Floriculture Market Outlook:

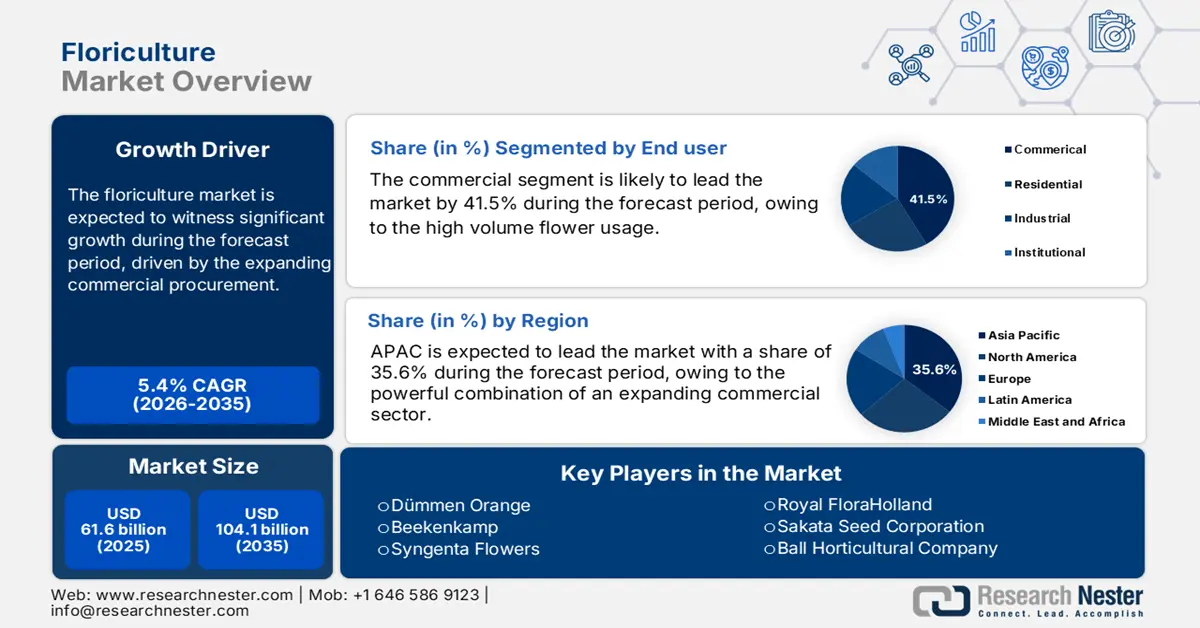

Floriculture Market size was valued at USD 61.6 billion in 2025 and is projected to reach USD 104.1 billion by the end of 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of floriculture is estimated at USD 64.9 billion.

The global floriculture market continues to scale due to expanding commercial procurement, stable import flows, and greater integration of controlled-environment production systems. Based on the data from the U.S. Department of Agriculture, the commercial floriculture sector in the U.S. represents a multi-million dollar industry with stable production. The data from the NASS 2023 depicts that the total number of floriculture producers in 2023 totaled 10,216, compared to 8,949 in 2022. Further, the area of production used to yield the floriculture crops was 851 million square feet in 2023, compared to 833 million square feet in 2022. This growth in both the producer count and production area shows a strong and expanding domestic industry. Furthermore, these measures indicate a solid supply base capable of meeting both local demand and foreign trade objectives.

The market’s structure is defined by its supply chain that moves product from growers to consumers via key channels, including mass merchandisers and garden centers that are the primary outlets. The operational focus for producers involves managing highly perishable inventory via complex logistics, including temperature-controlled transportation. International trade is a vital component of the market, supplementing domestic production to ensure year-round supply. The USDA’s Animal and Plant Health Inspection Service plays a vital role in facilitating this trade by enforcing phytosanitary regulations to reduce the pest and disease risks related to live imports. While domestic production meets a significant portion of demand, imports fulfill specific product and seasonal needs, creating an integrated North American market. The industry’s performance is closely tied to factors such as input cost management for energy and labor, and adherence to biosecurity protocols to maintain crop health and meet the standards for both international and domestic sales.

Key Floriculture Market Insights Summary:

Regional Insights:

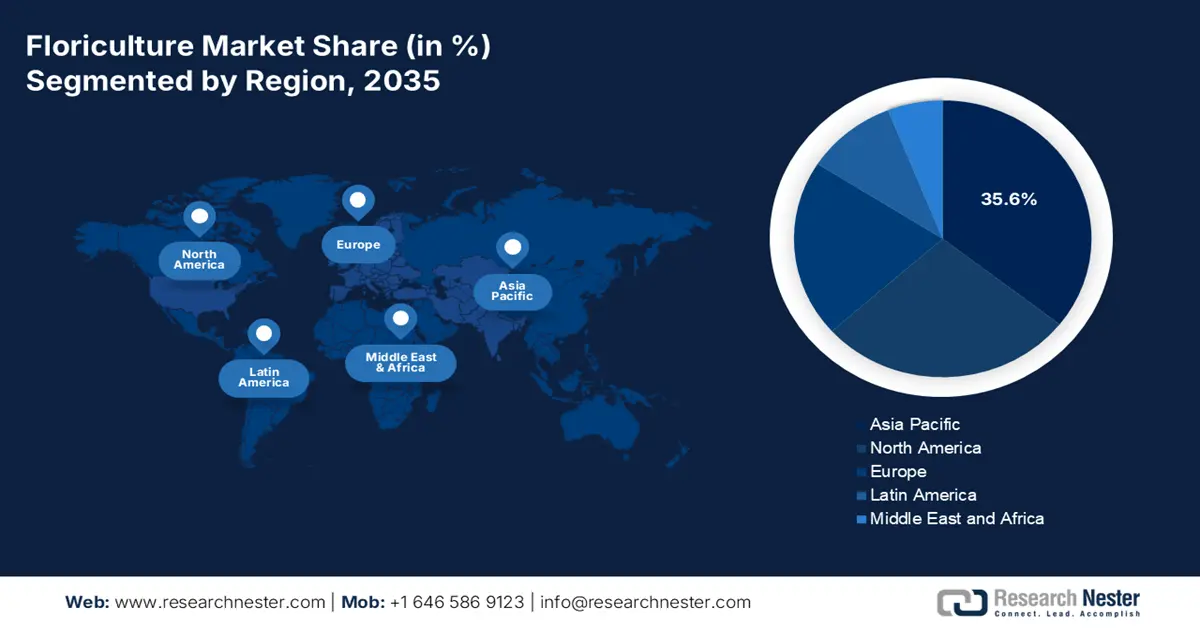

- By 2035, Asia Pacific is anticipated to secure a 35.6% revenue share in the floriculture market, attributable to the expanding commercial sector across the region.

- From 2026–2035, North America is expected to register a 5.2% CAGR, sustained by high per capita floral consumption.

Segment Insights:

- By 2035, the commercial segment in the floriculture market is projected to command a 41.5% share, underpinned by the expanding hospitality and events industries.

- The cut flowers segment is set to retain its dominance by 2035, propelled by surging global event and hospitality demand.

Key Growth Trends:

- USDA direct aid programs

- Shift in gifting culture and corporate expenditure

Major Challenges:

- Complex and robust supply chain and logistics

- Strict phytosanitary and regulatory hurdles

Key Players: Dümmen Orange (Netherlands), Beekenkamp (Netherlands), Syngenta Flowers (Switzerland), Royal FloraHolland (Netherlands), Sakata Seed Corporation (Japan), Ball Horticultural Company (U.S.), Selecta one (Germany), Afriflora (Ethiopia), Roses, Inc. (U.S.), Danziger "Dan" Flower Farm (Israel), Florigen (India), Marginpar (Kenya), Queens Group (Malaysia), Ruparelia Group (Uganda), Oserian Development Company (Kenya), Karuturi Global (India), Flavorite (Australia), The Van de Wetering Group (Netherlands), Hortex (Poland), Rijnplant (Netherlands).

Global Floriculture Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.6 billion

- 2026 Market Size: USD 64.9 billion

- Projected Market Size: USD 104.1 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: Netherlands, Colombia, Kenya, United States, Ecuador

- Emerging Countries: China, India, Vietnam, Mexico, Brazil

Last updated on : 3 December, 2025

Floriculture Market - Growth Drivers and Challenges

Growth Drivers

- USDA direct aid programs: The U.S. Department of Agriculture has announced a Marketing Assistance for Specialty Crops program and allocated USD 2 billion in direct payments to specialty crop growers, including floriculture, as per the National Potato Council data in January 2025. Eligible businesses are capable of receiving up to USD 125,000 per applicant to offset the rising input costs and expand the market opportunities. This unprecedented inclusion of flowers as a vital agricultural sector. Further, the U.S. growers should use this funding to modernize greenhouse infrastructure and expand the exports mainly to high-demand markets in Asia and Europe. This direct federal support provides a significant capital infusion to improve the global competitiveness of floriculture operations. Strategic allocation of these funds is significant for improving production efficiency and meeting the robust phytosanitary standards required for international trade.

- Shift in gifting culture and corporate expenditure: Floral products remain a core component of corporate gifting, hospitality, and promotional budgets. Recovery and growth in the post-pandemic service sector, as evidenced through U.S. Bureau of Economic Analysis data of personal consumption expenditures, indicates increased spending on experiences and gifting, with a portion of that money going to high-end floral arrangements for clients, employees, and partners; this trend ensures that demand remains strong outside the typical retail seasonal fluctuations. This is further expected to be enhanced by the increasing corporate wellness programs using biophilic design principles, integrating live plants and flowers into office environments.

- Government led tourism and event promotion: National and regional tourism boards often have substantial budgets to promote the destinations and fund large-scale events, conventions, and festivals. These events need massive short-term floral installations. For example the Tourism Australia’s annual report details significant government funding for major events that, in turn, drives the high volume, high value procurement from local and international floriculture suppliers for venue decoration and branding. This creates a predictable cycle of high-value procurement opportunities for floriculture suppliers capable of fulfilling large-scale, logistically complex orders. The emphasis on destination branding through events ensures that floral aesthetics are prioritized, making them a non-negotiable element of event budgets.

Challenges

- Complex and robust supply chain and logistics: The cold chain is vital, and the flowers are highly perishable, and any break in temperature-controlled logistics from farm to retailers results in massive spoilage. A delay of a few hours can destroy the entire shipment value. Companies such as Dummen Orange addressed this issue by investing millions in the integrated cold storage facilities and pre-cooling systems at their production sites. They also use advanced track and trace technology to monitor the conditions of the shipments in real time, ensuring the quality and reducing the losses. This system is too costly for the startups to implement fully.

- Strict phytosanitary and regulatory hurdles: International trade is mainly governed by the strict phytosanitary regulations to prevent pest and disease spread. The USDA APHIS and the EU plant health authorities require some specific import permits, inspections, and certification. Failure to comply leads to rejected shipments and massive financial loss. The Ball Horticultural Company navigates this by operating a dedicated global compliance team that manages the documentation and treatment protocols for every international shipment, a level of administrative overhead that is a significant barrier for smaller and new suppliers.

Floriculture Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 61.6 billion |

|

Forecast Year Market Size (2035) |

USD 104.1 billion |

|

Regional Scope |

|

Floriculture Market Segmentation:

End user Segment Analysis

Under the end user segment, the commercial segment is dominating the segment and is expected to hold a share value of 41.5% by 2035. Commercial users such as hotels, resorts, events, and malls are the top contributors to the market revenue due to the consistently high volume of flower usage. The May 2023 report by the NASS has reported that the overall sales of floriculture crops reached USD 6.69 billion. This significant revenue indicates the commercial segment's vital role in fueling the entire industry forward, reporting its economic importance and sustained growth trajectory within the global floral market. The trend is anticipated to continue, fueled by the hospitality and events industries. Landscaping in commercial real estate further expands rapidly, aided by government-led urban greening programs such as those indicated by the EPA. These macro-economic conditions make the commercial end users the largest revenue contributor by 2035.

Type Segment Analysis

The dominance of the cut flowers is aided by the rising event and hospitality demand worldwide, mainly in weddings, conferences, and corporate gifting. The U.S. Department of Agriculture report in May 2023 has stated that the import of cut flowers rose steadily due to the increased domestic consumption and seasonal demand increase. As per the report U.S. imported nearly USD 3.3 billion worth of cut flowers, plants, and nursery stock products from 81 countries. On the other hand, Europe is the key consumption hub backed by a strong retail floral culture. The European Environment Agency reported a continued expansion in the controlled environment horticulture, aiding year-round production. Further, the lifestyle changes and the e-commerce floral platforms have accelerated the demand.

Propagation Segment Analysis

The propagation segment of the market is projected to be led by the cuttings owing to their high genetic stability, faster rooting, and superior yield consistency, making them the preferred method for commercial flower producers worldwide. The demand for vegetative cutting has stimulated greenhouse expansion and controlled environment farming. According to the U.S. Department of Agriculture data in May 2023, the imports of live plants were valued at nearly USD 860 million. This data reflects a strong rise in propagation material utilization. This growth is reinforced by the expanded ornamental plant production capacity reported in major exporting countries and increased adoption of high-quality cultivar programs supported by horticultural development initiatives. As commercial growers opt for a uniform flowering and improved shelf life, cuttings remain the dominant choice across global floriculture operations.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Flower Type |

|

|

Application |

|

|

Distribution Channel |

|

|

End user |

|

|

Propagation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Floriculture Market - Regional Analysis

APAC Market Insights

Asia Pacific is the dominant player in the floriculture market and is projected to hold the revenue share of 35.6% by 2035. The market is driven by the powerful combination of an expanding commercial sector, rising disposable incomes, and strong cultural traditions. The key drivers include rapid urbanization that fuels the demand for green spaces and ornamental plants, and the growth of the hospitality and events industry. A prime trend is the modernization of the supply chains with an increased investment in the cold storage infrastructure to minimize the post-harvest losses. Furthermore, the government initiatives across the region actively promote floriculture as a high-value agricultural export.

The China’s market is the largest in the APAC region and is driven by the massive domestic production and rising consumer spending. The market is defined by a powerful combination of traditional gift-giving culture, mainly around festivals, and the modern integration of flowers into urban lifestyles and commercial décor. A key trend is the rapid digitalization of the supply chain, with the e-commerce platforms and live streaming sales becoming a dominant channel for both the B2C and B2B distribution, directly connecting growers with millions of consumers. Government support via modern agricultural policies also supports the facility-based cultivation to enhance quality and yield. According to the People‘s Republic of China data in May 2023, the country aims to achieve annual flower sales of over USD 100 billion by 2035, reflecting the immense scale of domestic production.

Japan’s floriculture market is a mature and high-value sector characterized by premium consumption and advanced retail logistics. The demand is based on the deeply ingrained cultural practices, including gift giving, ceremonial uses, and strong appreciation for seasonal varieties and aesthetic quality. A key trend is the industry’s response to an aging population and shifting demographics, leading to targeted marketing towards smaller households and a growing emphasis on small-sized low-maintenance potted plants. The market is also using technology to improve the traceability and shelf life. The data from the OEC in 2025 depicts that the nation has exported ¥1.55 billion in 2025. This data highlights the segment’s significant economic value despite a gradually contracting domestic production area.

North America Market Insights

The North America floriculture market is growing rapidly and is expected to grow at a CAGR of 5.2% during the forecast period 2026 to 2035. The market is defined by the strong commercial procurement from the hospitality, corporate gifting, and landscaping sectors, supported by an advanced cold chain logistics infrastructure. The key drivers include high per capita consumption and consistent demand from mass merchandisers. The primary trends involve a significant shift towards controlled environment agriculture to ensure year-round production and manage energy costs, alongside growing corporate and consumer emphasis on sustainability certifications. The industry is further shaped by the integrated cross-border trade and government-aided research initiatives aimed at enhancing production efficiency and biosecurity.

The U.S. floriculture market is shaped by strong import reliance, stable commercial procurement, and expanding protected cultivation. The OEC data in 2023 depicts that the U.S. is the top importer of cut flowers and has imported nearly USD 2.58 billion, reflecting sustained demand from retailers, hotels, event organizers, and e-commerce floral channels. Further, the rise in accommodation and food services by the tourism sector is reinforcing the usage of decorative flowers and foliage. On the other hand, the APHIS plays a central role in ensuring smooth floral movement via digital phytosanitary certification, minimizing the clearance times and improving the shipment reliability. Greenhouse operators continue to adopt energy-efficient technologies, aided indirectly by federal sustainability programs. Institutional buyers, including universities, municipal departments, and healthcare facilities, remain key consumers through landscape and public-space procurement.

U.S. Import Origins of Cut Flowers in 2023

|

Country |

Import Value (USD) |

|

Colombia |

1.62 billion |

|

Ecuador |

542 million |

|

Canada |

109 million |

|

Mexico |

57.1 million |

Source: OEC 2025

Canada’s floriculture market is supported by the greenhouse-intensive production, import supplementation, and public sector landscaping demand. Agriculture and Agri-Food Canada identifies ornamentals as a major greenhouse category, reinforced by the federal energy efficiency incentives improving heating and lighting operations. According to Statistics Canada data in April 2025, the nation witnessed a steady growth in greenhouse flower and plant sales exceeded 3.9% during 2024, compared with the previous year. This data indicates that there is strong purchase from retail chains, garden centers, and municipalities. Canada relies on imports of cut flowers and propagative materials from the U.S., Colombia, and Ecuador to meet the seasonal peaks. The urban infrastructure program involves streetscaping and public garden maintenance, increasing ornamental plant usage.

Canada Import of Cut Flowers in 2023

|

Country |

Import (USD) |

|

Colombia |

71.4 million |

|

Ecuador |

38.5 million |

|

Netherlands |

11.9 million |

|

U.S. |

4.51 million |

|

Mexico |

2.19 million |

Source: OEC 2025

Europe Market Insights

The market in Europe is a mature yet stable sector and is defined by a high per capita consumption and a strong demand for premium seasonal and sustainably certified products. The key drivers include well-established cultural traditions of gifting and gardening, coupled with robust commercial demand from the hospitality and event industries. A significant trend is the industry’s pivot towards sustainability, which is driven by both consumer preference and EU-wide policy. The European Green Deal indirectly influences production methods, pushing for a reduction in chemical pesticides and plastic waste and promoting local cultivation to reduce the carbon footprint. For instance, the EU’s Farm to Fork Strategy under the European Green Deal focuses on making food systems fair and environmentally friendly, a principle that is increasingly applied to ornamental horticulture, encouraging integrated pest management and resource efficiency.

Germany is projected to hold the highest revenue share in Europe market by 2035. The dominance is driven by the central geographic location that makes it a continental logistics and distribution hub, and the presence of the world’s largest wholesale flower market in Aalsmeer, Netherlands, which primarily serves the market. The key growth factors include high consumer purchasing power and a strong DIY and garden center retail sector. A significant trend is the professionalization of urban gardening and balcony floriculture. The AIPH data in March 2024 depicts that Germany’s cut flower market reached €3 billion. This data highlights the country's importance as both a large consuming market and a critical transit site for the European flower trade. The market's stability is further reinforced by a consistent consumer demand for both indoor and outdoor plants.

The UK market strength stems from a deeply ingrained gardening culture and high demand for seasonal plants such as bedding plants in spring. A primary driver is the trend towards grow your own and wildlife-friendly gardening, increasing sales of pollinator-attracting plants. However, a major challenge and defining trend is the adaptation of the supply chain to post-Brexit regulations, which has increased the complexity and cost of imports from the EU. The OEC data in 2025 depicts that the UK has exported £31.7 million in 2025 for cut flowers. Its export value is overshadowed by a much larger import volume, highlighting the domestic demand-supply gap. Consequently, the industry is aiming to enhance the local production and greenhouse capabilities to improve self-sufficiency and mitigate supply chain risks.

Key Floriculture Market Players:

- Dümmen Orange (Netherlands)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Beekenkamp (Netherlands)

- Syngenta Flowers (Switzerland)

- Royal FloraHolland (Netherlands)

- Sakata Seed Corporation (Japan)

- Ball Horticultural Company (U.S.)

- Selecta one (Germany)

- Afriflora (Ethiopia)

- Roses, Inc. (U.S.)

- Danziger "Dan" Flower Farm (Israel)

- Florigen (India)

- Marginpar (Kenya)

- Queens Group (Malaysia)

- Ruparelia Group (Uganda)

- Oserian Development Company (Kenya)

- Karuturi Global (India)

- Flavorite (Australia)

- The Van de Wetering Group (Netherlands)

- Hortex (Poland)

- Rijnplant (Netherlands)

- Dummen Orange is the top player in the floriculture market and is driving its strategy via large-scale investment in genetic research and biotechnology. By developing proprietary disease-resistant and climate-resilient plant varieties, the company secures a competitive edge. Their strategic initiative includes acquiring smaller breeders to consolidate their portfolio and expanding their global production footprint to ensure a year-round, reliable supply for growers worldwide, solidifying their position as an innovative leader.

- Beekenkamp plays a vital role in the market with a strong focus on sustainable propagation and breeding. Their prime strategic initiatives involve advancing the tissue culture and young plant production to ensure a superior quality and phytosanitary standards. They are heavily invested in creating sustainable product lines, including the reduction of plastic use and developing low-energy requirement varieties.

- Syngenta Flowers uses its global agriculture expertise to make significant advancements in the floriculture market. The primary strategy of the company is around intensive R&D to breed novel varieties with unique colors, patterns, and extended blooming cycles. A core strategic initiative is integrating digital tools to provide growers with data-driven agronomic advice, aiding them in optimizing yield and quality. The company has made sales of 16,981 million in 2024, driving the growth in the market.

- Royal FloraHolland is not just a participant but the central nexus of the global floriculture market via its world-leading flower auction. Its key strategic initiatives are digital transformation and data logistics. By developing advanced digital platforms for direct trading and providing market intelligence data, they streamline the entire supply chain. The company is leading in the international B2B floriculture platform with annual product turnover exceeding 5 billion euros.

- Sakata Seed Corporation brings its century-long plant breeding heritage to the forefront of the floriculture market. Their strategic initiative are centered on developing high-value patented varieties mainly in the bedding plant and cut flower segments. They invest heavily in biotechnology to enhance the traits such as drought tolerance and vibrancy. By focusing on these performance genetics, the company is expanding its global seed distribution network.

Here is a list of key players operating in the global market:

Of the top 20 global floriculture manufacturers, the competitive landscape is fragmented yet increasingly consolidated by the major players who use advanced breeding, sustainable cultivation, and complex global supply chains. The key strategic initiatives include significant investments in biotechnology to develop novel, resilient flower varieties, a strong focus on sustainable and energy-efficient greenhouse operations, and robust geographical expansion via acquisitions and partnerships. For example, in November 2024, Royal FloraHolland announced the acquisition of the remaining 15% shares of Floriway, making it a 100% owner of the floriculture transport company. E-commerce optimization and direct-to-consumer models are also vital strategies to capture the value and cater to evolving consumer preferences as companies compete not only on the price but also on the quality, consistency, and ethical production.

Corporate Landscape of the Floriculture Market:

Recent Developments

- In November 2025, Corteva has announced the launch of a new fungicide, Verpixo 100 SC, to boost Kenya's vital floriculture sector. The product is mainly developed for rose growers.

- In March 2025, Dutch Flower Group is the first trade company in the floriculture sector to be validated by SBTi for climate targets. This means that DFG’s sustainability targets align with the Paris Climate Agreement.

- Report ID: 1083

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Floriculture Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.