mmWave 5G Market Outlook:

mmWave 5G Market size was valued at USD 3.68 billion in 2025 and is expected to reach USD 14.25 billion by 2035, registering around 14.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of mmWave 5G is evaluated at USD 4.16 billion.

The enhanced mobile broadband (eMBB) in high-capacity locations is extensively used as the primary boosting factor for the market owing to its proficiency in handling large data transfers efficiently and maintaining high amidst network congestion. Sectoral growth is propelled by a robust increase in global mobile service revenues, which saw a rise of approximately 15% between 2020 and 2023, or about 4.6% annually. This technology is pivotal in areas such as airports and concerts, where demand for connectivity without speed degradation is critical.

In addition to these, factors that are believed to fuel the market growth of the market include enhanced last-mile connectivity solutions and mmWave’s seamless service delivery. eMBB’s advancements in high-density areas support diverse applications, from HD streaming to cloud services boosting sectoral expansion in urban centers.

Key mmWave 5G Market Insights Summary:

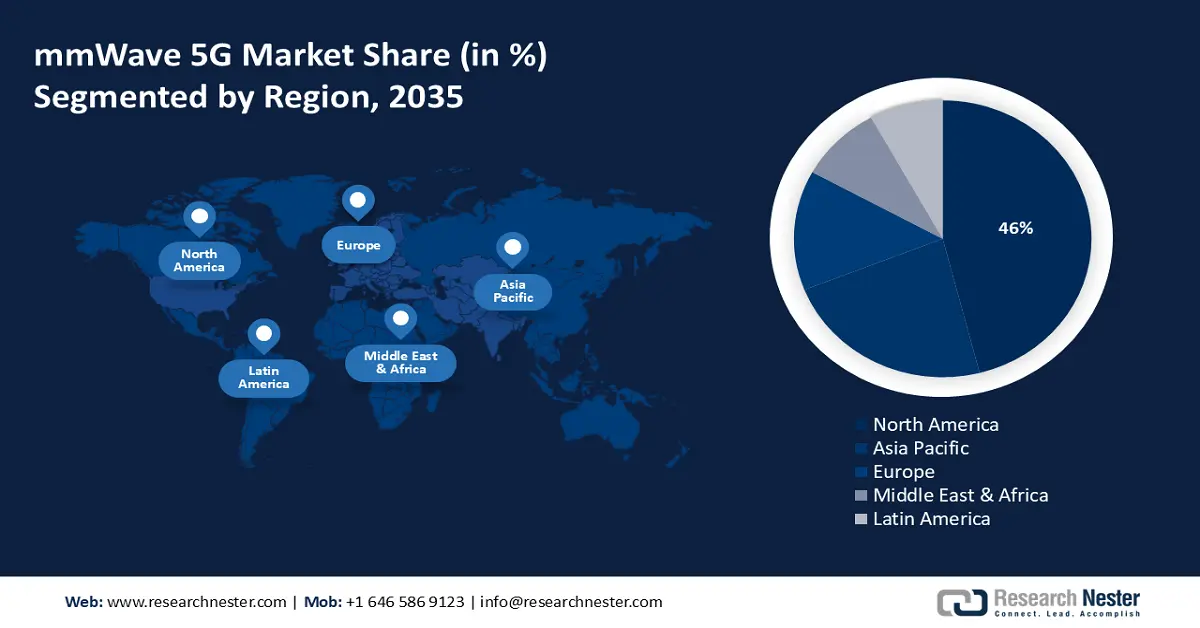

Regional Highlights:

- North America mmwave 5g market will secure over 46% share by 2035, driven by Verizon’s deployment of O-RAN radios and network innovation.

- Asia Pacific market will account for 23% share by 2035, driven by evolving regulatory frameworks and mmWave 5G advancements led by Qualcomm.

Segment Insights:

- The embb segment in the mmwave 5g market is expected to capture a 58% share by 2035, driven by the deployment of 5G NR technology enabling wired-like performance and support for high-bandwidth applications.

- The augmented reality-virtual reality segment in the mmwave 5g market is projected to achieve a 52% share by 2035, fueled by mmwave 5g's low latency and high bandwidth.

Key Growth Trends:

- Demand for High-Speed Connectivity

- Urban Development & Emerging Use Cases

Major Challenges:

- High Deployment Costs

Key Players: NXP Semiconductors, Airspan Networks, AT&T, Fastweb, Corning, Nokia, Mavenir, AMD, Qualcomm, Ericsson.

Global mmWave 5G Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.68 billion

- 2026 Market Size: USD 4.16 billion

- Projected Market Size: USD 14.25 billion by 2035

- Growth Forecasts: 14.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

mmWave 5G Market Growth Drivers and Challenges:

Growth Drivers

- Demand for High-Speed Connectivity: The mmWave 5G Marketis bolstered by an unparalleled demand for swift internet connectivity, with 2022 witnessing a leap in internet speeds by 20% year over year, reaching a national average of 119.03 Mbps. Tracking back to the 1980s, consumer internet use has surged by 62% annually, reflecting a profound shift in digital consumption habits. This relentless pursuit of rapid data services, powered by emergent technologies demanding high bandwidth like 4K/8K video streaming, AR, and VR propels the adoption of 5G mmWave, establishing it as a linchpin in the trajectory of a global internet services expansion.

- Urban Development & Emerging Use Cases: As the second-largest telecom market globally, India’s substantial subscriber base of 1.079 billion as of December 2023, showcases the burgeoning potential of 5GmmWave technology, particularly in untapped rural areas with a teledensity of 58.8%. In contrast, urban regions have a much higher teledensity of 133.76%, reflecting industry saturation and the need for advanced solutions like mmWave to address the dense data traffic. The deployment of 5G mmWave in these varied demographics is expected to revolutionize connectivity, enabling new use cases across the vast consumer spectrum, from smart cities in urban centers to digital inclusion initiatives in rural localities.

- Infrastructure Expansion & Device Ecosystem: Network densification stands as a critical driver in the 5G mmWave market’s growth, with operators expanding infrastructure through a denser array of small cells to meet urban demand. In parallel, the availability of mmWave-compatible devices is escalating, fueling market penetration. As of 2023, the expansion is synchronized with the increased internet speeds and consistent year-on-year growth in consumer internet usage since the 1980s. This synergy between infrastructure and device availability is crucial for the adoption and widespread utilization of mmWave’s high-speed capabilities, marking a new era in high-capacity, low-latency communication services.

Challenges

- High Deployment Costs: Expanding 5GmmWave technology comes with steep deployment costs due to the need for high-density small-cell networks. To cover areas effectively, carriers face substantial expenses from installing numerous cells, exacerbated by mmWave’s limited coverage and direct line of sight requirements. Until economies of scale are achieved and costs decrease, the proliferation of mmWavw will hinge on overcoming financial hurdles.

- mmWave’s range limitations render it less suitable for suburban and rural areas, potentially slowing adoption outside dense urban environments where its high capacity is less critical.

- The transition of mmWave 5G necessitates extensive underground fiber installations and a compatible device ecosystem, demanding significant infrastructural changes and market adaptation for widespread utilization.

mmWave 5G Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.5% |

|

Base Year Market Size (2025) |

USD 3.68 billion |

|

Forecast Year Market Size (2035) |

USD 14.25 billion |

|

Regional Scope |

|

mmWave 5G Market Segmentation:

Use Case Segment Analysis

The eMBB segment in the mmWave 5G market is estimated to gain a significant share of about 58% in the year 2035. The segment growth can be attributed to the deployment of 5G new radio (NR) technology, which focuses on operating across higher frequency bands between 410 MHz-7125 MHz or 24250 MHz-52600MHz. This initiative is set to provide wired-like performance and reliability, a strategic move to support the burgeoning influx of new devices and applications that demand extensive bandwidth. eMBB leverages these capabilities of 5G NR to ensure fast and reliable mobile broadband services. Such advancements are crucial for facilitating cutting-edge applications, including augmented reality (AR), virtual reality (VR), and 4K media, that are rapidly gaining prominence.

Application Segment Analysis

The AR/VR segment in the mmWave 5G market is estimated to gain a significant share of about 52% in the year 2035, riding on the back of 5G technology, which promises to revolutionize the user experience in augmented and virtual reality. This surge is directly linked to mmWave’s 5G capability to deliver expansive bandwidth with minimal latency ensuring that data transfers easily between devices. Such technological strides are essential for seamless AR and VR content without jitters and disruptions are pivotal, making mmWave 5G a cornerstone of AR/VR sectoral growth.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

Use Case |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

mmWave 5G Market Regional Analysis:

North American Market Insights

mmWave 5G market in North America industry is anticipated to dominate majority revenue share of 46% by 2035. The market growth in the region is expected on account of significant advancements like Verizon’s deployment of over 130,000 O-RAN capable radios, including massive MIMO units, across 15,000 virtualized sites. Verizons strategic acquisition of Verena networks enhances their trajectory in resolving mmWave 5G challenges, contributing to expansive network growth. Verena’s platform mitigates the need for separate wired backhauls by integrating access and backhaul in a single mmWave antenna, streamlining installations, and solidifying North America’s leadership in the global 5G landscape.

APAC Market Insights

The Asia Pacific mmWave 5G market is estimated to be the second largest, share of about 23% by the end of 2035. The market’s expansion can be attributed majorly to the evolving regulatory framework that supports 5G advancements. For instance, Qualcomm technologies incorporation, achieved a milestone with its 5G standalone (SA) mmWave performance, facilitating wider commercial mmWave deployment. With the global internet user base expanding, 5G SA mmWave is set to unlock new capabilities for more sectors and users. The Qualcomm snapdragon X65 5G modern-RF systems demonstrated its prowess by achieving over 7.1 Gbps download speed and 2.1 Gbps upload speed in tests conducted with ZTE, nokia shanghai bell, and CICT mobile’s network infrastructure, guided by China Academy of Information and Communication Technology (CAICT) and China’s IMT-2020 5G promotion group.

mmWave 5G Market Players:

- NXP Semiconductors

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Airspan Networks

- AT&T

- Fastweb

- Corning

- Nokia

- Mavenir

- AMD

- Qualcomm

- Ericsson

Recent Developments

- February 27, 2022; Fastweb collaborated with Qualcomm Technologies to harness standalone FR2 capabilities, which enabled swift deployment of 5G mmWave fixed wireless access across Italy, benefitting both households and businesses with advanced 5G connectivity.

- January 24, 2022; Nokia and SK Telecom joined forced in South Korea to develop a new virtualized RAN network. This partnership has led to the world’s first successful deployment of a 5G 64TRX vRAN, showcasing network adaptability and enhanced performance through baseband virtualization. A filed test for this vRAN technology was scheduled for 2022

- Report ID: 5944

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

mmWave 5G Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.