Global Cell Cryopreservation Market

- An Outline of the Global Cell Cryopreservation Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Cell Cryopreservation

- Recent News

- Regional Demand

- Global Cell Cryopreservation by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Cell Cryopreservation Demand Landscape

- Cell Cryopreservation Demand Trends Driven by Cell-based Therapies and Regenerative Medicine, Fertility Preservation, and Biobanking (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Cell Cryopreservation Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Cell Cryopreservation – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Thermo Fisher Scientific Inc

- Miltenyi Biotec GmbH

- BioLife Solutions INC

- PromoCell GmbH

- Corning Incorporated

- Cooper Companies

- Bio-Rad Laboratories

- Creative Biolabs

- Lonza

- HiMedia Laboratories

- Business Profile of Key Enterprise

- Global Cell Cryopreservation Market Outlook

- Market Overview

- Market Revenue by Value (USD Thousand), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Cell Cryopreservation Market Segmentation Analysis (2026-2036)

- By Application

- Stem Cell Banking, Market Value (USD Thousand), and CAGR, 2026-2036F

- Assisted Reproductive Technology (USD Thousand), and CAGR, 2026-2036F

- Cell Therapy, Market Value (USD Thousand), and CAGR, 2026-2036F

- Drug Discovery and Development, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End use

- Biopharmaceutical and Pharmaceutical companies, Market Value (USD Thousand), and CAGR, 2026-2036F

- CMOs and CDMOs, Market Value (USD Thousand), and CAGR, 2026-2036F

- Biobanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- IVF Clinics, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Product

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Market Overview

28.2.3.1.1. Ethylene Glycol, Market Value (USD Thousand), and CAGR, 2026-2036F

28.2.3.1.2. Dimethyl Sulfoxide, Market Value (USD Thousand), and CAGR, 2026-2036F

28.2.3.1.3. Glycerol, Market Value (USD Thousand), and CAGR, 2026-2036F

28.2.3.1.4. Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Equipment, Market Value (USD Thousand), and CAGR, 2026-2036F

- Freezers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Incubators, Market Value (USD Thousand), and CAGR, 2026-2036F

- Liquid Nitrogen Supply Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Consumable, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Vials, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Tubes, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cooler Boxes/Containers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Thousand), 2026-2036

- North America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- North America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Application

- Stem Cell Banking, Market Value (USD Thousand), and CAGR, 2026-2036F

- Assisted Reproductive Technology, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cell Therapy, Market Value (USD Thousand), and CAGR, 2026-2036F

- Drug Discovery and Development, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- By End use

- Biopharmaceutical and Pharmaceutical companies, Market Value (USD Thousand), and CAGR, 2026-2036F

- CMOs and CDMOs, Market Value (USD Thousand), and CAGR, 2026-2036F

- Biobanks, Adhesives and Sealants (CASE), Market Value (USD Thousand), and CAGR, 2026-2036F

- IVF clinic, Market Value (USD Thousand), and CAGR, 2026-2036F

- Other, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Product

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- Ethylene Glycol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Dimethyl Sulfoxide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Glycerol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Overview

- Consumable, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Vials, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Tubes, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cooler Boxes/Containers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Equipment, Market Value (USD Thousand), and CAGR, 2026-2036F

- Freezers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Incubators, Market Value (USD Thousand), and CAGR, 2026-2036F

- Liquid Nitrogen Supply Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- U.S. Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- By Application

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- Ethylene Glycol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Dimethyl Sulfoxide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Glycerol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Overview

- Consumable, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Vials, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Tubes, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cooler Boxes/Containers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Equipment, Market Value (USD Thousand), and CAGR, 2026-2036F

- Freezers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Incubators, Market Value (USD Thousand), and CAGR, 2026-2036F

- Liquid Nitrogen Supply Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- UK Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD Thousand), 2026-2036, By

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- Ethylene Glycol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Dimethyl Sulfoxide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Glycerol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- Overview

- Consumable, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Vials, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Tubes, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cooler Boxes/Containers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Equipment, Market Value (USD Thousand), and CAGR, 2026-2036F

- Freezers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Incubators, Market Value (USD Thousand), and CAGR, 2026-2036F

- Liquid Nitrogen Supply Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- China Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zealand Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2026-2036, By

- By Application

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- Ethylene Glycol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Dimethyl Sulfoxide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Glycerol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- By Application

- Overview

- Consumable, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Vials, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Tubes, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cooler Boxes/Containers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Equipment, Market Value (USD Thousand), and CAGR, 2026-2036F

- Freezers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Incubators, Market Value (USD Thousand), and CAGR, 2026-2036F

- Liquid Nitrogen Supply Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- Brazil Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East & Africa Market

- Overview

- Market Value (USD Thousand), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Thousand), 2026-2036, By

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- Ethylene Glycol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Dimethyl Sulfoxide, Market Value (USD Thousand), and CAGR, 2026-2036F

- Glycerol, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cell Freezing Media, Market Value (USD Thousand), and CAGR, 2026-2036F

- Overview

- Consumable, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Vials, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cryogenic Tubes, Market Value (USD Thousand), and CAGR, 2026-2036F

- Cooler Boxes/Containers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Others, Market Value (USD Thousand), and CAGR, 2026-2036F

- Equipment, Market Value (USD Thousand), and CAGR, 2026-2036F

- Freezers, Market Value (USD Thousand), and CAGR, 2026-2036F

- Incubators, Market Value (USD Thousand), and CAGR, 2026-2036F

- Liquid Nitrogen Supply Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Tanks, Market Value (USD Thousand), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Thousand)

- Saudi Arabia Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Thousand) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Cell Cryopreservation Market Outlook:

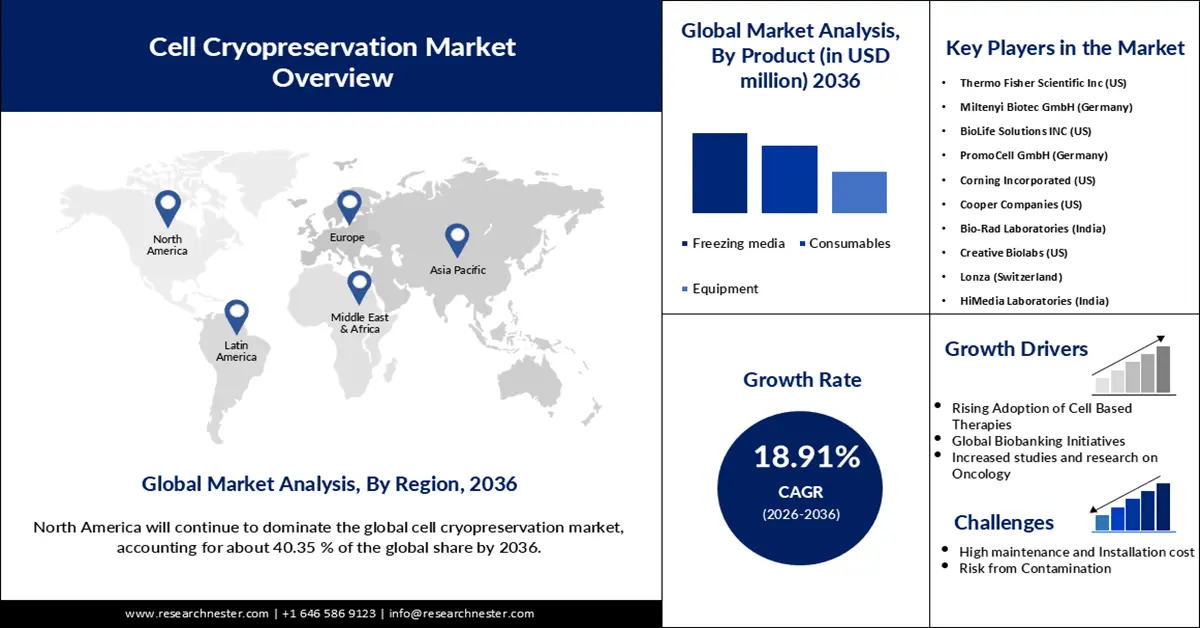

Cell Cryopreservation Market size was valued at USD 14.32 billion in 2025 and is projected to reach USD 101.98 billion by 2036, growing at a CAGR of 18.91% during the forecast period (2026-2036). In 2026, the industry size of cell cryopreservation is expected to be USD 18.05 billion.

Growing demand from the healthcare sector and the shift toward personalized medicine are significantly fuelling the cell cryopreservation market, as more cell-based therapies are tailored to individual patients. The NIH’s All of Us Research Program, for example, has exceeded 633,000 participants in its precision-medicine biobank, providing rich biospecimen data that must be properly cryopreserved. Simultaneously, there are over 1,744 CAR-based (cell/gene) therapy trials registered on ClinicalTrials.gov, showing how the clinical pipeline is increasingly patient-specific. This personalized-treatment trend requires large-scale, validated cryobanking, controlled-rate freezing, and cold-chain logistics to maintain cell viability, driving growth in cryopreservation infrastructure.

Strong government support for stem cell research and preservation is further driving the growth of the cell cryopreservation market. Moreover, artificial intelligence (AI) is playing an increasingly important role in advancing cell cryopreservation by improving efficiency, precision, and reproducibility across key processes. AI algorithms can analyze large datasets to determine the optimal freezing and thawing conditions, such as cooling rates, cryoprotectant concentrations, and storage temperatures, to maximize cell viability and functionality.

Key Cell Cryopreservation Market Insights Summary:

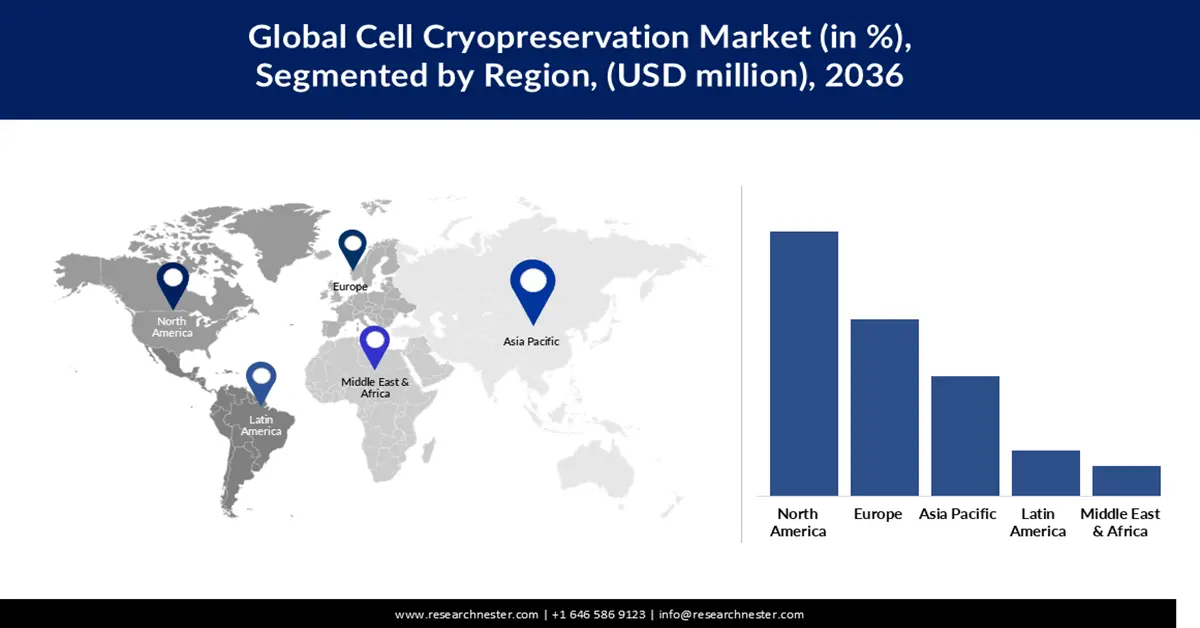

Regional Highlights:

- By 2036, North America is poised to command about 40.35% of the Cell Cryopreservation Market, sustained by its robust biotech ecosystem, strong regulatory foundations, and extensive cell-therapy clinical trial activity.

- Europe is projected to expand its market position by 2036, supported by coordinated ATMP oversight, EU-backed research programs, and broad biobanking integration impelled by rising requirements for validated long-term storage.

Segment Insights:

- By 2036, the cell freezing media segment in the Cell Cryopreservation Market is projected to capture a 38.64% share, supported by escalating adoption of high-performance and clinically compliant freezing media formulations.

- The stem cell banking segment is anticipated to secure a 39.29% share by 2036, underpinned by expanding inventories of diverse banked stem-cell units and broader utilization in regenerative therapies.

Key Growth Trends:

- Rising adoption of cell-based therapies

- Global biobanking initiatives

Major Challenges:

- Substantial cost in installation and maintenance

- Risk of contamination

Key Players: Thermo Fisher Scientific Inc (U.S.), Miltenyi Biotec GmbH (Germany), BioLife Solutions INC (U.S.), PromoCell GmbH (Germany), Corning Incorporated (U.S.), Cooper Companies (U.S.), Bio-Rad Laboratories (India), Creative Biolabs (U.S.), Lonza (Switzerland), HiMedia Laboratories (India).

Global Cell Cryopreservation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.32 billion

- 2026 Market Size: USD 18.05 billion

- Projected Market Size: USD 101.98 billion by 2036

- Growth Forecasts: 18.91% CAGR (2026-2036)

Key Regional Dynamics:

- Largest Region: North America (40.35% Share by 2036)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: South Korea, India, Singapore, Australia, Brazil

Last updated on : 4 December, 2025

Cell Cryopreservation Market - Growth Drivers and Challenges

Growth Drivers

- Rising adoption of cell-based therapies: The growing momentum behind cell-based therapies is significantly bolstering the demand for cryopreservation, as each autologous or allogeneic product needs dependable freezing, long-term storage, and validated cold-chain logistics. According to the Alliance for Regenerative Medicine, there are now 2,981 developers globally and 1,968 active clinical trials, backed by nearly US $3.0 billion of investment in Q3 2024. Regulatory headwinds are easing too: the FDA has removed REMS requirements for several approved autologous CAR-T therapies, reducing procedural burdens and opening the door to wider commercialization. At the same time, agency guidance increasingly emphasizes the need for stability studies both pre-freeze and post-thaw, driving sponsors to invest more in cryostorage and controlled-rate freezing systems. This convergence of clinical scale-up, favorable regulation, and technical rigor is making cryopreservation infrastructure a foundational pillar in the cell-therapy value chain.

- Global biobanking initiatives: Growing biobanking infrastructure is significantly accelerating the cell cryopreservation market by creating vast, well-characterized repositories of cells that require reliable freezing and long-term storage. For instance, BBMRI-ERIC connects around 400 biobanks across 32 countries, collectively cataloguing samples from over 5.1 million donors. The Italian node alone holds more than 2.1 million disease-oriented samples, including 200,000 rare-disease samples. As national and international biobanking initiatives expand, so does the need for infrastructure-controlled-rate freezers, cryovials, validation services, and certified protocols, pushing up demand in the cryopreservation market.

- Increased R&D investments in oncology: Growing oncology R&D investment is strengthening the cell cryopreservation market by fueling the development of cell-based cancer therapies and biospecimen repositories. The U.S. National Cancer Institute (NCI) allocated over US$6.54 billion in FY 2024 across research, treatment, and diagnosis programs. At the same time, the NIH is advancing novel T-cell therapies for solid tumors (e.g., enhanced CAR-T cells in preclinical models) that require large-scale cryopreservation infrastructure for storage, stability studies, and transportation. As the number of cellular immunotherapy agents has jumped, there were 2,756 active cell-therapy agents in the immuno-oncology pipeline as of April 2022, a 36% increase over the prior year, so does the demand for controlled-rate freezers, validated cryobanking platforms, and quality-tested consumables. In parallel, the NCI’s Biobanking & Biospecimen Science program supports standardized specimen collection, processing, and long-term storage, increasing the volume of biospecimens that must be cryopreserved.

Challenges

- Substantial cost in installation and maintenance: High capital expenditure is a major barrier in the cell cryopreservation market because advanced cryogenic freezers, controlled-rate cooling systems, backup power units, and monitoring platforms require significant upfront investment, often exceeding feasible budgets for small labs and emerging biotech firms. Ongoing maintenance adds further financial strain, as facilities must comply with strict regulatory standards, perform periodic validation, and replace high-grade liquid nitrogen or refrigeration components. The need for continuous temperature monitoring and emergency systems also raises operational costs. These financial burdens slow adoption, limit scaling, and can push organizations toward outsourcing rather than in-house cryopreservation capacity.

- Risk of contamination: The possibility of contamination during freezing, storage, or thawing creates considerable operational and safety challenges, limiting broader cell cryopreservation market expansion. Even minor breaches in sterility, such as compromised cryovials, cross-contamination during liquid-nitrogen immersion, or microbial infiltration, can render stored cell batches unusable. Regulations from agencies like the FDA and CDC require stringent aseptic protocols, validated handling procedures, and pathogen-free storage environments, which add complexity and costs for compliance. Any contamination event can lead to significant financial loss and delays in clinical or research programs, discouraging widespread adoption of cryopreservation systems.

Cell Cryopreservation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2036 |

|

CAGR |

18.91% |

|

Base Year Market Size (2025) |

USD 14.32 billion |

|

Forecast Year Market Size (2036) |

USD 101.98 billion |

|

Regional Scope |

|

Cell Cryopreservation Market Segmentation:

Product Segment Analysis

The cell freezing media segment in the cell cryopreservation market is projected to grow at a share of 38.64% by 2036. The use of specialized cell-freezing media (cryoprotectants) is a major growth lever for the cell cryopreservation market, because these media minimize ice crystal formation and osmotic damage during freezing and thawing, thereby preserving cell viability and function. DMSO penetrates cells and increases intracellular solute concentration, helping to prevent intracellular ice formation, a phenomenon well-understood in cryobiology. As demand for cell-based therapies (especially stem cells, CAR-T, etc.) rises, the requirement for GMP-grade, serum-free, defined freezing media is pushing innovation and adoption, because these formulations reduce toxicity, improve reproducibility, and meet regulatory quality standards. In short, increasing reliance on high-performance, clinically compatible freezing media is driving both the consumables (cryoprotectant solutions) and infrastructure segments of the cell cryopreservation market.

Application Segment Analysis

The stem cell banking segment in the cell cryopreservation market is expected to grow at a share of 39.29% by 2036. Stem cell banking, particularly through cord blood units, is a critical part of modern regenerative medicine, enabling long-term storage of hematopoietic stem cells for future therapeutic use. In the U.S., the C.W. Bill Young Cell Transplantation Program’s registry maintains more than 246,500 cord blood units. Public and private banks both contribute: decades of banking have created inventories that support transplants and research, with significant government backing through programs such as the National Cord Blood Inventory (NCBI). The genomic diversity of the banked units is increasing, which improves matching rates for patients from different ethnic backgrounds. Over 35,000 patients have benefited from cord blood transplants since the first one in 1989. Stem cell banking thus provides an essential reserve of clinically usable stem cells, fueling both life-saving therapies and long-term research into novel regenerative treatments.

End Use Segment Analysis

The biopharmaceutical & pharmaceutical companies’ segment is projected to grow at a CAGR of 19.53% in the cell cryopreservation market by the end of 2036. Biopharmaceutical and pharmaceutical companies are key end-users driving growth in the cell cryopreservation market because they develop and commercialize a growing number of advanced therapies that need robust cryostorage. According to the ASGCT-Citeline Q4 2024 report, there are 4,238 gene, cell, and RNA therapies in development, of which 2,117 (50%) involve gene-modifying or CAR-T cell approaches. The U.S. FDA has already approved multiple cellular therapies more than 40 distinct cell and gene therapy products to date. As big pharma invests in scalable manufacturing and supply chains for these products, demand for controlled-rate freezers, validated cryobanking, and reliable cold-chain logistics surges. Moreover, regulatory support from the FDA’s CBER, including RMAT designations, provides strong incentives for these companies to adopt high-quality cryopreservation infrastructure.

Our in-depth analysis of the global cell cryopreservation market includes the following segments:

|

Segment |

Subsegment |

|

Application |

|

|

End use |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cell Cryopreservation Market - Regional Analysis

North America Market Insights

North America will continue to dominate the global cell cryopreservation market, accounting for about 40.35% of the global share by 2036. This leadership is supported by the region’s well-established biotech infrastructure, strong regulatory frameworks, and deep investments in regenerative medicine from both public and private sectors. Over 1,200 clinical trials involving cell therapies are active in North America, representing a large and growing base of demand for reliable cryopreservation systems. Additionally, collaboration between academia and industry is widespread, enabling rapid translation of cryopreservation innovations into clinical and commercial applications. Key life-science companies (like Thermo Fisher and BioLife) further strengthen regional dominance by continually advancing freezing technology.

The U.S. drives the cell cryopreservation market through its leadership in cell and gene therapy research, supported by one of the world’s strongest biomedical R&D ecosystems. The NIH invests over US$48 billion annually in medical research, a portion of which supports cell-based therapy development and biobanking infrastructure. As of July 2021, the ClinicalTrials.gov database listed 1,014 clinical trials involving mesenchymal stem cells (MSCs), either completed or ongoing. FDA regulatory pathways such as RMAT designations and updated CBER guidelines facilitate streamlined development of advanced cell therapies, reinforcing the need for robust cryostorage. Extensive GMP manufacturing facilities and national biospecimen repositories (e.g., NCI’s Biorepositories & Biospecimen Research Branch) further position the U.S. as the central engine of innovation and adoption in cell cryopreservation technology.

Canada is strengthening its role in the cell cryopreservation market by expanding national investments in regenerative medicine research and biomanufacturing capacity. The Stem Cell Network (SCN) recently allocated CA$33 million to support clinical trials and translational research across more than 240 investigators nationwide, directly increasing demand for high-quality cryostorage. The Canadian government also invested CA$49.9 million in STEMCELL Technologies to enhance domestic production of tools used in cell and gene therapy development, improving the country’s self-sufficiency in advanced bioprocessing inputs. Canada ranks second globally in biomedical R&D cost competitiveness, according to CCRM, making it an attractive location for companies developing cell-based products that require large-scale cryopreservation. Strong academic industry partnerships and national biobanking programs further accelerate the adoption of cryopreservation technologies across research and clinical sectors.

Europe Market Insights

Europe’s cell cryopreservation market holds strong regulatory pipeline, coordinated research funding, and extensive biobanking networks are major engines for the cell cryopreservation market, because increasing numbers of ATMPs and academic translation projects require validated long-term storage and cold-chain logistics. The European Medicines Agency’s recent activity and ATMP oversight highlight steady regulatory throughput and inspections for advanced therapies, which support clinical/commercial scale-up. Pan-European research funding under Horizon Europe continues to prioritize health, regenerative medicine, and biomanufacturing, providing grants that upgrade laboratory and biobank capacity across member states. Meanwhile, BBMRI-ERIC’s federated biobanking infrastructure makes large, well-characterized sample collections discoverable to researchers across Europe, increasing the volume of materials that must be cryopreserved and tracked to GMP-compatible standards. These combined drivers, regulatory activity, targeted EU funding, and searchable biobank inventories translate into sustained demand for controlled-rate freezers, validated cryovials/media, and certified cold-chain services across the region.

Germany in the cell cryopreservation market advanced life-science ecosystem and mission-driven industrial policy accelerate demand for cryopreservation by supporting translational research, biomanufacturing, and clinical trials that rely on dependable biobanking. Federal strategies (e.g., Germany’s High-Tech Strategy and bioeconomy programs) explicitly back mission-oriented research in areas such as cancer and regenerative medicine, helping finance infrastructure upgrades in academic and industry laboratories. German national nodes of European biobank networks (e.g., BBMRI-IT/BBMRI links) and numerous university hospital biobanks expand sample inventories that require GMP-grade storage and traceability, raising demand for high-quality cryopreservation systems. Strong industry–university partnerships and inspection/QA activity tied to manufacturing for ATMPs further push the adoption of validated freezing equipment, monitoring platforms, and emergency-backup systems in Germany’s clinical and commercial facilities.

France drives regional cryopreservation demand through active regulatory engagement with ATMPs, growing clinical trial activity, and public-sector support for innovation—each increasing requirements for robust sample storage and chain-of-identity controls. The French regulatory authority (ANSM) reported notable increases in ATMP-related dossiers and clinical-trial applications in recent years, reflecting a rising pipeline that depends on cryostorage capacity. National research centres, university hospitals, and dedicated translational programmes are scaling biobanking and GMP-compatible facilities, which in turn create recurring demand for controlled-rate freezers, validated cryomedia, and certified cold-chain logistics. France’s active role in EU research consortia and growing clinical submissions for cell therapies mean that both public biorepositories and private developers are investing more heavily in cryopreservation infrastructure to meet regulatory and clinical standards.

Asia Pacific Market Insights

The cell cryopreservation market in the Asia Pacific region is expected to grow with a CAGR of 19.87% by 2036. The rapid expansion of laboratory capacity, national biobanking, and clinical-trial activity across the Asia-Pacific is increasing demand for validated cryopreservation and cold-chain infrastructure to support both research and clinical use of cell therapies. WHO / IARC programs and publications show growing regional investment in laboratory support and biobanking services (including training, specimen repositories, and regional biobank meetings), which enable larger, better-characterized sample collections that must be cryopreserved. National clinical-trial registries and the WHO-ICTRP network report substantial and rising registration activity from APAC countries (for example, the Chinese and Indian primary registries are among the largest partner registries to WHO-ICTRP), indicating a larger pipeline of studies that rely on specimen storage. Together with city- and national-level industrial policies that explicitly prioritise cell/gene therapy and biomanufacturing, these trends are translating into higher regional demand for controlled-rate freezers, GMP-grade consumables, and certified cold-chain logistics.

China’s rapid scaling of clinical research and government support for biotech innovation is a major driver of cryopreservation demand: the Chinese Clinical Trial Registry (ChiCTR) shows over 110,945 trials registered historically, reflecting a very active clinical-research environment that includes numerous cell- and stem-cell studies. National regulatory bodies (NMPA) have issued targeted guidance and technical documents to support clinical development and lifecycle regulation of advanced therapies, while municipal policies (e.g., Shanghai, Beijing) explicitly fund gene- and cell-therapy R&D and biomanufacturing, accelerating local capacity for ATMP development. China also hosts regional cryobiology and biobanking symposia (IARC/WHO–linked and national conferences) that disseminate best practice on specimen handling and long-term storage, raising technical standards and further increasing demand for validated cryostorage solutions. As investigators and hospitals expand investigator-initiated trials and translational programs, the need for GMP-quality freezing media, controlled-rate freezers, and secure biobanking grows across both public and private sectors.

In cell cryopreservation market, India is expanding national research ecosystem, driven by the Department of Biotechnology (DBT), the Institute for Stem Cell Science and Regenerative Medicine (inStem/ISRM), and other government initiatives, is increasing demand for cryopreservation infrastructure to support translational work and clinical trials. The Clinical Trials Registry-India (CTRI) now lists roughly 97,910 total registered trials (reflecting broad and growing clinical research activity), and DBT/PIB press releases document targeted funding for regenerative-medicine research and infrastructure that generates more biospecimens requiring long-term storage. India also supports dedicated institutes (e.g., inStem) and regular calls for proposals in cell and regenerative biology, which translate into increased biobanking and investments in controlled-rate freezers, validated storage workflows, and cold-chain logistics for multi-site trials. As academic–industry partnerships scale manufacturing and clinical translation, demand for GMP-grade cryomedia and certified cryobanking services is rising across research hospitals and biotech firms.

Key Cell Cryopreservation Market Players:

- Thermo Fisher Scientific Inc (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Miltenyi Biotec GmbH (Germany)

- BioLife Solutions INC (U.S.)

- PromoCell GmbH (Germany)

- Corning Incorporated (U.S.)

- Cooper Companies (U.S.)

- Bio-Rad Laboratories (India)

- Creative Biolabs (U.S.)

- Lonza (Switzerland)

- HiMedia Laboratories (India)

- Thermo Fisher is a leading provider of integrated cryopreservation solutions, offering controlled-rate freezers, cryogenic storage systems, and GMP-grade freezing media widely used in cell therapy, biobanking, and pharmaceutical research. The company’s Gibco CryoSuite and Nalgene cryogenic containers are industry standards for ensuring high post-thaw cell viability. Thermo Fisher also supports large-scale manufacturing through end-to-end cell-processing platforms that incorporate validated cryostorage workflows. Its extensive global distribution and service network enable reliable supply and compliance support for regulated laboratories. Continued investments in automation and digital monitoring technologies further strengthen the company’s role in the cryopreservation market.

- Miltenyi Biotec is a major innovator in cell-processing technologies, offering cryopreservation products designed to maintain the functionality and recovery of delicate cell types, particularly immune and stem cells. Its CryoMACS Freezing Bags and GMP-grade cryomedia are widely used in clinical manufacturing of cell and gene therapies. The company’s integrated CliniMACS platform ties upstream cell isolation and activation with downstream freezing workflows, making Miltenyi a preferred partner for ATMP developers. Miltenyi also operates multiple GMP facilities that support contract manufacturing and clinical research worldwide. Its consistent focus on translational applications positions it as a key driver of cryopreservation adoption in regulated environments.

- BioLife Solutions is a specialist in biopreservation, offering high-performance cryomedia such as CryoStor and HypoThermosol, which are recognized for improving post-thaw survival and stability of therapeutic cell products. The company also provides advanced liquid nitrogen freezers and ultra-cold storage solutions under the SciSafe® and Stirling Ultracold® brands, enabling end-to-end cold-chain continuity. BioLife’s products are widely adopted by cell therapy manufacturers, CDMOs, and biobanks due to their strong regulatory documentation and proven performance across numerous clinical programs. Strategic acquisitions have expanded its footprint in automated storage and cold-chain logistics. Its technologies are central to many commercial and late-stage cell therapy workflows, making it a cornerstone of the cryopreservation market.

- PromoCell provides high-quality primary human cells, culture media, and cryopreserved cell systems used extensively in research and preclinical applications. The company’s cryopreserved primary cells support consistent experimental reproducibility and are widely applied in regenerative medicine, toxicology, and drug discovery workflows. PromoCell also develops specialized freezing media optimized for sensitive human cell types, ensuring high viability after thawing. Its strong focus on standardized, ethically sourced human cell models makes it a valuable supplier for laboratories scaling biobanking and translational research. The company’s European manufacturing base and quality certifications further support adoption in regulated environments.

- Corning is a major supplier of cryogenic vials, storage bottles, cryoboxes, and liquid-nitrogen-compatible accessories essential for cell banking and long-term preservation. Its Corning and Falcon-branded cryovials are widely used across academic, clinical, and industrial laboratories due to their reliability, sterility, and regulatory compliance. Corning also offers advanced cell culture systems, including closed-system vessels, that integrate smoothly with freezing processes for cell therapy manufacturing. Ongoing innovation in materials science enables the company to produce durable, low-contamination storage solutions critical for maintaining sample integrity. As biobanking and GMP manufacturing expand globally, Corning’s broad product range and trusted quality make it a key enabler of cryopreservation workflows.

Below is the list of the key players operating in the global cell cryopreservation market:

Key players are accelerating the growth of the cell cryopreservation market by expanding their portfolios of GMP-grade freezing media, advanced controlled-rate freezers, and automated storage systems tailored for cell therapy and biobanking applications. Many companies are investing heavily in R&D to develop serum-free, low-toxicity cryomedia that improve post-thaw viability an essential requirement for cell and gene therapy workflows. Strategic partnerships with biopharmaceutical firms and research institutes are helping major vendors integrate cryopreservation systems into end-to-end cell-processing platforms. Leading manufacturers are also scaling global distribution networks and service capabilities to support rapidly expanding clinical trial and biobanking operations. Collectively, these efforts strengthen supply reliability, enhance product performance, and increase overall adoption across research, clinical, and commercial environments.

Corporate Landscape of the Global Cell Cryopreservation Market

Recent Developments

- In November 2025, BioLife Solutions, Inc. announced the opening of the Aby J. Mathew Center for Biopreservation Excellence. This dedicated facility will not only serve the cell and gene therapy industry but will also function as a hub for internal innovation. A key focus will be leveraging the company's newly acquired ice recrystallization inhibitor (IRI) technology to develop advanced cryopreservation solutions, aiming to significantly improve cell viability and recovery post-thaw.

- In April 2025, Thermo Fisher Scientific inaugurated its first U.S.-based Advanced Therapies Collaboration Center (ATxCC) in Carlsbad, California. This state-of-the-art facility is dedicated to accelerating the timeline from discovery to cell cryopreservation market for biotech and biopharma companies developing next-generation cell-based immunotherapies. By providing integrated expertise, technologies, and scalable solutions, the center aims to overcome critical development and manufacturing bottlenecks, getting transformative treatments to patients faster.

- Report ID: 5636

- Published Date: Dec 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cell Cryopreservation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.