Endoscopic Ultrasound Needles Market Outlook:

Endoscopic Ultrasound Needles Market size was over USD 320.4 million in 2025 and is estimated to reach USD 780.5 million by the end of 2035, exhibiting a CAGR of 7.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of endoscopic ultrasound needles is estimated at USD 348.4 million.

Growth in the market is an evident result of the growing patient pool of gastrointestinal and oncological conditions requiring minimally invasive diagnostic and therapeutic procedures. Testifying to this demography, the World Health Organization (WHO) report predicted the counts of incidence and deaths due to cancer worldwide to surpass 16.3 million and 30.2 million, respectively, by 2040. On the other hand, the International Agency for Research on Cancer (IARC) calculated the same figures to be 10 million and 20 million in 2022, which indicates the continuous rise in the epidemiology. Besides, the rapidly aging populations that are highly prone to developing associated ailments are pushing authorities to reinforce adequate diagnostic infrastructure to enable early prevention.

As the burden of these medical illnesses grows, the scale and volume of financial exhaustion become more evident, which can be optimized through timely detection and intervention. Thus, the trend of early-stage diagnosis is propelling demand in the market. However, despite the cost-effectiveness of these procedures, continuous inflation in raw material costs, strict quality control, and supply chain disruptions collectively impact the economic liberty of both manufacturers and service providers. This ultimately translates to a higher payer’s pricing of services, which limits adoption in underserved regions, particularly in low- and middle-income countries (LMICs).

Key Endoscopic Ultrasound Needles Market Insights Summary:

Regional Insights:

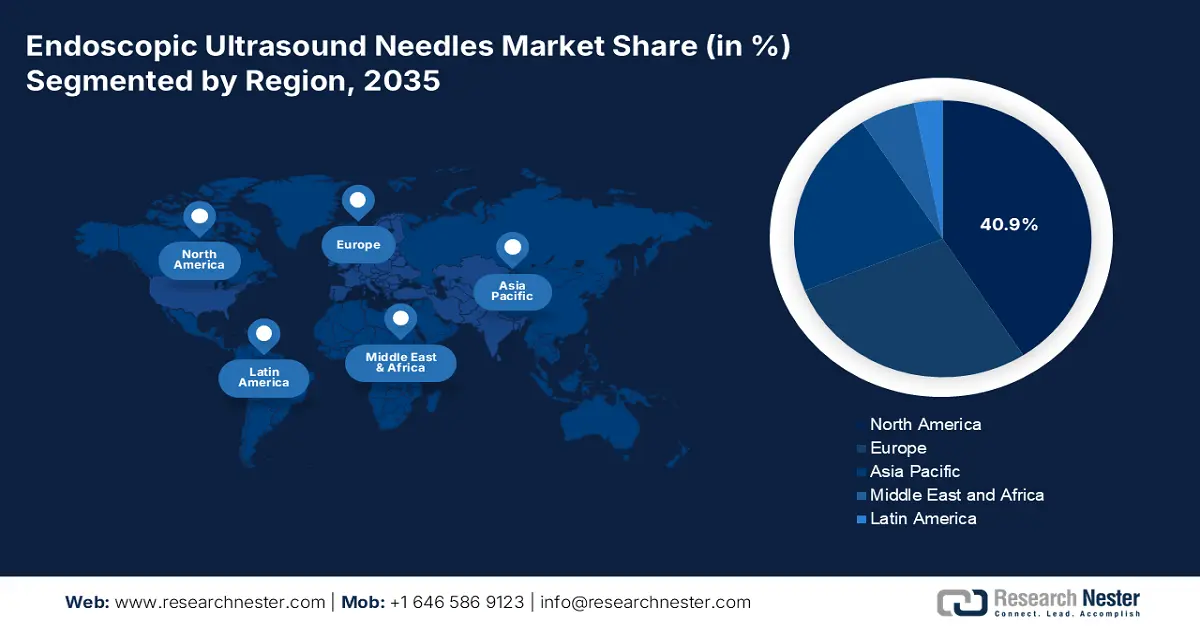

- By 2035, North America is projected to secure a 40.9% share in the global endoscopic ultrasound needles market, impelled by the high occurrence of gastrointestinal and pancreatic cancers.

- Asia Pacific is anticipated to be the fastest-growing region by 2035, owing to the amplifying burden of cancer mortality.

Segment Insights:

- The fine needle aspiration (FNA) needles segment is expected to command a 42.7% share by 2035 in the endoscopic ultrasound needles market, propelled by the increasing use in malignancy screening.

- Oncology diagnostics is projected to attain a 38.5% revenue share over 2026–2035, supported by the magnifying volume of the patient pool of malignancies.

Key Growth Trends:

- Emergence of minimally invasive surgeries (MIS)

- Advancements in product design and efficac

Major Challenges:

- Heightening expenses of manufacturing and compliance

- Competition with reprocessed devices

Key Players: Medtronic (Ireland), Cook Medical (U.S.), CONMED (U.S.), Johnson & Johnson (U.S.), Medi-Globe GmbH (Germany), Hobbs Medical (U.S.), STERIS (UK), Micro-Tech Endoscopy (U.S.), Taewoong Medical (South Korea), EndoFlex GmbH (Germany), STERLING (India), EndoChoice (U.S.), EndoMed Systems (Germany), M.I.Tech (South Korea), Unimax Medical Systems (Taiwan).

Global Endoscopic Ultrasound Needles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 320.4 million

- 2026 Market Size: USD 348.4 million

- Projected Market Size: USD 780.5 million by 2035

- Growth Forecasts: 7.2%

Key Regional Dynamics:

- Largest Region: North America (40.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Singapore

Last updated on : 21 August, 2025

Endoscopic Ultrasound Needles Market - Growth Drivers and Challenges

Growth Drivers

-

Emergence of minimally invasive surgeries (MIS): The shifting preference toward procedures with lesser recovery times, fewer complications, and improved efficiency is a major driver in the market. Testifying to the same, a 2024 study published in an AcademicMed article unveiled that patients in the MIS group had notably better overall satisfaction ratings in comparison to those in the open surgery (OS) group (9.13 vs 7.45). Additionally, the willingness to recommend MIS treatment was 17% higher than the OS. Such clinical evidence directly supports the increased adoption of EUS-guided needle procedures in modern healthcare practice.

-

Advancements in product design and efficacy: Continuous discoveries in the market are improving diagnostic accuracy and procedural efficiency, boosting adoption. Advanced products recently launched in this sector now offer greater flexibility and tissue acquisition capabilities, allowing for more reliable diagnoses of gastrointestinal and pancreatic conditions. Enhanced imaging systems, such as high-resolution ultrasound and elastography, also support better visualization of target lesions, increasing diagnostic confidence. Exemplifying the same, in February 2024, a research team in this category at UC Davis Health established the efficacy of a new ultrasound-guided EUS needle, EndoDrill GI, by successfully performing a core biopsy of a pancreatic tumor, outperforming regular needles.

-

Growing therapeutic usage of endoscopy: The increasing use of endoscopy in treating certain clinical ailments is also a propeller behind the expansion of the market. Beyond disease detection, EUS is increasingly being utilized for several therapeutic procedures, such as cyst drainage, targeted drug delivery, and tumor ablation, which is amplifying the use of commodities available in this sector. Testifying to such applicability, in March 2023, a comparative analysis between ultrasound-guided needle release plus corticosteroid injection and mini-open surgery for carpal tunnel syndrome was released by Frontiers. It underscored shorter operation time, quicker recovery, smaller wounds, and lower cost of the needle therapy than the conventional open surgery.

Historic Trends in the Patient Pool Growth of the Market

The Rise of Minimally Invasive Surgery: 16 Year Analysis

|

Procedure |

MIS Volume in 2003 |

MIS Volume in 2018 |

Change in MIS Volumes |

|

Cholecystectomy |

88% |

94% |

6% |

|

Inguinal Hernia Repair |

20% |

47% |

27% |

|

Appendectomy |

38% |

93% |

55% |

|

Colectomy |

8% |

43% |

35% |

|

Gastrectomy |

43% |

84% |

41% |

|

Nissen Fundoplication |

71% |

91% |

20% |

Source: NLM

Pricing Variability Among Different Product Types in the Market

Comparison of Payers’ Pricing Between 19G and 22G Franseen-tip Needle Biopsy (FNB) for Liver (2024)

|

Variable |

19G (in USD) |

22G (in USD) |

|

Cost of FNB Needle |

487 |

384 |

|

Average Procedural Cost of EUS-LB with FNB Needles |

768 |

664 |

Source: NLM

Challenges

-

Heightening expenses of manufacturing and compliance: The increasing costs of sourcing required raw materials and producing high-precision tools act as significant cost barriers in the market. Besides, the tightening of medical device manufacturing protocols is also contributing to such inflation, hindering both patient accessibility and company profitability in this sector. However, the utilization of public-private partnerships (PPPs), product innovation, and automated assembly lines is minimizing this disparity and benefiting the merchandise with greater profit margins.

-

Competition with reprocessed devices: Despite the growing acceptance, the market still lacks in competency with refurbished equipment use in terms of cost sensitivity among healthcare providers. Evidencing the same, in November 2023, the CDC unveiled that more than 30% of hospitals in the U.S. reuse at least one type of single-use medical device. This not only raises concerns about performance consistency and patient safety, but also limits the sector's exposure to attaining substantial purchase. To bridge this gap, pioneers are cultivating value-based pricing models, such as subscription-based procurement, to counter reprocessed devices with reliable alternatives.

Endoscopic Ultrasound Needles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 320.4 million |

|

Forecast Year Market Size (2035) |

USD 780.5 million |

|

Regional Scope |

|

Endoscopic Ultrasound Needles Market Segmentation:

Product Type Segment Analysis

The fine needle aspiration (FNA) needles segment is poised to hold the dominant share of 42.7% in the market by the end of 2035. The leadership is primarily attributable to the increasing use of this subtype in malignancy screening, with the rising incidence and complexity of cancer. Such large-scale utilization can be justified by the high diagnostic performance of these needles in cancer detection. As evidence, in June 2025, the NLM published an experimental study that evaluated the performance of endoscopic ultrasound-guided fine-needle aspiration for splenic lesions. It established this type of needle to be a highly accurate and safe diagnostic tool, delivering 100% in diagnostic accuracy, sensitivity, and specificity.

Application Segment Analysis

Oncology diagnostics is expected to account for 38.5% revenue share in the market over the assessed period. The critical role of these tools in cancer detection and staging is the foundational pillar of this forefront position. Thus, the magnifying volume of the patient pool of malignancies is directly benefiting this sector. With EUS-guided biopsies becoming a standard approach for evaluating tumors in hard-to-reach areas such as the pancreas and lungs, the segment is becoming the primary source of cash inflow in this field. Moreover, payer-driven support, notably insurance coverage expansion for EUS-based cancer staging, is increasing procedural volumes and encouraging wider clinical adoption.

End user Segment Analysis

Hospitals are estimated to dominate the end-user segment by capturing a 55.3% share in the market throughout the analyzed timeframe. The factor that solidifies their position is the widened access to advanced imaging infrastructure, skilled specialists, and comprehensive diagnostic and therapeutic capabilities. EUS procedures, particularly for cancer diagnosis and staging, are increasingly integrated into hospital workflows due to their complexity and the need for multidisciplinary care. Such a captivity over the large consumer base is further complemented by favorable reimbursement policies and institutional procurement initiatives, which enable them to adopt high-quality EUS needle technologies at scale.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Application |

|

|

End user |

|

|

Needle Size |

|

|

Usability |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Endoscopic Ultrasound Needles Market - Regional Analysis

North America Market Insights

North America is predicted to maintain its dominance in the global endoscopic ultrasound needles market during the discussed timeline, with a 40.9% share. High occurrence of gastrointestinal and pancreatic cancers, advanced healthcare infrastructure, and strong adoption of MIS technologies are collectively consolidating the region’s leadership in this sector. It also benefits from improved patient access to innovative medical devices, which is empowered by a streamlined and standardized regulatory framework. Besides, the extending Medicare coverage, incorporating EUS-based cancer diagnostics, is increasing procedural volumes across hospitals and specialized centers, reinforcing the significance of North America worldwide.

According to the NLM, 2.0 million new and 0.6 million death cases of cancer were registered across the U.S. in 2025 alone. In the same year, the American Cancer Society (ACS) unveiled that the number of cancer survivors in the country surpassed 18.6 million. These figures reflect the presence of a large consumer base and a favorable medical system, benefiting the endoscopic ultrasound needles market with greater adoption and cash inflow. The nation is also home to several global MedTech pioneers, making it an epicenter of growth for the region, while attracting more companies and investors to engage their resources in this landscape.

Canada is augmenting the endoscopic ultrasound needles market with the growing focus on elderly healthcare and minimally invasive technologies. As a result, major urban hospitals and cancer centers are increasingly investing in MIS-oriented infrastructural reinforcement, fueling the sector with stable capital influx. Moreover, national health policies and targeted R&D allocation to promote and enable equitable access to high-quality diagnostic care are cumulatively securing a prosperous future for this sector.

APAC Market Insights

Asia Pacific is expected to attain the position of the fastest-growing region in the global endoscopic ultrasound needles market by the end of 2035. The region’s propagation in this sector is highly pledged to the amplifying burden of cancer mortality, rapid healthcare modernization, and massive government allocations in extensive research. Besides, the increasing awareness of minimally invasive diagnostic procedures among patients and medical service providers is also fueling demand in this category. Moreover, public efforts to expand accessibility towards rural areas are notably propelling the adoption rate in this sector.

China leads the Asia Pacific endoscopic ultrasound needles market on account of its large population, increasing incidence of gastrointestinal and pancreatic cancers, and rapid centralization of its healthcare system. Government support for healthcare reform, along with rising investments in advanced diagnostic technologies, is fueling the adoption of EUS procedures across the country. On the other hand, the growing presence of local and international medical device manufacturers and an expanding network of specialized hospitals are further accelerating progress in this landscape.

India is becoming a prominent contributor to the ongoing progress in the APAC endoscopic ultrasound needles market, fueled by the accelerating infrastructural development in healthcare. The rising occurrence of cancers and other associated ailments, coupled with the shifting preference to MIS procedures, is fostering a sustainable consumer base in the country. The lucrative environment of business for this category can also be testified by the substantial expansion of the MedTech industry in India, where the medical device industry is estimated to reach $30 billion by 2030, as per the PIB report.

Country-wise Count of Identified Cancer Cases (2022)

|

Country |

Count of Registered Incidences |

|

China |

4.8 million |

|

Australia |

0.1 million |

|

India |

1.4 million |

Source: NLM and Australian Government

Europe Market Insights

Europe is expected to remain a considerable contributor to the global endoscopic ultrasound needles market during the tenure between 2026 and 2035. The robust medical infrastructure, a high adoption rate of advanced clinical technologies, and a strong focus on early disease diagnosis are collectively solidifying the region's persistent growth in this sector. The amplifying patient volume of cancer, coupled with the growing geriatric population, is also creating a surge in less invasive diagnostic assessments, including EUS. Besides, supportive reimbursement policies, ongoing clinical research, and the presence of leading medical device companies are further contributing to the region's augmentation.

Germany attained leadership in the Europe endoscopic ultrasound needles market, which is accomplished through its wide network of advanced healthcare facilities, strong emphasis on clinical R&D, and the rapidly growing patient population demanding early-stage MIS-based detection services. The country’s increasing incidence of gastrointestinal and pancreatic diseases, along with a growing aging population, is fueling the need for effective diagnostic tools like EUS needles. This demography can be testified by the 2022 count of new cancer cases, accounting for 0.5 million, where the age-standardized incidence rate was 557 per 100 thousand citizens in Germany, as per the OECD findings.

The UK is progressing in the regional endoscopic ultrasound needles market with a continuous inflow of capital from the governing bodies. The growing focus on early cancer detection and increasing adoption of MIS techniques are attracting massive public and private investments toward this category. In addition, strong government backing through cancer screening programs, combined with ongoing advancements in healthcare technology and specialized medical training, is contributing to the steady expansion of the country in this field.

Key Endoscopic Ultrasound Needles Market Players:

- Boston Scientific (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic (Ireland)

- Cook Medical (U.S.)

- CONMED (U.S.)

- Johnson & Johnson (U.S.)

- Medi-Globe GmbH (Germany)

- Hobbs Medical (U.S.)

- STERIS (UK)

- Micro-Tech Endoscopy (U.S.)

- Taewoong Medical (South Korea)

- EndoFlex GmbH (Germany)

- STERLING (India)

- EndoChoice (U.S.)

- EndoMed Systems (Germany)

- M.I.Tech (South Korea)

- Unimax Medical Systems (Taiwan)

The commercial dynamics of the market feature the consolidated presence of global MedTech pioneers, who are striving through product innovation, strategic partnerships, and geographic expansion. Such key players are concentrating their focus on the development of next-generation technologies that can deliver high precision and less invasiveness as per the evolving clinical demands. Moreover, mergers and acquisitions, along with investments and participation in extensive R&D, are also strengthening product portfolios and gaining a competitive edge in this sector.

Such key players are:

Recent Developments

- In May 2024, Cook Medical launched the next-generation EchoTip ClearCore Endoscopic Ultrasound (EUS) Biopsy Needle in the U.S. market. The 22-gauge ClearCore needle is designed with a Franseen tip made of a cobalt chromium alloy and used with an ultrasound endoscope for fine needle biopsies (FNB).

- In August 2023, Limaca Medical attained 510(k) clearance from the FDA for its gastroenterology-urology biopsy instrument, Precision GI. It is crafted to conduct fine needle biopsy (FNB) of submucosal lesions, mediastinal masses, lymph nodes, and intraperitoneal masses within or adjacent to the gastrointestinal tract.

- Report ID: 4312

- Published Date: Aug 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.