Aluminum Beverage Packaging Market Outlook:

Aluminum Beverage Packaging Market size was valued at USD 47.9 billion in 2025 and is projected to reach USD 78.8 billion by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of aluminum beverage packaging is estimated at USD 50.6 billion.

The increasing emphasis on recycling and circular economy policies is encouraging manufacturers and regulators to push for higher domestic reuse of aluminum, prompting a profitable business environment for the market. As of the October 2025 data revealed by the U.S. Environmental Protection Agency, the U.S. generated approximately 1.92 million tons of aluminum containers and packaging, which accounts for 0.7% of municipal solid waste, with beverage cans representing the largest share in a year. It also stated that out of this, 670,000 tons were recycled, corresponding to a 50.4% recycling rate, whereas 13% was combusted for energy recovery, and the remaining 52.1% was landfilled. In addition, the historical data show steady growth in generation, reflecting increased consumption and packaging demand, positively impacting market growth.

In terms of the raw‑material supply chain and manufacturing capacity, the aluminum beverage packaging market has witnessed an increased reliance on secondary (scrap-derived) aluminum. The analysis by PUBS USGS states that the aluminum industry in the U.S. experienced domestic smelter capacity of 1.36 million tons per year. It states that aluminum recovered from purchased scrap totaled approximately 3.3 million tons, out of which 55% derived from new manufacturing scrap and 45% from old scrap, representing about 38% of apparent consumption. Imports of crude and semi-manufactured aluminum amounted to 4.8 million tons, whereas the exports surpassed 1.2 million tons, which reflects a net import reliance of 44% for domestic consumption. Furthermore, the average U.S. market price of aluminum ingots decreased by 15% to 130 cents per pound, highlighting market adjustments.

U.S. Aluminum Production, Consumption, Trade, and Pricing Statistics (2019 to 2-23)

|

Metric |

Value |

|

Primary Aluminum Production |

750 thousand tons |

|

Secondary Production (Old Scrap) |

1,500 thousand tons |

|

Secondary Production (New Scrap) |

1,800 thousand tons |

|

Aluminum Recovered from Scrap |

3.3 million tons |

|

Imports (Crude & Semi-manufactures) |

4.8 million tons |

|

Exports (Crude & Semi-manufactures) |

1.2 million tons |

|

Net Import Reliance |

44% |

|

Average Market Price |

130 cents/lb |

|

Domestic Smelter Capacity |

1.36 million tons/year |

|

Employment |

30,000 |

Source: PUBS USGS

Key Aluminum Beverage Packaging Market Insights Summary:

Regional Highlights:

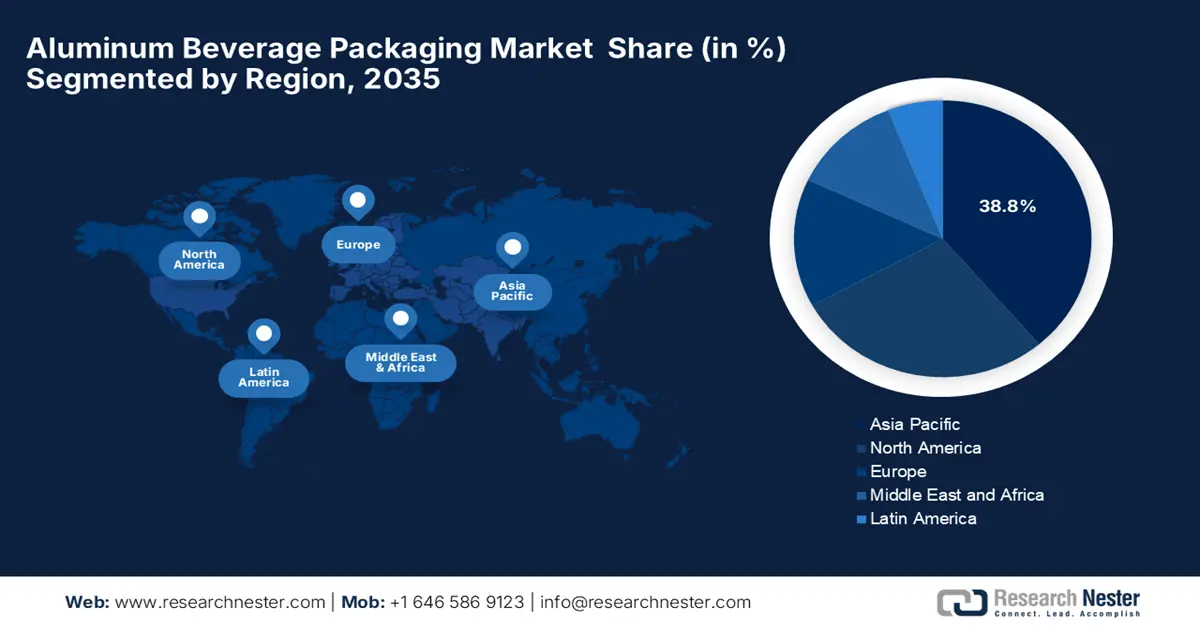

- By 2035, the Asia Pacific region is expected to command a 38.8% revenue share in the aluminum beverage packaging market, underpinned by rising urbanization, increasing disposable incomes, and expanding modern retail systems.

- North America is projected to secure a notable share by 2035, sustained by a large consumer base preferring recyclable packaging formats and a mature recycling infrastructure.

Segment Insights:

- By 2035, the cans segment in the aluminum beverage packaging market is anticipated to hold an 85.3% share, propelled by their sustainability, lightweight nature, and high recyclability.

- The 1 ml to 500 ml capacity segment is expected to capture a significant revenue share by 2035, supported by standard single-serving sizes for major beverages.

Key Growth Trends:

- Sustainability & recycling advantages

- Convenience & growing beverage demand

Major Challenges:

- Fluctuations in raw material pricing

- Environmental pressures

Key Players: Ball Corporation (U.S.), Crown Holdings, Inc. (U.S.), Ardagh Metal Packaging / Ardagh Group (Luxembourg), CANPACK S.A. (Poland), Silgan Holdings Inc. (U.S.), Toyo Seikan Group Holdings, Ltd. (Japan), CCL Industries Inc. (Canada), Nampak Ltd / BevCan (South Africa), Envases Universales (Mexico), Orora Ltd. (Australia), CPMC Holdings Ltd. (China), Kian Joo Can Factory Berhad (Malaysia), Baosteel Metal Co., Ltd. (China), MSCANCO (Saudi Arabia), Bangkok Can Manufacturing (Thailand).

Global Aluminum Beverage Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 47.9 billion

- 2026 Market Size: USD 50.6 billion

- Projected Market Size: USD 78.8 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.8% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, Vietnam

Last updated on : 5 December, 2025

Aluminum Beverage Packaging Market - Growth Drivers and Challenges

Growth Drivers

- Sustainability & recycling advantages: This is one of the important growth drivers for the aluminum beverage packaging market. In this regard International Aluminum Institute in November 2025 revealed that global aluminum beverage can recycling surpassed 75% in 2023, which marks a significant step toward a circular economy. Besides, this achievement positions the industry to meet the global beverage can circularity alliance’s 80% recycling target by the end of 2030. In addition, the exceptional regional results include 94.6% in East Asia and the Pacific and 94.0% in Latin America and the Caribbean, which underscores aluminum’s leadership as the most recycled single-use beverage container across the globe. Furthermore, as sustainability regulations and corporate environmental commitments tighten, these recyclability and circular‑economy advantages are the major drivers for growing adoption of aluminum packaging.

- Convenience & growing beverage demand: The increasing consumer demand for beverages, which includes soft drinks, ready-to-drink beverages, energy drinks, juices, and alcoholic drinks, is fueling demand in the market. As per an article published by ICRIER in September 2024, the global beverage industry witnessed a 7.1% increase from 2022 to 2023, which has also generated revenue of USD 213 billion, and is projected to reach USD 226 billion in 2024, with a CAGR of 5.33% from 2024 to 2028. Simultaneously, the carbonated soft drinks segment alone generated USD 18.25 billion in 2022. Hence, these trends reflect strong and sustained consumer demand, driving growth in aluminum beverage packaging in the years ahead.

- Increased chemical‑safety: This, coupled with labelling standards under revised CLP/REACH, is facilitating continued growth in the aluminum beverage packaging market. These rules are incentivizing the use of safer, well-documented materials such as aluminum, especially for manufacturers of beverage cans. In this regard European Commission reported that the revised EU CLP Regulation, which was effective from 2024, strengthens the classification, labelling, and packaging of chemicals to protect workers, consumers, and the environment. On the other hand, it also mandates clearer hazard communication online and in advertisements, introducing digital and fold-out labelling, and provides rules for complex substances and refill stations, reducing packaging waste. Furthermore, the update also enhances transparency for SMEs, thereby ensuring poison centers receive safety information, and aligns well with the UN globally harmonized system.

Challenges

- Fluctuations in raw material pricing: The aluminum beverage packaging market is negatively impacted by volatilities in terms of the raw material prices, owing to the changes in the cost of bauxite, alumina, and primary aluminum. The aspects such as supply chain disruptions, geopolitical tensions, as well as tariffs on imports can increase the input costs, in turn affecting the profit margins of manufacturers. In addition, energy-intensive smelting processes are making production extremely sensitive to electricity prices, which vary across regions. Most of the smaller packaging producers are vulnerable since they have limited ability to absorb the cost increases. Hence, the existence of long-term uncertainties creates hesitation among investors, affecting market growth and sustainability initiatives.

- Environmental pressures: This, coupled with the regulatory pressures, has hampered upliftment of the market. Governments in almost all nations and regulatory agencies are compelling the pioneers by necessitating recycled content, carbon footprint reduction, and waste management, wherein failure can lead to penalties and access restrictions. Therefore, producers must invest in eco-friendly technologies such as low-carbon smelting and closed-loop recycling systems, wherein the costs can be burgeoning, particularly for the older facilities that require upgrades. Hence, meeting sustainability goals by maintaining cost competitiveness makes it challenging for the firms, thereby influencing strategic decisions around production and product design.

Aluminum Beverage Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 47.9 billion |

|

Forecast Year Market Size (2035) |

USD 78.8 billion |

|

Regional Scope |

|

Aluminum Beverage Packaging Market Segmentation:

Product Type Segment Analysis

The aluminum beverage packaging market is expected to be dominated by the cans segment, which is anticipated to hold an 85.3% share during the forecasted duration. The dominance of the sub-segment is effectively attributable to their sustainability, lightweight natures, and high recyclability. These cans are the most recycled beverage package in most nations that have a high recycling rate and a closed-loop system that significantly reduces the carbon footprint. For instance, in December 2024, Ball Corporation announced that it had partnered with Dabur India to launch Réal Bites juice in completely recyclable aluminum cans, which offer consumers a sustainable, long-shelf-life packaging alternative. Besides, the 185 ml cans cater to on-the-go consumption and support the country’s growing demand for healthier beverages and eco-friendly formats.

Capacity Segment Analysis

The 1 ml to 500 ml sub-segment based on capacity is expected to capture a significant revenue share in the market by the end of 2035. The growth in the segment is driven by factors such as standard single-serving sizes for most carbonated soft drinks, beer, and energy drinks, which constitute the bulk of the market volume. Simultaneously, the demand for convenience, portion control, and on-the-go consumption is also solidifying its position in this sector. There has been an increased popularity of 250ml energy shots and 355ml standard cans, directly fueling this segment. Moreover, rising health-consciousness is readily accelerating the shift toward smaller, controlled-portion packaging formats. Additionally, expanding distribution channels such as convenience stores and rapid-delivery services are further boosting demand for these aluminum packaging sizes, hence denoting a positive market outlook.

End use Segment Analysis

By the end of the discussed timeframe, the alcoholic beverages segment is expected to lead this segment with a lucrative share in the aluminum beverage packaging market. The craft beer industry's preference for cans owing to their portability, light-blocking properties such as prevent skunking, and chill factor is a key contributor to this leadership. In addition explosive growth of ready-to-drink cocktails and hard seltzers is almost exclusively reliant on aluminum cans, facilitating continued growth in this field. In March 2024, Toyo Seikan introduced Japan’s lightest-ever aluminum DI can for 204mm SOT formats, leveraging compression bottom reform technology to strengthen the can base while significantly reducing material use. It also mentioned that the new 350 ml and 500 ml cans are up to 1.5 to 2.0 grams lighter, thereby reducing greenhouse gas emissions by about 9% per can. Furthermore, if deployed across all applicable aluminum beverage cans, this innovation could lower annual emissions by an estimated 40,000 tons, solidifying the segment’s leadership.

Our in-depth analysis of the aluminum beverage packaging market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Capacity |

|

|

End use |

|

|

Format |

|

|

Packaging Material Flow |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aluminum Beverage Packaging Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to command the largest revenue share of 38.8% in the international aluminum beverage packaging market during the analyzed timeframe. The proprietorship of the region in this sector is efficiently fueled by rising urbanization, increasing disposable incomes, and expanding modern retail systems. In August 2022, Suntory announced that it had launched the world’s first-ever 100% recycled aluminum can for limited editions of the premium malt’s CO₂ reduction can and the premium malt’s 〈Kaoru〉 ale, which was developed in collaboration with UACJ and Toyo Seikan Group. It also stated that the new can reduces CO₂ emissions by 60% when compared to conventional aluminum cans, marking a major step toward circular packaging. Hence, this initiative aligns with the firm’s sustainability goals, including significant greenhouse-gas reduction targets across its entire value chain.

China’s market is continuously propelled by a booming beverage industry, especially in ready-to-drink teas, energy drinks, as well as flavored beverages. Simultaneously, the Government initiatives are supporting waste reduction and circular economy practices, thereby encouraging wider adoption of aluminum packaging in the country. The Ministry of Ecology & Environment in March 2025 reported that it issued a work plan that covers the steel, cement, and aluminum smelting industries in the national carbon emission trading industry, which also includes aluminum production in the country’s carbon trading system. It also underscored that the initiative aims to reduce greenhouse gas emissions from aluminum smelting by offering incentives for cleaner production. Furthermore, the focus on low-carbon aluminum, this plan supports the growth of sustainable aluminum beverage packaging in the country.

India in the aluminum beverage market is efficiently growing on account of consumer preference for ready-to-drink refreshments, juices, and functional beverages. On the other hand, brands in the country are embracing aluminum cans to enhance product shelf life and elevate brand appeal. In November 2023, the Aditya Birla Group announced that through its subsidiary Novelis, it is advancing sustainable aluminum beverage packaging with a prime focus on lightweight, completely recyclable cans and innovative aluminum bottles. It also notes that Novelis recycled more than 2.2 million tons of aluminum in 2022, promoting a circular economy by reducing energy consumption by up to 95% when compared to primary aluminum production. Furthermore, Aditya Birla invested around USD 2 billion in recycling capacity and a global decarbonization strategy, and it is committed to carbon neutrality by the end of 2050.

North America Market Insights

North America is the central player in the aluminum beverage packaging market, which is backed by a large consumer base that prefers recyclable packaging formats. Most of the beverage producers in the region are adopting aluminum cans for carbonated drinks, energy beverages, seltzers, and ready-to-drink products, which is also being supported by a mature recycling infrastructure. Similarly, the growing emphasis on circular packaging and brand campaigns promoting eco-friendly formats is also supporting the region’s upliftment over the recent years. Innovations such as high recycled content alloys, along with the lightweighting technologies, are enhancing energy efficiency in can production, also reducing the carbon footprint of each unit. Furthermore, aluminum scrap and the integration of digital supply chain tracking and automated recycling sorting systems are enabling near-real-time optimization of aluminum recovery, which is setting a benchmark for sustainable beverage packaging across the world.

U.S. Aluminum Scrap Supply, Trade, and Energy Impact (2023-2024)

|

Category |

Detail |

Statistic |

Notes |

|

Domestic Scrap Consumption |

Total consumed by U.S. industry (2024) |

5.6 MMT |

Supports ~85% of U.S. aluminum production |

|

Scrap Exports |

Total exported (2023/24) |

~2.0 MMT |

Increased by>17% from the previous year |

|

Scrap Imports |

Total imported |

~0.68 MMT |

At a decade-long high |

|

Net Scrap Trade |

Exports minus Imports |

~1.3 MMT |

Effective trade deficit |

|

Used Beverage Cans (UBCs) |

Generated in the U.S. (2023) |

1.4 MMT |

Less than half is currently recycled |

|

UBCs Imported (2023) |

Imported from Canada and Mexico |

0.183 MMT |

Primarily from Canada and Mexico |

|

Domestic Supply Gap |

Total primary aluminum shortfall |

~4.0 MMT |

Amount of imported ingot/raw aluminum needed |

|

Energy Savings |

Potential annual savings from recycling |

~31 billion kWh |

- |

|

Equivalent Power |

Homes powered by recycled energy |

~3 million U.S. homes |

- |

|

Current U.S. secondary aluminum production |

Approximately annual output |

5 MMT |

- |

Source: The Aluminum Association

In the U.S., the aluminum beverage packaging market is amplifying at a robust pace, supported by the high per-capita beverage consumption and rapid innovations in terms of can design and customization. In this context, the article published by the Aluminum Association in December 2024 reported the key policy priorities to strengthen the country’s aluminum production, by recycling and supply chains, emphasizing the material’s highly essential role in the economy and national security. It also underscored that more than USD 1 billion worth of aluminum beverage cans are wasted on a yearly basis, which reflects the urgent need for improved recycling infrastructure and extended producer responsibility programs. Therefore, boosting domestic aluminum collection and sustainable production, these initiatives support the growth of eco-friendly packaging, hence denoting a positive market outlook.

Key Statistics on Aluminum Can Usage and Trade Impacts in the U.S. Craft Beer Market (2023-2025)

|

Metric |

Value |

Context |

|

Aluminum can share in craft beer packaging (2023) |

68.4% by volume |

Represents growth of ~4% from 2022 |

|

Aluminum can share in early 2025 |

~75% of packaged craft beer |

Volume and revenue share for U.S. craft beer |

|

Tariff on imported aluminum (U.S., March 12, 2025) |

25% |

Applies to Canada, Mexico, and other countries |

|

Canada’s share of U.S. aluminum imports |

Largest supplier |

Inclusion in tariffs expected to increase U.S. aluminum prices |

|

Canada’s share of U.S. craft beer exports |

37.5% |

Largest export market for U.S. craft beer |

Source: Brewers Association

Canada is witnessing significant growth in the market, primarily shaped by strong government support and high recycling rates, making aluminum a preferred choice among beverage producers. The Government of Canada, in April 2025, announced support measures for businesses affected by U.S. aluminum tariffs, which also include a temporary 6-month relief for imports used in manufacturing and beverage packaging. It also underscored that the countermeasure tariffs applied by Canada covered aluminum products worth USD 3 billion, which are a part of a broader USD 29.8 billion in affected goods. Hence, these actions aim to help the firms to adjust supply chains, maintain operations by strengthening domestic aluminum production, and packaging stability. Hence, the existence of suitable government policies is expected to accelerate the market growth at a rapid pace.

Europe Market Insights

Europe has gained the most prominent position in the global aluminum beverage packaging market, shaped by stringent sustainability regulations and the presence of advanced recycling systems. Simultaneously, the presence of key market players and strong environmental consciousness further supports aluminum’s prominence in this region. According to the European Aluminum article published in February 2025, the EU expanded its 16th sanctions package in 2025 to include primary aluminum imports from Russia, by addressing longstanding industry requests and tightening restrictions on products that were previously sanctioned. It also underscores that the regional aluminum producers, already facing electricity costs 2 to 4 times higher than in the U.S. and China, continue to focus on low-carbon electrification to maintain competitiveness. Hence, this could tighten supply, potentially increasing the price and incentivizing greater recycling and use of sustainable aluminum in beverage packaging.

Germany represents one of the mature and largest aluminum beverage packaging markets in which the aluminum cans are valued for their recyclability and suitability for premium and craft beverages. The country hosts a well-established recycling systems that ensure high recovery rates for aluminum, which is reinforcing its appeal as a sustainable packaging solution. In addition, the consumers in the country are preferring the products that are environmentally responsible, allowing the beverage producers to adopt aluminum cans not only for functional benefits but also as a strategic choice to align with sustainability goals. Furthermore, the country’s robust beverage industry and focus on quality standards are also supporting the widespread adoption of aluminum cans, particularly among craft and premium beverage segments. Hence, the presence of all of these factors responsibly elevates Germany’s growth potential in this market in the years ahead.

In the UK, the aluminum beverage packaging market has gained enhanced traction, which is benefiting from the ongoing sustainability commitments and shifts in beverage trends. According to the findings from AEROBAL in January 2024, demand for aluminum aerosol containers in the combined region of the 27 EU member states, including the UK, increased significantly by 9% in 2023. This represents a significant share of the global market, contributing to approximately 72% of total deliveries that are directed to Europe. Therefore, this growth reflects strong consumer demand and the established preference for aluminum packaging in these regions, owing to the recyclability, durability, and suitability across various industries, particularly in terms of personal care and beverages. Hence, such instances position the U.K. as the predominant leader in the international aluminum beverage packaging sector.

Key Aluminum Beverage Packaging Market Players:

- Ball Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crown Holdings, Inc. (U.S.)

- Ardagh Metal Packaging / Ardagh Group (Luxembourg)

- CANPACK S.A. (Poland)

- Silgan Holdings Inc. (U.S.)

- Toyo Seikan Group Holdings, Ltd. (Japan)

- CCL Industries Inc. (Canada)

- Nampak Ltd / BevCan (South Africa)

- Envases Universales (Mexico)

- Orora Ltd. (Australia)

- CPMC Holdings Ltd. (China)

- Kian Joo Can Factory Berhad (Malaysia)

- Baosteel Metal Co., Ltd. (China)

- MSCANCO (Saudi Arabia)

- Bangkok Can Manufacturing (Thailand)

- Ball Corporation leads the global aluminum beverage‑can market, supplying lightweight cans across North America, Europe, and Asia. The company continues to invest heavily in circular can‑sheet production, sustainability, and expansion - including new low-carbon plants and recycling-enabled aluminum supply chains.

- Crown Holdings, Inc. ranks among the top two global beverage‑can producers, which has a broad footprint across food and beverage metal packaging. The firm extensively emphasizes high-speed production lines and sustainable formats, which also include lightweight can designs and recycling-friendly ends, and pursues vertical integration to control raw‑material supply, capturing a high-end revenue stream.

- Ardagh Metal Packaging is considered to be the major global supplier, which focuses on aluminum beverage cans and specialty metal containers. The company leverages a widespread international production network with a prime focus on serving various beverage brands, and makes heavy investments in lightweighting and tailored packaging solutions, and explores sustainable metal‑packaging designs.

- CANPACK S.A. holds a significant share in Europe’s aluminum beverage packaging sector and serves many global beverage brands. The company is making heavy investments in modern production facilities and advanced printing or decoration capabilities, enabling custom packaging for regional as well as international customers by offering scalability and flexibility.

- Silgan Holdings Inc. is one of the top metals‑container producers that supplies beverage cans and related packaging solutions across the globe. The company’s strategy relies on cost-efficient manufacturing and product diversification across food and beverage containers. Furthermore, the company is also leveraging strategic acquisitions to expand its global footprint, hence contributing to extensive market reach.

Below is the list of some prominent players operating in the global market:

The aluminum beverage packaging is consolidated around a few global players such as Ball Corporation, Crown Holdings, Inc., and Ardagh Metal Packaging. Sustainability focus and geographic expansion into emerging markets, and the capacity to add to serve the growing demand are the key initiatives implemented by these pioneering companies to secure their market positions. In July 2024, Colep Packaging announced that it had completed the acquisition of the remaining 60% of ALM, which is a leading Spain-based aluminum aerosol manufacturer, thereby gaining full ownership and strengthening its position in Europe. The company has more than 35 years of experience, produces aluminum packaging for food, beverage, cosmetics, personal care, and household care industries, and is projected to achieve sales exceeding €16 million (≈USD 17.5 million) in 2024. It also stated that, following the acquisition, Colep plans to invest over €15 million (≈USD 16.4 million) to expand ALM’s Barcelona plant, doubling production capacity, thereby enhancing infrastructure and supporting growth.

Corporate Landscape of the Aluminum Beverage Packaging Market:

Recent Developments

- In August 2025, Novelis and DRT Holdings announced that they had entered a joint development agreement to advance the sustainability of aluminum beverage can ends by increasing recycled content. The collaboration focuses on developing a uni-alloy design that allows can ends to be made from up to 99% recycled aluminum.

- In November 2024, Ball Corporation announced that it had acquired Alucan, expanding its footprint in extruded aluminum aerosol and bottle packaging, which adds manufacturing facilities in Spain and Belgium, enhancing Ball’s ability to supply sustainable aluminum solutions.

- Report ID: 2881

- Published Date: Dec 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aluminum Beverage Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.