Beer Market Outlook:

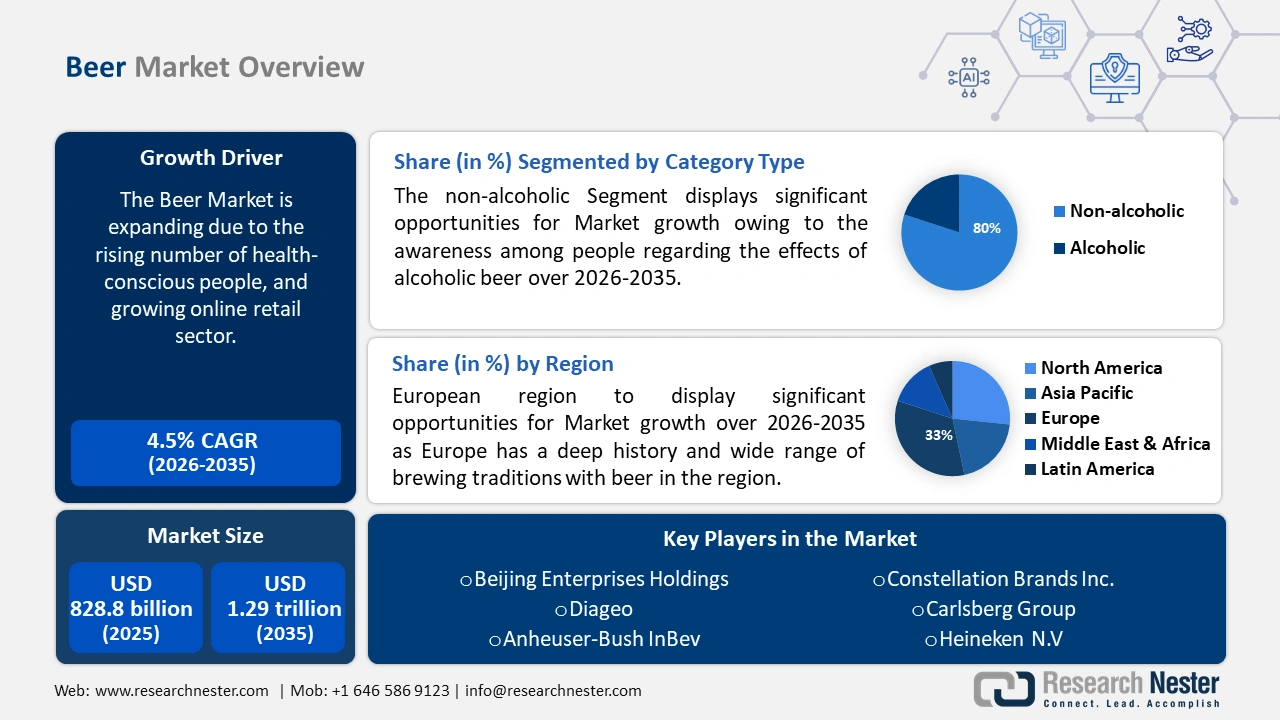

Beer Market size was over USD 828.8 billion in 2025 and is anticipated to cross USD 1.29 trillion by 2035, growing at more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of beer is assessed at USD 862.37 billion.

Developing nations around the globe are seeing rapid urbanization and lifestyle changes. Kids in these developing countries easily adopt Western ideals since Western entertainment is so widely consumed.

More conservative countries in the Middle East and Asia Pacific, where drinking alcohol is generally viewed as a negative habit, will witness an increase in beer consumption as a result of growing diversity and the acceptance of Western culture.

The National Family Health Survey of India, which was published in May, also discovered that men and women consumed more alcohol in rural than in urban regions. The northeastern state of Arunachal Pradesh has the highest rate of alcohol use in the nation, with 24% of women and 53% of males drinking.

Key Beer Market Insights Summary:

Regional Highlights:

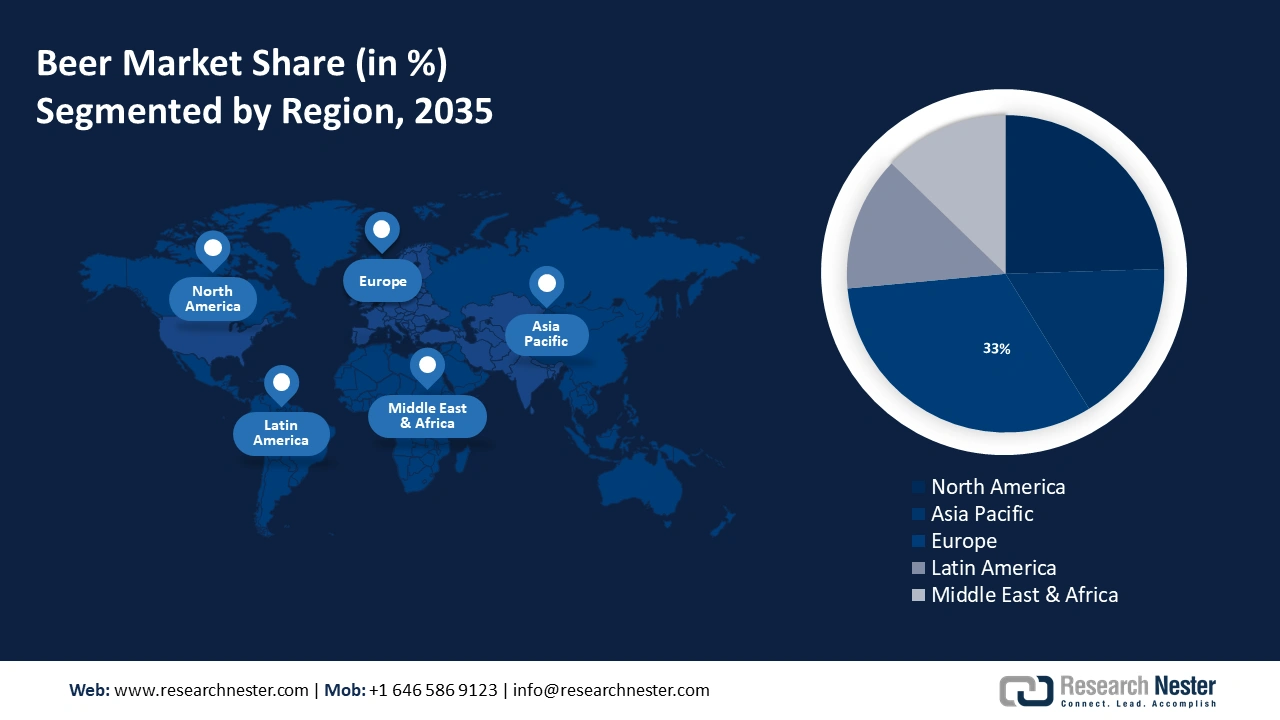

- Europe beer market will dominate around 33% share by 2035, driven by the immense consumption of alcoholic and non-alcoholic beer.

- North America market will achieve a substantial CAGR during 2026-2035, driven by the growing youth demographics and increasing demand for craft beer.

Segment Insights:

- The non-alcoholic beer segment in the beer market is anticipated to achieve substantial growth till 2035, driven by growing awareness of the health effects of alcoholic beer.

- The supermarket segment in the beer market is forecasted to secure the highest market share by 2035, fueled by the accessibility and competitive pricing of supermarkets.

Key Growth Trends:

- Growing awareness about health

- Escalating e-commerce and online retail sector

Major Challenges:

- Growing awareness about health

- Escalating e-commerce and online retail sector

Key Players: Anheuser-Bush InBev, Diageo, Beijing Enterprises Holdings, Dogfish Head Craft Brewery, Nited Brewery, Sierra Nevada Brewing Co.

Global Beer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 828.8 billion

- 2026 Market Size: USD 862.37 billion

- Projected Market Size: USD 1.29 trillion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Brazil, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Beer Market Growth Drivers and Challenges:

Growth Drivers

-

Growing awareness about health - The number of people becoming more health-conscious is one of the factors driving the expansion of this industry. A study in 2021 indicates that around 21.5% of consumers worldwide claim to be actively attempting to cut back on their alcohol use. Younger customers are especially affected by this trend since they are more inclined to look for non-alcoholic and low-alcohol products.

-

Escalating e-commerce and online retail sector - The growth of e-commerce and online retail drives the market. In addition, e-commerce has provided manufacturers and retailers with new opportunities to gain a wider customer base. Consumers can more easily access several product types from the comfort of their homes through Internet stores and delivery services. According to the U.S. Census Bureau's estimates, US retail e-commerce sales for the 4th quarter of 2023 were USD 285.2 billion while overall retail sales are evaluated to be USD 1,831.4 billion.

Challenges

-

Health issues associated with beer - The growth of this market is expected to be hindered by numerous health problems associated with beer and spirit consumption. Even though beer contains less alcohol, its consumption and mixing with other spirits can pose a problem. Liver tissue deterioration can occur due to excessive use of these beverages.

-

Legal standards linked with alcohol consumption are predicted to hinder the market growth in the upcoming period.

Side effects of beer are set to hamper the market growth in the forecast period

Beer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 828.8 billion |

|

Forecast Year Market Size (2035) |

USD 1.29 trillion |

|

Regional Scope |

|

Beer Market Segmentation:

Category Type Segment Analysis

Non-alcoholic beer segment is expected to capture over 80% beer market share by 2035. The penetration of no-alcohol beer seems to grow owing to the awareness among people regarding the effects of alcoholic beer.

In the United Kingdom, the United States, Germany, and Canada, where off-license and supermarket sales are growing rapidly, this trend can be seen in the demand for no-alcohol drinks by volume. For example, the volume of nonalcoholic beer imported into the United States in 2022 was 12.58 million gallons, up from 11.96 million gallons in the previous year, according to the Beer Institute.

Distribution Channel Segment Analysis

Based on distribution channels, the supermarket segment is foreseen to hold the highest market size by the end of 2035. Products are easily accessible in towns and villages to an enormous consumer base due to the market driven by supermarkets and hypermarkets.

This accessibility is designed to satisfy the evolving preferences of consumers who seek convenience in their shopping experiences. The purchasing power of supermarkets allows them to negotiate favorable terms with manufacturers, resulting in competitive prices for consumers, which further strengthens their growth.

Expansion of the supermarket network is set to propel the market growth in the future times. As per research, in 2022, the total number of sales made at supermarkets globally was accounted to be USD 1 trillion.

Packaging (PET Bottles, Glass Bottles, Aluminum Cans)

Cans segment in the beer market is poised to exhibit substantial CAGR till 2035. Glass bottles are durable, resistant to oxygen, and impenetrable. Furthermore, due to their heat-tolerant nature, they can cope with temperatures exceeding 100 degrees. Considering all these features glass bottles conserve the actual flavor of the beer.

Moreover, glass packaging is fully recyclable and environmentally friendly which allows it to be melted down and reused reducing its environmental footprint in comparison with other packaging materials. Research shows that more than 92 percent of beer consumed in the world comes from glass bottles.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Category Type |

|

|

Production |

|

|

Packaging |

|

|

Distribution Channel |

|

|

Flavor |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Beer Market Regional Analysis:

European Market Insights

Europe industry is predicted to account for largest revenue share of 33% by 2035. Europe is one of the world's largest markets, with a deep history and a wide range of brewing traditions.

In all European countries, beer plays a significant role and is an integral part of culture, heritage, and nutrition. One of the main beer-producing regions in the world is the European Union.

According to the Brewers' Association of Europe, 368,682 hectolitres were consumed in 2019, which is made by approximately 11,048 breweries worldwide.

The growth can be ascribed to the immense consumption of alcoholic and non-alcoholic beer in the United Kingdom.

Factors like the increased popularity of craft beers, rising demand for beer with a low alcohol content as well as health and wellness trends among large consumers in Germany have been driving the country's beer markets. As a result, there has been increased demand for the growth of the product. In Germany, for instance, a survey found that sales of craft beer increased by 13% in 2021 and are expected to grow further over the coming years.

The rise of microbreweries is one of the most important trends in France's market. This trend is mirrored by the worldwide movement of craft beer, which has been on an unprecedented growth path for several years.

North American Market Insights

The North America beer market will witness a substantial revenue share by 2035. Some of the factors likely to increase market growth are growing youth demographics and increasing demand for beer with rising populations.

In addition, the brewing industry is focusing on new product launches to increase its share of this market as a result of an increasing trend towards craft beer.

For example, in March 2021, Stone Cold Steve Austin, with partner El Segundo Brewing, will release a new American lager at Billy Bob Texas in Forth Worth, Texas, with a concert by Texas country rock band Reckless Kelly.

The increasing preference for alcohol among consumers has also been facilitated by the US beer market. In particular, for innovative drinking experiences, young people are more interested in sampling a variety of flavored beer and beer mixtures.

The increasing popularity of beer festivals and events is a trend on the market in Canada. These events allow consumers to sample a wide variety of beers from different breweries, which creates an atmosphere of community and curiosity.

Beer Market Players:

- The Boston Beer Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Heineken N.V

- Carlsberg Group

- Constellation Brands Inc.

- Anheuser-Bush InBev

- Diageo

- Beijing Enterprises Holdings

- Dogfish Head Craft Brewery

- United Breweries Holding Limited

- Sierra Nevada Brewing Co

Recent Developments

- United Breweries, a subsidiary of the Heineken Group, has launched Silver, which is part of the famous Heineken brand in Amsterdam. Brewed by experienced master brewers, Heineken Silver boasts natural ingredients like A-yeast and pure malt for an exceptional taste.

- InBev has introduced Seven Rivers in the Indian market a new beer that's similar to some famous brands such as Budweiser, Extra Corona, Anheuser, and Hoegaarden. Shortly, this service will be extended to other regions such as Delhi, Goa, Haryana, and Uttar Pradesh, which are already available in selected areas of Karnataka and Maharashtra.

- Report ID: 6085

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Beer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.