Dendritic Cell Cancer Vaccine Market Outlook:

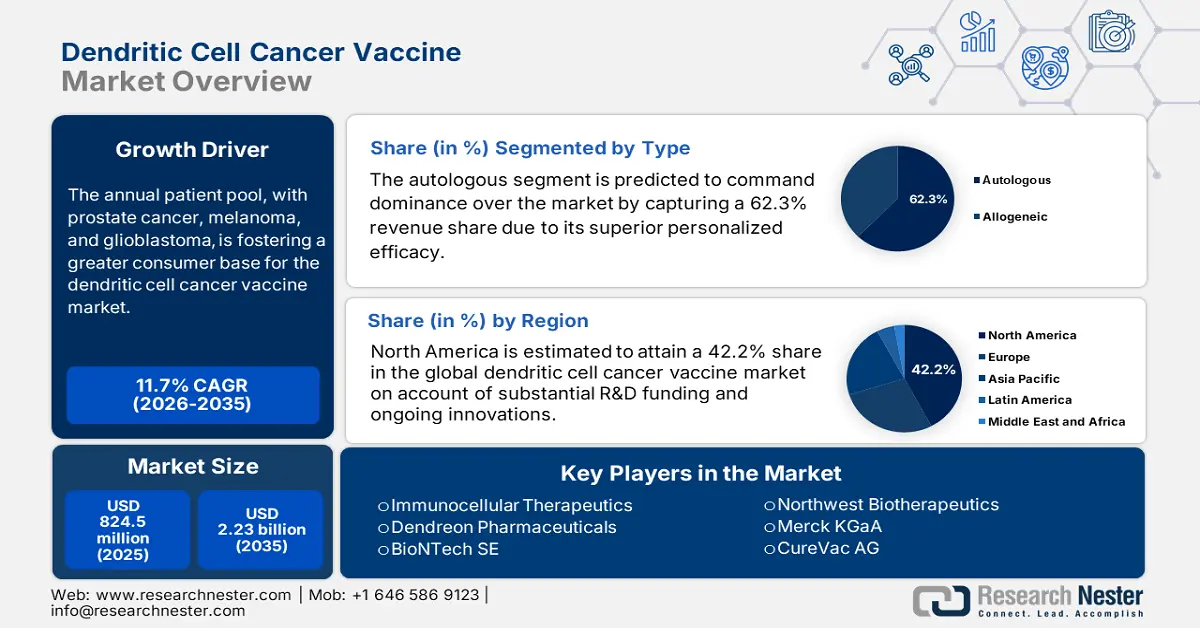

Dendritic Cell Cancer Vaccine Market size was valued at USD 824.5 million in 2025 and is projected to reach USD 2.23 billion by the end of 2035, rising at a CAGR of 11.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of the dendritic cell cancer vaccine is assessed at USD 920.9 million.

The explosive occurrence rates of life-threatening cancer are one of the primary growth factors in the market. As the need for advanced, targeted therapies grows to quench the surge in preventable measures, more healthcare authorities and high-risk patients tend to prioritize immunization before disease progression toward severity. This trend can be evidenced by the 2025 updates on future progress in RNA-based cancer vaccines, released by the NLM. It highlighted a potential 44% reduction in cancer recurrence in melanoma treatment with these biologics, accompanied by existing immunotherapy, where over 120 clinical trials are currently underway across various malignancies.

Such promising results unleash the clinical value and commercial significance of products available in the market. However, the high cost of these biologics remains a hurdle for widespread adoption in this sector, where RNA-based personalized immunotherapies account for approximately USD 100 thousand expenditure for each patient, as per the 2025 NLM article. Such inflated payers’ pricing underscores the requirement for dedicated R&D cohorts, insurance coverage, and funding to cultivate a balanced business model, combining affordability with sustainable reimbursement policies for manufacturers. Furthermore, cost-optimized production strategies are helpful in maintaining comprehensive product pricing.

Key Dendritic Cell Cancer Vaccine Market Insights Summary:

Regional Highlights:

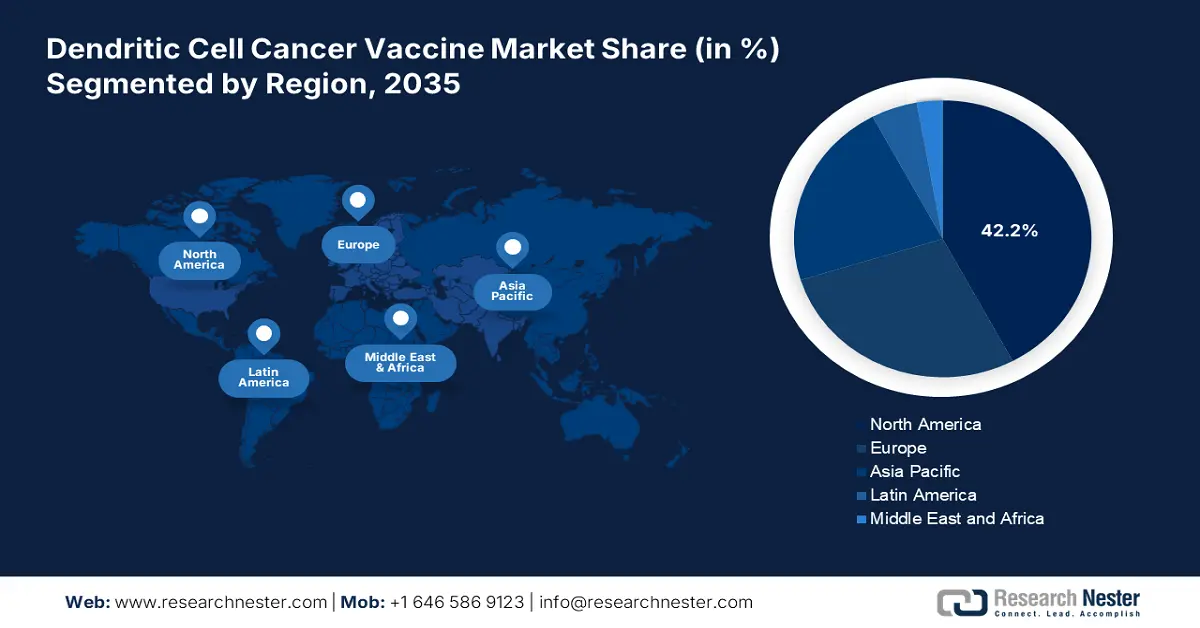

- North America is projected to capture a 42.2% share during the analyzed tenure, driven by a robust clinical trial infrastructure and expanding patient epidemiology.

- Asia Pacific is anticipated to be the fastest-growing region by 2035, owing to rising cancer incidence and strong government support.

Segment Insights:

- Autologous segment is projected to account for 62.3% share over the assessed timeframe, propelled by superior efficacy demonstrated through high 4-year progression-free survival rates among high-risk multiple myeloma patients.

- Prostate cancer (PC) segment is expected to hold a 38.4% share by 2035, owing to the rising global incidence and expanding patient pool.

Key Growth Trends:

- Advancements in immunotherapy research

- Tech-based upgrades in biologics production

Major Challenges:

- Limitations related to storage and logistics

- Shortage of eligible candidates for R&D

Key Players: Dendreon Pharmaceuticals (Sanpower Group), Northwest Biotherapeutics, BioNTech SE, Roche (Genentech), Eli Lilly and Company, GlaxoSmithKline (GSK), Medigene AG, Cartesian Therapeutics, Immunicum AB, Tella, Inc., Green Cross Cell, CureVac AG, CSL Limited, Dr. Reddy's Laboratories, LG Chem, Biocon Limited, ImmunoCellular Therapeutics, Hitachi Chemicals (Minaris Medical), GammaDelta Therapeutics (Takeda), Bio-Synergy, EnnoDC, Diakonos Oncology Corporation

Global Dendritic Cell Cancer Vaccine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 824.5 million

- 2026 Market Size: USD 920.9 million

- Projected Market Size: USD 2.23 billion by 2035

- Growth Forecasts: 11.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, France, Germany, Japan, Canada

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 30 September, 2025

Dendritic Cell Cancer Vaccine Market - Growth Drivers and Challenges

Growth Drivers

- Advancements in immunotherapy research: Ongoing allocations to research, development, and deployment (RDD) are propelling the scale of progress in the dendritic cell cancer vaccine industry. This is empowered by continuous breakthroughs in immunology and cancer biology, which have escalated the scale of development in this category. Exemplifying the same, in July 2025, a team of scientists at the Icahn School of Medicine at Mount Sinai developed a novel serum-free culture system that is capable of producing up to 3 billion functional conventional type I dendritic cells (cDC1s) from just 1 million hematopoietic stem cells (HSCs) derived from cord blood, paving the way for new off-the-shelf cellular cancer vaccines.

- Tech-based upgrades in biologics production: Advancements in cell culture, bioprocessing, and automation are revolutionizing manufacturing capacity in the dendritic cell cancer vaccine market. Particularly, the efforts to incorporate automation to achieve greater production efficiency are assisting pioneers in this sector in gaining successful globalization. Testifying to the same, a 2025 NLM report revealed that AI integration and modern manufacturing methods can reduce production time from nine weeks to under four weeks. Besides, the regulatory push for adopting GMP-compliant facilities is also cultivating greater opportunities for manufacturers in this sector.

- Strategic collaborations and partnerships: Pharma pioneers, academia, and biotech startups are increasingly forming alliances to empower R&D in the market. Such initiatives accelerate product launching by enabling the shared utility of clinical data and technological excellence from both parties. It also assists individuals in navigation through complex regulatory pathways across regions. To capitalize on the same strategy, in January 2025, GSK entered into a new research partnership with the University of Oxford (Oxford) to explore the potential of cancer prevention through vaccination. As per the agreement, GSK committed a USD 58.3 million over a minimum of three years.

Current and Recent Dynamics of Clinical Innovations in the Market

Recent Clinical Trials of Dendritic Cell Cancer Vaccines

|

Trial Name / Indication |

Status |

Population |

Vaccine/Intervention Description |

Sponsor / Location |

Timeline |

|

Phase 1 Study of DC/MM Fusion Vaccine + Elranatamab in Multiple Myeloma |

Recruiting |

Relapsed/Refractory Multiple Myeloma |

DC/MM fusion vaccine + GM-CSF and Elranatamab |

Dana Farber, Pfizer |

2025-2030 |

|

DC Vaccine in Triple Negative Breast Cancer |

Ongoing |

Triple negative breast / ovarian cancer |

DC vaccine against Her2/Her3 + pembrolizumab |

M.D. Anderson Cancer Center |

2022-2026 |

|

DC Vaccine in Advanced Melanoma |

Completed |

Stage III/IV melanoma |

Mature DC vaccine (mDC3/8) + pembrolizumab |

University of Pennsylvania |

2017-2023 |

|

DC Vaccine Therapy in Treating Patients with newly Diagnosed Glioblastoma Multiforme (ATTAC)

|

Completed |

Age >18; WHO Grade IV glioma with definitive resection prior to leukapheresis |

Therapeutic autologous dendritic cells & lymphocytes +tetanus toxoid |

Duke University |

2006-2022 |

|

Vaccination with DC Growth Factor in a combination of 4 therapies |

Completed |

Pathologically confirmed iNHL, MBC or HNSCC |

Flt3L/CDX-301 +Radiation+Poly-ICLC+Pembrolizumab |

Icahn School of Medicine at Mount Sinai |

2019-2025 |

|

DC Activating Scaffold in Melanoma

|

Completed |

Histologically or cytologically confirmed Stage IV melanoma

|

Dendritic Cell Activating Scaffold Incorporating Autologous Melanoma Cell Lysate (WDVAX) |

Dana-Farber Cancer Institute |

2013-2025 |

Challenges

- Limitations related to storage and logistics: The dendritic cell cancer vaccine sector faces an unavoidable hurdle in maintaining essential storage and logistics requirements. Particularly, in underserved settings, the lack of adequate temperature-controlled infrastructure often translates to massive spoilage in this sector. As evidence, a 2021 study recorded a lack of necessary access to vaccine doses for over 2.7 billion worldwide due to insufficient supply chains and logistics capabilities. This substantial wastage not only drives up costs but also severely limits patient access in developing regions.

- Shortage of eligible candidates for R&D: The limitations in patient enrollment for clinical trials are a major restriction in the progress of the market. For instance, in 2023, 85% of trials conducted across the U.S. failed to meet enrollment targets, even after spending an annual USD 1.9 billion on recruitment, as reported by the NLM. This is primarily caused by stringent eligibility criteria, limited patient awareness, and competition for oncology trial participants. Ultimately, the recruitment shortfalls delay trial completion, prolong development timelines, and increase costs for manufacturers.

Dendritic Cell Cancer Vaccine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 824.5 million |

|

Forecast Year Market Size (2035) |

USD 2.23 billion |

|

Regional Scope |

|

Dendritic Cell Cancer Vaccine Market Segmentation:

Type Segment Analysis

The autologous segment is predicted to command dominance over the dendritic cell cancer vaccine market by capturing a 62.3% revenue share over the assessed timeframe. The superior efficacy of this biologic can be portrayed through the 71% estimated rate of 4-year progression-free survival among high-risk multiple myeloma (MM) patients administered with DC vaccine before and after autologous stem cell transplant (ASCT). It was notably greater compared to a historical gain of only 50%. Such clinical evidence further strengthens the subtype’s acceptance across regulatory pathways.

Application Segment Analysis

The prostate cancer (PC) segment is expected to represent the largest share of 38.4% in the dendritic cell cancer vaccine market by the end of 2035. The predominant captivity of this malignancy on the associated demography is the primary driver behind this leadership. Testifying to the substantial expansion of the patient pool, a 2025 NLM data analysis underscored a 161.5% increase in global PC incidence, while identifying it as one of the most common malignancies among men in the world, accounting for 14.1% of total newly diagnosed cancers among this afflicted cohort. These factors, coupled with the escalating development and commercialization of DC vaccines, are positioning PC at the forefront of maximum revenue generation in this sector.

End user Segment Analysis

Hospitals & clinics are anticipated to hold a dominant share of 55.3% in the dendritic cell cancer vaccine market throughout the discussed period. These facilities serve as the primary point of care for patients suffering from associated malignancies, which is backed by fully equipped infrastructures and skilled medical professionals. Moreover, the ability of these service providers in administering complex immunotherapies makes them a critical asset for ongoing clinical trials and patient monitoring. Currently, the integration of DC vaccines into standard oncology practice at these centers is helping companies adhere to reimbursement protocols.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Product |

|

|

Application |

|

|

Patient |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dendritic Cell Cancer Vaccine Market - Regional Analysis

North America Market Insights

North America is estimated to attain a 42.2% share in the global dendritic cell cancer vaccine market during the analyzed tenure. The enlarging epidemiology of eligible patients across the region fosters a favorable atmosphere for the merchandise. This can be evidenced by the 2o22 GLOBOCON report, which recognized North America to be the 2nd highest position holder among all regions for melanoma incidence and prevalence, with 112,807 and 442,021 new cases, respectively. The leadership is also pledged to a robust clinical trial infrastructure, where the U.S. alone accounted for the highest number (a total of 757) of cancer vaccine-related trial registrations in the world, with more than 20 cancer types being identified for indication.

The U.S. is maintaining dominance over the regional market, which is backed by its favorable and continuously evolving regulatory and clinical trial frameworks. Exemplifying the same, in October 2023, Diakonos Oncology received FDA Fast Track designation for the use of its unique DC vaccine, DOC1021, in treating patients with glioblastoma multiforme. Further, in August 2024, researchers at the UCLA Health Jonsson Comprehensive Cancer Center launched a first-of-its-kind clinical trial to evaluate the safety and effectiveness of a cancer vaccine targeting H3 G34-mutant diffuse hemispheric glioma.

The industry value of the dendritic cell cancer vaccine market in Canada is escalating at a notable pace on account of notable provincial health investments and universal reimbursement policies. The country’s focus is also growing notably on advances and utility of advanced immunotherapies, prompting innovation in this landscape. Besides, the updated pathway of Priority Review from Health Canada reduced approval timelines, accelerating treatment accessibility across the nation. Despite such a lucrative environment, cost barriers remain a consistent challenge in this landscape, with restricted financial backing for eligible patients.

APAC Market Insights

Asia Pacific is poised to be the fastest-growing region in the dendritic cell cancer vaccine market by the end of 2035. The rising new and death cases of cancer, coupled with strong government support, are the major growth engines of the region's augmentation in this sector. Japan leads the landscape due to the PMDA reforms and fast-track approvals. On the other hand, China and India contribute to a majority of the worldwide low-cost API supply, fostering scope for regional leaders to produce cost-effective options. In addition, South Korea is advancing in this category with massive public and private funding, empowering mRNA-DC vaccine development and commercialization.

China is predicted to capture a considerable revenue share in the APAC market. The transformative regulatory reforms and growing emphasis on clinical trials are the primary propellers in this sector. This can be exemplified by the 2025 NLM findings, which revealed that the compliance acquisition rate for cancer vaccines in China was higher than in the U.S. market. It further mentioned that the proportions of trials with open, completed, and suspended status in the country were also greater than in the U.S., securing 56.2%, 41.6%, and 1.1%, in comparison to 43.6%, 29.9%, and 0.7%.

India is emerging as a lucrative scope of investment for the dendritic cell cancer vaccine market in both the Asia Pacific and global landscapes. The low-cost manufacturing capabilities and a substantial addressable patient pool are fueling the country's significance in this field. On the other hand, the prioritization of affordability in pharmaceuticals by the government is attracting dedicated companies to invest more in this landscape. Moreover, the emergence of cost-optimized production and scalable solutions is solidifying the position of the nation as a sustainable base of consumers and domestic capacity.

Feasible Opportunities in Key Landscapes

|

Country |

Metrics |

Timeline |

|

India |

The crude cervical cancer incidence is 18.7 per 100,000 women, with a cumulative cervical cancer risk of 2.0%; Targeting complete vaccination by 2030 |

2023 |

|

Japan |

Major prevalent cancer types align with DC indications Colorectal: 153,200 Lung: 126,200 Prostate: 91,800 Breast: 91,800 |

2024 |

|

Australia |

WEHI-led collaboration with the Peter MacCallum Cancer Centre awarded over USD 900 thousand in MRFF funding to develop a cancer vaccine, including DC. |

2023 |

Source: NLM, NCC, and WEHI

Europe Market Insights

Europe is expected to sustain a steady growth in the dendritic cell cancer vaccine market during the timeline between 2026 and 2035. The landscape is led by France, which is backed by heavy healthcare funding and fast-track approvals by the HAS. On the other hand, the region is home to globally leading key patient demographics, which ensures the sustainability of the demand base in this category. Testifying to the same, the 2022 GLOBOCON report recorded the highest occurrence rates of melanoma in Europe, accounting for 44.1% and 45.3% of worldwide incidence and prevalence. Besides, the European Association of Urology (EAU) unveiled that more than 450 thousand men living across Europe are diagnosed with PC every year, making the condition the second most common cause of male cancer death in the region.

Germany is anticipated to capture a significant revenue share in the Europe market, backed by its universal reimbursement system and biopharmaceutical advances. Besides, the country is home to several global pioneers, which ensures enhanced patient access and continuous innovation in this sector. The public health system in Germany is also proactively funding procurement and research cohorts of advanced therapies, escalating advancements in this category.

The UK maintains consistent progress in the regional dendritic cell cancer vaccine market, owing to the substantial government-led capital influx. In this regard, the National Health Service (NHS) implemented the Cancer Vaccine Launch Pad initiative that aims to treat more than 10 thousand patients across the country with personalized cancer vaccines by the end of 2030. The country is also amplifying its focus on developing mRNA-DC combination therapies, reflecting its growing emphasis on next-generation platforms.

Statistical Overview of Key Potential Demographics in Europe (2022)

|

Cancer Type |

New Cases |

Deaths |

|

Prostate |

473,011 |

115,182 |

|

Melanoma |

146,321 |

26,180 |

|

Brain CNS |

67,559 |

54,001 |

|

Lung |

484,306 |

375,569 |

|

Kidney |

145,721 |

52,347 |

|

Breast |

557,532 |

144,439 |

|

Ovarian |

69,472 |

46,232 |

|

Pancreatic |

146,477 |

138,644 |

|

Colorectal |

538,262 |

247,842 |

|

Bladder |

224,777 |

70,383 |

Source: GLOBOCON

Key Dendritic Cell Cancer Vaccine Market Players:

- Dendreon Pharmaceuticals (Sanpower Group)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Northwest Biotherapeutics

- BioNTech SE

- Roche (Genentech)

- Eli Lilly and Company

- GlaxoSmithKline (GSK)

- Medigene AG

- Cartesian Therapeutics

- Immunicum AB

- Tella, Inc.

- Green Cross Cell

- CureVac AG

- CSL Limited

- Dr. Reddy's Laboratories

- LG Chem

- Biocon Limited

- ImmunoCellular Therapeutics

- Hitachi Chemicals (Minaris Medical)

- GammaDelta Therapeutics (Takeda)

- Bio-Synergy

- EnnoDC

- Diakonos Oncology Corporation

The dendritic cell cancer vaccine market is competitively consolidated by the consortium of Dendreon, Northwest Biotherapeutics, and BioNTech, which controls more than 61.3% of the global revenue share. These pioneers are currently employing diverse strategies to strengthen their positions in this field, such as the collaboration between BioNTech and Regeneron and the alliance of GSK and the University of Oxford. On the other hand, companies from developing economies are prioritizing cost-optimized localized manufacturing to solidify their proprietorship in price-sensitive nations.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In December 2024, EnnoDC presented new preliminary data of a Phase I/IIa clinical study evaluating its immunotherapy candidate CD40.HVAC in patients with human papillomavirus (HPV16)-associated oropharyngeal carcinoma (OPC). This first-in-class approach combines the power of vaccines and immunotherapy antibodies to provide targeted immune responses for treatment.

- In July 2024, Diakonos Oncology attained FDA clearance for Fast Track designation for its unique dendritic cell vaccine (DCV) for pancreatic ductal adenocarcinoma. This marked another milestone in the company’s incredible potential for developing and commercializing such innovative immunotherapy for treating the deadliest cancers.

- Report ID: 7885

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.