Crude Oil Flow Improvers Market Outlook:

Crude Oil Flow Improvers Market size was over USD 1.98 billion in 2025 and is anticipated to cross USD 3.26 billion by 2035, growing at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crude oil flow improvers is assessed at USD 2.07 billion.

The increasing production of crude oil across the world will become the primary reason behind the growth of the crude oil flow improvers market. A recently published report anticipates that dependent on recent government policies and market trends, international oil requirement will increase by 6% between 2022 and 2028 to touch 105.7 million barrels per day (mb/d) – supported by strong requirements from the petrochemical and aviation sectors. Although this cumulative rise, yearly requirement expansion is anticipated to contract from 2.4 mb/d this year to just 0.4 mb/d in 2028, placing a peak in requirement in sight.

Another reason that will propel the market of crude oil flow improvers by the end of 2036 is the increasing demand for crude oil across the world. Rises in international oil requirements are set to split from 2.3 mb/d in 2023 to 1.2 mb/d this year, with the post-Covid revival all but fulfilled, GDP expansion below fashion in major economies, and as energy-effective modifications and electrification of the vehicle fleet limit oil use. Throughout 2023, the rate of requirement expansion apart from China was hindered substantially, to roughly 300 kb/d on average during 2H23. China will go on to lead oil requirement expansion in 2024, with its growing petrochemical sector acquiring an ever-larger share. At the beginning of 2024, the risk of international oil supply disturbances from the Middle East dispute stays raised, specifically for oil flows through the Red Sea and, critically, the Suez Canal. In 2023, approximately 10% of the world’s seaborne oil trade, or roughly 7.2 mb/d of crude and oil materials, and 8% of international LNG trade crossed over this major trade route.

Key Crude Oil Flow Improvers Market Insights Summary:

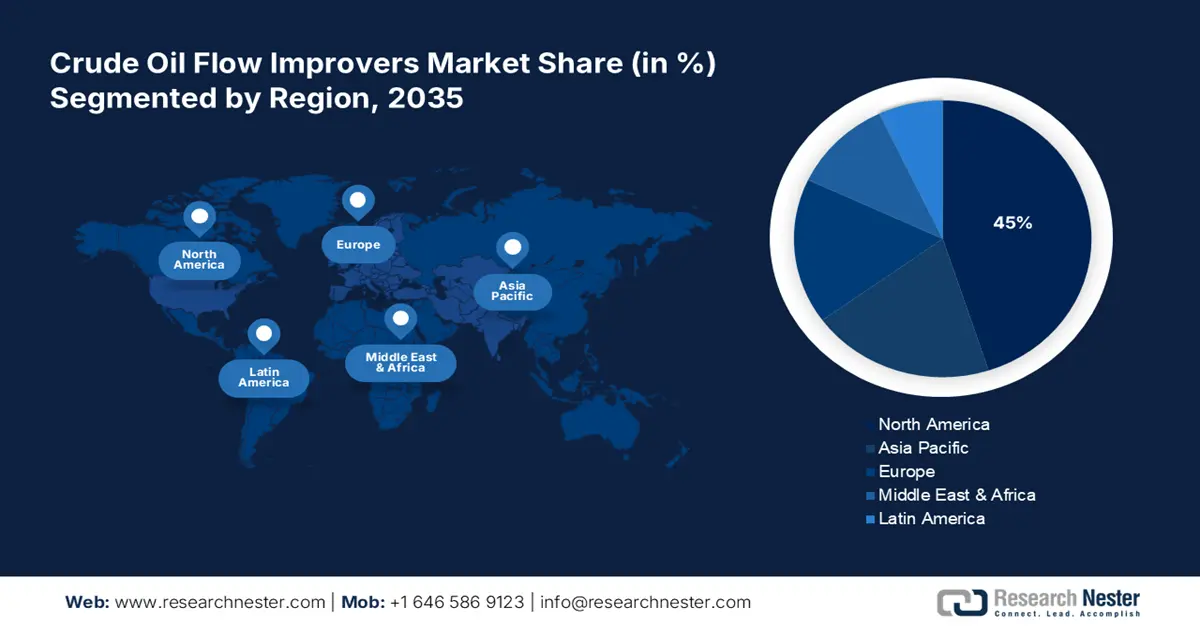

Regional Highlights:

- North America crude oil flow improvers market will dominate around 45% share by 2035, fueled by the U.S.'s large collection of businesses and industrialization driving crude oil flow improver demand.

- Asia Pacific market, holding the second largest share by 2035, is propelled by the expansion of crude oil refineries, particularly the multi-billion-dollar growth of ExxonMobil's Singapore facility.

Segment Insights:

- The extraction segment in the crude oil flow improvers market is anticipated to secure a 43% share by 2035, driven by the need to maximize hydrocarbon production while limiting environmental impact.

- The paraffin inhibitors segment in the crude oil flow improvers market is projected to witness robust growth through 2035, driven by their critical role in maintaining flow efficiency in cold and deep-water conditions.

Key Growth Trends:

- A Rise in Hydraulic Fracturing Proceedings

- Increasing Energy Requirements

Major Challenges:

- Fluctuation of the Price of Crude Oil Worldwide

- Rigorous Government Regulations

Key Players: Halliburton Energy Services, Inc., BASF SE, SLB, CLARIANT, Dorf Ketal Chemicals (I) Pvt. Ltd., The Lubrizol Corporation, Infineum International Limited, WRT BV, Production Chemical Group, Berkshire Hathaway Inc., Inpex Corporation, Air Liquide Japan G.K., Japan Oil Development Co., Ltd., Taiyo Oil Company, Limited.

Global Crude Oil Flow Improvers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.98 billion

- 2026 Market Size: USD 2.07 billion

- Projected Market Size: USD 3.26 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Canada, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 16 September, 2025

Crude Oil Flow Improvers Market Growth Drivers and Challenges:

Growth Drivers

- A Rise in Hydraulic Fracturing Proceedings - The crude oil flow improvers market will increase because of the rising hydraulic fracturing activities, rising crude oil requirements, and increasing investments in the growth of avant-garde and technical components. To assist in growing oil and gas resources, governments of multiple nations are helping hydraulic fracturing through different initiatives, comprising financial guidance, investment rations, and tax incentives. This contributes to the market's growth positively. Additionally, multiple manufacturers are developing low-dose hydrate inhibitors that substantially limit the requirement for extra chemical additives. As an outcome, the venture of hydrate plugs and line blockages is eradicated, which in turn is pushing the crude oil flow improvers market

- Increasing Energy Requirements - The enhanced energy requirements of the automotive industry have enhanced the requirement for crude oil. The increasing automotive industry is pushing the international market for crude oil because electric vehicles are not the most pocket-friendly choice and have plenty of room for modification. Organizations across the world have begun to take up non-conventional techniques, leaving behind conventional ones because of the increasing requirement for fuel and to match energy needs. The crude oil flow improvers market may profit from further growing these processes. Governments are also pressing for help through different initiatives, comprising financial and tools support. This grows the flow improvers market internationally. The culture of living and working situations are increasing in growing nations, making more growth in the crude oil flow improvers market

- Rising Implementation of EVs Globally - Electric vehicles are the main technology to decarbonize road transport, a sector that contributes to more than 15% of international energy-associated emissions. Current years have noticed an integral expansion in the sale of electric vehicles along with modified range, broader model attainability, and enhanced execution. Passenger electric cars are rising in reputation – the IEA calculated that 18% of the latest cars sold in 2023 will be electric. If the expansion experienced in the past two years is kept, CO2 emissions from cars can by 2030 be put on a route incorporated into the Net Zero Emissions by 2050 (NZE) Scenario. However, electric vehicles are not yet an international occurrence. Sales in growing and appearing economies have been slow because of the comparatively high buy price of an electric vehicle and a shortage of charging infrastructure accessibility.

Challenges

- Fluctuation of the Price of Crude Oil Worldwide - In the predicted forecast period, the volatility of crude oil prices and increasing environmental problems will act as market impediments to the expansion of crude oil flow improvers. The primary impediment to market growth is the international recession. Market growth will be hindered by the increase in oil prices, the transformation to natural gas, and the international economic decline. This is an answer to the continuous international economic recession and the price disagreement between the major oil-generating countries, comprising Iran, Saudi Arabia, and Russia. In this manner, the crude oil flow improvers market expansion is constrained. Both crude oil and petroleum material prices can be influenced by events that can interrupt the flow of oil and products to market, comprising geopolitical and weather-associated developments. These kinds of events may lead to real disturbances or develop doubtfulness about future supply or demand, which can lead to higher volatility in prices.

- Rigorous Government Regulations

- Lack of Trained Employees

Crude Oil Flow Improvers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 1.98 billion |

|

Forecast Year Market Size (2035) |

USD 3.26 billion |

|

Regional Scope |

|

Crude Oil Flow Improvers Market Segmentation:

Type Segment Analysis

The paraffin inhibitors segment predicted to account for 28% share of the global crude oil flow improvers market because of its wide implementation of crude oil as paraffin inhibitors. Paraffins created by long-chain hydrocarbons, naturally come in crude oil and inhibit the free flow of crude oil therefore raising power consumption, and limiting the effectiveness of pumps, and their lifetime. Paraffin inhibitors assist in limiting the deposition of wax on the surface of pipelines, wellbores, and at the time of processing. They change the wax emergence temperature therefore modifying flow and are frequently spoken of as pourpoint dispersants or cold flow modifications. Paraffin inhibitors are also utilized in deep-water pivotal applications in which the creation not only must be persistent at the cold setting seafloor temperatures (∼4 °C) but also must tackle the combined impact of exalted burden present in the umbilical line. Conversely, paraffin inhibitors are also utilized, in applications in which thermal situations are altered with heated storage and injection.

Application Segment Analysis

The extraction segment predicted to account for 43% share of the global crude oil flow improvers market owing to the requirement for crude oil flow enhancers (COFIs) is on track to notice expansion because of its skill to maximize hydrocarbon production cost-efficiently and to assist to limit its environmental impacts. The oil 2023 medium-term market report anticipates that dependent on recent government policies and market trends, international oil requirement will increase by 6% between 2022 and 2028 to come to 105.7 million barrels per day (mb/d) – helped by vigorous requirement from the petrochemical and aviation sectors. Although this accumulative rise, yearly requirement growth is projected to dry up from 2.4 mb/d this year to just 0.4 mb/d in 2028, putting a peak in requirement in sight. Specifically, the utilization of oil for transport fuels plunged into decline after 2026 as the expansion of electric vehicles, the expansion of biofuels, and the modification of fuel economy limited consumption.

Our in-depth analysis of the global crude oil flow improvers market includes the following segments:

|

Type |

|

|

Application |

|

|

Supply Mode |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crude Oil Flow Improvers Market Regional Analysis:

North American Market Insights

The crude oil flow improvers market in the North American region will have the biggest growth during the forecast period with a revenue share of around 45%. The United States commands the crude oil flow improvers market since it is a substantial industrialized country with an extensive collection of large medium and small businesses. The U.S. also has a particular definition of SMEs depending on the industry they function in. For instance, if an organization is part of the producing industry, it can be classified as an SME if it has an utmost of 500 employees, but an organization engaged in the wholesale trade can only have 100. Discrepancies also exist among the sectors of industry.

APAC Market Insights

The crude oil flow improvers market in the APAC region will also encounter huge growth during the forecast period and will hold the second position owing to the increasing expansion of refineries of crude oil in the APAC region. ExxonMobil exclaimed recently that it has made a final spending determination on a multi-billion-dollar growth of its unified producing intricate in Singapore to transform fuel oil and other bottom-of-the-barrel crude materials into higher-value lube base stocks and essences. The growth project is part of the organization’s plan to further increase the rivalries of the Singapore facility, which comprises the world’s only steam cracker competent in cracking crude oil. The project, which authorities proprietary technologies, unification, and scale, will substantially raise site downstream and chemical earnings possibilities. Engineering, acquisition, and construction activities have started, and startup is projected in 2023.

Crude Oil Flow Improvers Market Players:

- Halliburton Energy Services, Inc.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- SLB

- CLARIANT

- Dorf Ketal Chemicals (I) Pvt. Ltd.

- The Lubrizol Corporation

- Infineum International Limited

- WRT BV

- Production Chemical Group

- Berkshire Hathaway Inc.

Recent Developments

- January 29, 2024: Halliburton Company recently added the CorrosaLock™ cement system to its increasing carbon capture, implementation, and storage (CCUS) portfolio. The CorrosaLock cement system, which is planned for CO2 storage, is an amalgamation of Portland-dependent cement and Halliburton’s proprietary WellLock® resin system. The amalgamation of resin produces a film on the composite surface that develops a coating impact that helps in bonding. Resin also limits the system’s efficient porosity and creates an adhesive layer to assist in safeguarding cement from CO2 debasement.

- January 10, 2024: Halliburton Company introduced Reservoir Xaminer™, a creation testing service planned to give accurate creation pressure measurements and delegate samples of the reservoir fluid in less time. Reservoir Xaminer service is planned to give quick, high-quality, and personalized data, even in the toughest situations.

- Report ID: 5840

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crude Oil Flow Improvers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.