Cut Flower Packaging Market Outlook:

Cut Flower Packaging Market size was valued at USD 3.74 Billion in 2025 and is likely to cross USD 5.98 Billion by 2035, expanding at more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cut flower packaging is assessed at USD 3.9 Billion.

The growth of the market can primarily be accounted to the rising production of flowers. For instance, in 2022, approximately 3.5 million metric tons of flowers were produced in India alone.

Global cut flower packaging market trends such as, the constantly developing flower industry is projected to influence the growth of the market positively over the forecast period. It was estimated that in 2022, the flower industry in America reached around USD 4 billion. Additionally, the spiking production of flowers such as roses, tulips, sunflowers, orchids, lilies, and others is further estimated to hike the growth of the market during the forecast period. As of 2021, around 100 million stalks of roses were produced solely in Indonesia. Therefore, all these factors are anticipated to propel the growth of the market over the forecast period.

Key Cut Flower Packaging Market Insights Summary:

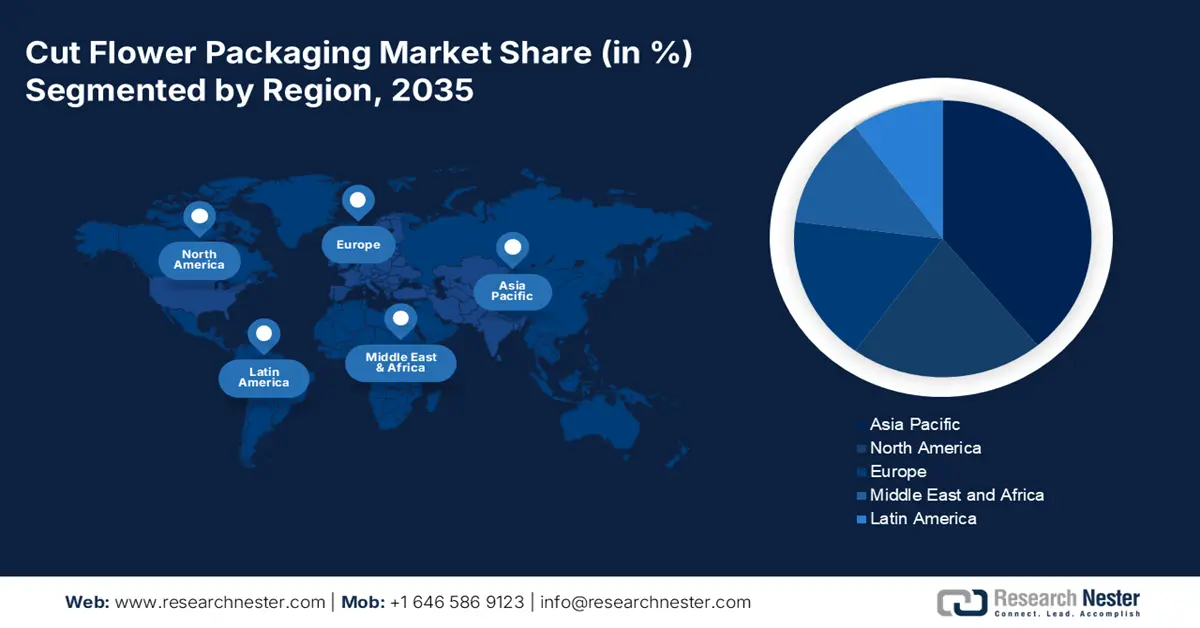

Regional Highlights:

- Asia Pacific cut flower packaging market, the largest share by 2035, is driven by higher flower utilization and cultivation in the region.

Segment Insights:

- The florists segment in the cut flower packaging market is anticipated to hold the largest share by 2035, driven by the increasing popularity of flower gifting trends.

Key Growth Trends:

- Rising Trends of Offering Flowers on Particular Occasions

- Growing Number of Floriculture Crops

Major Challenges:

- Presence of Alternatives in the Market

- Difficulty in Exporting and Importing the Flowers

Key Players: COMPARABLY, INC., Smurfit Kappa Group, Dilpack Kenya Limited, UFlex Limited, PerfoTec BV, Atlas Packaging & Displays, CAMAC HOLDING B.V., Flopak, Inc., Sirane Ltd, Flamingo Holland Inc.

Global Cut Flower Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.74 Billion

- 2026 Market Size: USD 3.9 Billion

- Projected Market Size: USD 5.98 Billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Netherlands, United States, China, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Cut Flower Packaging Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Trends of Offering Flowers on Particular Occasions - For instance, it was observed that approximately 300 million roses are produced across the globe for Valentine’s day. Additionally, around 25% of adults buy flowers on Valentine’s day solely in America.

-

Flowers need certain types of soil, temperature, and weather condition to bloom, hence, they are exported to different countries to fulfill the demand. Cut flowers are either flowers or flower buds and are generally exchanged on special occasions. Therefore, the demand for attractive packaging emerges in the market and is estimated to hike the market growth throughout the forecast period.

-

Growing Number of Floriculture Crops- As of 2021, the total sales of floriculture crops were estimated to be approximately USD 7 billion.

-

Higher Cultivation and Demand for Tulips - The Netherlands is the leading country in supplying flowers globally and was projected to produce nearly 150 hectares of tulip bulbs in 2021.

-

Noteworthy Increment in the Sales of Cut Flowers - In 2020, the sales of cut flowers were at their peak. Cut flower became the 351st most traded product across the globe in 2020.

Challenges

-

Presence of Alternatives in the Market

-

Difficulty in Exporting and Importing the Flowers

-

Requirement for Higher Initial Investment

Cut Flower Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 3.74 Billion |

|

Forecast Year Market Size (2035) |

USD 5.98 Billion |

|

Regional Scope |

|

Cut Flower Packaging Market Segmentation:

Distribution Channel Segment Analysis

The global cut flower packaging market is segmented and analyzed for demand and supply by distribution channel into retail, supermarkets, florists, and online sales, out of which, the florists segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be accounted to the rising trends of exchanging flowers. For instance, in 2021, the floral industry reached nearly USD 6 billion solely in the USA.

Our in-depth analysis of the global market includes the following segments:

|

By Packaging Type |

|

|

By Material Type |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cut Flower Packaging Market Regional Analysis:

Asia Pacific industry is predicted to hold largest revenue share by 2035, impelled by higher utilization of flowers in decoration and to make offerings to gods and goddesses and the rising cultivation of flowers.The growth of the market in the region can be accounted to the higher utilization of flowers in decoration and to make offerings to the gods and goddesses and the rising cultivation of flowers. For instance, the decoration segment in the Asia Pacific was estimated to generate total revenue of nearly USD 10 billion in 2022. Hence, such factors are estimated to hike the market growth in the region during the forecast period.

Cut Flower Packaging Market Players:

- COMPARABLY, INC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Smurfit Kappa Group

- Dilpack Kenya Limited

- UFlex Limited

- PerfoTec BV

- Atlas Packaging & Displays

- CAMAC HOLDING B.V.

- Flopak, Inc.

- Sirane Ltd

- Flamingo Holland Inc.

Recent Developments

-

Sirane Ltd., to provide EARTHBOARD, a tree-guard that utilizes enhanced water-resistant board and is helpful to keep plants last longer outside. Additionally, all the tree shelters of Sirane Ltd are sustainable, recyclable, compostable, and plastic free.

-

PerfoTec BV to talk about its trial to examine the methods that can increase the shelf life of tulips in PerfoTec LinerBags. These bags are based on Modified Atmosphere Packaging technology and can be useful to keep tulips fresh for many days.

- Report ID: 4554

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cut Flower Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.