Oilfield Biocides Market Outlook:

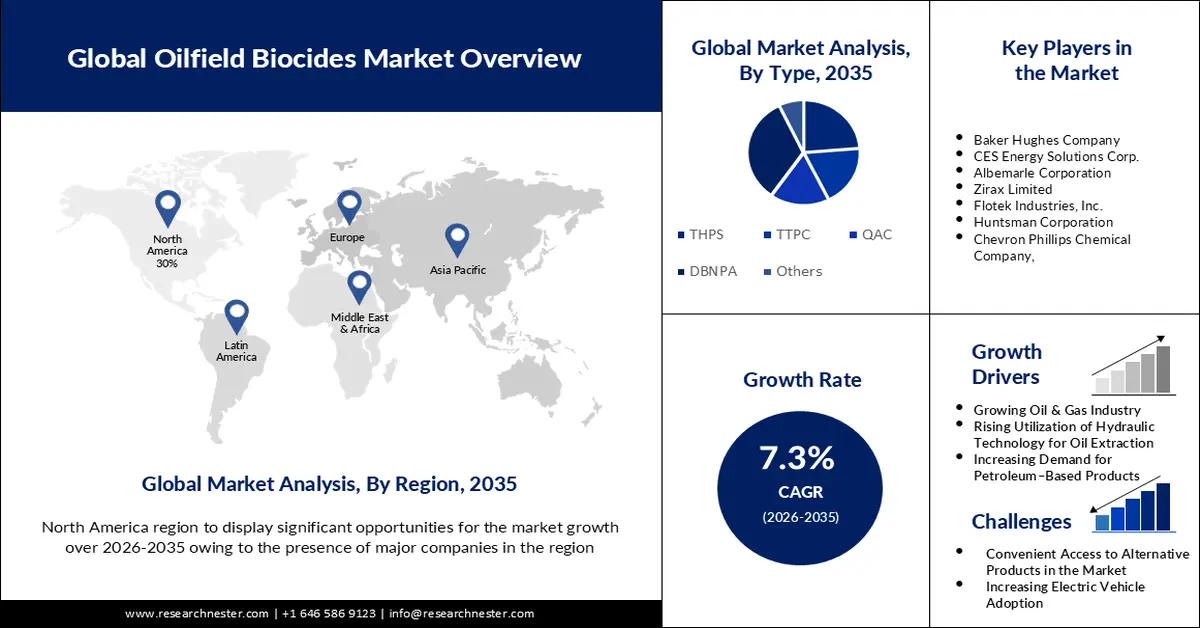

Oilfield Biocides Market size was valued at USD 21.97 billion in 2025 and is expected to reach USD 44.45 billion by 2035, registering around 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of oilfield biocides is assessed at USD 23.41 billion.

The reason behind the growth is impelled by the growing oil & gas industry across the world. The oil and gas industry uses oilfield biocides and bio-solvents on a massive scale since the oil and gas production well and equipment include a variety of bacteria.

Typically, biocides are employed throughout the whole oilfield development process which allows common forms of bacteria to grow less rapidly. In 2020, global oil production was estimated to be about 90 million barrels per day, which surged to over 95 million barrels per day in 2021. The demand for crude oil per day is estimated to reach approximately 100 million barrels globally by 2026.

The rising utilization of hydraulic technology for oil extraction is believed to fuel oilfield biocides market growth. For instance, oil and natural gas are extracted from the planet's interior using the drilling technique known as hydraulic fracturing, or "fracking" by using specialized, pressurized fluids that are pushed far underground. Moreover, biocides are essential parts of hydraulic fracturing since they increase productivity and lower operating costs.

Key Oilfield Biocides Market Insights Summary:

Regional Insights:

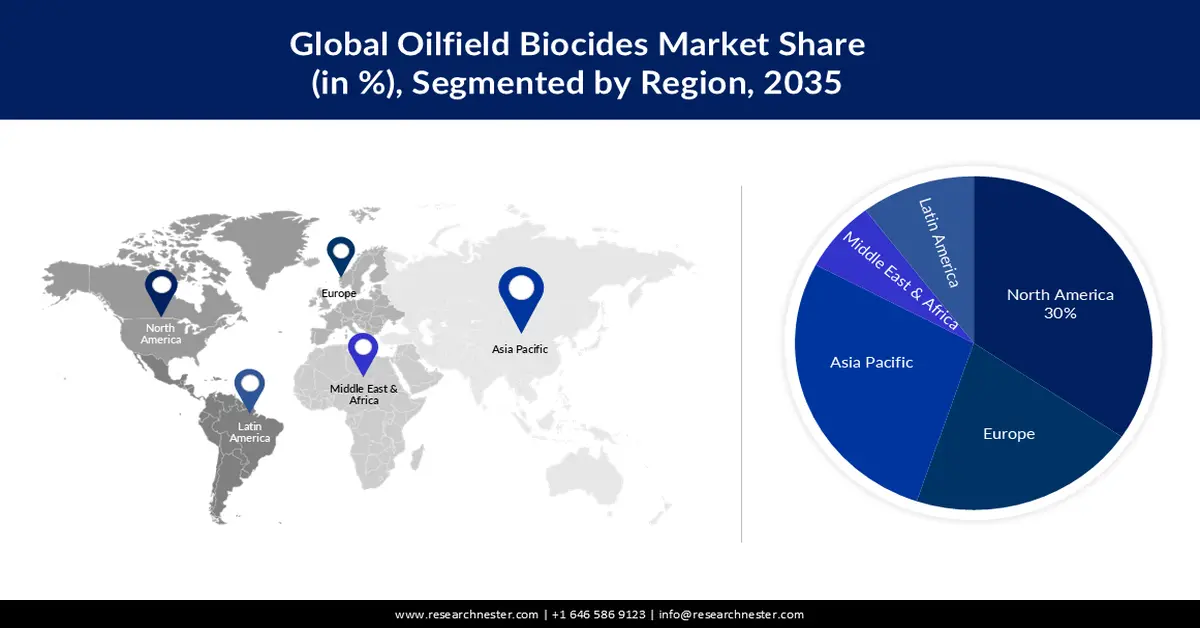

- North America oilfield biocides market is expected to hold a 30% share, impelled by the strong presence of key companies and continuous R&D efforts to advance contamination-control solutions.

- Asia Pacific region is projected to secure the second-largest share, sustained by rising consumption of industrial and consumer goods that elevate the need for biocides in water systems and cooling towers.

Segment Insights:

- The DBNPA segment in the oilfield biocides market is anticipated to achieve a substantial revenue share, propelled by its fast-acting antimicrobial capability amid escalating microbial activity in water-based oilfield chemicals.

- Upstream electronics segment is expected to capture a notable share, owing to expanded geological surveying, land rights acquisition, and drilling operations across offshore and onshore sites.

Key Growth Trends:

- Increasing Demand for Petroleum Based Products

- Stringent Safety Regulations

Major Challenges:

- Side Effects of Biocides

- Convenient Access to Alternative Products in the Market

Key Players: Evonik Industries AG, Baker Hughes Company, CES Energy Solutions Corp., Albemarle Corporation, Zirax Limited, Flotek Industries, Inc., Huntsman Corporation, Chevron Phillips Chemical Company, LLC, Gumpro Drilling Fluids Pvt. Ltd., Big Oil Co.

Global Oilfield Biocides Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.97 billion

- 2026 Market Size: USD 23.41 billion

- Projected Market Size: USD 44.45 billion by 2035

- Growth Forecasts: 7.3%

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, India, Germany

- Emerging Countries: Brazil, Mexico, Indonesia, Vietnam, Saudi Arabia

Last updated on : 21 November, 2025

Oilfield Biocides Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Demand for Petroleum-Based Products– It is expected that rapid economic expansion is driving the demand for petroleum-based products which are chemicals made from crude oil. Therefore, to meet this demand oil & gas companies frequently expand their operations which necessitates the use of oilfield biocide. The demand for crude oil worldwide was over 90 million barrels per day as of 2021 estimations.

- Stringent Safety Regulations- Exposures to risks present in the oil and gas well drilling, service, and storage industry are heavily regulated at various levels of government since oil and gas corporations with operations all over the world are plagued by the risk of microbial contamination which can cause a variety of infectious waterborne diseases, including cholera, typhoid, and hepatitis. As a result, biocides are extensively being used to reduce the growth of bacteria leading to health hazards.

Challenges

- Side Effects of Biocides - The presence of side effects of biocides such as rodenticides and insecticides can even cause damage to the environment. The use of anticoagulants for rodents can also cause toxicity for birds and other predatory animals. Occupational and domestic exposure to biocides can cause side effects in humans. Hence only professionals and required industries are intended to use these products.

- Convenient Access to Alternative Products in the Market

- Increasing Electric Vehicle Adoption

Oilfield Biocides Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 21.97 billion |

|

Forecast Year Market Size (2035) |

USD 44.45 billion |

|

Regional Scope |

|

Oilfield Biocides Market Segmentation:

Type Segment Analysis

The DBNPA segment in the oilfield biocides market is estimated to gain a robust revenue share in the coming years owing to its significant utilization in the paper & coating industry and slurries. As per a report by the National Library of Medicine (NLM), DBNPA is utilized as a vital biocide in water applications owing to its quick chemical breakdown and immediate antimicrobial activity. Increasing uncontrolled microbial activity in the water-containing oilfield chemicals is estimated to hike market growth.

Also, the DBNPA is the most widely used biocide in oilfields. The DBNPA is a fast-acting, non-oxidizing biocide that can control aerobic and anaerobic bacteria, fungi, and algae growth which is expected to boost the market growth in the coming years.

Application Segment Analysis

Oilfield biocides market from the upstream electronics segment is set to garner a notable share shortly driven by increasing exploration activities such as generating geological surveys, land rights, and production activities including offshore and onshore drilling. From the initial drilling of the wells to the ongoing production of oil and gas, biocides are utilized at all stages of oilfield development, since biocide has the right mix of physical and chemical qualities, which helps to limit and control bio growth in the subsurface, and are required for the good decontamination phase to manage organisms introduced during drilling and completion procedures.

Our in-depth analysis of the global oilfield biocides market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oilfield Biocides Market - Regional Analysis

North American Market Insights

Oilfield biocides market in North America is predicted to account for the largest share of 30% by 2035, impelled by the presence of multiple key companies. Moreover, in North America, the two biggest markets for oilfield biocides are the US and Canada since the companies in both countries have well-established industrial infrastructure and are continuously investing in research & development activities, to develop advanced oilfield biocides to maintain operational efficiency and prevent contamination.

APAC Market Insights

The Asia Pacific oilfield biocides market is estimated to be the second largest, during the forecast timeframe led by the increasing use of industrial and consumer goods. Asia's consumer packaged products sector is changing as a result of changing customer habits which is likely to increase the consumption of consumer products. The production of such goods involves water systems and cooling towers which necessitates the need for oilfield biocides to maintain the efficiency of these systems in the region.

Oilfield Biocides Market Players:

- Evonik Industries AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Baker Hughes Company

- CES Energy Solutions Corp.

- Albemarle Corporation

- Zirax Limited

- Flotek Industries, Inc.

- Huntsman Corporation

- Chevron Phillips Chemical Company, LLC

- Gumpro Drilling Fluids Pvt. Ltd.

- Big Oil Co.

Recent Developments

- Evonik Industries launched a new photovoltaic wafer cutting with an enhanced processing aid to improve its overall performance.

- Zirax Limited became a participant in the 20th anniversary of “Equipment and Technology for the Oil and Gas Complex”, an international exhibition held in Moscow, Russia.

- Report ID: 4129

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oilfield Biocides Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.