5G Chipset Market Outlook:

5G Chipset Market size was valued at USD 57.1 billion in 2025 and is projected to reach USD 277.1 billion by the end of 2035, rising at a CAGR of 18.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of 5G chipset is evaluated at USD 67.7 billion.

The global 5G chipset market is all set to witness tremendous growth owing to the increasing demand for high-speed, low-latency connectivity. Simultaneously, the investments in 5G infrastructure and the rise of private 5G networks are also continuously propelling market expansion. In September 2023, Congress.gov reported that in response to concerns about reducing domestic semiconductor production, the U.S. enacted the CHIPS for America program under the 2021 NDAA and later the CHIPS and Science Act, appropriating USD 52.7 billion to expand U.S. fabrication capacity, fund semiconductor R&D, advanced packaging, and workforce development. It also stated that East Asian countries, which include Taiwan, South Korea, Japan, Malaysia, and Singapore, have long supported their semiconductor industries, supplying leading-edge logic and memory chips, whereas China and India are increasing domestic capabilities through state-led investments and incentives.

Government Support and Key Statistics of Semiconductor Industries in Select Asian Countries

|

Country |

Government Support / Funding |

Key Industry Focus |

Major Companies |

Targeted Outcomes |

|

U.S. |

USD 52.7 billion (CHIPS Act 2022) |

Fabrication, R&D, advanced packaging, workforce development |

Domestic fabs; partnerships with TSMC, Micron |

Expand domestic fab capacity; strengthen critical supply chains |

|

Japan |

USD 6.8 billion (2021 package) + subsidies to TSMC, Micron, Western Digital |

Advanced chips, memory, sensors, and semiconductor materials |

TSMC (Kumamoto), Micron (Hiroshima), JS Foundry |

Develop new fab, R&D centers; maintain 10% global market share |

|

South Korea |

Tax credits 15-35%; USD 900 million AI chip development |

Memory chip fabrication (DRAM), strategic high-tech items |

Samsung, SK Hynix |

Local sourcing of 50% of materials by 2030; 84,000 workforce at Gyeonggi production base |

|

Taiwan |

R&D subsidies; tax & tariff incentives; USD 152 million ASML plant |

Leading-edge fabrication (2–3nm), assembly, packaging, testing |

TSMC, ASM International, ASML |

Expand advanced R&D; 90% of global high-volume leading-edge production |

|

China |

Large capital outlays, subsidies for domestic firms |

Full supply chain (fab, materials, IP acquisition) |

PRC national champions |

Catch up in capacity & capabilities; leverage global talent & R&D |

|

Malaysia & Singapore |

Government + private sector investments in foundries |

Assembly, packaging, testing, and some mature-node fab |

Local APT firms |

Capture outsourced APT demand from global fab expansions |

Source: Congress.gov

In addition, the U.S. semiconductor policy is currently operating within a global context of collaboration with allies and competition with strategic actors, which are aiming to balance market roles, prevent overcapacity, and thereby maintain technological leadership. Meanwhile, on the pricing side, the U.S. Bureau of Labor Statistics reports that from 2022 to 2024, U.S. semiconductor import prices represented fluctuations by rising 2.4% in 2022, falling 3.8% in 2023, and remaining stable in 2024, whereas the export prices reduced 3.6% over the same period. The report also notes that peaks in import prices occurred in the middle of 2022 owing to higher raw material costs, as well as decreases as input costs eased. Therefore, these trends reflect the presence of global supply dynamics and cost pressures that are directly influencing the market, along with the strategic trade decisions.

Key 5G Chipset Market Insights Summary:

Regional Insights:

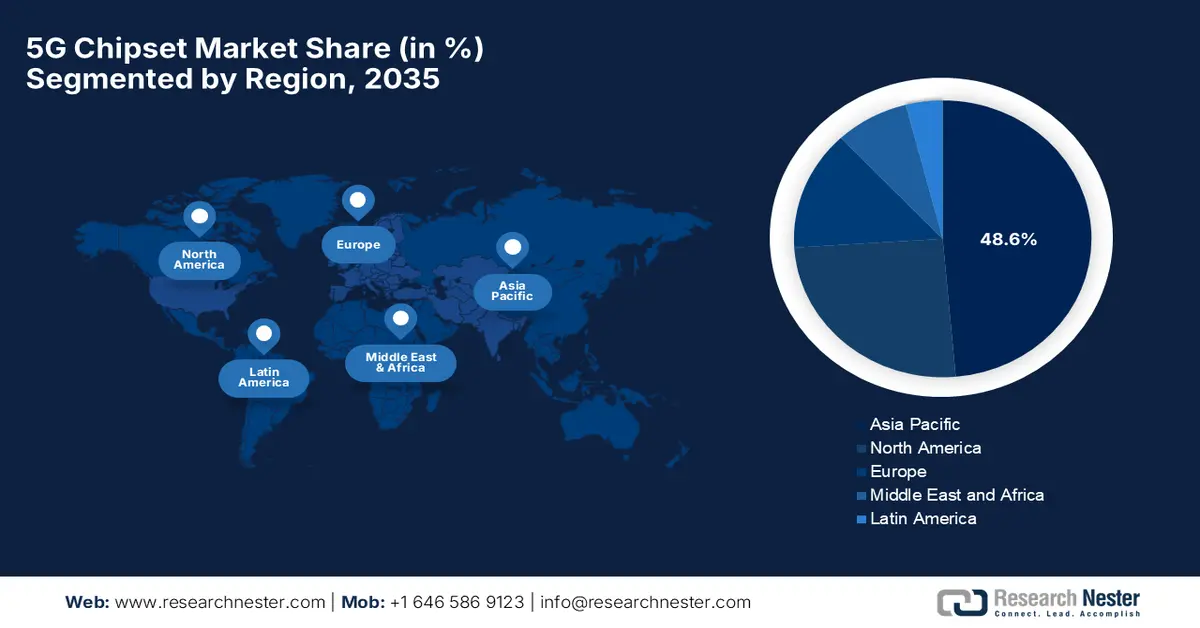

- Asia Pacific is projected to capture a 48.6% share by 2035 in the 5g chipset market, attributed to its large consumer base and early, aggressive 5G commercialization.

- North America is positioned to hold a prominent market share by 2035, owing to early 5G commercialization alongside strong R&D activity across leading chipset manufacturers.

Segment Insights:

- Smartphones & consumer devices is projected to command a 45.7% share by 2035 in the 5g chipset market, bolstered by high-volume global smartphone adoption and the integration of 5G as a standard feature.

- System on chip is anticipated to secure a considerable share by 2035, supported by rising demand for power-efficient and cost-efficient integrated solutions combining modem, application processor, and connectivity functions.

Key Growth Trends:

- Global 5G network rollout

- Rising adoption of 5 G-enabled devices

Major Challenges:

- High development & production costs

- Regulatory & security concerns

Key Players: Qualcomm, Inc. (US), Intel Corporation (US), Samsung Electronics Co., Ltd. (South Korea), Qorvo, Inc. (US), Huawei Investment & Holding Co., Ltd. (China), Xilinx, Inc. (US), Analog Devices, Inc. (US), NXP Semiconductors N.V. (Netherlands), Marvell Technology Group (Bermuda), Broadcom Inc. (US), Murata Manufacturing Co., Ltd. (Japan), Renesas Electronics Corporation (US), Infineon Technologies AG (Germany), Anokiwave (US)

Global 5G Chipset Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 57.1 billion

- 2026 Market Size: USD 67.7 billion

- Projected Market Size: USD 277.1 billion by 2035

- Growth Forecasts: 18.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.6% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, South Korea, Taiwan, Japan

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 5 December, 2025

5G Chipset Market - Growth Drivers and Challenges

Growth Drivers

- Global 5G network rollout: The worldwide deployment of 5G networks is a primary growth driver for the 5G chipset market. In this regard, the telecom operators across both emerging and established economies are making heavy investments in building 5G infrastructure to meet the increasing demand for high-speed, low-latency connectivity. In March 2025, IBEF disclosed that the Government of India has launched multiple initiatives under the Digital Bharat Nidhi with a prime focus on expanding telecommunication connectivity, which includes the telecom development plan, 4G saturation project, and amended BharatNet scheme, with investments exceeding USD 5 billion. It also mentioned that since the 5G launch, the country has installed 4.69 lakh 5G base stations, thereby achieving coverage in 99.6% of districts, hence marking one of the fastest rollouts across all nations.

- Rising adoption of 5 G-enabled devices: The advent of 5G-enabled devices, IoT devices, and connected automotive systems is constantly elevating the potential of the market. Also, both consumers and enterprises are showcasing a preference for devices that are capable of supporting high-speed data transmission and enhanced mobile broadband. TRAI in October 2023 revealed that the expansion of 5G in India is progressing better than ever, with telecom operators exceeding their deployment targets. The report also mentioned that by August 2023, the country had set up more than 3 lakh 5G sites, leading to noticeably faster mobile internet speeds and positioning the country at the forefront in global speed rankings. Hence, this rapid expansion is also fueling digital inclusion, creating encouraging opportunities in areas such as healthcare, agriculture, and education.

- Improvements in chipsets: The extensive advancements, such as AI-integrated chipsets, mmWave and sub-6 GHz support, multi-band carrier aggregation, and energy-efficient architectures, are identified as the key growth enablers for the upliftment of the 5G chipset market. In March 2025, Qualcomm introduced its X85 5G modem-RF, AI-powered connectivity platforms, and the Dragonwing fixed wireless access gen 4 elite platform, which delivers peak speeds up to 12.5 Gbps. This was at MWC Barcelona 2025, where the company highlighted its growing 5G Open RAN deployments with global operators and new 4G IoT modems with integrated SIMs for ultra-low power connectivity. Furthermore, these innovations drive wider adoption across various industries, hence making it suitable for overall market growth.

Challenges

- High development & production costs: The 5G chipset market is witnessing a major obstacle in terms of the expensive development and production costs. This is highly impacted by the investments in terms of semiconductor fabrication technologies, such as 5nm and below process nodes, which are both expensive and complex. Also, the R&D expenditures include designing energy-efficient, high-performance chips that support multiple frequency bands, including sub-6 GHz and mmWave. Similarly, the manufacturing necessitates costly materials, equipment, and specialized facilities, which often require government or private subsidies. In this regard, the smaller firms struggle to enter the market due to these high barriers, whereas the supply chain constraints for raw materials and precision components further escalate costs, limiting rapid scalability in this field.

- Regulatory & security concerns: This is the major drawback for the market, wherein these chipsets must comply with strict regulatory standards across different nations, which also include electromagnetic emission limits, spectrum allocations, and cybersecurity requirements. On the other hand, export controls, such as those imposed on China-based firms, are creating barriers for international market access. The security concerns are highly critical since any vulnerabilities in these chipsets can compromise the networks, devices, as well as sensitive data. In addition, governments are proactively scrutinizing 5G suppliers to protect national security, limiting partnerships and supply chain options. Hence, to address this, companies must invest in secure design practices, compliance testing, and certification processes, which increase costs and a very slow market entry.

5G Chipset Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.7% |

|

Base Year Market Size (2025) |

USD 57.1 billion |

|

Forecast Year Market Size (2035) |

USD 277.1 billion |

|

Regional Scope |

|

5G Chipset Market Segmentation:

End use Application Segment Analysis

The 5G chipset market is expected to be dominated by the smartphones & consumer devices segment, which is anticipated to hold a 45.7% share during the forecasted duration. The dominance of this segment is efficiently fueled by the high-volume global smartphone adoption and the integration of 5G as a standard feature. In September 2025, Qualcomm introduced the Snapdragon 8 Elite Gen 5, which is the world’s fastest mobile SoC, featuring the 3rd Gen Qualcomm oryon CPU, enhanced Adreno GPU, and hexagon NPU for superior performance, efficiency, and on-device AI. The company also notes that the platform enables agentic AI, advanced professional video recording, and enriched gaming and multitasking experiences. Furthermore, this is featured in upcoming flagship devices from global OEMs, wherein the Snapdragon 8 Elite Gen 5 sets new industry benchmarks for mobile computing.

Integration Type Segment Analysis

By the conclusion of 2035, system on chip is expected to account for a significant share within the market. The demand for power-efficient and cost-efficient solutions that integrate modem, application processor, and connectivity functions into a single chip is the key factor behind the segment’s leadership. In January 2025, Honda and Renesas announced that they had entered into a partnership to develop a high-performance SoC for Honda’s future 0 series software-defined electric vehicles, targeting 2,000 TOPS AI performance with 20 TOPS/W power efficiency. The SoC utilizes TSMC’s 3-nm automotive process and multi-die chiplet technology and integrates Renesas’ R-Car X5 series with Honda-optimized AI accelerators to power advanced driver assistance, automated driving, and vehicle functions. Furthermore, this collaboration aims to deliver industry-leading AI capabilities, energy efficiency, and flexible, upgradeable solutions for next-generation electric vehicles.

Product Type Segment Analysis

The 5G RFUCs subtype is expected to capture a lucrative share in the product type segment of the 5G chipset market over the analyzed timeframe. The growth in the segment is highly subject to the heightened demand for advanced radio front-end components to support mmWave and sub-6 GHz spectrum aggregation, which is essential for high-speed, low-latency 5G networks. For instance, in June 2023, Ansys and Synopsys together announced that they had launched a new reference flow for RFIC design using Samsung’s 14LPU process, integrating Ansys’ electromagnetic signoff tools with Synopsys’ custom design solutions. Therefore, this collaboration enhances predictive accuracy, accelerates design cycles, and supports high-frequency applications in 5G/6G, autonomous vehicles, IoT, and wearables, hence denoting a wider segment scope.

Our in-depth analysis of the 5G chipset market includes the following segments:

|

Segment |

Subsegments |

|

End use Application |

|

|

Integration Type |

|

|

Product Type |

|

|

Frequency |

|

|

Process Node |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5G Chipset Market - Regional Analysis

APAC Market Insights

In the 5G chipset market, Asia Pacific is likely to command the highest revenue share of 48.6% over the discussed timeframe. The leadership of the region in this field is effectively attributable to the large consumer base coupled with early & aggressive 5G emergence, especially in China & South Korea. The region also hosts strong semiconductor manufacturing ecosystems, government initiatives, and leading smartphone OEMs, which are continuously propelling growth in the region. In April 2025, AMD and KDDI announced that they had entered into a collaboration to integrate 4th Gen AMD EPYC CPUs into KDDI’s advanced 5G virtualized network. Hence, the partnership aims to enhance network performance along with 5G core capabilities, thereby supporting Japan’s next-generation communication infrastructure in the AI sector. Furthermore, both of these companies emphasize that this collaboration will strengthen KDDI’s data centers and accelerate technological innovation.

China plays a pivotal role in the upliftment of the global market owing to the aggressive government support, rapid deployment of 5G base stations, and a strong ecosystem of device manufacturers that need advanced chipsets. Simultaneously, the domestic chipset development and production help reduce dependency on foreign supply chains, thereby strengthening China’s position as a central node in the international supply and demand. In March 2025, ZTE and China Mobile introduced major 5G-A × AI innovations at MWC Barcelona 2025, introducing integrated communication-sensing-computing-intelligence capabilities that are designed to accelerate digital transformation across business, consumer, and emerging service markets. These companies also launched an end-to-end ambient IoT solution featuring zero-power tags, computing base stations, and a unified management platform to enable large-scale, ultra-efficient IoT connectivity, hence denoting a positive market outlook.

India is representing strong growth in the regional 5G chipset market owing to the surge in mobile data consumption and demand for affordable 5 G-enabled devices. The country’s market also benefits from a strong push for digital infrastructure, coupled with telecom expansion, which includes spectrum allocation, network rollouts, and support for local manufacturing. Ministry of Communications in July 2025 revealed that 5G services have now emerged across all states and Union Territories, covering around 99.8% of districts, which also has 4.86 lakh 5G base stations deployed. Besides, the report also underscored that telecom operators have expanded services more than the mandatory rollout requirements, with support from government initiatives as spectrum auctions, financial reforms, streamlined RoW permissions, and SACFA procedures, contributing to overall market growth.

North America Market Insights

North America holds a prominent position in the global market owing to the early commercialization of 5G, which includes mmWave networks and enterprise and private 5G applications, combined with strong R&D ecosystems among chipset leaders. The region also benefits from a robust semiconductor supply chain, which sustains demand for baseband, mmWave, and RF-front-end chipsets. The U.S. Department of Commerce reported that semiconductors play a critical role in powering modern technology and emphasized the impact of the bipartisan CHIPS and Science Act, which allocates USD 50 billion to strengthen domestic semiconductor manufacturing, research, and supply-chain security. The report also mentions that through this CHIPS for America, more than USD 32 billion in proposed funding has already been directed toward new U.S. fabs and R&D projects, as the nation expands its leadership in chip innovation.

The U.S. has gained strong exposure in the 5G chipset market, especially driven by high-density urban rollout of 5G, and enterprise-grade private 5G networks in sectors such as automotive manufacturing, healthcare, and logistics. In March 2024, Ericsson highlights its role as the U.S.’s largest-scale 5G manufacturer, which is producing advanced 5G radios and basebands at its Texas Smart Factory, which has grown over recent years. Besides, the facility delivers BABA-compliant equipment for U.S. carriers, supports BEAD-funded broadband expansion, and integrates Ericsson-designed silicon chips developed in Austin. Furthermore, it hosts end-to-end production, strong R&D linkage, and a LEED Gold–certified, renewable-energy-powered facility, thereby strengthening the country’s manufacturing and accelerating nationwide 5G deployment, hence denoting a positive market outlook.

Canada is readily blistering growth in the 5G chipset market, effectively propelled by deployments in rural fixed-wireless broadband initiatives, wherein these 5G chipsets are supporting sub-6 GHz bands. In November 2025, the Government of Canada announced a major partnership with Nokia with a collective goal of expanding advanced 5G research and development, which includes AI- and machine-learning–driven innovations, supported by a USD 40 million federal investment. In addition, Nokia’s expanded Ottawa facility is expected to strengthen the country’s ecosystem, digital infrastructure, and broader tech sector. Hence, this collaboration positions Canada as the critical leader in next-generation connectivity, thereby enabling new applications across defence, clean energy, agriculture, autonomous vehicles, and modern healthcare.

Europe Market Insights

Europe has acquired a strong position in the international market, primarily shaped by industrial and enterprise demand, 5G for industrial automation, smart factories, connected mobility, and private networks, thereby trending toward enterprise-grade chipset deployment. In October 2025, Vodafone announced that it had successfully completed the world’s first-ever 6GHz spectrum test using a commercial MediaTek M90 modem, achieving record 2.5 Gbps downlink speeds and demonstrating up to double the mobile data throughput with 200MHz channels when compared to 100MHz. Besides, the test highlights energy-efficient, high-capacity networks that can support AI applications, connected cars, smart glasses, and other next-generation services while reducing capacity costs by more than 40%. Therefore, this milestone positions Europe to lead in advanced 5G and 6G, with regulators considering full upper 6GHz band allocation to prevent future network congestion.

Germany is growing exponentially in the regional 5G chipset market on account of the heightened demand across sectors such as smart manufacturing, connected automotive, private campus networks, and factory automation. The country is gradually shifting toward digitalization and automation, supported by both private investments and government-backed initiatives, which is prompting a profitable business environment for pioneers in this field. In December 2022, Nokia and O2 Telefónica Germany together announced that they had achieved a commercial milestone by successfully implementing 5G two-component carrier (2CC) uplink carrier aggregation on sub-6 GHz spectrum, boosting peak uplink speeds to 144 Mbps. Simultaneously, by using Nokia’s AirScale portfolio and MediaTek’s M80 modem, the technology combines FDD and TDD frequencies to enhance coverage, capacity, and low-latency performance, thereby supporting advanced 5G use cases such as virtual reality, live broadcasts, and industrial applications.

The U.K. is gaining momentum in the 5G chipset market, which reflects a combination of consumer and enterprise demand. The telecos in the country are expanding 5G coverage, and investment in network infrastructure continues, whereas the growing interest in private 5G networks in sectors such as manufacturing, logistics, and enterprise IoT is increasing demand for robust 5G chipset solutions. In June 2025, AccelerComm announced that it had secured USD 15 million in funding, which was led by IP Group and other investors, to accelerate the deployment of its Direct-to-Device 5G solutions for space-based networks. The company also underscored that the funding will support collaborations with mobile operators and partners such as Lockheed Martin, which is using AccelerComm’s technology in the first regenerative 5G NTN payload in orbit.

Key 5G Chipset Market Players:

- Qualcomm, Inc. (US)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Intel Corporation (US)

- Samsung Electronics Co., Ltd. (South Korea)

- Qorvo, Inc. (US)

- Huawei Investment & Holding Co., Ltd. (China)

- Xilinx, Inc. (US)

- Analog Devices, Inc. (US)

- NXP Semiconductors N.V. (Netherlands)

- Marvell Technology Group (Bermuda)

- Broadcom Inc. (US)

- Murata Manufacturing Co., Ltd. (Japan)

- Renesas Electronics Corporation (US)

- Infineon Technologies AG (Germany)

- Anokiwave (US)

- MACOM Technology Solutions Holdings Inc. (US)

- Qualcomm, Inc. is recognized as a predominant leader in 5G chipset development, which is offering Snapdragon processors and 5G modem solutions. The company is heavily focused on mobile, automotive, and IoT applications, which are driving constant innovation in 5G RAN and private network deployments. Furthermore, Qualcomm has an extensive patent portfolio and partnerships with major OEMs, telecom operators, and cloud providers, which are positioning the firm as a central player in this field.

- Intel Corporation leverages its expertise in semiconductors to develop 5G modems, baseband processors, and network infrastructure solutions. The prime focus of the company lies in data center, enterprise, and IoT applications by enabling private 5G networks. Intel is making heavy investments in R&D to support next-generation 5G NR and Open RAN technologies. In addition, collaborations with telecom operators and equipment manufacturers strengthen its ecosystem.

- Samsung Electronics Co., Ltd. is one of the most popular and leading 5G chipset and smartphone manufacturers, which is producing Exynos processors and integrated 5G modems. The firm is primarily focused on mobile devices, network infrastructure, and consumer electronics applications. Samsung is readily investing in advanced semiconductor fabrication and memory technologies to support high-performance 5G chipsets. Its active involvement in 5G standardization is allowing the company to maintain a strong position in both hardware and network infrastructures.

- Qorvo, Inc. specializes in RF solutions and power management for 5G chipsets, which enable high-speed wireless communication and connectivity. The firm’s products target smartphones, base stations, and IoT devices. On the investment aspect, the firm is focused on GaN and RF front-end modules to enhance energy efficiency, signal performance, and multi-band support. Furthermore, the company is aiming to deliver integrated solutions that are critical for 5G device performance and adoption in global industries.

- Huawei Investment & Holding Co., Ltd. is the central player in developing 5G chipsets under its HiSilicon brand, which is focusing on smartphones, network infrastructure, and IoT. Simultaneously, the company is also maintaining strong R&D capabilities, thereby driving innovations in baseband processors, RF solutions, and network equipment. Huawei has partners across Asia, Africa, and Europe to deploy private and public 5G networks. In addition, the firm’s vertical integration of chip design and devices strengthens its competitive position in the 5G ecosystem.

Below is the list of some prominent players operating in the global market:

The 5G‑chipset market is efficiently shaped by the presence of global pioneers such as Qualcomm, MediaTek, Samsung Electronics, along with smaller firms. The established firms in this market are competing through a combination of factors, i.e., strong R&D, product innovations, and strategic partnerships. These strategic initiatives, coupled with investment in next-gen advanced modems, solidify market concentration, allowing them to grab a higher revenue stake. For instance, in June 2022, Qualcomm announced that it had acquired Cellwize to enhance its 5G RAN capabilities, focusing on network automation, multi-vendor management, and private and public 5G deployment. Besides, the acquisition strengthens the firm’s open RAN and cloud-native solutions, accelerating intelligent edge adoption across industries. Furthermore, strategic partnerships with firms such as Microsoft Azure, Verizon, and HPE enable simplified 5G network deployment, orchestration, and operational efficiency.

Corporate Landscape of the 5G Chipset Market:

Recent Developments

- In November 2025, Sequans Communications announced that it is repurchasing 755,349 American depositary shares, representing about 5% of its outstanding ADSs, funded by Bitcoin sales and operations, aiming to increase Bitcoin per share and strengthen its balance sheet. The company is advancing its 4G/5G IoT semiconductor solutions, reinforcing proper capital allocation and growth.

- In September 2025, GCT Semiconductor announced that it had secured USD 10.7 million in debt financing from strategic investor Anapass to accelerate production readiness and support volume shipments of its 5G chipsets.

- In February 2025, MediaTek announced the launch of the M90 5G-advanced modem, which offers up to 12Gbps downlink and 20% improved uplink performance, supporting both sub-6GHz and mmWave connectivity with dual 5G SIM dual-active capabilities.

- Report ID: 8275

- Published Date: Dec 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5G Chipset Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.