Hydrazine Hydrate Market Outlook:

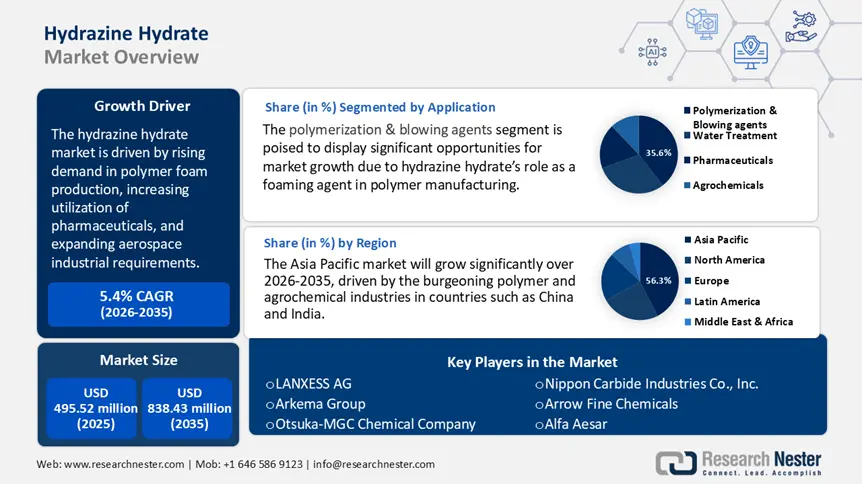

Hydrazine Hydrate Market size was over USD 495.52 million in 2025 and is projected to reach USD 838.43 million by 2035, growing at around 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrazine hydrate is evaluated at USD 519.6 million.

The hydrazine hydrate market is driven by rising demand in polymer foam production, increasing utilization of pharmaceuticals, and expanding aerospace industrial requirements. Its role as a blowing agent and polymerization initiator, along with enhancements in microencapsulation technology, further accelerates its industrial and commercial significance globally. Hydrazine hydrate, a highly reactive and colorless compound, plays a key role in the production of plastic compounds, polymer foam, and rubber.

Its derivatives, such as azodicarbonamide and azobisisobutyronitrile, function as low-temperature blowing agents and polymerization initiators, facilitating the formation of foam structures in materials like polypropylene and polyethylene. This application is especially significant in industries such as electronics, automotives, and footwear, where durable and lightweight materials are necessary. The pharmaceutical industry also contributes to the rising need for hydrazine hydrate. Its colorless nature makes it a preferred choice for the usage in several clinical drugs and pharmaceutical products, improving their efficacy and stability.

Investments in pharmaceutical applications of hydrazine hydrate are anticipated to produce substantial revenue, further accelerating hydrazine hydrate market growth. In April 2024, AB Botek Human Nutrition and Health (HNH) presented adiDAO Microencapsulation technology employs two food-grade protective layers to safeguard the DAO enzymes until they reach the targeted intestinal area, where they are released to aid in the breakdown of dietary histamine. This enhancement not only improves the stability and efficacy of DAO supplements but also facilitates their combination with other functional ingredients, broadening their application in digestive health products. These products underscore the expanding applications of hydrazine hydrate across several sectors, driven by the rising need for high-performance materials, technological innovations, and health supplements.

Key Hydrazine Hydrate Market Insights Summary:

Regional Highlights:

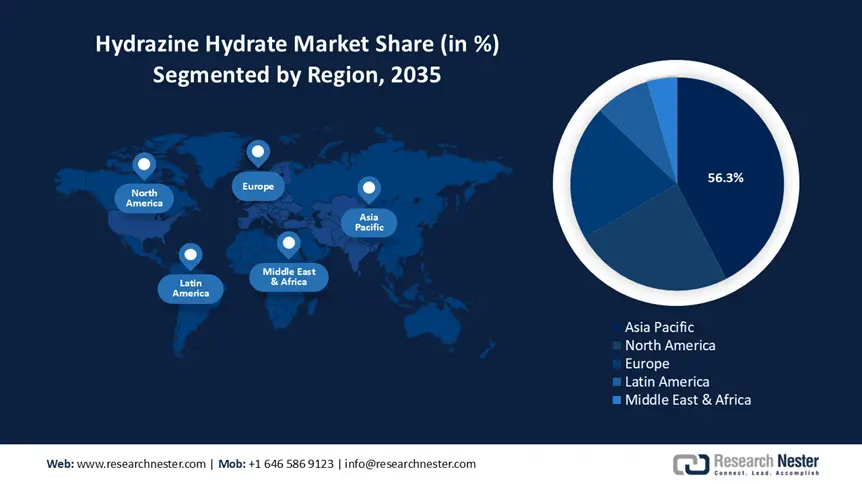

- Asia Pacific commands a 56.3% share in the hydrazine hydrate market, driven by growing polymer and agrochemical industries in China and India, positioning it for significant growth through 2035.

- North America’s hydrazine hydrate market is poised for rapid growth by 2035, attributed to strong chemical industry and R&D investment across pharma, agriculture, and water sectors.

Segment Insights:

- The Polymerization & Blowing Agent segment is anticipated to achieve 35.6% market share by 2035, driven by hydrazine hydrate's effectiveness as a foaming agent in polymer manufacturing for packaging, automotive, and construction.

- The 60-85% Concentration segment is expected to gain significant share from 2026-2035, driven by its balanced reactivity and manageability for aerospace propulsion and polymer foams.

Key Growth Trends:

- Rising demand for polymer foams boosts market growth

- The use of hydrazine hydrate in fuel cells surges market growth

Major Challenges:

- Harmful properties of hydrazine restrict the market growth

- Ecological challenges

- Key Players: LANXESS AG, Arkema Group, Otsuka-MGC Chemical Company, Nippon Carbide Industries Co., Inc., LCG Science Group Holdings Limited, Japan Finechem Inc., Arrow Fine Chemicals.

Global Hydrazine Hydrate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 495.52 million

- 2026 Market Size: USD 519.6 million

- Projected Market Size: USD 838.43 million by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Hydrazine Hydrate Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for polymer foams boosts market growth: Rising demand for polymer foams boosts hydrazine hydrate market growth: The increasing need for hydrazine hydrate in polymer foams is driven by its key role in developing chemical blowing agents like azodicarbonamide. Advancing applications of durable and lightweight foams in the automotive, packaging, and construction sectors, along with rising emphasis on energy efficiency and insulation, are primary factors propelling the requirement for hydrazine hydrate in polymer manufacturing processes.

Manufacturers are actively investing to scale up their hydrazine hydrate production capacities to satisfy the rising demand for the plastic and polymer industries. This trend is strongly supported by the growth of end-users such as construction, packaging, furniture, and bedding, all of which require durable, lightweight, and cost-effective materials like polymer foams. For instance, flexible polyurethane forms generally utilized in vehicle seating and insulation, depend heavily on blowing agents like azodicarbonamide, which is synthesized from hydrazine hydrate.The rising concentration on lightweight material and fuel efficiency in automotive design further propels the usage of polymer foams, thereby accelerating hydrazine hydrate consumption. For instance, Arkema, a global chemical company, uses hydrazine hydrate derivatives in the production of polymer forms. Particularly, Arkema's azo-bis-isobutyronitrile (AZDN or AIBN), derived from hydrazine hydrate, serves as a blowing agent for polyvinyl chloride (PVC) foams and as a polymerization initiator. This application is instrumental in creating durable and lightweight foam materials used across several industries. - The use of hydrazine hydrate in fuel cells surges market growth: The hydrazine hydrate usage in fuel cells is driven by the rising need for low-emission and high-energy alternatives to fossil fuels. Its suitability, high energy density, and portability for aerospace and defense applications make it ideal. Enhanced technologies and clean energy initiatives further propel its appeal in next-generation fuel cell development. Its ability to produce electricity through chemical reactions makes it an especially preferred choice for applications that need lightweight and compact power solutions.

Hydrazine hydrate is used as a monopropellant in rocket propulsion systems, where its decomposition releases substantial energy, facilitating spacecraft maneuvering and satellite thrusters. This application underscores the compound's significance in enhanced energy solutions. For instance, IHI Aerospace has developed hydrazine monopropellant thrusters, with over 900 units, offering thrust capabilities ranging from 1N to 50N. These thrusters are designed for both pulse mode and steady state operations, highlighting hydrazine hydrate’s critical role in enhanced aerospace propulsion systems.

Moreover, the rising adoption of fuel cells in several sectors, driven by the global movement towards sustainable energy sources, is boosting the need for hydrazine hydrate. Its role in fuel cells not only improves energy efficiency but also contributes to minimizing carbon emissions, aligning with international environmental objectives. As industries continue to seek cleaner energy alternatives, the usage of hydrazine hydrate in fuel cells is poised to experience substantial growth.

Challenges

-

Harmful properties of hydrazine restrict the market growth: Hydrazine hydrate market growth is prominently restricted by its hazardous chemical properties. As a highly reactive and unstable compound, it poses considerable safety concerns, especially under specific storage. Its strong decreasing nature makes it risky to handle, and exposure through inhalation can lead to severe health problems such as damage to the liver, lungs, spleen, and thyroid. Furthermore, hydrazine hydrate is categorized as a potential human carcinogen, further restricting its widespread industrial applications. These harmful characteristics increase environmental, safety, and regulatory challenges, thereby constraining its adoption and acting as a major hindrance to hydrazine hydrate market expansion.

- Ecological challenges: Hydrazine hydrate presents prominent ecological challenges due to its carcinogenic and toxic nature. Primarily released into water systems, with smaller quantities penetrating the air and soil, it poses numerous risks to aquatic life and plant ecosystems. Its degradation in water can slow, leading to prolonged environmental contamination under certain conditions. Improper handling, disposal, or transport can result in widespread ecological damage. Although effective mitigation is feasible through strict protocols in storage, waste management, and transport, only a restricted number of manufacturers actively implement these safeguards. This delinquency heightens environmental risks, highlighting the requirement for strict regulatory oversight and reliable manufacturing practices.

Hydrazine Hydrate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 495.52 million |

|

Forecast Year Market Size (2035) |

USD 838.43 million |

|

Regional Scope |

|

Hydrazine Hydrate Market Segmentation:

Application (Water Treatment, Polymerization & Blowing Agents, Agrochemicals, and Pharmaceuticals)

Polymerization and blowing agent segment is set to capture over 35.6% hydrazine hydrate market share by 2035. This prominence is primarily due to hydrazine hydrate’s role as a foaming agent in polymer manufacturing, facilitating the production of polymer foams used across several industries. Furthermore, derivatives such as azobisisobutyronitrile and azodicarbonamide serve as polymerization initiators and low-temperature blowing agents, improving polymer properties such as density and cell structure.

The escalating need for polymer foams in sectors including packaging, automotive, and construction is anticipated to further drive growth in this segment. Otsuka Chemical Co., Ltd., a Japanese company, produces Unifoam AZ, a blowing agent derived from hydrazine hydrate. Unifoam AZ is used to create foamed products in plastics and rubber, thus improving material properties such as weight reduction and insulation. This agent is commonly applied in manufacturing wallpapers, floor materials, and synthetic leather. In water treatment, hydrazine hydrate acts as an effective oxygen scavenger, preventing corrosion in boilers and pipelines. Whereas in agrochemicals, it is utilized to synthesize pesticides and plant growth regulators. Similarly, in pharmaceuticals, hydrazine derivatives serve as intermediates in producing various drugs, including anti-tuberculosis and cancer medications.

By Concentration Level (100%, 60-85%, 40-55%, and 24-35%)

The 60-85% concentration segment is expected to hold a substantial share in the hydrazine hydrate market during the forecast period. This concentration range is preferred for various applications due to its balance between reactivity and manageability. In the pharmaceutical sector, it is used in the synthesis of veterinary drugs. The polymer industry employs this concentration as a blowing agent or initiator in polymerization processes, facilitating the production of foamed plastics and rubber.

Additionally, in aerospace, hydrazine hydrate within this concentration serves as a propellant in emergency power units (EPUs) for aircraft such as the F16 fighter jet and single-engine planes. For instance, Aerojet Rocketdyne, a prominent aerospace and defense company, uses hydrazine hydrate within the 60%-85% concentration range for its rocket propulsion systems. This concentration is favored in aerospace applications due to its high reactivity and efficiency as a propellant. The increasing demand for high-performance rocket engines and space exploration missions has led to notable use of this concentration range in their products. The versatility and efficacy of the 60%-80% concentration level underscore its dominance in the market. Similarly, 40%-55% and 24%-35% of hydrazine hydrate concentration are used in chemical synthesis, corrosion prevention, and low-risk applications.

Our in-depth analysis of the global hydrazine hydrate market includes the following segments:

|

Application |

|

|

Concentration Level |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrazine Hydrate Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific hydrazine hydrate market is estimated to hold revenue share of more than 56.3% by 2035. This dominance is driven by the burgeoning polymer and agrochemical industries in countries such as China and India. The escalating need for polymer foam in the packaging and automotive sectors has significantly contributed to this growth. For instance, polymer foams, produced using hydrazine hydrate as a blowing agent, are extensively utilized in lightweight automotive components to enhance fuel efficiency and reduce emissions.

Furthermore, the agrochemicals sector’s expansion, marked by increased pesticide consumption, has bolstered the need for hydrazine hydrate. For instance, Gujarat Alkalies and Chemicals Limited (GACL), an Indian state-owned enterprise, has commenced the production of hydrazine hydrate at its Dahej facility in Gujarat. The new plant was implemented to produce an annual capacity of 10,000 MTA of hydrazine hydrate is utilized in various industries, including agrochemicals, where it serves as a precursor in the synthesis of pesticides and plant growth regulators, thereby supporting the expanding agriculture sector.

Moreover, government initiatives have also played a key role in this upward trend. In India, efforts to minimize reliance on hydrazine hydrate imports have led to substantial investments in domestic production capabilities, aligning with the ‘Make in India’ initiatives. Similarly, China’s government has emphasized research and development in hydrazine hydrate technologies, aiming to enhance the chemical industry’s competitiveness.

North America Analysis

North America has rapidly emerged as the fastest-growing hydrazine hydrate market, driven by robust chemical industries and substantial research and development investments in the U.S. and Canada. The region’s well-established pharmaceutical, agricultural, and water treatment sectors have significantly contributed to the escalating demand for hydrazine hydrate. In the U.S., in the pharmaceutical industry, hydrazine hydrate is used in the synthesis of active pharmaceutical ingredients (APIs) and various medical compounds. Additionally, in agriculture, it serves as a precursor in the production of pesticides and herbicides, supporting crop protection efforts. For instance, Arkema S.A., a global chemical company with operations in the U.S., produces hydrazine hydrate, which is used in the agrochemical sector for manufacturing products such as herbicides and plant growth regulators.

Furthermore, the water treatment industry also employs hydrazine hydrate as an oxygen scavenger to prevent corrosion in boiler systems. For instance, in Canada, rapid urbanization has further propelled industrial growth, leading to the establishment of numerous manufacturing plants. This industrial expansion has, in turn, increased the need for hydrazine hydrate in applications such as water treatment, where it serves as an effective oxygen scavenger to prevent corrosion in boilers and pipelines. Collectively, these factors have solidified North America’s position as a dominant force in the global hydrazine hydrate market.

Key Hydrazine Hydrate Market Players:

- Lonza Group Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LANXESS AG

- Arkema Group

- Otsuka-MGC Chemical Company

- Nippon Carbide Industries Co Inc.

- LCG Science Group Holdings Limited

- Arrow Fine Chemicals

- Alfa Aesar

- Capot Chemical Co. Ltd

Key players in the hydrazine hydrate market leverage enhanced synthesis technologies, energy-efficient production methods, and automation to improve yield and safety. Continuous research and development, eco-friendly processing, and integration of real time monitoring systems further enable them to optimize operations, meet regulatory standards, and maintain a competitive edge in the global hydrazine hydrate market.

Recent Developments

- In May 2023, Chemours announced an expansion of its hydrazine hydrate production facilities in China. This project is expected to be completed in 2024 and will result in a 50% increase in production capacity.

- In April 2023, GACL, IICT, and CSIR-IICT introduced an innovative method for producing hydrazine hydrate that is more environmentally friendly. This new approach has the potential to decrease the environmental impact of production by as much as 50%.

- Report ID: 7535

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrazine Hydrate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.