Automotive Radar Market Outlook:

Automotive Radar Market size was valued at USD 6.6 Billion in 2025 and is set to exceed USD 61.96 Billion by 2035, expanding at over 25.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive radar is estimated at USD 8.09 Billion.

The growth of the market can primarily be attributed to the growing number of vehicles on the road, along with rising concern over the increasing incidence of road accidents worldwide, and surging demand for features related to the safety of the vehicles. For instance, according to World Health Organization data, road traffic crashes result in nearly 1.3 million deaths each year.

Automotive radar systems are critical sensor systems in advanced driving assistance systems and primary sensors that are used in adaptive cruise control. Radars provide evident benefits such as detecting motion, measuring speed, distance, and the angle of arrival as well as the direction of movement that serve various purposes such as collision avoidance, and pedestrian & cyclist detection. Radar complements vision-based camera-sensing systems that can work in adverse conditions such as rain, fog, and dust, enabling the coverage of long-range as well as close distances. With the recent advancements in radar sensors as well as steering assistance, the demand for automotive radar is on the rise among vehicle users, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive radar market during the forecast period. For instance, steering assistance features used to keep a vehicle in its lane were installed in almost 63% and 56% of new cars sold in United States and Europe in 2021.

Key Automotive Radar Market Insights Summary:

Regional Highlights:

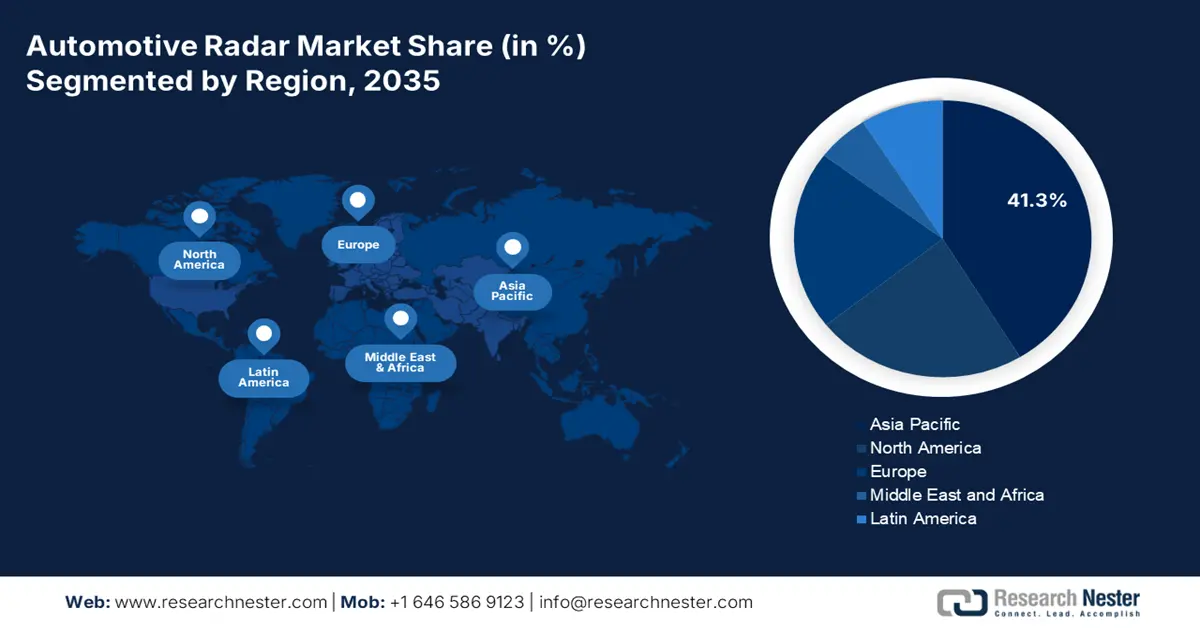

- The Asia Pacific automotive radar market will secure around 41.3% share by 2035, fueled by rising automobile production and growing radar demand.

- The Europe market will register notable growth from 2026 to 2035, driven by rising governmental regulations for vehicle safety.

Segment Insights:

- The adaptive cruise control (application) segment in the automotive radar market is expected to hold a significant share by 2035, attributed to its widespread adoption in key automotive markets and safety benefits.

- The commercial vehicles (vehicle type) segment in the automotive radar market is expected to capture the largest share by 2035, driven by the surge in demand and global sales of commercial vehicles.

Key Growth Trends:

- Growing Demand Radar in Autonomous Vehicles

- Increasing Demand for Cars

Major Challenges:

- Possibility of Data Threat

- Huge Investment is Required for Research & Development

Key Players: Infineon Technologies AG, Volvo Car Group, NXP Semiconductors N.V., Analog Devices, Inc., BorgWarner Inc., Denso Corporation, Continental AG, Robert Bosch GmbH, Texas Instruments, ZF Friedrichshafen AG.

Global Automotive Radar Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.6 Billion

- 2026 Market Size: USD 8.09 Billion

- Projected Market Size: USD 61.96 Billion by 2035

- Growth Forecasts: 25.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Automotive Radar Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Demand Radar in Autonomous Vehicles – Radar operates at frequencies of 24, 74, 77, and 79 GHz in autonomous vehicles. There are two types of radar for autonomous vehicular applications, impulse and frequency-modulated continuous wave (FMCW). With the rising demand for autonomous vehicles, the automotive radar market is expected to boost in the projected period. It is estimated that autonomous vehicles will account for approximately 12 percent of total car registrations by 2030 globally.

-

Increasing Demand for Cars – With the burgeoning population, the need for individualized and personalized transportation has generated a high demand for cars. With the increasing production of cars, the demand for automotive radars is also expected to grow and bring profitable opportunities for the market in the forecast period. The sales of the car are expected to reach more than 100 million units by 2030 worldwide.

-

Upsurge in the Installations of Advanced Driver Assistance System (ADAS) – Recent statistics revealed that advanced driver assistance system (ADAS) features were installed in about 1 billion cars in use in 2020 across the world.

-

Rising Penetration of Connected Cars – For instance, there were over 200 million connected cars in 2021, and this ratio is expected to expand to nearly 400 million connected cars by 2025 worldwide.

Challenges

- Possibility of Data Threat - Security flaws in automobile technologies such as radar and dedicated short-range communication (DSRC) must be properly investigated as vehicles become more automated. Existing automotive radar solutions are sensitive to data threats such as jamming, interference, and spoofing. Such spoofing attacks from outside parties, potentially result in deadly accidents, hence the associated data threat is estimated to hamper the growth of the market over the forecast period.

- Huge Investment is Required for Research & Development

- High Cost of Installation of Advanced Features in Automobiles

Automotive Radar Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.1% |

|

Base Year Market Size (2025) |

USD 6.6 Billion |

|

Forecast Year Market Size (2035) |

USD 61.96 Billion |

|

Regional Scope |

|

Automotive Radar Market Segmentation:

Vehicle Type

The global automotive radar market is segmented and analyzed for demand and supply by vehicle type into passenger, and commercial vehicles. Amongst these segments, the commercial vehicles segment is anticipated to garner the largest revenue by the end of 2035, as some radar sensors are specially adapted for commercial vehicle to enable fast, robust, and highly accurate object detection. Furthermore, the growing demand for commercial vehicles, along with the radical surge in the sale of commercial vehicles worldwide, is further anticipated to boost the market’s growth. For instance, the sale of commercial vehicles in the United States exceeded around 12,050,000 units in 2021.

Application

The global automotive radar market is also segmented and analyzed for demand and supply by application into blind spot detection (BSD), forward collision warning system, autonomous emergency braking (AEB), adaptive cruise control (ACC), intelligent park assist, and other advanced driver assistance system (ADAS). Out of these, the intelligent park assist segment is attributed to garner the highest revenue by the end of the forecast period. The major factor contributing to the high demand for intelligent park assist applications is the need for parking assistance by the population to avoid backside collisions and accidents. Further, the demand for luxury vehicles, sports cars, and advanced vehicles also needs intelligent park assist features to enhance safety. Also, another factor contributing positively to the segment’s growth is the installation of intelligent park assist in electric vehicles. On the other hand, the adaptive cruise control (ACC) segment is also expected to hold a significant share over the analysis period. The high utilization rate of adaptive cruise control in significant automotive markets such as Germany, the U.S., the UK, and China, among others, is considered to create a positive outlook for segment growth. In addition, the various advantages and prominent benefits offered by adaptive cruise control in vehicle safety and the level of automation in a vehicle make it an ideal option in the automotive industry for improving vehicles.

Our in-depth analysis of the global market includes the following segments:

|

By Range |

|

|

By Application |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Radar Market Regional Analysis:

APAC Market Insights

Asia Pacific region is projected to account for more than 41.3% market share by 2035, fueled by rising automobile production and growing radar demand. This trend is anticipated to fuel the demand for automotive radars in the region, especially in India and China. The total production of vehicles in the region was 46 million in 2021, whereas, the total sales in the region was 42 million in 2021 as per statistics released by the International Organization of Motor Vehicles. Further, the prevalence of a high number of car accidents and rising awareness about the benefits of automotive radar such as driving assistance features, brake assist, collision warning systems, and others are anticipated to drive the global automotive radars market’s growth.

Europe Market Insights

On the other hand, the market in the Europe region is also projected to grow steadily with a notable CAGR. Moreover, the rising governmental regulations for vehicle safety implemented by the government are anticipated to increase the utilization rate of automotive radars in the automotive sector. Other factors such as high demand for hybrid vehicles and increasing road accidents are also anticipated to positively contribute to market expansion.

Automotive Radar Market Players:

- Infineon Technologies AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Volvo Car Group

- NXP Semiconductors N.V.

- Analog Devices, Inc.

- BorgWarner Inc.

- Denso Corporation

- Continental AG

- Robert Bosch GmbH

- Texas Instruments

- ZF Friedrichshafen AG

Recent Developments

-

Infineon Technologies AG revealed that Teraki has selected Infineon AURIX TC4x for ML-based radar detection software to increase the accuracy and safety of overall ADAS and AD applications.

-

Volvo Car Group announced its new interior radar feature designed to be accurate and sensitive enough to detect the tiniest movements at the sub-millimeter scale and which will be included in the forthcoming Volvo EX90 all-electric SUV.

- Report ID: 4509

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Radar Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.