Connected Mining Market Outlook:

Connected Mining Market size was valued at USD 17.30 billion in 2025 and is projected to reach USD 94 billion by the end of 2035, rising at a CAGR of approximately 16% during the forecast period, i.e., 2026-2035. In 2026, the industry size of connected mining is evaluated at USD 20.1 billion.

The global market is rapidly advancing as interest in operational efficiencies, safety, and sustainability is growing. One of the largest trends in this market is the adoption of Artificial Intelligence (AI) and Machine Learning (ML). Companies such as KoBold Metals, are adopting AI to assess, analyze, and visualize complex geological data with a focus on accelerating and saving money in mineral discovering. In July 2025, KoBold Metals announced an investment in the mining sector in the Democratic Republic of Congo (DRC). As part of the agreement, there are plans to digitize the Archives of geology in the DRC, which is currently held at the Royal Museum for Central Africa in Belgium. Predictive maintenance based on AI and IoT sensors is another big trend that will and are allowing mining operators to predict and see when equipment will fail before that failure occurs.

The use of autonomous vehicles and drones is also changing how mining companies operate by eliminating workers from sometimes hazardous environments. In other respects, blockchain is increasingly being used to provide transparency of supply chains, improving traceability and authentication to minimize improper sourcing. Connected mining is also being further accelerated with the introduction of 5G networks, providing speed and low-latency communication. Sustainability continues to be the main focus, where connected mining technology provides venues to help maximize resources, decrease emissions, and limit environmental impact. As mining companies verify more online and become connected with other industries the need for proper cybersecurity protocols has become paramount to protect sensitive datasets and maintain operational control.

Key Connected Mining Market Insights Summary:

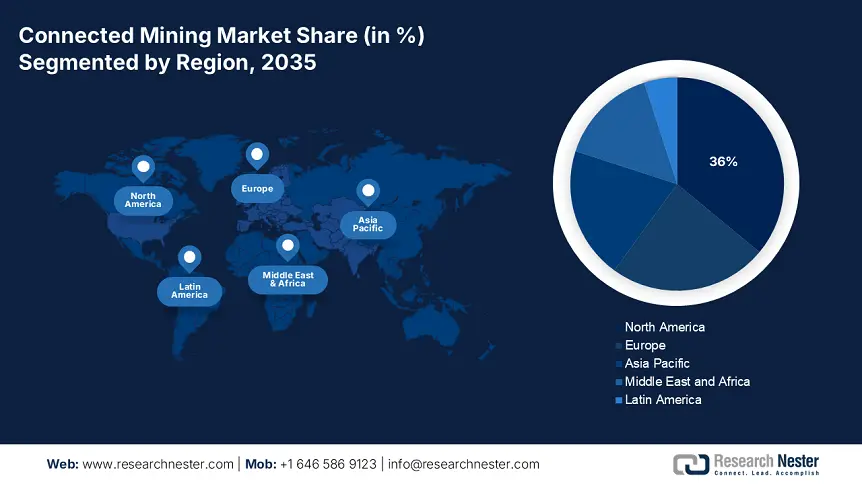

Regional Insights:

- North America is anticipated to secure a 36% share by 2035 in the connected mining market, supported by sophisticated digital infrastructure, strong mining industry presence, and rapid adoption of emerging technologies.

- Europe is projected to register a notable CAGR through 2035, encouraged by stringent sustainability regulations, heightened environmental scrutiny, and accelerated deployment of digital mining solutions.

Segment Insights:

- The solutions segment is estimated to capture a 59% share by 2035 in the connected mining market, propelled by the rising focus on asset tracking, predictive maintenance, and real-time operational optimization.

- The surface mining segment is set to lead with a 63% share by 2035, bolstered by expanded use of advanced analytics, automation, and autonomous vehicles for large-scale operational efficiency.

Key Growth Trends:

- Advances in automation and robotics

- Sustainability and environmental compliance

Major Challenges:

- Technical trade barriers (TBTs)

- Data protection & localization regulations

Key Players: BASF SE (Germany (EU)), Mitsui Chemicals, Inc. (Japan), Orica Limited (Australia), Samsung SDI Co., Ltd. (South Korea), Tata Chemicals Limited (India), Petronas Chemicals Group Berhad (Malaysia), Caterpillar Inc. (USA), Komatsu Ltd. (Japan), Hitachi Construction Machinery Co., Ltd. (Japan), ABB Ltd. (Switzerland (EU)), Cisco Systems, Inc. (USA), IBM Corporation (USA), Hexagon AB (Sweden (EU)), Wipro Ltd. (India).

Global Connected Mining Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.30 billion

- 2026 Market Size: USD 20.1 billion

- Projected Market Size: USD 94 billion by 2035

- Growth Forecasts: 16%

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 11 August, 2025

Connected Mining Market - Growth Drivers and Challenges

Growth Drivers

- Advances in automation and robotics: The mining industry's implementation of automation and robotics is creating significant growth in the market. In December 2024, Europe launched the iBot4CRMs project. The project intends to produce AI-driven robotic systems that can effectively identify, disassemble, and recover CRMs from urban waste. These robots will perform tasks that are complex, such as recovering neodymium magnets in electric motors and recovering metals in common discarded electronics. The industry's adoption of autonomous vehicles, drones, and autonomous systems is quickly changing the landscape for ore hauling, drilling, and surveying activities. The data provided by autonomous vessels and systems can be moved into a connected platform to allow mines to optimize workflows and maximize productivity.

- Sustainability and environmental compliance: Environmental regulations are tightening worldwide. As a result, mining companies are increasingly adopting environmentally conscious practices. Mining-connected technologies allow mining companies to measure the environmental parameters of air quality, water use, and waste disposal in real-time. Growth in the market is also driven by a shift to greener mining, especially in areas where environmental regulations have changed considerably. Connected technologies help with land management by providing tools to monitor. With geospatial data from drones and remote sensing, companies can use AI-assisted analysis to determine whether reclaimed areas are returning to their natural state or if additional action is required.

- Integration of AI and Machine Learning: AI and machine learning technologies are rapidly becoming integral parts of connected mine solutions. In January 2025, Earth AI raised USD 20 million to improve AI-enabled mineral exploration and drilling. The funding will support Earth AI's plans to increase its project pipeline to over 50 sites and increase its drilling capacity to 100,000m, and improve its AI and drilling technology. They can automate highly complicated tasks like mineral exploration, predictive maintenance, and optimizing operational processes. By integrating AI and ML into the connected mine platform, positioning companies to make more informed and timely decisions, and predict failures earlier. The advancements of AI and ML's analysis of large records to drive growth in operational improvements are all important drivers of the connected mine market.

Challenges

- Technical trade barriers (TBTs): Differing technical standards and certification requirements at the national level create compliance barriers to ICT suppliers entering the connected mining industry. These characteristics may impose increasingly burdensome costs on small firms that cannot afford to completely manage multiple regulatory compliance systems. These costs may vary by jurisdiction depending on the requirements for the software, AI algorithms, or network hardware. These conditions can lead to delays in time to market or compliance fatigue due to increased administrative burden.

- Data protection & localization regulations: Data sovereignty law is mandating mining tech providers to store and process operational data within borders. For instance, in India and Indonesia, data localization is extending customer entry timelines for suppliers. Moreover, data localization and e-waste laws in India have delayed product launches for some global companies by 5 months. Overall, localization regulations require companies to create additional and expensive infrastructure in-country, reduce operational flexibility, and create barriers to entry.

Global Connected Mining Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

16% |

|

Base Year Market Size (2025) |

USD 17.30 billion |

|

Forecast Year Market Size (2035) |

USD 94 billion |

|

Regional Scope |

|

Connected Mining Market Segmentation:

Component Segment Analysis

The solutions segment is estimated to account for the largest share of 59% in the market over the discussed timeframe. The asset tracking and optimization are already enabling improved operational efficiencies and cost savings. Mining companies can employ embedded IoT devices, GPS, and sensors to track the real-time location and condition of equipment, vehicles, and personnel to ensure improved asset utilization and, prevention of lost time. Predictive maintenance and a real-time data analytics approach to optimizing asset performance are also effective ways to ensure an improvement in operating efficiency and lengthen the effective working life of equipment. The growing push to operate more efficiently and the increasing complexity of a mining and regulatory-driven set of constraints make asset tracking and optimization a top priority area for mining companies.

Mining Type Segment Analysis

The surface mining segment is poised to dominate the global market with a share of 63% during the analyzed period. Due to the vast operations and ability to improve efficiency, the surface mining segment is well-regulated to take the leading share of the market. Surface mining refers to the extraction of minerals from the surface of the Earth, which would typically involve large fleets of equipment, like trucks, excavators, and drills. Connected technology will enable organizations to monitor equipment performance, especially the equipment’s location and health. The potential of connected mining in surface mining sectors will also be a factor for change. The potential use of automation and autonomous vehicles for surface mining, in all three operations, is starting to streamline and improve the process. The growth in the surface mining sector is being bolstered by expanded use of advanced data analytics and AI solutions for better decision-making.

Application Segment Analysis

The exploration segment will maintain its leading role in the connected mining segment with a share of 41% over the analysis period. Exploration applications dominate the connected mining sector as they are enormously effective to find new mineral deposits and assess their economic feasibility with greater accuracy and efficiency. Exploration in traditional mining is often associated with high cost, risk of injury or harm and time intensity. Connected technologies have completely transformed exploration and all its costs with associated remote sensing, IoT enabled sensors, drones, and geospatial data analysis tools. The miners using connected technologies have access to up-to-the-minute live-data, high-resolution satellite data which means they can better refine their exploration decisions, improve the whole exploration process and potentially bypass the need for large and costly physical surveys. Exploration applications as leading applications in the connected mining space are becoming more relevant to mining companies will the increase in resource demand.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Component |

|

|

Mining Type |

|

|

Deployment Mode |

|

|

Solution Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Connected Mining Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 36% in the global market by the end of 2035. The growth can be attributed to the sophisticated digital infrastructure, strong mining industry presence, and heavy uptake of emerging technologies. According to the U.S.-Saudi Business Council, in 2023, the mining industry in the U.S. provided about USD 85 billion to the U.S. GDP and provided approximately 400,000 people with direct employment in mining. North America is also home to some of the largest mining companies in the world, and many are in the midst of implementing digital transformation initiatives to improve operational effectiveness, safety, and sustainability. Additionally, in the U.S., government-led efforts to secure domestic critical mineral supply chains are accelerating the uptake of connected mining solutions in the areas of exploration, asset tracking, and remote operations. Furthermore, many mining operations in North America are large and remote, with greater attraction to deploy real-time monitoring and automated systems.

The U.S. is a major contributor to the market in North America due to the level of technology in the country and substantial government support to digitally transform key sectors. Mining companies in the region are purchasing and implementing more IoT (Internet of Things) technologies, AI, automation, and real-time analytics. The United States federal government even offered critical government initiatives to boost domestic production of critical minerals. With those policies, mining operations are encouraged to leverage smart technologies for exploration, asset management, and predictive maintenance. The United States also benefits from a high degree of digital infrastructure. Companies also utilize technologies like digital twins, remote operation centers, autonomous equipment, and more to achieve optimized operations in all mining configurations.

Canada is positioned to be a major player in the North American connected mining marketplace due to its wealth of minerals, commitment to sustainable mining practices, and supportive government policies. In addition to being some of the top producers of critical minerals, such as nickel, cobalt, and uranium. As per the Mining Association of Canada, 60 minerals and metals are mined through Canada's mining activity. The total value of mineral production from Canadian mines in 2022 was USD 74.6 billion. Canada has been integrating technology into its mining sector and is currently making quick strides towards connected mining practices. Mining-based companies in Canada are implementing connected technologies to make better decisions and save time and money on exploratory processes. The government of the region promotes the adoption of smart technologies in large and mid-sized operations through incentives. Additionally, Canada is primed to be an innovation hub for technology-based and sustainable mining practices.

Europe Market Insights

Europe is poised to exhibit a notable CAGR in the global connected mining market because of its attention to sustainability, high level of regulations, and fast uptake of digital technologies. European mining companies face increasing scrutiny on their environmental and safety impact, thereby encouraging the implementation of connected technologies. Europe has also invested enormously in research, providing funding for projects that are in line with Industry 4.0 technologies and green mining initiatives. The demand for critical raw materials will also see the global connected mining market keep moving upwards. With all of these elements, Europe positions itself as a significant player in the connected mining market globally.

France is progressing toward the development of a significant connected mining region, due to the focus on implementing innovation and development related to mining to enhance sustainability. Mining companies make significant investments in digital technology such as IoT, AI, and automation, so they can create mining operations that use modernized processes to minimize environmental and societal impact. Also, French mining firms are focused on smart asset management, predictive maintenance, and real-time situational awareness to allow for safer and more efficient operations. Additionally, there are federal mobilization efforts in France to protect critical minerals, a vital component of a new clean energy environment, which will likely incentivize the adoption of connected mining technologies.

Germany is in an excellent position in the connected mining ecosystem in Europe, as it has a well-developed industrial base and priorities for sustainable management of resources. The mining sector in Germany has made strides toward digitalization by leveraging connected technologies-including remote monitoring of equipment through the IoT, machine automation, and data-driven analytic decision-making capabilities. As a net advantage, Germany has an extensive co-creating network of academia, industry, and technology suppliers that shapes further advancements in the integration of advanced capital employed, technology adoption and overall innovation in mining. As a result, Germany is at the forefront of the adoption of connected mining systems in Europe.

APAC Market Insights

The Asia Pacific connected mining market is likely to gain a significant regional share of the global connected mining market owing to the region's mineral wealth, high industrialization rate, and investments in digital technologies. According to the Press Information Bureau, by 2029-2030, it is anticipated that the digital economy in India will have grown about twice as quickly as the entire economy and will account for nearly one-fifth of the country's income.

The demand for minerals critical to support the growth of the electronics, renewable energy, and electric vehicle sectors is also driving technology use in mining. Governments have introduced supportive policies and invested in infrastructure to promote the adoption of smart mining technologies throughout this sector.

India is rapidly becoming an important player in the broader Asia-Pacific connected mining space due to its mineral-rich endowment and government-led initiatives. The government of India, led by commercial and governmental mining companies, is strongly supporting a digital transformation agenda through initiatives such as 'Digital India'. This agenda encourages the use of IoT, automation, data analytics, and, above all, digital data in mining to reduce waste, increase efficiency and improve safety. Banks of the same mind, Indian mining companies are adopting predictive maintenance systems, connected solutions for real-time monitoring systems, and asset tracking to minimize downtime and reduce operational costs. Along with the momentum of investment in mining technologies and innovative mining approaches, India will soon establish a prominent presence in the connected mining landscape of the Asia-Pacific region. The data provided by Venture Lab states that the central government of India has a goal of attracting more than ₹2.5 lakh crore or around USD 30.12 billion of private and foreign investment by 2030 for critical mineral exploration and digital mining technologies.

China is firmly anchored in the Asia Pacific connected mining market through rapid industrialization and, advancement of its mining industry. China is the largest producer and consumer of many of the strategic minerals needed to drive green energy and green economy technologies and products, and is investing heavily in connected mining technologies. As per the Observer Research Foundation, in 2023, China's mining investment amounted to USD 19.4 billion. Throughout that decade, China's overseas mining investments grew rapidly, led primarily by lithium, nickel, and cobalt. China invested USD 10 billion in these commodities alone in the 1st half of 2023. Policies initiated by the Chinese Communist Party, including the Made in China 2025 program, are directed at innovation and advancing manufacturing. A concerted effort to mine sustainably and secure resources creates urgency within Chinese mining companies with respect to the utilization of data in driving connected solutions.

Key Connected Mining Market Players:

- Dow Inc. (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE (Germany (EU))

- Mitsui Chemicals, Inc. (Japan)

- Orica Limited (Australia)

- Samsung SDI Co., Ltd. (South Korea)

- Tata Chemicals Limited (India)

- Petronas Chemicals Group Berhad (Malaysia)

- Caterpillar Inc. (USA)

- Komatsu Ltd. (Japan)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- ABB Ltd. (Switzerland (EU))

- Cisco Systems, Inc. (USA)

- IBM Corporation (USA)

- Hexagon AB (Sweden (EU))

- Wipro Ltd. (India)

The connected mining market is dominated by established global ICT and industrial automation companies. The major suppliers, including Dow, BASF, and Mitsui Chemicals, have tens of percent, in some cases even double-digit market shares. Most of the equipment-integrated players, including Caterpillar, Komatsu, ABB, Cisco, IBM, Hexagon, and Wipro have developed their strengths, often based around industrial IoT, AI, and host cloud-based platforms. This enables them to engage in the kind of strategic activities identified across the connected mining market. Indian and Malaysian companies are securing market share by responding to recent changes in regulations and agency and jurisdictions.

Recent Developments

- In June 2024, Lundin Mining Corporation and BHP announced a partnership with Filo Corp to jointly purchase all of Filo's issued and existing common shares. Simultaneously with the closing of the Filo Acquisition, Lundin Mining and BHP will form a 50/50 joint venture. The Joint Venture will create a long-term partnership between Lundin Mining and BHP to develop an emerging copper district with world-class potential that could support a globally ranked mining complex.

- In March 2023, Botswana's Debswana, alongside Huawei, announced the first smart diamond mine project in the world with a priority on 5G. Huawei's 4G eLTE private network solution enables stable connectivity for the Jwaneng mine, linking more than 260 assets, allowing for interconnectivity between the mine's production, safety, and security systems.

- Report ID: 7912

- Published Date: Aug 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Connected Mining Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.