Automotive Shielding Market Outlook:

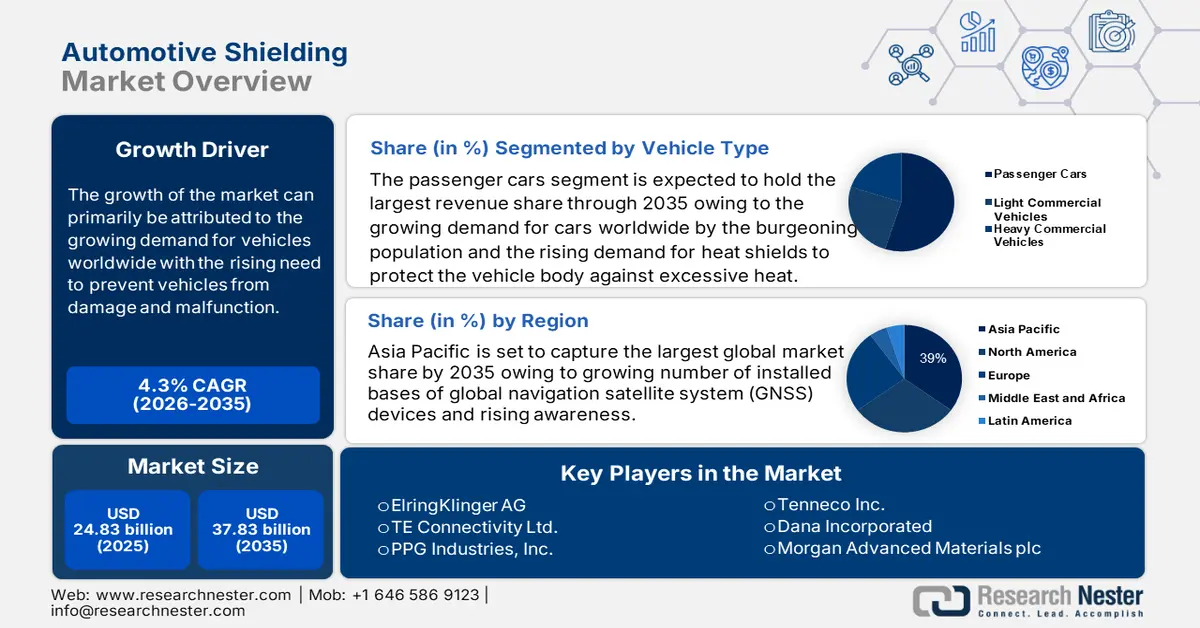

Automotive Shielding Market size was over USD 24.83 billion in 2025 and is anticipated to cross USD 37.83 billion by 2035, growing at more than 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive shielding is assessed at USD 25.79 billion.

The growth of the market can primarily be attributed to the growing demand for vehicles worldwide with the rising need to prevent vehicles from damage and malfunction. Also, the increased production rate of vehicles and rising focus on manufacturing fuel-efficient vehicles are anticipated to impetus significant revenue generation. It was found that there were about 80 million motor vehicles produced worldwide in 2021, with a rise of 3% from 2020.

Automotive shielding reduces the coupling of radio waves (RF shielding) and blocks electromagnetic and electrostatic fields from interfering with other electronic systems and devices. Rapid industrialization and the rising number of automobiles globally along with high prioritization for engine-efficient, light-weighting vehicles for abiding by the standards of fuel efficiency worldwide are estimated to propel the global automotive shielding market during the forecast period. Furthermore, the escalation in preference for electronic systems inside a vehicle and the adoption of technologically advanced systems increases the risk of creating strong electromagnetic fields which affect human health and cause inference and cross-connection of systems causing malfunctions. This trend is anticipated to bring in the need for the automotive shield which in turn, thus, helps in market expansion. In addition to the aforementioned factors, as a result of the surge in stringent emission control regulations by the government, automotive OEMs are compelled to reduce engine size, apply protective shields, and install high-efficient systems to enhance the driving experience and lower fuel consumption. This factor is projected to create a positive outlook for market growth in the forecast period.

Key Automotive Shielding Market Insights Summary:

Regional Highlights:

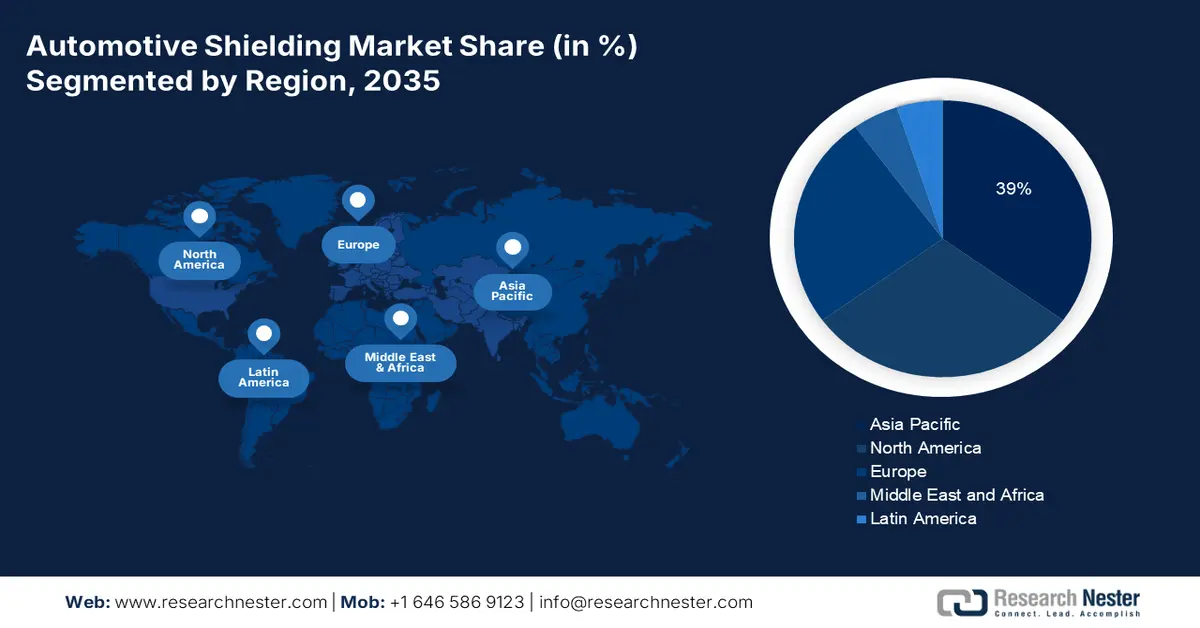

- Asia Pacific automotive shielding market is predicted to capture 39% share by 2035, driven by GNSS device penetration and growing EMI awareness.

- North America market will achieve noteworthy share by 2035, fueled by luxury car demand and R&D for emission-reducing vehicles.

Segment Insights:

- The heat shield segment in the automotive shielding market is projected to secure a significant share by 2035, attributed to high utilization in vehicle components to enhance performance and reduce fuel consumption.

- The passenger cars segment in the automotive shielding market is anticipated to hold the largest share by 2035, driven by growing global demand for cars and heat shields to protect against excessive heat.

Key Growth Trends:

- Rising Demand for Electric Vehicles

- Increasing Production and Sales of Vehicles

Major Challenges:

- High Cost of Maintaining Automotive Shields

- Risk of Product Failure

Key Players: Henkel AG & Co. KGaA, Company OverviewElringKlinger AG, TE Connectivity Ltd., PPG Industries, Inc., Laird Technologies, Inc., Tenneco Inc., Dana Incorporated, Morgan Advanced Materials plc, 3M Company, Parker-Hannifin Corporation, Marian, Inc.

Global Automotive Shielding Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 24.83 billion

- 2026 Market Size: USD 25.79 billion

- Projected Market Size: USD 37.83 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, India

- Emerging Countries: China, India, Mexico, Thailand, Indonesia

Last updated on : 10 September, 2025

Automotive Shielding Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Demand for Electric Vehicles – Electric vehicle (EV) manufacturing inevitably requires installing electronic systems in confined spaces and also needs to refrain the electromagnetic energy generated from these systems from “cross talking” and causing malfunctions and failures. As EMI shielding is important for EVs, the surge in the demand for EVs is expected to boost the automotive shielding market in the forecasted period. It was found that the global sales of EVs were over 3 million units in 2020 which was more than 4% of global vehicle sales.

-

Increasing Production and Sales of Vehicles – The International Organization of Motor Vehicle Manufacturers (OICA), released global sales of vehicle statistics which revealed that it rose to 56 million in 2021 from 53 million in 2020. Whereas, the global production of vehicles was calculated to be 57 million in 2021.

-

Growing Penetration of Automotive Radars – It is estimated that the utilization rate of automotive radars is anticipated to reach nearly 65% in Europe and 50% in the United States by 2030.

-

Rising Trend of Hydrogen Fuel Cell Technology – Fuel cell electric vehicles (FCEVs) are powered by hydrogen and manufactured using the latest technology. Thus, the integration of advanced systems is generating the need for automotive shields to protect the vehicle from malfunctions. It was found that there were more than 25,000 hydrogen fuel cell road vehicles registered worldwide in 2020.

-

The Surge in the Demand for Automotive Electronics – With the rising spending capacity, individuals are propelled towards adopting technologically advanced electronic systems in vehicles. As these electrical components control various electrical and mechanical functions in a vehicle, sometimes interference and cross-connections happen between the systems leading to malfunctions. Thus, to handle complex electronic circuitry, automotive shields are required. Thus, the higher integration of electronics in vehicles is estimated to bring lucrative growth opportunities for market growth. For instance, it is projected that by 2030, electronics will make up approximately 50% of a cost of a new car worldwide.

Challenges

-

High Cost of Maintaining Automotive Shields – Generally, automotive shielding is manufactured through metals and other composite materials. High-quality metals and alloys are used in producing automotive shields to increase the shelf life and durability of automotive shielding. However, owing to constant exposure to heating and harsh environments, the efficiency of automotive shields reduces in a short period of time. This brings the need for frequent repair and maintenance of automotive shields which subsequently increases the cost.

-

Risk of Product Failure

- Rising Concerns Related to the Complexity of Development of Automotive Shielding Components

Automotive Shielding Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 24.83 billion |

|

Forecast Year Market Size (2035) |

USD 37.83 billion |

|

Regional Scope |

|

Automotive Shielding Market Segmentation:

Vehicle Type Segment Analysis

The global automotive shielding market is segmented and analyzed for demand and supply by vehicle type segment into passenger cars, light commercial vehicles, and heavy commercial vehicles. Amongst these segments, the passenger cars segment is anticipated to garner the largest revenue by the end of 2035, backed by the growing demand for cars worldwide by the burgeoning population and the rising demand for heat shields to protect the vehicle body against excessive heat. It was found that the auto industry in the United States sold more than 3 million cars in 2021. Also, the rising adoption of technologically advanced systems in passenger cars owing to the rising per capita income and spending capacity of individuals along with the demand for individualized transportation and comfort is expected to surge the sales of automotive shields for passenger cars thus expanding the segment size. In addition, the stringent government rules to adopt fuel-efficient vehicles coupled with the rise in emission norms are anticipated to drive the growth of this segment in the market.

Type Segment Analysis

The global automotive shielding market is also segmented and analyzed for demand and supply by type into electromagnetic interference and heat. Out of these two, the heat shield segment is attributed to holding a significant share by the end of the forecast period. The major factor for segment growth is the high utilization of heat shields in various vehicle components such as engine compartments, exhaust systems, turbochargers, under chassis, and others. Moreover, heat shields are considered to be a preferred option owing to their capability of enhancing vehicle performance by reducing the temperature of the vehicle components and reducing fuel consumption. Also, the ability of heat shields in protecting the vehicle from overheating by absorbing, reflecting, and dispelling the heat, propels the vehicle manufacturer to adopt heat shields. All these factors add up to boost segment expansion in the next few years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Material Type |

|

|

By Application |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Shielding Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is set to dominate majority revenue share of 39% by 2035, backed by growing number of installed bases of global navigation satellite system (GNSS) devices and rising awareness amongst the automobile manufacturers for electromagnetic interference (EMI) sourced by navigation system. It was found that the Asia Pacific region leads the way in the usage of the navigation system, as it accounted for 900 million GNSS devices in 2021. Some developing countries such as China and India have expanded the automotive industry over the past few years which positively contributes to market growth. Furthermore, the rising initiatives including Vehicle-to-Infrastructure (V21), Vehicle-to-Vehicle (V2V), and Vehicle-to-Pedestrian (V2P) along with advancement in communication technologies are anticipated to increase the adoption rate of electronic systems in vehicles which in turn is projected to boost the global automotive shielding market.

North American Market Insights

On the other hand, the North America automotive shielding market is also attributed to grow at a significant rate and hold a noteworthy share. The burgeoning population demanding vehicles and luxurious cars is the major factor projected to increase the adoption of automotive shielding in the upcoming years. Further, the presence of major key players investing in research and development activities to develop fuel-efficient vehicles to curb carbon emissions and government policies to reduce environmental pollution are also anticipated to bring favorable opportunities for market growth in the region.

Automotive Shielding Market Players:

- Henkel AG & Co. KGaA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ElringKlinger AG

- TE Connectivity Ltd.

- PPG Industries, Inc.

- Laird Technologies, Inc.

- Tenneco Inc.

- Dana Incorporated

- Morgan Advanced Materials plc

- 3M Company

- Parker-Hannifin Corporation

- Marian, Inc.

Recent Developments

-

Henkel AG & Co. KGaA launched Loctite EA 9400 and Loctite FPC 5060 protective coating solutions, a fire protection solution for safer EV batteries.

-

TE Connectivity Ltd. completed the acquisition of shielding and sealing specialist, Kemtron, adding EMI and RFI shielding, environmental sealing, gaskets, and components to its portfolio.

- Report ID: 4620

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Shielding Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.