GPU Database Market Outlook:

GPU Database Market size was valued at USD 1.2 billion in 2025 and is projected to reach USD 3.7 billion by the end of 2035, expanding at a CAGR of 12.2% during the anticipated forecast timeline from 2026 to 2035. In 2026, the industry size of GPU database is evaluated at USD 1.4 billion.

A significant factor impacting the rising adoption rates of GPU databases is the heightened calls for real-time analytics across high-frequency transactions. This creates multiple application segments across industries such as cybersecurity, finance, and supply chain optimization. A key trend that is set to impact the market is the potential of CPU-based databases to be phased out by the next decade, paving the way for GPU databases, in a bid to support the large number of enterprises shifting to event-driven architectures from batch processing.

The supply chain of the GPU database market operates in a strong supply chain framework. Upstream activities in the supply chain are supported by the procurement of raw materials such as rare earth elements and silicon wafers. As per the U.S. Geological Survey (USGS), the U.S. imported more than 80% of its rare earth compounds in 2023, mostly from China. The ongoing tariff disagreements can cause an impediment to the smooth trade flow. In midstream, GPU manufacturing is concentrated in economies that are technologically mature, with final assembly done in North America and parts of East Asia. Additionally, over the years, the export volume of high-performance computing systems has expanded, particularly toward APAC and Europe economies, which bode well for the continued growth curve of the global market.

Key Graphics Processing Units Database Market Insights Summary:

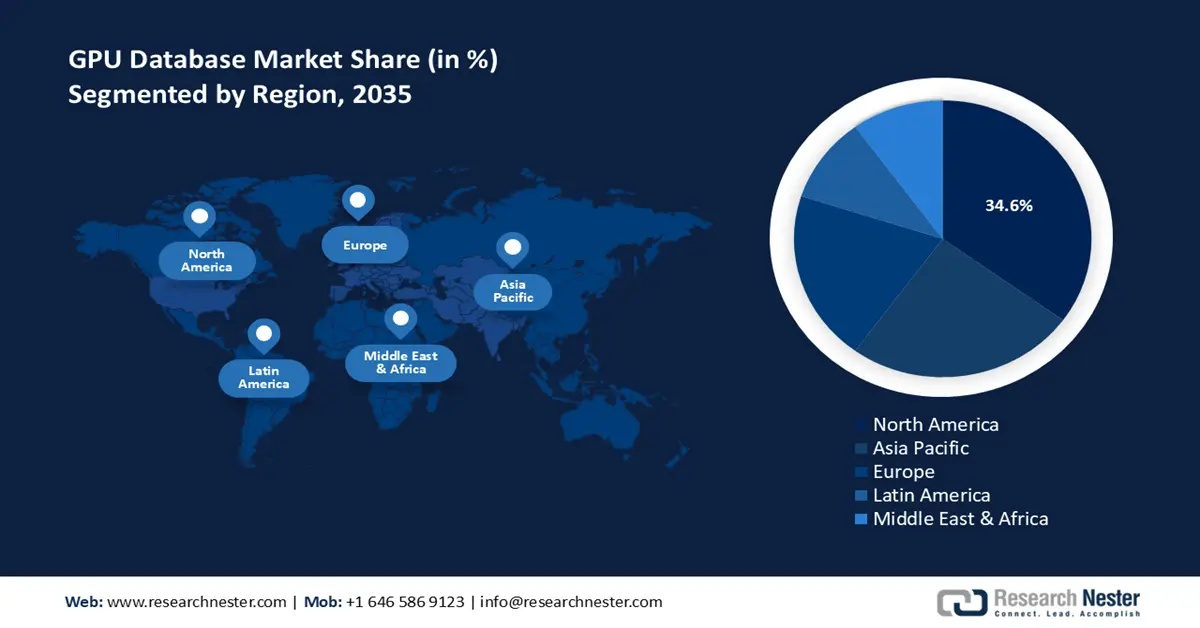

Regional Insights:

- The North America GPU Database Market is poised to hold a 34.6% share by 2035, impelled by heightened federal ICT investments and regulatory support for data security.

- The Asia Pacific GPU database market is expected to witness the fastest expansion during the forecast period, owing to accelerated digital transformation and investments in cloud infrastructure.

Segment Insights:

- The tools segment of the GPU Database Market is projected to account for 62.5% share by 2035, propelled by rising demand for GPU-accelerated data processing frameworks across multiple sectors.

- The customer experience management segment is expected to register a rapid CAGR during the forecast period, driven by high demand for real-time, personalized customer interactions.

Key Growth Trends:

- Integration of GPU databases in genomic research and precision medicine

- Rising deployment of GPU databases in 5G network optimization

Major Challenges:

- Data consistency and synchronization bottlenecks in real-time multi-source GPU database environments

- High implementation costs and complexity

Key Players: NVIDIA Corporation,AMD (Advanced Micro Devices),Intel Corporation,Samsung Electronics,Fujitsu Limited,ARM Holdings,ASML Holding,Toshiba Corporation,Micron Technology,Infosys Limited,Broadcom Inc.,Telstra Corporation Limited,STMicroelectronics,Renesas Electronics Corporation,Malaysian Technology Development Corporation (MTDC)

Global Graphics Processing Units Database Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.2 billion

- 2026 Market Size: USD 1.4 billion

- Projected Market Size: USD 3.7 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 15 September, 2025

GPU Database Market - Growth Drivers and Challenges

Growth Drivers

- Integration of GPU databases in genomic research and precision medicine: The heightened adoption of GPU databases has positively impacted genomic research and precision medicine initiatives. The impact has been noticeable in the healthcare sector via improvements in patient outcomes. A notable use case has been via the U.S. Million Veteran Program. For instance, in March 2024, research reported that analysis of vast datasets from more than 600,000 veterans' electronic health records achieved a 20% increase in speed through GPU-accelerated computing in comparison to traditional methods. The table below highlights additional successful use cases of GPU databases in the healthcare sector.

|

Initiative |

Outcome |

|

Australia's Rapid Genomic Screening |

Achieved a 70% precision care impact in critically ill children, delivering results in under three days. |

|

SOPHiA GENETICS' AI-Powered Platform |

Analyzed over 2 million patient genomic profiles, enhancing diagnostic accuracy and treatment decisions across 800 institutions in 72 countries. |

|

NVIDIA Parabricks v4.3 |

Reduced germline analysis time to under 10 minutes, achieving up to 108x acceleration, facilitating faster diagnostics. |

source: CRF, SOPHiA GENETICS, NVIDIA

- Rising deployment of GPU databases in 5G network optimization: The global deployment of 5G has increased over the years, with advanced economies already laying the groundwork for the push to 6 G. 5G networks require robust data processing capabilities, and this requirement drives the demand for GPU databases. In March 2023, NVIDIA introduced DGX Cloud, a cloud-based AI and GPU database platform aimed at enabling enterprises to accelerate AI workloads without on-premise infrastructure. This launch had a substantial business impact, contributing to a 20%+ increase in NVIDIA’s data center revenue in Q1 2024. Additionally, the integration of Multi-Access Edge Computing (MEC) with GPU technology has allowed for processing closer to end users.

Technological Advancements in the Market Landscape

The global GBU database market is undergoing a major transformation, bolstered by technological innovations across various industries. The advancements in GPU databases have led to a favorable impact in multiple sectors. For instance, the healthcare sector has leveraged GPU databases to improve genomic research, while the telecommunication sector has utilized them to improve network performance. Although the adoption patterns exhibit variation across sectors, the continuous advancements in GPU databases are expected to expand the scope of impact. The table below highlights technological trends and industry adoption cases.

|

Technological Trend |

Industry Adoption |

Impact |

|

GPU-Accelerated Genomic Analysis |

Healthcare: NVIDIA Parabricks accelerates genome sequencing by 50x in clinical settings |

Boosts precision medicine by enabling rapid genomic data processing |

|

Real-Time Fraud Detection |

Finance: Banks implement GPU databases for instant transaction analysis |

Reduces fraud incidents by enabling real-time monitoring |

source: NVIDIA

Challenges

- Data consistency and synchronization bottlenecks in real-time multi-source GPU database environments: In GPU database deployments, which span heterogeneous data sources such as IoT sensors, cloud platforms, edge devices, etc., a major technical challenge emerges in maintaining data consistency. In comparison to CPU databases, GPU architecture focuses on parallelism as a trade-off for consistency, creating further impediments via synchronization bottlenecks. Additionally, multiple industries, ranging from telecom to manufacturing, are increasingly relying on multi-source streaming data for faster analytics, causing a challenge for GPU databases in scalability.

- High implementation costs and complexity: The deployment of a GPU database requires robust investments and suitable infrastructure. This can be a challenge for SMEs due to budget constraints and insufficient infrastructure. In addition to this, integrating with legacy systems can enhance the complexity, slow down the deployment, and increase operational overhead.

GPU Database Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 1.2 billion |

|

Forecast Year Market Size (2035) |

USD 3.7 billion |

|

Regional Scope |

|

GPU Database Market Segmentation:

Component Segment Analysis

The tools segment is expected to account for 62.5% throughout the forecast timeline, attributed to rising demand for GPU-accelerated data processing frameworks across several sectors and growing need for high-performance computing in data-intensive applications such as AI, ML, and real-time analytics. The tools segment encompasses several software solutions that enhance the functionality and usability of GPU databases. These tools facilitate intricate tasks like data ingestion, query optimization, and visualization, enabling organizations to leverage the full potential of GPU databases.

GPU Database Tools & Ecosystem

|

Tool |

Function |

Works With |

|

RAPIDS.ai (NVIDIA) |

Open-source GPU-accelerated data science libraries (cuDF, cuML, cuGraph) |

Integrates with BlazingSQL, Dask, Spark |

|

cuDF |

Pandas-like GPU dataframe library |

Used in RAPIDS workflows |

|

cuML |

GPU-accelerated ML algorithms |

Works with scikit-learn style APIs |

|

Dask-cuDF |

Distributed GPU dataframe processing |

Scales across multiple GPUs/nodes |

|

Apache Arrow (GPU-enabled) |

Columnar in-memory data format |

Data interchange across GPU tools |

|

Tableau / Power BI |

Visualization and BI tools |

OmniSci, Kinetica |

Application Segment Analysis

The customer experience management segment is expected to register a rapid CAGR during the forecast period, owing to high demand for real-time, personalized customer interactions. GPU databases assist organizations in processing and analyzing large volumes of customer data more efficiently, offering the delivery of tailored recommendations and individualized customer interactions. In March 2025, Oracle partnered with NVIDIA to integrate NVIDIA’s computing technology and inference software with Oracle’s AI infrastructure and generative AI services. The partnership aims to help organizations across the globe speed up the development of AI applications. As per the partnership, over 160 AI tools and 100+ NVIDIA NIM microservices will be directly accessible via the Oracle Cloud Infrastructure (OCI) Console.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

GPU Database Market - Regional Analysis

North America Market Insights

The North America GPU database sector is poised to hold a leading revenue share of 34.6% throughout the forecast period. A major factor driving the regional market’s growth is the heightened federal ICT investments in the region. Major tech hubs in the region are key end users of GPU databases. Additionally, the NTIA’s ongoing digital equity programs have expanded access to GPU-powered database services in rural communities across the region. In addition to these drivers, the heightened regulatory push for data security in the U.S. and Canada is expected to ensure the continued dominance of the North America market.

The U.S. GPU database market is estimated to maintain its revenue share throughout the forecast timeline. A key facet of the U.S. market is the heightened federal funding, as reported by the NTIA. The U.S. Department of Energy’s exascale computing projects rely on GPU technology for scientific simulations, which spurs commercial GPU database development. In addition, rising investments and expansion plays by tech giants in the U.S. is expected to fuel market growth. For instance, in April 2025, Nvidia reported the ongoing production of Blackwell chips at TSMC facilities in Phoenix, Arizona. NVIDIA has also announced plans to invest up to US$500 billion in AI infrastructure across the U.S. over the next four years. This showcases improved broadband connectivity, increasing the market penetration for GPU database solutions in various sectors in the U.S.

APAC Market Insights

The Asia Pacific GPU database market is expected to witness the fastest expansion throughout the anticipated timeline, attributed to accelerated digital transformation efforts across the region. APAC is experiencing considerable investments in cloud infrastructure, particularly in big data analytics. In 2023, government reports from Japan’s Ministry of Internal Affairs and Communications emphasized strong subsidies for AI adoption across various sectors, which in turn creates ample opportunities for the deployment of GPU databases. Additionally, Southeast Asian countries such as Malaysia and Indonesia are leveraging GPU databases against the backdrop of the expansion of digital payment ecosystems and e-commerce.

The China GPU databases market is slated to maintain a dominant revenue share throughout the forecast period. The government-driven digital sovereignty initiatives drive the China GPU database market. According to China’s Ministry of Industry and Information Technology (MIIT) report 2023, several investments were made to improve AI infrastructure. Such investments create favorable opportunities for GPU database deployment. For instance, Chinese tech giants including ByteDance, Alibaba Group, and Tencent Holdings have reportedly placed orders worth over $16 billion for Nvidia’s H20 server chips during the first quarter of this year. Additionally, China’s aggressive push for digital economy reforms is predicted to boost GPU database integration.

Europe Market Insights

The GPU market in Europe is likely to register rapid growth during the forecast period rising demand for high-performance computing and real-time data processing technologies across several sectors, including finance, telecom, energy, and IoT. Several data centers in Europe are also focused on expanding GPU compute capacity. This is expected to fuel the demand for GPU databases in the coming years. The European Commission and national programs are allocating major capital to build large GPU clusters and AI factories to reduce the reliance on overall foreign cloud providers and chips. Moreover, several banks, payment firms, and insurers are adopting GPU acceleration for fraud detection and risk models that require low latency.

Germany is at the forefront of GPU database adoption in Europe, with a robust digital economy and a strong emphasis on AI and cloud computing. In 2024, the market for developing, training, and operating AI platforms in Germany increased by 43% to USD 2.5 billion, as reported by Bitkom, Germany’s digital industry association. This surge reflects the growing integration of GPU databases to support AI-driven applications and real-time analytics in sectors such as manufacturing, finance, and telecommunications.

Key GPU Database Market Players:

- NVIDIA Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AMD (Advanced Micro Devices)

- Intel Corporation

- Samsung Electronics

- Fujitsu Limited

- ARM Holdings

- ASML Holding

- Toshiba Corporation

- Micron Technology

- Infosys Limited

- Broadcom Inc.

- Telstra Corporation Limited

- STMicroelectronics

- Renesas Electronics Corporation

- Malaysian Technology Development Corporation (MTDC)

The global GPU database industry is highly competitive, comprising key players operating at global and regional levels. Major players such as NVIDIA, AMD, and Intel hold leading revenue shares in the sector. Apart from the U.S. firms, Samsung of South Korea and Fujitsu of Japan hold significant shares in the global market. Companies in the market are additionally focusing on geographic expansion to capitalize on the opportunities in the emerging markets. The table below highlights the major players in the global market.

Recent Developments

- In February 2025, Accenture revealed a strategic investment in Voltron Data to help organizations use GPU technology and accelerate large-scale analytics, particularly in generative AI and machine learning.

- In January 2025, NVIDIA announced new partnerships to accelerate the $10 trillion healthcare and life sciences industry using generative and agentic AI. Collaborating with leaders like IQVIA, Illumina, Mayo Clinic, and Arc Institute, NVIDIA aims to drive breakthroughs in drug discovery, genomics, and digital healthcare. The initiatives include AI agents to streamline clinical trials, AI models for drug discovery and pathology, and AI-powered robots for surgery and patient care.

- In January 2025, AMD unveiled the integration of DeepSeek-V3, an advanced open-source AI model designed to handle both text and image data, with its Instinct GPU accelerators, enhanced by the SGLang high-performance inference framework. By combining AMD’s strengths in memory bandwidth and compute density with SGLang’s optimized runtime, the collaboration enables developers to build next-generation AI solutions with greater efficiency, speed, and scalability

- Report ID: 2923

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Graphics Processing Units Database Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.