Virtual Event Platform Market Outlook:

Virtual Event Platform Market size was over USD 16.47 billion in 2025 and is anticipated to cross USD 54.44 billion by 2035, witnessing more than 12.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of virtual event platform is assessed at USD 18.35 billion.

The growth of the market can be attributed to the increased adoption of virtual event platforms owing to rapid digitization across private and public organizations. For instance, over 90% of companies are involved in digital initiatives and 88% are implementing digital-first strategies. From 2020 to 2023, companies are expected to invest USD 6 trillion in direct digital transformation as they build on prevalent investments and strategies and become digital enterprises. Digital transformation of organizations has enabled them to shift major operations and activities to the digital space. This has created a demand for virtual event platforms that provide features such as live streaming, virtual conferencing, and interactive features that allow users to have an engaging experience.

In addition to these, factors that are believed to fuel the market growth of virtual event platforms include the rising demand for cost-effective and secure communication solutions and the rapid adoption of digital technologies such as AI, cloud, and analytics. Furthermore, the availability of better internet infrastructure and the growing number of 5G subscriptions are also expected to drive the market growth. As of the year 2021, there were approximately 660 million subscriptions to the 5G network in use. The world is projected to have 5 billion subscriptions to 5G by 2028. 5G networks offer faster data speeds, which allow for more reliable streaming and higher-quality video for virtual events. This improved experience and increased reliability can help to drive more people to subscribe to virtual events platforms.

Key Virtual Event Platform Market Insights Summary:

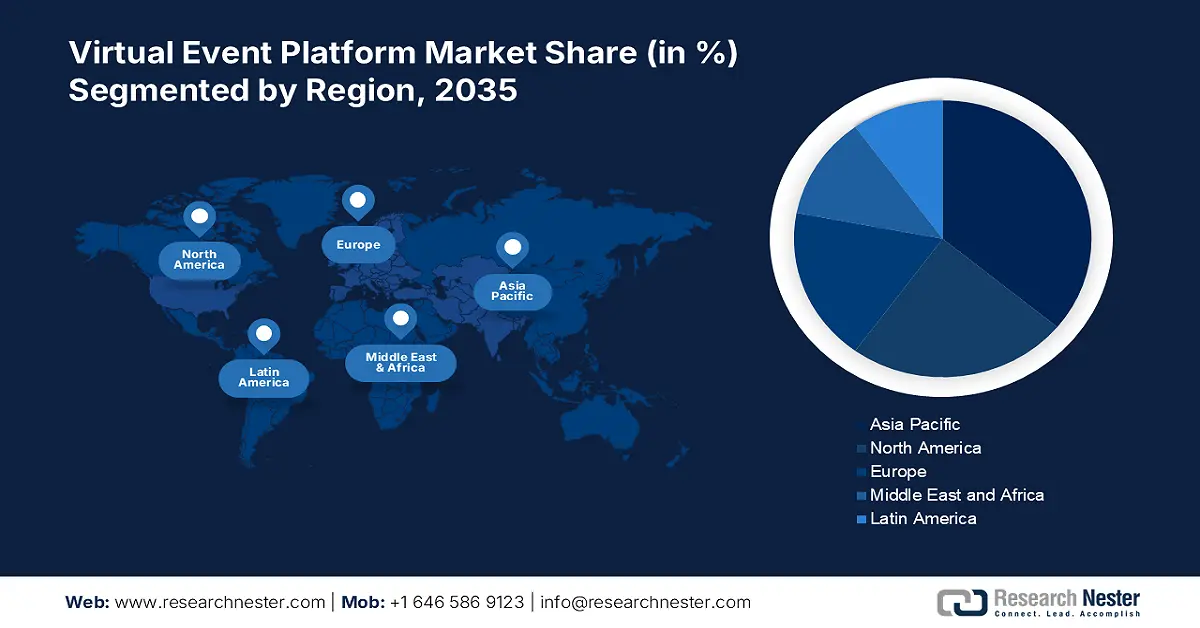

Regional Highlights:

- The Asia Pacific virtual event platform market is projected to capture a 38% share by 2035, attributed to the increasing tech-savvy millennial population and rising internet access.

- The North America market is expected to secure a 27% share by 2035, fueled by the increased adoption of cloud-based technology and virtual events.

Segment Insights:

- The small & medium enterprises segment in the virtual event platform market is projected to secure a 59% share by 2035, influenced by the affordability, scalability, and cost-effectiveness of cloud-based solutions.

- The services segment in the virtual event platform market is projected to capture a 34% share by 2035, driven by increased demand for consulting and support services for virtual platforms.

Key Growth Trends:

- Rising Popularity of Virtual Events

- Rise in Popularity of Online Streaming

Major Challenges:

- Network latency and inadequate bandwidth

- Lack of awareness about these platforms in certain regions

Key Players: Zoom Video Communications, Inc., 6Connex, Microsoft Corporation, Cisco Systems Inc., ALE International, HOPIN, On24, ALIVE, Avaya Inc., BIGMARKER.

Global Virtual Event Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.47 billion

- 2026 Market Size: USD 18.35 billion

- Projected Market Size: USD 54.44 billion by 2035

- Growth Forecasts: 12.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 11 September, 2025

Virtual Event Platform Market Growth Drivers and Challenges:

Growth Drivers

- Rising Popularity of Virtual Events- For instance, a survey in 2023 found that 76% of respondents cited ease of attendance in virtual events, 65% said global reach, and 48% said the low cost made them more inclined to consider virtual events. Virtual events, such as conferences, webinars, and live streaming, are becoming increasingly popular due to the convenience and ability to reach a larger audience. This increased demand for virtual events has caused an increase in the need for virtual event platforms, which provide the necessary technology and infrastructure for these events.

- Growing Importance of the Event Management Industry - It has been observed that 40% of marketers believe event marketing to be the most crucial channel, while 69% plan on continuing to invest in virtual meetings and events in the future. As organizations strive to increase their visibility, digital events are becoming more popular. Event management companies are increasingly relying on virtual event platforms to ensure that their events are successful and engaging.

- Promoted Remote Work as a Result of COVID-19 Pandemic - Between March 2020 and March 2021, remote job options increased by more than 1000%. A year after the pandemic, about 16% of jobs in the US offered remote work, up from about 1.3% at the start. Also, approximately 17% of companies around the world have remote employees that work from home. Remote work has allowed organizations to cut down on costs related to travel and accommodations for events and conferences, leading to an increased demand for virtual event platforms. The platforms offer features such as virtual meeting rooms, webinars, and video conferencing, to facilitate remote events.

- Emerging Trend of BYOD (Bring Your Own Devices) - BYOD allows people to connect with events remotely, making it easier for them to access content on their own devices. It is estimated that 76% of employees use their personal cell phones for work purposes. More than 80% of organizations worldwide have a BYOD policy.

- Rise in Popularity of Online Streaming - Approximately 60% of young adults in the United States prefer to watch TV online through streaming services. The number of subscribers for Netflix, a streaming service platform, had reached approximately 230 million by the end of the year 2022 worldwide. With the rise of online streaming, more people are now able to access events from anywhere in the world. This has created a demand for virtual event platforms which enable users to host, manage and promote virtual events in a secure and reliable manner.

Challenges

- Network latency and inadequate bandwidth - Without a reliable and fast internet connection, virtual events can be difficult to host and attend due to delays in audio and video streaming, as well as in communication between participants. These factors can severely limit the potential of virtual events and limit the growth of the virtual event platform market.

- Lack of awareness about these platforms in certain regions

high cost of developing and managing these platforms - Lack of two way communication

Virtual Event Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.7% |

|

Base Year Market Size (2025) |

USD 16.47 billion |

|

Forecast Year Market Size (2035) |

USD 54.44 billion |

|

Regional Scope |

|

Virtual Event Platform Market Segmentation:

Component Segment Analysis

The services segment is estimated to gain the largest market share of about 34% in the year 2035. The growth of the segment can be attributed to the increased demand for customized services such as consulting and support services. Management consulting is expected to be automated by 29% in the near future. In addition, investments in digital trust services are expected to reach 100 billion by 2025. Companies are recognizing the benefits of using virtual event platforms in terms of cost savings and enhanced customer experience. This is driving demand for services such as consulting and support services in order to help companies better understand the platform and maximize its potential. Additionally, companies are increasingly turning to virtual event platforms to host events, which is also driving the demand for services.

Organization Segment Analysis

The small & medium-sized enterprises segment is estimated to gain the significant market share of about 59% in the year 2035. The growth of the segment can be attributed to the rise in adoption of cloud-based solutions by small & medium-sized enterprises owing to their affordability and scalability, as well as their minimal upfront costs. Moreover, the rising trend of small businesses hosting virtual events as well as the increasing number of new entrants into the market providing specialized services which cater to this segment of customers. Additionally, the cost-effectiveness of virtual events compared to physical events is a major factor driving the adoption of virtual event platforms amongst small and medium-sized enterprises.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Organization Size |

|

|

By Event Type |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Virtual Event Platform Market Regional Analysis:

APAC Market Insights

The market share of virtual event platform in Asia Pacific, amongst the market in all the other regions, is projected to be the largest with a share of about 38% by the end of 2035. The growth of the market can be attributed majorly to the increasing number of millennials who are more tech-savvy and have a higher acceptance of virtual events, rising availability of high-speed internet access and increasing demand for cost-effective and personalized online events. Moreover, the growth in 4G (and 5G) internet connections in the region is projected to fuel the growth of the region's market. Approximately 55% and 80% of 4G internet connections were made in India and China, respectively, in 2019. 5G connections and base stations in China are the highest in the world. By the end of 2021, the number of 5G connections reached 478 million. As the internet connection speeds increase, more people are able to access and use cloud-based platforms, allowing them to take advantage of virtual event platforms such as video conferencing and streaming. This has made it easier for consumers to access events and participate in them from anywhere with a reliable internet connection, thereby driving up demand.

North American Market Insights

The North America virtual event platform market is estimated to be the second largest, registering a share of about 27% by the end of 2035. As a result of the pandemic, more and more companies and organizations in region are opting for virtual events owing to the restrictions on travelling and physical events, contributing to the regional market growth. Additionally, the increasing adoption of cloud-based technology in region, which is providing cost-effective solutions for virtual events, is also driving the growth of the market. Cloud-based technology offers scalability, enhanced storage, and cost-effectiveness, which makes it a viable choice in the event management industry. Additionally, the availability of high-speed internet in North America has enabled a large number of organizations to adopt cloud-based technology. In addition to reducing costs, this has allowed firms to take advantage of the latest technologies as well.

Europe Market Insights

Europe region is anticipated to register substantial growth through 2035. The European Union has been at the forefront of encouraging the use of digital technologies in various industries, owing to the numerous benefits they have to offer in terms of cost-effectiveness and flexibility. This has contributed to increased adoption of virtual event platforms in the region, driving the growth of the market. Moreover, with the increasing demand for financial services and products in the region, there has been a shift in the way these services are offered. More and more companies are turning to virtual events and platforms as a way to reach customers, as this allows them to reach a larger audience and provide more personalized services. As a result, the demand for these platforms is expected to increase in the near future.

Virtual Event Platform Market Players:

- Zoom Video Communications, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 6Connex

- Microsoft Corporation

- Cisco Systems Inc.

- ALE International

- HOPIN

- On24

- ALIVE

- Avaya Inc.

- BIGMARKER

Recent Developments

- Zoom Video Communications, Inc. introduced a number of enhancements to its OnZoom, End-to-End Encryption, Zapps, and Core UC platforms during its Zoomtopia keynote address. Over USD 1.5 million has also been pledged for grants to remote learning programs.

- 6Connex hosted a virtual winter event titled Winter Celebration in Virtual Downtown Square, in which friends and families could connect and celebrate with holiday-themed virtual venues. The event was designed to recreate the feeling of a traditional holiday celebration in a virtual space. It featured holiday-themed virtual venues, music, and movies, and allowed friends and families to come together to celebrate the season.

- Report ID: 4904

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Virtual Event Platform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.