mRNA Vaccines and Therapeutics Market Outlook:

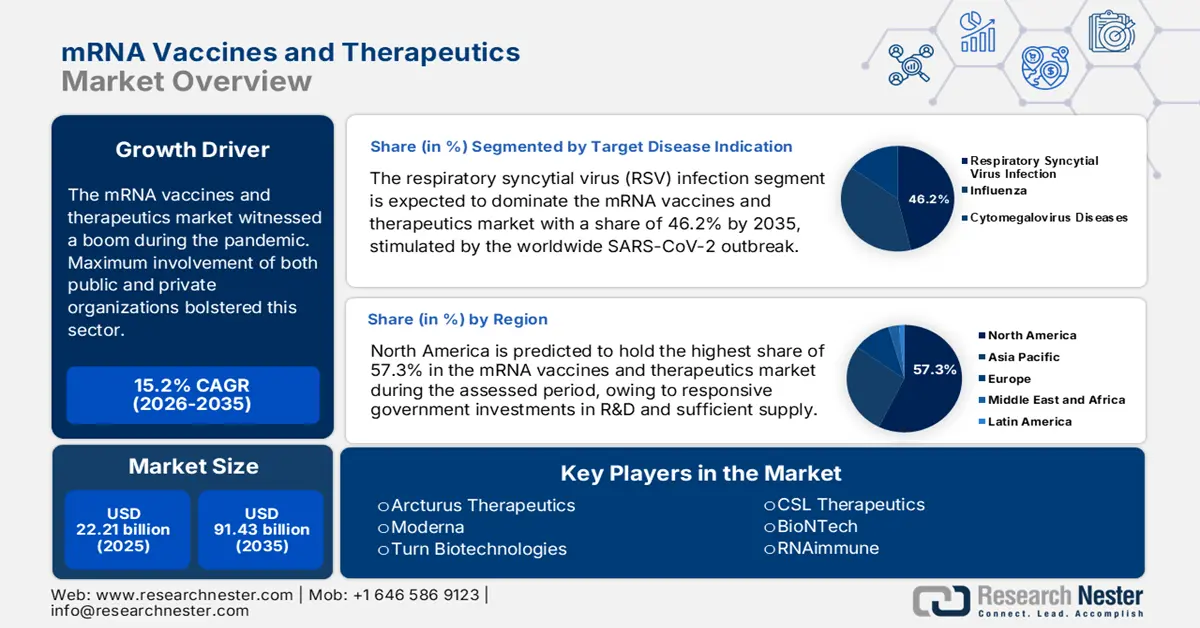

mRNA Vaccines and Therapeutics Market size was over USD 22.21 billion in 2025 and is poised to exceed USD 91.43 billion by 2035, witnessing over 15.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mRNA vaccines and therapeutics is estimated at USD 25.25 billion.

The mRNA vaccines and therapeutics market witnessed a boom during the pandemic. Many public and private organizations were proactively associated in developing and manufacturing vaccines and new treatment options during the worldwide spread, which bolstered this sector. For instance, in June 2021, Sanofi announced the commencement of an annual investment of USD 435.2 million in strengthening its mRNA-based center of excellence (CoE). The fund was dedicated to accelerate production of next-generation vaccine candidates at the facilities of Cambridge, Massachusetts (U.S.), Marcy l’Etoile, and Lyon (France). Similarly, many other initiatives took place over this COVID-19 period, bringing continuous capital influx in this field.

Besides large-scale production, the mRNA vaccines and therapeutics market was also pledged with continuous attempts in reducing payers’ pricing. The positive response from both pharma companies and governing bodies resulted in increased availability of affordable prevention and therapeutics. However, the pricing varied according to region and company’s marketing strategy. On this note, the cost of each dose was determined to range between USD 14.7 and USD 23.5 by Moderna and Pfizer in affluent countries and Europe. Whereas, the same accounted for up to USD 2.1, USD 4.0, USD 5.2 in Europe, the U.S., and South Africa respectively in case of AstraZeneca.: published in the Journal of the Royal Society of Medicine (JRSM), in November 2021. This indicates the need for a uniform standardization and value-based pricing.

Key mRNA Vaccines and Therapeutics Market Insights Summary:

Regional Highlights:

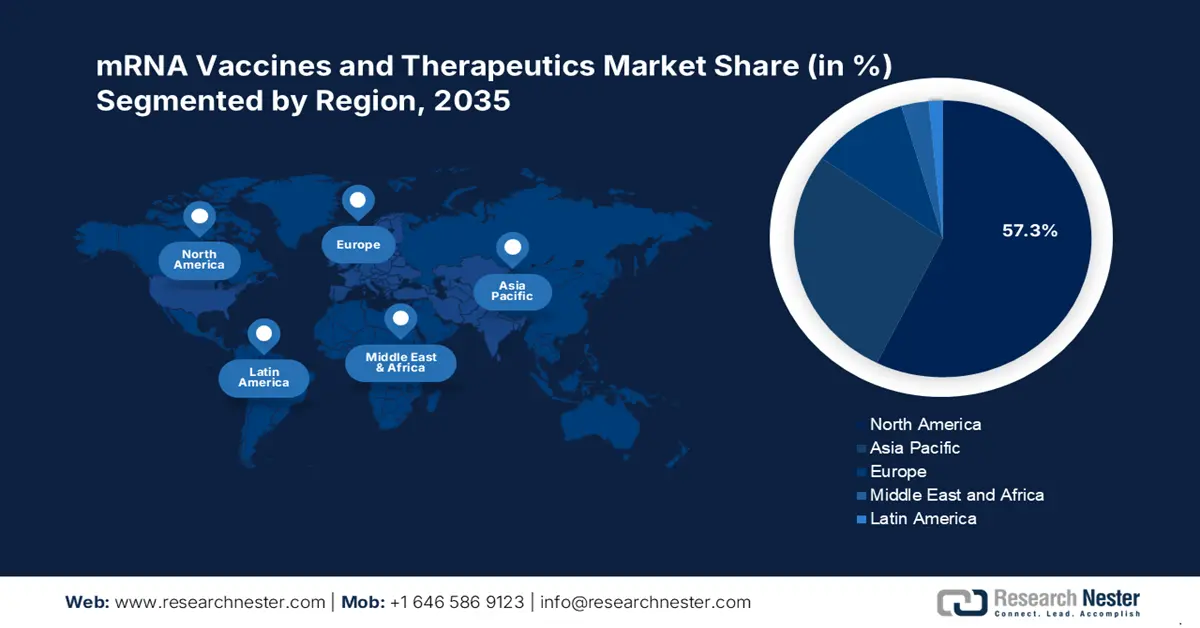

- North America holds a 57.3% share in the mRNA vaccines and therapeutics market, propelled by focused preventive measures for infectious outbreaks and genetic disorders, ensuring robust growth through 2035.

- Asia Pacific’s mRNA vaccines and therapeutics market is projected to maintain substantial growth by 2035, driven by biologics manufacturing capabilities and strong government support.

Segment Insights:

- The RSV infection segment is anticipated to capture a 46.2% share by 2035, propelled by increased vaccination demand following the global SARS-CoV-2 outbreak.

Key Growth Trends:

- Wide application of messenger technology

- Rising efforts for extensive R&D on RNA

Major Challenges:

- Limitations in preservation of products

- Ethical and legal concerns and disputes

- Key Players: Arcturus Therapeutics, Moderna, Suzhou Abogen Biosciences, Innovac Therapeutics, Ziphius Vaccines.

Global mRNA Vaccines and Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 22.21 billion

- 2026 Market Size: USD 25.25 billion

- Projected Market Size: USD 91.43 billion by 2035

- Growth Forecasts: 15.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (57.3% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Germany, China, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

mRNA Vaccines and Therapeutics Market Growth Drivers and Challenges:

Growth Drivers

- Wide application of messenger technology: The mRNA vaccines and therapeutics market has the potential to serve for a broad range of chronic conditions such as HIV and fibrosis. For instance, in May 2022, Moderna collaborated with International AIDS Vaccine Initiative (IAVI) to start the phase I trial on mRNA HIV vaccine antigen, mRNA-1644, in Rwanda and South Africa. The clinical trial, IAVI G003, was sponsored by IVAI, and was aimed at leveraging the HIV antidote development program across Africa. Further, continuous research and technological advances in this category have led to expansion in product reach toward oncology, targeted medicine, rare hereditary diseases, and autoimmune syndrome.

- Rising efforts for extensive R&D on RNA: Financial and regulatory support from various regions is fueling development in the mRNA vaccines and therapeutics market. This type of vaccine surpassed the abilities of other available solutions with faster production capacity and higher efficacy against infectious diseases. This has made this field an attractive option for both institutional and commercial forces to explore endeavors in this category. For instance, in May 2024, the University of Rochester and the University at Albany signed an RNA-associated R&D partnership, inspired by the remarkable contribution of mRNA biologics during the COVID-19 pandemic. This joint effort secured USD 250,000.0 fund for their newly founded CoE in New York, CERRT.

Challenges

- Limitations in preservation of products: Storing the pipeline of the mRNA vaccines and therapeutics market for future use is a major hurdle for companies. These commodities require ultra-low temperature settings, which is difficult to achieve in underserved areas, particularly in resource-constrained countries. Thus, the risk of getting spoiled in such extreme conditions impacts the long-term effectiveness and safety of these biologics, discouraging companies to invest in globalized distribution. This may shrink the market’s expansion.

- Ethical and legal concerns and disputes: The conjugated and rapid R&D activities and findings in the mRNA vaccines and therapeutics market often raise questions about intellectual property (IP). As the pandemic brought the worldwide companies together to develop new technologies and vaccines, there are many unresolved disputes over the ownership of patents and IPs. This also fosters ethical and legal disparities among manufacturers and developers, hindering privacy, consent, and public acceptance across this sector.

mRNA Vaccines and Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 22.21 billion |

|

Forecast Year Market Size (2035) |

USD 91.43 billion |

|

Regional Scope |

|

mRNA Vaccines and Therapeutics Market Segmentation:

Target Disease Indication (Influenza, Respiratory Syncytial Virus Infection, Cytomegalovirus Diseases)

Based on target disease indication, the respiratory syncytial virus (RSV) infection segment is anticipated to hold more than 46.2% mRNA vaccines and therapeutics market share by 2035. Growth in this sector was majorly stimulated by the SARS-CoV-2 outbreak across the world, which testifies to the largest contribution of this segment. According to NLM, the number of people around the globe, with a minimum one vaccination, crossed 5.2 billion till June 2022, encompassing 66.3% of the global population. The COVAX facility distributed around 1.0 billion biologic vials across 144 nations during this scenario. Thus, the severe respiratory illness caused by this virus among infants, older people, and immunocompromised individuals remarkably attracted investors, securing a good flow of business in this category.

Application Area (Covid-19, Others)

In terms of application area, the Covid-19 segment is anticipated to capture the largest share in the mRNA vaccines and therapeutics market throughout the forecasted timeframe. This widespread took a wild turn into a worldwide pandemic, affecting millions of people. This created a medical emergency globally, surging for preventive solutions with faster production and long-acting capacity. This presented an opportunity to display the potential of messenger RNA. In addition, this type of epidemic is still present and requires a sufficient supply of vaccines and medicines to combat upcoming events. This is garnering continuous support and engagement from both manufacturers and investors. For instance, in January 2023, Daiichi Sankyo applied for the marketing rights of a booster mRNA vaccine for COVID-19, DS-5670, in Japan.

Our in-depth analysis of the global mRNA vaccines and therapeutics market includes the following segments:

|

Target Disease Indication |

|

|

Application Area |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

mRNA Vaccines and Therapeutics Market Regional Analysis:

North America Market Analysis

North America in mRNA vaccines and therapeutics market is anticipated to account for more than 57.3% revenue share by the end of 2035. The authorities in this region are highly focused on establishing a strong supply of preventive measures for various infectious outbreaks and genetic disorders. For instance, in September 2024, FDA provided approval for an investigational new drug application of ARCT-032, developed by Arcturus Therapeutics. This solidified the company’s inhaled mRNA therapeutic profile in the cystic fibrosis industry in North America. Innovative messenger RNA-based medicines are now being engineered to address the unmet needs of these conditions, making them a priority accommodation for the regional healthcare system.

The U.S. is experiencing a notable strike of a new SARS-CoV-2 variant, pushing both public and private organizations to invest in this category. This country witnessed a 14.2% prevalence of JN.1 across the nation in 2024, with a significant variation of 1072 mutational sequences. This infection accounted for around 15.0-29.0% of new cases in the U.S. during September 2023, resulting in 10.5% and 8.7% increments in mortality and hospital admissions, as per the NLM article. Such a quick nationwide spread of the viral strain is pushing the government to cultivate adequate resources of vaccines and therapies, boosting demand in the mRNA vaccines and therapeutics market.

Canada is also accumulating forces against the potential epidemic by fostering innovation and extensive research in the mRNA vaccines and therapeutics market. With a 6.8% prevalence (as per 2024 NLM), the country is accepting new messenger technologies and strengthening local medicine production. For instance, in April 2023, the Government of Canada allocated a funding of USD 10.4 million to empower the WHO-issued mRNA Technology Transfer Programme. This contribution made the total national investment in this initiative USD 31.3 million, bolstering local manufacturing capacity of these biologics. This is signifying the potential growth in this marketplace.

APAC Market Statistics

Asia Pacific is estimated to secure a remarkable share in the mRNA vaccines and therapeutics market by exhibiting a notable growth rate over the forecast period. The exceptional capabilities of biologics manufacturing and demanding distribution channels are few of the major drivers in this landscape. As per the 2022 WHO report, approximately 55.0% of the global COVID-19 vaccine production is originated from East Asia. Further, the region is progressing toward a stable leadership in this sector through government support, captivating the interest of global pioneers.

India is one of the forefronts in biologics discoveries and production, placing it at the top of the region-wide mRNA vaccines and therapeutics market. For instance, in June 2023, Gennova Biopharmaceuticals introduced India’s first mRNA booster vaccine, GEMCOVAC -OM, to impart prevention qualities against the omicron variant in citizens. This development was backed by financial support from the Department of Biotechnology (DBT) and the Biotechnology Industry Research Assistance Council (BIRAC) and the company’s patented indigenous platform technology. Moreover, the biopharmaceutical excellence of this country is propelling its proprietorship in this field.

Singapore is also facing a sudden strike of mutational sequences such as JN.1, which is garnering new opportunities for the mRNA vaccines and therapeutics market. The country is utilizing its biomanufacturing abilities and national funding to escalate the pace of production and development in this field. For instance, in November 2024, the Agency for Science, Technology and Research (A*STAR) announced the launch of a non-GMP NATi mRNA BioFoundry at the Bioprocessing Technology Institute (BTI) in Singapore. This inauguration was a crucial part of the Nucleic Acid Therapeutics Initiative (NATi) commencement, aiming at strengthening the domestic capacity in nucleic acid therapeutics.

Key mRNA Vaccines and Therapeutics Market Players:

- Arcturus Therapeutics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BioNTech

- CureVac

- Ethris

- IMMORNA

- Moderna

- Providence Therapeutics

- RNACure

- Suzhou Abogen Biosciences

- Turn Biotechnologies

- Gennova

- Innovac Therapeutics

- Kernal Biologics

- Pantherna Therapeutics

- pHion Therapeutics

- Recode Therapeutics

- Rejuvenation Technologies

- RNAimmune

- Strand Therapeutics

- Walvax

- Ziphius Vaccines

The mRNA vaccines and therapeutics market is witnessing a trend in R&D participation and capacity expansion. Considering the past contribution and emerging surge in these commodities, many biopharma pioneers are showing a tendency to invest in this sector. In addition, government support is encouraging global leaders to incorporate their technologically advanced assets in accelerated production. For instance, in October 2023, the Japanese Ministry of Economy in Japan elected ARCALIS for a grant of USD 165.0 million, leveraging its mRNA vaccines and medications manufacturing capacity. Furthermore, these developers are encompassing new findings to improve patient outcomes and drug kinetics, bringing diversity in options. Suh key players are:

Recent Developments

- In January 2025, Arcturus Therapeutics commenced the phase II CF study on ARCT-032 dosing for 28 days. The multiple ascending dose observation is intended to evaluate the efficacy and safety of the drug in treating patients with cystic fibrosis (CF) and ornithine transcarbamylase (OTC) deficiency.

- In July 2024, CureVac reconstructed its development collaboration to a licensing agreement with GSK, acquiring the rights to develop, manufacture, and commercialize mRNA vaccines globally. The agreement allocated upfront cash and milestone payment of USD 435.3 million and USD 1.1 billion respectively to CureVac.

- Report ID: 7368

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.