Lead Mining Software Market Outlook:

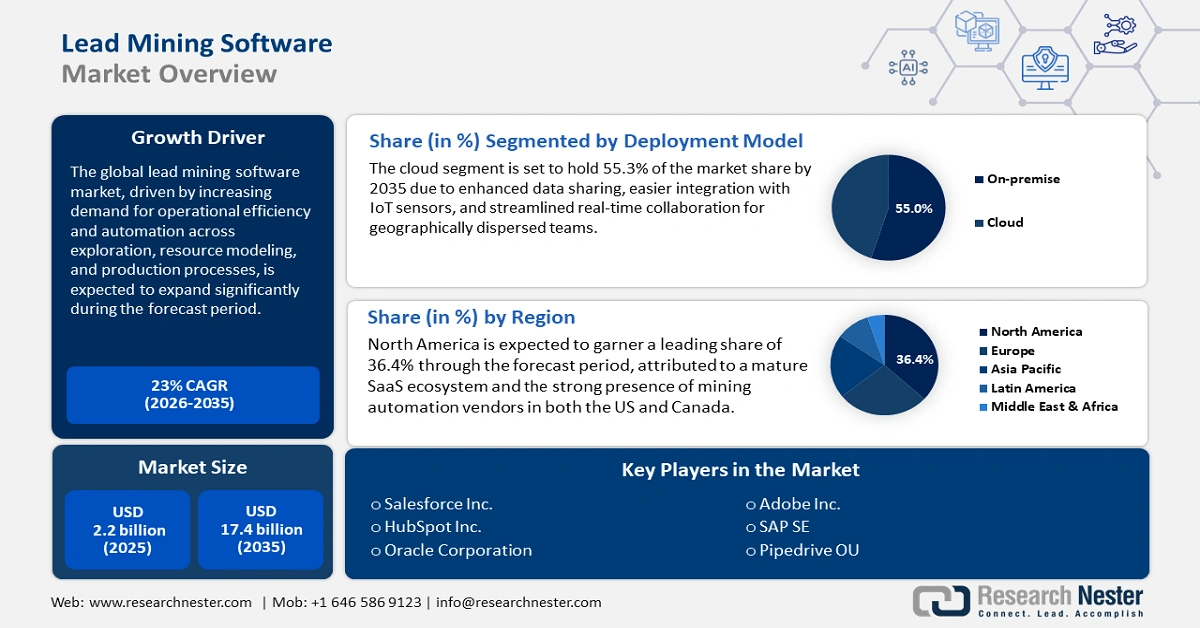

Lead Mining Software Market size is valued at USD 2.2 billion in 2025 and is projected to reach a valuation of USD 17.4 billion by the end of 2035, rising at a CAGR of 23% during the forecast period, i.e., 2026-2035. In 2026, the industry size of lead mining software is estimated at USD 2.7 billion.

The lead mining software market is expanding owing to the transition from siloed tools to AI-native, single-stack growth platforms that convert top-of-funnel intent into qualified opportunities with lower handoffs and tighter governance. One of the main drivers of growth is the merging of content, targeting, and measurement into one loop that increases experimentation and activation. In May 2024, Salesforce announced Einstein 1 Marketing and Commerce innovations to automate the creation of briefs, the generation of content, and promotions for more effective inbound capture and conversion. This aligns creative iteration directly with governed activation to increase lead capture and conversion speed at scale. As orchestration constricts, platforms that execute on this loop will be able to maintain accelerated test–learn cycles and better acquisition economics.

Privacy expectations are driving product design to consent provenance and responsible enrichment that are built into go‑to‑market implementation. To enable compliant activation, providers are formalizing lawful bases, retention windows, and opt‑out treatment within capture and scoring processes. The U.S. Federal Trade Commission in April 2024 updated its portals of guidance on privacy and data security to enterprises, reaffirming consumer data protection obligations. This keeps outreach and enrichment policy‑informed as campaigns grow regionally and channel‑specific. Consequently, buyers prefer tools that have verifiable consent trails, auditable processing, and clear governance.

Key Lead Mining Software Market Insights Summary:

Regional Highlights:

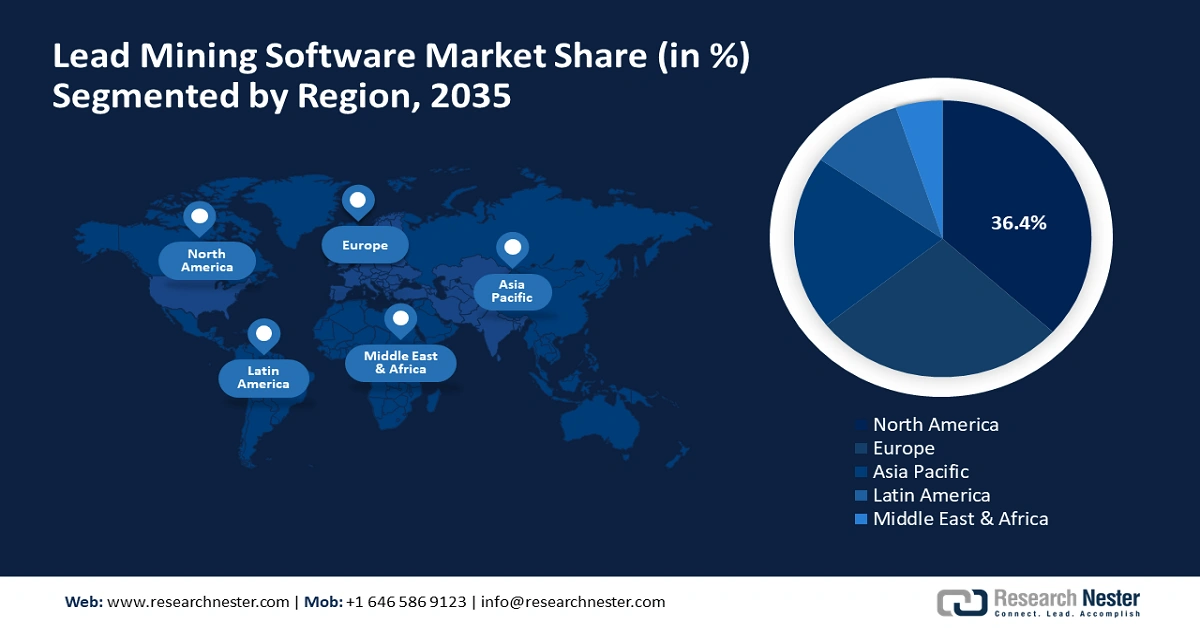

- North America is projected to command a 36.4% share of the lead mining software market by 2035, stimulated by vendor density, early adoption of agents, and mature RevOps practices.

- The Asia Pacific region is anticipated to exhibit a 37% CAGR from 2026 to 2035, fueled by mobile-first buyers, rapid SaaS penetration, and expanding e-commerce ecosystems.

Segment Insights:

- The cloud segment is projected to retain 55.3% share of the lead mining software market during 2026-2035, propelled by elastic AI inference, quick feature delivery, and natively integrated connections to ad, analytics, and collaboration suites.

- The customer relationship management (CRM) segment is anticipated to hold a 45% share by 2035, owing to its role as the system-of-record for lead states, activity, and attribution.

Key Growth Trends:

- AI agents for autonomous prospecting

- Content‑to‑activation supply chains

Major Challenges:

- Privacy, provenance, and policy drift

- Misuse risk from surveillance technologies

Key Players: Salesforce Inc., HubSpot Inc., Oracle Corporation, Zoho Corporation Pvt. Ltd., Adobe Inc., SAP SE, Pipedrive OU, Freshworks Inc., Monday.com Ltd., ActiveCampaign, LLC, Agile CRM Inc., Capsule CRM Ltd., Everlytic (Vox Telecom Group), Talenox Pte. Ltd.

Global Lead Mining Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.2 billion

- 2026 Market Size: USD 2.7 billion

- Projected Market Size: USD 17.4 billion by 2035

- Growth Forecasts: 23% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, India, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, South Korea

Last updated on : 26 September, 2025

Lead Mining Software Market - Growth Drivers and Challenges

Growth Drivers

- AI agents for autonomous prospecting: Predictable and timely follow‑up at the top of the funnel is needed by organizations to prevent leakage and impose SLAs. This is driving the adoption of agentic AI that captures inbound interest, qualifies, and automates scheduling. In September 2024, Salesforce previewed Winter ’25 features including Agentforce SDR Agent to automatically engage inbound leads, qualify, and schedule meetings. This institutionalizes first‑touch consistency and expands coverage without incremental headcount. Consequently, teams can redeploy human effort to complex selling while maintaining uniform first‑response quality.

- Content‑to‑activation supply chains: Enterprises are compressing the distance between creative production and performance feedback to scale winning variants quickly. This connection enables audiences and creatives to co‑evolve in regulated workflows. In April 2024, Adobe rolled out Frame.io V4 to speed up creative collaboration, review, and approvals for marketing content, enabling faster production for best‑of‑funnel assets. This increases iteration cycles per week and enhances conversion efficiency on measurable timelines. Subsequently, merging content and activation fuels lasting gains in qualified pipeline and channel ROI.

- Integrated, data‑rich GTM platforms: Key players in the market are converging enrichment, intent, identity, and activation to implement uniform scoring and eligibility across teams. This eliminates reconciliation mistakes that prolong revenue cycles. In September 2024, HubSpot released Breeze and Copilot with AI agents for content and prospecting, and Breeze Intelligence introduced enrichment, buyer intent, and form shortening that auto‑updates Smart CRM. This enhances intake quality and reduces time‑to‑value for high‑fit prospects. As a result, streamlined stacks advance governance, predictability, and revenue throughput.

AI-Driven Efficiency Gains in Sales/Marketing

Reflexive decision-making demands tools that deliver real-time lead intelligence, automate prioritization, and integrate seamlessly with CRM workflows. Lead mining software bridges the gap between data and action, enabling sales teams to engage prospects instantly while providing strategic insights for faster reflective decisions.

|

Initiative |

Efficiency Gain |

|

AI-Powered Lead Prioritization |

40% increase in sales productivity e.g., Microsoft’s "Daily Recommender" |

|

Real-Time Territory Redistribution |

Reduced planning cycles from annual to just-in-time, e.g., biopharma case |

|

Automated Campaign Execution |

Milliseconds to optimize outreach e.g., AdTech platforms |

|

Rapid Implementation Timelines |

9 months → 2 months for sales force restructuring e.g., high-tech company |

Source: HBR

Source: UNCAD

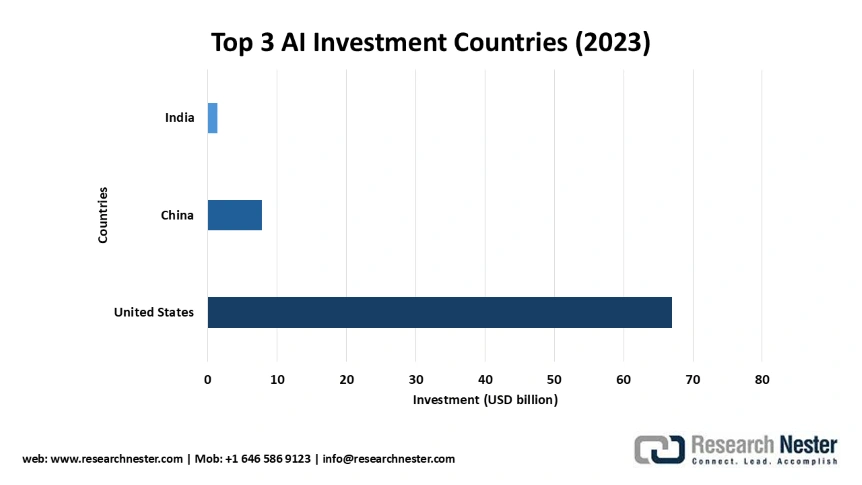

Dominant AI investment in the U.S. directly accelerates innovation in lead mining software, enabling advanced features like predictive lead scoring, natural language processing for intent signals, and seamless CRM integrations. Meanwhile, investments in China and India foster competitive, cost-efficient AI tools for globalized lead generation and outsourced sales operations, expanding market access and functionality for businesses worldwide.

Challenges

- Privacy, provenance, and policy drift: International buyers confront a patchwork of privacy regulation and tight controls on sensitive information that make cross‑border enrichment difficult. This sets a higher standard for transparent profiling, minimization, and clear opt‑outs in prospecting. The California Attorney General released updated CCPA materials in March 2024 that explained rights to know, delete, correct, and restrict use of sensitive information. This creates demand for platforms that demonstrate a lawful basis and have jurisdiction‑conscious audit trails. As a result, providers need to architect policy‑conscious pipelines that scale to international operations.

- Misuse risk from surveillance technologies: Public scrutiny of commercial spyware raises the stakes for defining ethical enrichment and intrusive surveillance. Purchasers increasingly demand evidence of consent, provenance, and purpose limitation throughout data use. In March 2023, the U.S. and allies released a joint statement to push back against abuse of commercial spyware, announcing tighter controls and rights‑respecting norms. This lifts governance to a competitive imperative and not merely an add‑on. In practice, apparent safeguards and open processing are core to vendor choice.

Lead Mining Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

23% |

|

Base Year Market Size (2025) |

USD 2.2 billion |

|

Forecast Year Market Size (2035) |

USD 17.4 billion |

|

Regional Scope |

|

Lead Mining Software Market Segmentation:

Deployment Model Segment Analysis

The cloud segment is expected to retain 55.3% of lead mining software market share throughout the forecast period based on elastic AI inference, quick feature delivery, and natively integrated connections to ad, analytics, and collaboration suites. A facilitating enabler is standardized governance across channels that reduces integration and speeds experimentation. In September 2024, Oracle's collaborative commerce releases combined buying and selling data to enable subscription and consumption models, enhancing buying groups' transparency. Such a cloud‑based unification standardizes activation without sacrificing control in sophisticated account situations. As such, cloud continues to be the run‑center of lead mining stacks, even where hybrid architectures service data residency and latency requirements.

Application Segment Analysis

The Customer Relationship Management (CRM) segment is predicted to maintain a 45% market share by 2035, which indicates CRM as the system‑of‑record for lead states, activity, and attribution. A real‑world benefit is in‑context agent execution that enhances reliability and maintains reporting fidelity for RevOps. In December 2024, Zoho CRM enhanced Canvas forms to collect important lead data with branding and required fields, and Kiosk Studio for a zero‑code, decision‑driven process. These features tighten capture‑to‑handoff loops while imposing core data quality. As a result, CRM‑anchored deployments are preferred for governed automation, explainability, and auditability.

Organization Size Segment Analysis

The large businesses segment is expected to command 63% market share by 2035 due to end-to-end control, cross-cloud security, and worldwide integrations. A critical need is lifecycle testing, usage governance, and multi-region deployment templates. In June 2025, Pipedrive rolled out a new Solution Provider Partner Program with tiered tiers, Authorized, Gold, and Platinum, to drive worldwide expansion through consultants and integrators. This ecosystem leverage decreases deployment risk and drives time‑to‑value in sophisticated environments. As a result, businesses converge on suites that integrate content, data, agents, and measurement at scale.

Our in-depth analysis of the lead mining software market includes the following segments:

|

Segment |

Subsegments |

|

Deployment Model |

|

|

Organization Size |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lead Mining Software Market - Regional Analysis

North America Market Insights

North America is expected to hold a 36.4% market share during the forecast period, with vendor density, early adoption of agents, and established RevOps practices as anchors. Lifecycle validation and safety testing before scaling automation across teams is a categorical requirement. In November 2024, Salesforce released Agentforce Testing Center to assess agents with simulated data prior to deployment, enhancing governance and dependability at scale. This aligns with North America's risk posture and speeds production‑grade adoption. Therefore, agent deployments are growing with more robust assurance frameworks.

The U.S. is anticipated to lead by combining bold AI roadmaps with compliant privacy and security guardrails that inform procurement. A recurring buyer requirement is elevation coupled with auditability and minimization criteria for targeting and profiling. In October 2024, Salesforce GA highlighted agents working across sales, service, marketing, and commerce, managing tasks beyond chat with accuracy and context. This trend keeps U.S. deployments at the leading edge of compliant automation. Therefore, U.S. programs tend to be a model of reference for worldwide scale‑outs.

Canada's contribution is predicted to increase as policy clarity and secure‑digital‑economy goals facilitate compliant analytics. An example national driver is to focus on privacy‑protective data environments and cybersecurity readiness, influencing enterprise GTM. In January 2025, the U.S. Department of Justice completed national security protections limiting bulk transfers of sensitive personal information to countries of concern, a cross-border message that companies in Canada commonly take into account while architecting governed data streams. As a result, compliant, consolidated platforms are poised to grow across mid-market and enterprise accounts as policy-aligned operations become table stakes.

APAC Market Insights

The lead mining software market in Asia Pacific is projected to register a CAGR of 37% from 2026 to 2035, driven by mobile‑first buyers, accelerated SaaS penetration, and e‑commerce scale. A real‑world enabler is streamlined, integrated stacks that minimize deployment and maintenance overhead for lean teams. This enables rapid wins in rapidly expanding APAC markets with constrained ops capacity. As a result, integrated SaaS platforms will be expected to take outsized share where agility is the determinant.

China is predicted to dominate a large percentage of APAC due to localization, platform ecosystems, and controlled access patterns for agent execution. A key policy trend shaping enterprise adoption is the state’s move to standardize safety, labeling, and filing obligations for AI services before they scale broadly. In mid‑March 2025, Chinese regulators adopted Measures for Labeling of AI‑Generated Synthetic Content that require explicit or metadata‑based labels on AI‑generated text, audio, images, and video, effective September 1, 2025. Consequently, partnerships and deployments that demonstrate policy‑grade controls and filing compliance are best positioned to capture share in China’s governed, high‑scale market.

India is expected to garner stable growth with digital‑first SMEs and large IT‑led businesses ramping up compliant acquisition. A procurement determinant is consent provenance and grievance workflows in terms of national regulations. For example, India released the Draft Digital Personal Data Protection Rules in February 2025 to bring into operation the DPDP Act, 2023, enhancing informed consent, erasure rights, and redressal. Therefore, suppliers with consent-conscious enrichment and verifiable journeys are likely to drive adoption in enterprise and upper-mid markets.

Europe Market Insights

Europe lead mining software is poised to record steady growth from 2026 to 2035, characterized by GDPR caution and explainable, AI-governed preference. An ongoing buyer requirement is platforms with retention controls, purpose limitation, and consent proof to maintain long-term compliance. Furthermore, a favourable policy environment encourages vendors to capture data handling and decision logic end‑to‑end. Therefore, adoption is quantified yet tenacious, with long‑term vendor partnerships driving Europe market expansion.

Germany is expected to retain a leading position across Europe, thanks to its industrial B2B foundation and strict bar for reliability and auditability. Buyers in Germany are prioritizing sovereign digital infrastructure, secure data flows, and lifecycle‑assured automation as federal policy sharpens around digital sovereignty and infrastructure acceleration. In June 2025, Germany's governing coalition passed legislation attributing “preeminent public interest” to fiber and mobile broadband expansion through 2030, streamlining approvals and planning, and reinforcing the national push for a sovereign administrative cloud and stronger cybersecurity oversight.

The UK is predicted to contribute to the sustained growth of Europe through 2035 by fusing innovation with enhanced governance and identity confirmation. Customers ask for quick yet compliant experimentation that does not sacrifice auditability in lead activities. In March 2024, the UK government published the Digital Development Strategy 2024–2030, setting measurable priorities for secure data sharing, standards adoption, and identity assurance across public programs to accelerate trusted digital transformation. This direction strengthens demand for lead operations that preserve auditability and consent provenance while enabling agile testing of audiences and creative.

Key Lead Mining Software Market Players:

- Salesforce Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HubSpot Inc.

- Oracle Corporation

- Zoho Corporation Pvt. Ltd.

- Adobe Inc.

- SAP SE

- Pipedrive OU

- Freshworks Inc.

- Monday.com Ltd.

- ActiveCampaign, LLC

- Agile CRM Inc.

- Capsule CRM Ltd.

- Everlytic (Vox Telecom Group)

- Talenox Pte. Ltd.

Competitors in the lead mining software market range from integrated suites to specialized innovators. Suppliers differentiate on agent maturity, governance depth, and the tightness of their content‑to‑conversion loop, as partner certifications de‑risk deployments and localize expertise. Organizations are coming to favor cross-suite agents that execute securely between systems-of-record and productivity apps of the day to eliminate handoffs. For example, Salesforce and Google, in September 2024, made a collaboration to create autonomous agents that execute across Salesforce and Google Workspace and aim at business development and e-commerce use cases. This partnership offers a resilient route to scale agentic workflows with enterprise controls and data context. Consequently, platforms that can operationalize agentic execution with verifiable consent, provenance, and performance accountability are best positioned to lead.

Here are some leading companies in the lead mining software market:

Recent Developments

- In June 2025, Salesforce announced Agentforce 3 expanding agent skills for inbound qualification, paid media optimization, and segment intelligence. The update targeted reduced lead leakage at handoffs by aligning marketing and sales with autonomous workflows. New skills improved prospect engagement across email, chat, and form channels. The announcement framed agent-human collaboration for productivity gains.

- In December 2024, Zoho’s CRM Q4 updates expanded auto-response rules and collaboration integrations for faster inbound responses. Enhancements improved duplicate checks, kiosk processes, and analytics suggestions by Zia. Forecast labeling helped teams focus efforts on high-probability deals. The updates strengthened end-to-end lead handling.

- In April 2024, Adobe unveiled the all-new Frame.io V4 to accelerate creative collaboration, feedback, and approvals for marketing content. Faster review cycles and asset versioning helped scale campaign production. Streamlined collaboration reduced

- Report ID: 4288

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lead Mining Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.