Active Implantable Medical Devices Market Outlook:

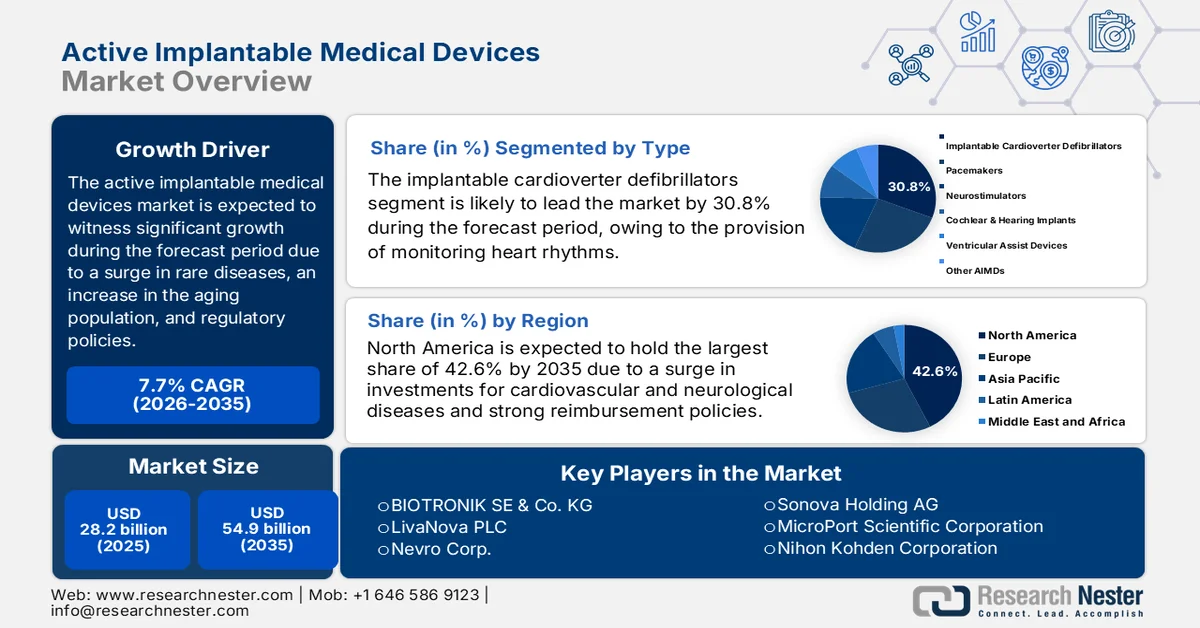

Active Implantable Medical Devices Market size was over USD 28.2 billion in 2025 and is estimated to reach USD 54.9 billion by the end of 2035, expanding at a CAGR of 7.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of active implantable medical devices is estimated at USD 30.3 billion.

The worldwide active implantable medical devices market is gradually entering into a transformative phase, highly fueled by aging populations, an increase in chronic disease prevalence, socio-economic forces, regulatory policies, and technological factors. According to official statistics published by the World Health Organization (WHO) in September 2025, noncommunicable diseases affected almost 43 million people, which is equivalent to 75% of non-pandemic-based deaths internationally. Additionally, 18 million people died from this disease before the age of 70 years, of which 82% of these deaths took place in low- and middle-income nations. Besides, cardiovascular diseases account for the majority of these deaths, accounting for about 19 million, followed by 10 million cancers, 4 million cases of chronic respiratory disease, and more than 2 million cases of diabetes, thereby bolstering the market’s growth.

Furthermore, the integration of cybersecurity in implantable devices, a sudden shift towards personalized medicine, and the expansion of outpatient implant procedures are trends that are proactively uplifting the active implantable medical devices market globally. As per an article published by NLM in July 2025, a clinical study was conducted on 456,954 patients, of which 330,424, which is 72.3%, underwent outpatient surgery. The significant likelihood of outpatient surgery effectively varied by hospital census division for 10 operations. Additionally, variation in hospital census division contributed to outpatient surgery for 8 of 10 operations in comparison with hospital and patient characteristics. Moreover, the hospital census division contributed to 20.6% of the variation in outpatient simple mastectomy, thereby making it suitable for boosting the market’s exposure.

Key Active Implantable Medical Devices Market Insights Summary:

Regional Insights:

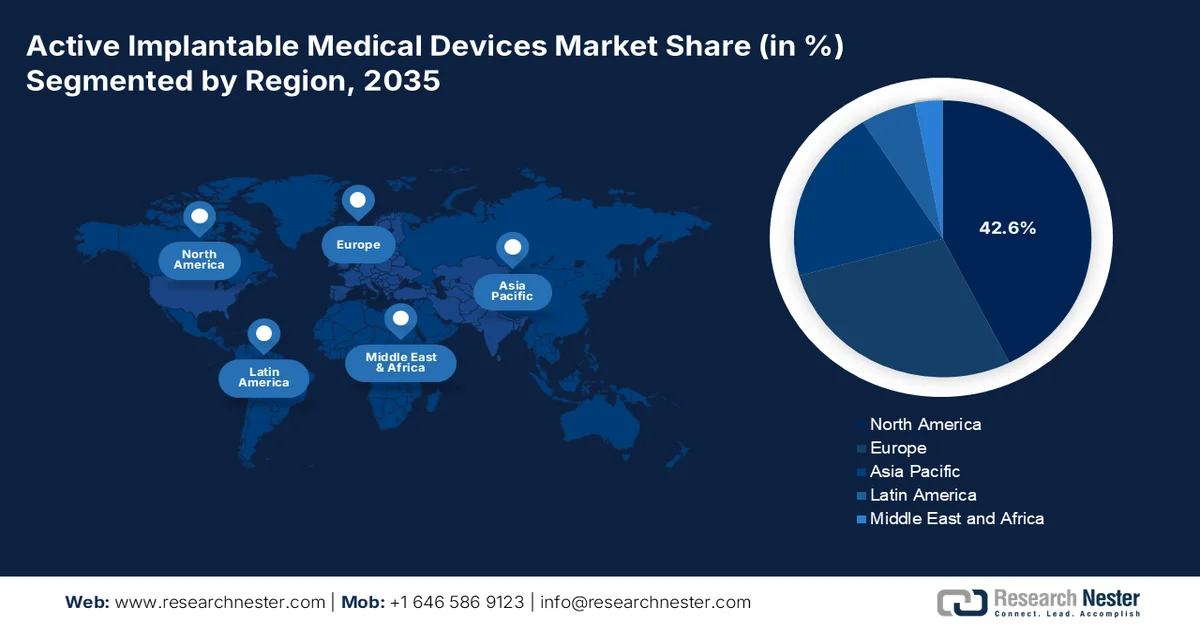

- North America is projected to account for the largest 42.6% share by 2035 in the active implantable medical devices market, underpinned by strong federal funding for neurological and cardiovascular device research, favorable reimbursement frameworks, and advanced healthcare infrastructure.

- Asia Pacific is expected to emerge as the fastest-growing region during the forecast period, accelerated by sustained government backing, expanding healthcare infrastructure, and a large and underserved patient population.

Segment Insights:

- The implantable cardioverter defibrillators sub-segment is expected to command a leading 30.8% share by 2035 in the active implantable medical devices market, supported by its critical role in continuous heart rhythm monitoring and the automatic correction of life-threatening arrhythmias.

- The cardiovascular disorders segment is projected to secure the second-largest share during the forecast period, reinforced by ongoing advancements in device development, innovation, and expanding clinical application across cardiac care.

Key Growth Trends:

- Government investment in digitalized health facility

- Rising demand in emerging economies

Major Challenges:

- Regulatory complexity and compliance burden

- High expenses and reimbursement limitations

Key Players: Medtronic, Abbott Laboratories, Boston Scientific Corporation, Cochlear Ltd., BIOTRONIK SE & Co. KG, LivaNova PLC, Nevro Corp., Sonova Holding AG, MicroPort Scientific Corporation, Nihon Kohden Corporation, Nurotron Biotechnology Co., Ltd., Oticon Medical, MED-EL, Terumo Corporation, Osstem Implant Co., Ltd., ZOLL Medical Corporation, Inspire Medical Systems, Inc., Lepu Medical Technology, Sahajanand Medical Technologies, Straits Orthopaedics.

Global Active Implantable Medical Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.2 billion

- 2026 Market Size: USD 30.3 billion

- Projected Market Size: USD 54.9 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, South Korea, Brazil, Singapore

Last updated on : 10 February, 2026

Active Implantable Medical Devices Market - Growth Drivers and Challenges

Growth Drivers

- Government investment in digitalized health facility: Countries are generously funding digital ecosystems that effectively integrate the active implantable medical devices market with national health records. According to official statistics published by the Digital Health and Discovery Platform (DHDP) in 2024, there is a prediction of allocating an overall USD 25 million by March 2027 through the Government of Canada’s Innovation, Science, Economic, and Development fund. This is expected to operate under a reimbursement model, along with individual eligible projects ranging between USD 1 million and USD 7 million in expenses. Besides, project teams are focused on demonstrating the combined level of financial assistance from total governmental sources not surpassing 75% of the eligible supported incurred costs, thus boosting the market’s demand.

- Rising demand in emerging economies: The rapid healthcare expenditure and urbanization growth in Latin America and the Asia Pacific is significantly driving the active implantable medical devices market adoption internationally. As per an article published by the UN-Habitat Organization in 2026, urbanization is continuing to be a notable megatrend in the Asia Pacific region, accounting for 54% of the international urban population, which is over 2.2 billion people. In addition, the urban population in Asia is projected to grow by 50%, denoting an additional 1.2 billion people by the end of 2050. Besides, more than 1 million homes have been developed, and over 3 million people are provided with basic services, thereby making it suitable for bolstering the market’s expansion.

- Material advancement in biocompatibility: The creation of innovative polymers and bioresorbable materials is optimizing device longevity and diminishing complications, thus fueling the active implantable medical devices market across different segments. As stated in an article published by NLM in October 2023, the international medical polymer industry size is valued at USD 19.9 billion as of 2022 and is further expected to grow at 8.0% between 2023 and 2030 despite expense limitations. Besides, the worldwide biomaterials industry size is worth USD 135.4 billion, with cardiovascular, dental, and orthopedic being over 50% of the overall biomaterials. In addition, tissue engineering, wound healing, ophthalmology, neurology, and plastic surgery composed 50% of the materials, thus skyrocketing the market’s upliftment.

Challenges

- Regulatory complexity and compliance burden: The active implantable medical devices market faces significant challenges due to increasingly stringent regulatory frameworks across regions. In Europe, the Medical Device Regulation (MDR 2017/745) has introduced stricter requirements for clinical evidence, post-market surveillance, and device certification. This has led to delays in product approvals, increased costs for manufacturers, and, in some cases, withdrawal of devices from the market due to compliance hurdles. In the U.S., the FDA’s Investigational Device Exemption (IDE) and premarket approval processes demand extensive clinical trials, which lengthen time-to-market. Moreover, small-scale companies struggle to meet these requirements, thus limiting innovation in the active implantable medical devices market globally.

- High expenses and reimbursement limitations: Active implantable medical devices are among the most expensive categories of medical devices, with pacemakers, ICDs, and neurostimulators costing thousands of dollars per unit. This creates affordability challenges, especially in emerging markets where healthcare budgets are limited. Reimbursement policies vary widely across regions, with countries, such as the U.S., offering Medicare and Medicaid support, while many developing nations lack comprehensive coverage. Even across developed economies, reimbursement delays and restrictive policies hinder adoption. Hospitals and clinics often face budget constraints, limiting procurement volumes despite clinical need. Besides, patients in low-income segments are disproportionately affected, as out-of-pocket costs remain prohibitive, thus negatively impacting the active implantable medical devices market.

Active Implantable Medical Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 28.2 billion |

|

Forecast Year Market Size (2035) |

USD 54.9 billion |

|

Regional Scope |

|

Active Implantable Medical Devices Market Segmentation:

Type Segment Analysis

The implantable cardioverter defibrillators sub-segment, which is part of the type segment, is anticipated to garner the highest share of 30.8% in the active implantable medical devices market by the end of 2035. The sub-segment’s upliftment is highly driven by its importance in monitoring heart rhythms and automatically delivering electrical shocks to correct rapid and life-threatening arrhythmias, such as ventricular fibrillation. According to official statistics published by America Heart Association Journal in 2025, implantable cardioverter defibrillators play a crucial role in effectively diminishing sudden cardiac death by 0.32% every year. Besides, since the past 4 years, hypertrophic cardiomyopathy has evolved to be the most treatable genetic disorder with an approximate prevalence of 1:200 to 500 within the general population, thus bolstering the sub-segment’s growth.

Application Segment Analysis

The cardiovascular disorders segment in the active implantable medical devices market is projected to hold the second-largest share during the forecast period. The segment’s growth is highly propelled by the aspect of developing, innovating, and ensuring clinical applications. Based on government estimates published by the CDC in October 2024, 1 person dies every 34 seconds from cardiovascular disease globally. Besides, as of 2023, 919,032 people have been severely impacted by this particular disease, which is equivalent to 1 in every 3 deaths. Besides, the payers' pricing of medications and healthcare services for heart disease usually amounts to over USD 168 billion. Moreover, in the U.S., nearly 805,000 people suffer from a heart attack, of which 605,000 denotes first heart attack, and the remaining 200,000 account for people with a second heart attack, thereby enhancing the segment’s growth.

Technology Segment Analysis

By the end of the stipulated duration, the conventional devices sub-segment, part of the technology segment, is expected to account for the third-largest share in the active implantable medical devices market. The sub-segment’s development is highly attributed to the earliest generation of life-sustaining and therapeutic implants, including pacemakers, implantable cardioverter defibrillators, cochlear implants, and neurostimulators designed with traditional circuitry and limited connectivity. These devices are characterized by their reliance on established biocompatible materials, standardized surgical implantation procedures, and basic monitoring capabilities. Unlike newer smart or AI-based AIMDs, conventional devices operate primarily in closed-loop systems, delivering therapy without advanced data integration or remote monitoring.

Our in-depth analysis of the active implantable medical devices market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

Technology |

|

|

End user |

|

|

Material |

|

|

Functionality |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Active Implantable Medical Devices Market - Regional Analysis

North America Market Insights

North America active implantable medical devices market is anticipated to garner the largest share of 42.6% by the end of 2035. The market’s upliftment in the region is highly driven by significant federal investment in neurological and cardiovascular device research, robust reimbursement policies, and innovative healthcare infrastructure. According to official statistics published by NLM in February 2023, there has been a growth in digital health technologies (DHTs) in neurological clinical trials, with a yearly growth rate of an estimated 39%. In addition, the relative frequency of DHT utilization in trials for focal conditions increases from 0.7% to 1.4%. Besides, Parkinson’s Disease trials demonstrated early uptake of these technologies and the highest utilization rate of more than 8.3%, thereby making it suitable for the market’s upliftment in the overall region.

The active implantable medical devices market in the U.S. is growing significantly, owing to the existence of reimbursement policies, federal healthcare expenditure, along with an increase in the demand for pacemakers. As per an article published by NLM in April 2025, heart disease continues to be one of the leading causes of death, with 702,880 individuals succumbing to the disorder, leading to 1 in 5 deaths. However, to diagnose the disorder, traditional cardiac pacemakers assist in integrating electrodes and capsule-based structures, with a rough measurement ranging from 25 mm to 30 mm in length, and also weighing less than 2 grams. Moreover, the Micra Transcatheter Pacing System clinical trial denotes a 96% implantation success rate, as well as a 48% reduction in the majority of complications in comparison to conventional pacing systems, thus proliferating the market’s growth.

The aspects of ensuring safety and compliance, an expansion in cochlear implant and neurostimulator adoption for chronic conditions, and the integration of wireless monitoring technologies are positively impacting the active implantable medical devices market in Canada. As stated in an article published by NLM in February 2025, remote patient monitoring (RPM) interventions diminish hospital readmissions by 30% to 50% in the country, and eventually translate into savings, amounting to USD 2,000 to USD 5,000 per patient every year. Besides, the payer’s pricing associated with managing chronic conditions and hospital readmissions is gradually accelerating, with more than USD 6 billion spent every year, solely on hospital readmissions. Therefore, with the presence of such technologies and generous expenditure, there is a huge growth opportunity for the market in the country.

APAC Market Insights

The Asia Pacific active implantable medical devices market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by robust governmental support, advanced healthcare infrastructure, and the presence of a massive patient population. According to official statistics published by NLM in February 2023, an estimated 4% to 7% of the overall GDP has been successfully invested in the health industry in the majority of regional nations. Besides, as per a data report published by the ESCAP Organization in October 2023, economic modelling readily yields expectations of total healthcare spending as a strong GDP in the region, increasing from 5.2% to 9.7% by the end of 2060, thereby enhancing the market’s exposure.

The active implantable medical devices market in China is gaining increased traction, owing to the NMPA regulatory support, government-funded reimbursement, and an increase in the elderly population. As per an article published by NLM in September 2024, there has been a surge in the public financial resources allocation to healthcare in the country from 141.8 billion yuan to 2,254.2 billion yuan as of 2023. In addition, the growth in spending peaked at 47.5% in the country and significantly stabilized below 10%. Besides, the coverage aspect under the medical insurance and urban resident medical insurance, the newest rural cooperative medical scheme has currently exceeded 1.3 billion individuals and gained a coverage rate of more than 95%, thus making it extremely suitable for the market’s expansion.

A rise in cardiovascular disease burden, an increase in chronic pain and neurological diseases, government healthcare spending growth, an expansion in medical infrastructure, and policy and reimbursement support are readily driving the active implantable medical devices market in India. As stated in an article published by the Aging and Health Research in March 2024, Kashmir has a prevalence rate of 14.1 per 100,000 of Parkinson’s disease, in comparison to a low prevalence rate of 27 per 100,000 in Bangalore and 16.1 per 100,000 in Bengal, and meanwhile, Mumbai recorded 328.3 per 100,000. Likewise, the Huntington’s disease frequency in the country is nearly 3 to 5 per 100,000 persons, or approximately 40,000 to 70,000 sufferers. Therefore, with an increase in neurological diseases, the market’s demand in the country is continuously growing.

Europe Market Insights

Europe active implantable medical devices market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly attributed to supportive regional regulations, an aging population, and the presence of strong healthcare infrastructure. According to official statistics published by the Europe Investment Bank in 2025, approximately €13 to €15 billion in capital investment is needed by the end of 2030 for building and upgrading technology infrastructure across the overall region. In addition, regional capital spending demands are expected to grow by more than 200% in the upcoming 5 years in comparison to present investment levels. Besides, the aspect of funding is sourced 47% from regional, 31% from national, and 11% from regional-level, thereby denoting an optimistic outlook for the market’s growth.

The active implantable medical devices market in Germany is gaining increased exposure due to the existence of government-funded advancements, robust reimbursement reforms, and an increase in cardiovascular disease prevalence. As stated in an article published by the ITA in August 2025, the country comprises an outstanding healthcare sector and ranks in the top 10 nations globally, employing an estimated 6.1 million people. Moreover, the domestic medical device industry is one of the largest internationally, accounting for approximately USD 44 billion in yearly revenue, effectively making up 26.5% of the regional market. Besides, 1 out of 6 jobs in the country is associated with the healthcare industry, generating a yearly economic footprint of USD 838 billion or approximately 12.8% of the country’s gross domestic product (GDP), thereby boosting the market’s expansion.

Medical Device Industry Growth in Germany (2022-2025)

|

Growth Estimates |

2022 (USD Billion) |

2023 (USD Billion) |

2024 (USD Billion) |

2025 (USD Billion) |

|

Total Exports |

27.1 |

30.0 |

31.0 |

36.4 |

|

Total Imports |

24.0 |

25.3 |

26.0 |

27.5 |

|

Imports from the U.S. |

5.2 |

5.6 |

6.0 |

6.4 |

|

Exchange Rates |

1.05 |

1.08 |

1.08 |

1.07 |

Source: ITA

An increase in the NHS adoption of AIMSs, support through governmental allocations, harmonized regulations under the EMA and Europe Commission, and ensuring device safety are bolstering the active implantable medical devices market in the UK. As stated in an article published by the ITA in January 2026, the medical technology sector in the country comprises more than 138,000 employment opportunities, with 31% of life sciences turnover, and more than 4,000 localized businesses. In addition, over 85% of the sector includes small and medium-sized enterprises (SMEs) across the entire country. Besides, Medtech is considered the fastest-growing sector, with the number of active organizations extending by more than 200% over the last decade, thereby denoting a huge growth opportunity and expansion of the market in the overall nation.

Key Active Implantable Medical Devices Market Players:

- Medtronic (U.S.)

- Abbott Laboratories (U.S.)

- Boston Scientific Corporation (U.S.)

- Cochlear Ltd. (Australia)

- BIOTRONIK SE & Co. KG (Germany)

- LivaNova PLC (UK)

- Nevro Corp. (U.S.)

- Sonova Holding AG (Switzerland)

- MicroPort Scientific Corporation (China)

- Nihon Kohden Corporation (Japan)

- Nurotron Biotechnology Co., Ltd. (China)

- Oticon Medical (Denmark)

- MED-EL (Austria)

- Terumo Corporation (Japan)

- Osstem Implant Co., Ltd. (South Korea)

- ZOLL Medical Corporation (U.S.)

- Inspire Medical Systems, Inc. (U.S.)

- Lepu Medical Technology (China)

- Sahajanand Medical Technologies (India)

- Straits Orthopaedics (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Medtronic is the global leader in active implantable medical devices, with a dominant presence in pacemakers, ICDs, and neurostimulators. Its extensive research and development investments and strong regulatory approvals position it as the largest player worldwide.

- Abbott Laboratories has a strong portfolio in cardiac rhythm management devices, including ICDs and pacemakers. The company’s focus on minimally invasive technologies and AI-enabled monitoring strengthens its competitive edge.

- Boston Scientific Corporation is a major active implantable medical device manufacturer specializing in ICDs, pacemakers, and neurostimulators. Its growth strategy emphasizes innovation in pain management and neuromodulation devices.

- Cochlear Ltd. is one of the global leaders in cochlear implants and hearing solutions. The company dominates the sensory restoration segment of active implantable medical devices, serving millions of patients worldwide.

- BIOTRONIK SE & Co. KG is a key European active implantable medical device manufacturer, focusing on pacemakers, ICDs, and cardiac monitoring devices. Its strong presence in Europe and emphasis on biocompatible materials drive its market share.

Here is a list of key players operating in the global active implantable medical devices market:

The international active implantable medical devices market is highly competitive, dominated by U.S. players such as Medtronic, Abbott, and Boston Scientific, alongside strong Europe-based firms such as BIOTRONIK and LivaNova. Asia-specific manufacturers, including Nihon Kohden and MicroPort, are rapidly expanding, supported by government-backed innovation programs. Strategic initiatives include mergers and acquisitions, research and development investments in AI-enabled monitoring, and geographic expansion into emerging markets. Besides, in January 2025, Integer Holdings Corporation joined as a tactical partner of choice for significantly amplifying consumers’ innovation and enhancing speed in the overall industry. The ultimate purpose is to introduce the newest advancements and extend capabilities in neuromodulation to ensure cutting-edge miniaturized active implantable medical devices, thereby proliferating the active implantable medical devices industry globally.

Corporate Landscape of the Active Implantable Medical Devices Market:

Recent Developments

- In September 2025, Medtronic plc declared that it has successfully received the U.S. Food and Drug Administration acceptance for the Altaviva device, which is a minimally invasive implantable tibial neuromodulation (ITNM) therapy, inserted near the ankle and has been designed to aid urinary incontinence.

- In July 2025, CARMAT readily provided a therapeutic alternative for patients suffering from innovative biventricular heart failure by achieving the CE mark under Regulation (EU) 2017/745 on medical devices.

- In December 2024, Sequana Medical NV received significant premarket acceptance from the FDA to commercialized alfapump for aiding refractory or recurrent ascites, owing to liver cirrhosis in the U.S.

- Report ID: 8387

- Published Date: Feb 10, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Active Implantable Medical Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.