Soil Conditioner Market Outlook:

Soil Conditioner Market size was over USD 4.89 billion in 2025 and is set to exceed USD 10.15 billion by the end of 2035, growing at over 6.9% CAGR during the forecast period i.e., between 2026-2035. In 2026, the industry size of the soil conditioner is estimated to reach USD 5.23 billion.

The most significant primary growth driver for the global soil conditioner market is rampant soil deterioration and loss of soil organic matter, compelling large-scale rehabilitation. Strategic use of farm waste in the form of manure and compost has dramatically enhanced soil fertility and environmental health. Various studies have shown that Vermicompost (VC) is a soil amendment that builds soil fertility by providing nutrients (NPK), improving microbial activity, improving water retention capabilities, making soil healthier and more productive, naturally. In alignment with this, USDA-supported programs, especially those targeting phosphorus and nitrogen management, have formally integrated soil conditioners into conservation practices. These initiatives are embedded in agricultural legislation aimed at reducing nutrient runoff and improving long-term farm productivity.

Global soil conditioner supply chains rely on crop by-products like composted manure and crop residues, which are commonly recovered from farm or municipal waste streams. Manufacturing operations (i.e., pelletizing and granulation) are becoming more centralized in stand-alone plants operating drum or disc granulators. Constructing manufacturing plant capacity has been facilitated by the integration of soil amendments into fertilizer plants to offer more throughput and product consistency. USDA's Agricultural Marketing Service (AMS) trade reports show increased organic equivalence arrangements for the exportation of soil amendment between the U.S., Canada, the EU, Japan, and Korea under the National Organic Program.

Key Soil Conditioner Market Insights Summary:

Regional Highlights:

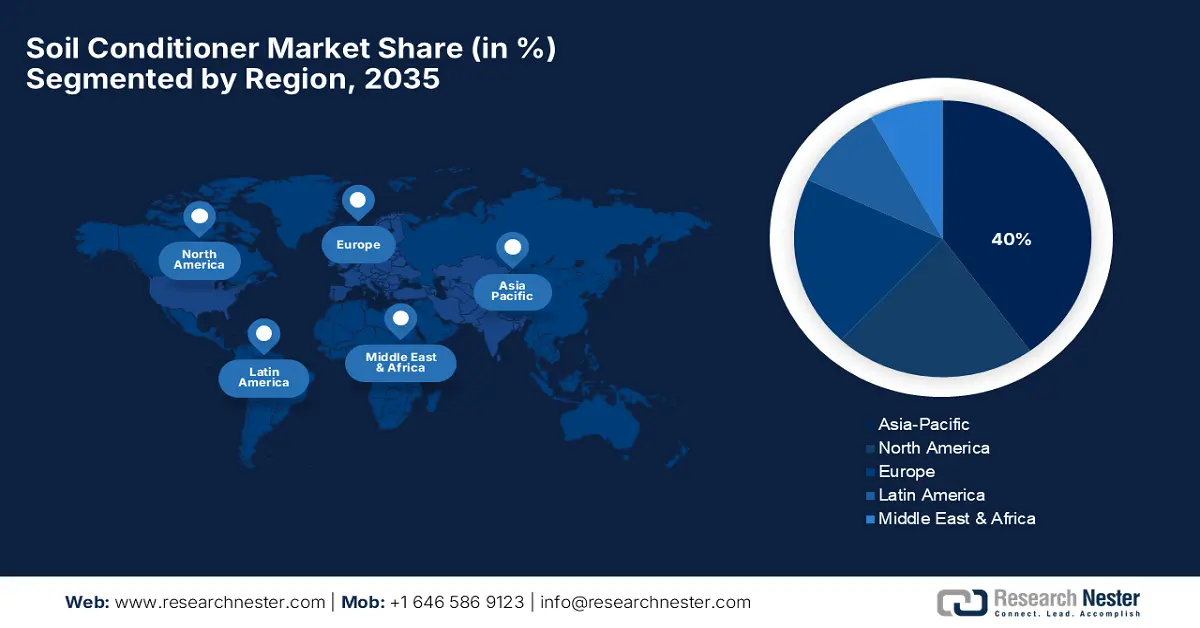

- Asia Pacific is projected to command nearly 40% share of the soil conditioner market by 2035, attributed to rapid population expansion and supportive government policies for sustainable agriculture.

- North America is expected to secure around 22% share by 2035, owing to increasing sustainable agriculture practices and rising investments in advanced soil recovery inputs.

Segment Insights:

- The granular segment is projected to hold about 50% share by 2035 in the soil conditioner market, supported by its ease of handling, storage, and application across large-scale agricultural operations.

- The agricultural farming segment is anticipated to secure nearly 45% share by 2035, propelled by the rising need to improve soil health and crop productivity amid increasing global food demand.

Key Growth Trends:

- Global push for sustainable agriculture

- Climate change and soil degradation challenges

Major Challenges:

- Supply chain fragmentation and raw material volatility

- Regulatory ambiguity and compliance burden

Key Players: BASF SE, The Mosaic Company, Yara International ASA, SQM S.A., Haifa Group, Haifa Chemicals Ltd, Coromandel International Ltd, UPL Limited, Koppert Biological Systems, Bio-Green Australia, LG Chem Ltd, Haifa Chemicals, K+S AG, Agrium Inc. (Now Nutrien Ltd.), Sapagro Malaysia Sdn Bhd.

Global Soil Conditioner Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.89 billion

- 2026 Market Size: USD 5.23 billion

- Projected Market Size: USD 10.15 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Saudi Arabia

Last updated on : 22 August, 2025

Soil Conditioner Market - Growth Drivers and Challenges

Growth Drivers

-

Global push for sustainable agriculture: This strong push toward sustainable agriculture is one major driver for the demand for soil conditioners. By the end of 2022, 96.4 million hectares were under organic management, representing a 26.6% increase, or 20.3 million hectares, from 2021. Australia rose by an incredible +17.3 million hectares to remain the country with the largest organic agriculture area at 53 million hectares, followed by India, which is second (4.7 million hectares), with significant growth. The organic farming area increased across all continents. Oceania has more than half of the organic area (53.2 million hectares), followed by Europe with 18.5 million hectares and Latin America with 9.5 million hectares.

-

Climate change and soil degradation challenges: Climate change will increase agricultural losses and production disruptions due to the exacerbation of soil decline from drought, flooding, and erosion. Soil conditioners can mitigate these effects by basically controlling the temperature and moisture absorption, structuring better availability of organic matter, hence rendering the crop tolerant to unfavorable conditions. Areas experiencing desertification, including parts of Africa, Australia, and the Middle East, are increasingly implementing conditioners to restore productivity. This driver is enabled by global climate resilience programs and international funding. Thus, soil conditioners are seen to be adopting broader resilience and adaptation strategies and land restoration.

-

Technological advancements in product formulation: Advances in material science and microbiology are driving the development of innovative soil conditioners that are more targeted, biodegradable, and easily removable, leading to improved efficiency and sustainability in agriculture. New developments include slow-release carriers of nutrients, conditioners containing bio-stimulants, and products that are specifically microbe-laden and type of soil-specific. Collectively, these developments will improve effectiveness, reduce application rates or at least frequency, and yield measurable benefits, driving original commercial-scale farmers to adopt conditioned soil on their farms. The added benefit of precision agriculture tools (seeders) allows farmers to use the conditioners as intended by eliminating application rates and measuring cost in precision with environmental impact.

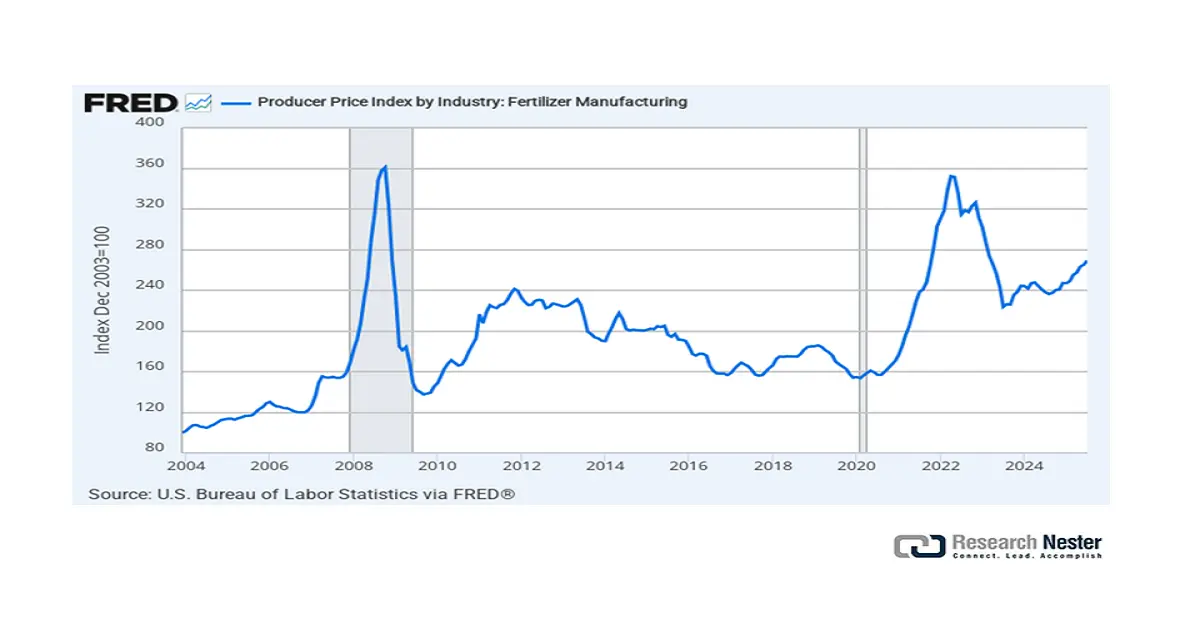

Price Analysis: Fertilizer Manufacturing

A rising Producer Price Index (PPI) for fertilizer manufacturing directly increases input costs for soil conditioners that utilize fertilizer-based components, such as mineral fortifiers or synthetic organic blends. This cost pressure compels manufacturers to optimize formulations and elevates the value proposition of alternative, non-fertilizer-based conditioners like bio-stimulants and humic substances. Consequently, market dynamics shift towards higher-margin, specialty soil amendment solutions that offer cost stability and enhanced efficiency.

Producer Price Index (PPI) by Industry: Fertilizer Manufacturing

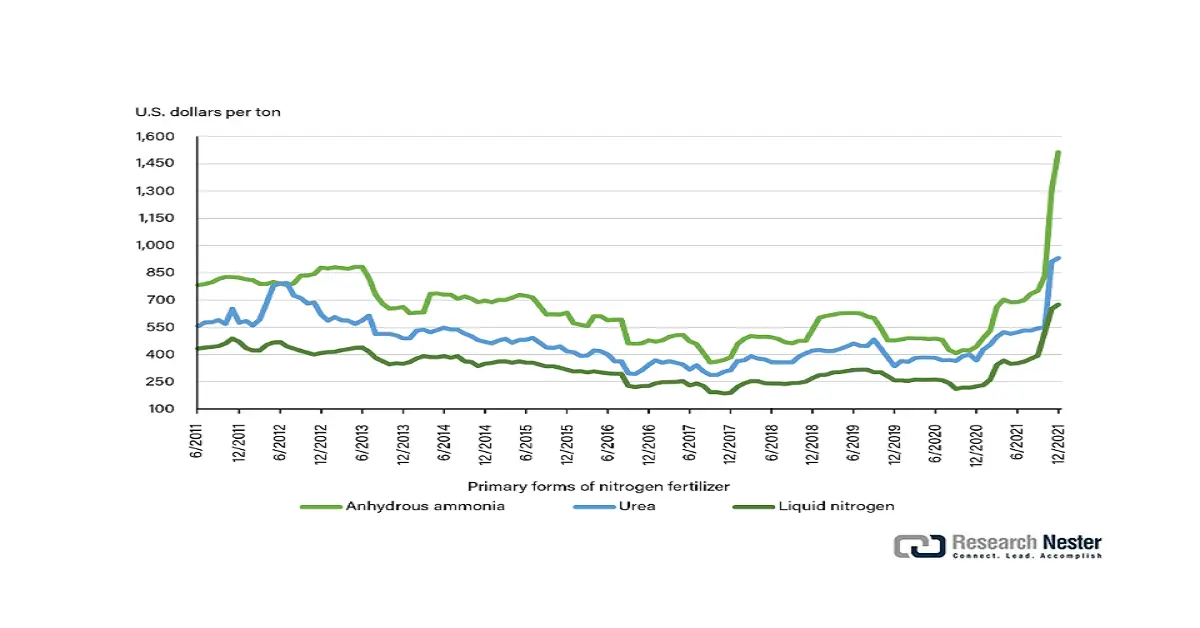

Monthly Average Fertilizer Prices (2011-2021)

(Source: USDA)

Challenges

-

Supply chain fragmentation and raw material volatility: The soil conditioners market relies significantly on organic waste material such as compost, manure, and seaweed extracts, whose supply is unbalanced through seasonality and regional inefficiency in collection. Further, logistics disruption during the COVID-19 period and the ensuing Ukraine conflict led to a shortage and increased transport prices. This disintegrated supply chain inhibits large-scale, homogenous production as well as impinges on price stability. As a result, the sector has higher costs of input, lower incentives for investing in new capacity, and lower margins. All these issues combined restrict scalability and hamper market development in developed economies and emerging economies.

-

Regulatory ambiguity and compliance burden: Unstable and changing environmental regulations from country to country, particularly in the EU, U.S., and India, offer global producers compliance challenges. Lack of harmonized certification of bio-based or organic soil conditioners restricts product approval and market access. Moreover, uncertainty about government regulations regarding permitted input sources (e.g., farm versus industrial compost) adds operational uncertainty. Small and medium-sized businesses struggle to cope with testing and documentation needs, as seen through increased operating expenses. Such regulation fragmentation discourages innovation and cross-border commerce, which decelerates the pace of international market development.

Soil Conditioner Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 4.89 billion |

|

Forecast Year Market Size (2035) |

USD 10.15 billion |

|

Regional Scope |

|

Soil Conditioner Market Segmentation:

Form Segment Analysis

By 2035, the granular segment is projected to dominate the market, potentially accounting for around 50% of total revenues. This is due to its advantages in ease of handling, storage, and application, particularly across large-scale agricultural operations. As granular soil conditioners, their usefulness is felt in terms of slow-release qualities that increase soil structure and nutrient retention; this is highly valued in commercial farming and small-scale agriculture. Large granules minimize run-off and losses during irrigation, thereby making them cost-efficient and effective compared to liquids and powders. Better granulation would give possibilities for tailoring nutrient profiles as well as improving microbial activities. These characteristics favor the usage of granular conditioners in widespread mechanized farming and soil management.

Application Segment Analysis

The agricultural farming segment is expected to capture approximately 45% of the market revenue by 2035, driven by the growing urgency to improve soil health and enhance crop productivity in response to rising global food demand. Commercial soil conditioners are commonly used to improve water retention, nutrient release, and soil aeration, all of which were considered crucial factors for sustaining productivity on lands with decreasing arability. This segment can also be credited with the presence of strong government subsidies and programs that promote sustainable methods of farming, mainly through the regions of the Asia-Pacific and North America. Moreover, precision agriculture practices enhance the targeted application of soil conditioners, thereby ensuring better input efficiency. Despite their importance, horticulture and residential gardens are relatively small markets that serve home usage needs and specialized crops.

Type Segment Analysis

By 2035, the organic soil conditioners segment is projected to dominate the market, potentially accounting for around 38% of total revenues. This is due to increasing sustainable farming practices and government policies that support organic farmers. Soil conditioners improve soil fertility, moisture retention, and microbial activity, which reduces the need for synthetic inputs. USDA’s Organic Transition Initiative or other programs seek to engage farmers to consider organic amendments. This demand shift in agriculture is fueled by environmental sustainability and food safety initiatives, which will also increase market demand.

Our in-depth analysis of the global soil conditioner market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Soil Conditioner Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is projected to dominate the global market for soil conditioners in 2035, with approximately 40% of the total market share. The growth drivers are rapid population growth, an increase in food demand, and government policies supporting sustainable agriculture. The prominent countries involved are actively investing in initiatives related to soil health and sustainable agricultural inputs. For example, China's Ministry of Agriculture and Rural Affairs (MARA), the area of organic fertilizer application in 2020 exceeded 36.7 million.

China is expected to hold the largest revenue market share of the APAC market for soil conditioners in 2035, due to a wide arable area, with the government adopting a soil-restoration program and agrotech. A historical analysis indicates China has the largest country share in the APAC region. The market estimates the global soil-conditioner market in the billions of dollars, and China has an outsized share due to extensive growth in minerals and organic conditioners, regulatory approvals, and commercialization of new polymeric water-retention products.

North America Market Insights

North America leads the overall soil conditioner market revenue, with an expected share of around 22% of the overall revenue until 2035. The United States accounts for the largest revenue, followed by Canada, as a result of sustainable market growth, together with increasing sustainable agriculture practices, increased government policies supporting the recovery of soil, and increasing consumer interest in organic food products. Key drivers are growing concerns about soil erosion, policy from governments, and investment in advanced farming inputs with water-holding capacity and soil fertility.

The United States is the top nation in the North American soil conditioners market, estimated to hold around 18% of the world's market share by the year 2035. The country is backed up by an expansive list of government initiatives, such as the USDA's Conservation Stewardship Program (CSP) and Environmental Quality Incentives Program (EQIP), which every year disburse funds towards sustainable soil management and reduced application of chemical fertilizers. The Infrastructure Investment and Jobs Act (IIJA) also boosts rural water conservation infrastructure further, enhancing the efficiency of moisture-retaining soil conditioners. The primary factor contributing to the greater returns in organic farming was the 20% price difference between organic and conventional food, indicating that organic farming can be profitable, provided farmers are paid more.

Europe Market Insights

Europe is expected to hold approximately 20% market share by 2035, mainly because of very stringent environmental regulations and government incentives promoting sustainable agriculture. The EU, under its Common Agricultural Policy (CAP), provides billions for soil health and organic farming programs aimed at encouraging widespread use of bio-based soil conditioners. Germany, France, and the Netherlands constitute the major players concerning advanced technologies for soil amendments, with heavy R&D spending backing these, alongside growing consumer demand for organic food. Soil degradation and shortage of water call for conditioners to retain moisture, further pushing the demand. Europe's supply chain infrastructure and circular economy principles also support market growth on a global scale, making the region a major player in the development of sustainable soil management.

Key Soil Conditioner Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Mosaic Company

- Yara International ASA

- SQM S.A.

- Haifa Group

- Haifa Chemicals Ltd

- Coromandel International Ltd

- UPL Limited

- Koppert Biological Systems

- Bio-Green Australia

- LG Chem Ltd

- Haifa Chemicals

- K+S AG

- Agrium Inc. (Now Nutrien Ltd.)

- Sapagro Malaysia Sdn Bhd

The global soil conditioner market is characterized by the presence of diversified multinational companies focused on product innovation, sustainability, and strategic partnerships to expand their global footprints. Leaders like BASF SE and The Mosaic Company leverage advanced R&D capabilities to develop eco-friendly and bio-based soil conditioners. Regional players such as Coromandel International and UPL Limited are expanding through acquisitions and localized product lines tailored to emerging markets like India. Japanese manufacturers Mitsubishi Chemical and Sumitomo Chemical emphasize technological advancements in organic and specialty conditioners to meet stringent environmental regulations. Collaborations and investments in sustainable agriculture continue to shape competitive dynamics globally.

Here is a list of key players operating in the global soil conditioner market:

Recent Developments

- In November 2024, Syngenta AG partnered with the Food and Agriculture Organization (FAO) to launch a $150 million sustainable soil health program targeting soil conditioner development in Africa and Southeast Asia. The program supports regenerative farming techniques and the adoption of organic conditioners, aligned with UN Sustainable Development Goals, to improve soil fertility and water retention under climate variability.

- In February 2024, Veolia unveiled its new strategic plan for 2024-2027, "GreenUp". It aims to establish Veolia as the recognized, everywhere and by everyone, help to form the ecological transformation, and through that accelerate the deployment of concrete solutions whilst boosting innovation to depollute, decarbonize, and regenerate resources. To protect health, quality of life, and purchasing power, for an ecology that greens, transforms, and protects.

- Report ID: 7864

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Soil Conditioner Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.