Data Mining Tools Market Outlook:

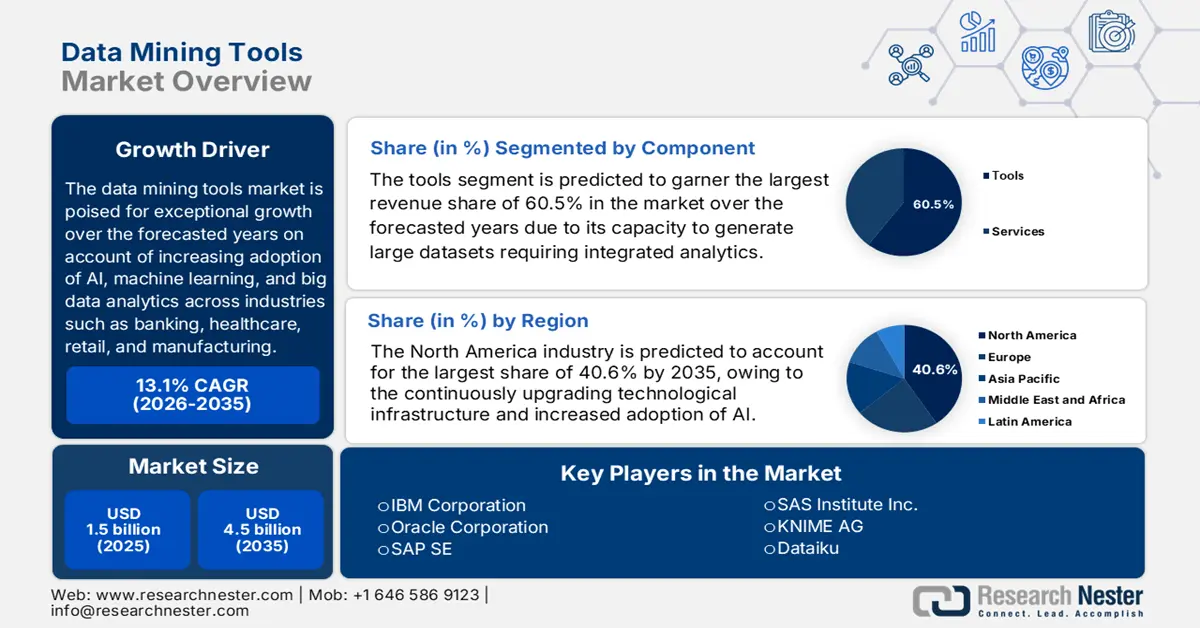

Data Mining Tools Market size was valued at USD 1.5 billion in 2025 and is projected to reach USD 4.5 billion by the end of 2035, rising at a CAGR of 13.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of data mining tools is evaluated at USD 1.7 billion.

The data mining tools market is poised for exceptional growth over the forecasted years on account of increasing adoption of AI, machine learning, and big data analytics across industries such as banking, healthcare, retail, and manufacturing. Simultaneously, organizations are making investments in advanced tools to derive actionable insights from structured and unstructured data and gain a competitive advantage. In May 2023, Celonis announced that it had launched a series of advanced process mining capabilities, which include an object-centric data model, business miner, and intelligence API, that are especially designed to help organizations rapidly analyze and optimize core business processes. It also mentioned that these innovations allow companies to model data more intuitively, uncover bottlenecks, and take actionable insights across functions such as accounts payable, procurement, and order management.

Furthermore, this in turn makes process intelligence accessible to all users and integrates with third-party platforms such as Power BI, Slack, and ServiceNow. Celonis enhances operational efficiency, also enabling enterprises to achieve measurable improvements in performance, cost savings, as well as customer satisfaction. Meanwhile, Adani Enterprises, in October 2025, announced that, through AdaniConneX, and Google had partnered to develop India’s largest AI data centre campus in Visakhapatnam by investing approximately USD 15 billion over a period of five years. It also mentioned that the project includes purpose-built AI infrastructure, a subsea cable network, and clean energy systems to support advanced AI workloads while also enhancing the resilience of India’s power grid. This collaboration emphasizes sustainability and positions India as a major hub for technology and AI innovation, reflecting both companies’ commitment to driving digital and energy transformation, benefiting the market growth.

Key Data Mining Tools Market Insights Summary:

Regional Highlights:

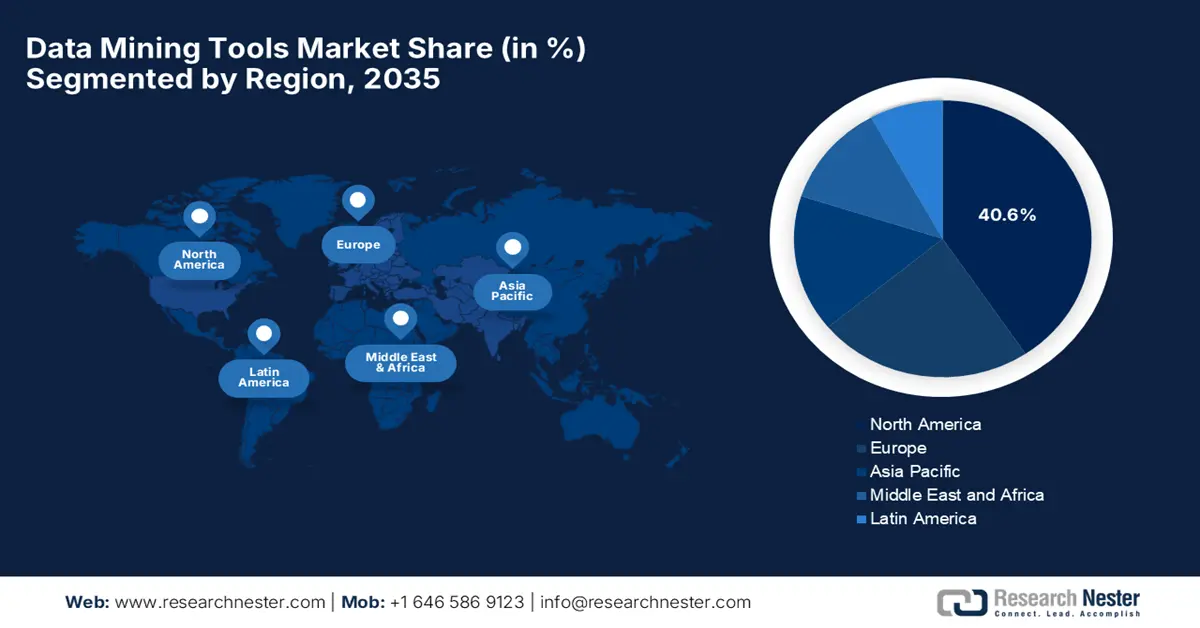

- North America is forecast to account for nearly 40.6% revenue share by 2035 in the data mining tools market, reinforced by continuous upgrades in digital infrastructure and expanding AI adoption complemented by sustained investments in cloud computing and enterprise digital transformation initiatives.

- Asia Pacific is expected to emerge as the fastest-growing region by 2035, accelerated by rapid digital transformation across emerging economies and increasing deployment of AI-driven analytics platforms for smart infrastructure, fintech, and e-commerce expansion.

Segment Insights:

- Tools segment is anticipated to secure the leading 60.5% revenue share over the 2026–2035 period in the data mining tools market, underpinned by its effectiveness in managing large and complex datasets through integrated analytics, predictive modeling, and actionable operational insights.

- Cloud deployment sub-segment is projected to attain a significant revenue share by 2035, strengthened by its scalability for massive unstructured data, real-time analytics enablement, and seamless AI–ML integration that accelerates insight generation.

Key Growth Trends:

- Explosion of data

- Integration with AI & ML

Major Challenges:

- Data privacy and security concerns

- Skills shortage and talent gap

Key Players: IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., KNIME AG, Dataiku.

Global Data Mining Tools Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.7 billion

- Projected Market Size: USD 4.5 billion by 2035

- Growth Forecasts: 13.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Canada

Last updated on : 2 January, 2026

Data Mining Tools Market - Growth Drivers and Challenges

Growth Drivers

- Explosion of data: The increasing volume of data that has been generated from digital platforms, IoT devices, social media, mobile apps, and enterprise systems is creating an urgent need for tools that can process and analyze this information. Ministry of Finance in March 2023 reported that the Government of India is leveraging data analytics, big data, and AI, ML in both direct and indirect tax administration to enhance efficiency, reduce discretion, and support taxpayers and businesses. It also mentioned that initiatives such as project ADVAIT for indirect taxes provide reports, dashboards, and analytical models using techniques of pattern recognition, predictive analytics, and text mining to detect any type of fiscal risks and improve compliance. Similarly, the CBDT employs these technologies to identify high-risk cases, send reminders, detect mismatches in tax returns, and analyze taxpayer networks for a very better enforcement and targeted campaigns, thus suitable for the market growth.

- Integration with AI & ML: This is the primary growth driver for the data mining tools market since the capabilities are currently core components of modern data mining tools, enabling pattern recognition and automated model building. This significantly enhances the value proposition of mining tools for real-time analytics and decision-making. In July 2025, Informatica released an intelligent data management cloud solution, which significantly enhances AI and ML integration for enterprise data management. The platform introduces features such as AI-powered master data enrichment, CLAIRE Copilot for natural language-driven data integration, automated validation and enrichment workflows, and GenAI connectors for integration with tools as NVIDIA NIM and Snowflake Cortex AI. In addition, these capabilities enable organizations to transform raw data into AI-ready, trusted, and actionable insights, supporting real-time analytics, governance, and accelerated decision-making.

- Digital transformation across industries: Enterprises are opting for digital transformation initiatives to optimize operations, improve customer experience, and unlock new revenue models. Data mining tools play a highly pivotal role in these efforts since they enable data-driven decision-making and performance improvement. In August 2022, the NCSES working paper examined how digitalization and cloud computing adoption vary across U.S. businesses by industry, size, and location, and how these technologies are linked to different types of innovation. Digitalization, especially of financial and personnel information, is widespread, whereas cloud computing adoption, primarily for IT outsourcing functions such as storage, servers, and billing, is intermediate but is strongly associated with data-driven decision-making and advanced technology use. In addition, the paper highlights that cloud computing lowers experimentation costs, particularly for young and small firms, enabling greater innovation in the market.

Industries with High Digitalization and Cloud Adoption Driving the Data Mining Tools Market

|

Industry |

Digitalization (%) |

Cloud Computing (%) |

|

Information |

83.47 |

65.68 |

|

Finance and Insurance |

75.17 |

52.04 |

|

Professional, Scientific & Technical Services |

80.62 |

60.79 |

|

Management of Companies and Enterprises |

76.36 |

45.72 |

|

Wholesale Trade |

73.62 |

48.53 |

|

Retail Trade |

68.79 |

43.43 |

|

Transportation and Warehousing |

68.26 |

44.01 |

|

Health Care and Social Assistance |

72.64 |

52.77 |

|

Manufacturing (Durable) |

79.15 |

45.88 |

|

Manufacturing (Nondurable) |

79.48 |

48.74 |

Source: NCSES

Challenges

- Data privacy and security concerns: This is one of the foremost challenges in the data mining tools market. Organizations in this field are collecting large amounts of data that can be sensitive, which includes personal, financial, and even healthcare information. This data is subject to strict regulatory frameworks such as GDPR, CCPA, and HIPAA. Therefore, any type of improper handling or unauthorized access can lead to legal penalties and financial losses. In this context, data mining tools must incorporate proper, reliable encryption, access controls, and anonymization techniques to keep the sensitive information safe. Furthermore, since the tools leverage cloud infrastructure and AI algorithms, the need to maintain secure data storage, transfer, and processing pipelines becomes extremely critical, adding complexity and cost to both deployment and adoption.

- Skills shortage and talent gap: This is yet another challenge negatively impacting the progress of the market. Data mining, machine learning, and AI require deeper knowledge of statistics, programming, data engineering, and domain knowledge. Therefore, most organizations struggle to find and retain talent that is capable of designing, implementing, and interpreting data mining models. The lack of skilled work professionals can slow down adoption, limiting the use of advanced analytics and resulting in suboptimal outcomes from existing tools. In addition, the tools integrate more automation and AI capabilities, wherein employees still need to understand model behavior, validation, and bias mitigation. In this context, vendors are launching models with more user-friendly, no-code features, but bridging the talent gap remains a major burden for the industry.

Data Mining Tools Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.1% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 4.5 billion |

|

Regional Scope |

|

Data Mining Tools Market Segmentation:

Component Segment Analysis

Based on the component, the tools segment is predicted to garner the largest revenue share of 60.5% in the data mining tools market over the forecasted years. The dominance of the subtype is effectively attributable to its capacity to generate large, complex datasets requiring integrated analytics, predictive modeling, and operational insights capabilities provided by dedicated tools. As per an article published by STEP in October 2025, HMRC’s Connect data analysis system generated an additional GBP 4.6 billion (approximately USD 6.1 billion) in tax revenue in the 2024/25 tax year, which marks over a third higher when compared to the previous year, by analyzing data from banks, online marketplaces, social media, and property databases. The report also notes that this system, which is used by around 4,300 HMRC staff, detected 540,000 cases of undeclared tax, demonstrating the power of dedicated data mining tools to handle larger, complex datasets, hence denoting a wider segment scope.

Deployment Segment Analysis

By the end of 2035, the cloud sub-segment based on deployment is expected to attain a significant revenue share in the market. They can handle massive and unstructured data at scale, enabling flexible resources for large analytics workloads, which is a critical factor as data volume surges across sectors. Simultaneously, the cloud platforms also support real-time analytics and AI, ML integration, which in turn enables organizations to generate actionable insights faster. In addition, cloud deployments reduce infrastructure costs and maintenance overhead when compared to on-premises systems. Their scalability and global accessibility make them particularly attractive for multinational enterprises and rapidly growing markets. Hence, the presence of all of these factors is positioning the cloud-based deployment at the forefront of revenue generation in this market.

Vertical Segment Analysis

In the data mining tools market BFSI segment is expected to grow at a considerable rate over the discussed timeframe. The industries generate high-volume transactional and customer data that benefits from segmentation, predictive trends, and risk modeling, creating a heightened demand for data mining tools. The adoption of fraud detection and credit risk assessment tools efficiently drives demand for advanced data mining solutions. Banks and financial institutions across the globe are leveraging AI and machine learning algorithms to gain insights from customer behavior and transaction patterns. Additionally, regulatory compliance requirements, such as AML (Anti-Money Laundering) and KYC (Know Your Customer), are encouraging the use of sophisticated analytics tools. In addition, the growing emphasis on personalized financial services and targeted marketing campaigns also contributes to the segment’s rapid expansion in the years ahead.

Our in-depth analysis of the data mining tools market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment |

|

|

Vertical |

|

|

Business Function |

|

|

Enterprise Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Mining Tools Market - Regional Analysis

North America Market Insights

North America is projected to dominate the data mining tools market, accounting for approximately 40.6% of the total revenue share by 2035. The continuously upgrading technological infrastructure and increased adoption of AI are the key factors behind the region’s leadership. Also, the continued investments in terms of cloud computing and digital transformation initiatives are propelling regional market progression. In October 2025, Iron Mountain announced updates to its InSight DXP platform by enhancing AI-powered extraction, search, and agentic workflows to transform fragmented physical and digital data into actionable intelligence. It also mentioned that this cloud-native platform unifies enterprise information, automates the discovery and remediation of redundant or obsolete data, and integrates with core business systems. Furthermore, these enhancements enable organizations to accelerate decision-making, improve compliance, and extract value from previously untapped unstructured data.

The U.S. is continuously progressing in the regional market owing to the proliferation of 5G networks, rising data volumes, and the integration of AI and ML into the nationwide analytical platforms. The sectors such as telecommunications, BFSI, and healthcare are proactively opting for these data mining tools, ensuring regulatory compliance and improving customer experience. In May 2025, Alteryx announced that its Alteryx One platform will serve as an AI Data Clearinghouse, enabling enterprises to centralize, clean, and govern data for AI applications. Besides, this platform supports auditable workflows, integrates structured and unstructured data across silos, and applies compliance and security controls to ensure trusted AI-ready data. Furthermore, this initiative empowers organizations to safely scale AI across business functions while maintaining transparency, governance, and high-quality data for analytics and generative AI use cases.

Canada in the data mining tools market is efficiently growing owing to the stronger emphasis on regulatory-compliant data analytics, particularly in banking, government, and healthcare sectors. The country’s market also benefits from increased utilization of these tools to improve fraud detection and support smart city initiatives by aligning with stricter privacy and data governance standards. In this context, GeologicAI in July 2025 announced that it had secured USD 44 million in Series B funding to expand its AI-based data mining and analytics platform for the mining sector, mainly focused on critical minerals such as lithium, copper, and rare earth elements. On the other hand, the company combines advanced AI, sensors, and geoscience expertise to analyze drill core data in real time, which in turn enables faster, higher-resolution decision-making for exploration and production. Furthermore, GeologicAI aims to scale its platform, reducing waste and strengthening mineral supply chains, contributing to the overall market growth.

APAC Market Insights

Asia Pacific is considered to be the fastest-growing region in the market, owing to the rising adoption facilitated by accelerated digital transformation across emerging nations. Governments and enterprises across this region are implementing AI-based analytics platforms to support smart infrastructure, e-commerce growth, and financial technology solutions. In this regard, Minitab in November 2025 announced that it had inaugurated a new office and training facility in Tokyo to support local industries with advanced data analytics and AI solutions. It also introduced tools such as Prolink for automated data collection and Simul8 for process simulation, which help enterprises optimize operations, improve quality, and accelerate decision-making. Furthermore, this expansion highlights the growing adoption of data mining and analytics platforms in the region, enabling businesses to harness structured and unstructured data.

China is the dominant player in the regional data mining tools market, which is focused on integrating data mining tools with AI and IoT applications across manufacturing, fintech, and e-commerce sectors. The country’s market also benefits from government-driven smart city projects and national AI initiatives, which encourage enterprises to deploy scalable analytics. The market is also strengthened by the rising adoption of cloud computing and big data platforms, which enable enterprises to process larger volumes of structured and unstructured data even more efficiently. In addition, leading domestic technology firms in the country are continuously innovating AI-powered analytics tools, which are suitable for local industries, enhancing predictive insights and operational efficiency. This integration of IoT with data mining allows real-time monitoring and decision-making in smart factories and logistics networks, hence making it suitable for standard market growth.

India is witnessing exceptional growth in the regional market, efficiently propelled by increasing digitization, the proliferation of mobile and cloud platforms, and government programs that are supporting AI and data-driven decision-making. In December 2025, HCLTech announced that it had signed an agreement to acquire HPE’s Telco Solutions business, with a prime focus on enhancing its AI, engineering, and cloud-native offerings for the telecom sector. This acquisition brings nearly 1,500 telecom specialists, industry-leading IP, and relationships with top global communication service providers, supporting more than 1 billion devices across 200+ deployments. In addition, this move strengthens HCLTech’s focus on network transformation, AI-led autonomous networking, and higher-value, IP-driven services, building on its previous HPE transaction in 2024, hence indicating a positive market outlook.

Europe Market Insights

In Europe, data mining tools market adoption is primarily shaped by advanced digital infrastructure, compliance requirements, and cross-industry demand for analytics-driven decision-making. Enterprises in this region mainly prioritize integrating tools that support AI, predictive analytics, and business intelligence by also adhering to GDPR and other regional data protection standards. In this context, Metso announced in September 2025 that it had launched data-driven performance services to enhance mining operations with AI-powered analytics and real-time equipment monitoring. The company also notes that these solutions enable predictive, insight-driven decision-making, reducing downtime, improving reliability, and accelerating issue resolution across minerals processing and metals refining. Furthermore, by combining advanced data analytics with Metso’s expert network, mining companies can optimize performance, prevent production losses, and make fact-based operational decisions even more efficiently.

In Germany, the data mining tools market is solidifying its dominance over the regional landscape since it strongly emphasizes industrial analytics, smart manufacturing, and the automotive sector. Domestic companies are leveraging data mining tools to optimize production processes and improve operational efficiency. In October 2023, One Data GmbH announced that it had launched its AI-powered data product builder in Germany, which also allows companies to transform fragmented data into high-quality, AI-ready data products that drive analytics and decision-making. Besides, the software automates key data processes, promotes a product-thinking approach, and allows users to access data through a centralized marketplace, which increases value across various departments. Furthermore, clients such as thyssenkrupp, ebm-papst, and SCHOTT demonstrate how this tool enhances collaboration, data governance, and actionable insights in dynamic, evolving markets.

In the U.K. market is focused majorly on BFSI, retail, and healthcare sectors, with widespread deployment of AI-enhanced data mining tools for fraud detection, customer analytics, and regulatory compliance. Simultaneously, the public sector initiatives also promote the use of advanced analytics to support smart government services and improve citizen engagement. In November 2025, Quantexa announced that it had launched Quantexa AI, which marks the next evolution of its decision intelligence platform to unify fragmented enterprise data and provide contextual, trustworthy insights. This platform integrates predictive analytics, graph machine learning, and AI agents through its agent gateway and Q assist workspace, which also enables secure, explainable, and auditable decision-making at scale. Further, this innovation empowers both enterprises and government agencies to deploy AI confidently, improve operational efficiency, and transform data into actionable, decision-ready intelligence.

Key Data Mining Tools Market Players:

- IBM Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- SAS Institute Inc. (U.S.)

- KNIME AG (Switzerland)

- Dataiku (France)

- H2O.ai (U.S. / Global open‑source)

- Alteryx Inc. (U.S.)

- Teradata Corporation (U.S.)

- Angoss Software Corporation (Canada)

- Orange S.A. (France)

- FICO (Fair Isaac Corporation) (U.S.)

- TIBCO Software Inc. (U.S.)

- SunTec India Pvt. Ltd. (India)

- Biomax Informatics AG (Germany)

- IBM Corporation is one of the most established leaders in terms of enterprise data analytics, and is offering data mining capabilities through platforms such as IBM SPSS Modeler and Watson Studio. The firm combines predictive analytics, machine learning, and advanced statistics to uncover patterns and insights from large datasets. In addition, IBM continuously enhances its offerings with AI integration and cloud services to support cross-industry analytical workloads, making it a primary choice for large enterprises.

- Oracle Corporation efficiently integrates data mining and analytics within its broader cloud data platform and database ecosystem, thereby allowing customers to perform predictive modeling, anomaly detection, and pattern analysis. On the other hand, the firm’s continuous innovations underscore its strategic focus on unifying data management with AI and machine learning to accelerate insight discovery and operational automation across enterprise applications.

- SAP SE is based in Germany and is identified as the international enterprise software leader, which embeds data mining and advanced analytics within its SAP business technology platform and ERP solutions to help organizations analyze operational data. The company’s SAP combines in-memory computing (HANA), predictive analytics libraries, and AI services, ENABLING businesses to drive predictive insights directly within transactional workflows, reinforcing its position among the most prominent global analytics vendors.

- SAS Institute Inc. is recognized as the frontrunner in this field, which hosts hosting analytics software suite, including tools such as SAS Enterprise Miner and SAS Viya, which provide proper data mining, predictive modeling, and machine learning capabilities. The firm has a strong adoption in regulated industries such as banking and healthcare, and it emphasizes trusted analytics, explainability, and rigorous statistical foundations to extend its suite’s capabilities.

- KNIME AG is yet another dominant force in this market, which offers an open‑source data analytics platform focused on modular, visual workflows that integrate data mining, machine learning, and reporting tools. Moreover, the company’s extensible architecture and strong community ecosystem are making it highly popular among data scientists and analytics teams who are seeking flexible solutions. In addition, KNIME’s continued evolution and placement in industry rankings reflect its growing role in democratizing data mining across many organizations.

Below is the list of some prominent players operating in the global market:

The global data mining tools market features a combination of major enterprise software firms and specialized analytics innovators who are intensely competing in terms of scalability, AI/ML integration, and cross-platform compatibility. Key pioneers in the market are making investments in R&D to embed machine learning, automation, and mergers & acquisitions to expand their geographic reach. In this regard, dotData in December 2025 announced that it has launched dotData TextSense, which is an AI-powered tool that extracts structured meaning from unstructured business text, such as reports, customer feedback, and support tickets. It leverages generative AI and converts text into semantic labels, integrating with existing structured data to enable faster, more accurate insights. Furthermore, this solution empowers non-experts to perform advanced text mining, enhancing data mining workflows and accelerating AI-based business intelligence across various industries.

Corporate Landscape of the Data Mining Tools Market:

Recent Developments

- In November 2025, SAS launched Data Maker, which is a synthetic data generator that creates statistically accurate datasets without exposing sensitive information. The tool supports enterprise data mining and AI workflows with built-in validation, no-code interfaces, and privacy-enhancing features.

- In October 2025, Oracle announced the launch of the AI data platform, which is a unified enterprise solution that combines automated data ingestion, semantic enrichment, vector indexing, and generative AI tools to streamline data-to-insight workflows.

- Report ID: 1696

- Published Date: Jan 02, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Mining Tools Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.