Beverage Packaging Market Outlook:

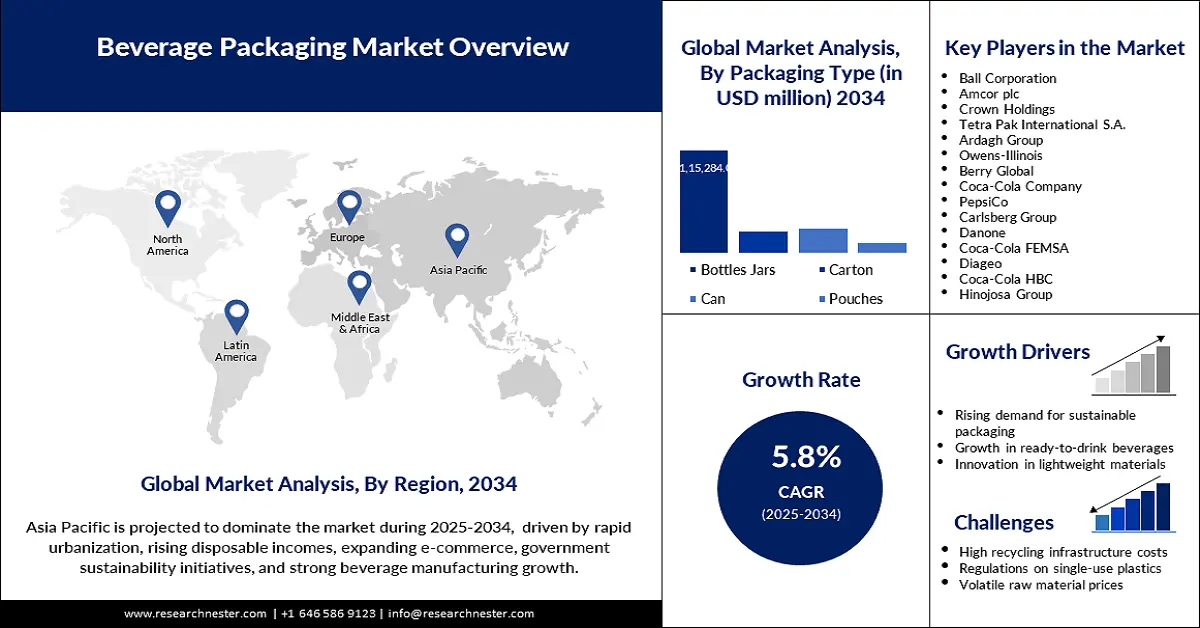

Beverage Packaging Market size was valued at USD 93.9 billion in 2024 and is projected to reach a valuation of USD 165.3 billion by the end of 2034, rising at a CAGR of 5.8% during the forecast period, i.e., 2025-2034. In 2025, the industry size of beverage packaging is estimated at USD 99.4 billion.

The beverage packaging market is undergoing considerable expansion as brands and manufacturers invest in sustainability, innovation, and visual differentiation. For instance, Kellanova reduced plastic use in packaging on Cheez-It Snap'd and Club Crisps in December 2023, removing 124,000 pounds of plastic and 548,000 pounds of cardboard annually. This action aligns with a broader industry trend towards sustainability and efficiency in packaging. Packaging redesigns are also gaining popularity at the same time, as Impossible Foods launched powerful red packaging in March 2024 to stand out and acquire new customers beyond the plant-based sector. Smart labeling and oxygen scavengers are also employed by firms to enhance shelf life and encourage traceability. Governments are also introducing stricter controls, such as India's July 2024 Extended Producer Responsibility guidance, which demands greater rPET adoption and more ambitious recycling targets of drink companies.

One of the major opportunities in the market is to adopt new, lighter, and recyclable materials. In May 2024, Diageo piloted paper bottles with Baileys Irish Cream, introducing 2,000 small bottles that weigh five times less than glass and aim to reduce carbon emissions. Brands like Nestlé and Paper Boat have introduced recyclable packaging for premium beverages and flexible pouches, with consideration to shifting consumer views towards sustainability. Regulatory efforts are also contributing to the trend, with California mandating a minimum level of 15% post-consumer recycled content in beverage bottles from January 2024, up to 50% by 2030. These developments reflect a shift towards circular economy models and packages that balance convenience, safety, and sustainability.

Key Beverage Packaging Market Insights Summary:

Regional Highlights:

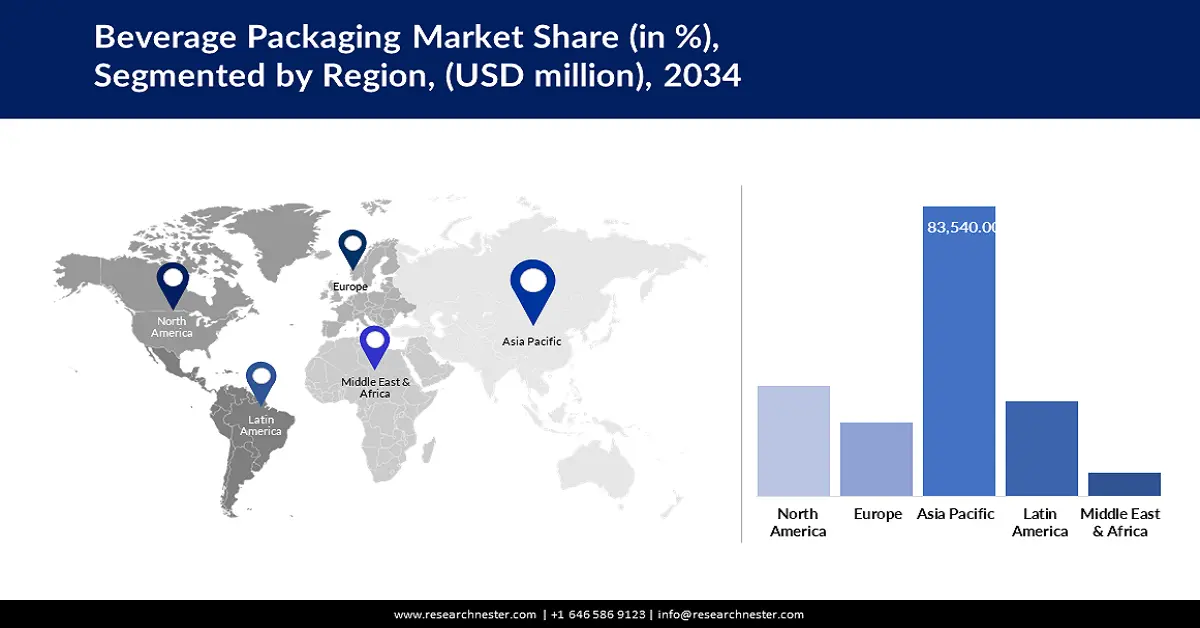

- The Asia Pacific beverage packaging market is projected to hold a 35.5% share by 2034, stimulated by rapid urbanization, rising disposable incomes, and government emphasis on sustainability.

- North America is anticipated to grow at a 5.8% CAGR from 2025 to 2034, bolstered by strict regulatory mandates, eco-conscious consumer behavior, and advancements in packaging innovation.

Segment Insights:

- The bottles & jars segment in the beverage packaging market is anticipated to capture around 63% share by 2034, propelled by their convenience, versatility, and compatibility with diverse beverage types.

- The plastic segment is projected to account for a 37.5% share by 2034, supported by its flexibility, cost-effectiveness, and large-scale production capabilities.

Key Growth Trends:

- Increasing demand for sustainable and recyclable packaging

- Shifting functionality and convenience

Major Challenges:

- Compliance and minimum recycled content requirements

- Moving towards phasing out single-use plastics

Key Players: Ball Corporation, Amcor plc, Crown Holdings, Tetra Pak International S.A., Ardagh Group, Owens-Illinois, Berry Global, Coca-Cola Company, PepsiCo, Carlsberg Group, Danone, Coca-Cola FEMSA, Diageo, Coca-Cola HBC, Hinojosa Group.

Global Beverage Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 93.9 billion

- 2025 Market Size: USD 99.4 billion

- Projected Market Size: USD 165.3 billion by 2034

- Growth Forecasts: 5.8% CAGR (2025-2034)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.5% Share by 2034)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, Thailand

Last updated on : 23 September, 2025

Beverage Packaging Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for sustainable and recyclable packaging: One of the significant drivers of growth is the rising demand for sustainable and recyclable packaging material. In June 2024, Nestlé introduced recyclable packs for its ready-to-drink coffee and tea beverages aimed at premium consumers and in line with global sustainability trends. The move reflects increasing consumer awareness and regulatory pressures for environmentally friendly packaging that push brands to break through in material science and design. Government incentives, such as India's April 2024 green manufacturing production-linked incentives, are also driving further investment in green packaging technologies and infrastructure.

- Shifting functionality and convenience: Another growth driver is the trend of packaging convenience and functionality. Red Bull and Monster Energy launched resealable aluminum cans in November 2024, offering more convenience and reduced single-serve wastage. Functional attributes, such as tamper-evident seals and resealable closures, led by Yakult and Danone's Activia in March 2024, are advancing product protection and consumer convenience. The technologies respond to changing lifestyles and consumption patterns on the go, driving growth in drink categories.

Challenges

- Compliance and minimum recycled content requirements: A significant concern is the intensification of regulatory pressures on waste and recycled content. Connecticut required a 25% post-consumer recycled content mandate on drink containers by 2027, with an increase to 30% by 2032. Reaching such levels involves considerable investment in supply chains and recycling infrastructure, especially for those with multiple jurisdictions' footprints. Companies are expected to cope with a patchwork of local regulations that can add complexity and compliance obligations.

- Moving towards phasing out single-use plastics: The pressure to reduce single-use plastics and shift to alternatives is another barrier to market growth. In December 2022, India's plastic waste management rules led to a ban on single-use plastic straws and cutlery, forcing beverage brands to adopt paper-based and biodegradable alternatives. The transition over is technical and costly, with companies needing to validate new materials for equivalent performance and safety features. The pressure for speedy material development, combined with consumer education, adds packaging complexity.

Beverage Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

5.8% |

|

Base Year Market Size (2024) |

USD 93.9 billion |

|

Forecast Year Market Size (2034) |

USD 165.3 billion |

|

Regional Scope |

|

Beverage Packaging Market Segmentation:

Packaging Type Segment Analysis

The bottles & jars segment is anticipated to capture around 63% share of beverage packaging during the forecast period, owing to their convenience, versatility, and compatibility with a wide range of beverages. In October 2023, Bisleri and Kinley (Coca-Cola) launched lightweight, recyclable PET bottles for their bottled water products in India, adopting sustainability and increasing demand for eco-friendliness in hydration. Bottles and jars remain the preference of both carbonated and non-carbonated drinks, with high shelf presence and resealability. The growth of the segment is also enhanced by ongoing light-weighting and material reduction technology. As brands seek to differentiate and meet regulations, bottles and jars will lead the packaging space.

Material Segment Analysis

The plastic segment is projected to account for a 37.5% share of the beverage packaging market by 2034, driven by its flexibility, value, and bulk production capabilities. In May 2024, PepsiCo increased the level of recycled PET in its soft drink bottles in India and Southeast Asia to meet government demands and consumer demand for greener packaging. Plastic remains the material of choice for light, shatter-resistant, and lightweight beverage containers, especially in emerging economies. Companies are investing in end-of-life recycling technology to close the loop and reduce their reliance on virgin plastic.

Our in-depth analysis of the beverage packaging market includes the following segments:

|

Segment |

Subsegments |

|

Packaging Type |

|

|

Material |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Beverage Packaging Market - Regional Analysis

APAC Market Insights

Asia Pacific beverage packaging maket is likely to account for a 35.5% market share during the forecast period, with the influence of urbanization, rising disposable income, and government regulations toward sustainability. The region is also seeing a shift towards lighter, recyclable PET bottles, as seen with the expansion by Bisleri and Kinley in April 2024 in India. In addition, Government subsidies and EPR policy are propelling the use of recycled and biodegradable materials.

China beverage packaging market is expanding at a rapid rate due to innovation in aseptic and intelligent packaging. In May 2024, the sales of Tetra Pak China's aseptic packaging increased, reflecting consumer trends toward safety and extended shelf life. Chinese brands are investing in material recyclability and lightweight design, with government policies encouraging the use of post-consumer materials. The market focus on quality, safety, and sustainability is driving the take-up of cutting-edge packaging technology.

India beverage packaging market is expanding rapidly due to regulatory requirements and customer demand for sustainable packaging. India made plastic waste management compulsory with Extended Producer Responsibility in July 2024, pushing beverage companies to increase rPET usage and reach higher recycling rates. Furthermore, companies such as Bisleri and Paper Boat are gearing up for green and lighter packaging, and the government is offering incentives for green manufacturing.

North America Market Insights

North America is anticipated to rise at a 5.8% CAGR from 2025 to 2034, driven by regulatory mandates, consumer demand for sustainability, and innovation in packaging. In January 2024, California's minimum requirement of 15% PCR content in plastic beverage cans set the standard for other states, with targets leaping to 50% by 2030. Mergers and acquisitions are also dominating the market, as seen in Sonoco's December 2024 $3.8 billion acquisition of Eviosys and its subsequent expansion into metal packaging.

The U.S. beverage packaging market is witnessing the considerable adoption of sustainable and functional packaging, with top beverage brands launching innovative designs and materials. The industry is also benefiting from packaging redesigns, such as 7UP's August 2024 redesign and Coca-Cola's regulation-free Sprite bottles piloted in early 2024. These innovations are enhancing recyclability and shelf appeal, making the U.S. a leader in packaging innovation.

Canada beverage packaging market is advancing with a focus on sustainable materials and regulatory compliance. In December 2024, Novolex, backed by Apollo Global, acquired Pactiv Evergreen for $6.7 billion to strengthen its regional food service and carton packaging businesses. Canadian brands are also investing in packaging that is recyclable and compostable, with government policies encouraging the incorporation of post-consumer material. Moreover, the market is experiencing growth in smart and functional packaging, driven by consumer demand, fueling innovation in safety and convenience attributes.

Europe Market Insights

Europe is estimated to garner significant growth between 2025 and 2034, with strong regulatory regimes and a shift towards circular economy models. In October 2024, Mondi acquired Western European assets of Schumacher Packaging for €634 million, strengthening its dominance in e-commerce and consumer goods packaging. The region is also witnessing expansion in paper-based and recyclable packaging, with Smurfit Kappa and WestRock merging in July 2024 to form a global leader in paper packaging. Governments across Europe are setting ambitious PCR content and recycling requirements, driving market innovation.

Germany beverage packaging market is expanding steadily, driven by demand for premium, sustainable, and functional packaging. In January 2025, International Paper acquired DS Smith for $7.2 billion, expanding its European presence for fiber-based solutions. German brands are adopting light aluminum cans and smart glass bottles, while pressure on recycling and material reduction from the regulatory climate is impacting product design. The market's emphasis on quality, safety, and sustainability is opening avenues for innovation and expansion.

The UK beverage packaging market is embracing packaging sustainability and innovation, with companies experimenting with new materials and formats in response to evolving consumer and regulatory requirements. During January–March 2024, Coca-Cola piloted labelless Sprite bottles in selected UK stores, streamlining recyclability and supporting the World Without Waste strategy. UK companies are investing in paper-based and compostable packaging, with government policy requiring ambitious recycling levels. The market is benefiting from increasing consumer awareness and appetite for simple, eco-friendly packaging.

Key Beverage Packaging Market Players:

- Ball Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amcor plc

- Crown Holdings

- Tetra Pak International S.A.

- Ardagh Group

- Owens-Illinois

- Berry Global

- Coca-Cola Company

- PepsiCo

- Carlsberg Group

- Danone

- Coca-Cola FEMSA

- Diageo

- Coca-Cola HBC

- Hinojosa Group

The beverage packaging industry includes leaders concentrating on sustainability, innovation, and geographical expansion. With growing regulatory burdens and increasing consumer demands, competition is expected to intensify, leading to further development of eco-friendly, functional, and visually distinctive beverage packages worldwide. One of the noteworthy recent developments occurred in November 2024, when Amcor placed an $8.4 billion offer for Berry Global to create a packaging giant with $27.2 billion in annual sales and a broader global reach. The union will likely drive innovation around sustainable materials, as well as enhance the firm's ability to serve global beverage brands. Here are some leading companies in the beverage packaging market:

Recent Developments

- In December 2024, Sonoco acquired Eviosys, a leading European metal packaging company, for $3.8 billion. This strategic move significantly expanded Sonoco's presence in both the beverage and food packaging markets, bolstering its global footprint and product offerings.

- In December 2024, Novolex, backed by Apollo Global, acquired Pactiv Evergreen for $6.7 billion. This acquisition was a key step in strengthening Novolex's foodservice and carton packaging portfolio, enhancing its competitive position and market share in the packaging industry.

- In October 2024, Mondi acquired Schumacher Packaging’s Western European assets for €634 million. This acquisition expanded Mondi's reach in the e-commerce and consumer goods packaging sectors, enhancing its operational capabilities and market presence across Western Europe.

- Report ID: 4487

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Beverage Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.