Molded Plastic Packaging Market Outlook:

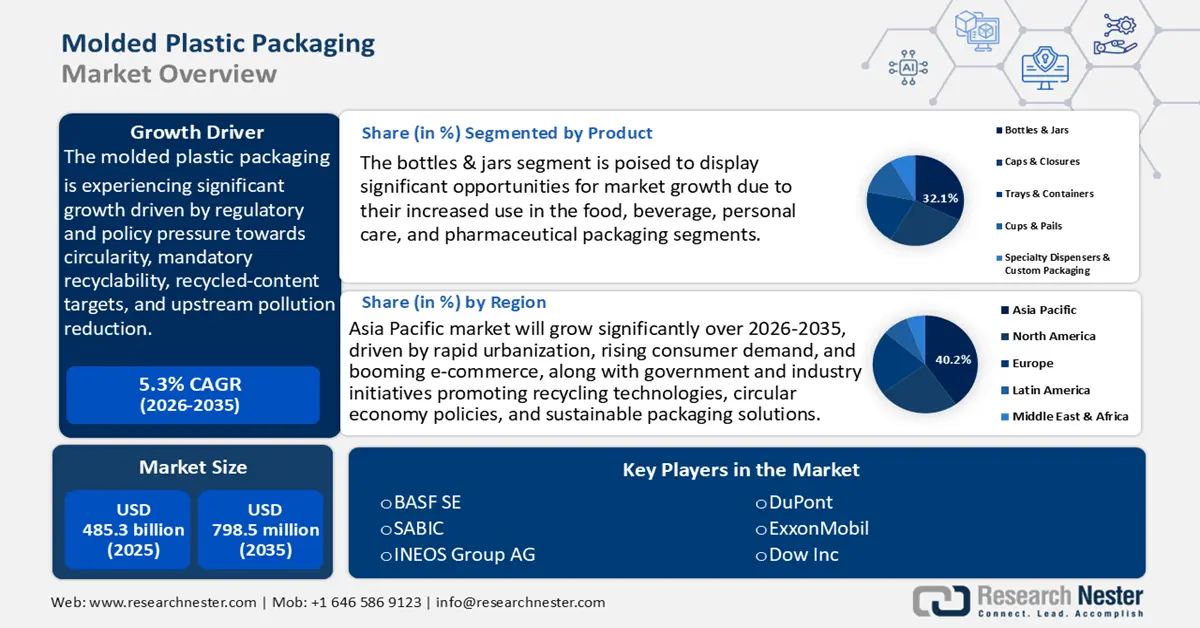

Molded Plastic Packaging Market size was valued at USD 485.3 billion in 2025 and is projected to reach USD 798.5 billion by the end of 2035, rising at a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of molded plastic packaging is estimated at USD 515.6 billion.

The molded plastic packaging market is expected to grow with an upward trend over the projected years, primarily driven by regulatory and policy pressure towards circularity, mandatory recyclability, recycled-content targets, and upstream pollution reduction, which has become the single most significant short-term driver of product growth in molded plastic packaging as brand owners and packagers are compelled to redesign SKUs, implement proven post-consumer resin (PCR), and invest in verification and traceability. The challenge and the response by policy are quantified in government strategy documents (e.g., the U.S. National Strategy to Prevent Plastic Pollution), which indicate targets across the lifecycle and report historically low recovery rates (single-digit recycling of municipal plastic waste in the previous years), showing a material gap between current PCR supply and the demand that regulation will generate.

OECD policy scenarios indicate that plastics production and consumption will grow sharply without more vigorous policy (projected +70% to about 736 Mt by 2040), underscoring why regulators and industry focus on recyclability and reuse demands that will significantly restructure the sourcing and specification of molded packaging. Combined, these policy drivers generate short-term demand for qualified food-grade rPET/rHDPE, re-design services, and tooling to realize constructions using mono-materials and measurement/reporting systems, which increase the volume of procurement, capital spending, and contracted R&D to certify materials and process.

Molded plastics supply chains are international and strongly linked to petrochemical feedstock supply, downstream resin manufacturing, and cross-border trade in finished plastic articles. The total exports of plastics and plastic products around the world have increased, and by 2021, the value of the market was up to nearly USD 1.2 trillion. This growth involves both raw materials to produce plastics, finished plastic products, and plastic wastes that are traded across geographical boundaries. The increased volume of plastic trade reveals a dire necessity to seek alternatives to plastic and introduce more serious measures to decrease plastic contamination, safeguard oceans, and address climate change.

Monthly fluctuations in exports/imports, illustrated by national trade releases and customs data, influence mill-level resin availability and pass-through of price to the packagers. In the United States, the producer price index (PPI) of rubber and plastic products was 254.72 in July 2025, using an index with December 1984 = 100. This is a slight improvement over the last month and also over one year ago. PPI values of plastic materials and resin (primary products) were around 284.25 in July 2025. U.S. federal research funding and grant programs (NSF awards and convergence projects) have recently allocated millions to polymer discovery, sustainable polymers, and circular-economy manufacturing processes, in response to RDD and capacity expansion, which signals government support of co-investment in the qualification of new materials and process upgrades by OEMs and packagers.

Key Molded Plastic Packaging Market Insights Summary:

Regional Insights:

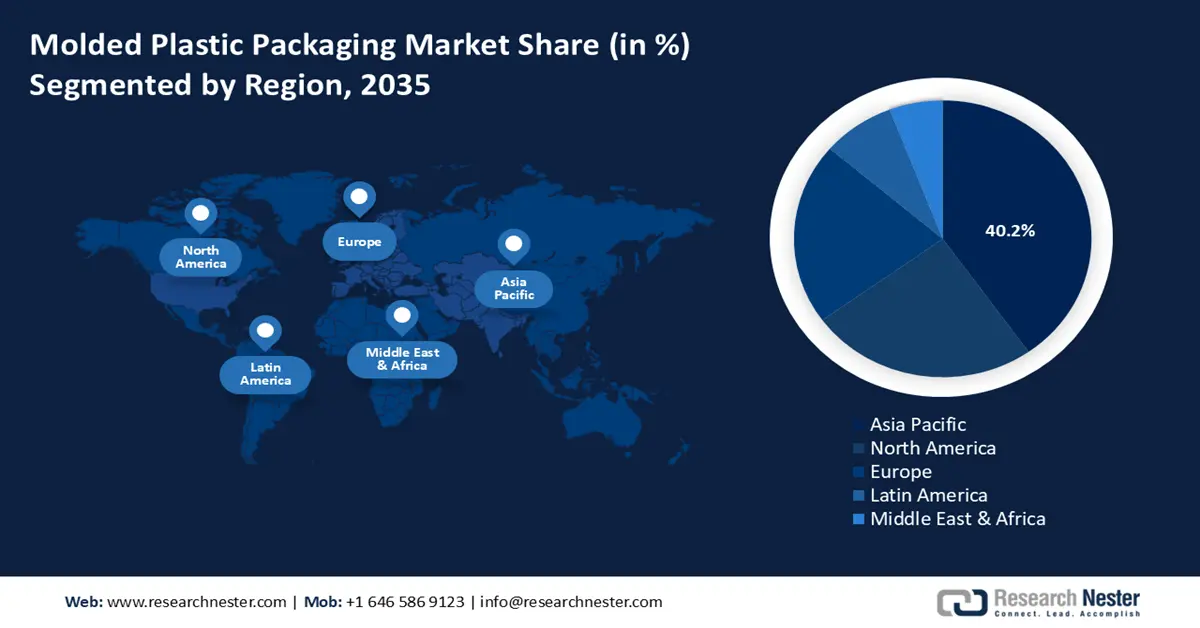

- The Asia Pacific molded plastic packaging market is projected to hold the largest 40.2% revenue share during 2026–2035, owing to rapid urbanization, expanding e-commerce, and rising consumer demand.

- The North American market is anticipated to capture a 24.8% share by 2035, spurred by stringent sustainability initiatives and innovation in recyclable and bio-based molded plastics.

Segment Insights:

- The bottles & jars segment is projected to account for 32.1% share of the Molded Plastic Packaging Market by 2035, propelled by rising consumption of food, beverage, personal care, and pharmaceutical products.

- The blow molding segment is anticipated to capture a 30.2% revenue share during 2026–2035, fueled by innovations in PET-based lightweight bottle designs and advancements in multi-layer extrusion technologies.

Key Growth Trends:

- Limitations on supply of post-consumer resin (PCR)

- Development of technology in chemical production and recycling

Major Challenges:

- Limitations on the supply of post-consumer resin (PCR)

- Poor collection and segregation infrastructure

Key Players: BASF SE, SABIC, INEOS Group AG, DuPont, ExxonMobil, Dow Inc, Eastman Chemical Company, Chevron Phillips Chemical LLC, LG Chem, Reliance Industries Limited, Hup Seng Industries Berhad, Toray Industries, Inc., Sekisui Chemical Co., Ltd., Mitsubishi Chemical Holdings, Kuraray Co., Ltd.

Global Molded Plastic Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 485.3 billion

- 2026 Market Size: USD 515.6 billion

- Projected Market Size: USD 798.5 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, Thailand

Last updated on : 1 October, 2025

Molded Plastic Packaging Market - Growth Drivers and Challenges

Growth Drivers

- Limitations on supply of post-consumer resin (PCR): The increase in global demand for post-consumer recycled (PCR) plastics in packaging is increasing faster than the supply. The OECD estimates that plastic waste will almost triple globally by 2060, and recycling of all waste will not reach more than 17% without more robust policies. This has created a premium pricing situation for food-grade PCR resins, such as rPET and rHDPE, which are more expensive than virgin resin in controlled markets. The U.S. Environmental Protection Agency (EPA) restates that an increase in recycled-content requirements (like the 50% PCR goal of beverage bottles in California by 2030) will narrow the feedstock supply chains. With the growing desire of governments to establish Extended Producer Responsibility (EPR) systems, producers of molded plastic packaging are facing heightened competition over available PCR feedstocks, both in terms of procurement lead times and overall production costs.

- Development of technology in chemical production and recycling: The supply of resin and the economics of molded plastic packaging are changing due to government-supported innovation in chemical manufacturing. According to the U.S. Department of Energy (DOE), catalyst and process innovations have the potential to achieve significant improvement in the energy efficiency of the chemical processes related to plastics. Similarly, DECHEMA and the International Energy Agency (IEA) report that sophisticated catalytic cracking and electrification of the processing process could reduce the CO2 emissions of the chemical sector by up to 45 percent in 2050. These advantages reduce operating expenses and lifecycle emissions of plastics and have a direct positive impact on packaging manufacturers operating under tighter carbon disclosure regimes. Improvements in the yield of 15-20% are also demonstrated in pilot-scale chemical recycling plants with EU Horizon-program support, where packaging-grade resins can also be recovered. All these developments are increasing cost efficiency and achieving the fulfillment of sustainability-related procurement requirements.

- Extended Producer Responsibility (EPR) & cost reallocation: The implementation of the EPR is transferring the cost of recycling and disposal out of municipalities to the packaging manufacturers. The EPR scheme in the UK is estimated to cost producers between £1.3-1.7 billion in compliance costs each year by the UK Department for Environment, Food and Rural Affairs (DEFRA) once the scheme is fully implemented. The Packaging and Packaging Waste Regulation (PPWR, 2025/40) of the European Commission requires that all packaging should be recyclable by 2030 and that there should be a minimum threshold of recycled content. Such actions are pushing to redesign light and mono-material packaging, as well as greater PCR integration. In the case of molded plastic packaging, compliance is expressed in increased R&D, testing, and sourcing costs--industry estimates indicate that the immediate cost per unit has increased.

Challenges

- Limitations on the supply of post-consumer resin (PCR): Demand in the global molded plastic packaging market is increasing steadily towards the use of post-consumer recycled (PCR) plastics as more governments impose minimum requirements on recycled plastic content and corporations make pledges to sustainable practices. However, the collection, sorting, and reprocessing infrastructure has not kept up with the policy ambition, causing shortages in supply and high costs. Food-grade PCR, including rPET and rHDPE, is especially scarce and can frequently fetch a higher price than virgin resin. Such an unequal distribution makes procurement strategies more difficult, increases the lead times, and puts smaller manufacturers with less bargaining power at a disadvantage. Supply pressure is likely to remain steady without major public and private investment in recycling systems, and this will put pressure on suppliers of molded plastic packaging in the long term to find dependable PCR feedstocks.

- Poor collection and segregation infrastructure: In most areas, there are underdeveloped systems of plastic waste collection, sorting, and segregation. Such infrastructure deficiencies greatly minimize the effectiveness of recycling and recovery activities. In the absence of effective collection systems, plastic waste tends to be contaminated with other waste products, complicating the process of sorting and reducing the quality of any potential recyclable materials. In addition, the number of segregation facilities and the technologies are old-fashioned, which makes the processing of different types of plastics difficult. The lack of adequate infrastructure in transportation and transfer also interferes with the timely disposal of waste. These difficulties cause more pollution of the environment and the loss of the possibility of getting resources back.

Molded Plastic Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 485.3 billion |

|

Forecast Year Market Size (2035) |

USD 798.5 billion |

|

Regional Scope |

|

Molded Plastic Packaging Market Segmentation:

Product Segment Analysis

Bottles & jars are expected to grow with the largest molded plastic packaging market share of 32.1% during the projected years. This growth is driven by their increased use in the food, beverage, personal care, and pharmaceutical packaging segments. Driven by the water, dairy, and juice consumption patterns, more than 36% of the global plastic packaging volumes are represented by beverage packaging. EU PPWR and national EPR compulsory recycled-content requirements are also driving an increase in the usage of rPET and recyclable mono-material bottles by manufacturers and boosting the demand. The low cost of production, scalability of the sub-segment, and regulatory alignment have made it a leading force in molded plastic packaging growth globally. Capacity expansion is also supported by investment in high-speed blow-molding lines and automated filling systems.

Beverage bottles are driven by high consumption of water, carbonated drinks, juices, and dairy products in the world. An increasing focus on the recyclability of these bottles is also being placed on recyclable materials such as PET, driven by increasing sustainability practices and regulatory requirements to increase the level of recyclable content in packaging. Meanwhile, the cosmetics and personal care bottles are presenting a booming packaging demand, due to the increasing consumer expenditure and the rise of e-commerce stores. This demand stresses high-quality, durable, and recyclable molded bottles produced using materials like PET and polypropylene. These fundamental innovations are upgrading the overall market of bottles and jars in the background of environmental concerns and towards emerging customer inclinations.

Process Segment Analysis

The blow molding segment in the molded plastic packaging market is anticipated to grow at a revenue share of 30.2% 2026 to 2035, because it is efficient in manufacturing high-volume packages, particularly bottles and jerrycans. PET-based blow molding is leading to the production of lightweight bottles that can effectively address environmental issues. Innovations in design decrease material consumption, improve durability, increase recyclability, and reduce carbon footprints. These inventions meet the increased regulatory and consumer requirements regarding the use of sustainable packaging solutions. Furthermore, improved extrusion technologies and multi-layer blow molding have made materials more efficient and reduced energy usage and production costs. Together with policy-based requirements of recyclability, these technological advances are directly stimulating molded plastic packaging market expansion in the sub-segment.

Jerrycans & large containers are used to carry liquids in bulk like lubricants, oils, cleaning agents, and farming chemicals. The regulatory requirements of chemical-resistant, food-grade, recyclable materials (HDPE, PP, rHDPE) raise the demand for certified and standardized containers. Trade statistics reported by 127 countries show that global exports of Containers that are designed and equipped to be transported by one or more modes of transport reached over 12.6 billion in 2023. This is a downgrade of 17.7 billion in 2022. China was the leading exporter with 65.34% molded plastic packaging market share and a value of about USD 8.28 billion, Guyana with almost USD 1.26 billion, and the U.S. with almost USD 503 million. Industrial bottles are preferred due to their high requirement for lightweight, durable, and customized containers in the chemicals, pharmaceutical, and automotive industries. Blow molding technology is gaining momentum because of the need to have strong packaging that will protect the product and also provide it with a long shelf life. In addition, these bottles also enjoy the advantage of the EPA Container Standards and EU CLP, which have promoted the use of tough, labelled bottles and recycled materials.

Material Segment Analysis

The molded plastic packaging (PET) segment is projected to grow at a molded plastic packaging market share of 29.3% over the forecast years, as it is the most used material in molded plastic packaging because of its strength, barrier capability, and recyclability. PET bottles and containers are also very useful in beverage, food, and pharmaceutical applications. PET comprises a big share of the packaging waste, and as Eurostat estimates, Europe only used nearly 16.1 Mt of plastic packaging waste in 2022, reflecting that it is in high demand and under pressure to be recycled. Global sustainability programs and mandatory recycled material levels (e.g., 30% rPET by 2030) are playing into the hands of the rPET, increasing its market share. The ability of PET to be used in injection, blow, and thermoforming processes ensures consistent demand in a wide range of end-use markets, making it an important market growth driver.

Our in-depth analysis of the molded plastic packaging market includes the following segments:

|

Segment |

Subsegment |

|

Process |

|

|

Material

|

|

|

Product |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Molded Plastic Packaging Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the global molded plastic packaging market with the highest revenue share of 40.2% during the projected years from 2026 to 2035, attributed to the increasing consumer demand, urbanization, and booming e-commerce. However, the rising consumption, urbanization, and the lack of proper waste management systems have led to an increasing plastic pollution crisis in the Asia-Pacific region, resulting in serious environmental and health consequences. There is a push to reinforce policies, innovation, and infrastructure to address plastic pollution, thereby driving the growth of the molded plastic packaging market in the region.

Furthermore, to curb the situation of the ecological issue, governments and industries are investing in recycling technology, and in the recycling of materials like biodegradable plastic. For instance, according to the APEC report, the ASEAN Regional Action Plan aims to use regional cooperation to align the region on policies, knowledge sharing, and joint funding to address marine plastic pollution. These are organized efforts to strengthen recycling systems, sustainable use of materials, and minimize plastic waste in the Asia-Pacific countries. Circular economy and extended producer responsibility policies are on the rise, leading to new trends in the design and material composition of molded plastic packaging. These will provide a balance between market expansion and environmental sustainability, where much of the sustainable packaging future will be in the Asia Pacific region.

China’s molded plastic packaging market is expected to lead the Asia Pacific region during the projected years, driven by industrialization and increased demand for packaged products. As per the OECD Regional Plastics Outlook study, plastics account for roughly 2.2% of manufacturing input cost in China, and it suggests that the sector is highly integrated through a range of industrial supply chains and plays a significant role in the support of national manufacturing. Recyclable and bio-based materials are being preferred, replacing petroleum-based substances due to the environmental regulations, including the 2021 Plastic Pollution Control Action Plan. Technological developments in injection molding and automation have increased the efficiency of production and the quality of the products. In addition, e-commerce and urbanization maintain high demand for protection and light packaging solutions. Waste management is a challenging task; however, the advancement of recycling infrastructure and the model of the circular economy, which would help to achieve the sustainable growth of the molded plastic packaging market, is supported by government-led projects and collaboration with industries.

The molded plastic packaging market in India is likely to grow at the fastest CAGR over the forecast years, attributed to the rising food, pharmaceutical, and retail industries. The plastics industry in India contributed approximately ₹3.5 lakh crore (around USD 43 billion) to the national GDP in 2021, with packaging among the key segments driving this economic growth. The demand for molded containers made of plastic increased with the development of e-commerce and cold-chain logistics that are essential to pharmaceutical and perishable goods. The Plastic Waste Management Rules (2016), amended in 2021 by the Indian government, are concerned with Extended Producer Responsibility (EPR) involving the collection and recycling of plastic waste by producers and brand owners. The guidelines also facilitate a sustainable packaging design and the use of recycled plastic content. The needs of consumers and regulations are met by the innovations of multilayer packaging solutions and biodegradable plastics. Increasing molded plastic packaging market awareness is leading to a change in the industry, and the growth of the molded plastic packaging market is pegged on affordability, performance, and environmental compliance.

North America Market Insights

The North American molded plastic packaging market is expected to grow significantly, with a notable revenue share of 24.8% during the projected years from 2026 to 2035. According to Greenpeace USA, in 2021, households in the United States produced about 51 million tons of plastic waste, of which 2.4 million tons were recycled, or about 5-6% of the total. Contrary to popular belief, none of the forms of plastic packaging in the U.S. qualify as recyclable. In addition, in 2023, the Global Commitment Progress Report of the Ellen MacArthur Foundation, companies that represent 20% of the worldwide plastic packaging sector have made determined 2025 goals, including the use of more recycled material and the reusable packaging systems. Innovations in recyclable and bio-based molded plastics are being pushed by increasing regulations and consumer demand. In order to achieve environmental targets, stakeholders are concerned with the development of recycling facilities, material design to facilitate recyclability, and single-use plastics. These measures are consistent with regional campaigns to tackle plastic pollution and to encourage sustainable packaging.

The U.S. molded plastic packaging market is projected to dominate the North American region by 2035, mainly driven by a growing demand in the food, beverage, and healthcare packaging markets. As per the U.S. Environmental Protection Agency (EPA), 12.2% of municipal solid waste consisted of plastics and amounted to 35.7 million tons. Only 8.7% of this was recycled, 27 million tons were deposited in landfills, and 5.6 million tons were burned as a source of energy. PET bottles/jars were 29.1% recycled, and HDPE natural bottles were 29.3%. E-commerce has further created the need to develop durable molded plastic containers with the advantage of protection and lightweight shipping. Additionally, regulations like the U.S. Plastics Pact are driving the designers of packaging to a more sustainable package design that promotes the use of recycled materials and materials that can be recycled. Advanced manufacturing technologies such as injection molding and thermoforming are increasing the efficiency of production and making it possible to form complex packaging. Positive forces that have helped the market move forward despite the environmental setbacks include the development of biodegradable plastics and the modernization of recycling plants.

The molded plastic packaging market in Canada is predicted to expand at a steady pace during the forecast year, by 2035. The Zero Plastic Waste Strategy of the Canadian government aims at reducing plastic pollution significantly, encouraging manufacturers of packaging materials to use more recyclable and bio-based molded plastics. In 2021, 28% of all plastics manufactured to be consumed in Canada were packaging. Canadians produced 4,986 kilotons of plastic waste, and approximately 365 kilotons of recycled plastic resins were obtained out of this, with 87.3% of the plastic resins being recycled packaging materials and mostly bottles. The food and beverage industry continues to be a major consumer of lightweight, tamper-evident, molded plastic containers. Composite plastics and additives are also being innovated to be more recyclable, which further boosts the demand in the country. Industry, government, and environmental groups are working together to streamline the packaging supply chain and fulfill the consumer demands of more environmentally friendly packaging.

Europe Market Insights

The European molded plastic packaging market is expected to grow substantially during the projected year, with the revenue share of 21.3% by 2035, owing to strict environmental requirements, demand for sustainable packaging by consumers, and high market innovation. Europe generates almost 32 million tonnes of plastic waste each year, with Western Europe alone consuming approximately 150 kg of plastic per person annually—more than twice the global average (around 60 kg). Only around 9% of all plastics ever produced have been recycled. The market is moving quickly towards bio-based, compostable, and recyclable molded plastics as a way of addressing environmental concerns. The packaging industry is also prioritizing investments in eco-design, cutting-edge sorting technologies, and infrastructure upgrades that will increase material recovery and minimize landfill disposal. The Resources and Waste Strategy for the UK has the goal of ensuring that all the plastic packaging that goes into the market will be recycled, reused, or compostable by 2025, with legally binding and voluntary targets to support this. Some of the ambitious goals set in the plan include making sure that there is no avoidable plastic waste by 2042 and no avoidable waste by 2050. In addition, the UK Plastics Pact, a voluntary industry action involving producers responsible for 80% of the nation’s supermarket plastics packaging, commits to ensuring 70% of all plastic packaging is properly recycled or composted by 2025, and that the average proportion of recycled material in all plastic wrappings is 30%. With its established dual system collection network, heavy recycling quotas, and sophisticated sorting facilities, Germany, a pioneer in the management of plastic waste, has increased its portion of mechanically recycled plastic packaging from 42.1 % in 2018 to 68.9 % in 2023, leading by example in the promotion of a circular economy on a regional scale.

Key Molded Plastic Packaging Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SABIC

- INEOS Group AG

- DuPont

- ExxonMobil

- Dow Inc

- Eastman Chemical Company

- Chevron Phillips Chemical LLC

- LG Chem

- Reliance Industries Limited

- Hup Seng Industries Berhad

- Toray Industries, Inc.

- Sekisui Chemical Co., Ltd.

- Mitsubishi Chemical Holdings

- Kuraray Co., Ltd.

The molded plastic packaging market is dominated by the multinational giants and the specialized manufacturers, spread around the competitive market landscape. Major competitors are focusing on product line development through innovative, sustainable plastics and bio-based plastics to meet the global environmental requirements and consumer demand for environmentally friendly packaging. Strategic acquisitions, investment in better manufacturing technologies, and geographic expansions are common among these companies. Furthermore, Japanese manufacturers like Toray or Sekisui Chemical specialize in high-performance polymers, while U.S. firms like DuPont and Dow are the pioneers of a new era in the realm of chemistry. This varied competitive ecosystem helps to sustain a steady technological advancement and promotes sustainability efforts.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2025, Avantium, in collaboration with the Bottle Collective, unveiled new fiber bottles based on Dry Molded Fiber technology with Avantium's own plant-based polymer PEF. Under this partnership, the re-recyclable packaging interventions will be implemented on board that is 100% recyclable because of mounting customer and government pressure to use materials that are environmentally friendly. The fiber bottles have excellent barrier properties that contribute to enhanced product shelf life and mechanical strength, and can be used in food, beverage, and personal care packaging. This introduction makes Avantium and the Bottle Collective leaders in sustainable innovation in the molded plastic packaging industry, aiming at a transition towards the circular economy and low environmental impact.

- In June 2025, Ence started the production of a new range of renewable packaging materials based on molded cellulose, to be used in place of traditional trays made of plastic, mostly in the food sector. Sustainability objectives are supported within this product by providing compostable and fully recyclable options, consistent with more stringent environmental policies and consumer choices in support of green packaging. The company expects to reach an annual production of 40 million containers in 2026 after investing heavily in production, which will boost production capacity and optimization of processes. The introduction of Ence is a part of an even greater trend within the industry, to turn to renewables and devise technologies that will make the packaging process sustainable enough to potentially eliminate plastic waste and the carbon footprint.

- Report ID: 8162

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Molded Plastic Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.