5G Infrastructure Market Outlook:

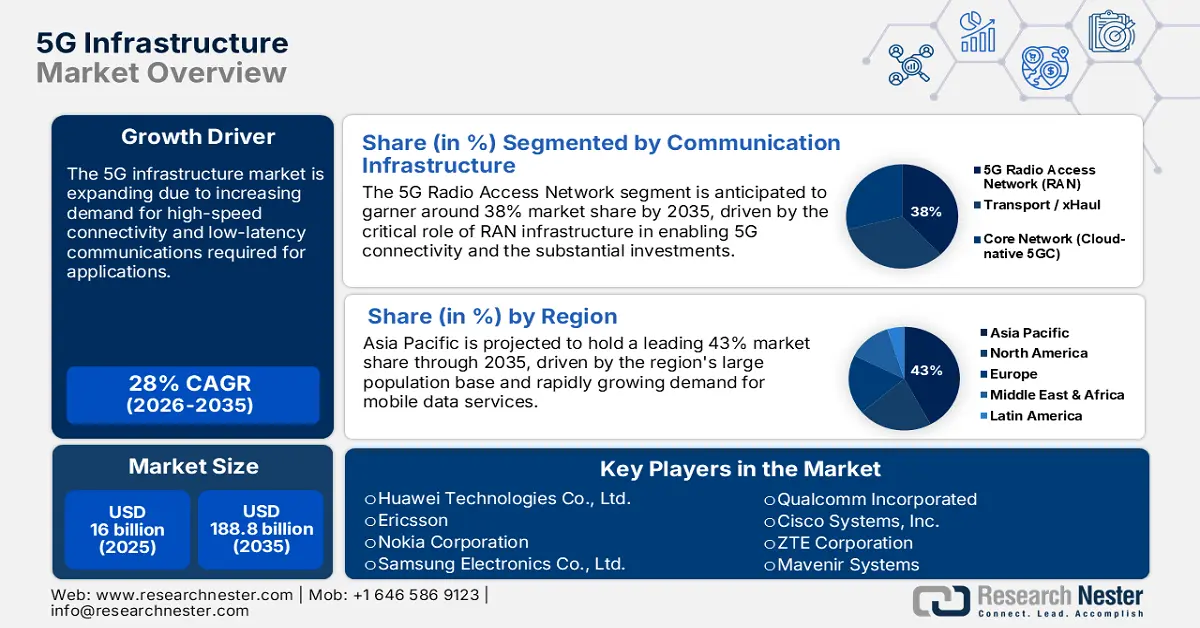

5G Infrastructure Market size is valued at USD 16 billion in 2025 and is projected to reach a valuation of USD 188.8 billion by the end of 2035, rising at a CAGR of 28% during the forecast period, i.e., 2026-2035. In 2026, the industry size of 5G infrastructure is estimated at USD 20.4 billion.

The 5G infrastructure market is expanding as telecommunication operators worldwide accelerate the rollout of networks to meet growing demands for ultra-low latency communications and massive device aggregation. Companies across various industries envision 5G's transformative potential, enabling industry automation, autonomous offerings, and immersive digital experiences through reliable, high-speed connectivity. For instance, Huawei Technologies Co., Ltd. launched its full commercial 5.5G network equipment in June 2023, featuring AI-native capabilities and ultra-large antenna arrays with 10-gigabit downlinks, demonstrating the technical excellence that is driving the industry forward. Network densification initiatives gain traction as operators deploy millions of small cells and macro base stations to offer complete coverage across urban and rural environments.

Government initiatives stimulate 5G infrastructure development with broad-based policy strategies, spectrum planning for availability, and massive investment projects aimed at digitalization objectives. The United States Federal Communications Commission initiated the 5G Fund for Rural America in December 2024 to facilitate the buildout of high-performance mobile wireless broadband infrastructure in underserved regions throughout the nation. Regulatory harmonization efforts enable international roaming functionality and interworking of networks across countries, while facilitating compliance with security standards across multiple jurisdictions. Public-private partnerships are viewed as critical enablers of sharing infrastructure capital expenditure costs and accelerating coverage expansion project timelines through collaborative financing models.

Key 5G Infrastructure Market Insights Summary:

Regional Highlights:

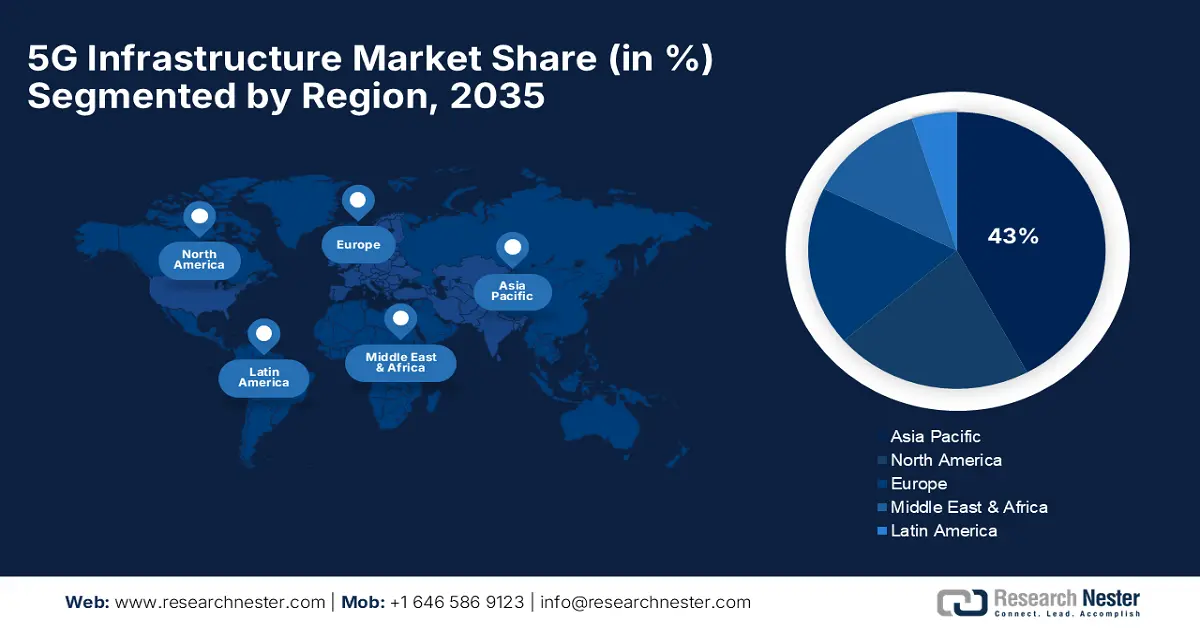

- The Asia Pacific region is projected to command a 43% share by 2035 in the 5G infrastructure market, driven by large-scale infrastructure investments, government subsidies, and a rapidly growing mobile subscriber base.

- North America is anticipated to register a 19% CAGR through 2035, spurred by accelerated operator deployment and extensive government funding in next-generation telecommunications infrastructure.

Segment Insights:

- The 5G Radio Access Network segment is projected to account for around 38% share by 2035 in the 5G infrastructure market, propelled by the extensive infrastructure installation requirements for macro base stations, small cells, and distributed antenna systems.

- The mid-band (1–6 GHz) segment is expected to hold a 45% share by 2035, sustained by superior coverage properties and capacity capabilities meeting varied 5G deployment needs.

Key Growth Trends:

- AI-powered network optimization and automation

- Ultra-low latency applications and enhanced mobile broadband

Major Challenges:

- Spectrum fragmentation and regulatory over-complexity

- Security vulnerabilities and supply chain issues

Key Players: Huawei Technologies Co., Ltd., Ericsson, Nokia Corporation, Samsung Electronics Co., Ltd., Qualcomm Incorporated, Cisco Systems, Inc., ZTE Corporation, Mavenir Systems, CommScope Holding Company, Inc., Oracle Corporation, NEC Corporation, Fujitsu Limited, Hitachi, Ltd., NTT Corporation, Panasonic Corporation

Global 5G Infrastructure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16 billion

- 2026 Market Size: USD 20.4 billion

- Projected Market Size: USD 188.8 billion by 2035

- Growth Forecasts: 28% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: India, Indonesia, Vietnam, Brazil, United Arab Emirates

Last updated on : 26 September, 2025

5G Infrastructure Market - Growth Drivers and Challenges

Growth Drivers

- AI-powered network optimization and automation: Integrating artificial intelligence transforms 5G infrastructure management by enabling predictive maintenance, automated network optimization, and intelligent resource allocation through complex distributed architectures. Machine learning algorithms are used by network providers to forecast traffic, optimize spectrum utilization, and provide low latency while reducing operational expenditure using automatic fault detection and healing. Emergent AI capabilities enhance network slicing capabilities by allocating resources dynamically based on application requirements and performance goals. In April 2025, Ericsson and GCI Communication Corp established a joint partnership for the deployment of cloud-native 5G Core networks with Intelligent Operations Center capabilities powered by AI. Smart network orchestration solutions orchestrate automated deployment workflows with guaranteed peak performance on heterogeneous infrastructure environments, including macro cells, small cells, and distributed antenna systems.

- Ultra-low latency applications and enhanced mobile broadband: Dissemination of bandwidth-demanding services like augmented reality, virtual reality, and 4K video streaming precipitates unprecedented capacity requirements for high-capacity 5G infrastructure with multi-gigabit data rates. Industrial automation applications require ultra-high-reliability, low-latency communication capability that only 5G networks in maturity can offer economically for mission-critical manufacturing procedures. Telehealth apps leverage the use of 5G connectivity for remote surgery, patient monitoring in real time, and telemedicine services with guaranteed quality of service parameters. For example, Qualcomm Incorporated made an announcement in March 2025 regarding the X85 5G Modem-RF with a built-in AI Processor, providing 12.5 Gbps download and 3.7 Gbps upload speeds. Autonomous vehicle operations necessitate vehicle-to-everything communication support based on end-to-end 5G infrastructure networks that provide high-speed, low-latency, and reliable coverage on transportation routes.

- Government digital infrastructure modernization programs: National governments around the world embrace end-to-end digital transformation paradigms that call for massive-scale deployment of 5G infrastructure to support smart city operations, digital government services, and economic competitiveness programs. Government organizations view 5G as a critical enabler of the digitalization of emergency services, transport networks, and public safety communications requiring assured high-speed connectivity. Military and defense requirements drive demand for secure private 5G networks for high-visibility communications, surveillance networks, and autonomous defense systems. In October 2024, the U.S. Department of Defense released its Private 5G Deployment Strategy, focusing on Open RAN solutions and advanced cybersecurity for military bases. The educational sector leverages 5G connectivity to enable virtual labs, distance learning, and collaborative research through high-bandwidth applications as well as real-time interactive capabilities.

5G and IoT Growth Drivers and Infrastructure Implications

|

Factor |

Detail |

Implication for 5G and IoT Markets |

|

5G Data Traffic Dominance |

76% of all data traffic by 2028 (2.6B TB) |

Massive infrastructure investment required for network capacity, edge computing, and low-latency solutions |

|

IoT Subscription Growth |

From 3.1B (2024) to 4.5B (2026) |

Expanding demand for LPWA networks, device management platforms, and industry-specific IoT solutions |

|

5G Network Rollout |

314 networks (2024) → 450 (2025) |

Accelerated global deployment creates opportunities for infrastructure vendors, spectrum management, and Open RAN solutions |

|

Smartphone-IoT Convergence |

6.6B smartphones + 3.1B IoT devices (2024) |

Hybrid connectivity solutions will thrive, necessitating interoperable protocols and unified security frameworks |

Source: 5GAmericas

Projected Global 5G Connections (2024-2029)

The global adoption of 5G technology is projected to experience exponential growth, rising from 2.25 billion connections in 2024 to 8.3 billion by 2029. This expansion represents a nearly fourfold increase in just five years, significantly outpacing previous wireless generations. By the end of this period, 5G is expected to dominate the wireless landscape, capturing 59% of all global wireless technology connections.

Source: 5GAmericas

Challenges

- Spectrum fragmentation and regulatory over-complexity: Network operators face enormous challenges in managing intricate spectrum allocation regimes that vary exponentially across global markets, resulting in deployment inefficiencies and increased operational costs. Other regulatory approaches to spectrum licensing, interference protection, and sharing mechanisms complicate network planning processes while hampering cross-border roaming optimization potential. The lack of harmonized frequency bands between regions requires equipment vendors to design multiple radio variants, increasing development costs, and eroding economies of scale benefits. Interference management becomes progressively more difficult as spectrum reuse becomes more acute, particularly in densely urbanized areas where multiple competing operators contend over scarce frequency of assets.

- Security vulnerabilities and supply chain issues: 5G infrastructure deployments are confronted with growing security risks because network architectures are increasingly dispersed, virtualized, and reliant on software-defined technologies that enhance attack surface exposure. Government security standards impose extensive vetting processes on infrastructure equipment vendors, leading to supply chain impediments and restricting the choice of vendors for operators globally. The transition to open and virtualized network infrastructure introduces new security threats that need to be countered by end-to-end threat detection and mitigation across the entire technology stack. 5G network-specific advanced persistent threats require sophisticated cybersecurity controls to add complexity and cost to infrastructure deployment while requiring specialized security expertise.

5G Infrastructure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

28% |

|

Base Year Market Size (2025) |

USD 16 billion |

|

Forecast Year Market Size (2035) |

USD 188.8 billion |

|

Regional Scope |

|

5G Infrastructure Market Segmentation:

Communication Infrastructure Segment Analysis

The 5G Radio Access Network segment is predicted to hold around 38% market share during the forecast period, driven by enormous infrastructure installation requirements for macro base stations, small cells, and distributed antenna systems. Technological advancements in antenna technologies, such as Massive MIMO, beamforming, and carrier aggregation, require cutting-edge radio equipment investments, which drive rapid RAN market growth. Nokia Corporation has effectively tested Massive MIMO radio performance in the upper 6 GHz bands with support for the 5G-Advanced and 6G network deployments in February 2025. Complexity in multi-band deployment necessitates immense radio infrastructure for concurrent deployment across low-band, mid-band, and high-band spectrum allocations with optimal performance capabilities.

Spectrum Band Segment Analysis

The mid-band (1-6 GHz) segment is predicted to maintain its leadership with a 45% market share until 2035, offering the best coverage properties and capacity capability requirements to meet diverse 5G deployment needs. Network operators prefer mid-band spectrum acquisitions via state auctions, while a large volume of infrastructure is invested in hosting these frequency bands in macro and small cell networks. For example, T-Mobile in March 2024 gained access to an additional 2.5 GHz mid-band spectrum it had procured through an auction in 2022, resulting in a median download performance gain of 29.64 Mbps within one month, which evidences the direct impact of mid-band spectrum deployment on network performance. Antenna technologies and next-generation modulation maximize mid-band spectrum efficiency while supporting massive IoT deployments and more mature mobile broadband services concurrently.

Network Architecture Segment Analysis

The non-standalone (NSA) market is forecast to command a dominant 70% market share by 2035, fueled by realist deployment strategies that build on the existing 4G infrastructure and bring in 5G functions in a gradual manner. Network operators choose NSA structures to speed up 5G service introductions without full core network replacements, lowering initial investment needs and deployment times considerably. Network slicing capabilities in NSA architectures enable differentiated services provision with backward compatibility to installed applications and devices that require 4G access. Ericsson revealed Compact Packet Core solutions that reduce the complexity of deployment by 80% and enable NSA configurations in December 2024. The cost-saving advantages of NSA deployments appeal to emerging market operators, where capital efficiency and phased technology adoption strategies align with market development imperatives.

Our in-depth analysis of the 5G infrastructure market includes the following segments:

|

Segment |

Subsegments |

|

Communication Infrastructure |

|

|

Spectrum Band |

|

|

Network Architecture |

|

|

Core Network Technology |

|

|

End user Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5G Infrastructure Market - Regional Analysis

APAC Market Insights

Asia Pacific is forecast to maintain a leading 43% market share through 2035, driven by significant investment in infrastructure, government subsidies, and rapidly expanding mobile subscriber numbers across numerous high-growth emerging economies. The region is supported by aggressive 5G rollout timetables, sound regulatory environments, and enormous manufacturing capacity supporting equipment manufacturing and network expansion initiatives. Government policies facilitate digital transformation, smart city development, and industrial automation by leveraging detailed 5G infrastructure strategies and funding mechanisms.

China leads the 5G infrastructure deployment, driven by record government funding, comprehensive end-to-end national strategies, and extensive operator collaboration to achieve national coverage and capacity enhancement. The country has approximately 4.09 million 5G base stations, serving 981 million subscribers, while targeting 85% user penetration by 2027 through ambitious rollout programs. For instance, China's Ministry of Industry and Information Technology issued aggressive targets in November 2024, including 38 5G bases per 10,000 residents and 75% of mobile traffic carried by 5G. Government-owned operators like China Mobile, China Unicom, and China Telecom invest billions in network expansions and cooperate on infrastructure sharing and common deployment strategies.

India is experiencing increased 5G infrastructure deployment, driven by operator investment, policy support, and rising demand for digital services in the world's largest country. The country achieved nationwide 5G coverage in 773 districts, with 469,000 base stations installed, while recording one of the world's fastest deployment durations through aggressive operator strategies. In February 2025, the Indian Government made large-scale 5G deployment announcements, including spectrum auctions, fiscal reforms, and liberalized clearance procedures, which enable quick deployment. Telecom operators like Bharti Airtel, Reliance Jio, and Vodafone Idea compete fiercely on coverage growth, quality of service, and price strategies for various market segments from urban consumers to rural enterprises.

North America Market Insights

North America 5G infrastructure market is anticipated to record 19% CAGR by 2035, fueled by aggressive operator deployment and substantial government spending on new-generation telecommunication infrastructure. The region has the backing of advanced technology ecosystems, open regulation, and the first-mover benefit in terms of leveraging innovative 5G applications in enterprise, consumer, and public domains. Major players invest billions in network modernization programs using spectrum auctions and infrastructure sharing agreements to fuel urban, suburban, and rural market coverage growth.

The U.S. drives 5G infrastructure development with heavy operator investment, government programs for spending, and technology innovation initiatives that promote American telecommunications leadership. Federal agencies utilize private 5G networks for defense, public safety, and mission-critical infrastructure deployment while adhering to security standards and operating efficiency. In January 2025, the Biden-Harris Administration invested $117 million in the Wireless Innovation Fund, encouraging the development of open and interoperable wireless networks. Large wireless carriers like Verizon, AT&T, and T-Mobile are investing heavily in nationwide 5G deployments and compete on coverage, capacity, and innovative services in consumer and enterprise markets.

Canada exemplifies robust 5G infrastructure growth, driven by operator upgrade plans, governmental digital policies, and a widening demand for high-speed coverage across a wide geographic area. The financial sector is adopting 5G connectivity for digital banking applications, fraud prevention systems, and customer experience enhancements, while ensuring compliance with regulatory requirements and security standards. In March 2025, the Canada Government asserted that Huawei and ZTE devices would be used in 5G networks and the installation of end-to-end telecommunications security systems. Healthcare organizations leverage 5G infrastructure for telemedicine growth, remote patient monitoring, and medical imaging uses, addressing healthcare access for rural and underserved areas.

Europe Market Insights

Europe 5G infrastructure market is expected to maintain stable growth from 2026 to 2035, attributed to regulatory harmonization efforts, significant public and private investment strategies, and expanding demands for advanced connectivity across various industries. The European Union employs comprehensive digital strategies that promote 5G deployment, alongside competitive markets, consumer protection, and technological sovereignty, through coordinated policy responses. Telecommunications operators invest heavily in network modernization programs amidst tough regulatory environments and compliance with data protection, cybersecurity, and competition laws. Public policy facilitates digital transformation, industrial competitiveness, and social inclusion through comprehensive 5G infrastructure policies for even urban and rural coverage.

Germany is at the forefront of 5G infrastructure leadership with better manufacturing integration, comprehensive government support schemes, and considerable operator investment in network modernization and extended coverage. Industrial companies use private 5G networks for the automation of factories, predictive maintenance, and quality control systems, and to support Industry 4.0 programs and digital transformation projects. In July 2024, the German Federal Government executed agreements requiring the elimination of Huawei and ZTE equipment from 5G networks and promoting technological sovereignty through EUR 5 billion mobile support programs. Manufacturing sectors leverage 5G connectivity to facilitate precision engineering, robotics integration, and real-time monitoring to enable operation efficiency and product quality.

The UK is pioneering the creation of 5G infrastructure with broad government policies, investments by operators, and innovative deployment strategies relative to coverage requirements in urban and rural areas. The financial sector holds the forefront of enterprise 5G deployment through digital banking, fintech innovation, and customer experience maximization while ensuring London retains its role as a world financial center. In July 2025, the UK Government published strategic priorities to achieve 99% gigabit-capable coverage by 2032 while optimizing spectrum for future technologies. Furthermore, telecom operators embrace end-to-end 5G rollout approaches with the help of government incentives and sharing of infrastructure deals to reduce costs and accelerate coverage expansion timelines.

Key 5G Infrastructure Market Players:

- Huawei Technologies Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ericsson

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Qualcomm Incorporated

- Cisco Systems, Inc.

- ZTE Corporation

- Mavenir Systems

- CommScope Holding Company, Inc.

- Oracle Corporation

- NEC Corporation

- Fujitsu Limited

- Hitachi, Ltd.

- NTT Corporation

- Panasonic Corporation

The 5G infrastructure industry is marked by intense rivalry between traditional telecommunications equipment behemoths and emerging technology companies developing next-generation network solutions and applications. Huawei Technologies Co., Ltd., Ericsson, Nokia Corporation, and Samsung Electronics Co., Ltd. dominate the global market share with deep portfolio offerings, heavy investments in research, and strategic partnerships with operators around the globe. These industry giants compete on technology leadership, deployment excellence, and total cost of ownership while catering to diverse customer needs in emerging and mature economies.

Key players in the market exhibit unrelenting innovation through strategic acquisitions, research spending, and partnership deals, propelling 5G capabilities across various technology domains and applications. Companies are significantly investing in technologies such as artificial intelligence, edge computing, and software-defined networking to enable end-to-end 5G solutions that support operator transformation and enterprise digitalization initiatives. In June 2025, Cisco Systems Inc. launched a secure network architecture that accelerates workplace AI innovation, with 97% of firms discovering that network upgrades that facilitate AI and IoT success are a requirement. Strategic alliances between equipment providers, operators, and technology companies propel 5G ecosystem expansion while addressing interoperability, security, and performance requirements in global markets.

Here are some leading companies in the 5G infrastructure market:

Recent Developments

- In August 2025, Cisco Systems, Inc. released Ultra Cloud Core Access and Mobility Management Function Release 2025.03.0 enhancing 5G network capabilities with improved traffic management and scalability. The update introduces Differentiated Services Code Point marking on N2/SCTP and N26/GTPC interfaces enabling appropriate Quality of Service prioritization.

- In August 2025, NEC Corporation developed AI-enhanced traffic prediction system leveraging optical fiber sensing technology for intelligent transportation infrastructure. The breakthrough system achieved 80% reduction in prediction errors compared to conventional methods by analyzing vehicle vibrations through proprietary algorithms.

- In August 2025, Fujitsu Limited unveiled AI-driven agent platform targeting healthcare sector to enhance operational efficiency and ensure stable medical service provision. The platform includes centralized coordination of multiple specialized healthcare-specific agents leveraging NVIDIA's foundational AI agent technology.

- In March 2025, ZTE Corporation launched three groundbreaking AI-powered 5G Fixed Wireless Access products at MWC Barcelona in strategic cooperation with Qualcomm. ZTE G5 Ultra delivers peak speeds up to 19Gbps with AI voice control and QoS management, while G5 Max Wi-Fi supports 30dBi ultra-high-gain antenna design with 6km coverage.

- Report ID: 8130

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5G Infrastructure Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.