Automated Container Terminal Market Outlook:

Automated Container Terminal Market size was valued at USD 11.3 billion in 2025 and is projected to reach USD 22.4 billion by the end of 2035, rising at a CAGR of 7.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automated container terminal is estimated at USD 12.1 billion.

The worldwide dynamics of the automated container terminal market are witnessing immense growth facilitated by the ever-increasing trade volume, the need for greater efficiency, and the emergence of technologies such as robotics, IoT, and AI. These container terminals for a critical node in terms of the maritime supply chain, wherein the ingredients such as stacking cranes, remotely‑operated systems, and automated vehicles must be sourced, assembled, and maintained properly. The Bureau of Transportation Statistics in 2025 disclosed that the U.S. container port is dominated by the presence of a small number of major gateways, wherein the top 25 container ports handled 96% of all loaded twenty-foot equivalent units in 2022. In addition, the Port Authority of New York and New Jersey led this with 6.66 million TEUs, followed by the West Coast ports of Los Angeles with 6.42 million and Long Beach with 6.09 million.

The report also underscored that infrastructure critical for automation, whereas container cranes, is heavily concentrated at these top ports, which collectively operated 570 ship-to-shore gantry cranes as of December 2024. Out of these, 248 were super post-panamax cranes, which are capable of serving the largest vessels and represent the most advanced and productive equipment, regarded as a key area for automation investment. In addition, landside connectivity is a focus, with 17% of the top 25 container ports having on-dock rail transfer facilities, which helps reduce port congestion and is often integrated with automated terminal operations. Hence, these transported containers contribute to B2B trade, thereby positively impacting automated container terminal market growth.

Key Operational Metrics Influencing Automation Investment at U.S. Container Ports

|

Metric |

Statistic |

Details |

|

Total U.S. Loaded TEUs (2022) |

45.7 million TEUs |

Defines the total annual market size and volume potential that automated systems are deployed to handle. |

|

Ports Handling Containers |

110 U.S. Ports |

Indicates the number of potential sites for automation, though investment is likely concentrated in the highest-volume locations. |

|

TEU Handling by Coast (2022) |

East Coast: 47% |

Shows the competitive balance and regional market share, guiding where automation investments are most strategic. |

|

Key Infrastructure: Channel Depth |

West Coast ports have the deepest channels (e.g., natural harbors of LA/LB). |

Deep channels accommodate the largest vessels, which are primary users of highly automated terminals. |

|

Impact of External Disruption |

Port of Baltimore imports dropped 70% month-over-month after the Key Bridge collapse. |

Highlights the vulnerability of supply chains and the value of resilient, automated operations that can adapt and reroute cargo. |

Source: Bureau of Transportation Statistics

Key Automated Container Terminal Market Insights Summary:

Regional Highlights:

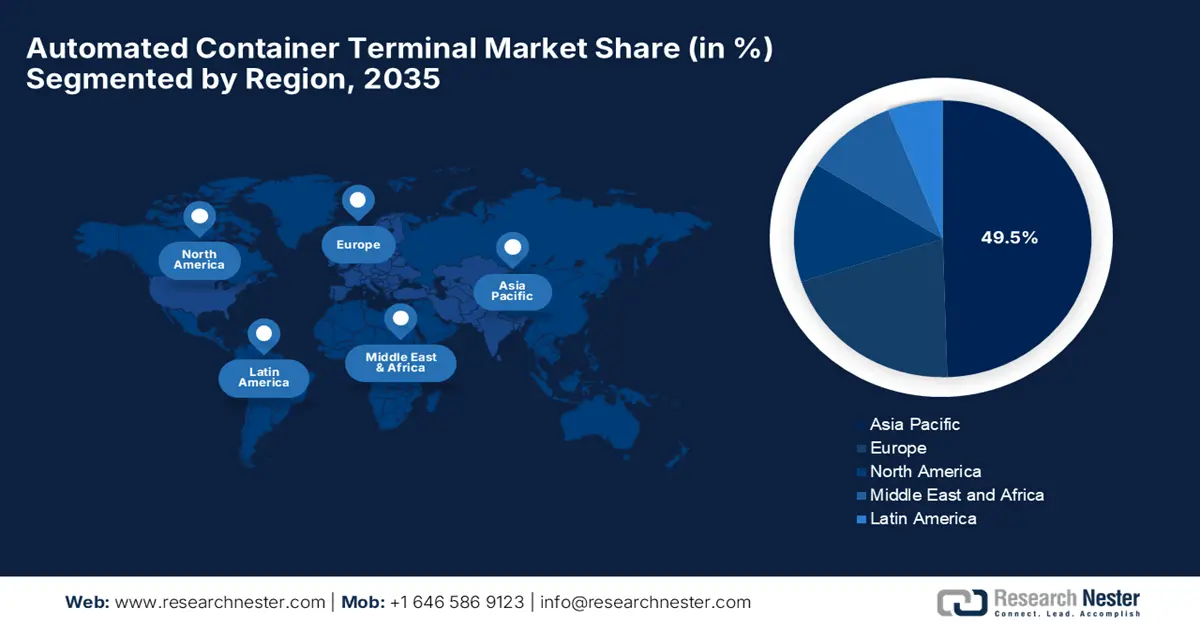

- The Asia Pacific in the automated container terminal market is projected to hold a 49.5% share by 2035, increasingly fueled by high-volume ports and strong government support for port digitalization.

- Europe is expected to secure a notable share by 2035, owing to modernization of terminals and investments in automated stacking cranes and AGVs.

Segment Insights:

- In the automated container terminal market, the software & integration services sub-segment is projected to account for a 55.7% share during the forecast period 2026–2035, driven by rising investments in advanced software solutions for complex automated operations.

- The brownfield projects segment is expected to attain a significant share by 2035, impelled by phased automation of existing terminals and sustainability upgrades.

Key Growth Trends:

- Rising worldwide trade & container volumes

- Increased labor costs

Major Challenges:

- Extensive capital expenditure

- Workforce & skill gaps

Key Players: TOTAL SOFT BANK LTD. (South Korea), INFORM SOFTWARE (Germany), Logstar ERP. (India), infyz.com (India), Tideworks (U.S.), Loginno Logistic Innovation Ltd. (Israel), World Crane Services FZE (U.A.E.), STARCOMM SYSTEMS (U.K.), Kalmar Corporation (Finland), Cargotec Corporation (Finland), Konecranes Plc (Finland), Shanghai Zhenhua Heavy Industries Co., Ltd. (China), LIEBHERR Group (Switzerland), ABB Ltd. (Switzerland), HAPAG LLOYD (Germany), APM Terminals (Netherlands), BECKHOFF AUTOMATION GMBH & CO. KG (Germany), Künz GmbH (Austria), CyberLogitec Co., Ltd. (Korea), Camco Technologies NV (Belgium), IDENTEC SOLUTIONS AG (Austria), ORBCOMM Inc. (U.S.), PACECO Corp. (U.S.).

Global Automated Container Terminal Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.3 billion

- 2026 Market Size: USD 12.1 billion

- Projected Market Size: USD 22.4 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Singapore, Netherlands

- Emerging Countries: India, Brazil, Vietnam, Mexico, South Korea

Last updated on : 3 December, 2025

Automated Container Terminal Market - Growth Drivers and Challenges

Growth Drivers

- Rising worldwide trade & container volumes: Continued growth in international trade is readily increasing pressure on ports to handle cargo more efficiently, driving growth in the automated container terminal market. In December 2024, Shanghai Port announced that its Yangshan phase IV automated terminal had achieved a major milestone by handling its 50 millionth TEU, which has set a new global record for annual container throughput. This is a fully automated terminal, operates 24/7 with remote-controlled quay cranes, AGVs, and integrated IT systems, which have enabled faster, more efficient handling of rising cargo volumes augmented by global trade growth. Therefore, the high container volumes are accelerating demand for automated terminals, as high-throughput operations enable ports to handle growing cargo efficiently.

- Increased labor costs: This, coupled with the shortage of skilled work professionals, is one of the primary drivers for the automated container terminal market since this reduces dependence on human labor and provides more predictable operational costs. In March 2022, PSA Singapore reported that, in collaboration with A*STAR’s Institute of High-Performance Computing has signed a research agreement to develop advanced fleet management solutions for automated guided vehicles at Tuas Port. The AGVs, which already play a key role in yard and wharf operations, enhance efficiency, reduce reliance on manual labor, and cut carbon emissions by approximately 50%. Hence, this initiative supports the organization’s vision of a smart, resilient, and sustainable port, enabling a very responsive automation that is capable of handling large container volumes by improving operational agility and overall productivity.

- Technological advances: The integration of AI, machine learning, IoT sensors, and digital twin technologies allows terminals to optimize operations, carry out predictive maintenance, and simulate workflows, providing encouraging opportunities for pioneers in the automated container terminal market. In April 2025, Kalmar Corporation announced that it had signed an agreement to supply Victoria International Container Terminal in Melbourne, Australia, with four hybrid automated straddle carriers, wherein each terminal is capable of 60-ton twin lifts. The company also underscored that these carriers will operate under the Kalmar One Automation System, which is an end-to-end solution combining automated equipment and integrated software, enhancing productivity and reducing loading times. Hence, this expansion reinforces its long-standing partnership with VICT by supporting Australia’s only fully automated terminal in handling large boxships more efficiently.

Global Automated Container Terminal Initiatives and Automated Container Terminal Market Potential

|

Year |

Project / Terminal |

Location |

Market Opportunity |

|

2025 |

INVT & Qingdao Port Automation Upgrade |

Qingdao, China |

Upgrade of traditional terminal with fully automated rail-mounted gantry cranes, enhancing efficiency and safety |

|

2025 |

Konecranes Electric Reach Stacker & Ecolifting Portfolio |

Global (APAC, Middle East, Africa, South America) |

Electrification and automation of port equipment, reducing emissions and downtime, and expanding the adoption of smart handling systems |

|

2023 |

Evergreen Terminal 7 |

Kaohsiung, Taiwan |

First fully-automated terminal in Taiwan with remote-controlled STS and automated RMGC cranes, improving yard efficiency and eco-friendly operations. |

Source: Company Official Press Releases

Challenges

- Extensive capital expenditure: This is one of the major issues posed by the automated container terminal market. Automation in terms of container terminals requires huge upfront cash in hardware such as automated stacking cranes, AGVs, and software systems. The costs associated with retrofitting existing infrastructure, integrating terminal operating systems, and ensuring compliance with safety standards can be restrictive for smaller ports. Therefore, the existence of this financial burden often delays adoption in this field. Additionally, high capital expenditure creates extensive dependency on financing, thereby making terminals sensitive to interest rate fluctuations and macroeconomic shifts. As a result, ROI calculations must be carefully modeled to justify the automation projects.

- Workforce & skill gaps: This is another major bottleneck for the automated container terminal market to capture the desired revenue over the forecasted years. The requirement for specialized personnel to manage, maintain, and optimize complex systems can not be possible in certain developing nations. In addition, the traditional port labor often lacks expertise in robotics, data analytics, and digital orchestration, which can create a skill gap that can slow adoption. The training programs add additional burgeoning costs, making it challenging for widespread adoption in this field. Furthermore, labor unions are resisting automation, leading to operational disruptions. In this context, maintaining a hybrid workforce capable of operating both automated and conventional systems is not so easy, requiring continuous upskilling.

Automated Container Terminal Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 11.3 billion |

|

Forecast Year Market Size (2035) |

USD 22.4 billion |

|

Regional Scope |

|

Automated Container Terminal Market Segmentation:

System Type Segment Analysis

In the automated container terminal market, the software & integration services sub-segment is expected to garner the largest share of 55.7% during the forecast timeline. The sub-type dominates as the hardware, such as cranes, vehicles, represents a one-time capital expense, whereas the software platforms for terminal operating systems, equipment control, and data analytics require continuous licensing, updates, and support. As per an article published by the U.S. Department of Defense in February 2022, the expanding spectrum of cyberactors and their tactics poses significant risks to critical supply chains by threatening the confidentiality, integrity, and availability of both IT and OT systems associated with global logistics. Furthermore, Nation-states and ransomware cybercriminals represent one of the most dangerous threat actors, which are capable of inflicting large-scale operational disruption, necessitating more investments in advanced software solutions to manage complex automated operations.

Project Type Segment Analysis

By the end of 2035, the brownfield projects segment is expected to attain a significant share in the automated container terminal market since most of the ports are established entities with significant sunk infrastructure costs. Simultaneously, the ports are extensively prioritizing the phased automation of existing terminals, denoting the presence of a large consumer base. In October 2024, Konecranes reported that its largest-ever automated horizontal transport order marks a major brownfield modernization at HHLA’s Burchardkai terminal, where 116 Li-Ion AGVs and 20 automated charging stations are being integrated while operations continue. Besides, this upgrade transitions CTB from manual, diesel-powered systems to a fully electric, automated fleet, supporting HHLA’s goal of carbon neutrality by the end of 2040, thereby enabling CO₂ reductions of up to 12,000 tons on a yearly basis. Further, as one of the biggest brownfield automation projects, it strengthens both terminal efficiency and sustainability.

Automation Level Segment Analysis

In terms of automation level, the fully automated terminals segment is likely to grow at a considerable rate in the automated container terminal market over the analyzed timeframe. The growth in the segment is highly driven by the critical need to maximize throughput and resilience at major gateway ports. The full automation directly addresses the high vessel wait times by enabling all-weather operations, optimizing asset utilization, as well as mitigating labor disruption risks, thereby making it the preferred long-term investment for high-volume ports. In addition, the rising deployments of mega ships and record container volumes are encouraging ports to adopt fully integrated automated systems to maintain competitiveness. Simultaneously, the proof of performance from leading facilities is also enhancing operator performance. Hence, these factors position the fully automated terminals as the rapidly advancing segment in this sector.

Our in-depth analysis of the automated container terminal market includes the following segments:

|

Segment |

Subsegments |

|

System Type |

|

|

Project Type |

|

|

Automation Level |

|

|

Component |

|

|

Offering |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Container Terminal Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the automated container terminal market is predicted to account for the largest share of 49.5% by the end of 2035. This rapid upliftment is increasingly propelled by high-volume ports and strong government support for port digitalization. The region remains a global hub for automated terminal development, wherein most of the brownfield projects incorporate advanced robotics, automated vehicles, and integrated terminal operating systems. In this regard, MPA Singapore notes that Tuas Port, which was officially inaugurated in 2022, is Singapore’s next-generation smart and green mega-port, set to handle 65 million TEUs by the 2040s with 66 berths across 1,337 hectares. The report also mentioned that its development spans four phases, featuring extensive land reclamation, advanced automation such as AI-enabled vessel management, 5G-powered AGVs, and remote-operated cranes. Furthermore, the aims for net-zero emissions by the end of 2050 through electrified equipment, smart-grid systems, and green buildings, hence placing a positive impact on automated container terminal market growth.

China is recognized as the global leader in the automated container terminal market, efficiently driven by several large ports which are operating fully automated facilities, which are built for high throughput as well as continuous operations. In the meantime, the state-backed initiatives are readily promoting the use of smart port technologies, artificial intelligence, and autonomous handling equipment, allowing a steady revenue stream in the country’s market. In October 2025 People’s Republic of China reported that the country is currently leading global smart port development with 60 automated container terminals and rapidly expanding smart waterways covering over 10,000 km. It also stated that from January to August 2025, the nation recorded strong growth in waterway freight (6.56 billion tonnes), port cargo throughput (12 billion tonnes), and container volume (230 million TEUs), hence solidifying China’s position in the global dynamics.

India is also expanding gradually in the automated container terminal market on account of the modernization of ports to support growing export activity and infrastructure development. Operators in the country are opting for remote management and energy-efficient equipment to enhance performance, whereas the public–private partnerships are laying the groundwork for broader adoption. For instance, in November 2025, Camco Technologies announced that it is partnering with Adani Vizhinjam Port to automate India’s first mega transshipment container terminal, strategically located just 10 nautical miles from major international shipping lanes. The project includes advanced gate automation, STS-crane OCR using Camco’s patented BoxCatcher system, and bay-load verification to ensure accurate stowage data. Furthermore, with real-time equipment tracking and the unified Bridge software interface, the terminal is set to achieve high operational efficiency.

Europe Market Insights

Europe has a strong scope to revolutionize the international automated container terminal market, propelled by the long-standing utilization of automated stacking cranes and AGVs. Ports in this region are extremely focused on modernization, operational reliability, and compliance with environmental regulations, which is encouraging investments in this field. In July 2025, Hamburg announced that its Waltershofer Hafen is all set for major modernization, including widening its turning circle to 600 metres, expanding terminal yards, and creating new berths to boost efficiency and safety for the world’s largest vessels. This was backed by public funding and Eurogate’s €700 million (USD 824.5 million) investment, and the project will enable a shift toward fully automated, electrified terminal operations, supporting Hamburg’s climate-neutral goals. Furthermore, the upgrade strengthens the port’s long-term competitiveness and its role as a key logistics hub for global trade.

Germany is the major hub of innovation in the automated container terminal market, which is integrating highly advanced automated yard systems and AGV-based horizontal transport. Simultaneously, collaborations between port operators and technology providers continue to accelerate automation adoption. In May 2024, HHLA stated that its container terminal Burchardkai in Hamburg has undergone a major transformation, replacing diesel-powered straddle carriers with ABB’s all-electric, automated stacking cranes to increase yard capacity, speed, and safety. The company also underscored that the phased implementation across 19 container blocks, supported by renewable electricity, has boosted productivity, improved flexibility, and reduced emissions. Hence, these transformation activities coupled with decarbonization initiatives are prompting a favourable business environment in the country.

The U.K. is showcasing notable growth in the regional automated container terminal market, which is efficiently driven by the need to enhance port competitiveness, particularly amid evolving trade patterns and capacity constraints. Meanwhile, the ongoing investments target remotely controlled equipment, digital optimization tools, and energy-efficient handling systems, in turn boosting the pace of progress in this field. Also, ports in the country are adopting automation to strengthen operational resilience and support long-term sustainability goals. Furthermore, major ports such as Felixstowe, Southampton, and London Gateway are leading the adoption of automated quay cranes, automated guided vehicles, and smart yard management systems. Hence, these initiatives are helping ports to handle larger vessels more efficiently by reducing carbon emissions.

North America Market Insights

North America also represents one of the largest landscapes of the automated container terminal market, successfully backed by a collective goal to handle growing trade volumes and address labor shortages. There has been an increased adoption of automated stacking cranes, remote-controlled equipment, and digital yard systems to improve efficiency and reduce congestion. The U.S. Customs and Border Protection in June 2025 disclosed that the U.S. and Morocco have signed a new Container Security Initiative agreement with a collective goal to enhance cargo security and streamline trade between the two countries, with a key focus on ports such as Casablanca and Tanger Med. The article further underscored that the initiative uses risk-based targeting, pre-screening, and intelligence-sharing to identify high-risk maritime cargo before it reaches ports in the U.S. Hence, this partnership strengthens global supply chain security while supporting Morocco’s ports.

In the U.S., the automated container terminal market is gaining enhanced traction as ports are with aging infrastructure, high operational costs, and the need to enhance vessel turnaround times. The West Coast ports in the country are at the forefront of the exploration of automation as a strategy to remain competitive with the terminals that are already operating with higher productivity levels. Simultaneously, the regulatory scrutiny, coupled with labor considerations, shape the pace of adoption, but large terminals continue to integrate automated systems in phases. In addition, ports such as the Port of Los Angeles, Long Beach, and Savannah are leading the adoption of automated stacking cranes, automated guided vehicles, and advanced terminal operating systems, encouraging more players to make investments in this field. Hence, these are helping U.S. ports increase throughput and maintain competitiveness in global supply chains.

Canada is also reaping advantages from the automated container terminal market owing to the expansion programs at major Pacific and Atlantic gateways, which are adopting automation to improve reliability and accommodate rising container flows. In October 2023, the Country’s government announced a USD 150 million investment under the National Trade Corridors Fund to build a new container terminal at the Port of Montréal in Contrecoeur, Québec, by increasing the port’s capacity by around 55%. It also stated that the project includes a 675-metre dock, container handling yard, rail and road connections, and operational facilities to improve cargo flow and connectivity to worldwide automated container terminal markets. Furthermore, this expansion aims to strengthen Canada’s supply chain, boost trade efficiency, and support long-term economic growth across the country’s vast geography, thereby encouraging the adoption of automated terminals.

Key Automated Container Terminal Market Players:

- TOTAL SOFT BANK LTD. (South Korea)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- INFORM SOFTWARE (Germany)

- Logstar ERP. (India)

- infyz.com (India)

- Tideworks (U.S.)

- Loginno Logistic Innovation Ltd. (Israel)

- World Crane Services FZE (U.A.E.)

- STARCOMM SYSTEMS (U.K.)

- Kalmar Corporation (Finland)

- Cargotec Corporation (Finland)

- Konecranes Plc (Finland)

- Shanghai Zhenhua Heavy Industries Co., Ltd. (China)

- LIEBHERR Group (Switzerland)

- ABB Ltd. (Switzerland)

- HAPAG LLOYD (Germany)

- APM Terminals (Netherlands)

- BECKHOFF AUTOMATION GMBH & CO. KG (Germany)

- Künz GmbH (Austria)

- CyberLogitec Co., Ltd. (Korea)

- Camco Technologies NV (Belgium)

- IDENTEC SOLUTIONS AG (Austria)

- ORBCOMM Inc. (U.S.)

- PACECO Corp. (U.S.)

- Total Soft Bank Ltd. is a leading maritime‑IT company that specializes in terminal operating systems, simulation, stowage planning, and port community systems. The company’s CATOS solution deliberately supports automated and semi-automated terminals and integrates with IoT and autonomous infrastructure, due to which it is trusted by over 100 terminals across 20+ countries. Their strong R&D investment is readily prompting innovations in cloud, AI, and big‑data for digital port transformation.

- INFORM Software GmbH is a veteran software company focused on AI and operations research optimization. In the terminal space, they offer their Syncrotess Intermodal TOS, which is modular and built for highly automated, intermodal, and sustainable terminals. At the Duisburg Gateway Terminal, INFORM’s AI-driven TOS will optimize crane jobs, barge handling, stacking, and train loading, laying the groundwork for further crane automation. Their strength lies in real-time decision support, reducing unproductive moves and energy consumption via intelligent scheduling.

- Logstar ERP is one of the most prominent software providers that delivers a cloud-based terminal operating system for container, multi-cargo, and intermodal terminals. The company hosts a TOS that handles yard planning, gate planning, container & cargo management, and resource planning, which enabled it to gain the interest of a wider audience group. Also, the platform is highly scalable, supports multi-site operations, and it also has a pay-as-you-go model and cloud hosting, targeting both large port operators and smaller terminals, reducing CAPEX burden.

- Infyz Solutions is a technology company based in India focused on ports, shipping, and logistics. Their flagship product, called iTOMS, is a SaaS-based TOS that supports automation, real-time cargo tracking, equipment processing, and terminal workflows. The company is also providing an equipment processing system for managing container-handling equipment digitally. For instance, Infyz partnered with Microsoft Azure to make its iTOMS available on the Azure marketplace by leveraging cloud-native infrastructure and AI/ML for scalable digitalization.

- Tideworks Technology, Inc. specializes in terminal operating system software for marine as well as intermodal terminals. Their next-generation platform, called Mainsail 10, provides intelligent user configuration, high visibility, and integration with third-party systems and automation. Furthermore, Tideworks also supports process automation, i.e., their AVI/OCR-based gate automation solutions for fully automated gate operations.

Below is the list of some prominent players operating in the global automated container terminal market:

The automated container terminal market is witnessing intense competition between the key pioneers, such as Konecranes, Kalmar/Cargotec, ZPMC, Liebherr, and ABB, supported by software and systems players such as CyberLogitec and Tideworks. These leading players are focusing on sustainability, launching electrified cranes, AGVs, and greener terminal systems to meet decarbonisation goals. In September 2025, INVT announced that, in collaboration with Qingdao New Qianwan Container Terminal, it had set a new benchmark for traditional terminal automation by completing a fully automated rail-mounted gantry crane system with 100% localized core components. The project has been recognized with the first prize of science and technology by the China Ports Association and features high-performance GD350-19 crane inverters enabling precise motor control, encoder redundancy, and operational speeds up to 270 m/min, hence denoting a positive automated container terminal market outlook.

Corporate Landscape of the Automated Container Terminal Market:

Recent Developments

- In September 2025, Liebherr announced that it had entered a 10-year partnership with Transnet Port Terminals in South Africa to supply and support key port equipment, which includes STS, RTG, RMG, and mobile harbour cranes, backed by a 20-year asset management program.

- In July 2025, Konecranes announced a major order of an automated horizontal transport system, which includes 42 lithium-ion automated guided vehicles and fast-charging stations from Hutchison Ports ECT Rotterdam to modernize the Euromax terminal, which marks a step in electrifying the terminal's operations.

- In February 2025, Port of Tanjung Pelepas reported that it had signed an agreement with ZPMC to purchase 58 eco-efficient, electrified rubber-tyred gantry cranes, which are automation-ready, enhancing its handling capabilities and supporting its expansion as Malaysia’s leading transshipment hub.

- Report ID: 5281

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Container Terminal Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.