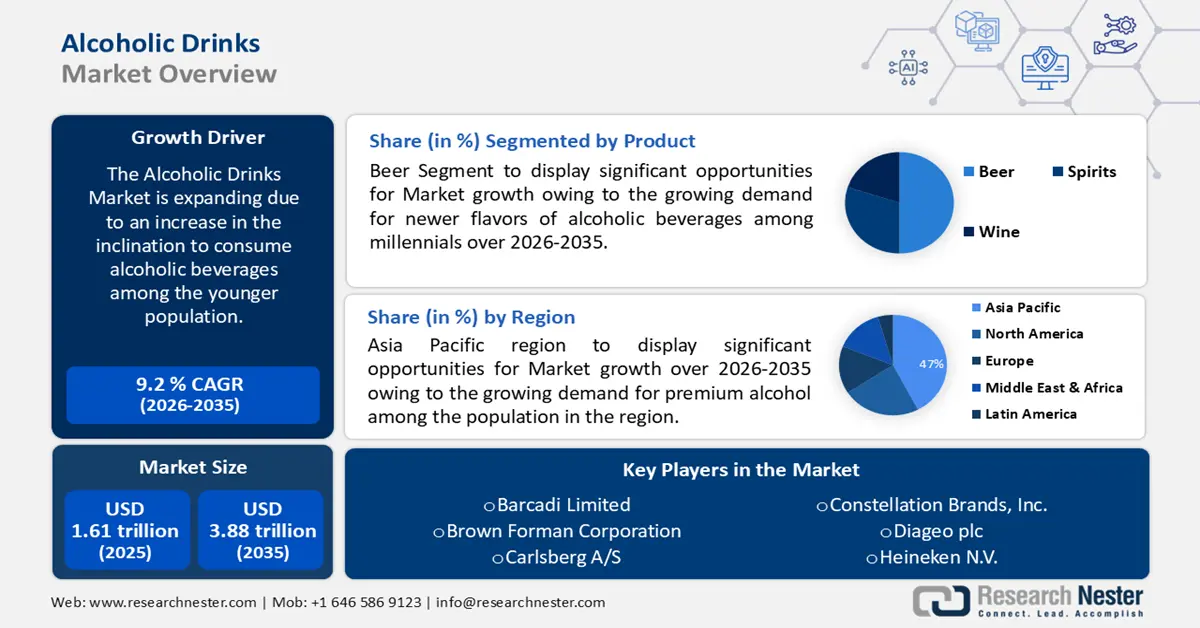

Alcoholic Drinks Market Outlook:

Alcoholic Drinks Market size was over USD 1.61 trillion in 2025 and is poised to exceed USD 3.88 trillion by 2035, witnessing over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alcoholic drinks is estimated at USD 1.74 trillion.

The alcoholic drinks market is led by an increase in the inclination to consume alcoholic beverages among the younger population. According to The National Survey on Drug Use and Health (NSDUH) for 2022 states that 17.5 million young adults (50.2% of this age group) reported drinking alcohol.

Key Alcoholic Drinks Market Insights Summary:

Regional Highlights:

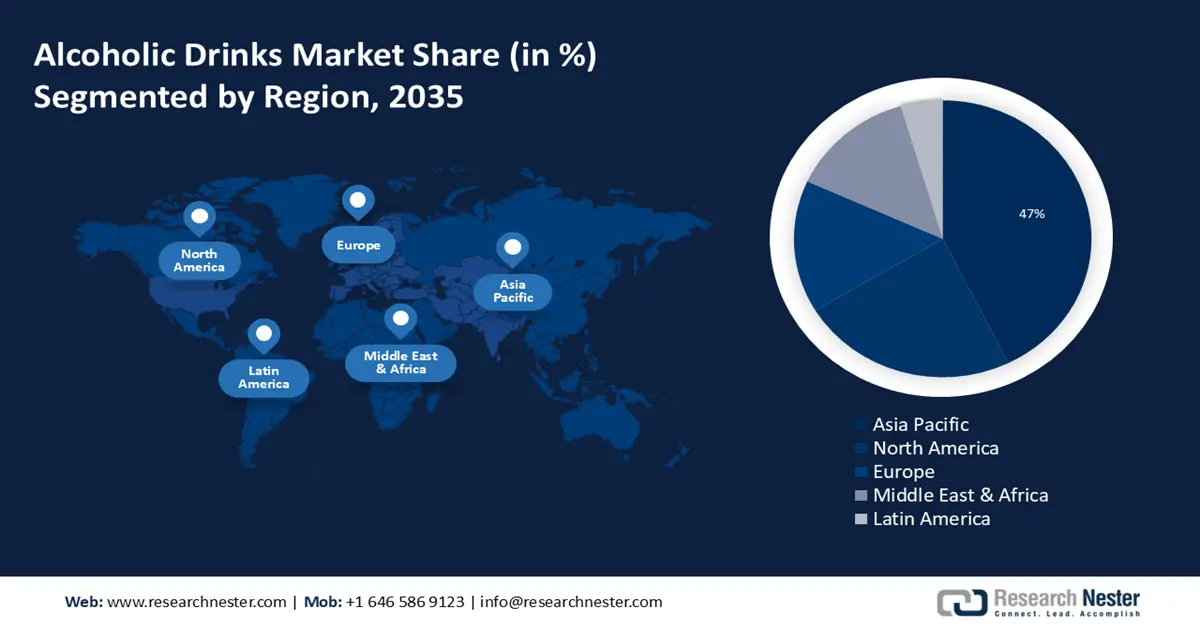

- Asia Pacific alcoholic drinks market is anticipated to capture 47% share by 2035, driven by urbanization and premium alcohol demand.

- North America market will account for 26% share by 2035, driven by rising alcohol consumption and demand for premium whiskey.

Segment Insights:

- The beer segment in the alcoholic drinks market is poised for significant growth, with a 40% share driven by rising demand for new beer flavors among millennials and cultural shifts, over the forecast period 2026-2035.

- The liquor stores segment in the alcoholic drinks market is anticipated to achieve significant growth till 2035, driven by the growing number of liquor stores and supportive government license policies.

Key Growth Trends:

- Surge in the number of wineries and breweries

- Growing shift towards the consumption of hybrid alcohol beverages

Major Challenges:

- Growing concerns regarding health and fitness

- Strict regulatory laws and restrictions

Key Players: Bracadi Limited, Brown Forman Corporation, Carlsberg A/S, Constellation Brands, Inc., Diageo plc, Heineken N.V., Pernod Ricard SA, Beam Suntory Inc., Molson Coors.

Global Alcoholic Drinks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.61 trillion

- 2026 Market Size: USD 1.74 trillion

- Projected Market Size: USD 3.88 trillion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Alcoholic Drinks Market Growth Drivers and Challenges:

Growth Drivers

- Surge in the number of wineries and breweries – Wineries and breweries have the equipment necessary to carry out these fermentation processes and create alcoholic beverages. Thus, the growth of the alcoholic beverage market is being facilitated by an increase in the number of wineries and breweries.

According to the most recent estimates, there are over 100,000 wineries worldwide and approximately 1 million people who work in the wine industry. Because of all of that activity, the wine industry is worth USD 300 billion. Also, according to the Bureau of Labor Statistics, there were 5,024 wineries in 2020—more than four times as many as there were in 2001. - Growing shift towards the consumption of hybrid alcohol beverages – Ready–to–drink (RTD) hybrid beverages have been introduced by alcoholic beverage makers in response to changing consumer tastes and preferences. These are alcoholic cocktails known as mixed drinks, which incorporate components from other beverage categories.

These are made with flavor–enhancing ingredients and production techniques and served with a variety of beverages. To impart a certain flavor to beers or spirits, age them in wine barrels. In the spirit category, hybrid drinks combining tea and rum with vodka are popular right now. - Surge in the production of premium category alcohols – Premium alcoholic drinks have a huge possibility due to the increased use of natural and functional additives in premium category alcohols. For instance, in January 2023, with the launch of its three alcoholic beverages, Bluebird Hardwater—the first and only company to blend premium spirits with ultra–purified water at an ABV (alcohol by volume) of just 4%—finally created a whole new category within the crowded alcoholic drinks market: "hard water." Furthermore, because of this, the top producers of alcoholic beverages are placing a strong emphasis on forming alliances with important companies that produce high–end alcoholic beverages.

Challenges

- Growing concerns regarding health and fitness – Consumer behavior is influenced by knowledge of the negative health impacts of excessive alcohol intake, such as liver disease, cardiovascular problems, and mental health issues. Public health campaigns and educational programs that draw attention to the dangers of alcohol consumption help change consumers' perceptions of alcohol use and encourage abstinence or more responsible drinking. Reduced consumption and a preference for lower alcohol–free alternatives are the results of this increased awareness, which affects demand and sales in the alcoholic drinks market.

- Strict regulatory laws and restrictions – Alcohol advertising, packaging, and labeling are subject to strict rules, as is the promotion of responsible consumption. Policies designed to reduce alcohol consumption and related harm, such as minimum drinking age laws and restrictions on alcohol availability, can stymie industry growth.

Compliance with complex and growing regulatory regimes demands significant resources and can be a barrier to entry for smaller companies. Furthermore, legal complications and varying rules between regions can pose obstacles for organizations operating in several markets, affecting market strategies and profitability.

Alcoholic Drinks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 1.61 trillion |

|

Forecast Year Market Size (2035) |

USD 3.88 trillion |

|

Regional Scope |

|

Alcoholic Drinks Market Segmentation:

Product Segment Analysis

Beer segment share in the alcoholic drinks market is projected to cross 40% by the end of 2035. The segment growth can be credited to the growing demand for newer flavors of alcoholic beverages among millennials. The beer market is largely fragmented, with numerous domestic and foreign competitors vying for market share. The increasing demand for creative beer flavors among the younger population has led beer manufacturers to innovate their products. Furthermore, Southeast Asian consumers' perceptions of alcohol–based beverages, particularly beer, have been greatly impacted by the embrace of Western culture and cultural shifts.

The spirits segment is poised to grow majorly with a substantial share during the forecast timeframe. The segment is growing due to the surge in the number of distillers worldwide. The rise of social media has simplified the process for consumers to find local distilleries and hear about new spirits releases. Also, there has been a surge in the program launches for the trading of distilled spirits.

For instance, the 2024 strategy of the Distilled Spirits Council of the United States (DISCUS) highlights impending trade promotion prospects in Canada, Australia, India, the United Kingdom, and Germany for American distillers. Products distilled domestically from at least 51% of American agricultural material are eligible to participate in the USDA–funded initiative.

Retail Segment Analysis

Liquor stores segment is predicted to capture alcoholic drinks market share of over 34% by 2035. The segment growth is propelled by the growing number of liquor stores globally. The emerging economies' rapid urbanization will create a network of connected liquor stores. Domestic liquor stores are offering a more affordable and varied selection of alcoholic beverages, which will help drive the growth of the industry.

Market expansion will be fueled by supportive actions adopted by numerous governments worldwide to reduce the complexity of liquor licenses. For instance, in January 2024, Gov. Phil Murphy approved the bill removing food and event restrictions on brewers and allowing towns to regain some expired liquor licenses.

Our in–depth analysis of the global market includes the following segments:

|

Product |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alcoholic Drinks Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 47% by 2035. The market growth in the region is also expected on account of the growing demand for premium alcohol among the population. The market is progressing due in part to the rapid urbanization and simple availability of alcoholic beverages in metropolitan areas. According to the Asian Development Bank, Asia will have a population that is over 55% urban by 2030.

China's economic growth has raised people's disposable income, which permits them to spend more on upscale products like fine wine. According to data from the National Bureau of Statistics, China's per capita disposable income was USD 1,624.57 in the first quarter of 2024, growing nominally 6.2% year over year. Globalization and the impact of Western culture have also shaped consumer tastes, with a rise in interest in imported alcoholic beverages.

In South Korea, consumers are looking for more distinctive and high–quality alcoholic beverages, like small–batch spirits and artisanal brews. The rising demand for traditional Korean alcoholic beverages is one of the major trends in the country's alcoholic drink sector. Traditional Korean alcoholic beverages like soju and makgeolli are becoming more and more well–liked among younger customers. For instance, Over the previous two years, soju consumption has climbed by 1.4%, accounting for 47.9% of the total consumption rate among those polled in May 2024.

North America Market Insights

North America alcoholic drinks market is predicted to capture revenue share of around 26% by the end of 2035. This is owing to the growing concerns regarding health which has increased the demand for honey–based drinks in the region. Also, the growing consumption of alcohol is accelerating the market demand. For instance, 62% of American adults claim to have ever consumed alcohol, while 38% never do.

The rising demand for alcoholic beverages, especially whiskey, in the United States is influencing the market's expansion. For instance, it is anticipated that 34.9 million 9–liter cases of straight whiskey will be consumed by 2025, a more than 100% increase over the volume consumed in the late 1990s and early 2000s. Several causes, such as the emergence of craft distilleries, growing interest in mixology and cocktails, and the reputation of whiskey as a classy and premium beverage, have contributed to the surge in whiskey consumption in recent years.

It is projected that the money given by private companies in Canada to purchase high–end alcoholic beverages will accelerate industry expansion. For instance, the Molson Coors Beverage Company unveiled new capital deployment plans, a long–term financial outlook, and a new plan to accelerate growth today. The Acceleration Plan was unveiled at the company's 2023 Strategy Day in New York City. Its goal is to further the company's growth in the years to come.

Alcoholic Drinks Market Players:

- Barcadi Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Brown Forman Corporation

- Carlsberg A/S

- Constellation Brands, Inc.

- Diageo plc

- Heineken N.V.

- Pernod Ricard SA

- Beam Suntory Inc.

- Molson Coors Brewing Co.

- Anheuser–Busch InBev SA/NV

Industry Players in the alcoholic beverage industry are expanding their product lines to better satisfy customer needs and diversify their offerings. Additionally, they are implementing a variety of tactics, such as joint ventures and acquisitions, to bolster their brand's visibility in international markets for alcoholic beverages.

Recent Developments

- BACARDI Rum launched Mango Chile in the US, capturing the sweet and spicy flavors of the Mexican fruit snack in each bottle. Following an exceptionally successful introduction in Mexico, the world's most awarded rum brand will bring Mango Chile to the United States for the first time, with the product arriving in liquor stores across the country.

- Constellation Brands launched Next Round Cocktails™, its first–ever ready–to–drink (RTD) and multi–serve boxed wine cocktails prepared with a blend of real fruit juice* and crisp wine. The product is artistically packaged for crowd–pleasing style and flavor. Party hosts can instantly set the mood with Next Round Cocktails, which come in popular flavors such as Salted Lime Margarita and Strawberry Lime Sangria, and attendees can simply pour from the box over ice in a glass to enjoy.

- Report ID: 6230

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Alcoholic Drinks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.