Endoscopy Devices Market Outlook:

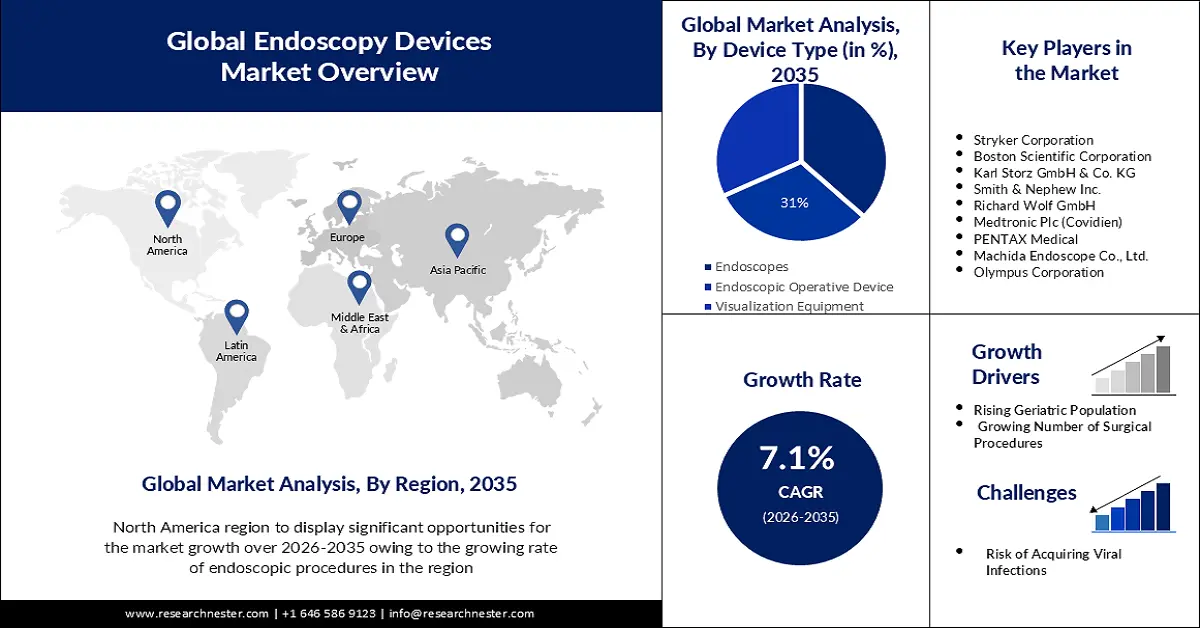

Endoscopy Devices Market size was over USD 62.35 billion in 2025 and is anticipated to cross USD 123.8 billion by 2035, growing at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of endoscopy devices is assessed at USD 66.33 billion.

The market is impelled by the increasing worldwide prevalence of chronic ailments such as cancer, gastrointestinal disorders, and cardiovascular diseases (CVD). According to the GLOBOCON statistics, the number of new and death cases of cancer around the globe is expected to reach 4.6 million and 3.5 million by 2050. Similarly, an NLM projection calculated the global count of CVD deaths to reach 20.5 million by 2025 and 35.6 million by 2050. It also predicted 90%, 73.4%, and 54.7% increments in crude prevalence, mortality, and disability-adjusted life-years (DALYs) throughout the same timeframe. These medical issues require high-end diagnostic and therapeutic procedures to enable early detection and intervention to prevent them from worsening.

The payers’ pricing of commodities from the market varies as per the type of procedure, technology used, and device. For instance, in November 2022, NLM published a comparative cost-analysis of oral, transnasal, and magnet-assisted capsule endoscopy, examining the upper gastrointestinal tract in dyspepsia. Per procedure expense for transnasal endoscopy (TNE) had the lowest value of USD 142.8, in comparison to the oral and magnet-assisted one (USD 208.8 and USD 461.7). On the other hand, the annual purchase and maintenance costs of oral and TNE instruments were USD 89982and USD 92805.2, respectively, higher than USD 17490.5 for the magnet-assisted system. Thus, the need for standardized pricing is highly required to make this sector more publicly accessible.

Key Endoscopy Devices Market Insights Summary:

Regional Highlights:

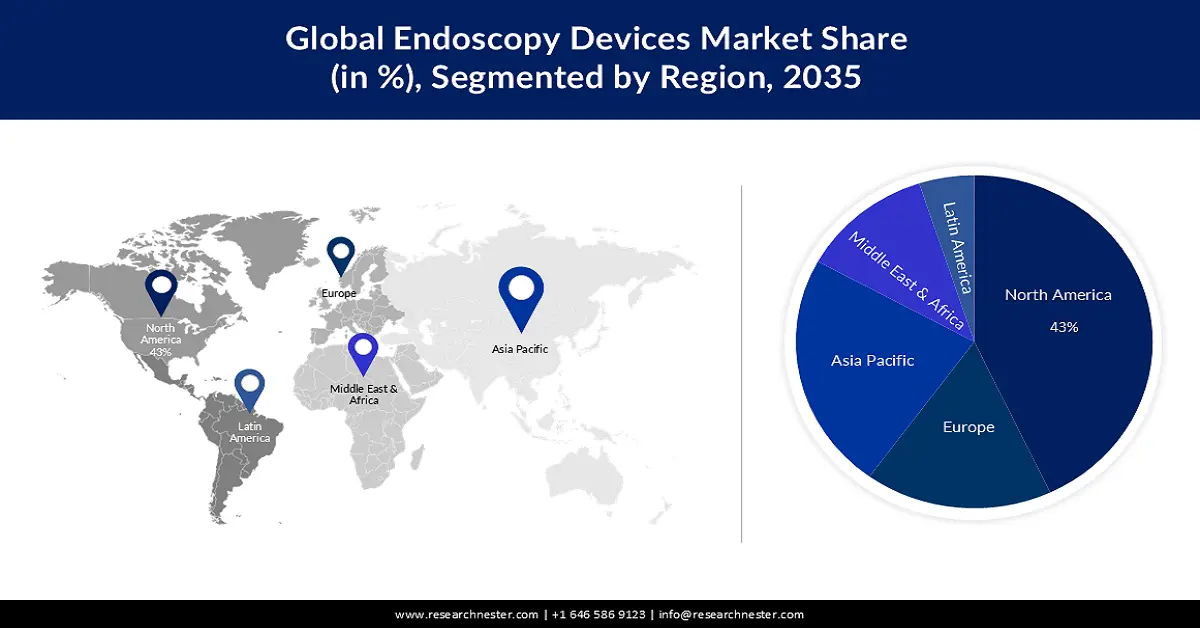

- North America’s endoscopy devices market will dominate more than 43% share by 2035, driven by improved accessibility of procedures and rising patient population with high-risk factors.

- Asia Pacific’s market will register notable growth during the forecast timeline, attributed to healthcare industry expansion and continuous government and investor funding.

Segment Insights:

- The endoscopes segment segment in the endoscopy devices market is projected to capture a 37% share by 2035, driven by rising investments, technological advancements, and adoption in ASCs.

Key Growth Trends:

- Tech-based operations in surgical interventions

- Increasing popularity of minimally invasive procedures

Major Challenges:

- Risk of acquiring healthcare-associated infection (HAI)

Key Players: Stryker Corporation, Boston Scientific Corporation, Karl Storz GmbH & Co. KG, Smith & Nephew Inc., Richard Wolf GmbH, Medtronic Plc (Covidien), PENTAX Medical, Machida Endoscope Co., Ltd., Olympus Corporation.

Global Endoscopy Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 62.35 billion

- 2026 Market Size: USD 66.33 billion

- Projected Market Size: USD 123.8 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, India

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 11 September, 2025

Endoscopy Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Tech-based operations in surgical interventions: Technological advancements, such as the integration of robotics and AI, are believed to fuel growth in the endoscopy devices market. For instance, in March 2024, Fujifilm gained 510(k) clearance from the FDA for its novel AI detection system, CAD EYE, for endoscopic imaging. This compatible tool enables endoscopists the ability to offer real-time detection and removal of colonic mucosal lesions such as polyps and adenomas, irrespective of their size, shape, and color. High sensitivity and accuracy, delivered by such next-generation tools, in all simple and complex procedures are inspiring more healthcare settings to invest in this sector.

- Increasing popularity of minimally invasive procedures: The rapid shift of consumer preference towards procedures with fewer incisions and faster recovery is fueling growth in the market. This approach of less-invasive treatments allows doctors to see within the body without creating any incisions, as the associated instruments are directly put into organs through anus or mouth openings. Moreover, endoscopic surgeries provide cost-saving benefits such as fewer hospital stays and reduced risk of infection, boosting demand in this sector.

Challenges

-

Risk of acquiring healthcare-associated infection (HAI): The most common instruments, used in clinical practice, from the market are often linked to bacterial infection outbreaks. This can be acquired outside or internally through contaminated equipment or from endoscopic staff members to patients. On the other hand, the development of sophisticated non-autoclavable fiberoptic endoscopes has made sterilizing the instrument technically impractical as appropriate cleaning of flexible scopes is still a challenge. It may further raise the possibility of transmitting unwanted bacterial infections, creating concerns about the product’s safety profile. However, the introduction of safer alternatives has the potential to mitigate this issue.

Endoscopy Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 62.35 billion |

|

Forecast Year Market Size (2035) |

USD 123.8 billion |

|

Regional Scope |

|

Endoscopy Devices Market Segmentation:

Device Type Segment Analysis

The endoscopes segment is estimated to account for a 37% share of the global endoscopy devices market throughout the assessed timeframe. There are multiple drivers behind this segment’s predominant captivity, such as rising investments in medical infrastructure, ongoing technological upgradation, and growing adoption of ambulatory surgical centers (ASCs). Additionally, new advancements are widening endoscopic applications, such as bariatric surgery for weight reduction, broadening the consumer base for this segment. The increasing use of disposable and single-use endoscopes due to financial benefits is also contributing to the segment’s greater revenue generation. For instance, a 2021 Journal of Hand Surgery concluded a USD 102 cost-saving in disposable endoscopic carpal tunnel release procedure.

Application Segment Analysis

The endoscopy devices market from the gastroenterology segment is set to garner a notable share by the end of 2035. The high prevalence of gastrointestinal disorders, advancements in endoscopic technologies, and growing awareness of the advantages of early detection & treatment are expected to maintain this segment’s dominance. As per a 2020 NLM study, the new and death cases of gastrointestinal cancer (GI) around the world are poised to increase by 58% and 73% by 2040, accounting for 7.5 million and 5.6 million respectively. Currently, the most prevalent locations of this malignancy are the colorectum, stomach, Liver, Esophagus, and Pancreas. In addition, the global population of residents with peptic ulcers surpassed 4 million in 2022 (NLM). This demography is a clear indication of stable capital influx in this segment.

Our in-depth analysis of the global endoscopy devices market includes the following segments:

|

Device Type |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Endoscopy Devices Market Regional Analysis:

North American Market Insights

The endoscopy devices market in North America is predicted to account for the largest share of 43% over the discussed timeframe. The improved availability and accessibility of associated procedures impels the region’s leadership. This is expected to create a huge demand for these devices. In addition, the patient population is continuously magnifying due to the presence of high-risk factors such as obesity, alcohol consumption, and sedentary lifestyles. For instance, in 2022, the estimated number of new and death cases of gastrointestinal cancer (GI) in the U.S. was 343,040 and 171,920, accounting for 18% and 28% of the total cancer incidence and mortality. These figures are further expected to rise by 9.8% & 11.5% and 27.9% & 21.9% for men & women in the country, respectively (American Journal of Gastroenterology).

According to a 2020 NLM study, the annual count of gastrointestinal endoscopies performed in the U.S. surpassed 75million and over 19million of them were colonoscopies. Other projections from the Gastrojournal concluded the nationwide annual expenditure on GI cancer management to reach USD 21billion by 2030. These figures indicate the heightening surge in the U.S. market, attracting global leaders to participate. On this note, in October 2023, Olympus Corporation initiated the commercialization of its EVIS X1 Endoscopy System in this country, as per the announcement in the annual meeting of the American College of Gastroenterology (ACG), held in Vancouver, Canada.

APAC Market Insights

The Asia Pacific endoscopy devices market is anticipated to be the second largest shareholder by exhibiting a notable CAGR during the forecast timeline. Recent developments and expansion in the healthcare industries from developing countries, such as Japan, China, and India, are driving the region’s propagation. Particularly, continuous funding from governments, foreign investors, and domestic pioneers to establish a strong and efficient network of medical infrastructure is contributing to its progress. For instance, by the end of 2023, foreign direct investments (FDI) in hospitals in India totaled USD 1.5 billion, accounting for 50% of the total healthcare FDI of the nation. This secure capital influx is further inspiring global pioneers to cultivate their channels of marketing in this landscape.

Japan is emerging as the hub of innovation for the market due to being home to several internationally recognized companies such as Fujifilm, Olympus Corporation, and PENTAX Medical. For instance, in January 2023, PENTAX Medical attained the CE mark for its new premium video processor and video endoscope series, INSPIRA and the i20c, supporting their commercial launch. The country’s enlarging medical device industry is also solid evidence of its technological leadership in this field. In this regard, the International Trade Administration reported that the domestic production of medical devices in this country was valued at USD 19.5 billion in 2022. It also calculated the size of this industry in Japan to surpass USD 40.1 billion in the same year.

Endoscopy Devices Market Players:

- Ethicon Endo-surgery, LLC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Stryker Corporation

- Boston Scientific Corporation

- Karl Storz GmbH & Co. KG

- Smith & Nephew Inc.

- Richard Wolf GmbH

- Medtronic Plc (Covidien)

- PENTAX Medical

- Machida Endoscope Co., Ltd.

- FUJIFILM Healthcare

- Olympus Corporation

The market is continuously evolving with the integration of technological advances in the existing pipelines. Key players in this sector are participating in the trend of automation by introducing AI-powered next-generation systems. For instance, in October 2024, Olympus Corporation, in collaboration with Odin Medical, earned CE clearance for its three cloud-AI-based medical devices, CADDIE, CADU, and SMARTIBD. With this regulatory support from the European Union, the company further aimed to cultivate a complete AI-powered endoscopy ecosystem by 2025 to streamline the workflow for medical professionals. Such innovations are attracting both MedTech pioneers and consumers to invest in this sector. This cohort of innovators includes:

Recent Developments

- In April 2025, FUJIFILM announced the commercial launch of its new advanced endoscopy system, ELUXEO 8000, in Europe. This innovation is designed to deliver additional enhanced therapeutic capabilities, workflow management, and improved image quality.

- In September 2024, Olympus made its most advanced endoscopy system, EVIS X1, commercially available in Brazil. This device is equipped with advanced imaging technologies, such as Texture and Color Enhancement, Red Dichromatic, Brightness Adjustment with Maintenance of Contrast, and Narrow Band.

- Report ID: 5420

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Endoscopy Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.