Biopsy Needle Market Outlook:

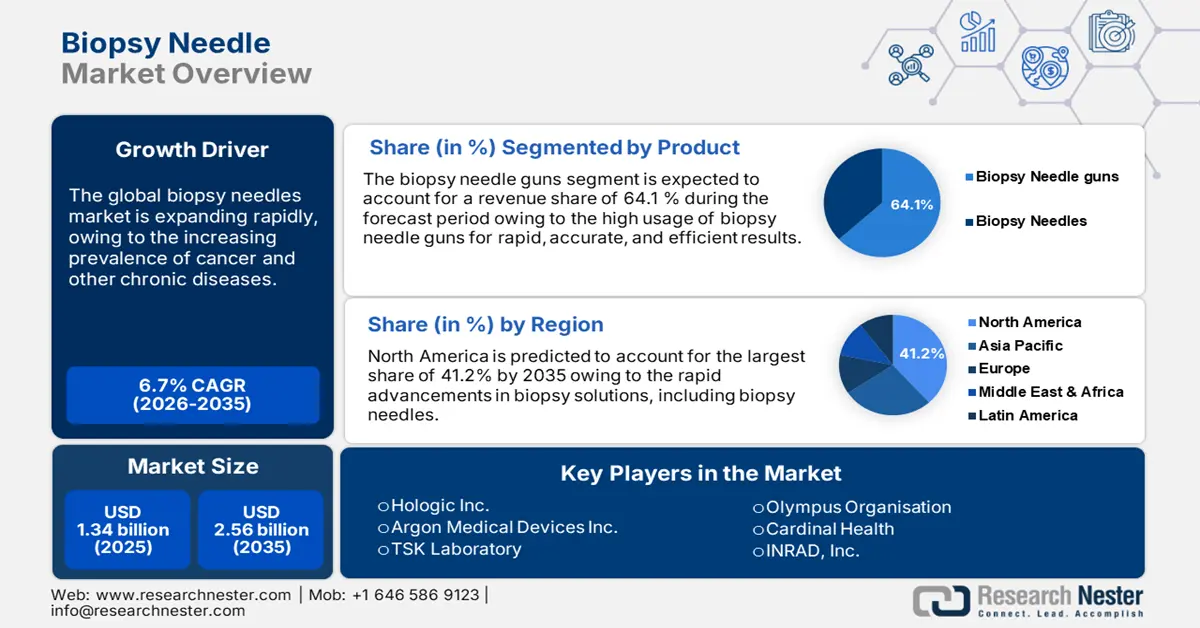

Biopsy Needle Market size was over USD 1.34 billion in 2025 and is poised to exceed USD 2.56 billion by 2035, growing at over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biopsy needle is estimated at USD 1.42 billion.

The biopsy needle market is rapidly expanding due to the rising prevalence of various chronic diseases. Biopsy needles play a crucial role in the healthcare sector, enabling healthcare professionals to gain accurate diagnosis results and develop effective treatment schedules. With advancements in technology and continuous research and development in this domain, the focus is shifting toward minimally invasive procedures, expanding healthcare infrastructure, and result-oriented outcomes. Furthermore, automated and image-guided biopsy needles induce market demand enhancing precision and reducing tissue trauma. This market emphasizes needle designing, manufacturing, and distribution to conduct biopsy procedures for the end users with an effortless and time-saving approach leading to improved diagnostics accuracy and reliability.

Key Biopsy Needle Market Insights Summary:

Regional Highlights:

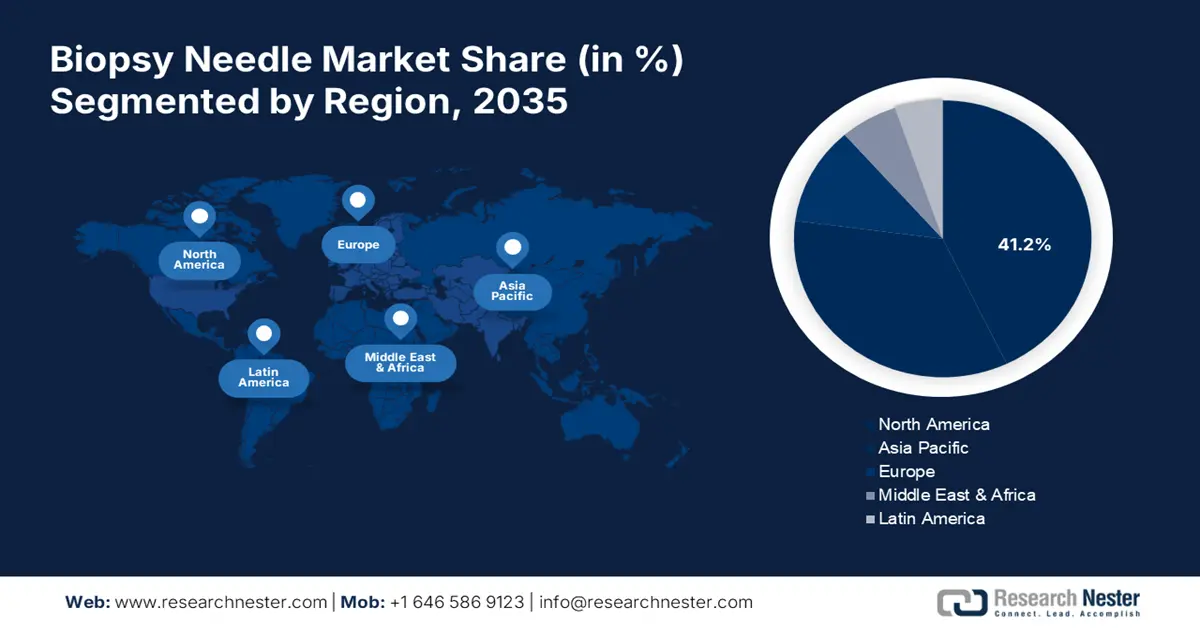

- North America’s biopsy needle market will account for 41.2% share by 2035, driven by strong healthcare infrastructure and medical R&D.

Segment Insights:

- Biopsy needle guns segment in the biopsy needle market is forecasted to achieve 64.10% growth by the forecast year 2035, driven by adjustable needle depth, handheld designs, and availability in various sizes.

- The cancer segment in the biopsy needle market is projected to experience a staggering CAGR through 2035, attributed to the increasing number of emerging cancer cases raising demand for biopsy needles.

Key Growth Trends:

- Rising prevalence of types of cancer

- Expanding applications of biopsy needles

Major Challenges:

- Risk of complications and infections

- Regulatory challenges and compliance issues

Key Players: Becton, Medtronic Plc, Cardinal Health, Hologic Inc., Olympus Corporation, Argon Medical Devices Inc., Devicor Medical Products, Inc., Cook Group Incorporated, Boston Scientific Corporation, FUJIFILM Holdings Corporation, Dickinson and Company, and INRAD, Inc.

Global Biopsy Needle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.34 billion

- 2026 Market Size: USD 1.42 billion

- Projected Market Size: USD 2.56 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 18 September, 2025

Biopsy Needle Market Growth Drivers and Challenges:

Growth Drivers

-

Rising prevalence of types of cancer: Rising cases of cancer globally is one of the major factors boosting the biopsy needles market growth. According to the WHO, cancer was the second leading cause of death, worldwide, in 2018, accounting for approximately 9.6 million deaths. Additionally, environmental and lifestyle factors, exposure to carcinogens, and unhealthy food habits contribute to the growing cancer burden, underscoring the need for advanced biopsy technologies that support timely and accurate diagnosis and its treatments. This has resulted in increasing demand for biopsy needles. Early detection through biopsy needles helps to improve treatment outcomes and increase survival rates.

-

Expanding applications of biopsy needles: The wide usage of biopsy needles in medical fields such as neurology, ophthalmology, gastroenterology, cardiology, and pediatric applications is driving its market growth. In neurology, biopsy needles are used to detect and diagnose brain tumors, in ophthalmology, they are used in treating eye diseases. In gastroenterology, the biopsy needle plays a vital role in treating liver diseases and pancreatic cancers. Additionally, biopsy needles perform various functions aiding research settings to study and develop disease mechanisms and new treatments respectively. The constant breakthroughs in the biopsy needle market are broadening its applications.

-

Growing demand for minimally invasive procedures: The growing awareness and demand for minimally invasive procedures are driving demand for innovations in the biopsy needle market. Patients and healthcare professionals strive to reduce recovery time and complications by experiencing less pain, improved satisfaction, and reduced hospital days. Moreover, minimally invasive procedures result in high accuracy and are cost-effective. As the demand is increasing, manufacturers are deemed to be more specific regarding needle designing, handling, and configurations to meet the requirements and revolutionize the biopsy and diagnostics procedures.

Challenges

-

Risk of complications and infections: The concern over the utilization of biopsy needles causing complications and infections during treatment is likely to hinder the growth in the market. Bacterial or viral infections are common infections that patients might experience at the biopsy sites, abscesses, sepsis, and cellulitis. Additionally, complications such as organ damage, bleeding, and tissue trauma can lead to severe health issues for the patient risking his life.

-

Regulatory challenges and compliance issues: Regulatory challenges and lack of adherence to compliance pose a significant obstacle in the biopsy needle market, as manufacturers and healthcare providers are responsible for scrutinizing complex regulatory frameworks. Moreover, compliance with regulations related to patient data privacy and security is essential to be maintained. Failure to comply with these details may lead to fines, legal charges, and damaging the reputation.

Biopsy Needle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 1.34 billion |

|

Forecast Year Market Size (2035) |

USD 2.56 billion |

|

Regional Scope |

|

Biopsy Needle Market Segmentation:

Product Segment Analysis

Biopsy needle guns segment is poised to hold over 64.1 % biopsy needle market share by the end of 2035. Biopsy needle guns are crucial in treating patients in procedures requiring rapid, accurate, and efficient results. The features associated with biopsy guns that make the procedure more effortless are their adjustable needle depth, handheld designs, and availability in various sizes. Biopsy needle guns offer enhanced accuracy, and reduce risks and complications, with valuable outcomes for healthcare professionals, and practitioners. The demand for biopsy guns has improved efficiency in healthcare settings and has led the field toward a revolutionized and advanced approach to diagnostics.

Application Segment Analysis

The cancer segment is expected to register a staggering CAGR throughout the forecast period. Breast cancer and prostate cancer are the most highlighted sub-segments of cancer applications. The diverse range of emerging cancer cases has increased the demand for biopsy needles making it a significant diagnostics tool. In July 2021, GE Healthcare installed Serena Bright, the first-contrast-guided biopsy solution in 5 leading hospitals in the U.S. to support clinicians and patients in their fight against breast cancer.

Our in-depth analysis of the biopsy needle market includes the following segments:

|

Product |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biopsy Needle Market Regional Analysis:

North America Market Insights

North America industry is predicted to dominate majority revenue share of 41.2% by 2035, owing to the presence of advanced healthcare infrastructure and significant investments in medical research and development, fostering innovation and adoption of cutting-edge biopsy technologies. A robust regulatory framework enhancing trust and confidence among healthcare professionals and patients is expected to further boost the market growth.

The biopsy needle market in the U.S. is expected to register a significant revenue share during the forecast period owing to increasing prevalence of several chronic diseases, rising availability of different types of biopsy needles, and presence of advanced healthcare infrastructure. Moreover, the public and private sectors are heavily investing in R&D activities to develop and launch advanced biopsy needles for better results.

APAC Market Insights

Asia Pacific biopsy needle market is driven by a significant increase in the demand for minimally invasive procedures and a rise in cancer across the region. Factors that add to this surge include increasing investments in liquid biopsy techniques, rising inclination toward personalized healthcare, and a high adoption of advanced diagnostic tools in healthcare centers in APAC.

In India, the biopsy needle market is likely to experience an upsurge owing to enhancing healthcare system infrastructure, and government initiatives. Key Players in this region including Boston Scientific and Medtronic play a vital role in revolutionizing the scenario of diagnostics procedures and preparation of systematized treatment plans.

Biopsy Needle Market Players:

- Argon Medical Devices Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton

- Cardinal Health

- Olympus Corporation

- Argon Medical Devices Inc

- Devicor Medical Products, Inc

- B. Braun Melsungen AG

- Cook Group Incorporated

- FUJIFILM Holdings Corporation

- Dickinson and Company

- Stryker Corporation

- INRAD, Inc.

The biopsy needle market is highly competitive, consisting of key players operating at global and regional levels. The key players are focused on developing advanced tools and products to cater to the rising demand for effective diagnostic tools. These key players are also adopting several strategies such as joint ventures, acquisitions, and product launches to sustain their market position and enhance their product base. Here’s a list of key players operating in the global market:

Recent Developments

- In May 2024, Cook Medical announced the launch of EchoTipAcuCore, an endoscopic ultrasound biopsy needle for precision gastrointestinal lesion biopsies. The needle’s tip is made of a cobalt-chromium alloy which allows healthcare experts to puncture tissue with flexibility and controlled precision.

- In May 2022, Argon Medical, a leading market player in the U.S. partnered with Terum India to expand its product base including IVC filters, and bone and soft tissue biopsy needles.

- Report ID: 6404

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biopsy Needle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.