5G Fixed Wireless Access Market Outlook:

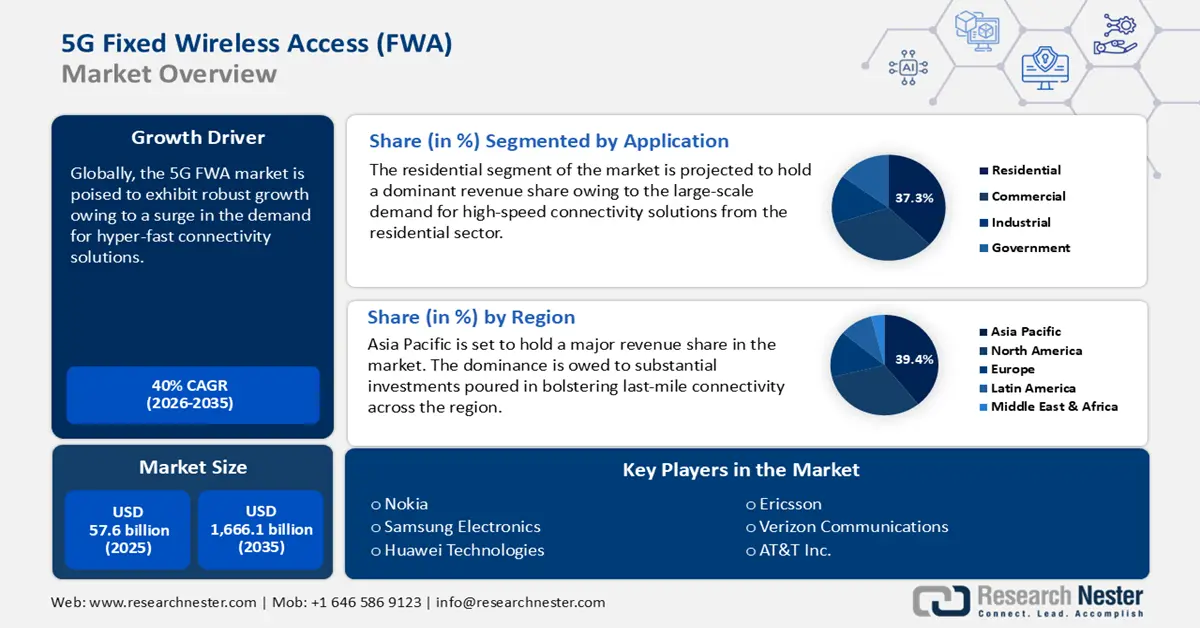

5G Fixed Wireless Access Market was valued at USD 57.6 billion in 2025 and is projected to reach USD 1,666.1 billion by 2035, expanding at a CAGR of 40% from 2026 to 2035. In 2026, the industry size of 5G fixed wireless access is assessed at USD 80.6 billion.

The rapid advancements in 5G technology is a key factor expected to fuel the global market growth during the forecast period. The supply chain for 5G FWA encompasses components such as antennas, network equipment, and semiconductors. Thus, the U.S. government has identified the need to strengthen the telecommunications supply chain, which was outlined in the 2021-2024 Quadrennial Supply Chain Review by the National Archives. The review highlights the requirement to invest in critical sectors to offset the impact of geopolitical tensions and any breakdown in trade relationships.

In relation to pricing, the Bureau of Labor Statistics (BLS) highlighted changes in the Consumer Price Index (CPI) for telecommunications services. These include the transition from 4G to 5G networks. Furthermore, the CPI has recorded changes in wireless telephone plans, indicating that the quality adjustment has not reflected the ongoing shift to 5G. Additionally, at the investment front, the large-scale allocation of funding by the U.S. government to support the deployment of 5G infrastructure bodes well for prospects. For instance, the Broadband Equity, Access, and Deployment (BEAD) program aims to broaden broadband access, including 5G FWA, to remote areas, bolstering home internet and mobile broadband services.

A prime example is the USD 42.45 billion BEAD Program under the Infrastructure Investment and Jobs Act (IIJA), which provides funding to all 56 U.S. states and territories for high-speed internet planning, infrastructure deployment, and adoption initiatives. This large-scale investment is projected to drive the overall market forward, positioning it as a key enabler of universal broadband access and digital inclusion. The market analysis predicts a positive outlook against the backdrop of these initiatives.

Key 5G Fixed Wireless Access Market Insights Summary:

Regional Highlights:

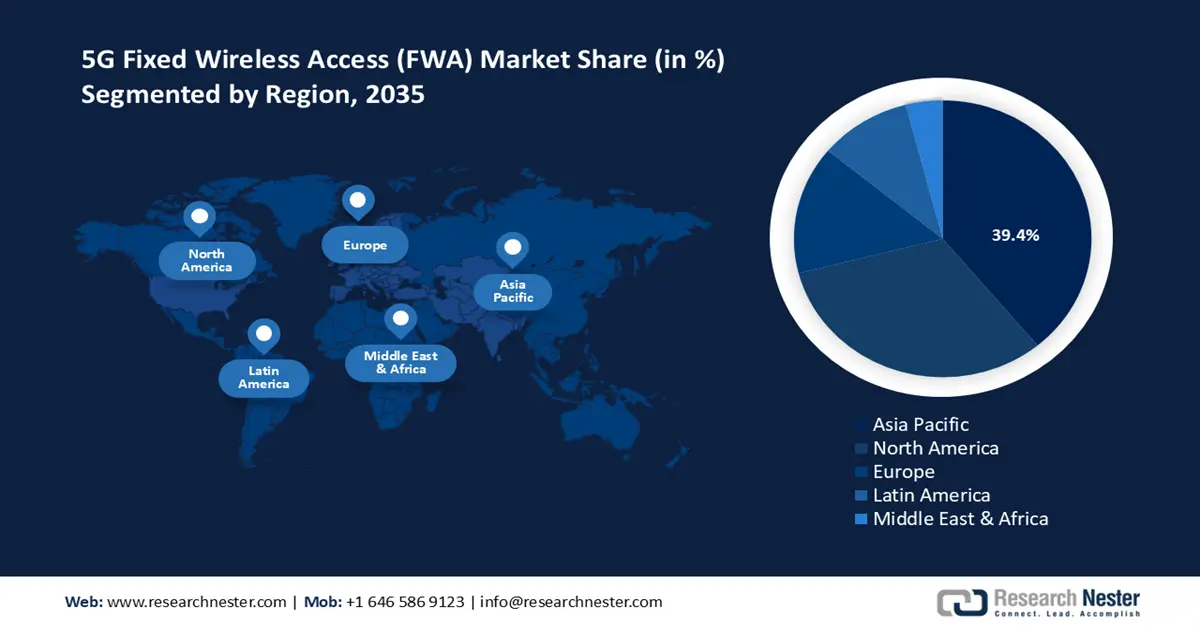

- APAC is projected to secure a 39.4% share by 2035 in the 5G fixed wireless access market, supported by rising investments in 5g infrastructure and the rapid adoption of low-latency applications across leading and emerging economies.

- North America is anticipated to hold a 31.9% revenue share through 2035, strengthened by sustained telecommunications investments and expanding rural connectivity initiatives.

Segment Insights:

- The residential segment is expected to command a 37.3% share by 2035 in the 5G fixed wireless access market, reinforced by the growing adoption of smart home devices and the heightened need for reliable remote-work connectivity.

- The sub-6 ghz band segment is set to capture a substantial revenue share over the forecast timeline, supported by its superior coverage capabilities and efficient signal penetration across diverse environments.

Key Growth Trends:

- Use of 5G FWA in modernization of military base

- Booming demand for affordable high-speed internet

Major Challenges:

- Data localization requirements

- Arbitrary blocking of cross-border data flows

Key Players: Samsung Electronics, Huawei Technologies, Ericsson, Verizon Communications, Inseego Corp., Qualcomm Technologies, CommScope, AT&T Inc., Vodafone Group, NTT Docomo, KDDI Corporation, SoftBank Corporation, Rakuten Mobile, Fujitsu Ltd.

Global 5G Fixed Wireless Access Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: APAC (39.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 8 October, 2025

5G Fixed Wireless Access Market - Growth Drivers and Challenges

Growth Drivers

- Shifts in consumer behavior and increased demand for remote work and education: With increasing work-from-home job opportunities, remote learning, and IoT adoption, the need for reliable high-speed, low-latency internet is rising. According to the U.S. Bureau of Labor Statistics, about 35.5 million people worked remotely or from home for pay in the first quarter of 2024, an increase of 5.1 million as compared to the previous year. Remote workers made up 22.9% of the employed population, rising from 19.6% in Q1 2023. Therefore, the implementation of 5G fixed wireless access is rapidly gaining momentum as a cost-effective alternative to conventional wired broadband, offering fiber-like speed without extensive cable or fiber expansion.

- Use of 5G FWA in modernization of military base: Governments worldwide are increasingly investing in 5G FWA‐style or private 5G networks to modernize military bases, enhance logistics, and improve command and control. For instance, in October 2020, the U.S. Department of Defense pledged USD 600 million for experimentation and large-scale testing at five military installations, using 5G to support dual‐use functions such as smart warehouses, AR/VR training, and distributed command structures. In another project, the DoD granted a USD 18 million contract to launch a standalone private 5G network at Naval Air Station Whidbey Island to support secure base operations, maintenance, and flight line coordination. These investments demonstrate how 5G FWA is becoming a vital enabler of secure, high-speed, and resilient connectivity in defense operations.

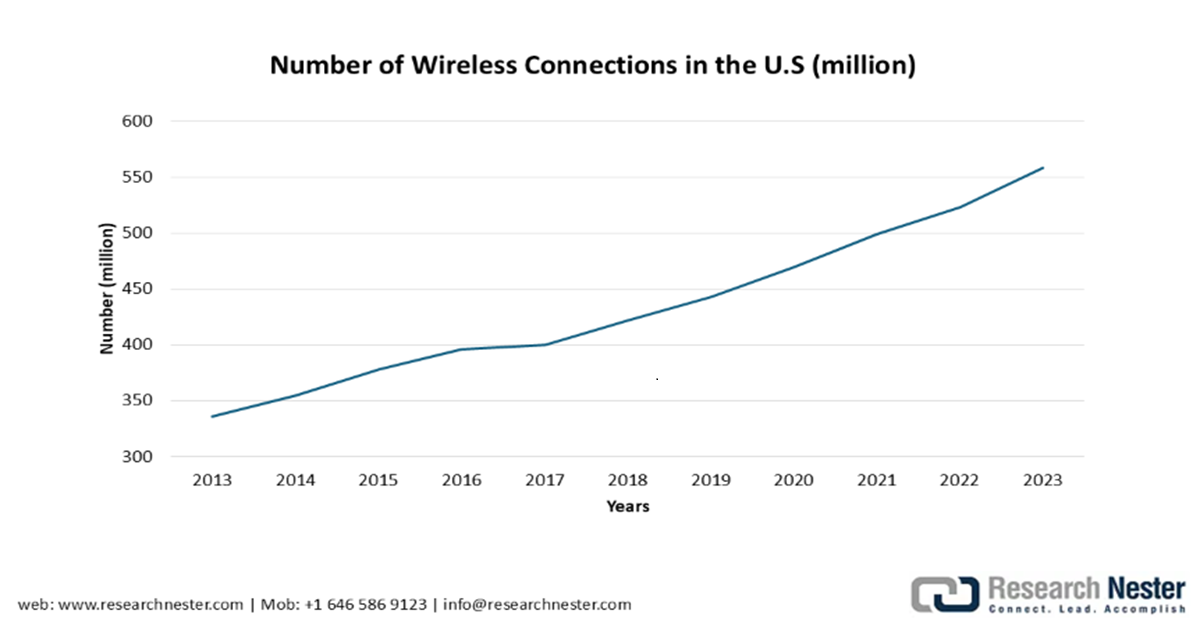

- Booming demand for affordable high-speed internet: Consumer and enterprise demand for fast, reliable, and affordable broadband is increasing, fueled by remote work, online education, streaming, cloud services, and telehealth. In areas where fiber and cable are limited, FWA provides an accessible alternative at competitive prices. According to the CTIA-The Wireless Association report, strong competition and sustained investment in the wireless industry have driven prices down, even amid record inflation. The report states that Americans pay less for wireless services, with unlimited data plans costing nearly 40% less than they did in 2010. This growing need for cost-effective, high-speed connectivity positions fixed wireless access as an important solution in bridging coverage gaps. With falling prices and expanding availability, FWA is set to play a critical role in meeting future digital demand.

Source: CTIA Annual Survey (2024)

Challenges

- Data localization requirements: The data localization guidelines have adversely impacted the market at various points. For instance, countries such as Russia and Indonesia have mandated that the data collected from their citizens must be stored within their national borders. While these guidelines bode well for data sovereignty, they also pose a challenge by increasing investment requirements in local infrastructure, thereby adding to the cost for companies.

- Arbitrary blocking of cross-border data flows: There are regional disparities in the mandates on cross-border data flows. For instance, China requires the filtering of internet traffic, which, in turn, places a substantial burden on the foreign suppliers operating in the country. Furthermore, the challenge may exacerbate in the near future owing to a push for data sovereignty.

5G Fixed Wireless Access Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

40% |

|

Base Year Market Size (2025) |

USD 57.6 billion |

|

Forecast Year Market Size (2035) |

USD 1,666.1 billion |

|

Regional Scope |

|

5G Fixed Wireless Access Market Segmentation:

Application Segment Analysis

The residential segment is projected to hold a dominant 37.3% revenue share by the end of 2035, owing to a surge in demand for smart home devices as smart cities increase. Moreover, the COVID-19 pandemic created a ripple effect across the workforce worldwide and promoted the popularity of remote work, which, in turn, has driven demand for high-speed connectivity in residential spaces. According to the Federal Communications Commission (FCC) report, between December 2022 and December 2023, residential fixed connections rose by about 2.0% to roughly 121 million, while mobile connections with full internet access increased by 2.9% to 340 million. High-speed adoption is also remarkable, as in December 2023, nearly 97% of residential fixed connections offered at least 10 Mbps downstream, 93% 25 Mbps, and over 53% delivered 100 Mbps or more. This rising demand for reliable, high-speed internet is fueling 5G FWA deployment, granting a cost-effective and scalable solution to meet the connectivity needs of residential users, especially in areas where fiber rollout is limited.

Operating Frequency Segment Analysis

The sub-6 GHZ band segment is poised to account for a major revenue share in the market. The sub-6 GHZ frequencies offer improved propagation characteristics, which in turn allow signals to effectively penetrate solid obstacles such as buildings and walls seamlessly. The band’s ability to provide improved coverage and ability to navigate the obstacles make them ideal for deployments in the urban and rural areas. Moreover, to keep up with the demand, the network operators have aimed to expand the 5G coverage with the sub-6 GHz band projected to be a key component in the expansion plans.

Demography Segment Analysis

The urban segment is expected to register rapid growth during the forecast period as cities face rising demand for high-speed broadband to support streaming, gaming, smart homes, and remote work. In urban areas, 5G FWA is revolutionizing broadband connectivity by offering high-speed internet without the need for extensive fiber installations. This is especially advantageous in densely populated regions where traditional broadband infrastructure is restricted or costly to deploy.

The Federal Communications Commission (FCC) has been actively supporting the expansion of 5G FWA through the Rural Digital Opportunity Fund (RDOF), which grants up to USD 20.4 billion over the next decade to provide fixed broadband and voice services to millions of unserved homes and small businesses in rural areas of the U.S. This federal support has supported providers to extend high-speed internet services to urban neighborhoods, enhancing connectivity for residents and businesses alike.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Offering |

|

|

Operating Frequency |

|

|

Demography |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5G Fixed Wireless Access Market - Regional Analysis

APAC Market Insights

The APAC market is projected to account for a leading share of 39.4% by the end of 2035. A key factor supporting the market dominance is the increase in investments in expanding 5G infrastructure across major economies such as Japan and China. Moreover, APAC’s market is positively impacted by the proactive efforts of the emerging economies such as India, Vietnam, and Indonesia. The leading economies in 5G deployment are China, Japan, and South Korea, which are supporting the widespread deployment. Additionally, the advancements in low-latency applications in APAC have added to the adoption rates by consumers from the residential and commercial sectors.

The 5G fixed wireless access (FWA) market in China is expected to grow rapidly due to the country's extensive 5G expansion. According to the Ministry of Industry and Information Technology (MIIT) report of December 2024, 5G mobile subscriptions in China became 1.002 billion by November, accounting for 56% of all mobile phone subscriptions, up 9.4 percentage points from the previous year. This rapid surge, enabled by the implementation of around 4.2 million 5G base stations, is promoting the adoption of 5G Fixed Wireless Access services, as widespread network coverage enables faster, more reliable broadband connectivity across urban and rural areas. In addition, rising demand for fast home and business internet is fueling the adoption of 5G FWA as a cost-effective alternative to fiber.

The India 5G fixed wireless access market is expected to undergo rapid expansion throughout the forecast period due to increasing subscriber base and nationwide investments to create a digital economy. In September 2025, the India Brand Equity Foundation (IBEF) report stated that, as of July 2025, India’s telecom sector achieved an impressive record with 365 million 5G subscribers, marking a 35% penetration in just three years after the technology’s release. Further, the strong subscriber growth and network expansion by leading operators are making India a top market for 5G fixed wireless access growth.

North America Market Insights

North America is poised to hold a revenue share of 31.9% throughout the forecast period as the market’s supply chain is bolstered by consistent investments in the telecommunications infrastructure, particularly by the U.S. and Canada. The U.S. Federal Communications Commission (FCC) has actively channeled investments in improving the connectivity of rural areas across the country. Moreover, in Canada, the government has actively supported the expansion of ultra-fast connectivity services. The regional market analysis indicates that a rising number of enterprises in North America are dependent on 5G services to ensure the seamless functioning of operations, whereas the existence of a consumer base with high disposable income creates a sustained growth for low-latency, ultra-fast solutions.

Rising government investments have ensured the continuous expansion of the U.S. 5G fixed wireless access (FWA) market. For instance, the U.S. National Telecommunications and Information Administration (NTIA) awarded more than USD 550 million from the USD 1.5 billion worth of Wireless Innovation Fund to bolster the development of open wireless networks. Additionally, the Federal Communications Commission (FCC) implemented the 5G Fund for Rural America in a bid to expand the deployment of 5G mobile broadband to rural areas of the country.

The 5G fixed wireless access (FWA) market in Canada is expected to experience significant growth during the forecast period. According to the OECD, Canada had a 7% share of FWA subscriptions among fixed broadband connections by the end of 2023, showing a notable presence in the market. This growth can be attributed to the rising demand for high-speed internet services, mainly in underserved and rural areas where traditional wired infrastructure is limited or prohibitively expensive to implement. The expansion of 5G networks and developments in wireless technology have supported highly efficient and cost-effective delivery of broadband services, further encouraging the adoption of FWA solutions across the nation.

Europe Market Insights

The 5G fixed wireless access (FWA) market in Europe is gaining traction as demand for high-speed internet continues to outpace fiber rollouts, especially in underserved urban and suburban regions. Operators are investing majorly in spectrum and network upgrades to provide fiber-like broadband speeds wirelessly. The growth is also enabled by EU initiatives for digital inclusion and broadband access targets for 2030.

In the UK, the market is expanding rapidly as operators focus on narrowing connectivity gaps and providing alternatives to expensive fiber rollouts. The merger between Vodafone and Three UK in 2025 declared an USD 12.8 billion investment to expand standalone 5G coverage to 99.95% of the population by 2034, enabling widespread FWA adoption. Urban households are taking up FWA as a replacement for traditional fixed broadband, given its faster setup and competitive pricing. Enterprises are also taking up FWA for backup and flexible connectivity. Government policies are helping digital infrastructure further accelerate growth.

Germany is emerging as one of the strongest 5G fixed wireless access (FWA) market in Europe, driven by high internet consumption and its strong industrial ecosystem. The demand is especially strong in urban and semi-urban places where fiber expansion is slow or expensive. The government’s Gigabit Strategy, aiming for nationwide gigabit coverage by 2030, also supports operators’ FWA investments. The scheme, initially approved in November 2020 and set to end on 31 December 2025, has now been extended until December 2028 with a budget expansion of USD 30.3 billion, raising the total to USD 44.4 billion. The additional funding will be equally shared between the federal budget and the budgets of states and local authorities. The extended program is designed to ensure that by 2030, every household, business, and public institution in Germany can access a Gigabit network.

Key 5G Fixed Wireless Access Market Players:

- Nokia

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung Electronics

- Huawei Technologies

- Ericsson

- Verizon Communications

- Inseego Corp.

- Qualcomm Technologies

- CommScope

- AT&T Inc.

- Vodafone Group

- NTT Docomo

- KDDI Corporation

- SoftBank Corporation

- Rakuten Mobile

- Fujitsu Ltd.

The 5G fixed wireless access market is experiencing rapid growth, bolstered by mergers, innovations in products, and strategic investments by major players in the industry. For instance, in July 2024, Nokia reported an expansion in its broadband portfolio by introducing a 5G FWA outdoor receiver and an indoor gateway that has Wi-Fi 7 capabilities in a bid to increase its presence and connectivity in North America. These developments highlight the lucrativeness of the market and the push by leading players to maintain a competitive edge in the market.

Here is a list of key players operating in the market:

Recent Developments

- In May 2025, Hi3G Access AB (Three Sweden) chose Nokia to provide its advanced Fixed Wireless Access (FWA) technology for serving its B2B customers. This partnership enables Three Sweden to deliver high-speed, reliable, and high-capacity broadband to households and small businesses nationwide, with a strong focus on regions where fiber networks are not yet available.

- In February 2025, Samsung Electronics announced that UScellular has strengthened its 5G network in the Mid-Atlantic region by deploying Samsung’s 5G solutions. Through this collaboration, the companies have introduced a new network architecture that integrates Samsung’s 5G mmWave and virtualized Radio Access Network (vRAN) technologies to accommodate UScellular’s expanding fixed wireless access and mobile traffic needs.

- Report ID: 3025

- Published Date: Oct 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5G Fixed Wireless Access Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.