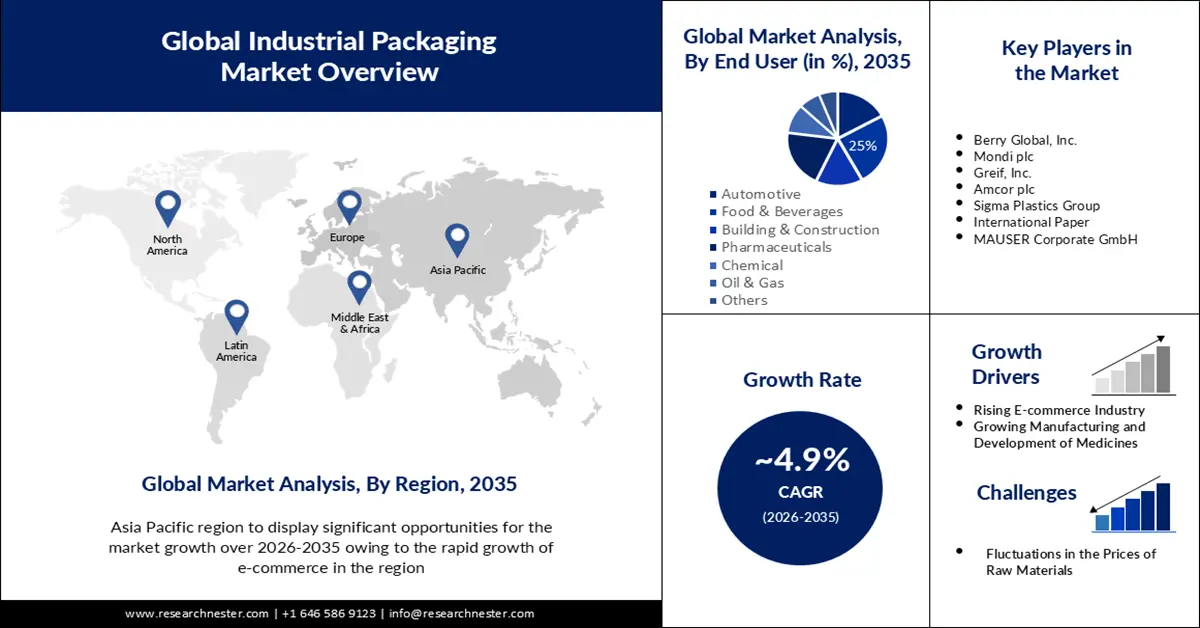

Industrial Packaging Market Outlook:

Industrial Packaging Market size was over USD 73.99 billion in 2025 and is anticipated to cross USD 119.38 billion by 2035, growing at more than 4.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial packaging is assessed at USD 77.25 billion.

The growth of the market can be attributed to the rising use of packaging in the food and beverage industries. Moreover, it is widely used for beverages packaging, so that it can be transported to various places. As per the reports, the total alcoholic beverage sales have increased to more than 200 Billion in the United States in the year 2021.

Industrial packaging aims to safeguard a product while it is being transported from one location to another. It may take place between companies or suppliers from the same sector. Additionally, it can be transported by truck, ship, plane, or train, among other modes. The industrial packaging must therefore be resistant to vibration and travel. Industrial packaging also contains materials in addition to this protection. It includes many instances of a product with the same final destination. And because it is made specifically for so many different things, it is unique and made of various materials. Large containers are available in wood, plastic, and corrugated cardboard. Even packaging that incorporates these and other materials, as well as the inclusion of additional materials to wrap the interior to safeguard the parts, is available.

Key Industrial Packaging Market Insights Summary:

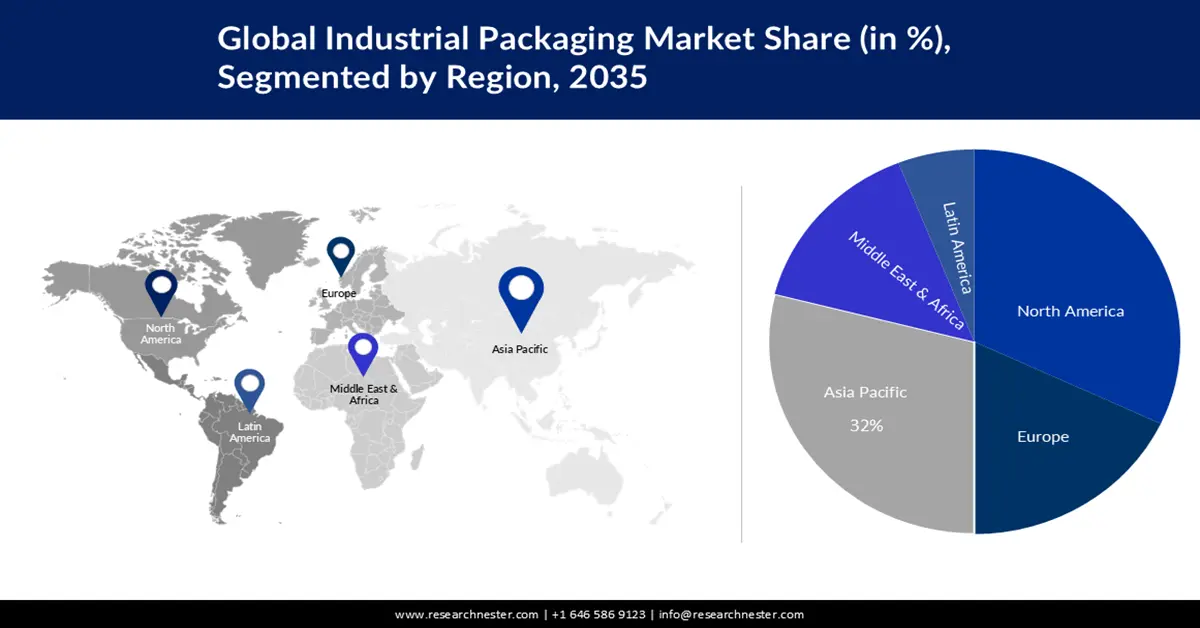

Regional Highlights:

- The Asia Pacific industrial packaging market is forecasted to hold a 32% share by 2035, driven by rapid e-commerce growth, rising population, and increased demand from industries like electronics and automotive.

- The North America market is expected to secure a 29% share by 2035, attributed to growing demand for convenient packaging options and increased investment in packaging sector development.

Segment Insights:

- The corrugated box (product type) segment in the industrial packaging market is expected to capture a 46% share by 2035, driven by high structural strength and cushioning properties making it ideal for fragile goods.

- The food & beverages segment in the industrial packaging market is poised for substantial growth over 2026-2035, driven by increasing food delivery via e-commerce raising demand for safe packaging.

Key Growth Trends:

- Growing Manufacturing and Development of Medicines

- Rising E-Commerce Industry

Major Challenges:

- Environmental Concern Related to the Industrial Packaging

- Fluctuations in the Prices of the Raw Materials

Key Players: WERIT Kunstsoffwerke W. Schneider GmbH & Co., Greif, Inc., Mondi plc, Global-Pak, MAUSER Corporate GmbH, International Paper, Orora Packaging Australia Pty Ltd, Sigma Plastics Group, Amcor plc, Berry Global, Inc.

Global Industrial Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 73.99 billion

- 2026 Market Size: USD 77.25 billion

- Projected Market Size: USD 119.38 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Industrial Packaging Market Growth Drivers and Challenges:

Growth Drivers

- Growing Manufacturing and Development of Medicines– The medications necessitate packaging that is chemically and corrosion resistant. There is a need to protect the medicines from being physically damaged while being transported from the location of manufacturing to the retail store. Moreover, the capacity of flexible plastic packaging coatings to protect medications from external environmental conditions is expected to increase its demand during the analysis period. The entire spending on medications in 2021 is expected to be around USD 1.5 trillion across the globe.

- Rising E-Commerce Industry – There has been an increase in the number of people ordering fresh food, FMCG, and other products through e-commerce channels, which increases the demand for industrial packaging. Therefore, it is anticipated to boost the growth of the Industrial packaging market in the upcoming years. For instance, global retail sales of e-commerce are projected to reach more than USD 8.0 trillion by the end of 2026.

- Increasing Sale in Automotive Industry– The industrial packaging is used to ship the automotive parts and components. Moreover, the increasing demand for automobiles in the automotive sector is surging the need for the transportation of more components to the manufacturing units. Hence, it is projected to surge the growth of the global industrial packaging market over the forecast period. As per the reported data, the car sales across the globe have increased to more than 65 Million in the year 2022.

- Growing Use of Packaging in Chemical Industry– Chemicals are packed in order to protect them from exposure to moisture, and allow the users to use them without any hazards. Therefore, it is predicted to surge the Industrial packaging market’s growth by the end of 2035. According to the estimates, the production volume of chemicals around India was more than 11 million metric tons in the fiscal year 2021.

Challenges

- Environmental Concern Related to the Industrial Packaging – Industrial packaging is one of the major concerns for the environment, as it generates air emissions. Moreover, the packaging waste is dumped into the soil, and ocean, which is degrading the environment. In addition, the underdeveloped method for the recyclability of the packaging is creating a problem in the industrial packaging market. Thus, it is estimated to hamper the growth of the market in the upcoming years.

- Fluctuations in the Prices of the Raw Materials

- High Cost of the Industrial Packaging

Industrial Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 73.99 billion |

|

Forecast Year Market Size (2035) |

USD 119.38 billion |

|

Regional Scope |

|

Industrial Packaging Market Segmentation:

End-user Segment Analysis

The industrial packaging market is segmented and analyzed for demand and supply by end user into automotive, food & beverages, building & construction, pharmaceuticals, chemical, oil & gas, and others. Out of these sub-segments, the food & beverages segment is estimated to gain the largest market share by the end of the year 2035. The growth of the segment can be attributed to the increasing number of people ordering food and beverages through e-commerce platforms, which increases the need for corrugated packaging. In addition, the packaging meets the need for the food safety requirements set by the regulatory bodies. Moreover, the industrial packaging is used for the preservation of food and beverage products while they are delivered from the manufacturers to the retailers. Therefore, all these attributes are predicted to increase the growth of the segment in the market. According to the survey, it is anticipated that the food and beverages. More than 80 percent of the people in India use food through delivery apps owing to the convenience.

Product Type Segment Analysis

The global industrial packaging market is also segmented and analyzed for demand and supply by product type into crates, snacks, corrugated box, drums, pails, intermediate bulk containers (IBC), and others. Amongst these three segments, the corrugated box segment is expected to garner a significant share of around 46% in the year 2035. This can be attributed to the benefits attached to the corrugated box such as its high structural strength, and cushioning properties, which make it a better option for packing fragile products. Moreover, they are able to pack different varieties of products that are of different shapes and sizes. Moreover, they are able to transport goods and products that are delicate in nature. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global Industrial packaging market includes the following segments:

|

By End User |

|

|

By Material |

|

|

By Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Packaging Market Regional Analysis:

APAC Market Insights

Industrial packaging market share in Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 32% by the end of 2035. The growth of the market can be attributed majorly to the rapid growth of e-commerce in the country such as China, India, followed by the rising population. In addition, the increasing demand for industrial packaging from various industries, such as electronics, automotive, and others, is further anticipated to boost the growth of the market in the region. Furthermore, the surge in the number of working people, which increases the demand for ready to eat food products, is also expected to expand the market’s growth in the Asia Pacific region. In addition, there have been rising manufacturing activities in the emerging nations, for meet the demands of customers. All these, factors are expected to surge the growth of the Industrial packaging market by the end of 2035. According to the recent reports, the e-commerce penetration has reached to nearly 29 percent of the retail sales in China, as of 2022.

North American Market Insights

The North America industrial packaging market is estimated to be the second largest, registering a share of about 29% by the end of 2035. The growth of the market can be attributed majorly to the growing demand for convenient packaging options, that have become popular in the region. Furthermore, the surging investment by the market players for the development of the packaging sector is further projected to drive the growth of the market over the forecast period. Moreover, the increasing demand for packed and processed food and beverages in the region is another factor that is anticipated to expand the Industrial packaging market’s growth in the region in the upcoming years.

Europe Market Insights

Europe region is set to witness significant growth till 2035. The growth of the market can be attributed majorly to the increasing consumer awareness related to the importance of sustainability, along with the growing strictness of the stringent regulations for banning the use of plastic products. In addition, the rapid industrialization, and improving standard of living among the population in the European region is further anticipated to surge the market’s growth in the region.

Industrial Packaging Market Players:

- WERIT Kunstsoffwerke W. Schneider GmbH & Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Greif, Inc.

- Mondi plc

- Global-Pak

- MAUSER Corporate GmbH

- International Paper

- Orora Packaging Australia Pty Ltd

- Sigma Plastics Group

- Amcor plc

- Berry Global, Inc.

Recent Developments

- Berry Global, Inc. announced the launch of new, global center excellence, and circular innovation hub in Barcelona, Spain. The aim of the center is to spur global collaboration, local jobs, and develop sustainable packaging solutions.

- Mondi plc announced the launch of new packaging solutions for the food industry at Anuga FoodTec in Cologne, Germany. Two tray packaging devices offer recyclable options for fresh food businesses and can assist to reduce food waste.

- Report ID: 4865

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.