Brucellosis Vaccines Market Outlook:

Brucellosis Vaccines Market size was valued at USD 267.91 million in 2025 and is set to exceed USD 428.16 million by 2035, registering over 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of brucellosis vaccines is estimated at USD 279.48 million.

The brucellosis vaccines market is of incremental development, triggered by continued global occurrence of the disease, particularly where intensive livestock production is common. Prevailing trends in the market are towards giving precedence to safer, more effective vaccine development, where there is shifting towards subunit and recombinant technology to minimize live attenuated strain danger. For instance, in March 2025, the Centers for Disease Control and Prevention (CDC), Food and Drug Administration (FDA), and U.S. Department of Agriculture (USDA) reported that highly pathogenic avian influenza (HPAI), more precisely avian influenza virus type A (H5N1), has been discovered in U.S. dairy cattle for the first time.

Furthermore, the market is also experiencing increased investment in funding diagnostic tests for vaccine programs so that more focused intervention and improved surveillance can be offered. For instance, in August 2024, a ground-breaking partnership between the Royal Veterinary College and the Pirbright Institute sought to drastically lower methane emissions from cattle by investigating potential interventions, such as the development of a novel vaccination. This ambitious initiative was funded by a USD 9.4 million grant from the Bezos Earth Fund. It aimed to use cutting-edge biotechnology to determine how vaccines can reduce cattle methane emissions by over 30%, addressing a significant contributor to climate change.

The regulatory systems are also evolving to bring about more harmonization of standards for vaccine production and distribution so that international collaboration and market access can be facilitated. The demand for thermostable vaccines which can survive unstable environmental conditions, is also growing, thereby overcoming logistical hurdles in remote and resource-constrained locations. The industry is thus increasingly looking to develop integrated disease control programs with vaccination supplemented by improved animal husbandry and public health intervention.

Key Brucellosis Vaccines Market Insights Summary:

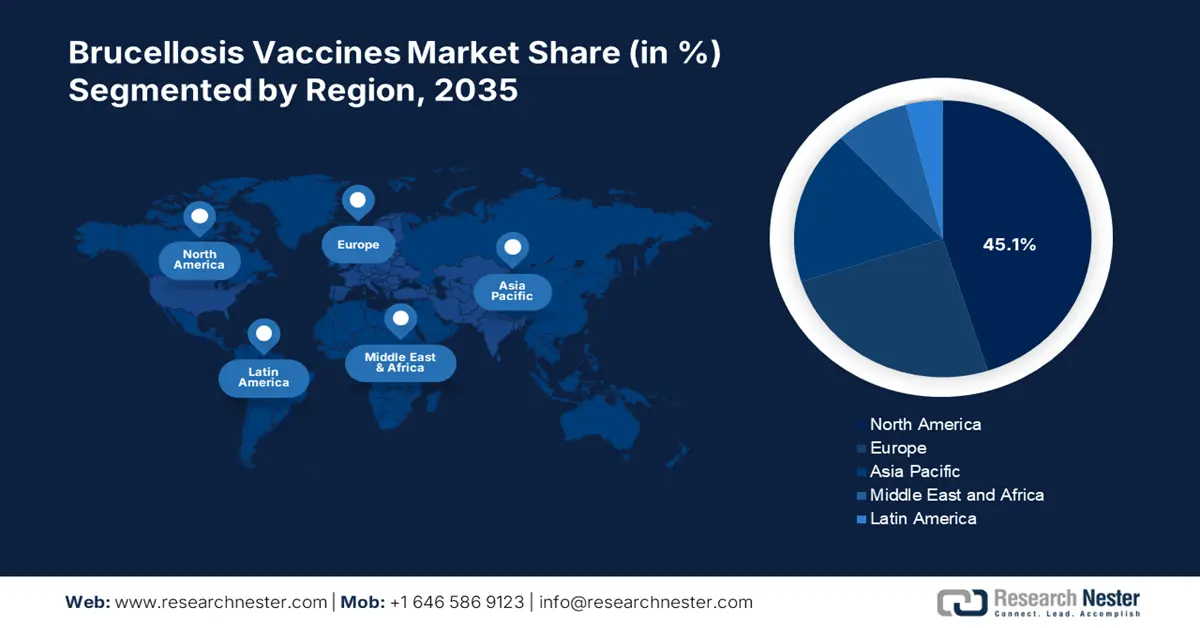

Regional Highlights:

- North America's 45.1% share in the Brucellosis Vaccines Market dominates due to regulatory guidance and assistance towards the upliftment of livestock welfare, driving robust growth through 2035.

Segment Insights:

- The RB51 Vaccine segment is projected to hold a major share by 2035, fueled by its ability to confer protective immunity without disrupting diagnostic tests.

- The Cattle Segment is projected to achieve a 59.2% share by 2035, fueled by government initiatives supporting vaccination for economic and health benefits.

Key Growth Trends:

- Increasing livestock population

- Economic impact of brucellosis

Major Challenges:

- Diagnostics interference

- Variability in vaccine efficacy

- Key Players: Colorado Serum Company, Indian Immunologicals, Hester Biosciences, Veterinary Technologies Corporation, and more.

Global Brucellosis Vaccines Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 267.91 million

- 2026 Market Size: USD 279.48 million

- Projected Market Size: USD 428.16 million by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Argentina

Last updated on : 12 August, 2025

Brucellosis Vaccines Market Growth Drivers and Challenges:

Growth Drivers

- Increasing livestock population: A prominent growth driver for the brucellosis vaccines market is the increasing population of livestock. For instance, in November 2024, it was revealed by the Basic Animal Husbandry Statistics that, with more than 537 million animals, India has the greatest livestock population in the world. Moreover, with rising demand for animal proteins, particularly in the developing economies, animal rearing becomes more intensive and therefore conducive to the outbreak of brucellosis. Huge numbers of animals provide suitable conditions for free transmission of the brucella pathogen, thus necessitating mass vaccination against huge economic losses and public health risks.

- Economic impact of brucellosis: The brucellosis vaccines market is economically impacted, underpinning losses due to reduced fertility, reduced milk production, and mortality burden of the livestock and producers. In May 2023, the Oxford Analytica’s model was developed using the UN Food and Agriculture Organization and the World Organization for Animal Health (WOAH) data that covered 180 nations between 2005 and 2022. It revealed that every year livestock sickness lowers worldwide production by 179.5 billion kgs of dairy and 80 billion kgs of meat. This results in a USD 358.4 billion decrease in producer revenue. Hence, producer income would rise by USD 3.2 billion for every 1% decrease in the illness rates of beef cattle and by USD 3.8 billion for every 1% decrease in dairy cattle illness rates.

Challenges

- Diagnostics interference: Within the brucellosis vaccines market, a multifaceted issue is the impact on disease surveillance and control. Furthermore, the core issue is the serological reaction that is produced by certain vaccines from live attenuated strains of brucella. In addition, the diagnostics interference reduces the application of test-and-cull measures, one of the chief elements of eradication programs in brucellosis. The need for manufacture and verification of highly specific diagnostic tests to be able to distinguish between naturally induced and vaccine-induced antibodies necessitates a significant commitment to research and development. It is heightening the expense and complexity of brucellosis control and underscoring the need for marker-based, safer vaccines.

- Variability in vaccine efficacy: Immunogenicity variation in the brucellosis vaccines market has been a persistent problem that has led to the failure to achieve consistent and uniform disease control. Predominantly, the variability is the multifactorial interaction between host, environment, and vaccine strain. Immunity of the host, age, and genetics play an important role in the immune response after vaccination. The intensity could also be decided by vaccine viability strain variation and storage. Environmental stressors such as co-infections or starvation can also compromise the effectiveness of the vaccine. Such heterogeneity necessitates ongoing research to optimize vaccine preparation and delivery, as well as modulator properties of vaccine-induced immunity.

Brucellosis Vaccines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 267.91 million |

|

Forecast Year Market Size (2035) |

USD 428.16 million |

|

Regional Scope |

|

Brucellosis Vaccines Market Segmentation:

Application (Cattle, Sheep & Goat)

Cattle in brucellosis vaccines market is set to account for more than 59.2% revenue share by the end of 2035. Government initiatives create a safe market for brucellosis vaccines with impetus generated by economic as well as health requirements. For instance, as per the March 2025 report unveiled by the Department of Animal Husbandry, the National Animal Disease Control Programme (NADCP), a flagship initiative was introduced by the government of India to combat cattle diseases. A total of USD 152.9 billion was spent over five years (2019–20 to 2023–24) to vaccinate 100% of cattle, buffalo, sheep, goats, and pigs against foot and mouth disease (FMD) and 100% of bovine female calves aged 4–8 months against brucellosis.

Type (RB51 Vaccine, S19 Vaccine)

Based on the type, the RB51 vaccine segment is expected to garner the major share in the brucellosis vaccines market by the end of 2035 attributable to its ability to confer protective immunity without disrupting conventional diagnostic procedures, a characteristic of prime value for surveillance integrity. For instance, in May 2024, at the World Buiatrics Congress, Merck Animal Health presented innovations in ruminant health highlighting that BOVILIS RB51 does not affect the results of diagnostic tests and can be used at any time. It is an effective way to prevent bovine brucellosis and does not cause abortions in pregnant animals that have already received the vaccination as calves. Coupled with diagnostic compatibility and well-established efficacy, RB51 is highly preferred for the national brucellosis control programs.

Our in-depth analysis of the global brucellosis vaccines market includes the following segments:

|

Type |

|

|

Vaccine |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Brucellosis Vaccines Market Regional Analysis:

North America Market Statistics

North America brucellosis vaccines market is anticipated to hold revenue share of more than 45.1% by 2035, driven by regulatory guidance and assistance towards the upliftment of livestock welfare. For instance, in December 2024, a new federal order was issued by the USDA Animal and Plant Health Inspection Service regarding the testing and surveillance for the H5N1 variant of the Highly Pathogenic Avian Influenza in all U.S. dairy herds. The new federal orders required infected herds to adhere to enhanced biosecurity planning, which includes movement controls, contact tracing, and additional testing.

The U.S. brucellosis vaccines market is growing exponentially owing to the initiatives taken by the companies and regulatory bodies for the protection of ruminants. For instance, as per its 2025 article, GALVmed and AgResults announced the embarking of the Brucellosis Vaccine Initiative, a USD 30 million prize competition designed to encourage animal health firms to create a brucellosis vaccine that will primarily be utilized in developing nations. The award was sponsored by AgResults, a joint program between the US, UK, Canada, and Australia governments and the Bill & Melinda Gates Foundation.

Canada's brucellosis vaccines market is likely to witness substantial growth during the forecast period driven by its focus on infrastructural development to fabricate a supportive ecosystem and restore the ruminant habitat. For instance, in August 2024, by creating a foot and mouth disease (FMD) vaccination bank, the Government of Canada is furthering its efforts to safeguard animal health. The CFIA was given USD 57.5 million over five years, in Budget 2023 to create an FMD vaccine bank for Canada and create FMD response strategies.

Asia Pacific Market Analysis

The brucellosis vaccines market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline. Owing to a sizable consumer base and growing awareness of the brucella vaccination among them, this region has seen a significant demand for brucellosis vaccines in recent decades. Furthermore, attributed to the abundance of highly qualified medical personnel and the significant number of important participants involved in the creation and introduction of novel brucella vaccines, this market is likely to unfold lucrative growth opportunities.

India's increasing brucellosis vaccines market is being driven foremost by the heavy investments and financial aids from governments and other authoritative bodies to combat diseases and investigate measures to combat and safeguard the livestock. For instance, the Livestock Health and Disease Control Programme (LHDCP) was updated by the Union Cabinet in March 2025, with a total budget of USD 44.4 billion for 2024–2025 and 2025–2026. This included incentives for the selling of medications under the Pashu Aushadhi component and a provision of USD 0.8 billion to supply high-quality and inexpensive generic veterinary drugs.

China's brucellosis vaccines market is witnessing lucrative growth opportunities owing to initiatives implemented by local governments. For instance, in the November 2024 Emerging Microbes and Infections article, it was published that the five-year action plan for brucellosis prevention and control in livestock (2022–2026) was introduced by the China government in 2022. In accordance with China's national standard (GB/T 18646-2018), the Rose Bengal Plate Test (RBPT), Milk Ring Test (MRT), Standard Agglutination Test (SAT), Complement Fixation Test (CFT), indirect ELISA (iELISA), competitive ELISA (cELISA), and PCR were employed for the diagnosis during the controlling.

Key Brucellosis Vaccines Market Players:

- Merck & Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Biovet

- CZ Vaccines

- Colorado Serum Company

- Indian Immunologicals

- Hester Biosciences

- Veterinary Technologies Corporation

- Laboratorios Tornel

- Five Animal Health

- VETAL Animal Health Products Inc.

- Vytelle

The company landscape in the brucellosis vaccines market is predominantly driven by the strategic moves made by the companies to cope with the law prevailing for environmental protection. For instance, in April 2022, Elanco and Royal DSM announced a strategic partnership in the U.S for Bovaer, a ground-breaking cattle feed product that reduces methane emissions. In order to assist the Global Methane Pledge's objective of reducing emissions by 30% by 2030, the strategic partnership links two sustainability leaders.

Here's the list of some key players in brucellosis vaccines market:

Recent Developments

- In February 2025, Biovet received a liscense from the national medicines regulator CDSCO, to sell Biolumpivaxin, a vaccine to prevent lumpy skin disease (LSD) in dairy cattle and buffaloes.

- In April 2023, Vytelle acquired USD 20 million in Series B funding to speed up cow genetic advancement. With this additional funding, Vytelle expanded its business internationally while providing clients with the most dependable, predictable, and easily accessible reproductive technology.

- Report ID: 7350

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Brucellosis Vaccines Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.