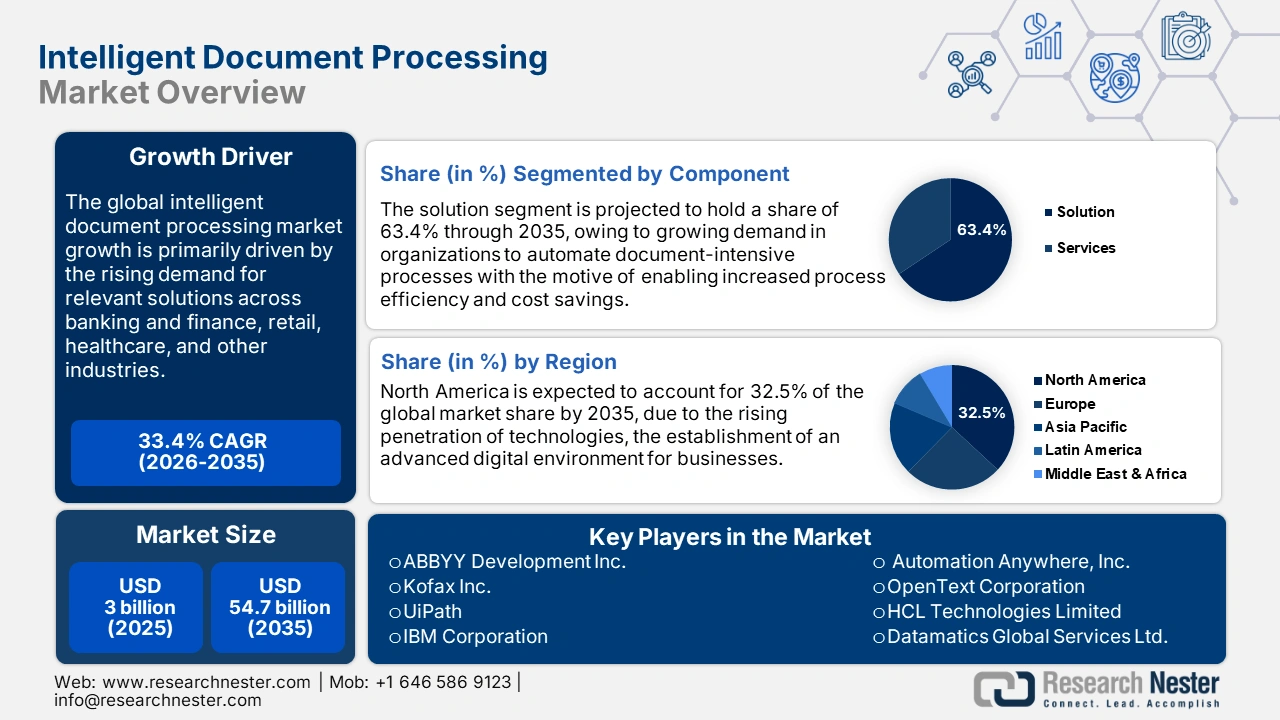

Intelligent Document Processing Market Outlook:

Intelligent Document Processing Market size was USD 3.0 billion in 2025 and is projected to reach USD 54.7 billion by the end of 2035, expanding at a CAGR of 33.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of intelligent document processing is assessed at USD 4.1 billion.

The global intelligent document processing (IDP) market is anticipated to expand rapidly, owing to the rising demand for relevant solutions across banking and finance, retail, healthcare, and other industries. Organizations in these industries are consistently adopting IDP solutions with the motive of achieving increased efficiency, reduced errors, scalability, cost-efficiency, and enhanced data analysis. For example, Discover Financial Services, a leading financial service provider, revealed its strategic partnership with Google Cloud to leverage Vertex AI in customer care centers in April 2024. The generative AI is empowering around 10,000 agents in the contact centers of the business with capabilities such as intelligent document summarization, real-time search assistance, and many more.

The global IDP market is driven by prominent strides in AI and automation. Technologies such as AI and ML are incorporated in IDP solutions to automate repetitive tasks, enhance data accuracy, and keep workflows streamlined in organizations. With rapid investments in the development of AI and ML technologies, IDP solutions are likely to be more advanced. As part of the Networking and Information Technology Research and Development (NITRD) Program, the U.S. government was granted USD 3316.1 million in AI research and development in 2025.

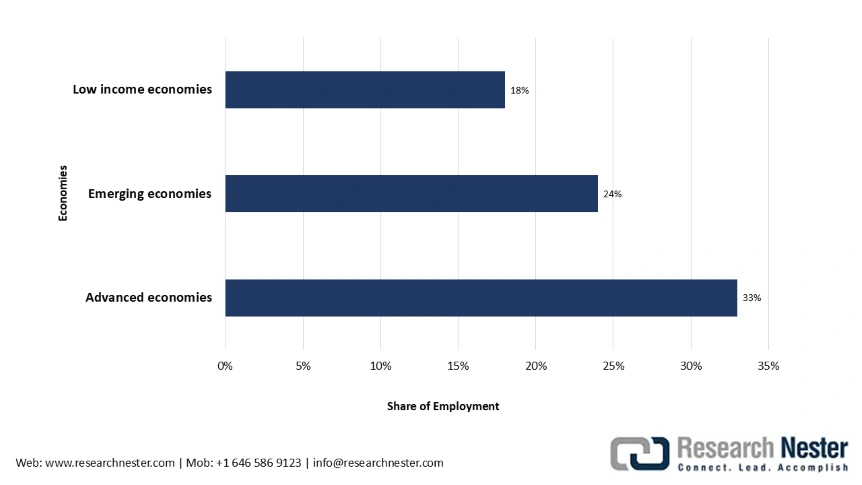

Estimated Share of Employment Exposed to Artificial Intelligence by Country Grouping, Percentage In 2023

Source: UNCTAD

Key Intelligent Document Processing Market Insights Summary:

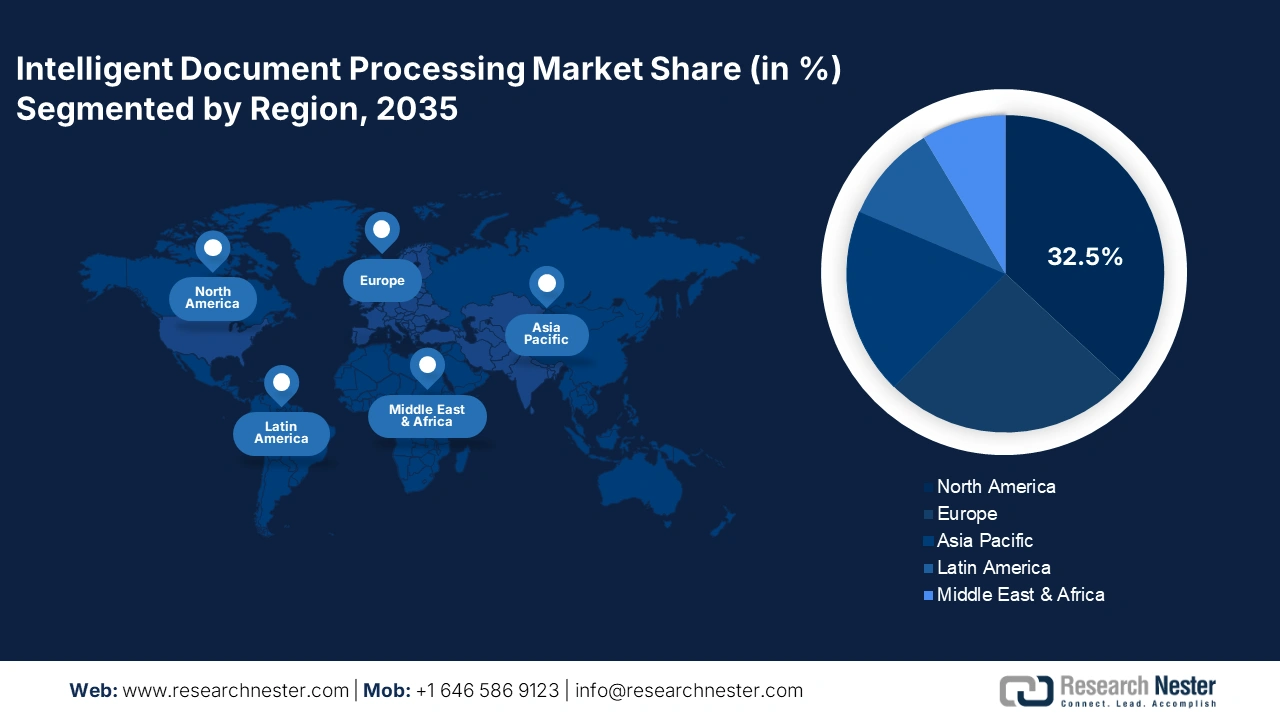

Regional Highlights:

- North America is anticipated to hold 32.5% share by 2035 as technological penetration and a mature digital infrastructure accelerate the uptake of IDP solutions.

- Europe is projected to secure a strong share by 2035 as enterprises intensify IDP adoption

Segment Insights:

- The solution segment is set to capture 63.4% share by 2035 as enterprises prioritize automation of document-heavy workflows to enhance efficiency and reduce operational costs in the Intelligent Document Processing Market.

- The machine learning segment is anticipated to record a significant share during 2026–2035 as its ability to execute high-precision data extraction and validation supports growing requirements for processing cloud-based unstructured data.

Key Growth Trends:

- Increasing digital transformation initiatives

- Rising volume of unstructured data and integration with Robotic Process Automation (RPA)

Major Challenges:

- Shortage of skilled workforce

- High initial investment and complexity in integration

Key Players: Kofax Inc., UiPath, IBM Corporation, Automation Anywhere, Inc., OpenText Corporation, HCL Technologies Limited, Datamatics Global Services Ltd., AntWorks, Fujitsu Limited, Samsung SDS, Appian Corporation, MDEC (Malaysia Digital Economy), Hyperscience, Unisys Australia.

Global Intelligent Document Processing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.48 billion

- 2026 Market Size: USD 2.66 billion

- Projected Market Size: USD 5.06 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (Highest Share by 2034)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 6 October, 2025

Intelligent Document Processing Market - Growth Drivers and Challenges

Growth Drivers

- Increasing digital transformation initiatives: The drive for digital transformation is fueling the influx of investments in the intelligent document processing market. Among the OECD countries, Korea, Denmark, and the United Kingdom ranked top in the Digital Government Index (DGI) with scores of 0.9, 0.8, and 0.7, respectively. This shift of governments to digitalization indicates an increased need for IDP solutions in the government sector. Companies are keen on pursuing cloud-based intelligent document processing solutions to cut down infrastructure costs.

- Rising volume of unstructured data and integration with Robotic Process Automation (RPA): The advent of the Internet has led to a massive boom in unstructured information, such as graphics, emails, and documents. In December 2023, the European Commission reported that 42.5% of enterprises in the EU were incorporated with cloud computing services in 2023 for email, office software, and storage purposes. Technology companies are also investing actively to integrate robotics in IDP solutions. For example, in November 2024, Tungsten Automation launched TotalAgility 8.1. The technology has established strengths in IDP, RPA, and others, allowing organizations to form and orchestrate intelligent processes faster than ever.

- Regulatory pressure on organizations to enable auditable, traceable data processing: The regulatory pressure for auditable, traceable data, and labor shortage across various industries are accelerating the demand for IDP solutions. These laws are stricter in Europe, and developing economies like India are also focusing on the same. In August 2023, the government of India published the Digital Personal Data Protection Act, 2023, the country’s first comprehensive data protection framework. The need for handling data securely in businesses is likely to attract them to IDP solutions.

Challenges

- Shortage of skilled workforce: Skilled labor shortage is creating a slump in business processes, increasing the demand for automation in document-intensive processes. As revealed by the International Information System Security Certification Consortium in October 2023, a shortage of around 4 million cybersecurity experts was looming across various industries. The rate of labor participation in different industries is also hovering around 83.6% in 2025, from a 20-year surge of 83.9% in August 2024. Thus, industries are experiencing a rising need for IDP solutions to keep the document processing efficient, disruption-free, scalable, and cost-effective.

- High initial investment and complexity in integration: Investment in the integration of IDP solutions is significantly high for businesses with low-investment capabilities. The high computational and processing costs influence the cost of integrating IDP solutions to be high. The compatibility of every ID solution with existing organizational technologies cannot be ensured, which is expected to lead to disruptions and delays in enabling business procedures. Therefore, integrating IDP solutions wisely is a significant area of challenge for businesses.

Intelligent Document Processing Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

33.4% |

|

Base Year Market Size (2025) |

USD 3 billion |

|

Forecast Year Market Size (2035) |

USD 54.7 billion |

|

Regional Scope |

|

Intelligent Document Processing Market Segmentation:

Component Segment Analysis

The solution segment is set to account for the highest revenue share of 63.4% by the end of 2035, owing to growing demand in organizations to automate document-intensive processes with the motive of enabling increased process efficiency and cost savings. Regulatory support for businesses to delve into digital transformation is also influencing the adoption of different IDP solutions integrated with technologies, such as natural language processing (NLP), ML, AI, and others. In September 2024, the U.S. Department of State disclosed that in 2023, the government announced a funding of USD 15 trillion in foreign assistance at the 78th Session of the UN General Assembly with the motive of constructing the capacity of developing and governing AI in ways that can boost progress towards the achievement of sustainable development goals. The integration of IDP solutions in organizations can significantly reduce paper consumption.

Technology Segment Analysis

The machine learning segment is anticipated to account for a remarkable market share during the stipulated study period, owing to its capacity to enable data extraction precisely, ensure proper data validation, and reduce errors. With rapid internet penetration, the volume of unstructured data is increasing on the cloud, influencing the need for intelligent tools like ML that can process and extract data efficiently. As reported by the World Bank, 64% of the global population used the internet in 2024. The capability of ML to work in conjunction with natural language processing is also expected to influence the dominance of the segment in document processing.

Deployment Segment Analysis

The cloud deployment segment is projected to hold a significant market share by 2035, due to the practical benefits cloud systems offer, especially in terms of flexibility and long-term savings. The adoption of cloud services is also fast-paced in the government sector, influencing cloud deployment of intelligence document processing for administrative purposes. As reported by the India Equity Brand Foundation in January 2024, cloud services are being adopted in government organizations frequently with the intent of enhancing service delivery, advancing data-driven governance, and reducing expenses.

Our in-depth analysis of the global intelligent document processing market includes the following segments:

|

Segments |

Subsegment

|

|

Component |

|

|

Technology |

|

|

Deployment

|

|

|

Organization Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intelligent Document Processing Market - Regional Analysis

North America Market Insights

The North America intelligent document processing market is anticipated to capture a revenue share of 32.5% during the forecast period. The rising penetration of technologies, the establishment of an advanced digital environment for businesses, and key suppliers of relevant technologies across the region are expected to increase the adoption of IDP solutions. Regional expansion of broadband infrastructure is also likely to make the adoption and utilization of IDP solutions more convenient in North America. As reported by the U.S. Federal Communications Commission in May 2025, around 110 million small businesses and homes, which account for 95% of the potential users, had access to terrestrial fixed service with a speed of 20 Mbps upload and 100 Mbps download, as of June 2024.

The intelligent document processing market in the U.S. is anticipated to witness a robust CAGR during the forecast timeline, owing to rapid advancements in AI and ML. This can lead to a surge in the effectiveness of IDP solutions in terms of process and cost efficiency. The government makes the federal data, computing resources, and models available to AI researchers, research and development experts, and industries, providing opportunities for key players to make their IDP solutions more advanced technologically. Rising availability of broadband services is also expected to accelerate the adoption of IDP solutions in the U.S. The National Telecommunications and Information Administration (NTIA) has rendered USD 42.4 billion in 2023 for broadband equity, access, and deployment across 56 states and territories.

Canada is projected to emerge as an expanding intelligent document processing market at an extensive CAGR during the study period due to the government's push for paperless governance. For example, in February 2024, the Public Policy Forum revealed that the government is encouraging the healthcare sector to refrain from the use of faxes for medical data transmission and go paperless by 2028. This is expected to accelerate the adoption of the IDP solutions for medical data transmission and record-keeping. Continuous cloud adoption in enterprises across Canada is also driving the likelihood of a rising integration of IDP solutions in the enhancement of document-intensive business procedures.

Europe Market Insights

The Europe intelligent processing market is projected to account for a robust share by 2035, owing to stringent environmental regulations that prohibit the use of paper for the conservation of the environment. As revealed by the European Commission, the implementation of the new Regulation (EU) 2023/1115 is accelerating deforestation-free product consumption with the motive of reducing greenhouse gas emissions and loss of biodiversity. This is indirectly increasing the inclination towards integrating IDP solutions in enterprises to contribute to reducing deforestation. Regulatory support for organizational digital transformation is also expected to fuel the adoption of IDP solutions. Under the Horizon Europe work programme, the European Union raised funding of USD 4.2 billion to accelerate digital transformation across the region in 2023.

The intelligent document processing market in the UK is anticipated to retain its dominance during the forecast period, owing to rising digital transformation across several domains. Strategic public-private partnerships are also being initiated in the UK, increasing the chances of a rising adoption of IDP solutions in the public sector. In June 2025, the Central Government programme was undertaken by TechUK to boost digital transformation in the public sector. The focus areas of the programme are, but not limited to, acceleration of industry support in the delivery of public services digitally, effective implementation of AI in the public sector, extension of digital and data public infrastructure, and many more. Strict data protection regulations are also influencing the incorporation of IDP solutions by organizations for secure data processing.

Germany intelligent document processing market is projected to experience a robust growth throughout the stipulated time period, owing to the need for enterprises to comply with the EU data protection regulations. Organizations operating in the financial sector of the country are significantly attracted to the IDP solutions to streamline business operations. For instance, Deutsche Bank Partners unveiled its multi-year innovation collaboration with NVIDIA to boost the utilization of AI and ML to succeed organizational cloud transformation. The AI and ML capabilities of NVIDIA are helping in fraud detection in the financial business.

APAC Market Insights

The intelligent document processing market in the Asia Pacific is anticipated to account for a robust revenue share by the end of 2035, owing to expanding economies. Expanding economies indicate that the volume of unstructured data is increasing, influencing the need to adopt IDP solutions for precise data management in organizations. According to the International Monetary Fund in April 2025, around 3.9% and 4.0% of economic growth is likely to be noticed in the region by the end of 2025 and 2026, respectively. As updated by UNESCO in November 2024, Japan’s Society 5.0 campaign is going to enable the delivery of goods and services to customers in depopulated areas using autonomous vehicles and drones. This is likely to increase the demand for IDP solutions for automated customer data management in logistics.

China intelligent document processing market is projected to lead the regional market, owing to robust IT infrastructure development. Several government initiatives are bolstering the development of IT infrastructure across China. As per the report by the World Economic Forum, published in June 2025, the Made in China 2.0 initiative is accelerating the adoption of AI-augmented, self-reliance-oriented, and green energy-powered transformation in the majority of the formidable industrial bases. Local businesses have also identified the vitality of adopting modern technologies to streamline their work processes and boost operational efficiencies, increasing the probability of the use of IDP solutions.

The intelligent document processing market in India is estimated to witness a rapid CAGR, attributed to the digital transformation efforts in banking, healthcare, insurance, and retail industries, leading to the adoption of IDP solutions. As reported by the Press Information Bureau in January 2025, government obligations, policy reforms, and advancements in technology are driving digital transformation in the healthcare sector.

Key Intelligent Document Processing Market Players:

- ABBYY Development Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kofax Inc.

- UiPath

- IBM Corporation

- Automation Anywhere, Inc.

- OpenText Corporation

- HCL Technologies Limited

- Datamatics Global Services Ltd.

- AntWorks

- Fujitsu Limited

- Samsung SDS

- Appian Corporation

- MDEC (Malaysia Digital Economy)

- Hyperscience

- Unisys Australia

The global market is highly competitive, comprising key players operating in the global market. The key players have identified gaps in supply and demand and are capitalizing on the sprawling market opportunities. They are implementing strategic initiatives such as product/service launches, collaborations, capital fundings, mergers and acquisitions, and geographical expansions.

Below are the key players operating in the space:

Recent Developments

- In June 2025, Hyland launched a next-generation agentic document processing solution. The IDP solution is integrated with AI and delivers end-to-end business automation, building upon its semantic, context-aware intelligence.

- In May 2025, Appian unveiled enhancements in Appian AI to help businesses work smarter with quicker insights, improved scalability, and more appropriate access to AI. The IDP solution is facilitating user queries, related case matching, and intelligent agent actions.

- In May 2024, ABBYY redesigned and launched the ABBYY Marketplace, catering to AI-powered documentation and improving large language model data accuracy. The IDP solution is significantly helping in referencing specific data in the organizational knowledge base.

- Report ID: 4826

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.