Protective Packaging Market Outlook:

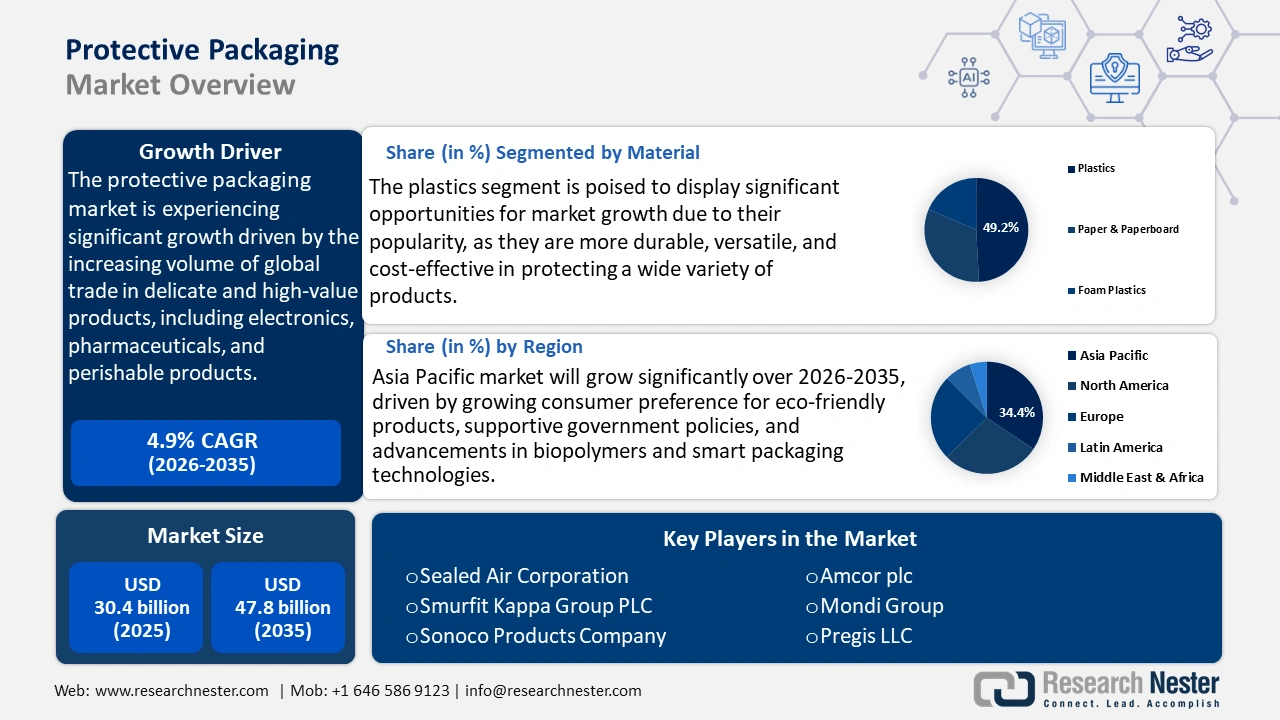

Protective Packaging Market size was valued at USD 30.4 billion in 2025 and is projected to reach USD 47.8 billion by the end of 2035, rising at a CAGR of 4.9% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of protective packaging is assessed at USD 31.7 billion.

The protective packaging market is expected to witness an upward trend over the forecast years, primarily driven by the increasing volume of global trade in delicate and high-value products, including electronics, pharmaceuticals, and perishable products. According to the U.S. Bureau of Transportation Statistics, cross-border freight value between the U.S., Canada, and Mexico was USD 1.6 trillion in 2024, a 1.8% growth over 2023, of which surface modes (trucking and rail) comprised 77.1% of total freight value. This growth emphasizes increased frequency of shipments and distance, which require more protective shipping options to reduce damage during shipping and handling. In addition, industrial changes to the model of regional distribution and just-in-time delivery focus on internal logistics in which protective packaging is a decisive factor. Protective packaging will not only maintain product safety in transit, but will also contribute to sustainability through waste and cost reduction. This highlights the increased importance of protective packaging in maximising supply channel efficiencies and in harmony with the environmental objectives that are central to the demands of new industrial distribution models.

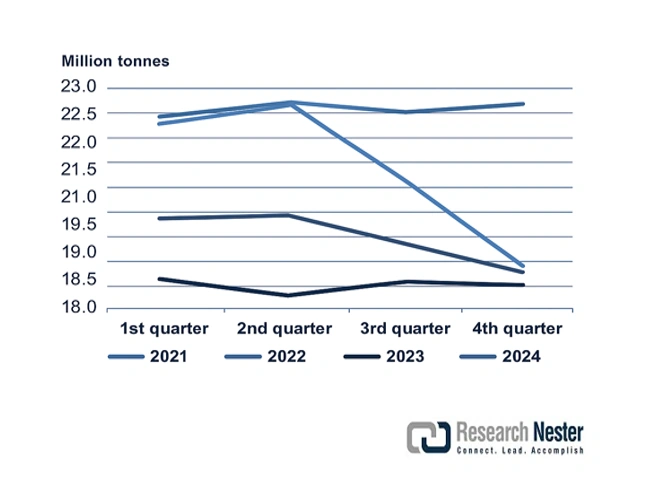

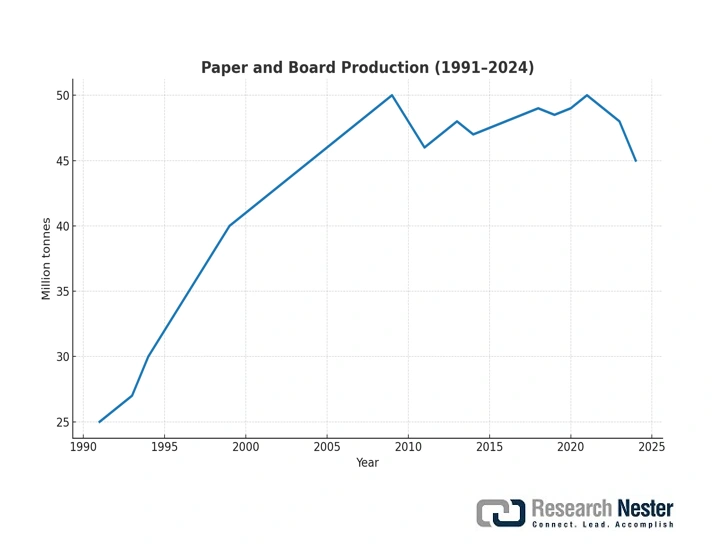

The supply chains are responding to increasing demand through increasing producer price indices and production activity. The U.S. Bureau of Labor Statistics reported that the PPI of corrugated paperboard in sheets and rolls rose by about 331.80 in June 2024 to 348.40 in June 2025. Similarly, the PPI of corrugated shipping containers was 326.617 in July 2024 and 356.022 in July 2025. Such indices indicate that packaging manufacturers face significant cost strain and point towards the continuous investment in production facilities to match the rising demand. In addition, as per the CEPI Preliminary Statistics 2024 report, paper and board output in the CEPI member countries increased by 5.2% in 2024 to an estimated 77.8 million tonnes. This is a solid recovery of earlier declines and a positive indicator of an increase in demand across all the major grades of paper and board. Other major production countries that saw similar growth trends include the U.S., China, India, Brazil, Canada, and South Korea, with growth rates of between 1.5% and 5.5%. This recovery reflects an increasing role of paper-based materials, including those used in protective packing, in global trade and supply chains. Collectively, these dynamics support the idea that the growth of the protective packaging market is driven by the strong growth of the supply chain, the high production capacity, the increased input costs, and the increased global trading activity.

(Source: cepi.org)

(Source: cepi.org)

Key Protective Packaging Market Insights Summary:

Regional Highlights:

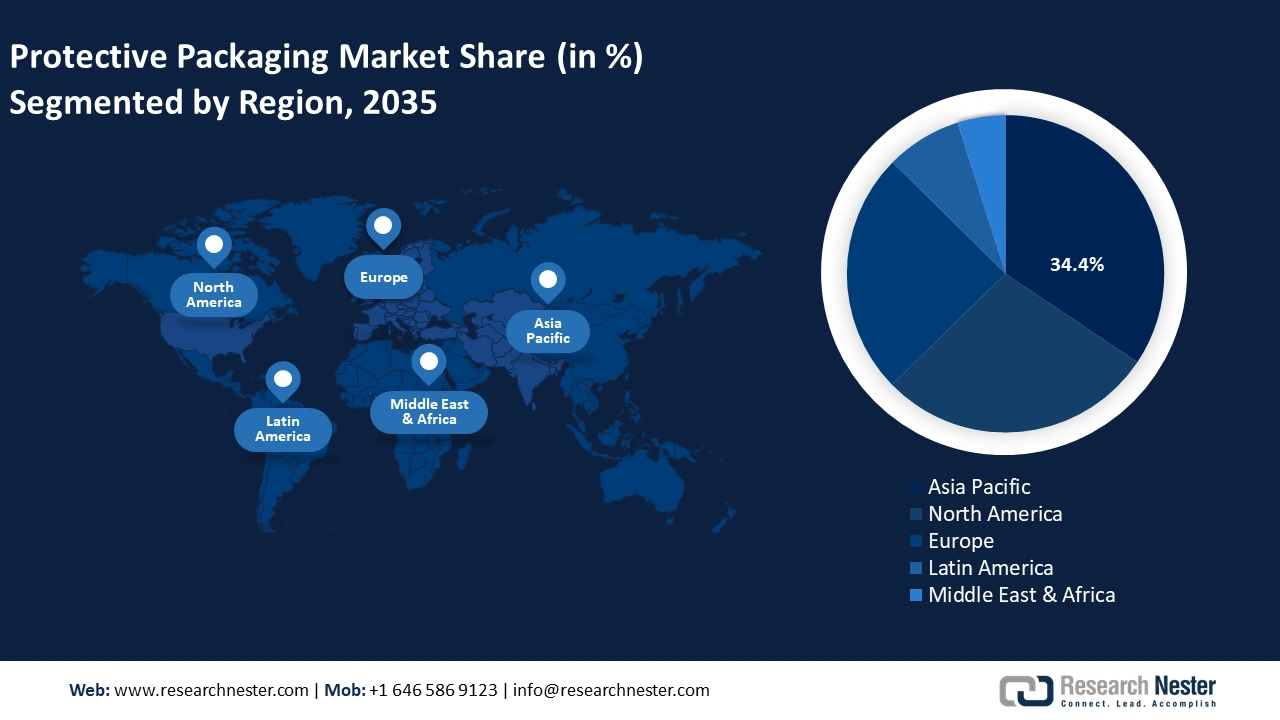

- The Asia Pacific region is expected to dominate the protective packaging market with the highest revenue share of 34.4% from 2026 to 2035, fueled by expanding manufacturing industries, export growth, and accelerating adoption of sustainable and smart packaging technologies.

- North America is projected to capture a 28.3% market share through 2035, supported by stringent sustainability policies, Extended Producer Responsibility (EPR) programs, and strong government initiatives promoting circular economy packaging practices.

Segment Insights:

- The plastics segment is projected to hold a 49.2% share by 2035 in the protective packaging market, propelled by its durability, versatility, cost-effectiveness, and the rising adoption of recyclable and bio-based plastics for sustainable packaging solutions.

- The flexible packaging segment is anticipated to secure a 41.5% share during 2026–2035, owing to its lightweight, cost-efficient, and eco-friendly properties that help reduce carbon footprints and material waste while meeting sustainability goals.

Key Growth Trends:

- Expansion of green chemical manufacturing

- Green initiatives and carbon reduction

Major Challenges:

- Multifaceted and multidimensional global regulatory systems

- Inadequate infrastructure to support production of sustainable packaging

Key Players: Sealed Air Corporation, Smurfit Kappa Group PLC, Sonoco Products Company, Amcor plc, Mondi Group, Pregis LLC, Huhtamaki Oyj, Essel Propack Ltd., Supreme Industries Ltd., Synthetic Packers Pvt. Ltd., Pro-Pac Packaging Ltd.

Global Protective Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 30.4 billion

- 2026 Market Size: USD 31.7 billion

- Projected Market Size: 47.8 billion by 2035

- Growth Forecasts: 4.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Indonesia, Australia, Canada

Last updated on : 1 October, 2025

Protective Packaging Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of green chemical manufacturing: The green chemicals market is expected to reach 10 billion dollars by 2027, as a direct result of increasing demand for sustainable and bio-based chemical products. This rise, according to the 2023 chemicals report by the International Energy Agency (IEA), can be attributed to the increased use of renewable feedstocks and the opening up to the so-called circular economy, which has a less adverse impact on the environment. Demand for protective packaging also increases because chemical manufacturers are interested in biodegradable and recyclable packaging materials that are being used with green chemicals. For example, Greenchemicals S.R.L. specializes in environmentally friendly and non-toxic polymer formulations. They are focused on high levels of environmental performance, mechanical quality, and high requirements (REACH, CLP, RoHS). Their packaging solutions make it possible to extract harmful substances from polymers and convert plastics into high-quality, non-polluting materials. The movement promotes the use of sustainable and durable packaging materials, and the economy is expanding according to the requirements of sustainability.

- Green initiatives and carbon reduction: Sustainability leads to innovation in protective packaging as chemical producers aim at reducing carbon footprints. According to the Waste Reduction Model (WARM) Version 15, published by the U.S Environmental Protection Agency, explicitly incorporates packaging materials (corrugated containers, paper, and plastics) into the list and quantifies their greenhouse gas release during their life cycles. The model considers the potential role of practices such as sourcing reduction (e.g., lightweighting packaging), recycling, and material selection in greatly decreasing packaging production, transportation, and disposal emissions. This allows businesses and policymakers to make informed decisions in order to reduce the environmental impact of packaging and encourage sustainable materials management. The specified environmental imperative is also reshaping the packaging design to be made from renewable and recyclable materials, as well as light materials, that ensure the integrity of the product, while meeting the specific emissions reduction quotas.

- Increase in chemical production capacity: The chemical production in the Asia-Pacific region is on the rise with a CAGR of 4.5% till 2030, contributing to the rise in the demand for protective packaging. The 2023 Chemicals report by the International Energy Agency notes that this continued growth has been fueled by growth in industrial capacity and domestic consumption. Increased volumes of production demand the use of packaging solutions that will guarantee the safety of the product during transportation and the ability to meet new regulatory requirements. For instance, Noah Chemicals came up with special customized packaging, which follows the safety precautions of handling hazardous substances. Their packaging helps to ensure safe storage and transportation and reduces the chances of contamination or damage without violating local, state, and federal standards. This growth of capacity causes the innovation and scale creation of packaging materials, market development, and improvement in the chemical field.

Challenges

- Multifaceted and multidimensional global regulatory systems: Protective packaging producers have a critical problem with various and multiplexing worldwide regulatory systems. WTO recognizes that non-tariff complications, such as differences in chemical safety and packaging laws, delay access to the market and increase compliance costs. In 2022, China passed additional, tougher norms in the field of chemical safety, which led to six-month delays in the approval of protective packaging chemicals, which paralyzed supply chains and influenced streams of revenue. These regulatory variations are forcing manufacturers to design products to meet the varied locations, making operations difficult and expensive. Harmonization is still slow, and it is a continuing hurdle to the international expansion of many suppliers.

- Inadequate infrastructure to support production of sustainable packaging: The transition to sustainable protective packaging demands a high level of production infrastructure that is not available in most of the emerging markets. As per the OECD Environmental Outlook 2023, the Southeast Asian countries are behind Western countries in setting up bioplastic and environmentally friendly packaging manufacturing plants. This infrastructure difference slows the launch of green packaging products and reduces the market expansion and incorporation of green solutions. In addition, the limit of start-up and unskilled labour also casts doubt on the potential development of sustainable packaging industries in the states in question and, hence, on the ability of local manufacturers to meet the growing environmental concerns and needs of consumers.

Protective Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.9% |

|

Base Year Market Size (2025) |

USD 30.4 billion |

|

Forecast Year Market Size (2035) |

USD 47.8 billion |

|

Regional Scope |

|

Protective Packaging Market Segmentation:

Material Segment Analysis

By the year 2035, the plastics segment is expected to grow at the largest protective packaging market share of 49.2%, owing to their popularity, as they are more durable, versatile, and cost-effective in protecting a wide variety of products. The development of recyclable and bio-based plastics is also providing renewed demand as manufacturers seek sustainable sources to replace traditional materials. The U.S. Department of Energy presumes that new technologies in plastics will lead to new, lighter packaging measures that will decrease transportation emissions and energy use. Such a performance-sustainability equilibrium is increasing market penetration of plastics, in particular in food and beverage and electronic markets, where protection and environmental regulation are becoming a requirement.

Polyethylene (PE) is a highly flexible plastic, moisture-resistant and durable, which is most commonly applied in films, bags, and wraps. Polypropylene (PP) is stiffer and melts at a higher temperature, and proves more consistent when working with rigid containers and reusable packaging. PE and PP together are the basis of affordable and efficient packaging systems. Such materials are also being recycled to make them more sustainable as per the regulatory requirements of greener packaging. The U.S. Department of Energy believes that PE and PP can be more effectively mechanically recycled to achieve a reduction in plastic waste by 2030, which would ensure its leadership and growth in the field of protective packaging. The global plastic production is projected to increase dramatically by 2050, in terms of total production and per capita consumption. Polyolefins, especially polypropylene (PP) and low-density polyethylene (LDPE), are still the most widespread polymers, and have taken the most significant portion of production throughout this period. This projection highlights the constantly growing and unabated need for polyolefin-based packaging and consumer products globally.

Type Segment Analysis

The flexible packaging segment is expected to grow at a significant protective packaging market share of 41.5% over the projected years, attributed to its flexibility, affordability, and environmental friendliness. It also provides lightweight space-saving solutions that save on shipping expenses and material waste. EPA reports that flexible packaging can reduce carbon footprints significantly, in comparison to rigid packaging, and also greatly reduce the volume of material consumed. Flexible packaging allows industries like food and beverage and e-commerce to maintain the freshness of their goods and offer a level of tamper resistance. This flexibility, combined with the growing need to use sustainable packaging, makes flexible packaging an outstanding growth driver.

Bags & pouches are practical and convenient, and are used across the food and beverage and health care sectors as they are lightweight, can be resealed, which extends the shelf life of foods, and reduces waste. Flexible bags are expected to reduce the use of packaging materials, which is also part of the sustainability agenda. Stretch films and wraps dominate the industrial and online market with a high level of load stability and protection during transit. These sub-segments taken together improve the environmental compliance and market share of flexible packaging.

Function Segment Analysis

The cushioning segment is projected to expand at a protective packaging market share of 37.6% from 2026 to 2035. This sub-segment plays an important role in protecting fragile and sensitive products in industries such as electronics, healthcare, and automobiles. Bubble wrap, foam padding, and inflatable packaging are materials that absorb shocks and protect against damage during transportation and handling. There is a growing demand for a strong protective solution as the volume of global trade and the complexity of supply chains are also increasing. Cushioning materials are also shifting towards eco-friendly materials to satisfy stricter environmental regulations, both in terms of product safety and in terms of regulatory requirements.

Our in-depth analysis of the protective packaging market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Material |

|

|

Function |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Protective Packaging Market - Regional Analysis

North America Market Insights

The North American protective packaging market is projected to grow at a substantial revenue share of 28.3% over the forecast years, mainly due to strict region-wide policy on sustainability and waste management. Packaging manufacturers are currently required to take the initiative to fund and manage recycling initiatives by extended Producer responsibility (EPR) programs, and this has facilitated the development of new eco-friendly materials, including bioplastics, molded pulp, reworkable polymers, etc. Recent policy developments are forcing manufacturers and distributors to redesign products and supply chains in the direction of the circular economy. For example, California Senate Bill 54 requires that by 2032, packaging should be recyclable or compostable, with plastic packaging targets of 30% by 2028, 40% by 2030, and 65% by 2032. Such shifts require manufacturers and distributors to re-architect products and supply chains in light of the circular economy. According to the EPA statistics, containers and packaging form approximately 28.1 percent of total municipal solid waste over the past years, which is why it is important to make containers and packaging increasingly recyclable. The government standards also govern the manner in which protective packaging is to be labelled, processed, and recovered to reduce the effect of landfill and help resource conservation efforts.

By 2035, the U.S. protective packaging market is predicted to dominate the North American region with the largest revenue share, owing to the booming e-commerce, making heavy investments in sustainable packaging solutions to minimize the impact on the environment. The U.S. Environmental Protection Agency (EPA) records that approximately 28.1% of total municipal solid waste is packaging waste, which has led to more stringent guidelines on what is recyclable. Additionally, the new technologies that have been incorporated in the industry, like automated packaging lines, are also helping to make the industry more efficient. According to the U.S. Department of Energy, there is an increasing need for lightweight and strong packaging materials to reduce carbon footprints. These factors lead to sustained development and innovation in the protective packaging market in the country.

The protective packaging market in Canada is likely to grow substantially in the North American region, attributed to the increasing emphasis on environmentally friendly packaging materials and alignment with government sustainability policies. According to Environment and Climate Change Canada, packaging makes up about 25% of the overall waste stream in Canada, and efforts are being made to increase recycling and the use of a circular economy. Furthermore, the government of Canada is promoting the utilization of biodegradable and compostable packaging materials, which has created demand in the food, pharmaceutical, and electronic industries. The adoption of smart packaging to improve product tracking and protection can be considered a technological development. These trends make Canada a notable player in sustainable protective packaging solutions.

Asia Pacific Market Insights

Asia Pacific is expected to dominate the protective packaging market with the highest revenue share of 34.4% from 2026 to 2035. This growth is attributed to the huge manufacturing sector, increased industrialization, and the flourishing export business. E-commerce, electronics, automotive, and healthcare are listed as key industries demanding more advanced solutions for the protection of products in transit. According to the Asian Development Bank report, the interest in green business investments in Asia and the Pacific is growing due to the increase in policy frameworks and innovation of green technologies. All these are contributing to the fact that the biodegradable packaging market is expanding at a rapid pace in the region due to the growing consumer need for sustainable products, stronger governmental laws, and the development of biopolymer materials. Moreover, technology, such as automation and smart packaging, can help enhance efficiency and improve the tracking of products. A recent Asia-Pacific Economic Cooperation (APEC) study stated that the management of packaging waste and activities related to a circular economy is a crucial area that contributes to the further expansion of the market. In general, the region is placed among the global leaders in implementing sustainable and innovative protective packaging solutions.

The protective packaging market in China is projected to lead the region during the forecast years, owing to the significant growth of the electronic and e-commerce industries. For instance, in 2021, China became the largest market for e-commerce with a revenue of USD 1.5 trillion, placing it ahead of the U.S. This rapid growth in e-commerce has significantly increased the demand for high-quality protective packaging solutions to ensure product safety during shipping and handling. Sustainability efforts by the government in relation to the environment have resulted in more stringent rules regarding the use and disposal of plastics. According to the Ministry of Ecology and Environment, packaging waste is a significant part of urban solid waste, and more should be done to recycle and use biodegradable resources. In China, the solid waste produced in urban areas was about 240 million tonnes in 2019, and a large proportion is composed of packaging waste, including plastics, paper, glass, and metals. According to the government, sorting and recycling are important activities in the recovery of useful resources, particularly packaging materials. These two factors taken together place the Chinese market in a stable position to grow in the field of protective packaging.

The Indian protective packaging market is likely to grow substantially over the projected years by 2035, attributed to the rise in e-commerce, increasing organized retail, and growing manufacturing industries such as pharmaceuticals, electronics, and FMCG. Ministry of Environment, Forest and Climate Change has highlighted the need to reduce plastic waste through the use of sustainable and compostable packaging options. The fast urbanization and the development of consumer consciousness in terms of environmentally-friendly packaging are also very significant factors, driving the market growth in the country. Moreover, smart and automated packaging technologies are increasing the efficiency of the supply chain and product security, increasing the need to find new packaging solutions. These factors combined make the market outlook of India very positive.

Europe Market Insights

By 2035, the European market is anticipated to grow with a notable revenue share of 24.7%, mainly driven by strict environmental laws like the EU Circular Economy Action Plan and the Single-Use Plastics Directive, which facilitate sustainability through the use of recyclable, reusable, and biodegradable packaging materials. The increasing e-commerce, automotive, pharmaceutical, and food markets are leading to the need to create high-tech protective packaging products that help to ensure product integrity during shipping. In the UK, the growth is supported by increasing online retail sales and programs by the government, like the Resources and Waste Strategy, which is promoting the reduction of packaging waste and an increase in recycling. The German market is the most suitable choice as it is worth USD 3.4 billion in 2024 and has stringent packaging waste laws and a strong demand for eco-friendly products. The nation is a leader in implementing biodegradable packaging technologies and the circular economy. The European market of protective packaging will continue to grow steadily due to regulatory compliance, sustainability objectives, and technological developments in packaging materials and smart solutions.

Key Protective Packaging Market Players:

- Sealed Air Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Smurfit Kappa Group PLC

- Sonoco Products Company

- Amcor plc

- Mondi Group

- Pregis LLC

- Huhtamaki Oyj

- Essel Propack Ltd.

- Supreme Industries Ltd.

- Synthetic Packers Pvt. Ltd.

- Pro-Pac Packaging Ltd.

The protective packaging market is highly competitive, and major players have concentrated on sustainability, innovation, and geographical growth. Smart packaging and automation solutions are dominated by US firms such as Sealed Air Corporation. In addition, Smurfit Kappa Group is an example of European companies using recycling and a circular economy. To meet the requirements of the rigid environment regulation, the Japanese companies, Kuraray, Sekisui Chemical, Toyo Seikan, and Mitsui Chemicals, are attentive to the innovation of high-performance materials and sustainable packaging. Moreover, to meet the needs of the e-commerce and manufacturing industries, Indian and Australian firms are increasing their production. The acquisition and mergers are common because companies want to expand their products and market base.

Top Global Protective Packaging Manufacturers

Recent Developments

- In April of 2024, the 2M Group of Companies and Xampla announced a historic deal to increase the commercialization of Morro. This partnership uses the manufacturing strengths of 2M to commercially scale the Xampla novel plant-protein technology into food, cosmetic, and packaging markets. The collaboration guarantees industrial quantities of Morro are in supply when there is a rapid demand for substitutes to single-use plastics. Manufacturing was done at 2M’s, one of the European locations, allowing Xampla to expedite rollout schedules and minimize the carbon footprint of distribution.

- In September 2023, Xampla launched its consumer-facing brand, Morro, a plant-based, biodegradable, and compostable packaging material. Morro is a protein-derived product based on pea protein, and is designed to mimic the strength and elasticity of traditional plastic, yet is entirely plastic-free, edible, and home-compostable. The brand is used in films, sachets, and coatings in foodservice and personal care packaging. Xampla states that Morro provides a scalable solution to regulatory pressure presented by global prohibitions on the use of single-use plastics. It is also a strategic positioning step to reach environmentally conscious brands and consumers upon launch.

- Report ID: 8160

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Protective Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.