Healthcare Logistics Market Outlook:

Healthcare Logistics Market size was over USD 103.7 billion in 2025 and is projected to reach USD 243.25 billion by 2035, growing at around 8.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare logistics is evaluated at USD 112.01 billion.

The global market is expanding rapidly, driven by the globalization of pharmaceutical manufacturing and the rise of cross-border trade. Integration of blockchain for enhanced transparency and security is gaining traction in regions with high counterfeiting risks. The import and export of medical supplies and pharmaceuticals have grown vividly over the years, which significantly impacts the healthcare logistics industry. Advancements in medical technology, the rise of biologics, and increasing demand for temperature-controlled logistics are driving further market growth.

For instance, U.S. International Trade in Goods and Services, October 2024, the country exported USD 38,761 million worth of medical equipment in 2023, and USD 38,488 million in 2024. The exporter of medical instruments in the U.S. was California, with USD 505 million in exports to mainly Netherlands with USD 437 million worth of exports in September 2024. Moreover, the adoption of predictive analytics to forecast demand and optimize inventory management, reducing wastage of perishable medical products including vaccines is also boosting the market.

Furthermore, the growing trend of decentralized clinical trials drives the need for customized logistics solutions to transport sensitive medical samples and supplies to diverse locations worldwide. In October 2023, Cyroport, Inc. and CGTCatapult entered a strategic partnership to support the advancement of cell and gene therapies. The collaboration establishes Cryoport Systems’ first global supply chain logistics center in the UK, which is a Good Manufacturing Practice (GMP)-compliant facility located within the bioscience cluster in Stevenage.

Key Healthcare Logistics Market Insights Summary:

Regional Highlights:

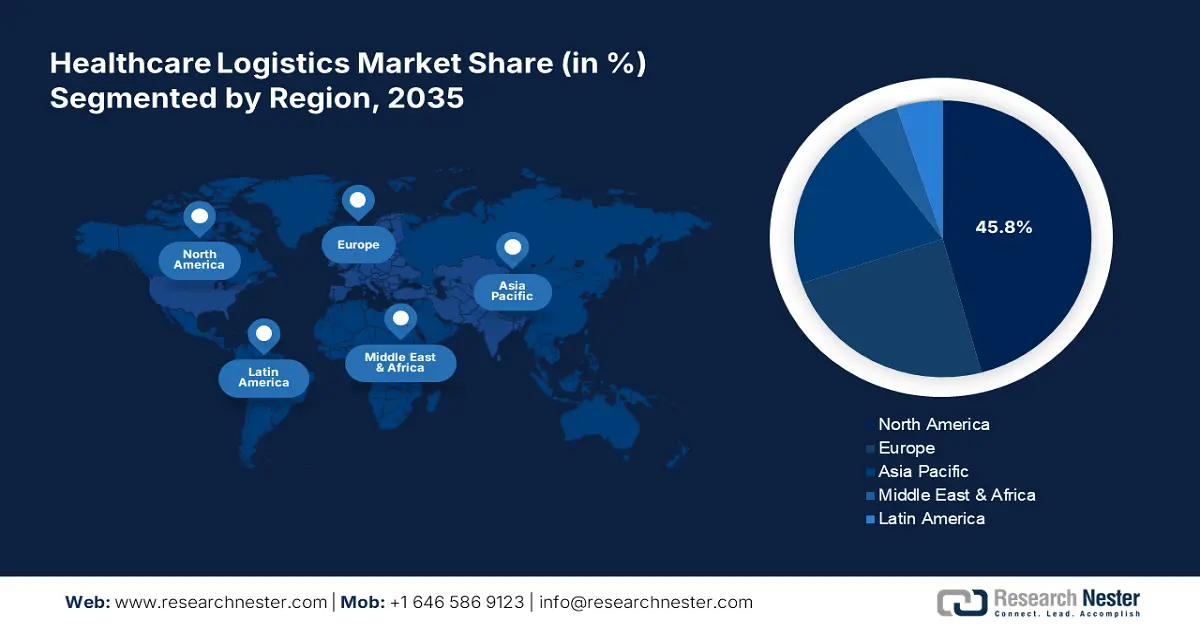

- North America healthcare logistics market will account for 45.80% share by 2035, driven by a well-established pharmaceutical industry and robust supply chain infrastructure.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, attributed to improving medical infrastructure and supply chain efficiency in emerging economies.

Segment Insights:

- The medical devices segment segment in the healthcare logistics market is projected to secure a 51.80% share by 2035, driven by rising diagnostic demand, chronic disease prevalence, and increasing surgical procedures.

Key Growth Trends:

- Rising demand for advanced medical devices

- Increased government healthcare spending

Major Challenges:

- Supply chain disruptions

Key Players: DHL Supply Chain, UPS Healthcare (United Parcel Service, Inc.), FedEx Corporation, Kuehne+Nagel International AG, DB Schenker, CEVA Logistics, XPO Logistics, Inc., Cardinal Health, Inc., Owens & Minor, Inc., AmerisourceBergen Corporation (Cencora).

Global Healthcare Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 103.7 billion

- 2026 Market Size: USD 112.01 billion

- Projected Market Size: USD 243.25 billion by 2035

- Growth Forecasts: 8.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Healthcare Logistics Market Growth Drivers and Challenges:

Growth Drivers

-

Rising demand for advanced medical devices: Increased imports of cutting-edge medical devices market, particularly from the U.S. and Europe, require specialized logistics solutions to ensure safe and timely deliveries. According to the India Brand Equity Foundation (IBEF), the medical devices market in India is projected to grow up to USD 50 billion by 2030., which is currently driven by 70-80% imports from countries such as the U.S., China, and Germany. Furthermore, as healthcare companies expand globally, reliance on imported raw materials for developing and manufacturing advanced medical devices also necessitates cross-border logistic solutions.

-

Increased government healthcare spending: Governments are allocating higher budgets for healthcare infrastructure and services around the world. This is leading to investments in modernized supply chains and logistics networks. In the Union Budget of India 2024-25, USD 10.73 billion was allocated for the healthcare sector. This implies that with bigger budgets, the countries will be investing more in upgrading the healthcare infrastructure, resulting in high demand in the healthcare logistics market for ensured safety of the transported products.

Challenges

-

Rising operational costs: The increasing costs of fuel, labor, and maintaining specialized logistics infrastructure, such as cold chain systems, pose significant challenges. These expenses are further exacerbated by the need to invest in advanced technologies including IoT and automation, making it difficult for smaller logistics providers to remain competitive. This creates a challenge in the market, limiting the industry expansion.

-

Supply chain disruptions: Geopolitical tensions, natural disasters, and pandemics lead to shortages of essential medical supplies and raw materials, straining healthcare logistics operations. Furthermore, these increase transportation costs and reduce access to critical routes, severely impacting the healthcare logistics market by creating supply chain disruptions. Delays in the transportation of critical medical supplies and pharmaceuticals, coupled with fluctuating demand, create inefficiencies and strain on logistics networks.

Healthcare Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.9% |

|

Base Year Market Size (2025) |

USD 103.7 billion |

|

Forecast Year Market Size (2035) |

USD 243.25 billion |

|

Regional Scope |

|

Healthcare Logistics Market Segmentation:

Product Segment Analysis

By 2035, medical devices segment is anticipated to account for healthcare logistics market share of around 51.8%. The growing demand for diagnostic tools, in addition to the increasing prevalence of chronic diseases, and rising surgical procedures drive the need for efficient and timely logistic solutions. The developing economies around the world are importing a wide range of medical devices, majorly from the U.S.

For instance, according to the OEC, in 2022, the U.S. exported USD 33.3 billion in medical instruments, becoming the first largest exporter of medical instruments in the world. Additionally, in 2022, medical instruments were the eleventh most exported products from the U.S. to countries including the Netherlands (USD 5.4 billion), China (USD 3.7 billion), Mexico (USD 3.2 billion), Japan (USD 2.4 billion), and Germany (USD 2.4 billion). This in turn is boosting the market growth further.

Type Segment Analysis

Based on type, the generic drugs segment is projected to dominate the healthcare logistics market during the forecast period. Generic drugs form the basic layer of hospital and preventive healthcare and comprise the vast majority of shortages. The increasing demand for affordable medicines has boosted the production and distribution of generic drugs. These drugs also benefit from streamlined logistics, as they typically have less stringent storage requirements, allowing efficient large-scale transportation and accessibility across the diverse market.

For instance, according to the CPA, in the U.S. generic pharmaceuticals were the second largest manufactured import, with a value of USD 176 billion in imported products in 2021. India, Mexico, and China held 57% of all pharmaceutical imports (by weight) in 2021. In addition, 84% of all prescription volume in the U.S. includes generics in comparison to 35% in other OECD nations, paying USD 0.8 for generic drugs compared to other OECD nations. In 2019, the U.S. FDA approved more than 1,100 generic drugs under the abbreviated new drug application (ANDA). This has promoted the demand for generic drugs, in turn boosting the transport demand in the market.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Product |

|

|

Service |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Logistics Market Regional Analysis:

North America Market Insights

North America in healthcare logistics market is poised to capture over 45.8% revenue share by 2035. The region benefits from a well-established pharmaceutical industry and a robust supply chain infrastructure. Furthermore, according to the International Trade Administration, in January 2024, the U.S. witnessed an estimated 25% rise in medical device exports in the last three years and an estimated import value of USD 600 million in the year 2022. Increasing collaborations between logistics providers and healthcare companies are propelling further market growth in the region.

The market in the U.S. is driven by advancements in technology and the growing demand for temperature-sensitive pharmaceuticals. Additionally, regulatory standards set by the FDA emphasize supply chain transparency, and security, further boosting investments in modern logistics infrastructure. For instance, in February 2022, DHL Supply Chain’s Life Sciences and Healthcare (LSHC) sector invested more than USD 400 million. The investment was aimed at expanding the company’s pharmaceutical and medical device distribution network footprint by 27% in the same year.

Canada healthcare logistics market is witnessing growth due to its emphasis on improving healthcare access across its vast geography. The demand for cold chain logistics has surged particularly vaccine distribution, with a focus on ensuring compliance with Health Canada. Technological innovations, including real-time tracking systems, are being adopted to enhance delivery efficiency and overcome challenges posed by the country’s remote and rural regions.

Asia Pacific Market Insights

APAC healthcare logistics market is projected to witness the fastest growth during the forecast period. Emerging economies in the region are focusing on improving medical infrastructure and supply chain efficiency to enhance access to medicines and vaccines. International Trade Administration stated in 2024 that India imports nearly 80% of its medical devices, particularly, high-end equipment such as cancer diagnostics, medical imaging, and ultrasonic scans. E-commerce in healthcare is also boosting last-mile delivery innovations in the Asia Pacific.

India market is expanding majorly due to government initiatives such as the Make in India campaign. The rise of telemedicine and home healthcare services further fuels the need for strong delivery networks in the country. For instance, in September 2023, Cipla Limited partnered with Skye Air Mobility and launched drone-powered deliveries of critical medicines for hospitals and pharmacies in the state of Himachal Pradesh, India. Such factors are significantly boosting market innovation and expansion for a greater outcome by the end of 2035.

China market witnesses growth owing to its advanced manufacturing capabilities and extensive cold chain infrastructure. The local government’s focus on healthcare reforms and investments in smart logistics technologies, including IoT and AI, is transforming this sector. Furthermore, the aging demographic of the country demands efficient and reliable logistics support, majorly for home-based care, and specialized treatments.

Healthcare Logistics Market Players:

- Air Canada

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- AmerisourceBergen Corp

- CEVA Logistics AG

- Cold Chain Technologies LLC

- Deutsche Post DHL Group

- FedEx Corp

- Kuehne + Nagel International AG

- Schenker AG

- United Parcel Service Inc.

- Owens & Minor

- Lufthansa Cargo

- Alloga

- PHEONIX Group

- H. Robinson

- DSV

Healthcare logistics market companies are focusing on regional expansion by establishing distribution hubs in emerging markets to improve supply chain efficiency. For instance, in November 2024, FedEx expanded its state-of-the-art Korea Life Science Center in Gimpo, Gyeonggi-do, spanning 2,288 square meters, designed to meet increasing demand for specialized healthcare transportation solutions. Overall, the company achieved a target of USD 1.8 billion in structural cost-out in FY24, showcasing its worldwide growth and expansion. These expansion strategies are boosting companies’ growth and maintaining competition in the market significantly.

Recent Developments

- In June 2024, Konoike Transport Co., Ltd. acquired 82% of the shares of SPD India Healthcare Pvt. Ltd. to strengthen its position in the key businesses of India and the country’s medical market.

- In January 2024, Mitsui O.S.K. Lines, Ltd. and MOL Logistics Co., Ltd. signed a memorandum of understanding (MoU) with Revital Healthcare Limited, aiming to build a medical supplies and pharmaceutical distribution center in the Mombasa Special Economic Zone.

- In September 2024, UPS acquired Frigo-Trans, and its sister company BPL. The acquisition is aimed at enhancing the company’s end-to-end capabilities among Europe customers, increasingly seeking temperature-sensitive and time-critical logistics.

- In April 2021, CEVA Logistics launched a new sub-brand CEVA FORPATIENTS for healthcare and pharmaceutical companies considering patients as the center of the supply chain, with end-to-end logistics solutions.

- Report ID: 6865

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.