C5 Resin Market Outlook:

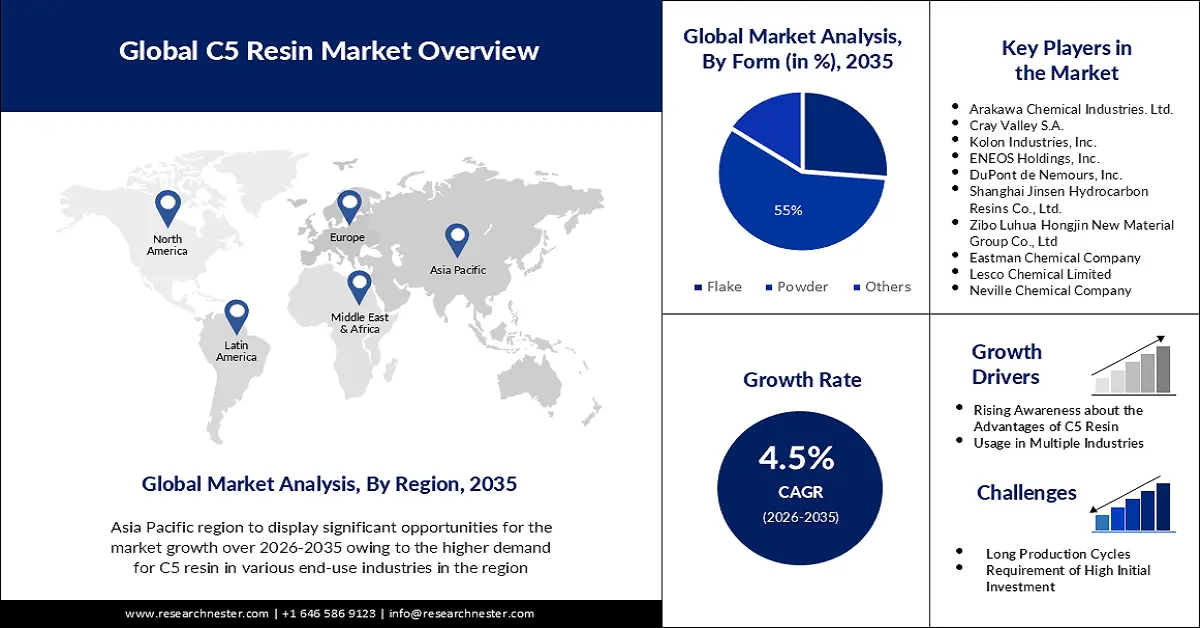

C5 Resin Market size was over USD 880.6 million in 2025 and is poised to exceed USD 1.37 billion by 2035, witnessing over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of C5 resin is estimated at USD 916.26 million.

The major factor that is attributed to market growth is the rising construction industry across the world. Owing to the advantageous chemical composition of C5 resins, it is considered to be one of the vital components in building infrastructures and other construction projects. For instance, the worldwide construction industry was worth about USD 6 trillion in 2020 and is anticipated to be worth nearly USD 14 trillion by 2030.

Additionally, it is noticed that the growth of the market is dependent on the various advantages provided by C5 resins i.e. good adhesion, along with the compatibility with most of the base polymers, polymer modifiers, and antioxidants.

Key C5 Resin Market Insights Summary:

Regional Highlights:

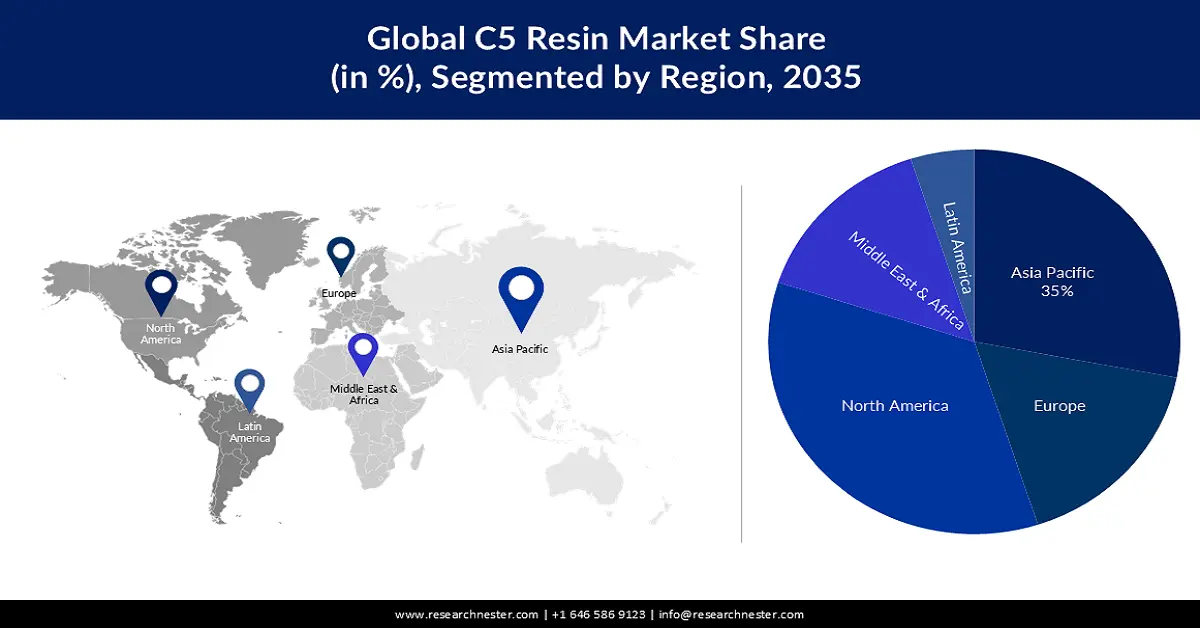

- Asia Pacific C5 resin market will hold around 35% share by 2035, attributed to rising C5 resin production and construction activity.

- North America market will achieve a 24% share by 2035, driven by the growing automotive industry and advanced technologies.

Segment Insights:

- The paint & coating segment in the c5 resin market is projected to capture a 38% share by 2035, driven by increasing demand for paints and coatings in industries like automotive and construction.

- The construction segment in the c5 resin market is forecasted to capture a 32% share by 2035, driven by the rapid growth of the real estate sector and infrastructure development initiatives.

Key Growth Trends:

- Growing Paints and Coatings Industry

- Rapid Growth of Adhesives and Sealants Industry

Major Challenges:

- Long Manufacturing Cycles

- Requirement of Higher Initial Investment

Key Players: Arakawa Chemical Industries. Ltd., Cray Valley S.A., Kolon Industries, Inc., ENEOS Holdings, Inc., DuPont de Nemours, Inc., Shanghai Jinsen Hydrocarbon Resins Co., Ltd., Zibo Luhua Hongjin New Material Group Co., Ltd, Eastman Chemical Company, Lesco Chemical Limited, Neville Chemical Company.

Global C5 Resin Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 880.6 million

- 2026 Market Size: USD 916.26 million

- Projected Market Size: USD 1.37 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

C5 Resin Market - Growth Drivers and Challenges

Growth Drivers

- Growing Paints and Coatings Industry – C5 resin has an extensive range of applications as a modifier for paints and coatings processes. It also can act as a tackifier for adhesives and pressure-sensitive adhesives, when used in combination with various types of resins. All these factors coupled to extend the utilization rate of C5 resins in the paints and coatings industry expected to contribute positively to market growth during the forecast period. The worldwide paint and coatings market was expected to be worth over USD 160 billion in 2021, rising to nearly USD 240 billion by 2029.

- Rapid Growth of Adhesives and Sealants Industry – In the recent period, the demand for C5 resin in various adhesives and sealants applications as it provides good adhesion and promotes tack in hot-melt and pressure-sensitive adhesives. It has been stated that the global adhesives and sealants industry was valued at almost USD 70 billion in 2022 and is further expected to grow at 6% CAGR.

- Extensive Growth in the Automotive Industry - Recently, it has been calculated that the global automotive industry manufacturing industry amounted to almost USD 3 trillion by the end of 2021.

- Growth in the Chemical Industry - According to recent estimates, the global chemical industry's revenue in 2021 was projected to exceed over USD 5 trillion.

Challenges

- Long Manufacturing Cycles – The manufacturing of C5 resin requires a lot of raw materials which need to be handled carefully. Unfortunately, the constant fluctuation in prices of the raw materials along with the long manufacturing cycles is estimated to lower the adoption rate and subsequently hamper the market growth during the forecast period.

- Requirement of Higher Initial Investment

- Stringent Government Rules

C5 Resin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 880.6 million |

|

Forecast Year Market Size (2035) |

USD 1.37 billion |

|

Regional Scope |

|

C5 Resin Market Segmentation:

Application Segment Analysis

Paint & coating segment is poised to capture C5 resin market share of over 38% by 2035, as increasing demand for paints and coatings from various end-use industries such as automotive, construction, healthcare, adhesives, and others. According to recent statistics, it is anticipated that 860 million gallons of architectural paint was estimated to be used in the United States in 2020. Furthermore, C5 resin has an extensive range of applications as a modifier for paints and printing inks which is also estimated to create a positive outlook for market growth.

End-User Segment Analysis

Construction segment is expected to account for C5 resin market share of more than 32% by the end of 2035, due to rapid growth of the real estate sector and the rising favorable initiatives for infrastructure development. According to recent forecasts, real estate businesses generated around USD 10 billion in income in 2021. Furthermore, the increasing number of residential and non-residential building projects, as well as rising investments in research and development activities, are expected to boost segment expansion.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

Form |

|

|

Distribution Channel |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

C5 Resin Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 35% by 2035, attributed to rising growth in the C5 resin production and its high utilization. China and India are the leading countries in the Asia Pacific to churn out the C5 resin. For instance, the total C5 resin production in China amounted to cross USD 175 billion USD 165 billion in 2021. Also, the market is growing on the back of rapidly increasing construction activities.

North American Market Insights

The North America C5 resin market is estimated to register a share of about 24% by the end of 2035, owing to the excessive utilization of C5 resin in tire manufacturing and adhesive formulation. The growing automotive industry is expected to increase the demand for C5 resin. Also, the market growth is ascribed to the rising investments in prominent applications in various industries along with the emerging advanced technologies in the region during the forecast period.

C5 Resin Market Players:

- Arakawa Chemical Industries. Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cray Valley S.A.

- Kolon Industries, Inc.

- ENEOS Holdings, Inc.

- DuPont de Nemours, Inc.

- Shanghai Jinsen Hydrocarbon Resins Co., Ltd.

- Zibo Luhua Hongjin New Material Group Co., Ltd

- Eastman Chemical Company

- Lesco Chemical Limited

- Neville Chemical Company

Recent Developments

- Cray Valley to add sustainably sourced farnesene-based resins in two of its standard hydroxyl-terminated diene resin, Krasol F3100, and Krasol F3000.

- ENEOS Holdings, Inc. becomes a member of the ‘Alliance to End Plastic Waste’ to rise concern about global plastic waste and address four targeted areas, engagement, education, innovation, and infrastructure.

- Report ID: 4058

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

C5 Resin Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.