Clostridium Vaccine Market Outlook:

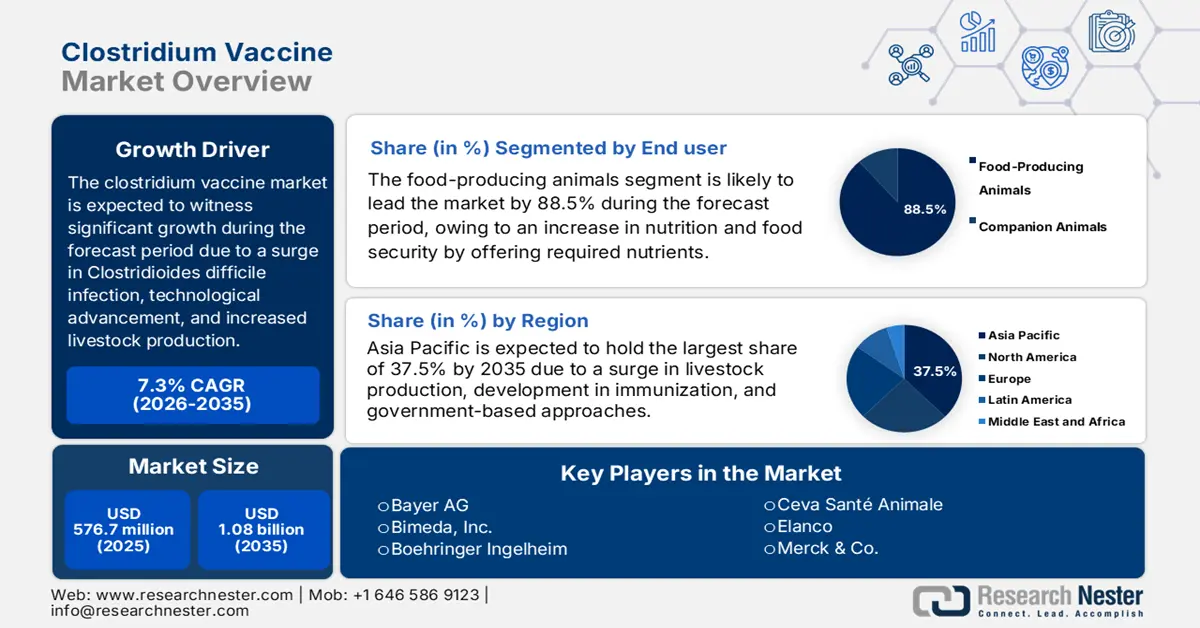

Clostridium Vaccine Market size was USD 576.7 million in 2025 and is anticipated to reach USD 1.08 billion by the end of 2035, increasing at a CAGR of 7.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of clostridium vaccine is estimated at USD 618.8 million.

The international market is currently witnessing strong growth, which is highly attributed to an amalgamation of technological, economic, and regulatory drivers. These include a rise in the global need for animal protein, which has intensified livestock production, along with an increase in the risk of increased clostridial disease prevalence across dense farming operations. According to an article published by the CDC in June 2025, there have been 116.1 cases Clostridioides difficile infection (CDI) per 100,000 persons emerging infections program sites as of 2022. In addition, the underlying conditions were extremely common among CDI incidences, and for 56% of these cases, antibiotics were readily utilized in the prior 12 weeks, which is positively impacting the market growth.

Moreover, the presence of strict government regulations, animal welfare policies, increased awareness among farmers, and technological advancements in vaccine development are also driving the clostridium vaccine market. As stated in the 2025 USDA article, the Animal Welfare Act (AWA), which was signed by the U.S. in August 1966, provides the USDA with the authority to make, implement, and enforce the law to offer suitable treatment and care for animals bred. Besides, as per the February 2024 Think Global Health Organization article, the Gavi Alliance made a provision of USD 1.8 billion to allow developing nations to manufacture their respective vaccines, which is also uplifting the overall market.

Key Clostridium Vaccine Market Insights Summary:

Regional Insights:

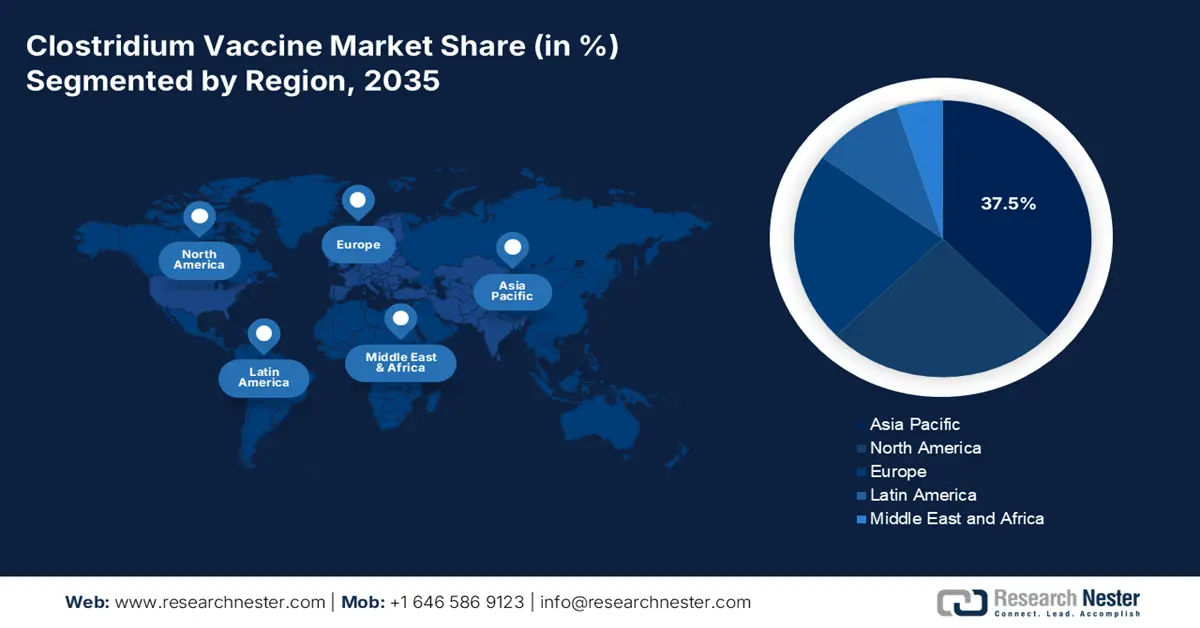

- The Asia Pacific region in the Clostridium Vaccine Market is anticipated to hold the largest share of 37.5% by 2035, impelled by government-supported immunization programs, expanding livestock production, and strategic rural outreach initiatives.

- Europe is projected to be the fastest-growing region by 2035, propelled by technological innovation, supportive regulations, and robust government funding for animal health R&D.

Segment Insights:

- The food-producing animals segment in the Clostridium Vaccine Market is projected to secure an 88.5% share by 2035, propelled by its vital role in supporting global nutrition and food security through essential animal-derived nutrients such as B12, iron, and proteins.

- The farms/production units segment is anticipated to account for the second-largest share by 2035, owing to its strong linkage with cost-effective biosecurity measures and improved herd immunity in large-scale livestock operations.

Key Growth Trends:

- An increase in the demand for animal protein

- Awareness among farmers

Major Challenges:

- Complexities in supply chain and cold distribution

- Barrier in market education and adoption

Key Players: Bayer AG, Bimeda, Inc., Boehringer Ingelheim, Ceva Santé Animale, Elanco, Merck & Co., Inc., Sanofi S.A., Virbac Corporation, Zoetis, Colorado Serum Company, Valneva SE, Eli Lilly and Company, Intervet Inc., Arko Labs, CanFel Therapeutics.

Global Clostridium Vaccine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 576.7 million

- 2026 Market Size: USD 618.8 million

- Projected Market Size: USD 1.08 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, India, Germany, United Kingdom

- Emerging Countries: Brazil, Mexico, South Korea, Australia, Indonesia

Last updated on : 1 October, 2025

Clostridium Vaccine Market - Growth Drivers and Challenges

Growth Drivers

- An increase in the demand for animal protein: The aspect of animal protein is essential since it is a source of micronutrients and amino acids that tend to support muscle maintenance, growth, and overall health, which is readily driving the market globally. As per an article published by Frontiers Organization in February 2025, 7 developed nations have declared to diminish the animal-to-plant protein ratio, with the current ratio being 65:35, accounting for 2/3rd of the overall protein originating from dairy, eggs, meat, and animal sources. Besides, strategies to lower the dietary ratio to 50:50, 40:60, or below are considered a suitable healthy protein transition.

- Awareness among farmers: This is extremely crucial for the clostridium vaccine market since bacteria tend to cause deadly disorders, such as enterotoxemiain, botulism, and tetanus in livestock, ultimately leading to effective economic losses. Therefore, an increased awareness regarding this assists farmers to integrate preventive measures, including water quality, monitoring feed, incorporating vaccination programs, improving hygiene, and administering wounds to combat the infection spread. Therefore, this is considered a proactive strategy to protect animal health, safeguard farm productivity, and reduce the disease spread.

- Expansion in the veterinary healthcare sector: The veterinary healthcare service is extremely essential for combating disease, protecting public health, and ensuring animal welfare by effectively addressing zoonotic disorders and promoting food safety, all of which positively impact the market internationally. According to the 2022 Health for Animals Organization data report, an improvement in animal health deliberately optimizes the livelihoods of almost 1.3 billion people, heavily relying on livestock production, thereby creating an optimistic outlook for the overall market across different countries.

Clostridioides Difficile Infection 2022 Surveillance Boosting the Market

|

Components |

Incidences |

|

Cases across 10 sites |

14,119 |

|

Medical record review |

9,107 |

|

Non sampling |

5,012 |

|

Partial CRF |

1,820 |

|

Without medical record accessibility |

159 |

|

With a complete CRF |

7,128 |

Source: CDC

Challenges

- Complexities in supply chain and cold distribution: The aspect of effectively maintaining an unbroken cold chain from standard production to suitable administration is logistically challenging and expensive, particularly across developing economies with underdeveloped facilities, which is negatively impacting the clostridium vaccine market. Vaccines are temperature-sensitive, and any kind of deviation can diminish the efficiency or even spoil entire batches. Therefore, it is essential to manage, which demands personalized packaging, refrigerated transport, and dependable local storage, each adding complexity and increased expenses.

- Barrier in market education and adoption: The component of shifting established veterinary practices and producer habits is a resource-intensive and slow process, which has caused a hindrance in the market. Farmers and veterinaries are frequently risk-adverse, depending on proven vaccines, and combating this inertia needs a huge investment in technical support, field trials, and educational campaigns to successfully display the latest product’s advantages. Therefore, this incorporation barrier can exist for long years, during which there can be reductions in commercial returns.

Clostridium Vaccine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 576.7 million |

|

Forecast Year Market Size (2035) |

USD 1.08 billion |

|

Regional Scope |

|

Clostridium Vaccine Market Segmentation:

End user Segment Analysis

Based on the end user, the food-producing animals segment in the clostridium vaccine market is expected to garner the largest share of 88.5% by the end of 2035. The segment’s growth is highly driven by its essentiality for international nutrition and food security by providing necessary minerals, vitamins, fats, and proteins, such as B12 and iron, which are pivotal for human health. According to an article published by Animal in March 2022, the Great Food Transformation by the EAT-Lancet Commission has proposed a semi-vegetarian diet, permitting limited animal-source food, comprising 14% caloric intake. Additionally, it has prescribed 14 g/d and 30 ckal/d of red meat or 13 g/d and 19 kcal/d of eggs, thereby uplifting the segment’s exposure.

Application Segment Analysis

Based on the application, the farms/production units segment in the clostridium vaccine market is anticipated to cater the second-largest share during the projected timeline. The segment’s upliftment is highly fueled by its direct association with the economic imperative of overcoming critical clostridial incidence across high-density livestock operations. For large-scale producers, increased vaccination programs result in a fundamentally affordable biosecurity measure, which readily outweighs treatment expenses, morbidities, and losses from mortality. Besides, the on-farm and direct vaccine administration frequently provides unparalleled control and efficacy, thus ensuring herd-wide immunity.

Type Segment Analysis

Based on type, the recombinant vaccines segment in the clostridium vaccine market is projected to account for the third-largest share by the end of the predicted duration. The segment’s development is highly attributed to its safety, efficiency, and easy manufacturing with cost-effectiveness, in comparison to conventional vaccines. In this regard, a clinical study was published by the New England Journal of Medicine in December 2023, wherein 1,630,328 vaccinees were included, of which 632,962 were in the recombinant-vaccine group and 997,366 in the standard-dose group. This resulted in a 15.3% relative vaccine effectiveness, thereby denoting an average suitability of the recombinant vaccine in the market.

Our in-depth analysis of the clostridium vaccine market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Application |

|

|

Type |

|

|

Disease Indication |

|

|

Animal Species |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Clostridium Vaccine Market - Regional Analysis

APAC Market Insights

Asia Pacific in the clostridium vaccine market is anticipated to garner the highest share of 37.5% by the end of 2035. The market’s growth in the region is highly attributed to government-based immunization programs, a rise in livestock production and urbanization, private and public partnerships, tactical rural outreach, and an increase in patient numbers. According to an article published by the Food and Agriculture Organization of the United Nations in 2025, the dog population is approximately 1.6 million, based on which there is a huge endemic for rabies. Besides, in Bhutan, 366 village-based outbreaks in animals have been recorded, with the majority of cases taking place near the India border, thus creating an optimistic outlook for the market.

The clostridium vaccine market in China is growing significantly, owing to government-based immunization programs for funding, a rise in livestock manufacturing and urbanization, private and public collaborations, strategic rural outreach, and improved healthcare infrastructure. As per the March 2023 MDPI article, a clinical study was conducted on 1,100 pathogen-free pigs, along with 14,487 commercial fattening pigs in the country. Besides, the HLJ/18-7GD strain has been readily evaluated, generating the absence of any disease, and denoting a survival protection rate of more than 80%, particularly for commercial pigs, thus uplifting the market’s demand.

The clostridium vaccine market in India is developing due to a surge in government spending, an increase in the patient volume, widespread rural vaccination programs, and effective growth in the animal husbandry sector. According to an article published by the PIB in June 2023, the livestock industry in the country is continuously growing at 7.9%, and there has been a further increase from 24.3% to 30.1%, which is readily contributing to 4.9% of the overall GVA. Besides, there exist 303.7 million bovines, such as yak, mithum, buffalo, and cattle, followed by 74.2 million sheep, 148.8 million goats, 9.0 million pigs, and nearly 851.8 million poultry, thus suitable for bolstering the market’s exposure.

Europe Market Insights

Europe in the clostridium vaccine market is expected to emerge as the fastest-growing region during the projected duration. The market’s exposure in the region is highly driven by effective innovation in technologies, supportive regulations, government-based funding for R&D, the integration of animal health policy, and widening in the end use incorporation. As per an article published by the EHMA in January 2023, measles is one of the diseases, owing to which the region has extensive vaccination services, and almost 91% measles-containing vaccine second dose coverage has been made available, thus suitable for bolstering the overall market in the region.

The clostridium vaccine market in Germany is developing, owing to an upsurge in the disease prevalence, strong presence of National Health campaigns, substantial budget provision, and increased focus on the livestock sector. As stated in the August 2025 ITA article, the overall pet food export valuation is USD 3,284 million, with USD 2,536 million in terms of imports. In addition, imports from the U.S. account for USD 6 million, along with an exchange rate of 1.0%. Therefore, all these numerical values regarding pet food availability have a pivotal role in boosting the market in the country.

The clostridium vaccine market in the UK is also growing due to the proactive involvement of the NHS, a rise in zoonosis and biowarfare awareness, effective growth in companion animal vaccination, and the existence of private and public partnerships. According to the September 2024 Vaccine article, a clinical study was conducted on 712,266 dogs and 306,888 cats regarding the EHR application. This resulted in a three-year vaccination range from 81.3% to 84.4% for dogs and 73.9% to 77.8% for cats. This denotes a huge presence of companion pet adoption in the country and the whole of the region, which in turn is suitable for uplifting the overall market.

Pet Population Driving the Clostridium Vaccine Market in Europe (2022)

|

Countries |

Dogs (Million) |

Cats (Million) |

|

Germany |

10.7 |

15.7 |

|

Spain |

54.2 |

23.9 |

|

France |

7.6 |

14.2 |

|

Russia |

17.2 |

22.7 |

|

UK |

13 |

12 |

|

Italy |

7 |

7.3 |

|

Netherlands |

1.9 |

3.1 |

Source: Health for Animals Organization

North America Market Insights

North America in the clostridium vaccine market is expected to grow steadily by the end of the forecast duration. The market’s development in the region is highly fueled by the presence of veterinary healthcare infrastructure, government-based R&D investments, awareness regarding zoonotic diseases, and notable industrial participation. As per an article published by the AVMA in 2025, an estimated 2/3rd of veterinarians in the U.S. operate in corporate or private clinical practice, ensuring suitable and standard veterinary care for all species. Besides, few tend to aid only exotic or conventional pets, such as small mammals, birds, cats, and dogs, thus denoting a huge growth opportunity for the market.

The clostridium vaccine market in the U.S. is gaining increased traction, owing to the increased prevalence of clostridial disorders, the existence of federal funding programs, regulatory policies, a surge in pet ownership, the humanization trend, and an expansion in Medicaid and Medicare services. As stated in the 2025 AVMA data report, 45.5% of households own dogs and 32.1% own cats, while the average number of per pet-owning household for dogs is 1.5 and 1.8 for cats. In addition, the overall number of households owning dogs is 59.8 million, followed by 42.2 million for cats, and the average spending on veterinary care is USD 580 and USD 433 for dogs and cats.

The clostridium vaccine market in Canada is growing due to an increase in the demand for livestock and meat industry, land scarcity, provincial investment in public health, government and industrial collaboration, and multivalent vaccine uptake. Besides, according to the May 2025 Frontiers Organization article, approximately 60% of families in the country have at least one companion animal, which is either a dog or a cat. However, it has been observed that almost 1.6 million families witness gaps to access preventive care, and 719,000 are devoid of emergency care. Therefore, to overcome this, there is a huge need for veterinary graduates to address this issue, which in turn is suitable for the market’s development.

Expected Veterinary Graduates and Existing Employment in North America (2023-2035)

|

U.S. (2023-2035) |

Canada (2023) |

||

|

Academic Year |

Total Graduates |

Employment |

Rate |

|

2025 |

4,339 |

Private clinical practice |

90.4% |

|

2026 |

4,483 |

Academia and shelter work |

6.3% |

|

2027 |

5,022 |

Industry and commercial |

1.5% |

|

Through 2030 |

40,424 |

Government |

1.5% |

|

Through 2032 |

52,926 |

Provincial veterinary medical associations |

7.9% |

|

Through 2035 |

71,733 |

Internships and CVMA |

3.1% |

Sources: AAVMC; SCVMA

Key Clostridium Vaccine Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bimeda, Inc.

- Boehringer Ingelheim

- Ceva Santé Animale

- Elanco

- Merck & Co., Inc.

- Sanofi S.A.

- Virbac Corporation

- Zoetis

- Colorado Serum Company

- Valneva SE

- Eli Lilly and Company

- Intervet Inc.

- Arko Labs

- CanFel Therapeutics

The international clostridium vaccine market is extremely competitive, and highly dominated by large-scale multinational pharma and animal health campaigns, which are based in Europe and the U.S. Notable leaders in the market, such as Ceva Santé Animale, Boehringer Ingelheim, and Bayer, are continuously investing in R&D to create cutting-edge vaccines with optimized efficacy and safety profiles. Besides, tactical collaborations, acquisitions, along with licensing agreements are prevalent, which have enabled technology transfer and expansion in the global reach. Meanwhile, emerging biotech organizations, including CanFel Therapeutics and Arko Labs, are highlighting advanced trends by focusing on recombinant vaccine platforms, thereby suitable for boosting the clostridium vaccine market.

Here is a list of key players operating in the global market:

Recent Developments

- In November 2024, Ceva Animal Health unveiled its newest investment in Europe-based vaccine manufacturing by constructing a new facility in Hungary, with the intention to extend the Ceva Phylaxia capacity.

- In August 2024, Fonterra has successfully signed a multi-year joint development deal with biomass fermentation startup Superbrewed Food, with the objective to explore the potential of its postbiotic ingredient.

- Report ID: 8153

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Clostridium Vaccine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.