Carbon Composites Market Outlook:

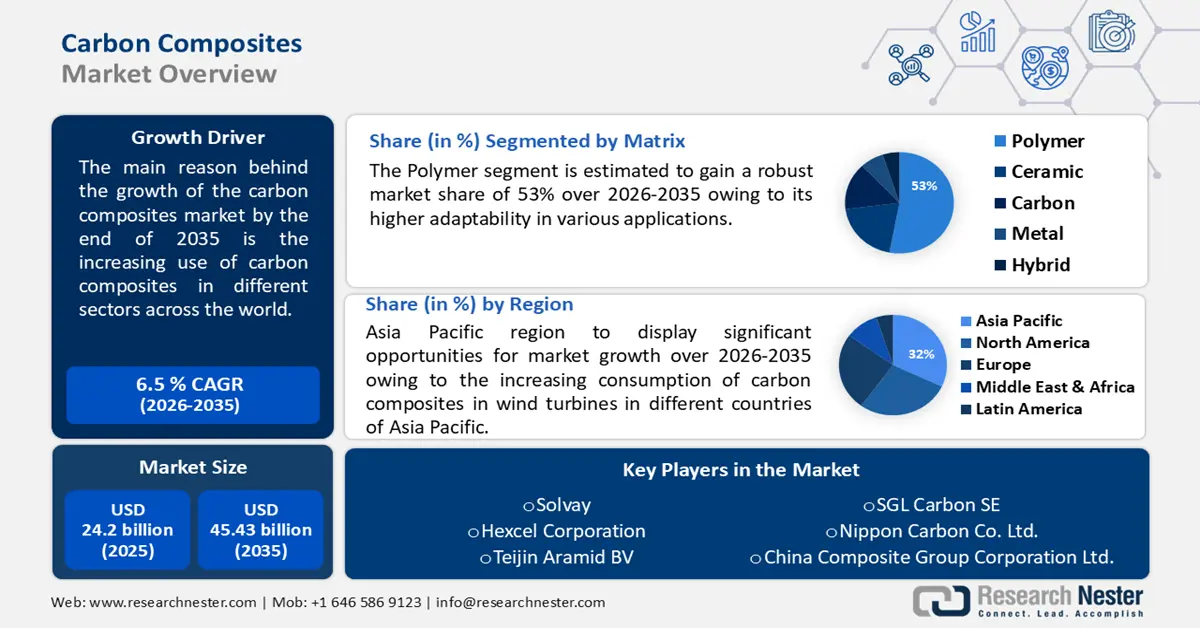

Carbon Composites Market size was valued at USD 24.2 billion in 2025 and is likely to cross USD 45.43 billion by 2035, expanding at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of carbon composites is assessed at USD 25.62 billion.

The main reason behind the growth of the carbon composites market by the end of 2036 is the increasing use of carbon composites in different sectors across the world. According to the Clean Energy Manufacturing Analysis Center, moderate to large-tow fibers a collection of parallel filaments are used in wind energy carbon fiber. It represents almost 17% of the entire demand for carbon composites market and is foreseen to increase from 7,600 to 25,000 tons annually.

Key Carbon Composites Market Insights Summary:

Regional Highlights:

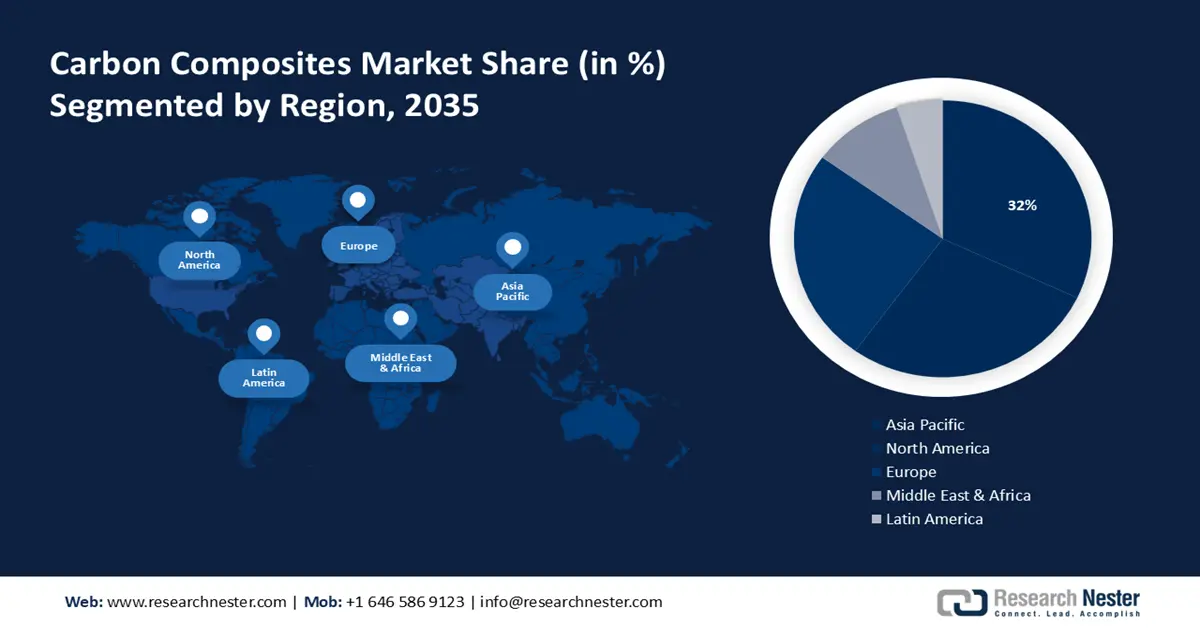

- Asia Pacific carbon composites market will secure over 32% share by 2035, driven by increasing consumption of carbon composites in wind turbines in the region.

Segment Insights:

- The polymer segment in the carbon composites market is forecasted to secure a 53% share by 2035, due to its higher adaptability in various applications.

- The aerospace & defense segment in the carbon composites market is projected to attain a 46% share by 2035, fueled by the increasing expansion of the aerospace and defense sector.

Key Growth Trends:

- Rising use of carbon composites in the aerospace sector

- Increasing use of electric vehicles across the world

Major Challenges:

- Carbon composites are toxic to the human body

- High cost and accessibility of alternatives

Key Players: ZOLTEK Corporation, Solvay, Hexcel Corporation, Teijin Aramid BV, SGL Carbon SE, Nippon Carbon Co. Ltd., China Composite Group Corporation Ltd., Epsilon Composite, Carbon Composites Inc., Plasan Carbon Composites, Mitsubishi Chemical Co., Ltd., K. Sakai & Co., Ltd., Uchida Co., Ltd., Toray Industries Inc.

Global Carbon Composites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.2 billion

- 2026 Market Size: USD 25.62 billion

- Projected Market Size: USD 45.43 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Carbon Composites Market Growth Drivers and Challenges:

Growth Factors

- Rising use of carbon composites in the aerospace sector - Another reason will be the increasing use of carbon composites in aerospace that will propel the carbon composites market through 2035. Furthermore, aerospace was one of the first industries to implement carbon fiber because of its power and weight savings, and they've made good implementation of the component.

For instance, according to the Clean Energy Manufacturing Analysis Center, CFRP makes it possible for "light-weighting," which reduces energy consumption through fuel savings, in transportation applications like cars and aircraft. An estimated 6%-8% more fuel economy is achieved for every 10% reduction in vehicle mass.

In addition, utilizing carbon fiber composites to create an airplane limits its weight by equal to 20%, versus the weight of a conventional aluminum plane. For every kilogram of weight limitation, specialists calculate a savings of about USD 1 million in costs over the life of the plane which adds up to huge savings.

- Increasing use of electric vehicles across the world - Rising sales impelled the total number of electric cars in the world’s ways to 26 million, an increase of 60% compared to 2021, with BEVs attributing to more than 70% of total yearly expansion, as in earlier years. As an outcome, around 70% of the international stock of electric cars in 2022 were BEVs.

The rise in sales from 2021 to 2022 was just as great as from 2020 to 2021 in absolute terms, an increase of 3.5 million but comparative expansion was lower (sales two-folded from 2020 to 2021). The remarkable rise in 2021 may be described by EV markets keeping up in the wake of the coronavirus (COVID-19) epidemic.

Challenges

- Carbon composites are toxic to the human body - Carbon fiber composite components are utilized in several applications in industries, and machining techniques frequently produce aerosols of these components in the workplace. Because the possible health impacts of these particles are doubtful, researchers assessed the toxicity of a series of carbon fiber composites artificially utilizing rabbit alveolar macrophages and in living organisms utilizing straight glottic injection into rat lungs.

- High cost and accessibility of alternatives - One significant issue with the carbon composites market expansion is the high cost of carbon fiber. Since these composites are expensive, their use is limited, and the manufacturer's biggest difficulty is coming up with low-cost technology. Carbon fiber composites are exclusively seen in high-end, premium vehicles in the automobile industry.

Carbon Composites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 24.2 billion |

|

Forecast Year Market Size (2035) |

USD 45.43 billion |

|

Regional Scope |

|

Carbon Composites Market Segmentation:

Matrix Segment Analysis

Polymer segment is anticipated to capture around 53% carbon composites market share by the end of 2035. This growth will be seen due to its higher adaptability in various applications. In contrast to 1163 kg of iron and steel, an average vehicle uses 150–300 kg of plastics and plastic composites; as of late, it has been moving around 15-20% of the car's overall weight or more than 2,000 pieces and materials of various sizes and forms.

Although up to 13 various polymers may be utilized in a single car model, just three kinds of plastics fabricate about 66 % of the total plastics utilized in a car polypropylene (32%), polyurethane (17 %), PVC (16 %).

Application Segment Analysis

By the end of 2035, aerospace & defense segment is predicted to dominate around 46% carbon composites market share. The increasing expansion of the aerospace and defense sector will help this segment to advance.

Its supremacy is the outcome of the fact that carbon composites are massively used in making lightweight aviation and defense equipment. According to the Oklahoma Commerce Government Association, the state is home to about 1,100 aerospace organizations, including manufacturers, MRO, R&D, the military, and others.

End-Use Segment Analysis

In carbon composites market, automotive segment is projected to hold over 35% revenue share by the end of 2035. This growth will be noticed due to the increasing expansion of the automotive industry globally and the rising use of carbon composites to make lightweight engines. Global auto sales will rise overall, but by 2030, the yearly growth rate is predicted to fall from the 3.6 percent seen over the previous five years to about 2 percent.

Our in-depth analysis of the global carbon composites market includes the following segments:

|

Matrix |

|

|

Process |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Carbon Composites Market Regional Analysis:

APAC Market Insights

Asia Pacific carbon composites market is anticipated to capture revenue share of over 32% by 2035. This growth will be noticed due to the increasing consumption of carbon composites in wind turbines in different countries of Asia Pacific.

Global Wind Report says that the sector in APAC managed to reach the new benchmark of 100 GW of yearly installations in 2021, with difficulties over the years. Due to erroneous government policies regarding procurement and offtake agreements, many of the industry's core manufacturers have witnessed growing financial losses as a result of the "race to the bottom" price. These losses have been made worse by increased inflation and logistical expenses.

China will hold a significant position in the carbon composites industry because of the country’s increasing expansion of renewable energies where carbon composites are required magnificently. According to the International Renewable Energy Agency (IRENA), Asia led the 473 GW renewable energy boom once again, accounting for 326 GW or 69% of the total. China was the main driver of this rise, with a 63% increase in capacity to 297.6 GW.

The Korean carbon composites sector will grow as an outcome of the Korean Government’s rigid regulations on restricting automotive pollution. Moreover, the Korean government intends to reduce the fine dust concentration by more than 35 percent by 2030 compared to the fine dust concentration in 2018, according to the recently revealed master plan, which was published in December 2022.

Japan has the most expanded automotive industry which will help the industry to increase at a fast rate. According to the International Trade Association (ITA), Japan has the fourth-largest automobile market globally after China, the US, and India. Japan, home to the manufacturers Toyota, Honda, Nissan, Mazda, Suzuki, Subaru, Daihatsu, and Mitsubishi, is renowned as a global leader in the manufacture of automobiles and smart automobile steering systems.

North American Market Insights

The carbon composites market in the North America region will increase significantly because of giant manufacturers' increasing use of carbon composites in making aircraft. North American carbon composites industry will produce a demand of over 55 kilotons by 2035. For instance, NASA has published USD 50 million in awards to 14 companies to create manufacturing techniques and progressed composite components for aircraft frameworks. These green technologies hold the power to assist in limiting aviation carbon secretions.

In the U.S. the carbon composites industry will especially boom because of the presence of some special key players. For its attribution to the Sustainable Flight National Partnership, HiCAM works with a public-private co-operation, the Advanced Composites Consortium, which enables partners to take benefit of each other’s expertise and raise the probability of the U.S. aviation industry accepting results. Companies inside the consortium that accomplished funding through these newest awards will match NASA’s funding.

The Canadian industry of carbon composites will also have massive growth due to the rising construction industry in this region and the rising use of carbon composites in this country. Several big projects, such as the rebuilding of the George Massey Tunnel on Highway 99, which spans the Fraser River in Vancouver, British Columbia, or the 16-kilometer subway line in Toronto that connects Ontario Place to the Ontario Science Centre.

Carbon Composites Market Players:

- ZOLTEK Corporation

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solvay

- Hexcel Corporation

- Teijin Aramid BV

- SGL Carbon SE

- Nippon Carbon Co. Ltd.

- China Composite Group Corporation Ltd.

- Epsilon Composite

- Carbon Composites Inc.

- Plasan Carbon Composites

The carbon composites market is quite fragmented worldwide. The companies in this market are adopting various organic and inorganic strategies. Several key players in the carbon composites industry are:

Recent Developments

- SGL Carbon SE and E-Works Mobility made a technology cooperation. The Munich-based organization E-Works Mobility, which specializes in the growth and generation of electrically power-driven vans, is driving ahead with the progression of the E-Works HEERO, the high-execution e-transporter in its class: the engineers currently concentrated on the total regrowth of a new battery box to substitute the earlier aluminium construction. The E-Works team noticed what they were searching for in the fiber-strengthened plastics specialist SGL Carbon. The organization is now delivering the first battery boxes made of glass fiber-strengthened plastic to E-car manufacturers following wide prototype tests. These highly steady protecting battery casings present multiple benefits - primarily in terms of energy and raw material effectiveness and in the safety-appropriate area.

- Zoltek Companies, Inc., the international leader in low-cost industrial-grade carbon fiber, has declared it is growing its carbon fiber generation potential at the facility situated in Guadalajara, Mexico. By growing operations, the Mexico carbon fiber generation potential will rise to 13,000MT yearly and will raise Zoltek’s international generation potential of its PX35 carbon fiber to a complete 28,000MT.

- Report ID: 6081

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Carbon Composites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.