Pneumococcal Vaccine Market Outlook:

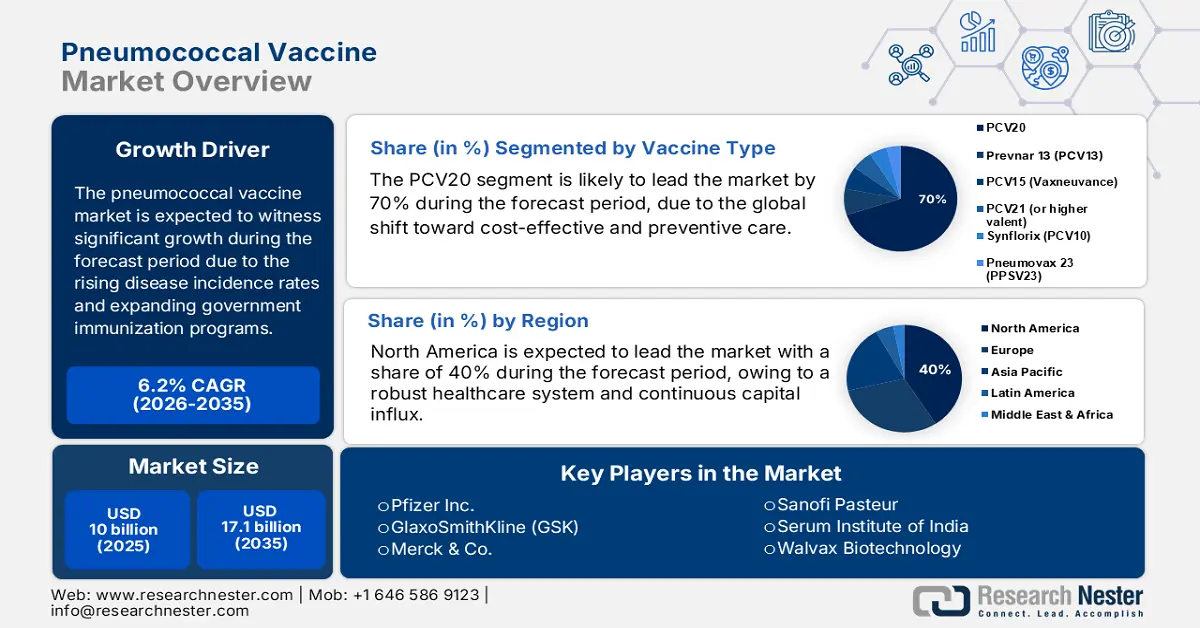

Pneumococcal Vaccine Market size was valued at USD 10 billion in 2025 and is projected to reach USD 17.1 billion by the end of 2035, rising at a CAGR of 6.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of pneumococcal vaccine is assessed at USD 10.6 billion.

The growth of the global market is driven by rising disease incidence rates, expanding government immunization programs, and international health initiatives. Payers are increasingly pressured into negotiating vaccine prices. As per a report by CMS in September 2025, the U.S. Centers for Medicare & Medicaid Services (CMS) reimburses pneumococcal vaccines at 95% of the average wholesale price (AWP) under Medicare Part B. The low uptake rate in at-risk groups and disparities (such as on ethnicity or age) has been motivating research and development of vaccines with broader valency and other delivery technologies. Furthermore, the continued expansion of adult vaccination guidelines has increased the pool of eligible patients, thereby promoting continued demand for this market.

With the perspective of adult vaccination becoming larger and larger, it is simply changing the landscape of the market. According to a report by NLM in January 2024, of 45.6 million adults aged 19 to 64 years existing in the database, 12.5 million adults satisfied the inclusion criteria and thus had at least one qualifying condition, among which most were smokers; others often had chronic lung disease, asthma, or diabetes. After weighting, the total U.S. population of ages from 19 to 64 who were newly eligible for PCVs was estimated at around 56 million. This expansion in patient population will surely boost vaccine uptake, affecting the way health care is planned for and resources allocated. This is a continuously growing consumer base and sustainable demand in the market.

Key Pneumococcal Vaccine Market Insights Summary:

Regional Highlights:

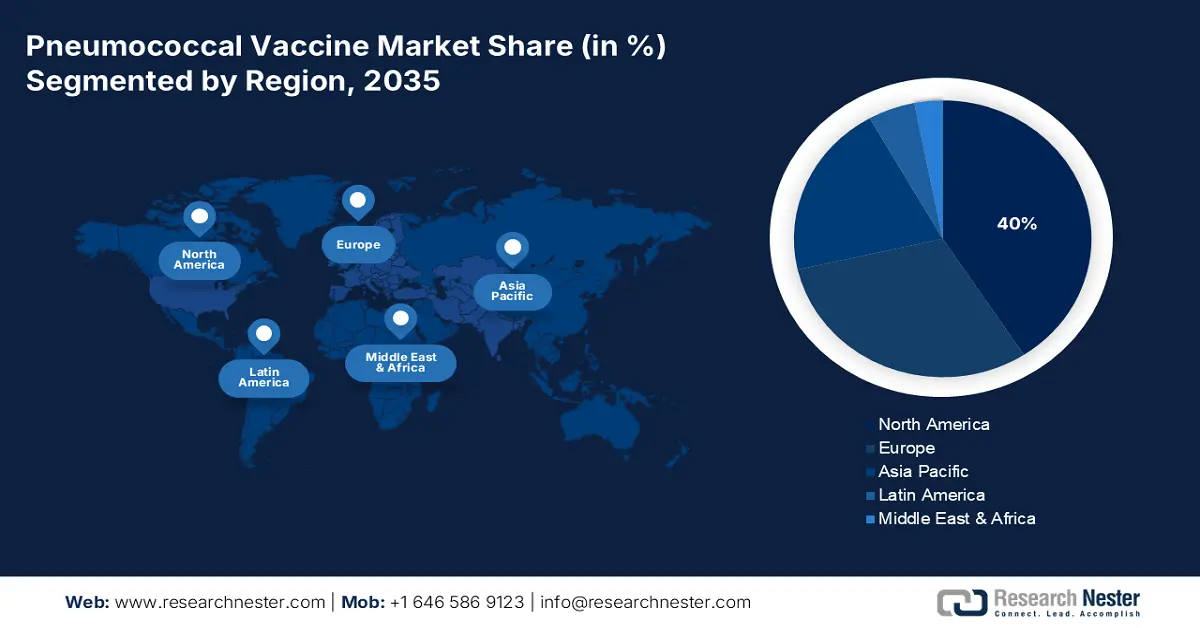

- North America is set to secure a 40% share by 2035 in the pneumococcal vaccine market, spurred by its robust healthcare infrastructure and strong capital inflows.

- Asia Pacific is projected to emerge as the fastest-growing region by 2035, underpinned by the escalating burden of severe respiratory illnesses across age groups.

Segment Insights:

- The PCV20 segment is anticipated to command a 70% share by 2035 in the pneumococcal vaccine market, propelled by the global shift toward cost-effective and preventive care.

- The pediatric segment is forecast to lead the market through 2035, reinforced by the critical need for childhood immunization.

Key Growth Trends:

- Clinical and financial benefits from immunization

- Improvements in therapeutic and production efficiency

Major Challenges:

- Limitations in long-term storage and distribution

Key Players: Pfizer Inc., GlaxoSmithKline (GSK), Merck & Co., Sanofi Pasteur, Serum Institute of India, Walvax Biotechnology, AstraZeneca, CSL Limited, Bharat Biotech, Panacea Biotec, Biological E, KM Biologics, LG Chem, Takeda Pharmaceuticals, Bio Farma.

Global Pneumococcal Vaccine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10 billion

- 2026 Market Size: USD 10.6 billion

- Projected Market Size: USD 17.1 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 26 September, 2025

Pneumococcal Vaccine Market - Growth Drivers and Challenges

Growth Drivers

- Clinical and financial benefits from immunization: As people and healthcare organizations become more aware of the importance of defending against disease at an early stage to reduce mortalities, investments in the market increase. As per a report by NLM in December 2024, vaccinating 52.7 million adults aged ≥60 years with an adjuvanted RSVPreF3 vaccine could prevent 244,424 quality-adjusted life year (QALY) losses over five years, demonstrating significant improvements in quality of life. Though the incremental cost of vaccination for society stands at an estimated USD 4.5 billion, these are recompensed in part through savings on healthcare costs resulting from disease, highlighting the effectiveness of immunization programs as a whole.

- Improvements in therapeutic and production efficiency: Besides accessibility, the enhancement of formulation and functionalities has also become a priority for both public and private organizations, promoting innovation in the market. Subsequently, magnifying investments in extensive R&D propels the pipeline in this sector, creating diverse business opportunities. For instance, a report by NLM in March 2025, as of January 2024, global investment for human bacterial vaccine R&D, including pneumococcal vaccines, amounted to USD 4.5 billion, with much of it earmarked for Streptococcus pneumoniae.

- Broadened eligibility and rising awareness in at-risk groups: The market is primarily driven by the expanding at-risk population, particularly adults with chronic conditions such as diabetes, asthma, and smoking-related illnesses. The update in vaccination guidelines has opened the criteria broadly enough for almost every individual to be recommended for vaccination. The magnitude of demand has risen as a consequence of this broad target group and the increasing awareness related to the seriousness of pneumococcal diseases. Further, the government immunization programs and worldwide health initiatives work hard to promote vaccine access and coverage.

Global Export and Import Values of Vaccines for Human Use (2023)

|

Country |

Exports (USD) |

Imports (USD) |

|

Belgium |

15.3 billion |

13.2 billion |

|

Germany |

3.2 billion |

4.4 billion |

|

U.S. |

8.5 billion |

5.3 billion |

|

Canada |

614 billion |

1.4 billion |

|

India |

1.2 billion |

291 million |

|

Japan |

- |

2.5 billion |

Source: OEC

Challenges

- Limitations in long-term storage and distribution: Spoilage and financial loss due to logistics are becoming significant roadblocks to the rapid expansion of the market. In resource-constrained regions, stocking vaccines is particularly challenging due to inadequate infrastructure in many clinical settings. This level of wastage not only causes budget overruns but also discourages government authorities from procuring vaccines in bulk, increasing the risk of shortages during emergencies. However, the adoption of technology-based transportation to deliver vials and necessary components is helping to mitigate this hurdle.

Pneumococcal Vaccine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 10 billion |

|

Forecast Year Market Size (2035) |

USD 17.1 billion |

|

Regional Scope |

|

Pneumococcal Vaccine Market Segmentation:

Vaccine Type Segment Analysis

The PCV20 segment of the vaccine type segment is expected to hold the highest share of 70% in the market by the end of 2035. The global shift toward cost-effective and preventive care is the basic growth driver behind this. Several clinical studies have also proved the extensive clinical advantages of using this subtype as an alternative to PCV13 and PCV15. As per a report by CDC, September 2024, in adults aged ≥65 years, PCV20 was shown to meet noninferiority criteria for all 13 shared serotypes compared with PCV13. As a result, PCV20 has become the most preferred option for both healthcare professionals and patients.

Age Group Segment Analysis

Based on the age group, the pediatric segment is anticipated to lead the market throughout the forecast period. The requirement of immunization for young children, ensuring their protection from potentially life-threatening conditions, such as pneumonia, meningitis, and blood infections, is a major factor in the segment's dominance. As a result, the involvement of both private and public organizations in advocating and managing vaccination for this age group is highly engaged. Their continuous participation and support further reinforce the expansion of this segment. As per a report by NLM in December 2023, global coverage of the final dose of PCV was only 51% in the last 4 years, highlighting the continued need for equitable distribution and education.

Distribution Channel Segment Analysis

The public health segment is expected to hold the highest share of the distribution channel segment in the market by 2035. This dominance could primarily be attributed to large-scale immunization programs implemented by government bodies and international health organizations such as WHO, Gavi, and UNICEF to improve access to and affordability of vaccines in low- and middle-income countries through public procurement and donor funding schemes. In addition, national immunization schedules, which include pneumococcal vaccines for routine childhood and adult vaccination, add to the clout of the public sector.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Vaccine Type |

|

|

Age Group |

|

|

Distribution Channel |

|

|

Region |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Pneumococcal Vaccine Market - Regional Analysis

North America Market Insights

The pneumococcal vaccine market in North America is poised to dominate the global landscape with the largest share of 40% over the forecast period. The presence of a robust healthcare system and continuous capital influx are the primary propelling factors for this region. The initiative by the regulating bodies is captured by several initiatives, including expansion of Medicare coverage, provincial and Federal financing, and budget-friendly procurement. As per a report by CMS published in June 2025, Medicare expenditures rose 8.1% to USD 1,029.8 billion in 2023, or 21% of total NHE. This heavy investment is a demonstration of the preventive healthcare commitment by the U.S. government, complemented further by increased vaccine accessibility and utilization.

The pneumococcal vaccine market in the U.S. is growing due to a strong reimbursement policy structure and financial support from payers. Moreover, the national evolution from lower to higher-valency vaccines is readily uplifting both domestic and foreign biopharma leaders to cultivate more innovative formulations. According to a report by CMS, June 2025, in 2024, National Health Expenditure (NHE) growth is projected to have reached 8.2%. Despite an anticipated 7.9% reduction in Medicaid coverage, the insured proportion of the population is anticipated to have remained high at 92.1%. This continued insurance coverage and healthcare usage trend is anticipated to directly drive higher pneumococcal vaccine consumption, supporting market growth nationwide.

Asia Pacific Market Insights

Asia Pacific is expected to hold the fastest-growing market in the pneumococcal vaccine market during the forecast period. The transmission of pneumococcal disease is being driven rapidly by the increasing rate of severe respiratory illnesses across all age groups, especially as the population matures quickly. This trend is generating a strong demand for protective measures, which is backed by various government programs and joint activities. For example, in emerging markets such as China and India, programs such as the Expanded Program on Immunization (EPI) and the Universal Immunization Programme (UIP) have highlighted the importance of adequate supply of pneumococcal vaccines for the citizens.

China is standing as the pillar of domestic production in the regional pneumococcal vaccine market. The country's exceptional manufacturing capacity is a result of immense government support and initiatives. As per a report by NLM, March 2023, patients with an immunocompromising condition need a third dose of PPSV23 at age ≥ 65 years, with a minimum time interval of 5 years after the second dose. Moreover, patients with cochlear implants, CSF leaks, or immunocompromising conditions should have a minimum time interval of 1 year after the last dose of PCV13 and 5 years after the last dose of PPSV23. These are anticipated to drive demand and fuel growth in the market.

Europe Market Insights

The pneumococcal vaccine market in Europe is growing due to rising awareness of respiratory conditions, increased vaccination programs in countries, and robust government incentives towards immunization programs for high-risk groups such as the elderly and those suffering from chronic diseases. Furthermore, high R&D spending is driving the formulation of next-gen vaccines with greater protection and enhanced efficacy. Governments in Europe are also strengthening funding mechanisms to enable vaccine access and affordability, further fueling market growth. Joint initiatives between public health authorities and pharmaceutical firms continue to spur innovation and delivery throughout the region.

The pneumococcal vaccine market in the UK is growing due to is growing due to rising awareness of respiratory illnesses, growing immunization programs within countries, and government support for immunization campaigns among risk groups such as the geriatric population and chronic patients. As per a report by ONS April 2025, the UK government's net expenditure in research and development (R&D) rose to £17.4 billion in 2023 from £16.1 billion in 2022, a rise of 8.2%. This enormous rise in R&D expense is expected to accelerate work on new generation pneumococcal vaccines with enhanced effectiveness and broader protection.

GDP spent on Research and development expenditure in Countries of Europe (2022)

|

Country |

Most Recent Value |

|

Austria |

3.2 |

|

Belgium |

3.4 |

|

Denmark |

2.8 |

|

France |

2.2 |

|

Germany |

3.1 |

|

Greece |

1.4 |

|

Italy |

1.3 |

|

Netherlands |

2.2 |

|

Portugal |

1.7 |

|

Spain |

1.4 |

|

Sweden |

3.4 |

Source: World Bank, February 2024

Key Pneumococcal Vaccine Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline (GSK)

- Merck & Co.

- Sanofi Pasteur

- Serum Institute of India

- Walvax Biotechnology

- AstraZeneca

- CSL Limited

- Bharat Biotech

- Panacea Biotec

- Biological E

- KM Biologics

- LG Chem

- Takeda Pharmaceuticals

- Bio Farma

The present market depicts the existence of strongholds in certain regions, with Pfizer and Merck collectively exporting pneumococcal vaccines from America and Europe. Basically, their dominance in export is via an early market rollout and an aggressiveness in the commercialization of flagship products. During the same time, given these emerging landscapes, the key manufacturers and distributors are shifting the supply chain, with Serum Institute becoming one source of Gavi's pneumococcal vaccine. In the meantime, the China-based manufacturers are causing API production to speed up, to keep their rank in the global raw material supply.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2024, Merck announced their FDA approval for CAPVAXIVE, which is a Pneumococcal 21-valent Conjugate Vaccine, especially designed to help protect adults against pneumococcal disease.

- In March 2024, Pfizer’s PREVENAR 20 got approval from the European Commission. The 20-valent pneumococcal conjugate vaccine is for active immunization for the prevention of invasive disease, pneumonia, and acute otitis media.

- Report ID: 2352

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Pneumococcal Vaccine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.