Bronchiectasis Therapeutic Market Outlook:

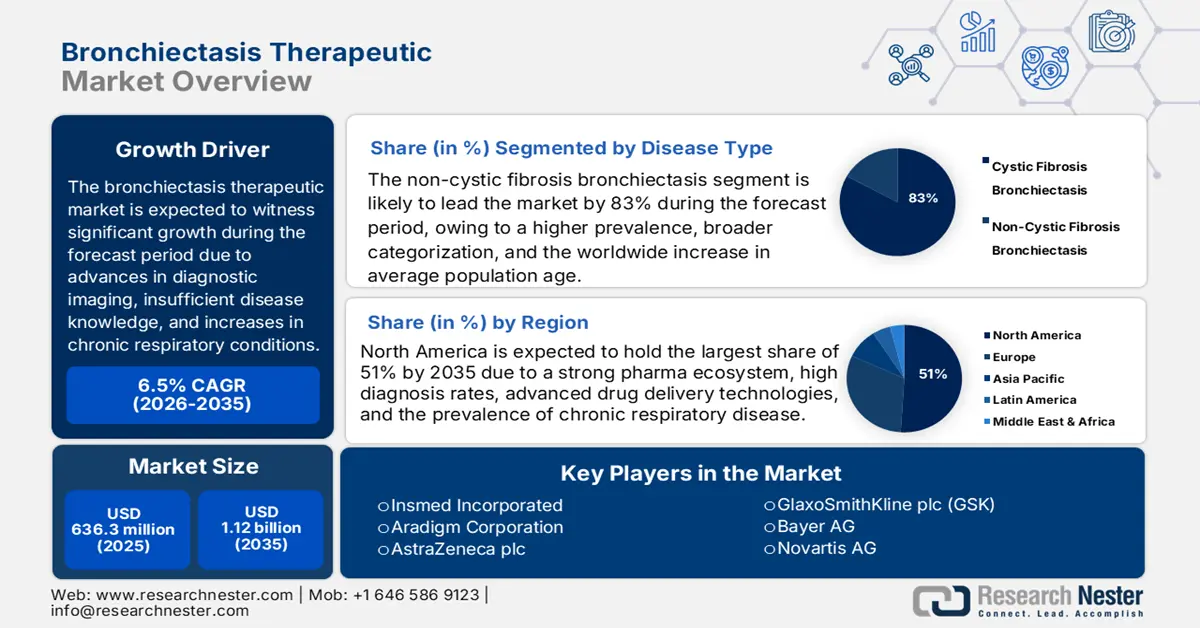

Bronchiectasis Therapeutic Market size was valued at USD 568.94 million in 2025 and is set to exceed USD 1.09 billion by 2035, registering over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bronchiectasis therapeutic is estimated at USD 603.25 million.

The global bronchiectasis therapeutics market is being driven by multiple growth drivers, such as advances in diagnostic imaging, insufficient disease knowledge, and increases in chronic respiratory conditions such as COPD, bronchiectasis, and non-tuberculous mycobacterial (NTM) infections. As per a report published by NLM in October 2024, there is an increase in mortality in bronchiectasis patient cohorts in some regions of the world, with mortality rates of 16% to 24.8% in 4 to 5 years of follow-up. This chronic respiratory condition with abnormal bronchial dilation needs to be treated in the future using inhaled antibiotics, bronchodilators, corticosteroids, and airway clearance devices.

Moreover, bronchiectasis management in a clinical setting aims at limiting inflammation and infections to preserve lung function and reduce the chances of exacerbations, which is also driving the bronchiectasis therapeutic market. As per a report by NLM in October 2024, data available on the prevalence of bronchiectasis are quite diverse, with prevalence reported between 50 to 1,000 cases per 100,000 individuals. Mucolytics, macrolide antibiotics, inhaled bronchodilators, and airway clearance devices such as the oscillatory positive expiratory pressure (OPEP) system are widely used for treatment. Even if the condition remains uncured, diagnostic imaging has evolved, facilitating early detection. Bronchiectasis is now a major concern in public health and medical research, in the bronchiectasis therapeutics market, due to the escalating concerns of its disease burden and its coexistence with other chronic lung diseases.

Key Bronchiectasis Therapeutic Market Insights Summary:

Regional Highlights:

- North America bronchiectasis therapeutic market will dominate more than 35% share by 2035, attributed to rising cases of bronchiectasis, increased R&D activity, and advancements in treatment technologies.

- Asia Pacific market will exhibit significant CAGR during 2026-2035, driven by rising respiratory disorders, growing aging population, and technological advances in diagnosis and treatment.

Segment Insights:

- The antibiotic segment in the bronchiectasis therapeutic market is expected to experience significant growth by the forecast year 2035, driven by increasing respiratory disorders and targeted antibiotic development.

- The online pharmacy segment in the bronchiectasis therapeutic market is expected to see significant growth through 2035, driven by the convenience of home delivery and competitive pricing.

Key Growth Trends:

- Growing Awareness About the Disease

- Expansion of Biologics and Targeted Therapies

Major Challenges:

- Growing Awareness About the Disease

- Expansion of Biologics and Targeted Therapies

Key Players: Zydus Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., Insmed Inc., Reddy’s Laboratories Ltd.

Global Bronchiectasis Therapeutic Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 568.94 million

- 2026 Market Size: USD 603.25 million

- Projected Market Size: USD 1.09 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

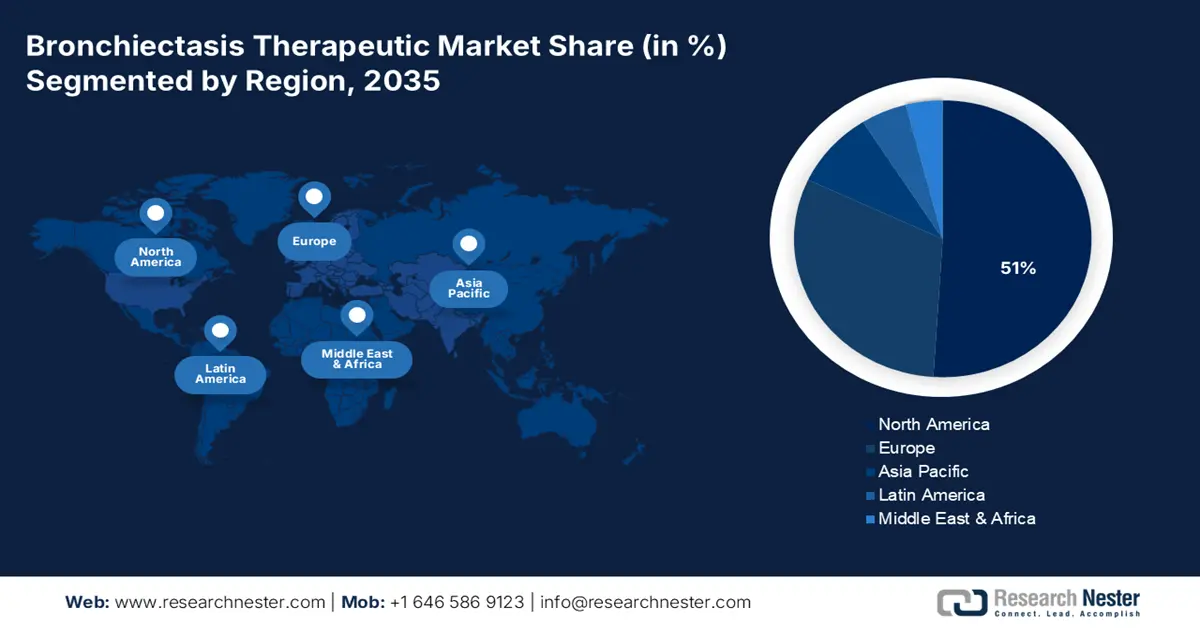

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, China

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Bronchiectasis Therapeutic Market Growth Drivers and Challenges:

Growth Drivers

- High prevalence and complex management of Nontuberculous Mycobacterial (NTM) infections: The bronchiectasis therapeutic market continues to grow from the increasing incidence of nontuberculous mycobacteria (NTM) infections in bronchiectasis patients. According to a report by NLM in December 2023, 37.9% of the patients recorded in the U.S. Bronchiectasis and NTM Research Registry were impacted during the last few years. The report has also highlighted that delayed treatment initiation, especially for Mycobacterium avium complex (MAC) infections, underscores the urgent need for improved diagnostics and targeted therapies. These drive the expansion and innovation of therapeutic options for enhanced management of the disease.

- Growing comorbidity with chronic respiratory diseases: Increasingly common long-term lung conditions, including COPD, asthma, and non-tuberculous mycobacterial (NTM) infections, help to drive the need for bronchiectasis treatment in the bronchiectasis therapeutics market. These conditions tend to worsen the disease and increase the healthcare costs, which creates a demand for better long-term treatment solutions. As per a report by NLM in October 2024, the average age of bronchiectasis patients in the US grew from 61 to 68 years, also growing from 64.2 to 67.6 years in Germany. There is now a greater need to address the combined respiratory issues with integrated care approaches, which is being responded to by healthcare facilities globally.

- Advancements in therapeutic technologies and personalized medicine:

The bronchiectasis therapeutics market continues to expand and evolve due to new therapies, such as inhaled antibiotics, targeted biologics, and other drug delivery systems. These therapies allow for less invasive and more precise treatment, and they also decrease the side effects and increase the chances that more patients are getting treatment. Clinical outcomes are also improving due to personalized medicine approaches, which customize treatment to the microbiology and genetic profiles of each patient. These developments are increasing the scope of treatments while fostering further investment in research and development of bronchiectasis.

Exporters and Importers Trend in Market

Exporters And Importers of Therapeutic Respiration Apparatus in 2023

|

Country |

Export/Import Value (USD) |

Role |

|

Singapore |

1.7 billion |

Exporter |

|

China |

1.5 billion |

Exporter |

|

Japan |

456 million |

Importer |

|

India |

191 million |

Importer |

|

Germany |

1.0 billion |

Exporter |

|

Netherlands |

704 million |

Exporter |

|

UK |

466 million |

Importer |

|

France |

421 million |

Importer |

|

U.S. |

1.3 billion |

Exporter |

|

Mexico |

567 million |

Exporter |

|

U.S. |

3.6 billion |

Importer |

|

Canada |

394 million |

Importer |

|

Australia |

1.2 billion |

Exporter |

|

New Zealand |

413 million |

Exporter |

|

Australia |

234 million |

Importer |

|

Brazil |

128 million |

Importer |

Source: OEC, August 2025

Challenges

- Complexity of disease management: Managing the bronchiectasis therapeutic market is inherently challenging due to the heterogeneous nature and frequent coexistence with other respiratory conditions of this disease. Treatment often requires a multifaceted approach involving long-term antibiotics, airway clearance techniques, and management of exacerbations, which can be a burden for patients and healthcare systems. The lack of standardized treatment protocols and variability in disease severity complicate clinical decision-making, leading to inconsistent outcomes and difficulties in optimizing therapy across diverse patient populations.

- Limited access to specialized therapies: Availability of bronchiectasis-targeted treatments is still an important hurdle, especially in underprivileged or rural communities where there may be limited access to specialist pulmonologists and high-end diagnostics. Moreover, treatment options, such as inhaled antibiotics and airway clearance devices, may be expensive. This limits the ability of patients to fully comply with the treatment regimen and to initiate treatment on time. As a result, the management of the condition is sub-optimal, increasing the chances of exacerbations and hospitalizations. Access to treatment for bronchiectasis patients is critical for improving long-term patient outcomes.

Bronchiectasis Therapeutic Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 568.94 million |

|

Forecast Year Market Size (2035) |

USD 1.09 billion |

|

Regional Scope |

|

Bronchiectasis Therapeutic Market Segmentation:

Disease Type Segment Analysis

The non-cystic fibrosis bronchiectasis subsegment is expected to hold the highest market share of 83% in the disease type segment within the forecast period in the bronchiectasis therapeutic market due to a higher prevalence, broader categorization, and the worldwide increase in average population age. According to a report by NLM in March 2024, non-cystic fibrosis bronchiectasis is prevalent globally, yet the incidence is mostly unreported due to inaccurate diagnosis coding, with ICD-9-CM and ICD-10-CM codes displaying low sensitivities of only 34% and specificities ranging from 69% to 81%, respectively. This indicates a greater need for effective diagnostic tools and treatments.

Product Type Segment Analysis

The antibiotics subsegment is expected to hold the highest market share in the product type segment within the forecast period in the bronchiectasis therapeutic market. The hospitalization-at-home model seems to further inflate this cost. As per a report by NLM in October 2024, outpatient hospital costs are mainly due to drug prescriptions, especially antibiotics, and constitute as much as 41% of the total spending. Such a significant clinical and economic reliance on antibiotics intensifies their reliance in the treatment options available and further fuels the development and funding of newer, advanced, and targeted antibiotic delivery methods, including inhaled formulations and combination therapies.

Route of Administration Segment Analysis

The oral subsegment is expected to hold the highest market share in the route of administration segment within the forecast period for the bronchiectasis therapeutic market. Oral treatments are the most favored in terms of compliance. They are easier to self-administer and have better patient adherence. For example, oral mucolytics and antibiotics serve as the cornerstone treatment for bronchiectasis. These medications extend the care of bronchiectasis patients to out-of-hospital settings, enabling effective treatment. Furthermore, such oral therapies help reduce the use of invasive treatments and hospitalizations.

Our in-depth analysis of the bronchiectasis therapeutic market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Disease Type |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

Geography |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bronchiectasis Therapeutic Market Regional Analysis:

North America Market Insight

The bronchiectasis therapeutic market in North America is expected to hold the highest growing market with 51% market share within the forecast period due to a strong pharma ecosystem, high diagnosis rates, advanced drug delivery technologies, increasing geriatric population, and prevalence of chronic respiratory disease. As per a report by NLM published in April 2024, as the baby boomer population in the region gets older and moves towards the age of retirement, the proportion of the population aged 65 or older is expected to increase significantly from 17% in 2022 to 21% in 2030 to 23% in 2050. Such a population growth trend would drive long-term demand for maintenance therapies as well as respiratory care innovation.

The bronchiectasis therapeutic market in the U.S. is projected to grow in the forecast period due to favorable FDA channels, excessive levels of awareness among patients, availability of prominent industry players, and elevated insurance coverage for novel therapies. As per a report by NLM in April 2024, the population aged 65 years and older in the US is expected to increase by 40% by 2050, from 58 million in 2022 to 82 million by 2050. The population 85 years and older and aging bring with them new challenges for the medical system, including the market for bronchiectasis therapy. Increased patient knowledge, driven by intensified screening efforts and education campaigns by health institutions, is leading to early diagnosis and use of treatment.

The bronchiectasis therapeutic market in Canada is expected to grow within the forecast period government funding for respiratory health, a growing older population, increased COPD burden, and advances in pulmonology research infrastructure. Exacerbation of COPD is the second leading cause of hospitalization in Canada. According to the report of NLM September 2023, in Canada, COPD currently affects an impressive 10% of the adult population and almost 1 in 5 individuals aged over 70 years. This heavy burden has triggered national efforts directed towards chronic respiratory disease management. As awareness and diagnostic capabilities improve, more bronchiectasis cases are being identified and treated earlier.

Asia Pacific Market Insight

The bronchiectasis therapeutic market in the Asia Pacific is expected to be the fastest-growing market within the forecast period due to rising healthcare expenditure, growing burden of non-cystic fibrosis bronchiectasis, supportive government initiatives, and growth of pharmaceutical firms in countries such as Japan and China. As per a report by NLM, September 2024, the overall prevalence of bronchiectasis is 464 per 100,000 population in Korea and 1,200 per 100,000 persons over 40 years old in China. Governments across the region are placing increasing focus on respiratory health in national healthcare policy, subsidies, and coverage for chronic respiratory therapies under public insurance schemes.

The bronchiectasis therapeutic market in China is expected to grow within the forecast period due to urbanization, respiratory issues arising out of it, increased usage of Western therapy, a high number of undiagnosed patients, and increasing clinical research activity. As per a report by NLM, September 2024, the economic burden of bronchiectasis in patients of Asia is notable, with epidemiological data from China indicating an annual per capita cost of USD 7,697 for patients with bronchiectasis. The increasing economic burden has motivated a greater government focus on disease management and health system strengthening.

The bronchiectasis therapeutic market in India is expected to grow within the forecast period due to the growing incidence of post-TB bronchiectasis, health access improvement, generic manufacturing of drugs, and growing pulmonology specialty care. The patients in India with bronchiectasis also have a high comorbidity rate and are mostly suffering from asthma and COPD. As per a report by NLM, September 2024, the prevalence of diabetes mellitus among patients in India is approximately 14%, much higher than that in other countries of Asia. Furthermore, coronary heart disease among bronchiectasis patients of India is higher at 16.2%, which indicates a large cardiovascular burden.

Comparison of the Clinical Characteristics of Bronchiectasis Between Countries in Asia (2024)

|

Comparison of the clinical characteristics of bronchiectasis between Asian countries |

Korea |

India |

China |

|

Demographics |

|||

|

Age, years |

66 (60 to 72) |

56 (41 to 66) |

57 (48 to 64) |

|

Men |

264 (44.1) |

1249 (56.9) |

48.4% |

|

Body mass index, kg·m−2 |

22.9 (20.7 to 25.4) |

21.5 (18.5 to 24.5) |

21.5 (19.0 to 23.9) |

|

Current or former smokers |

211 (35.3) |

619 (28.2) |

22.2% |

|

Comorbidities |

|||

|

COPD |

226 (37.8) |

512 (23.3) |

12.9% |

|

Asthma |

134 (22.4) |

485 (22.1) |

8.8% |

|

Osteoporosis |

70 (11.7) |

130 (5.9) |

21.2% |

|

GORD |

89 (14.9) |

346 (15.8) |

18.4% |

|

Neoplastic disease |

50 (8.4) |

17 (0.8) |

NA |

|

Disease severity |

|||

|

BSI score |

6 (4 to 9) |

7 (3 to 10) |

9 (5 to 11) |

|

BSI score risk class |

|||

|

- Mild |

171 (29.4) |

728 (33.2) |

6.5% |

|

- Moderate |

257 (44.1) |

674 (30.7) |

33.8% |

|

- Severe |

154 (26.5) |

793 (36.1) |

59.7% |

|

Clinical status |

|||

|

mMRC dyspnoea scale |

1 |

2 (1 to 3) |

1 (0 to 2) |

|

Exacerbation in the previous year |

1 (0 to 2) |

1 (0 to 2) |

1 (0 to 3) |

|

≥1 hospital admission in the previous year |

109 (18.2) |

851 (38.8) |

59.9% |

|

Microbiology |

|||

|

Pseudomonas aeruginosa |

66 (11.0) |

301 (13.7) |

24.0% |

|

Haemophilus influenzae |

9 (1.5) |

11 (0.5) |

7.8% |

|

Staphylococcus aureus |

4 (0.7) |

50 (2.3) |

1.0% |

|

Moraxella catarrhalis |

3 (0.5) |

22 (1.0) |

0.1% |

|

Enterobacteriaceae |

23 (3.9) |

215 (9.8) |

5.3% |

|

Treatment |

|||

|

Long-term antibiotics |

23 (3.9) |

271 (12.3) |

3.9% |

|

Inhaled antibiotics |

0 |

79 (3.6) |

1.6% |

Source: NLM, September 2024

Europe Market Insight

The bronchiectasis therapeutic market in Europe is expected to grow steadily within the forecast period due to government health insurance programs, high rate of clinical diagnosis that is high, aging population, and increased R&D spending on respiratory diseases. In addition, growing awareness of bronchiectasis among physicians supports early treatment adoption and diagnosis. Technological innovation in targeted therapies and biologics propels market innovation, while effective collaborations between healthcare institutions and pharma companies enhance patient access. Furthermore, strict regulatory standards ensure the safety and effectiveness of new therapeutic options, enhancing market confidence.

The bronchiectasis therapeutic market in the UK is expected to grow within the forecast period due to NHS-approved treatment availability, rising asthma and COPD comorbidity, expansion of biologics trials, and strong regulatory backing. As per a report by Asthma and Lung published in November 2022, new COPD diagnoses in the country dropped by 51% due to the pandemic, and the proportion of all five core treatments that the patients received fell from 24.5% to 17.6%, representing a drop of 6.9%. However, increased government spending on COPD and bronchiectasis, better patient knowledge, and adoption of novel treatments are driving steady market expansion.

The bronchiectasis therapeutic market in Germany is expected to grow within the forecast period due to a healthy pharma sector, rising hospitalizations caused by exacerbations, good quality diagnostic imaging equipment, and rising consumption of antibiotics and anti-inflammatory drugs. Additionally, increased government encouragement for respiratory disease management and ongoing clinical trials facilitate market growth. Rising patient sensitivity and improved health infrastructure further drive earlier diagnosis and treatment adoption. Furthermore, collaborations between doctors and pharmaceutical companies speed up the process of developing new medications.

Bronchiectasis Therapeutic Market Players:

- Insmed Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aradigm Corporation

- AstraZeneca plc

- GlaxoSmithKline plc (GSK)

- Bayer AG

- Novartis AG

- Pfizer Inc.

- Merck & Co., Inc.

- Sun Pharmaceutical (India)

- Dr. Reddy’s Laboratories

- Zambon S.p.A.

- Chiesi Farmaceutici

- Teva Pharmaceuticals

- Boehringer Ingelheim

- Inogen Inc. (Device focus)

The bronchiectasis therapeutic market is led by niche players such as Insmed and Aradigm, alongside major pharmaceutical companies such as AstraZeneca and GSK, which utilize biologics and AI-enhanced delivery systems. New inhaled, oral, and personalized therapies drive innovation, as firms focusing on generics keep their foothold in developing regions. The late-stage pipeline assets and strategic alliances of Japan-based companies round out the ecosystem. The competition revolves around clinical innovation, the ability to market therapies for other related conditions, and the use of advanced drug delivery systems.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Insmed's Brensocatib for non-cystic fibrosis bronchiectasis got granted by the FDA, setting a PDUFA. If approved, it will be the first-ever treatment for bronchiectasis and the first DPP1 inhibitor.

- In June 2024, Verona Pharma's Ohtuvayre (ensifentrine) received FDA approval as the first dual PDE3/4 inhibitor for COPD maintenance treatment, offering both bronchodilation and non-steroidal anti-inflammatory effects via nebulization, marking the first inhaled innovation in over 20 years.

- Report ID: 5679

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bronchiectasis Therapeutic Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.