5G Virtual Reality Market Outlook:

5G Virtual Reality Market size was valued at USD 113.6 billion in 2025 and is projected to reach USD 641.5 billion by the end of 2035, rising at a CAGR of 18.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of 5G virtual reality is assessed at USD 135.1 billion.

The 5G virtual reality market is being shaped by public sector investment in advanced wireless infrastructure and by enterprise-led adoption across training, healthcare, manufacturing, and defense use cases. The government data confirms the rapid expansion of the 5G capacity that underpins the VR deployment at scale. The report from CITA 2024 has depicted that 330 million people in the U.S. have access to 5G services with mid-band spectrum deployment delivering significantly higher capacity and lower latency than earlier networks, directly supporting immersive applications in industrial and institutional settings. The data from Congress.gov in November 2023 reported that the FCC has allocated USD 9 billion for 5G funding, prioritizing low-latency use cases such as advanced simulation, telemedicine, and workforce training and environments.

From a demand perspective, the government and non-profit organizations highlight VR as a strategic digital capability rather than a consumer novelty. The U.S. Department of Defense has disclosed expanding use of immersive simulation for pilot training, battlefield rehearsal, and equipment maintenance with networked VR environments, reducing training costs and physical asset usage while increasing the repetition frequency. In healthcare, the National Institutes of Health report growing federally funded research into VR-assisted surgery planning, pain management, and clinical skills training aided by the high-speed wireless connectivity in the hospital campuses. Further, the 5G virtual reality market is being driven by institutional spending, regulated network expansion, and measurable productivity outcomes rather than short-cycle consumer demand.

Key 5G Virtual Reality Market Insights Summary:

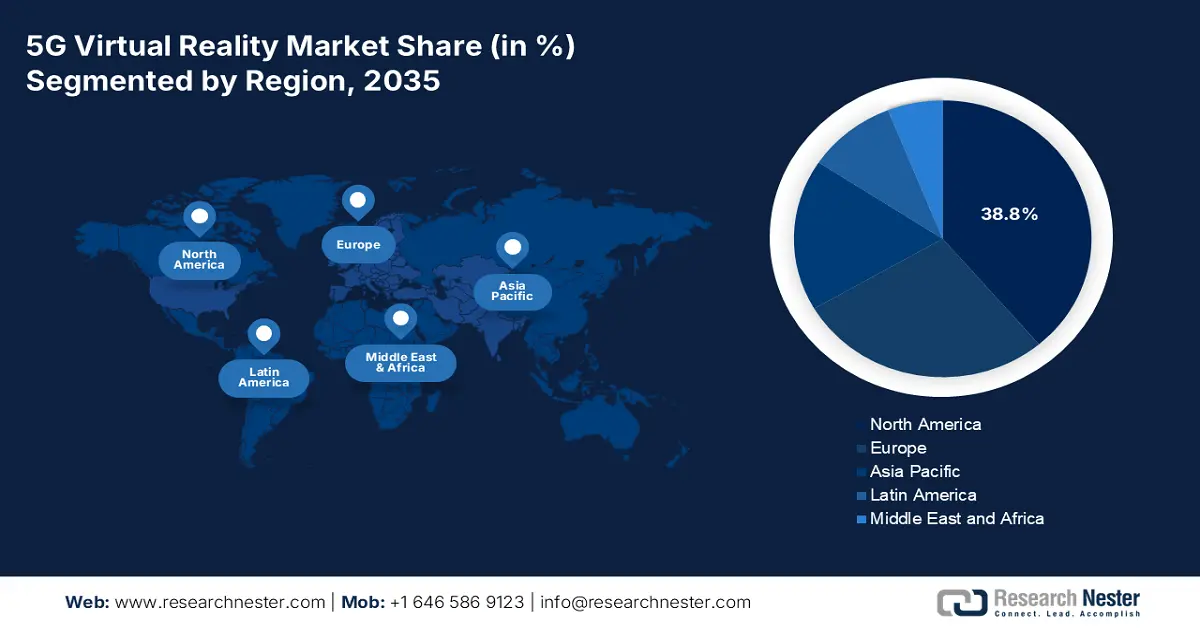

Regional Insights:

- North America is projected to command a 38.8% share by 2035 in the 5g virtual reality market, supported by early leadership in 5G standalone rollouts, heavy defense-sector simulation spending, and a strong venture capital environment advancing immersive technologies

- Asia Pacific is forecast to expand at a CAGR of 26.5% during 2026–2035, underpinned by large-scale government-backed 5G infrastructure investments and rapid digitalization across manufacturing, gaming, and cloud-based immersive ecosystems

Segment Insights:

- 5G standalone network VR, under the technology segment, is anticipated to capture a dominant 70.4% share by 2035 in the 5g virtual reality market, enabled by ultra-reliable low-latency communication and network slicing that enhance real-time cloud-rendered immersive experiences

- Enterprise, within the end-user segment, is expected to hold the leading share by 2035, accelerated by high ROI from immersive training, digital twin simulations, and remote collaboration across manufacturing, defense, and healthcare sectors

Key Growth Trends:

- Accelerating 5G SA Deployment

- Smart city and public infrastructure projects

Major Challenges:

- Technical complexity of 5G integration

- Network infrastructure and latency dependence

Key Players: Microsoft (U.S.), Apple (U.S.), Google (U.S.), Qualcomm (U.S.), NVIDIA (U.S.), HTC Vive (China), Sony (Japan), Samsung (South Korea), Pico (China), Varjo (Finland), Vive ((Taiwan, Province of China), Nokia (Finland), Ericsson (Sweden), Deutsche Telekom (Germany), SK Telecom (South Korea), LG Uplus (South Korea), Reliance Jio (India), Lenovo (China), Telefónica (Spain).

Global 5G Virtual Reality Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 113.6 billion

- 2026 Market Size: USD 135.1 billion

- Projected Market Size: USD 641.5 billion by 2035

- Growth Forecasts: 18.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: India, Canada, United Kingdom, France, Singapore

Last updated on : 24 December, 2025

USD 641.5 billion 5G Virtual Reality Market - Growth Drivers and Challenges

Growth Drivers

- Accelerating 5G SA Deployment: The global proliferation of the 5G standalone network infrastructure is a primary driver for the professional mobile VR adoption. The report from 5G Americas in April 2025 indicates that 5G has reached the inflection point with over 2.25 billion global connections, stimulating the rate 4 times faster than 4G. In the U.S., this translates to a rapid expansion of the core SA networks. The Federal Communications Commission data shows that there is a rise in population requiring high-speed. This robust low-latency connectivity enables high-fidelity cloud rendering, reducing the PC tethers and empowering standalone headsets in the field service and training. This infrastructure maturity is directly reflected in surging hardware procurement, with U.S. import data for the VR apparatus showing a YoY increase in advanced electronics categories, signaling a strong 5G virtual reality market response to improved network conditions.

- Smart city and public infrastructure projects: Smart city investments are creating new deployment environments for the 5 G-enabled VR used in urban planning, emergency response training, and infrastructure management. The U.S. Department of Transportation’s Smart City Challenge and subsequent programs continue to fund digital infrastructure pilots. The European Commission confirms that smart city initiatives are core to the national recovery and resilience plans. VR supported by 5G allows public authorities to simulate traffic systems disaster scenarios and construction projects before physical execution. Further, the U.S. Department of Transportation has highlighted that federally supported smart mobility and infrastructure programs are increasingly emphasizing digital twins and immersive simulation tools to improve the project planning accuracy and reduce the cost overruns on the large scale urban projects.

- Expansion of national 5G infrastructure program: Government-funded 5G rollouts are the foundational demand driver for enterprise VR adoption. Low latency and high bandwidth mandated under the national 5G strategies directly enable multi-user VR training simulation and remote operations. The report from the 5GAmericas in April 2025 has indicated that nearly 314 million subscriptions were registered in the U.S. in Q1 2025. Further, in Europe, the EU members launched 5G services, which were supported by public funding under the Digital Decade framework. These investments reduce network uncertainty for enterprises allowing long-term VR integration into manufacturing, healthcare, and defense workflows. Vendors aligned with public-sector 5G corridors, smart city zones, and federally funded campuses gain faster institutional adoption.

NTIA 5G-Related Grants

|

Applicant |

Funding Amount (USD) |

Project Title and Description |

|

Airspan Networks Inc. |

42,729,740 |

Highly Efficient 4G/5G O-RU Extensible Platform: Builds power-efficient radio units for 5G |

|

Analog Devices, Inc. |

9,979,097 |

Rakino Direct RF Radio Platform: Integrates chips for 5G interfaces |

|

DeepSig Inc. |

9,998,638 |

AI-Enabled O-RU Spectrum Awareness: AI/ML for 5G spectrum sharing |

|

EpiSys Science, Inc. |

8,168,674 |

Sidelink + ULPI: Unlocking O-RAN for 6G: Develops 5G-compatible sidelink radios |

|

New York University |

9,960,960 |

Spectrally Agile Open Radio Units for Upper Mid-Band: Advances 5G MIMO deployment |

|

Otava Inc. |

9,974,504 |

Advancing RF for FR3 Spectrum: Targets 7-24 GHz for 5G expansion |

|

Rampart Communications |

9,971,458 |

ASPEN - Advanced Signal Processing for O-RUs: 6G-ready but 5G foundational |

|

SecureG, Inc. |

6,468,420 |

SCT Registry for O-RU Security: Boosts 5G supply chain trust |

|

Skylark Wireless |

10,118,112 |

ArMORED: Massive-MIMO for Energy-Efficient 5G Devices |

Source: NTIA January 2025

Challenges

- Technical complexity of 5G integration: Seamlessly integrating 5G modems into lightweight power efficiency headsets presents significant engineering challenges in thermal management, antenna design, and battery life. The key players approach this with the Vision Pro, which opts for a Wi Fi first design, and a tethered battery pack indirectly highlights the difficulty of embedding high-performance 5G without compromising form factor. This complexity necessitates a deep expertise in both consumer electronics and telecommunications.

- Network infrastructure and latency dependence: The immersive promise of 5G VE is contingent on widespread ultra-reliable 5G standalone networks with edge computing. In regions with poor coverage, the user experience fails. Telecom partnerships are vital, as seen with SK Telecom in South Korea, which has enabled the 5G XR services and cloud streaming platforms to create a viable environment for the use of VR devices. Further 5G networks demonstrate the essential collaboration required to mitigate this core technical roadblock.

5G Virtual Reality Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.9% |

|

Base Year Market Size (2025) |

USD 113.6 billion |

|

Forecast Year Market Size (2035) |

USD 641.5 billion |

|

Regional Scope |

|

5G Virtual Reality Market Segmentation:

Technology Segment Analysis

Under the technology segment, the 5G standalone network VR is leading the 5G virtual reality market and is expected to hold the share value of 70.4% by 2035. The segment provides the essential ultra-reliable low-latency communication and network slicing required for seamless, high-fidelity immersive experiences. Unlike the non-standalone networks, the 5G SA offers a dedicated architecture that minimizes the latency and jitter, which is vital for real-time cloud rendering, multi-user social VR, and precise enterprise simulations. The key statistical indicator of this infrastructure push is the Federal Communications Commission’s reporting on the 5G deployment. The report from Ericsson in 2025 has depicted that the 5G smartphone subscriptions reaching 59% of North America smartphone connections signal broad availability, network maturity, and improving user experience, all of which are foundational enablers for 5G-based VR adoption.

End user Segment Analysis

In the end user, the enterprise sub-segment is expected to hold the largest share value in the 5G virtual reality market. The segment is driven by the high return on investment from deploying 5G VR for training design and remote collaboration. Industries such as manufacturing, defense, and healthcare use it for complex simulation, digital twin interaction, and procedural training, which reduces the physical risks and operational costs. The U.S. government’s investment highlights this trend. Federal funding for immersive training and digital engineering programs across the defense and healthcare sectors stimulates enterprise adoption. Further, the Public-sector pilot deployments also validate scalability, encouraging broader private-sector investment.

Device Type Segment Analysis

Standalone VR headsets are leading the device type segment and are driven by their untethered all-in-one design, which is fundamentally enhanced by 5G connectivity that delivers the high-speed data necessary for cloud computing and content streaming. This eliminates the need for the connected PC, making professional and consumer VR more accessible and mobile. The growth in this category is evident in trade data. The U.S. Census Bureau report in 2025 has indicated that as of January 2025 U.S. has imported 74,694.0 USD millions of advanced technologies, including virtual reality headsets, reflecting a strong 5G virtual reality market demand and production scaling for the standalone hardware. This growth in imports indicates a rising enterprise procurement for training and visualization use cases.

Our in-depth analysis of the 5G virtual reality market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Device Type |

|

|

Technology |

|

|

Application |

|

|

End user |

|

|

Offering |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5G Virtual Reality Market - Regional Analysis

North America Market Insights

North America is dominating the 5G virtual reality market and is poised to hold the share of 38.8% by 2035. The 5G virtual reality market is driven by the first-mover advantage in the 5G standalone deployment, substantial defense industrial spending, and a robust venture capital ecosystem for immersive tech. The key drivers include the U.S. Department of Defense’s multi-million-dollar investment in simulation and training, creating a high-value demand pipeline for enterprise and defense VR solutions. Further, Canada’s focused national strategy on digital adoption and 5G infrastructure in rural areas expands the accessible 5G virtual reality market. The primary trend is the shift from the tethered to cloud-rendered standalone professional headsets, fueled by the comprehensive SA coverage from the major carriers. The region is also a hub for R&D in core enabling technologies such as edge computing and AI-integrated VR, supported by the initiatives from the National Science Foundation and Canada’s innovation in Superclusters.

The U.S. 5G virtual reality market is defined by the deep integration of the 5G VR defense and critical infrastructure. The primary trend is the procurement of scalable networked simulation systems for Joint All-Domain Command and Control and soldier readiness backed by the sustained congressional appropriations. The recent trend is the use of 5G VR for the complex equipment maintenance and operational procedures in aviation and energy, leveraging federated digital twins. The DPVR has launched a new 5G cloud VR at CES in April 2021, supporting the demand for shifting from device-bound VR to network-enabled, cloud-based VR, particularly relevant for enterprise and institutional use cases. Further, the expansion of the public 5G SA networks and edge computing enables the transition from the PC, reducing the cost and increasing the flexibility.

Canada’s 5G virtual reality market is propelled by the strategic public investments aimed at digital adoption across the key economic sectors and bridging geographic connectivity divides. A foremost trend is the deployment of the 5G VR solutions for training and remote operations in mining, forestry, and energy supported by the federal programs such as the Innovation Superclusters Initiatives. Further, the market in Canada is gaining momentum with the recent news reporting Rogers Communications launching the nation’s first commercial 5G Standalone network, in March 2022. This deployment enabled a new national 5G core and device certification, providing the essential low latency high reliability connectivity required for the professional-grade cloud-rendered VR applications. Moreover, the infrastructure advancement directly supports the federal priorities outlined in the Canada Digital Adoption Program in June 2024, a USD 4 billion initiative to help businesses adopt digital technologies such as VR for training and operational planning.

APAC Market Insights

Asia Pacific is the fastest-growing 5G virtual reality market and is expected to grow at a CAGR of 26.5% during the forecast period 2026 to 2035. The 5G virtual reality market is driven by the massive state-led investments in the 5G infrastructure, aggressive digitalization of manufacturing, and the world’s largest consumer electronics and gaming base. China’s national strategy prioritizes integrating the 5G VR into smart factories and city management. Japan and South Korea focus on high-value enterprise solutions and premium consumer content, leveraging their advanced semiconductor and display industries. Emerging giants such as India are vital for future scale, with government programs using digital twins for infrastructure planning, and other initiatives for IT hardware aim to boost the local VR device manufacturing. The key trend is the expansion of affordable cloud-based VR experiences, bypassing the need for expensive local processing and making the technology accessible to millions of new users.

The 5G virtual reality market in China is fundamentally shaped by the state-driven industrial policy and real-world applications developed via strategic partnerships between the telecom operators and technology providers. The prime example is the launch of the country’s first 5G VR remote patient visitation system at the West China Hospital in Sichuan province in March 2021, a collaboration between the ZTE Corporation and China Telecom. This system utilized the 5G high-speed, low-latency transmission to power the medical robots and 8K panoramic cameras, allowing the family members to wear VR glasses to conduct immersive, real-time visits with the ICU patients, directly addressing the challenges in visitation. This early, practical deployment exemplifies the application-centric approach mandated by national initiatives like 5G and Industrial Internet.

Recent Developments to the 5G Virtual Reality Market

|

Launch Year |

Company/Consortium |

Aim |

|

August 2024 |

Dang Hong Qi Tian, ZTE, China Mobile, Qualcomm, Xiaomi |

Free-roam immersive VR gaming via 5G-A Minimalist Private Network at ChinaJoy 2024; supports 100+ users at <10ms latency using mmWave and Snapdragon X75 |

|

February 2023 |

Fujitsu (with NTT DOCOMO OREC) |

5G vRAN solution with NVIDIA GPU for virtualized CU/DU; enables global carrier deployment for high-capacity 5G VR infrastructure starting March 2023 |

|

January 2021 |

iQIYI (Qiyu VR) with Qualcomm |

iQiyu 3 headset launch (Q2 2025) powered by Snapdragon XR2 and Q-Light 6DoF CV tech; focuses on untethered gaming/streaming enhanced by 5G connectivity |

Source: ZTE, Fujitsu, iQIYI

The India 5G virtual reality market is experiencing a rapid growth and is fueled by the nation’s massive digital public infrastructure push and expanding 5G connectivity, with the adoption spanning from the consumer-facing innovations to large scalw governemtn projects. Illustrating this consumer and commercial frontier, Bharti Airtel launched India’s first 5 G-powered immersive VR advertisement in October 2022, showcasing a novel format on its Airtel Thanks app to enable deeper brand engagement and signaling the beginning of scalable consumer marketing applications for the technology. This development complements foundational state led initatives that drive the enterprise and public sector demand. The strategic partnerships among the telecom giants and content creators are accelerating this ecosystem, with Airtel collaborating with the major studios to develop native 5G VR experiences.

Europe Market Insights

The Europe 5G virtual reality market is defined by a strong focus on enterprise and industrial applications driven by the strategic EU-wide digital initiatives and significant public-private investment. As a centerpiece of the Eu’s Digital Decade 2030 policy which aims to have all critical entities covered by 5G and to double the EU’s share in the VR/AR production growth is heavily focused on sectors such as advanced manufacturing healthcare training and automotive design, a key driver is the integration of VR with digital twin technology for smart factories and urban planning supported by substantial EU funding. This emphasis on professional applications, combined with the robust data privacy standards, positions Europe as a leader in developing secure, high-value B2B 5G VR solutions rather than mass consumer entertainment.

The Germany 5G virtual reality market is anchored in its world-leading Industrie 4.0 manufacturing sector, where the technology is the vital enabler for the digital twins remote maintenance and complex assembly training. The growth is driven by the federal strategies, such as the 5G strategy for Germany, which prioritizes the industrial campuses and has led to substantial private investment from automotive and engineering giants. A significant growth of the 5G virtual reality market is the deployment of the number of operational 5G base stations. Germany is witnessing an increase of 4%, from 49,571 in 2023 to 56,558 in 2024, based on the Mobile Europe May 2025 data. This extensive infrastructure rollout, mainly focused on industrial sites, is essential for synchronizing physical production lines with their virtual counterparts in real-time.

The UK virtual reailty market is distinguished by the world-class creative industries and a strategic focus on network diversification and security, driving the demand in defense, immersive media, and professional services. A primary example is the BT’s launch of the UK’s first 5G enabled interactive immersive spaces in partnership with immersive interactive Ltd in May 2023. These spaces utilize the EE mobile network to create rooms or mobile units under 360 degree projected content augmented with lights sounds and smells simulates the real environment for training education and consumer experiences early adoption by the institutions such as Cadoxton Primary School in Wales and Borders College in Scotland demonstrates the tangible use of 5G VR for creating and interactive remote classrooms and enhancing the vocational training. This move by a major telecom operator to productize 5G VR for enterprise and the public sector underscores the shift beyond consumer gaming towards scalable, network-dependent B2B solutions that enhance learning, simulation, and remote collaboration.

Key 5G Virtual Reality Market Players:

- Meta (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft (U.S.)

- Apple (U.S.)

- Google (U.S.)

- Qualcomm (U.S.)

- NVIDIA (U.S.)

- HTC Vive (China)

- Sony (Japan)

- Samsung (South Korea)

- Pico (China)

- Varjo (Finland)

- Vive ((Taiwan, Province of China)

- Nokia (Finland)

- Ericsson (Sweden)

- Deutsche Telekom (Germany)

- SK Telecom (South Korea)

- LG Uplus (South Korea)

- Reliance Jio (India)

- Lenovo (China)

- Telefónica (Spain)

- Meta is actively shaping the consumer 5G virtual reality market via its Meta Quest line, betting on a social mobile-first metaverse. The company's core strategy involves subsidizing hardware to build a massive user base while investing in the Horizon social platforms and developer partnerships to create an exclusive content ecosystem. The company has made a revenue of 48,385 USD million in the Q4 2024.

- Microsoft aims at the enterprise and professional 5G virtual reality market with its HoloLens mixed reality devices and Azure cloud services. Its strategic initiative centers on the Azure Mixed Reality & Cloud Services pairing high-performance HoloLens 2 devices with the 5 G-powered cloud rendering and digital twin solutions.

- Apple is entering the high-end 5G virtual reality market with its Apple Vision Pro, emphasizing a spatial computing paradigm. Its strategy is one of vertical integration and premium positioning, creating a tightly controlled ecosystem where custom silicon, a dedicated operating system, and seamless integration with Apple products surely deliver a seamless user experience.

- Google is pursuing a platform-agnostic approach in the 5G virtual reality market primarily via its Android ecosystem and Google Cloud. Its strategic initiatives include developing Android XR to standardize software for OEM partners and advancing immersive streaming for XR on Google Cloud. This service uses 5G for high bandwidth to stream photorealistic, VR, and AR experiences.

- Qualcomm is a dominant player in the mobile 5G virtual reality market as the foundational silicon provider. Its strategy revolves around its Snapdragon XR platforms that are system-on-chip specially designed for the AR/VR devices, integrally bundled with 5G modems. By providing the reference design for most standalone headsets, the company controls the core architecture driving the performance which is vital for cloud-assisted VR. The company has made a revenue of USD 11.3 billion in Q4 2025.

Here is a list of key players operating in the global 5G virtual reality market:

The 5G virtual reality market is fiercely competitive and is fragmented into hardware/ecosystem giants and enabling technology network programmers. The key strategy includes vertical integration, as seen with Apple’s controlled ecosystem and Meta’s heavy investment in VR R&D and social platforms. The strategic partnerships are vital with companies such as NVIDIA collaborating with telecoms for the cloud-based VR rendering and Qualcomm providing essential XR chipsets to multiple headset makers. The network operators, such as SK Telecom and Deutsche Telekom, are driving the adoption via curated 5G VR content services and enterprise solutions, aiming to monetize the 5G infrastructure. The race is to define the dominant platform and capture the early market share in both consumer and enterprise segments. A recent news is that Ericsson, Volvo Group, and Airtel announced the research collaboration on Digital Twins & XR over 5G Advanced in India in March 2025, directly targeting the core use cases of the 5G VR ecosystem.

Corporate Landscape of the 5G Virtual Reality Market:

Recent Developments

- In June 2025, China has announced the opening of its first 5G virtual reality (VR) theme park in south China’s Guangxi Zhuang Autonomous Region. This new theme park is designed by VR entertainment company Sky Limit Entertainment, is situated on a tourism street in the southern Chinese city of Liuzhou.

- In March 2025, HTC G REINGS has announced that it is building a latest immersive VR collaboration solution that leverages 5G and Edge computing to effectively address existing pain points in VR multi-user collaboration.

- In October 2025, NVIDIA and Nokia announced a strategic partnership to add NVIDIA-powered, commercial-grade AI-RAN products to Nokia’s industry-leading RAN portfolio, enabling communication service providers to launch AI-native 5G-Advanced and 6G networks on NVIDIA platforms.

- Report ID: 3441

- Published Date: Dec 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5G Virtual Reality Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.