5G From Space Market Outlook:

5G From Space Market size was over USD 652.96 million in 2025 and is anticipated to cross USD 74.07 billion by 2035, witnessing more than 60.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 5G from space is assessed at USD 1.01 billion.

The 5G from space market is anticipated to observe significant growth due to rising global needs for connectivity, especially in underserved and remote areas. The promise of extending 5G further beyond terrestrial limitations offers enormous opportunities to facilitate communication gaps and other advanced technologies, such as autonomous vehicles and IoT devices. A key recent development comes from Sateliot in the form of its preparation, in March 2024, for the launch of four nanosatellites as part of its 5G constellation. This is an example of the rapid strides that the industry is taking toward commercial deployment. Another factor contributing to the market growth relates to the increasing number of public-private partnerships that form and develop for enhancing space-based 5G infrastructure.

Expansion of the market is also being driven by governments worldwide through the creation of a supportive regulatory environment and investments in space technology. For example, in November 2023, OneWeb was granted a provisional spectrum assignment to launch commercial satellites to start communication services in India. This progress within the regulatory environment showcases government initiatives to increase access to these satcom-enabled 5G services, particularly in highly populated but connectivity-constrained areas. Government-backed funding for space and telecom projects with the relaxation of licensing requirements for satellite networks, also indicates better growth prospects in the segment.

Key 5G from Space Market Insights Summary:

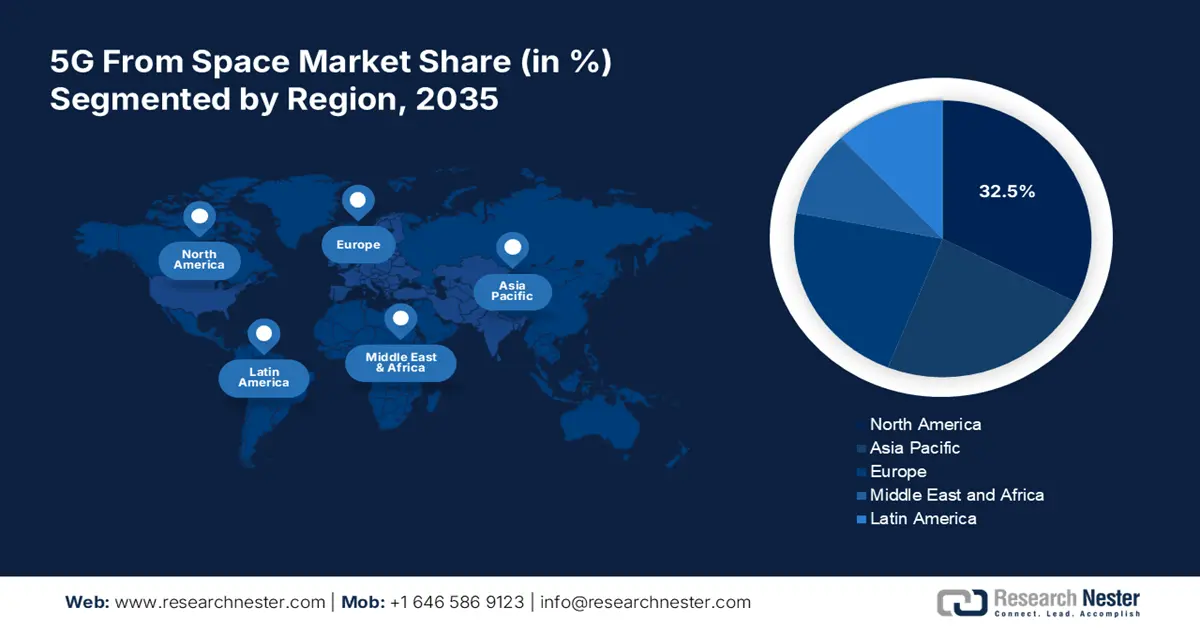

Regional Highlights:

- North America dominates the 5G From Space Market with a 32.5% share, driven by significant government support and an expanding space industry, fostering robust growth prospects through 2035.

- The Asia Pacific 5G from space market is poised for lucrative growth by 2035, driven by increasing demand for advanced communication technologies.

Segment Insights:

- The Hardware segment of the 5G From Space Market is poised for significant growth by 2035, driven by the development and deployment of satellite infrastructure, including payloads and ground stations.

- The URLLC segment is poised for substantial growth with a CAGR of over 46% from 2026-2035, driven by its critical role in enabling real-time communication for autonomous driving and telemedicine.

Key Growth Trends:

- Expanding global connectivity in remote areas

- Growing demand from industrial applications

Major Challenges:

- Issues of regulation and spectrum allocation

- Technical complexity of non-terrestrial networks

- Key Players: Lockheed Martin, Airbus Defence and Space, Boeing, Thales Alenia Space, and Northrop Grumman.

Global 5G from Space Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 652.96 million

- 2026 Market Size: USD 1.01 billion

- Projected Market Size: USD 74.07 billion by 2035

- Growth Forecasts: 60.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

5G From Space Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding global connectivity in remote areas: A major driver for the 5G from space market is the need to bridge the digital barriers in the case of remote or underserved areas. Traditional network infrastructure faces extreme challenges while covering wide and isolated regions. Satellite-based 5G, on the other hand, presents a plausible efficiency for extending connectivity on a global scale. For example, SpaceX launched the first 5G satellite for IoT applications in April 2023 to offer high-speed communications across the earth, especially in outlying and unserved regions of the world.

-

Growing demand from industrial applications: Industrial applications are significantly driving the market, as 5G integration in industries such as autonomous vehicles, healthcare, and agriculture requires low latency reliable communication for their critical operations. Satellite-based 5G has thus become an indispensable tool for these sectors. It enables seamless connectivity in remote areas where traditional infrastructure is lacking. Additionally, the technology supports real-time data processing, enhancing automation and operational efficiency across various industries.

- Advances in satellite technologies: Improved satellite technologies contribute to the better performance and scalability of 5G networks in space. In 2022, AccelerComm presented its LEOphy, a power-efficient modem for Low Earth Orbit 5G satellites. It significantly minimizes signal errors and offers optimized spectral efficiency of the 5G network while further boosting growth prospects.

Challenges

-

Issues of regulation and spectrum allocation: Among the major challenges, the 5G from space market players have to pass the complex regulatory and spectrum allocation processes. Variated policies by governments across the globe further delay this process. The involvement of agencies makes the satellite deployment timeline complicated in coordination. Such regulations apply to coordination between terrestrial and space-based networks. This often gets reflected in the overall rollout of 5G via satellite.

-

Technical complexity of non-terrestrial networks: The introduction of 5G non-terrestrial networks encompasses major technical challenges in performance. Systems like these require years of research and testing for them to work well in the real environment. Adding to the complexity, it involves satellite and ground networks working together. The problem with compatibility and the need for strong signal transmission is a contributing element that delays its implementation, thus limiting market expansion.

5G From Space Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

60.5% |

|

Base Year Market Size (2025) |

USD 652.96 million |

|

Forecast Year Market Size (2035) |

USD 74.07 billion |

|

Regional Scope |

|

5G From Space Market Segmentation:

Component (Hardware, Services, Software)

Hardware segment is poised to account for more than 53% 5G from space market share by the end of 2035. This is majorly due to the development and deployment of satellite infrastructure, which involves a significant investment in satellite payload, antenna, and ground station. In November 2023, Lockheed Martin developed the payload 5G.MIL, which was aimed at improving military communication systems. As more countries and private enterprise investments in space-based 5G networks are expected to continue expanding, so will the demand for highly sophisticated hardware solutions, thereby acting as a driver for segment growth.

Application (Enhanced Mobile Broadband (eMBB), Ultra-Reliable Low Latency Communications (URLLC), Massive Machine, Type Communications (mMTC), Fixed Wireless Access (FWA))

By 2035, ultra-reliable low latency communications (URLLC) segment is estimated to capture over 44% 5G from space market share, as it enables applications that require real-time communication with no delay. Segments like these see a massive demand for industries such as autonomous driving, telemedicine, and defense since even milliseconds of latency could result in major consequences. In July 2022, Qualcomm and Thales demonstrated the key role of URLLC in the announcement of a collaboration on testing 5G networks on Earth-orbiting satellites. Consequently, it is expected that more industries will use URLLC for mission-critical operations, pushing the demand for this segment further upwards.

Our in-depth analysis of the market includes the following segments:

|

Component |

|

|

Frequency Band |

|

|

End use |

|

|

Orbit Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5G From Space Market Regional Analysis:

North America Market Analysis

North America in 5G from space market is poised to dominate around 32.5% revenue share by the end of 2035 due to significant government support and an expanding space industry. This is also due to the major focus of the region on civilian and military satellite-based communication technologies that serve as a key growth factor. The existence of renowned space technology companies, such as SpaceX and Lockheed Martin contributes to the increasing competitive advantage of North America in the sector.

The U. S. continues to be one of the important players in the market, with companies like SpaceX staying ahead in deploying 5G from space. In April 2023, SpaceX launched a 5G satellite intended for IoT connectivity, a critical component in the expansion of global satellite-based communication networks. Due to innovations such as these, the U.S. leads in the development of advanced space technologies for commercial and industrial uses.

Canada is also turning to be a significant market for 5G from space, with a few initiatives running to expand satellite communications. Companies in the country are also capitalizing on these opportunities to launch new technologies to capture market share. In November 2023, OQ Technology launched two new LEO satellites, TIGER-5 and TIGER-6, further enhancing Canada's capability to offer high-speed, low-latency satellite communication services. As the country further invests in its satellite infrastructure, so will 5G from space be increasingly present in Canada.

Asia Pacific Market Analysis

Asia Pacific 5G from space market is expected to witness significant growth rate from 2026 to 2035. This is due to the increasing demand for advanced communication technologies in the region. With the expanding digital infrastructure space and initiatives taken by several governments to heighten internet penetration in their remote and under-served areas, the ecosystem for space-based 5G solutions is getting favorable. Countries such as India and China are leading in the adoption of satellite-based 5G networks as they upgrade their respective digital economies and industries.

With government support for satellite communication technologies, India market is growing rapidly. In March 2022, Nelco and Omnispace collaborated on bringing satellite-powered 5G services to South Asia, including India, a fact that shows the commitment of the country toward better connectivity. Such developments are likely to play a crucial role in connecting the remote areas outside the cities, boosting the adoption of 5G from space solutions in India.

China is also one of the leading players in Asia Pacific market, since the country is increasingly investing in space technology and telecommunications. For example, Alén Space officially announced its intent to launch four satellites for Sateliot's 5G constellation in March 2024. The announcement suggests the country’s aspirations to become a leader in space-based 5G technologies. This supportive outlook of China 5G from space industry opens new investment and expansion opportunities for players.

Key 5G From Space Market Players:

- Lockheed Martin

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boeing

- Thales Alenia Space

- Airbus Defence and Space

- Northrop Grumman

The 5G from space market is highly competitive, with several key players driving innovative ideas and technological advancements to capture a large share. Key companies in the market include Lockheed Martin, Airbus Defence and Space, Boeing, Thales Alenia Space, and Northrop Grumman. These companies are significantly investing in satellite technology and 5G infrastructure to provide greater connectivity even to the most unreachable parts of the world.

Moreover, several telecom providers and aerospace companies are partnering or collaborating to accelerate the deployment of 5G from space solutions. The launch of 5G satellites by companies represents a fundamental step to achieving global 5G coverage and illustrates the efforts put in by various players to deploy new solutions versatile enough to meet the rising demand for satellite-based 5G services.

Here are some leading players in the market:

Recent Developments

- In March 2024, Vodafone and Ericsson announced their collaboration to deploy compact 5G antennas across Germany. These smaller, more efficient antennas are engineered to boost 5G coverage and capacity in high-demand urban areas. The partnership aims to enhance Germany's existing 5G infrastructure, providing faster and more reliable connections in densely populated regions.

- In January 2024, SpaceX launched a new batch of Starlink satellites designed to provide 5G direct-to-cell connectivity. This upgrade allows the satellites to link directly with mobile phones, enabling enhanced internet and communication services without relying on ground infrastructure. The new technology marks a significant step toward global satellite-based mobile communications.

- Report ID: 6504

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5G from Space Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.