Biopharmaceutical Third-Party Logistics Market Outlook:

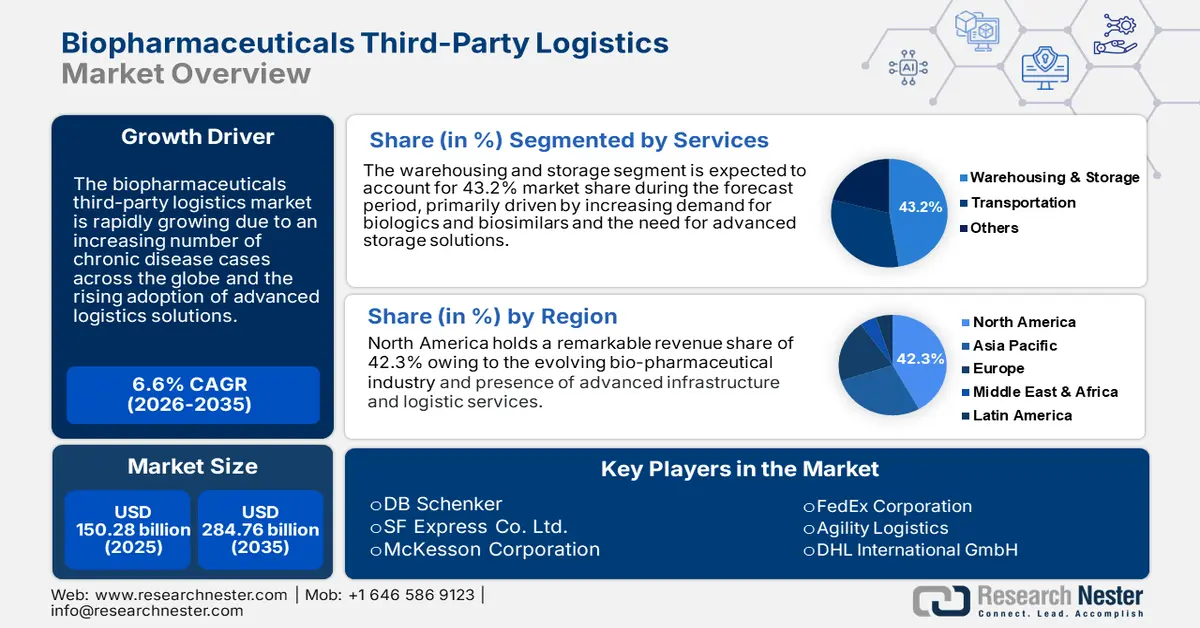

Biopharmaceutical Third-Party Logistics Market size was valued at USD 150.28 billion in 2025 and is likely to cross USD 284.76 billion by 2035, expanding at more than 6.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of biopharmaceutical third-party logistics is assessed at USD 159.21 billion.

The market growth is fostered due to emerging biopharmaceutical industries with advanced technologies offering immense growth opportunities. The high demand for effective logistics, increasing prevalence of chronic diseases, and rising approval for a wide range of biologics and biosimilars are some key factors boosting global biopharmaceutical third-party logistics market growth. Moreover, the rising manufacturing of biopharmaceuticals has encouraged third-party providers to develop advanced temperature-controlled storage and transportation solutions and services.

The market growth has been surged by the expansion into the biopharmaceuticals sector by logistics companies such as DHL and UPS, and growing adoptions of advanced technologies such as IoT sensors and blockchain, further enhancing supply chain visibility and security. For instance, McKesson Third Party Logistics (3PL) pledges to render comprehensive support to biopharma companies of all sizes, ranging from licensing needs to business planning to monitoring programming. Companies follow stringent norms and complex procedures for the pricing and manufacturing of biological products and biopharmaceuticals as these are derived from living cells and are sensitive as compared to traditional pharmaceutical drugs. According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) of biological products and drug manufacturing reached 254.0 in July 2024.

Key Biopharmaceutical Third-Party Logistics Market Insights Summary:

Regional Highlights:

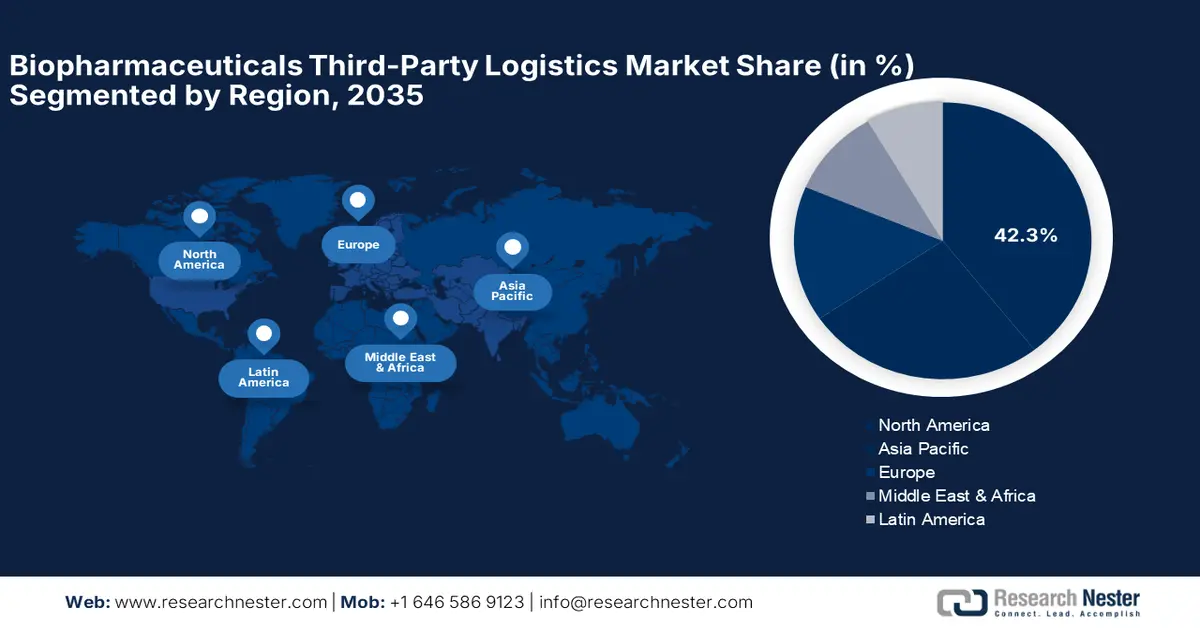

- North America biopharmaceutical third-party logistics market will account for 42.30% share by 2035, driven by a strong biopharmaceutical industry, advanced infrastructure, and regulatory compliance.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by rising demand for biosimilars and investment in healthcare infrastructure and logistics.

Segment Insights:

- The warehousing and storage segment in the biopharmaceutical third-party logistics market is anticipated to see substantial growth till 2035, propelled by the demand for storage of temperature-sensitive biologics and biosimilars.

- The non-cold chain segment in the biopharmaceutical third-party logistics market is expected to see robust growth till 2035, fueled by rising demand for ambient-stable biologics and flexible logistics.

Key Growth Trends:

- Rising demand for biologics and biosimilars

- Increasing frequency of chronic diseases

Major Challenges:

- Integration of technology

- Capacity constraints

Key Players: DHL Supply Chain, FedEx Corporation, United Parcel Service, Inc. (UPS), Kuehne+Nagel International AG, DB Schenker, CEVA Logistics, XPO Logistics, Inc., Nippon Express Co., Ltd., Panalpina World Transport (Holding) Ltd., Yusen Logistics Co., Ltd.

Global Biopharmaceutical Third-Party Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 150.28 billion

- 2026 Market Size: USD 159.21 billion

- Projected Market Size: USD 284.76 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Biopharmaceutical Third-Party Logistics Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for biologics and biosimilars: The increasing utilization of biologics for treating chronic diseases such as cancer, autoimmune diseases, and diabetes is a key factor boosting market growth. This has resulted in a growing need for sophisticated logistics solutions to handle multifaceted requirements such as navigation of distribution requirements, temperature-controlled storage, and timely transportation.

- Increasing frequency of chronic diseases: The rising incidence of different types of chronic diseases is a key factor boosting market growth. The constant demand for coordinated care and precision medication delivery drives innovation and leads to an increase in research and development activities in the market. It has also intensified the development of conducive treatment solutions to ensure temperature-controlled transportation and high-value services. Moreover, specialized logistic providers with equally intricate supply chains maintain product integrity to propel market growth.

Challenges

- Integration of technology: The main challenge to the biopharmaceuticals third-party logistics market is the integration of advanced technologies such as IoT sensors, blockchain, and data analytics. The incorporation requires investments in infrastructure, gathering resources, and training people. Moreover, the process of integration also creates technical challenges such as breaches of data and lack of security thus causing complexities in delivering expertise. Thus, as technology is advancing, it is becoming increasingly complex to attain an efficient and secure market.

- Capacity constraints: The lack of cold chain logistics and transportation capacity raises immense challenges to any biopharmaceutical third-party logistics market. The increasing demand for biologics and biosimilars is comparatively much higher than the capacity provided. Cold chain storage, refrigerated vehicles, and skilled personnel to handle high-value biologics are under-supplied, which creates a bottleneck in the supply chain, causing delay, damage, and increased costs. Lack of standardization in equipment and facilities further limits the flexibility and adaptability of logistics providers to respond to changing market conditions thus impacting the capacity in the biopharmaceutical supply chain.

Biopharmaceutical Third-Party Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 150.28 billion |

|

Forecast Year Market Size (2035) |

USD 284.76 billion |

|

Regional Scope |

|

Biopharmaceutical Third-Party Logistics Market Segmentation:

Service Segment Analysis

Warehousing and storage segment is set to capture around 43.2% biopharmaceutical third-party logistics market share by the end of 2035, primarily driven by increasing demand for biologics and biosimilars and the need for advanced storage solutions, ensuring the integrity and efficacy of temperature-sensitive biologics. The warehousing and storage segment is expected to continue dominating this sector, as logistics companies are investing heavily in expanding their capacity to accommodate the new patterns and trends being followed by ensuring its safe and efficient storage and distribution.

SupplySegment Analysis

The non-cold chain segment is anticipated to register robust growth during the forecast period owing to the growing demand for ambient and room temperature-stable biologics such as tablets, capsules, or powders. Higher concern towards supply chain flexibility and agility will further push the demand for non-cold chain solutions, as it provides better flexibility in dynamic market conditions. Innovations in the process of packaging and shipping technologies are assisting in transporting non-cold chain biopharmaceuticals more safely and efficiently.

Our in-depth analysis of the market includes the following segments

|

Services |

|

|

Supply |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biopharmaceutical Third-Party Logistics Market Regional Analysis:

North America Market Insights

North America industry is set to account for largest revenue share of 42.3% by 2035, owing to several driving forces as the region has a vast and rapidly evolving biopharmaceutical industry, characterized by a strong presence of biotech companies, research institutions, and manufacturing facilities that have created strong demand for specialized logistics services. The region has well-structured and established transport infrastructure such as airports, seaports, and highways which ensures efficient and safe transportation of biopharmaceutical products.

North America is governed by a strict regulatory environment heavily dominated by authorized which has led to logistics providers making the necessary investment in compliant and secure solutions hence supporting the growth of the market. The strong economic growth in this region, coupled with the growing investments in the research and development of biopharmaceuticals, and the trend of outsourcing logistics operations by third-party specialized providers is further boosting this market.

The U.S. is the largest revenue-generating country for biopharmaceutical third-party logistics in North America. This growth is attributed to factors such as increasing demand for biopharmaceuticals, the presence of advanced healthcare systems, and the growing adoption of cutting-edge technologies such as real-time monitoring and temperature-controlled logistics. In June 2024, Alcami Corporation announced the expansion of its warehousing and storage of pharma products with the launch of a new 65,000 ft2 state-of-the-art pharma storage facility in Garner.

Asia Pacific Market Insights

Asia Pacific is expected to be the fastest-growing region in the biopharmaceutical third-party logistics market owing to rising demand for biosimilars and biopharmaceuticals to cater to the rising cases of chronic illnesses and the growing need for advanced storage and logistics solutions. Additionally, growing expenditure on healthcare and the high adoption of innovative therapies are all contributing to this market growth.

The local government strives to formulate policies that aim at developing biopharmaceuticals through several infrastructure investments, tax incentives, and streamlined regulatory procedures. Thus, the Asia Pacific continues to grow in leaps and bounds as logistics providers continue to invest in building sound infrastructure and meeting the changing needs of biopharmaceutical companies.

In India, the market is expected to witness rapid revenue growth owing to rising demand for advanced healthcare solutions, expanding pharmaceutical production, and the need for robust infrastructure for cold-chain transitions and warehousing to store specialty drugs and vaccines.

Biopharmaceutical Third-Party Logistics Market Players:

- Agility Logistics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AmerisourceBergen Corporation

- DB Schenker

- DHL International GmbH

- FedEx Corporation

- Kerry Logistics Network Limited

- Kuehne + Nagel International AG

- McKesson Corporation

- SF Express Co. Ltd.

- United Parcel Service of America, Inc.

Companies play a vital role in fostering the growth of the market, by introducing innovations and developments. In the biopharmaceutical third-party logistics market companies have revolutionized storage and transportation services by ensuring regulatory compliance and product safety. The market consists of several global and regional key players focused on adopting several strategies such as mergers and acquisitions, product launches, partnerships, and joint ventures to retain their market position and enhance their product base.

The eminent contributors in the industry include:

Recent Developments

- In September 2024, MD Logistics, a third-party logistics provider announced its plans to convert half of its largest in-network facility into cGMP-compliant warehouse space to serve the growing needs of the life sciences and pharmaceutical industries.

- In November 2023, Pharmaceutical distributor Mawdsleys, announced the launch of its expanded third-party logistics (3PL) warehouse in Doncaster requiring additional space for better functioning.

- In August 2023, third-party logistics provider CEVA Logistics acquired an omnichannel contract logistics provider in Mumbai to expand its operations within India.

- Report ID: 6463

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biopharmaceutical Third-Party Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.