Natural Language Processing Market Outlook:

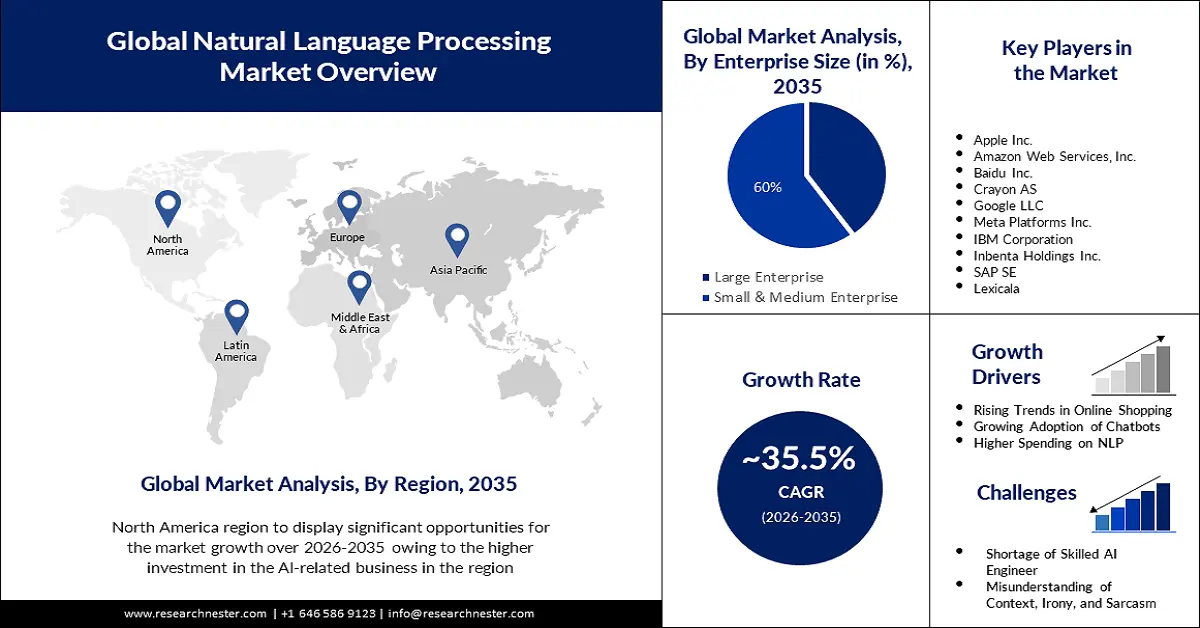

Natural Language Processing Market size was valued at USD 48.79 billion in 2025 and is expected to reach USD 1.02 trillion by 2035, expanding at around 35.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of natural language processing is evaluated at USD 64.38 billion.

Growth of the market can be attributed to the increasing use of chatbots for assisting customer services and for advertising the business. Customer service leverages NLP tools as a first point of contact to answer simple questions related to products and features. Around 75% of Chinese marketers are keen to employ chatbots for promoting their products and businesses. In addition, nearly 54% of respondents in China believe chatbots can deliver intelligent solutions to customer complaints. In addition to this, around 62% of customers would rather utilize a customer care bot than wait for human personnel to respond to their inquiries.

In addition to these, factors that are believed to fuel the market growth of natural language processing include the rising adoption of automation and higher implementation of the multi-languages in the machines. For instance, in August 2022, Ameca, created by the UK-based corporation Engineered Arts, presented a wide range of human-like expressions. Ameca's creators have now revealed a new video in which the robot is seen demonstrating its polyglot-like abilities, speaking numerous languages including Japanese, German, Chinese, French, British, and American English. Besides this, the NLP market growth is attributed to the rising spending on AI-related technologies. In 2021, end-user spending on artificial intelligence (AI) systems in Japan was over USD 2 billion.

Key Natural Language Processing Market Insights Summary:

Regional Highlights:

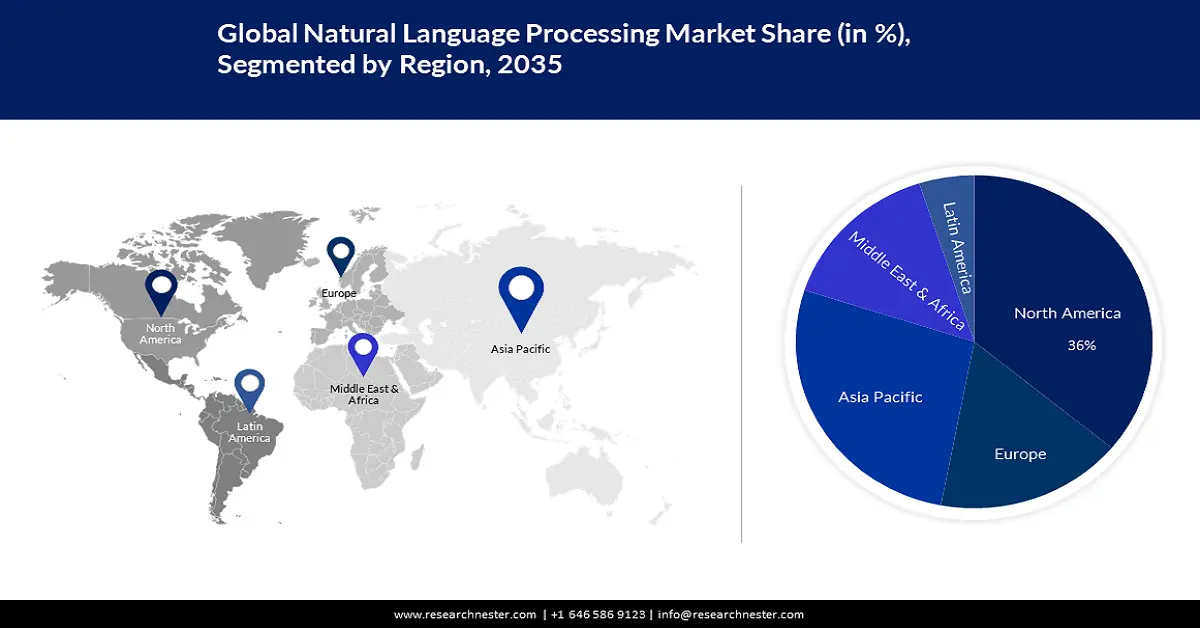

- North America natural language processing market will hold over 36% share by 2035, driven by increasing investment in AI technologies and rising use of chatbots and social media.

- Asia Pacific market will capture a 27% share by 2035, driven by higher adoption of digitization and rising smartphone users.

Segment Insights:

- The cloud deployment segment in the natural language processing market is projected to achieve significant share by 2035, fueled by higher deployment of cloud services accelerated by the epidemic.

- The small & medium enterprises segment in the natural language processing market is expected to maintain the largest share by 2035, fueled by the increasing adoption of digitization by small and medium businesses.

Key Growth Trends:

- Growing Sector of E-Commerce

- Increasing Spending on the Adoption of Natural Language Processing

Major Challenges:

- Lack of skilled engineers for developing NLP software

- Phrase, Slang, Irony, and Other NLP Barriers

Key Players: Lexicala, Apple Inc., Amazon Web Services, Inc., Baidu Inc., Crayon AS, Google LLC, Meta Platforms Inc., IBM Corporation, Inbenta Holdings Inc., SAP SE.

Global Natural Language Processing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 48.79 billion

- 2026 Market Size: USD 64.38 billion

- Projected Market Size: USD 1.02 trillion by 2035

- Growth Forecasts: 35.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 10 September, 2025

Natural Language Processing Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Sector of E-Commerce – Machines can quickly identify which phrases and terms are commonly used by humans when searching for a specific product using NLP. Global e-commerce increased from about 15% of total retail sales in 2019 to almost 21% in 2021. Furthermore, by 2022, it is expected to account for 22% of total revenues.

-

Increasing Spending on the Adoption of Natural Language Processing – More than 75% of organizations in the United Kingdom with active natural language processing (NLP) efforts intend to boost the amount they spend in the next 12 to 18 months.

- Surging Use of Social Media– NLP is used to gauge sentiment in social media. Moreover, content analytics is an NLP-driven strategy of categorizing videos. One of the most popular internet activities is using social media. Over 4 billion individuals used social media worldwide in 2021, with that figure expected to rise to more than six billion by 2027.

- Rising Penetration of Digitization–Natural Language Processing (NLP) provide solutions to the difficulties associated with unstructured data generated by digital transformation. There are around 5 billion active internet users globally. That equates to nearly 62% of the global population. Every day, over 500,000 new internet users are added.

- Rising Implementation of Chatbots– NLP is an artificial intelligence (AI) program that assists your chatbot in evaluating and comprehending natural human language communication with the consumers and developing an conversational systems. Globally chatbots were expected to be used by nearly 25% of customers in 2020, up from nearly 13% in 2019.

Challenges

-

Lack of skilled engineers for developing NLP software - There is a scarcity of AI specialists who are looking for work. There was around a 15% reduction in applicant searches for AI-related employment between May 2018 and May 2019. It indicates that extremely few people choose to work in artificial intelligence. Furthermore, in Japan, there is going to be a shortfall of roughly 270,000 artificial intelligence engineers by 2030. Moreover, according to estimates from various interest groups, Germany now has a shortfall of around 96,000 IT specialists. Therefore, the shortage of AI engineers is likely to hamper the development of natural language processing.

-

Phrase, Slang, Irony, and Other NLP Barriers

- NLP Has Limited Functionality

Natural Language Processing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

35.5% |

|

Base Year Market Size (2025) |

USD 48.79 billion |

|

Forecast Year Market Size (2035) |

USD 1.02 trillion |

|

Regional Scope |

|

Natural Language Processing Market Segmentation:

Organization Segment Analysis

The NLP market is segmented and analyzed for demand and supply by enterprise size into large enterprises, and small & medium enterprises. Out of the two sizes of enterprises, the small & medium segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing adoption of digitization by small and medium businesses. According to a survey, digitization is continuously growing, with up to 70% of small firms increasing their use of digital technologies as an outcome of the pandemic across the globe. On the other hand, the growth of the segment is also attributed to a rise in the number of small size of businesses. According to the World Economic Forum, small enterprises are the foundation of the world's economy, representing 90% of all businesses, around 60-70 percent of overall employment, and 50% of the global GDP. In addition to this, there are currently approximately 400 million SMEs worldwide. They are responsible for the majority of new employment creation and account for around 99% of all firms.

Deployment Segment Analysis

The global natural language processing market is also segmented and analyzed for demand and supply by deployment into on-premise, and cloud. Amongst these two segments, the cloud segment is expected to garner a significant share in the year 2035. The growth of the segment is primarily attributed to the higher deployment of cloud services. The exceptional circumstances imposed by the epidemic prompted the usage of the cloud. By 2020, more than 80% of company workloads will have been migrated to the cloud. On the other hand, many organizations have made considerable expenditures in updating their cloud computing infrastructures. Moreover, around 94% of all organizations globally use cloud computing in their operations. On the other hand, higher use of cloud natural language processing services is likely to augment the segment growth. A cloud NLP service is used by more than three-quarters of natural language processing (NLP) users, worldwide. Furthermore, cloud-based NLP solution provides multiple pricing options based on usage and necessity.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Deployment |

|

|

By Enterprise Size |

|

|

By Processing Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Natural Language Processing Market Regional Analysis:

North American Market Insights

The natural language processing market in North America, amongst the market in all the other regions, is projected to be the largest with a share of about 36% by the end of 2035. The growth of the market can be attributed majorly to the increasing investment in AI-related technologies. Funding for artificial intelligence startups in the United States has expanded significantly in recent years, rising from a minimum of under USD 300 million in 2011 to about USD 17 billion in 2019. On the other hand, the rising use of chatbots and social media is likely to boost market growth in the region. With approximately 16,000 websites containing a chatbot, the United States is a global leader. Furthermore, the United States had approximately 300 million social media users as of 2023. That is, approximately 90% of the general public in the United States actively uses social media.

APAC Market Statistics Insights

Asia Pacific natural language processing market is projected to be the second largest, registering a share of about 27% by the end of 2035. This growth is attributed to the higher adoption of digitization followed by a rise in the number of smartphone users. The start of the government's Digital India plan of action, coupled with recent increases in internet penetration, resulted in the country's digital population reaching approximately 692 million active users by February 2023. Furthermore, mobile user traffic in India is the second greatest in the world. In addition to this, the number of organizations offering virtual assistant platforms is increasing, as the use of natural language processing is also expected to boost the natural language processing market growth in the region. For instance, Kore.ai, a prominent AI software vendor, has launched an enterprise-grade virtual assistant platform. This platform encompasses various conversational AI technologies including NLP, machine learning, NLU, predictive analytics, and deep learning.

Europe Market Insights

Europe region is likely to register significant growth till 2035. The growth of the market can be attributed majorly to the rise in the number of online shoppers. According to Eurostat, the average number of e-shoppers increased by 20 percentage points (pp) from 55% in 2012 to 75% in 2022. Moreover, in 2022, the Internet users who bought or ordered products or services through the internet in the Netherlands, Denmark, and Ireland had the largest proportions of 92%, 90%, and 89%, respectively.

Natural Language Processing Market Players:

- Lexicala

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Apple Inc.

- Amazon Web Services, Inc.

- Baidu Inc.

- Crayon AS

- Google LLC

- Meta Platforms Inc.

- IBM Corporation

- Inbenta Holdings Inc.

- SAP SE

Recent Developments

- SAP SE announced the acquisition of Askdata for strengthening its capability to assist the companies for taking informed decision regarding the AI-driven natural language searches.

- Lexicala K Dictionaries introduced new set of services for the language technology business and academia. The emphasis is on multilingual lexical data solutions that combine human-created and curated language resources with content generated automatically.

- Report ID: 4843

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Natural Language Processing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.