization utilizes a multidisciplinary strategy to attack stabilized active ingredients, thereby denoting an optimistic outlook for the microencapsulation market.

Corporate Landscape of the Microencapsulation Market:

Recent Developments

- In November 2024, Xampla and the Quadram Institute jointly secured funding from BBSRC and Innovate UK, with the intention of making advancements in the probiotic microencapsulation technology.

- In September 2024, Calyxia declared that it has raised USD 35 million in a Series B funding round, which was led by Lombard Odier Investment Managers through Bpifrance and its Plastic Circularity Fund.

- In May 2024, FMC Corporation entered into a research-based agreement with AgroSpheres, with the objective of escalating the development and discovery of notable nioinsecticides, which is considered a notable part of its long-lasting tactical plan.

- Report ID: 3862

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microencapsulation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.