Motion Control Software in Robotics Market Outlook:

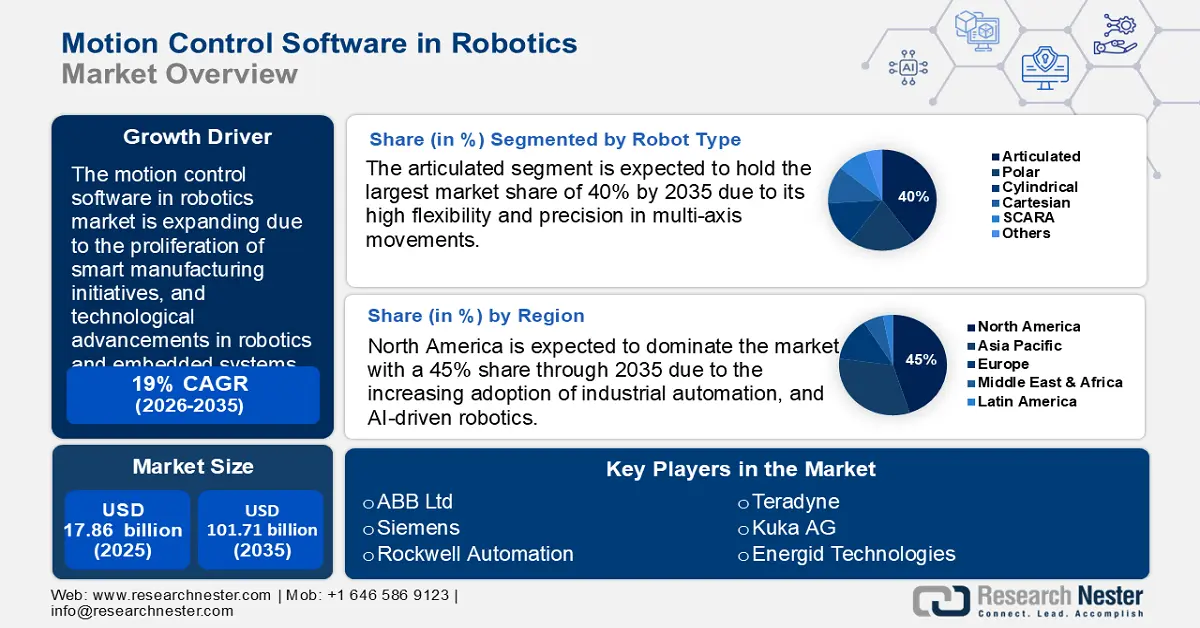

Motion Control Software in Robotics Market size was valued at USD 17.86 billion in 2025 and is expected to reach USD 101.71 billion by 2035, expanding at around 19% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of motion control software in robotics is evaluated at USD 20.91 billion.

The proliferation of smart manufacturing initiatives is a key factor in the growth of motion control software in robotics market. The global push towards Industry 4.0 and smart manufacturing is a major catalyst for the motion control software segment. Governments are investing in automation through policy-backed initiatives, including the U.S. Department of Energy’s Advanced Manufacturing, which aims to bolster domestic productivity and sustainability. Motion control software serves as the digital backbone of robotic systems in smart factories, supporting real-time data integration, flexible production lines, and high throughput performance.

A recent example of governmental support for smart manufacturing initiatives is the U.S. Department of Energy’s (DOE) State Manufacturing Leadership Program. In January 2025, the DOE announced nearly USD 13 million in funding to promote the adoption of smart manufacturing technologies among small and medium-sized manufacturers (SMMs). This initiative aims to enhance domestic manufacturing competition by facilitating access to advanced technologies and high-performance computing resources. The funding is intended to support states, territories, and state-funded institutions in implementing programs that assist SMMs in modernizing their operations, thereby improving productivity and sustainability. This investment in smart manufacturing is directly relevant to the motion control software in robotics market as it accelerates the adoption of automation technologies that rely on advanced motion control systems.

Key Motion Control Software in Robotics Market Insights Summary:

Regional Highlights:

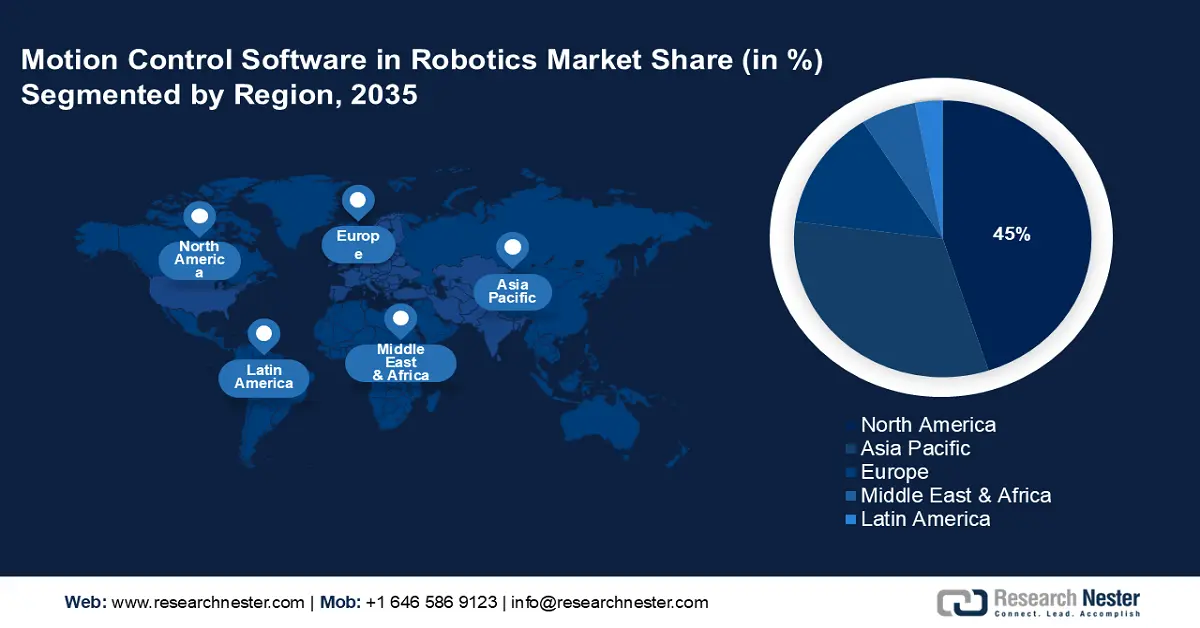

- North America commands a 45% share of the Motion Control Software in Robotics Market, with increasing adoption of industrial automation and AI-driven robotics solidifying its lead through 2026–2035.

Segment Insights:

- The Articulated segment is anticipated to hold a 40% share by 2035, driven by precision and flexibility in industrial robotic tasks.

- The Manipulation segment of the Motion Control Software in Robotics Market is projected to achieve a 52% share from 2026 to 2035, driven by its critical role in precision-focused tasks like surgery and assembly.

Key Growth Trends:

- Technological advancements in robotics and embedded systems

- Rising demand for high-precision automation in healthcare and aerospace

Major Challenges:

- Real-time precision and latency issues

- Cybersecurity threats in networked robotics:

Key Players: ABB Ltd, Teradyne, Rockwell Automation, Kuka AG, Nachi Robotics System, Energid Technologies.

Global Motion Control Software in Robotics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.86 billion

- 2026 Market Size: USD 20.91 billion

- Projected Market Size: USD 101.71 billion by 2035

- Growth Forecasts: 19% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Motion Control Software in Robotics Market Growth Drivers and Challenges:

Growth Drivers

- Technological advancements in robotics and embedded systems: Continuous R&D in sensor integration, edge computing, and advanced kinematics modeling is strengthening the capabilities of motion control platforms. Research funded by agencies highlights innovation in decentralized control systems and machine learning-enabled motion planning. For instance, in July 2024, researchers at Rowan University received a USD 1.8 million grant from the National Institute of Health (NIH) to develop Robossis, a robotic surgery system designed to improve the alignment of fractured long bones such as the femur. This system utilizes advanced kinematics modeling and real-time feedback to enhance surgical precision, demonstrating significant progress in embedded robotics technologies. These developments enable robots to operate in dynamic environments with reduced human oversight, fueling demand across sectors from warehousing to precision agriculture.

- Rising demand for high-precision automation in healthcare and aerospace: The demand for ultra-precise robotics in healthcare and aerospace is expanding. In these industries, tasks often require exceptional accuracy and consistency, which advanced motion control software in robotics facilitates by enabling precise manipulation and control of robotic systems. In October 2024, NYU Langone Health performed the world’s first fully robotic double lung transplant using the Da Vinci Xi system. This minimally invasive procedure involved the precise removal of damaged lungs and the attachment of donor lungs, all executed with the aid of robotic arms controlled through advanced motion control software. This technology allowed for smaller incisions, enhanced precision and quicker patient recovery times.

- Increasing labor shortages and demand for autonomous systems: As industrial sectors face labor shortages, especially in logistics, manufacturing, and agriculture, companies are investing in autonomous robotics to maintain operational efficiency. For instance, in November 2024, Agility Robotics introduced Digit, a humanoid robot designed to address labor shortages in warehouses and factories. Digit is capable of performing repetitive and physically demanding tasks, such as moving boxes into conveyor belts, thereby alleviating workforce gaps in the manufacturing sector. The U.S. Department of Labor and related agencies cite a widening skills gap, prompting firms to deploy collaborative robots (cobots) and AGVs. According to the International Federation of Robotics 2024 report, collaborative robots accounted for 10.5% of the 541,302 industrial robots installed in 2023. These machines depend heavily on adaptive motion control software to operate safely and efficiently in human-centric workspaces.

Challenges

- Real-time precision and latency issues: Motion control software must process vast amounts of sensor data in real-time to ensure smooth and accurate robotic movements. Any delay in processing can lead to positioning errors, affecting operational efficiency in high-speed applications. Synchronizing multiple robotic systems requires advanced algorithms to prevent collisions and inefficiencies. This complexity makes real-time motion control a key challenge in industries.

- Cybersecurity threats in networked robotics: As motion control software becomes more integrated with cloud and IoT platforms, it is likely to face increased cyber risks. Hacking threats can disrupt robotic operations, leading to production downtime and safety hazards. Additionally, data breaches can expose sensitive operational information, that impacts industries such as aerospace and automotive. Thus, strengthening encryption and cybersecurity protocols is crucial to mitigate these risks.

Motion Control Software in Robotics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19% |

|

Base Year Market Size (2025) |

USD 17.86 billion |

|

Forecast Year Market Size (2035) |

USD 101.71 billion |

|

Regional Scope |

|

Motion Control Software in Robotics Market Segmentation:

Robotic Type (Articulated, Polar, Cylindrical, Cartesian, SCARA)

Articulated segment is anticipated to capture over 40% motion control software in robotics market share by 2035, due to its high flexibility and precision in multi-axis movements. These robots, typically with four to six joints, rely on advanced motion control algorithms for smooth coordination and accuracy in industrial applications. These kinds of robots are widely used in automotive assembly, welding, material handling, and medical robotics where precision is critical. With advancements in AI-driven motion control, articulated robots are becoming more adaptive, efficient, and capable of complex tasks in dynamic environments.

Robotic System Type (Manipulation, Data Acquisition and Control, Mobile)

By 2035, manipulation segment is predicted to account for around 52% motion control software in robotics market share, as it plays a crucial role in precision-driven robotic applications such as pick-and-place, assembly, and surgical robotics. These systems rely on advanced motion algorithms and sensor integration to enable smooth, accurate and adaptive object handling. Industries such as manufacturing, healthcare and logistics benefit from intelligent motion control that enhances robotic dexterity and efficiency. With AI powered optimization, manipulator robots are becoming more autonomous, responsive, and capable of handling complex tasks in dynamic environments.

Our in-depth analysis of the global motion control software in robotics market includes the following segments:

|

Robot Type |

|

|

Robotic System Type |

|

|

Application |

|

|

Software |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Motion Control Software in Robotics Market Regional Analysis:

North America Market Analysis

North America in motion control software in robotics market is expected to hold more than 45% revenue share by 2035, due to the increasing adoption of industrial automation and AI-driven robotics. The U.S. and Canada are heavily investing in smart manufacturing, logistics automation, and AI-integrated robotics, creating a high demand for precision motion control solutions. Government initiatives such as the U.S. Chips Act and Canada’s Advanced Manufacturing Supercluster are accelerating robotic adoption in semiconductor manufacturing, aerospace, and automotive industries. Moreover, the World Robotics 2024 Report reveals that North America is one of the highest adopters of automation in manufacturing, comprising a robot density of 197 units per 10,000 employees, marking an increase of 4.2%. This shift is enhancing efficiency, reducing production costs, and driving innovation in robotics technology.

In the U.S., the surge in warehouse automation and e-commerce fulfillment centers has intensified demand for motion control software in autonomous and mobile robots (AMRs) and robotic arms. Companies such as Amazon and Boston Dynamics are deploying AI-powered motion control systems to improve sorting, picking, and last-mile delivery operations. For instance, in October 2024, Amazon launched its most advanced AI-powered fulfillment center in Shreveport, Louisiana, covering over 3 million square feet. The facility features eight cutting-edge robotic systems, including the Sequoia inventory system and Sparrow robotic arm to automate tasks such as sorting, lifting, and transporting packages. Additionally, the growing adoption of robotic-assisted surgeries in the healthcare sector is pushing advancements in motion planning algorithms for high-precision robotic systems such as the Da Vinci Surgical System.

Canada motion control software in robotics market is thriving due to the country’s focus on collaborative robots and AI-driven industrial automation. The Canada government is promoting robotics in agriculture and mining, where motion control software plays a crucial role in enabling autonomous harvesting machines and robotic drilling systems. Additionally, Canada’s support for advanced manufacturing and innovation in robotics is pushing adoption across different sectors. For instance, the Government of Canada launched NGen in June 2024 to support 15 advanced manufacturing projects accounting for USD 59 million. This investment will fund 31 companies working towards innovation in AI, robotics, and smart industries.

Asia Pacific Market Analysis

Asia Pacific is anticipated to garner a significant share from 2026 to 2035 owing to strong government backing for robotics, and R&D in countries such as Japan, South Korea, and China. The rise of precision electronics manufacturing and smart city infrastructure is creating demand for advanced motion control in service and industrial robots. Additionally, the region’s expanding semiconductor and EV industries are integrating AI-powered robotic systems for high precision high-volume production.

The motion control software in robotics market in China is fueled by the country’s aggressive investment in robotics under initiatives such as Made in China 2025. The rapid expansion of EV manufacturing, 5G infrastructure, and high-tech assembly lines demands precise, real-time robotic control systems. Tech giants in China and startups are developing proprietary motion algorithms to support autonomous robotics across smart factories and logistics hubs.

The motion control software in robotics market in South Korea is advancing rapidly due to its leadership in semiconductor fabrication and smart medical devices. In December 2024, researchers at the Korea Advanced Institute of Science and Technology (KAIST) unveiled the WalkOn Suit F1, an advanced wearable robot designed to assist paraplegic individuals in walking and navigating obstacles. This exoskeleton weighing 50kg, is powered by 12 electronic motors and utilizes sensors that anticipate and replicate human movement, enabling users to walk at speeds up to 3.2kph and climb stairs. The WalkOn Suit F1 highlights South Korea’s advancements in motion control software and robotics, significantly enhancing mobility for individuals with disabilities.

Key Motion Control Software in Robotics Market Players:

- Siemens

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ABB Ltd.

- Teradyne

- Rockwell Automation

- Kuka AG

- Nachi Robotics System

- Energid Technologies

The leading companies in motion control software in robotics market such as Siemens, Rockwell Automation and Mitsubishi Electric leverage AI, edge computing, and open architecture platforms to stay ahead. These firms compete by offering scalable, interoperable solutions tailored for sectors such as automotive, healthcare, and logistics. Here are some leading players in the motion control software in robotics market:

Recent Developments

- In March 2025, L&T made robotic drilling machine automated LCA Tejas Wing Production, reducing the time needed to drill holes by 95%. Instead of taking 25–35 minutes per hole, it now takes just 1 minute. Of 8,000 holes per wing set, 5,280 now take 88 hours instead of 2,640 hours, which saves over 2,500 hours per Tejas aircraft.

- In January 2025, Robot System Products opened its first factory in Chennai, India to boost the country’s robotics market. This goal is to take advantage of India’s growing demand, reduce production costs, and encourage local manufacturing. This move aims to establish India as a key hub for robotics in South Asia.

- Report ID: 7566

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Motion Control Software in Robotics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.