Virtual Workspace Solutions Market Outlook:

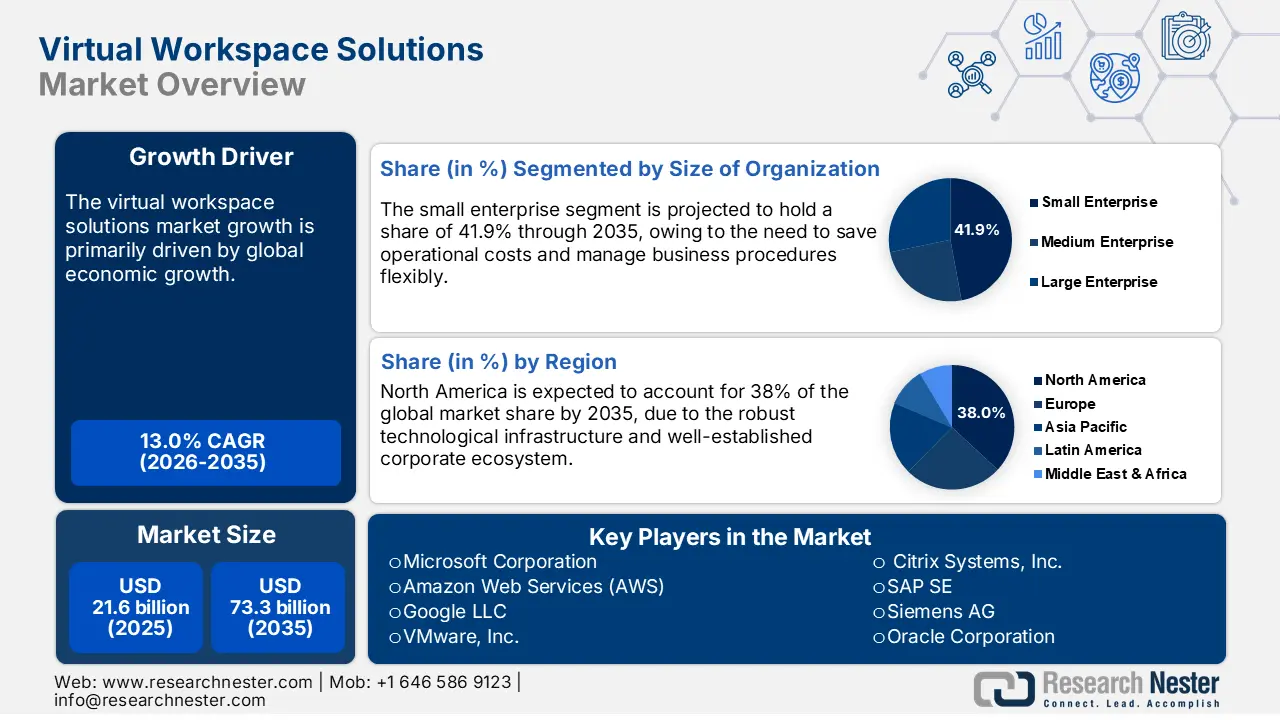

Virtual Workspace Solutions Market size was valued at USD 21.6 billion in 2025 and is projected to reach USD 73.3 billion by the end of 2035, rising at a CAGR of 13% during the forecast period, i.e., 2026-2035. In 2026, the industry size of virtual workspace solutions is estimated at USD 24.4 billion.

Global economic growth is a key factor expected to fuel the market during the forecast period. The GDP growth globally, as well as in lucrative regional markets, has become extensive and is a way to recover from the downturn that occurred during the COVID-19 pandemic. For instance, as disclosed by the International Monetary Fund in July 2025, global GDP is anticipated to grow by 3.1% in 2026. This is likely to lead to a stable economic environment for investments in virtual workspaces.

The rise of remote and hybrid work and gig employees globally is also expected to fuel the market growth. Organizations involved in the management of remote and hybrid work settings and the gig workforce rely heavily on virtual workspace solutions to keep employees and teams connected and coordinated.

Percent Of Remote Workers by Major Industry Group, Ranked from Largest to Smallest In 2022

|

Industry |

Percentage |

|

Professional, Scientific, And Technical Services |

41.4% |

|

Information |

38.8% |

|

Finance And Insurance |

37.6% |

|

Management Of Companies And Enterprises |

33.0% |

|

Utilities |

16.5% |

|

Educational Services |

17.8% |

|

Real Estate And Rental, And Leasing |

21.4% |

|

Wholesale Trade |

15.7% |

|

Administrative And Waste Management Services |

16.8% |

|

Arts, Entertainment, And Recreation |

15.9% |

|

Durable Manufacturing |

12.4% |

|

Agriculture, Forestry, Fishing, And Hunting |

13.6% |

|

Manufacturing |

11.9% |

|

Nondurable Manufacturing |

11.0% |

|

Healthcare And Social Assistance |

11.3% |

|

Retail Trade |

9.4% |

|

Mining |

7.2% |

|

Other Services, Except The Government |

9.6% |

|

Transportation And Warehousing |

8.8% |

|

Construction |

7.8% |

|

Accommodation And Food Services |

4.8% |

Source: BLS

As reported by the World Economic Forum in April 2023, 74% of employees in the information technology and insurance industries had access to remote working facilities. Similarly, as of 2025, around 42 million individuals in the U.S. were engaged in some form of gig work.

Key Virtual Workspace Solutions Market Insights Summary:

Regional Highlights:

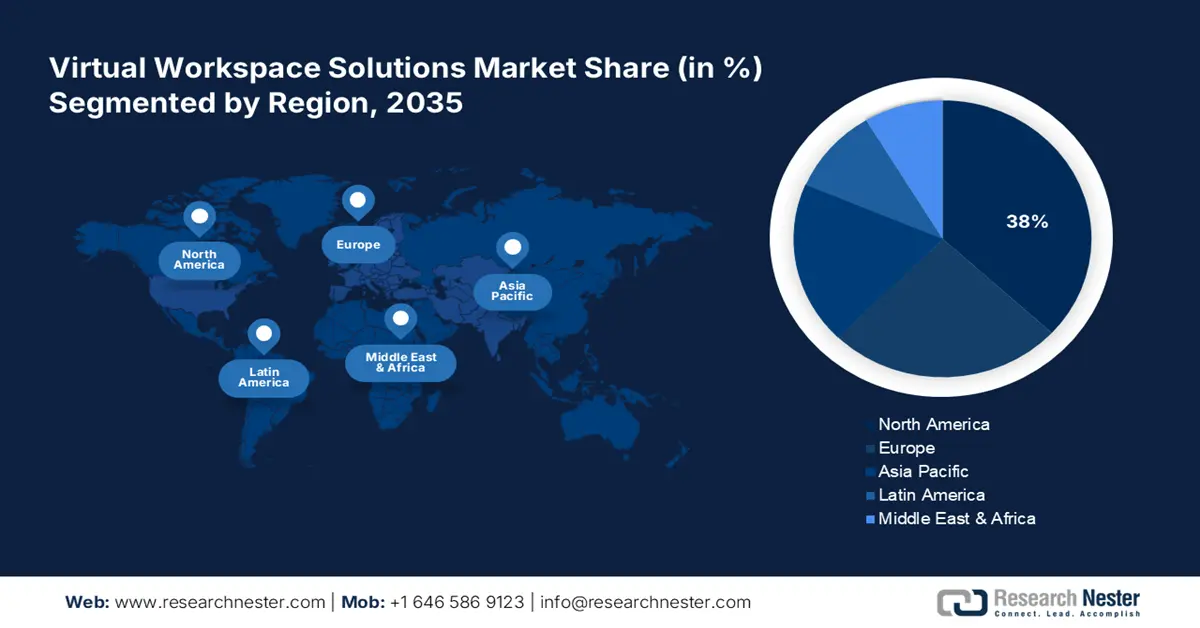

- By 2035, the North America Virtual Workspace Solutions Market is projected to command a 38% share, propelled by robust technological infrastructure and a well-established corporate ecosystem with higher cloud adoption.

- Europe is expected to secure a 24.7% share by 2035, stemming from rising demand for video conferencing, instant messaging, and collaboration tools driven by the adoption of remote and hybrid working models.

Segment Insights:

- The small enterprise segment in the Virtual Workspace Solutions Market is forecast to capture 41.9% share by 2035, propelled by the need to save operational costs and manage business procedures flexibly.

- The BFSI segment is projected to attain a 38.5% share by 2035, underpinned by the need for enhanced customer experience, virtual financial advisory services, and effective employee training aligned with modern business requirements.

Key Growth Trends:

- Technological advancements in Cloud and AI integration

- Surge in cybersecurity investments to safeguard virtual workspaces

Major Challenges:

- Constraints in data privacy and compliance management across multiple jurisdictions

- Slow adoption in developing economies

Key Players: Microsoft Corporation, Amazon Web Services (AWS), Google LLC, VMware, Inc., Citrix Systems, Inc., SAP SE, Siemens AG, Oracle Corporation, Huawei Technologies Co., Ltd., Fujitsu Limited, Samsung Electronics, Atlassian Corporation Plc, Zoho Corporation, Tata Consultancy Services (TCS), Acer Inc.

Global Virtual Workspace Solutions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.6 billion

- 2026 Market Size: USD 24.4 billion

- Projected Market Size: USD 73.3 billion by 2035

- Growth Forecasts: 13% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 6 October, 2025

Virtual Workspace Solutions Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements in Cloud and AI integration: The rising integration of AI and ML has been instrumental in improving virtual workspace solutions. The growth of the large cloud service providers is also making access to virtual workspace solutions increasingly convenient. As reported by the Economic Co-operation and Development (OECD) in May 2025, Amazon and Microsoft’s cloud computing services had a combined market share of 80%. These platforms provide remote access whilst improving the end user experience through multiple facets such as intelligent workflow and improved data security protocols. With a greater number of businesses expected to shift to AI, the integration is poised to be a driving factor in the virtual workspace solutions market’s growth.

- Surge in cybersecurity investments to safeguard virtual workspaces: With a larger percentage of organizations actively adopting virtual workspace solutions to facilitate remote and hybrid work models, cybersecurity has emerged as the backbone of the sector. The volume of sensitive data exchanged in connected environments has surged, driving a growth in investments for cybersecurity solutions. Corporations that are supplying and managing different virtual workspace solutions have access to government funds to strengthen their cybersecurity expertise. For example, in August 2025, the U.S. Department of Homeland Security (DHS) raised a financial grant of USD 91.7 million under the State and Local Cybersecurity Grant Program.

- Globalization of businesses: Globalization and the management of distributed teams have become increasingly prevalent, highlighting the surging need for virtual workspace solutions to establish organizational presence across multiple geographical locations. As reported by the World Trade Organization, global trade in goods and commercial services grew by 4% to USD 32.2 trillion in 2024 on a balance of payments basis. In addition, businesses based in developed economies are expanding their business procedures into developing economies, indicating a growing need for virtual workspace solutions.

Challenges

- Constraints in data privacy and compliance management across multiple jurisdictions: A significant constraint of the virtual workspace solutions market is ensuring data privacy across multiple regional markets with fragmented laws. For instance, as reported by IT Governance Europe Ltd in December 2022, Microsoft 365 faced criticism for failing to meet the GDPR requirements. Moreover, with a growing number of economies implementing or discussing robust data localization laws, vendors face a burgeoning challenge to maintain the sanctity of the client’s data privacy while adhering to regional compliance mandates.

- Slow adoption in developing economies: The adoption of virtual workspace solutions is comparatively lower in developing economies, due to factors such as poor IT infrastructure, lack of technological literacy among the population, and varying regulatory standards. It was reported in March 2024 that 1.4 billion people globally lived in least developed countries, who were falling behind on digital transformation.

Virtual Workspace Solutions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13% |

|

Base Year Market Size (2025) |

USD 21.6 billion |

|

Forecast Year Market Size (2035) |

USD 73.3 billion |

|

Regional Scope |

|

Virtual Workspace Solutions Market Segmentation:

Size of Organization Segment Analysis

The small enterprise segment is expected to account for a market share of 41.9% by the end of 2035, owing to the need to save operational costs and manage business procedures flexibly. With the adoption of virtual workspace solutions, small enterprises eliminate multiple expenses, ranging from expenses for rent to utility bills and equipment maintenance. Thus, the involvement of small enterprises in managing employees remotely is expected to influence the dominance of the segment in the coming years as well.

End use Segment Analysis

The BFSI segment is anticipated to acquire 38.5% of revenue share by the end of 2035, attributed to the need for enhanced customer experience, provision of financial advisory services to the clients virtually, and training employees effectively as per the needs of the 21st-century business world. A rising number of companies in the BFSI sector are adopting virtual workspace solutions, which is expected to fuel the dominance of the segment in the upcoming years. Technology companies are also developing virtual workspace solutions best suited to be adopted by organizations operating in the BFSI sector. For example, in June 2023, a leading IT and consulting firm, Wipro, launched Wipro Industry Innovation Experience for Financial Services. Building upon Microsoft Cloud, the virtual workspace solution offers a new suite of solutions related to banking and finance.

Our in-depth analysis of the market includes the following segments:

|

Segments |

Subsegments |

|

Size of Organization |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Virtual Workspace Solutions Market - Regional Analysis

North America Market Insights

The North America market is positioned to hold a leading revenue share of 38% during the forecast timeline. A vital factor contributing to the regional market’s expansion is the robust technological infrastructure and well-established corporate ecosystem, which has displayed a higher rate of cloud adoption. The North America market benefits from a rising percentage of enterprises shifting or already having made the transition to cloud environments. As disclosed by the UN Trade and Development (UNCTAD), industries, such as finance, consulting, advertising, and information technology, have become prone to AI in 2025, indicating the extent of digital readiness. Additionally, the growth of remote work policies against the backdrop of changing work dynamics reinforces opportunities in the North America market.

The U.S. virtual workspace solutions market is projected to witness an extensive CAGR throughout the forecast timeline, owing to rising cloud-based virtual workspace adoption across multiple industries. Recent trends proliferating the market include the calls for remote collaboration and a greater focus on cybersecurity. The federal government has played a supportive role in the growth, through a sustained push for digital transformation as well as improving the nationwide connectivity. As revealed by the U.S. Department of the Treasury, through the Federal Risk and Authorization Management Program (FedRAMP), the government is promoting the standardized and secure utilization of cloud services, including virtual workspace solutions. Additionally, the well-established venture capital ecosystem is expected to fuel the U.S. market growth in the coming years.

Canada is projected to emerge as an expanding market on account of the norm of remote working set by the outbreak of the COVID-19 pandemic. The demand and use of virtual workspace solutions is also likely to increase, with the government's push to engage global talent in organizations. As per an update from the Government of Canada, in July 2024, there is no need for digital nomads from outside of the country to have a work visa to work in Canada. They are allowed to work remotely from their domiciliary nations under employers who are in Canada.

Europe Market Insights

Europe market is projected to obtain a revenue share of 24.7% during the stipulated timeline, as a consequence of the growing demand for video conferencing, instant messaging, and collaboration tools, driven by the growing adoption of remote and hybrid working models. As reported by the London School of Economics and Political Science in August 2025, one in every five workers in Europe was engaged in hybrid mode in 2023. Growing preferences for cloud adoption in organizations are also anticipated to lead to a surge in the adoption of virtual workspace solutions.

The market in Germany is likely to experience a rapid CAGR throughout the forecast period, due to the growing demand that is driven by an increase in remote working opportunities. As briefed by the Centre for the Promotion of Imports (CBI) in October 2022, Germany is emerging as the best country to work in hybrid settings in Europe. The use of virtual workspace solutions is likely to accelerate with to growing focus of Germany-based businesses on organizational sustainability, since hybrid and remote working has been proven effective for employee well-being.

The UK is expected to witness a robust expansion of the virtual workspace solutions market, with the growing need for small and medium-sized enterprises across the country to apply cost-effective solutions in enabling business procedures. Stringent environmental regulations are also obligating organizations in the UK to reduce their carbon footprint. Moreover, stringent regulations are also pushing organizations operating in the UK to enable centralized data management for optimal data security, influencing the growing adoption of virtual workspace solutions.

Asia Pacific Market Insights

The APAC virtual workspace solutions market is anticipated to expand at a high CAGR during the forecast period, owing to heightened adoption of cloud technologies along with nationwide digitalization initiatives. Additionally, APAC has undergone large-scale 5G deployment, making it feasible for enterprises of all sizes to effectively utilize virtual workspace solutions and creating a favorable ecosystem for vendors. In December 2024, the State Council informed that around 4.2 million 5G base stations had already been established across China. The regional market also benefits from a large workforce that is technologically mature, improving the adoption metrics.

The India virtual workspace solutions market is expected to expand its revenue share during the forecast timeline. The market is characterized by a rising number of SMEs along with the entry of global corporations, creating lucrative opportunities for the sustained adoption of workspace solutions. According to the disclosure by the Press Information Bureau in December 2024, the count of micro, small, and medium enterprises in India increased to 1,73,350 during the financial year 2024-2025 from 52,849 in 2020-2021. In addition, as per the report published in May 2025, Foreign Direct Investment in India grew by 14% to USD 81 billion in 2024.

China is also set to be proven as a growing market by the end of the forecast period, owing to the growing demand from SMEs. With the rise in the number of SMEs, the need for workspace solutions is also likely to be accelerated. As per the report by the State Council in January 2022, the development of around 200,000 new high-tech small and medium-sized enterprises took place in 2025. Hybrid and remote workplaces are in demand among professionals in China, indicating the likelihood of a more widespread use of virtual workspace solutions. The motive of organizations to foster the well-being of employees is also leading to a rising adoption of virtual workspace solutions.

Key Players in the Virtual Workspace Solutions Market:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon Web Services (AWS)

- Google LLC

- VMware, Inc.

- Citrix Systems, Inc.

- SAP SE

- Siemens AG

- Oracle Corporation

- Huawei Technologies Co., Ltd.

- Fujitsu Limited

- Samsung Electronics

- Atlassian Corporation Plc

- Zoho Corporation

- Tata Consultancy Services (TCS)

- Acer Inc.

The virtual workspace solutions market is highly competitive. The market is reaching maturing status, bolstered by the widespread adoption of cloud services by enterprises of all sizes globally. Leading companies in the sector, such as Google, Amazon, and Microsoft, are seeking to expand their revenue share by offering improved virtual collaboration platforms. Strategic initiatives include AI integration, cloud expansion, and 5G readiness that can assist market players in strengthening their positions. The table below highlights the major players of the market:

Recent Developments

- In August 2025, Microsoft introduced a new VDI solution for Teams. The components of the update include Teams vdiBridge, Custom virtual channel (VC), Plugin, and SlimCore.

- In April 2024, VMware announced the launch of the Horizon 8.6 update. The new update features a major improvement in the cloud-based virtual desktop infrastructure (VDI). The new update integrates security protocols via multi-cloud environments.

- In March 2024, Microsoft launched an improved version of the Azure Virtual Desktop. The new version integrated AI-powered tools for heightened security in hybrid work environments, along with improved collaboration.

- Report ID: 3789

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Virtual Workspace Solutions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.